Saudi Arabia Nutritional Supplements Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD3216

November 2024

89

About the Report

Saudi Arabia Nutritional Supplements Market Overview

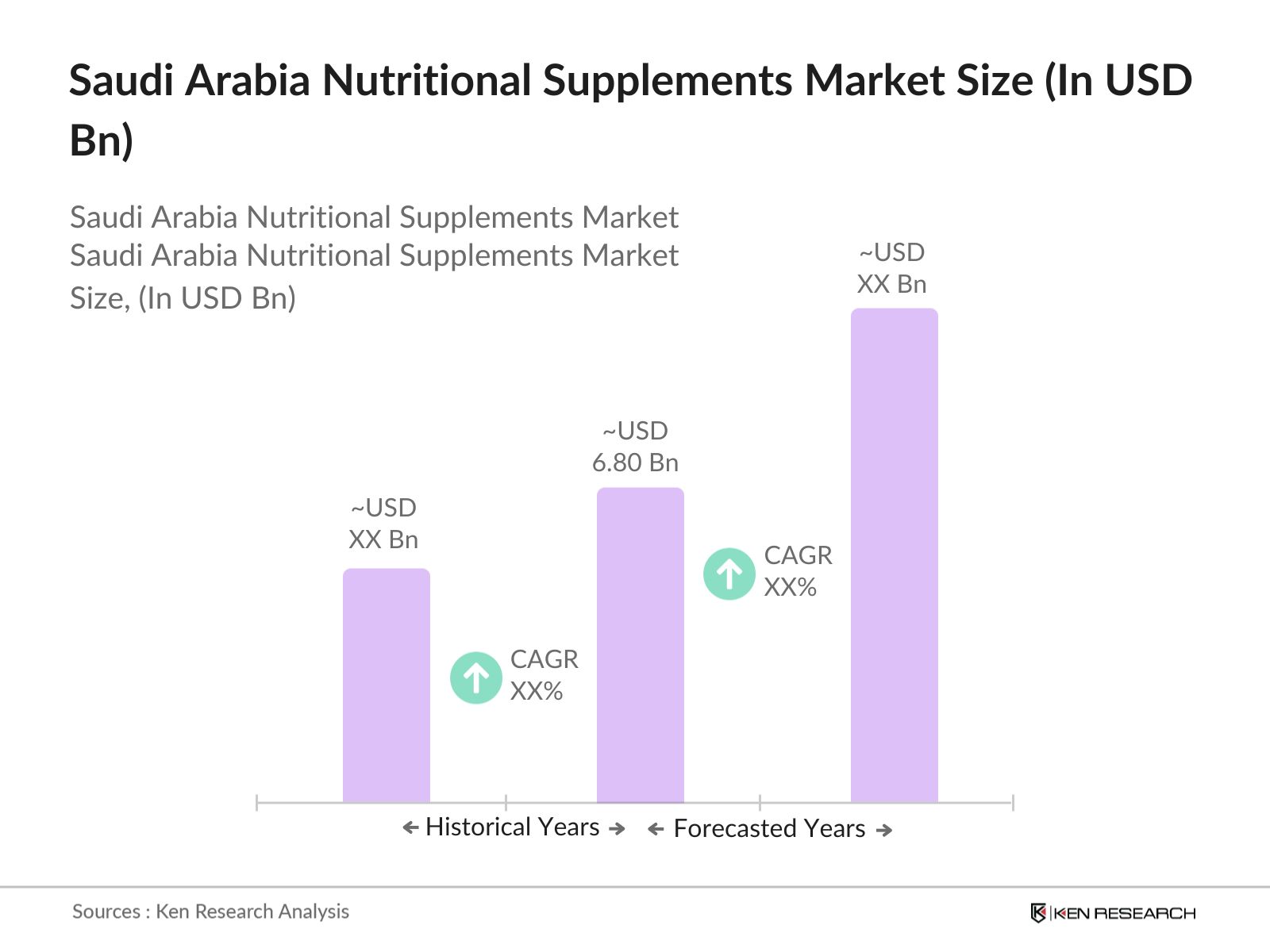

- The Saudi Arabia Nutritional Supplements market is valued at USD 6.80 billion, based on a five-year historical analysis. The market is driven by rising consumer awareness of health and wellness, supported by increased disposable income and higher healthcare expenditures. A growing demand for nutritional products to support immunity and general health, particularly post-pandemic, has also contributed to the market's expansion.

- Dominant regions in the market include Riyadh, Jeddah, and Dammam. These cities lead due to their higher population density, affluent lifestyle, and greater access to retail channels offering supplements. The demand is further driven by the presence of well-established healthcare infrastructure and increased awareness about preventative healthcare among the urban population.

- The SFDA plays a pivotal role in regulating the nutritional supplements market in Saudi Arabia. In 2023, the authority introduced stricter guidelines to ensure the safety and efficacy of supplements sold in the market. These regulations focus on ingredient sourcing, labeling, and marketing claims. As of 2024, all supplements must undergo rigorous testing before they can be sold in the country, creating challenges but also ensuring that consumers are protected from substandard products.

Saudi Arabia Nutritional Supplements Market Segmentation

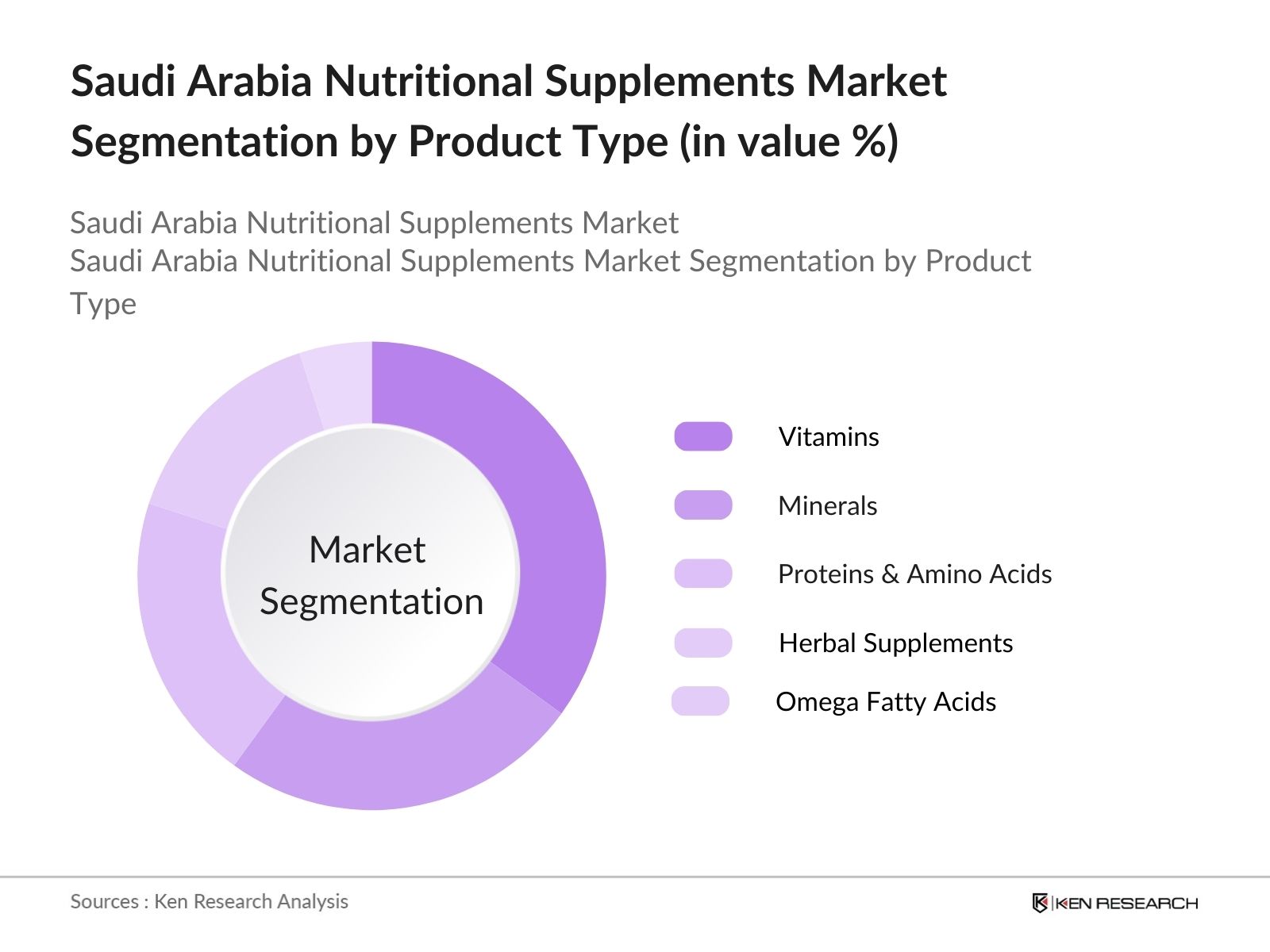

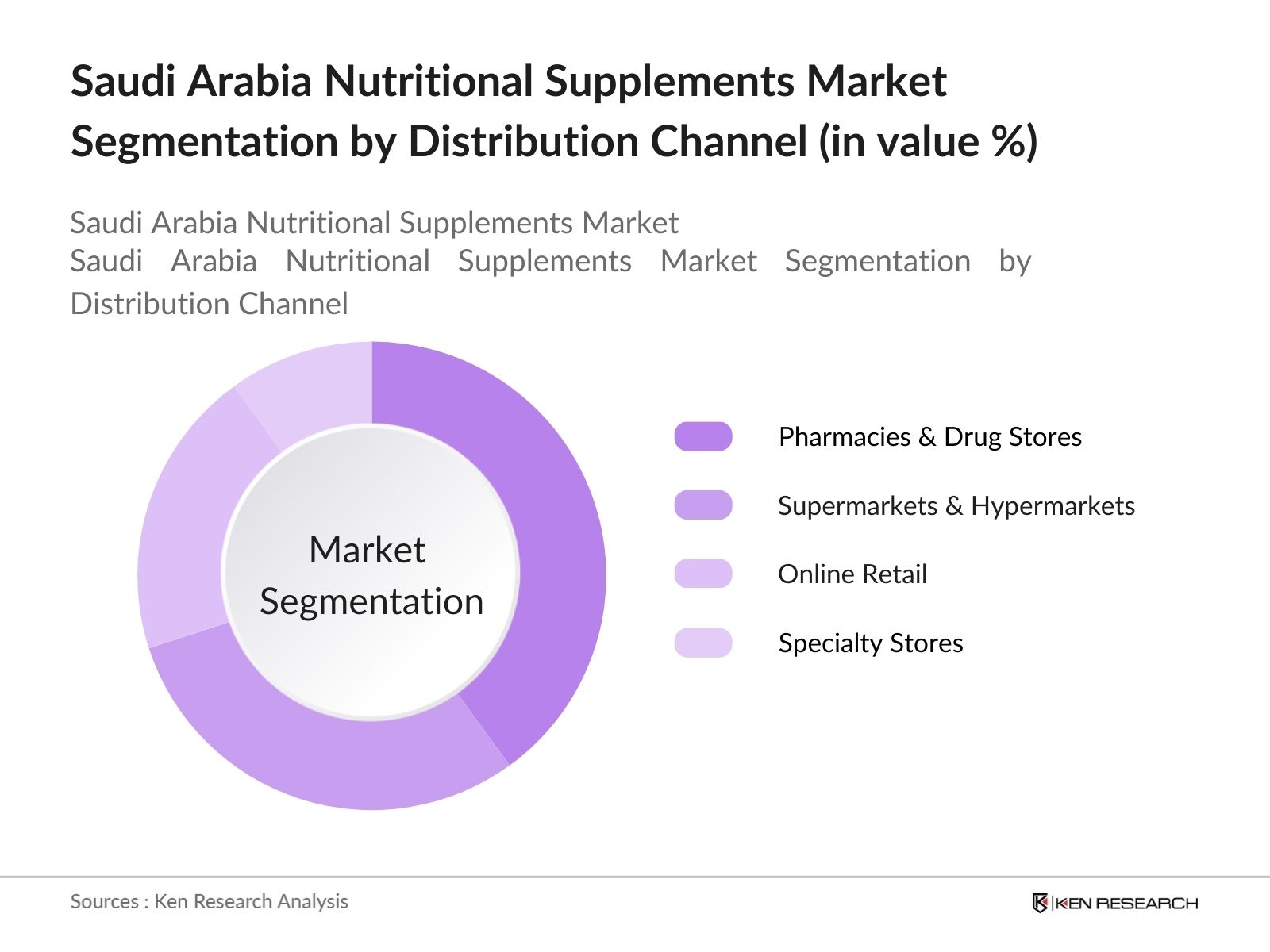

Saudi Arabia's Nutritional Supplements market is segmented by product type and by distribution channel.

- By Product Type: The market is segmented by product type into vitamins, minerals, proteins & amino acids, herbal supplements, and omega fatty acids. Vitamins hold a dominant market share under the product type segmentation. The high demand for vitamins is driven by increasing consumer awareness of their role in boosting immunity, especially after the COVID-19 pandemic. Vitamins are also widely recommended by healthcare professionals for general health maintenance, further supporting the growth of this segment.

- By Distribution Channel: The market is also segmented by distribution channel into pharmacies & drug stores, supermarkets & hypermarkets, online retail, and specialty stores. Pharmacies and drug stores dominate this segment, holding the largest market share due to the trust consumers place in these outlets for purchasing health-related products. Additionally, pharmacies offer a wide variety of nutritional supplements and are perceived as reliable sources, with knowledgeable staff providing personalized recommendations.

Saudi Arabia Nutritional Supplements Market Competitive Landscape

The Saudi Arabia Nutritional Supplements market is highly competitive, with both international and domestic players contributing to market dynamics. Global brands like Natures Bounty and Herbalife Nutrition have strong market penetration due to their extensive product portfolios and established brand presence. Meanwhile, local players are gaining traction by offering products tailored to regional tastes and preferences, especially in the herbal and halal-certified supplement categories.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Revenue |

Customer Reach |

Sustainability Initiatives |

Brand Reputation |

|

Natures Bounty |

1971 |

United States |

||||||

|

Amway |

1959 |

United States |

||||||

|

Herbalife Nutrition |

1980 |

United States |

||||||

|

GNC Holdings, Inc. |

1935 |

United States |

||||||

|

Pfizer Inc. |

1849 |

United States |

Saudi Arabia Nutritional Supplements Industry Analysis

Market Growth Drivers

- Health and Wellness Trends (Consumer Behavior): In Saudi Arabia, health-conscious consumer behavior has significantly shaped the nutritional supplements market. The government's National Vision 2030 health initiatives promote healthier lifestyles, increasing demand for supplements. According to the Saudi Ministry of Health, over 60% of Saudi adults are either overweight or obese, prompting higher consumption of vitamins, minerals, and other dietary supplements to maintain health and wellness. This growing awareness is further supported by Saudi consumers' preference for holistic health solutions, with an increasing shift toward preventive healthcare, as reported by the World Bank.

- Rising Geriatric Population (Demographics): Saudi Arabias geriatric population, which currently stands at around 3.5 million people, is increasing at a steady rate, according to the United Nations Population Division. This demographic is highly susceptible to age-related health conditions, driving the need for nutritional supplements that support bone health, immunity, and cognitive function. Government healthcare programs targeted at elderly care, such as subsidized supplements for seniors, are further propelling demand in the market, making the aging population a key growth driver in the sector.

- Increase in Disposable Income (Economic Trends): Saudi Arabias economic reforms under the Vision 2030 initiative have contributed to an increase in disposable income. With a GDP per capita of $24,875 in 2023, Saudi consumers are willing to spend more on health and wellness products, including nutritional supplements. Higher disposable incomes enable consumers to purchase premium brands and personalized nutrition solutions. This economic empowerment, coupled with a growing middle class, is contributing to the growth of the nutritional supplement market in Saudi Arabia.

Market Challenges

- Strict Regulatory Framework (Compliance): Saudi Arabia's nutritional supplement market faces stringent regulations under the Saudi Food and Drug Authority (SFDA), which mandates rigorous safety and efficacy tests before product approval. The SFDA recently updated its regulatory guidelines in 2023 to strengthen the monitoring of health claims and ingredient sourcing, creating compliance challenges for manufacturers. As of 2024, over 200 products have been pulled from the shelves due to regulatory violations, making it difficult for new entrants to navigate the market.

- Competition from Pharmaceuticals (Market Dynamics): Pharmaceutical companies, which already dominate the healthcare sector in Saudi Arabia, are increasingly entering the nutritional supplements market by offering clinically proven alternatives. Many doctors prefer prescribing pharmaceutical-grade vitamins over dietary supplements. Saudi Arabia's pharmaceutical market was valued at $7 billion in 2023, overshadowing the supplement sector in terms of market dominance and consumer trust. This creates stiff competition for traditional supplement manufacturers.

Saudi Arabia Nutritional Supplements Market Future Outlook

Over the next five years, the Saudi Arabia Nutritional Supplements market is expected to show significant growth, driven by rising health consciousness, an aging population, and government initiatives to promote healthy lifestyles. The increased penetration of e-commerce platforms and innovations in product formulations, particularly in plant-based and halal-certified supplements, are expected to further boost market growth. The growing emphasis on personalized nutrition, supported by advancements in technology, will also play a critical role in shaping the future of the market.

Future Market Opportunities

- E-Commerce Growth (Distribution Channels): Saudi Arabias e-commerce sector is rapidly expanding, providing a new distribution channel for nutritional supplements. In 2023, the Saudi e-commerce market exceeded $20 billion in sales, driven by widespread internet penetration and a young tech-savvy population. Online platforms such as Amazon.sa and Noon.com are now major players in the distribution of supplements, offering consumers a wider variety of options and convenience, which is expected to drive market growth further.

- Innovation in Formulation (R&D and Technology): There has been a noticeable shift toward the development of advanced formulations in the nutritional supplement market, driven by growing consumer demand for personalized and effective solutions. In 2023, several Saudi-based companies invested in research and development to create supplements tailored to individual health needs, such as probiotics, omega-3 supplements, and vitamin blends. Companies are leveraging technological advancements, such as DNA-based nutrition plans, to gain a competitive edge.

Scope of the Report

|

||

|

By Distribution Channel |

General Health Weight Management Sports Nutrition Immune Support Prenatal & Postnatal Health |

|

|

By Application |

Pharmacies & Drug Stores Supermarkets & Hypermarkets Online Retail Specialty Stores |

|

|

By Consumer Group |

Adults Children Geriatric Population |

|

|

By Region |

North East West South |

Products

Key Target Audience

Nutritional Supplements Manufacturers

Pharmaceutical Companies

Retailers and Distributors (Pharmacies, Supermarkets)

Sports Nutrition Companies

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Investment and Venture Capitalist Firms

Online Retail Platforms

Banks and Financial Institutes

Fitness and Wellness Centers

Companies

Major Players in the Saudi Arabia Nutritional Supplements Market

Natures Bounty

Amway

Herbalife Nutrition

GNC Holdings, Inc.

Pfizer Inc.

Abbott Laboratories

Nestle Health Science

NOW Foods

Blackmores Limited

Jamieson Wellness

Vitabiotics Ltd.

Glanbia Performance Nutrition

NutraClick

Nature's Way

Sundown Naturals

Table of Contents

1. Saudi Arabia Nutritional Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Nutritional Supplements Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Nutritional Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Health and Wellness Trends (Consumer Behavior)

3.1.2. Rising Geriatric Population (Demographics)

3.1.3. Increase in Disposable Income (Economic Trends)

3.1.4. Government Health Initiatives (Regulatory Support)

3.2. Market Challenges

3.2.1. Strict Regulatory Framework (Compliance)

3.2.2. Competition from Pharmaceuticals (Market Dynamics)

3.2.3. Consumer Misinformation (Awareness)

3.3. Opportunities

3.3.1. E-Commerce Growth (Distribution Channels)

3.3.2. Innovation in Formulation (R&D and Technology)

3.3.3. Increasing Focus on Sports Nutrition (Consumer Preferences)

3.4. Trends

3.4.1. Personalized Nutrition (Product Innovation)

3.4.2. Plant-Based Supplements (Ingredient Trends)

3.4.3. Dietary Supplements for Immune Support (Post-Pandemic Trends)

3.5. Government Regulation

3.5.1. Saudi Food and Drug Authority (SFDA) Guidelines (Regulatory Compliance)

3.5.2. Import and Export Regulations (Trade Policies)

3.5.3. National Vision 2030 Health Objectives (Government Initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Saudi Arabia Nutritional Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins

4.1.2. Minerals

4.1.3. Proteins & Amino Acids

4.1.4. Herbal Supplements

4.1.5. Omega Fatty Acids

4.2. By Application (In Value %)

4.2.1. General Health

4.2.2. Weight Management

4.2.3. Sports Nutrition

4.2.4. Immune Support

4.2.5. Prenatal and Postnatal Health

4.3. By Distribution Channel (In Value %)

4.3.1. Pharmacies & Drug Stores

4.3.2. Supermarkets & Hypermarkets

4.3.3. Online Retail

4.3.4. Specialty Stores

4.4. By End-User (In Value %)

4.4.1. Adults

4.4.2. Children

4.4.3. Geriatric Population

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Nutritional Supplements Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Natures Bounty

5.1.2. Amway

5.1.3. Herbalife Nutrition

5.1.4. GNC Holdings, Inc.

5.1.5. Abbott Laboratories

5.1.6. Nestle Health Science

5.1.7. Pfizer Inc.

5.1.8. NOW Foods

5.1.9. NutraClick

5.1.10. Blackmores Limited

5.1.11. Nature's Way

5.1.12. Jamieson Wellness

5.1.13. Glanbia Performance Nutrition

5.1.14. Vitabiotics Ltd.

5.1.15. Sundown Naturals

5.2 Cross Comparison Parameters (Market Presence, Product Portfolio, Revenue, R&D Investment, Customer Reach, Brand Reputation, Sustainability Practices, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Nutritional Supplements Market Regulatory Framework

6.1. SFDA Compliance Standards

6.2. Labeling and Advertising Guidelines

6.3. Certification Processes for Nutritional Supplements

7. Saudi Arabia Nutritional Supplements Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Nutritional Supplements Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Nutritional Supplements Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we construct an ecosystem map encompassing all major stakeholders in the Saudi Arabia Nutritional Supplements market. Extensive desk research and the use of secondary data sources help identify the critical variables that drive market trends.

Step 2: Market Analysis and Construction

We compile and analyze historical data pertaining to market growth, penetration levels, and distribution channels. Additionally, we assess revenue generation from different product segments to establish a comprehensive view of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses are validated through consultations with industry experts via computer-assisted telephone interviews (CATI). These consultations help refine and confirm data insights, ensuring accuracy in the market forecasts.

Step 4: Research Synthesis and Final Output

We engage directly with manufacturers, distributors, and retailers to gather insights on consumer behavior, product performance, and industry challenges. This data is synthesized into actionable insights, forming the final market analysis output.

Frequently Asked Questions

1. How big is the Saudi Arabia Nutritional Supplements Market?

The Saudi Arabia Nutritional Supplements market was valued at USD 6.80 billion, driven by increased consumer demand for health and wellness products, particularly post-pandemic.

2. What are the challenges in the Saudi Arabia Nutritional Supplements Market?

Key challenges in Saudi Arabia Nutritional Supplements market include stringent regulatory requirements from the Saudi Food and Drug Authority, rising competition from pharmaceuticals, and a lack of consumer education on the proper use of supplements.

3. Who are the major players in the Saudi Arabia Nutritional Supplements Market?

Major players in the Saudi Arabia Nutritional Supplements market include Natures Bounty, Herbalife Nutrition, GNC Holdings, Pfizer Inc., and Amway. These companies dominate due to their extensive product portfolios and strong distribution networks.

4. What are the growth drivers of the Saudi Arabia Nutritional Supplements Market?

Saudi Arabia Nutritional Supplements Market Growth is propelled by rising health consciousness, government initiatives promoting healthy lifestyles, and increasing consumer spending on preventative healthcare products.

5. What are the key trends in the Saudi Arabia Nutritional Supplements Market?

Key trends in Saudi Arabia Nutritional Supplements market include the growing demand for personalized nutrition, increased popularity of plant-based supplements, and the rise of e-commerce platforms as a major distribution channel for supplements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.