Saudi Arabia Oil & Gas Drilling Tools Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD8007

December 2024

98

About the Report

Saudi Arabia Oil & Gas Drilling Tools Market Overview

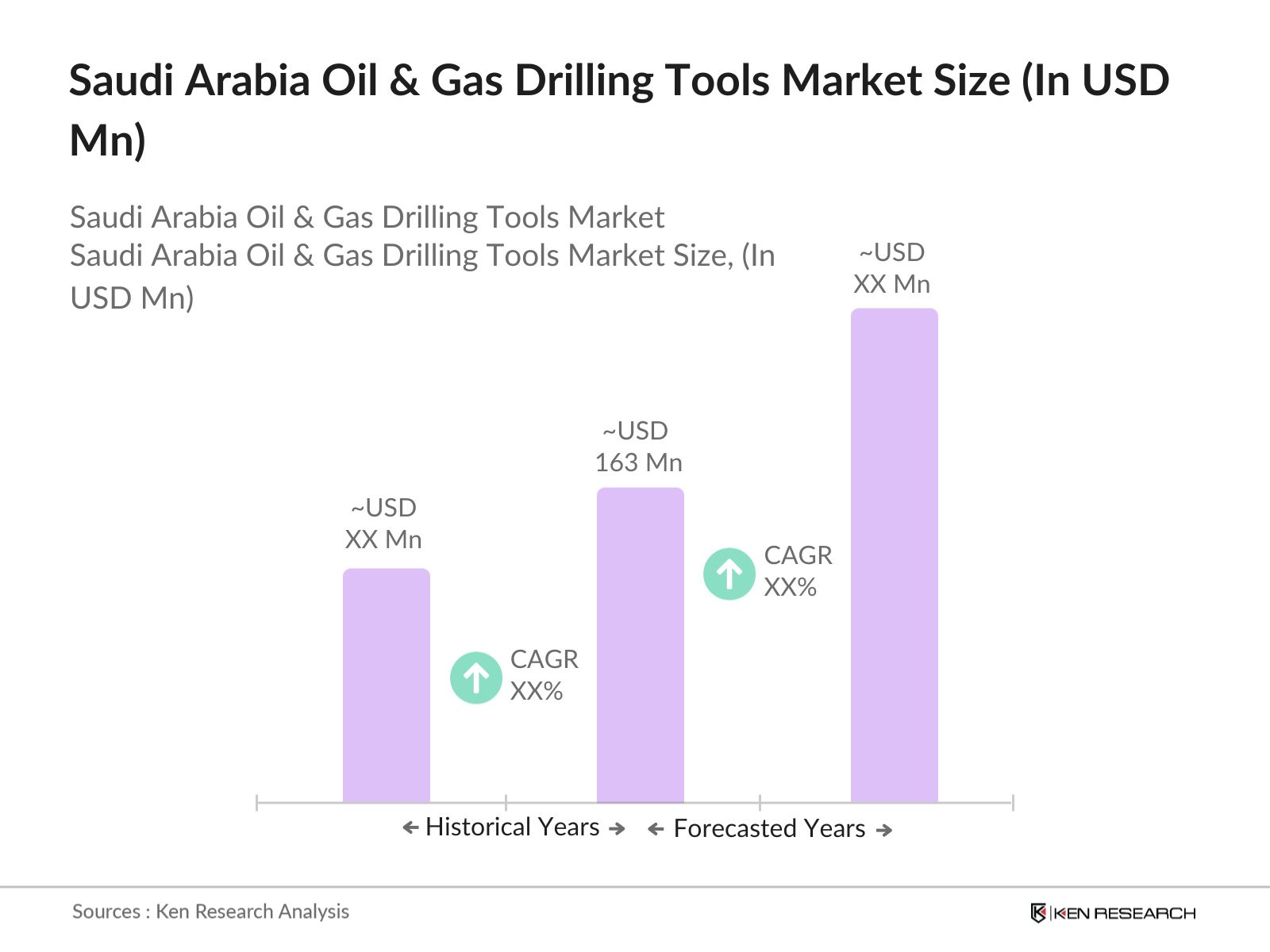

- The Saudi Arabia Oil & Gas Drilling Tools market is valued at USD 163 Million. This market is driven by the countrys massive oil production activities, which are among the highest in the world. The expansion of offshore drilling and the increasing depth of exploration activities in mature fields have amplified the demand for advanced drilling tools. The governments Vision 2030 also emphasizes the growth of local manufacturing, including in the oilfield equipment sector, further propelling market growth.

- Saudi Arabia's oil and gas drilling activities are primarily concentrated in regions like the Eastern Province, where large reserves of crude oil are located. Cities like Dhahran and Jubail dominate due to their proximity to the largest oil fields and well-established infrastructure. The regions dominance is also supported by the presence of national oil giant Saudi Aramco, whose extensive drilling operations lead the market.

- Saudi Arabias Vision 2030 has had a profound impact on local manufacturing and employment within the oil and gas drilling tools sector. Under the IKTVA initiative, the kingdom aims to achieve 75% local content in the oil and gas industry by 2025, which has led to the establishment of local manufacturing facilities for drilling tools and equipment. Furthermore, Vision 2030 has contributed to a significant increase in employment, with over 300,000 new jobs created in the energy sector since 2022, many of which are in oilfield services and manufacturing.

Saudi Arabia Oil & Gas Drilling Tools Market Segmentation

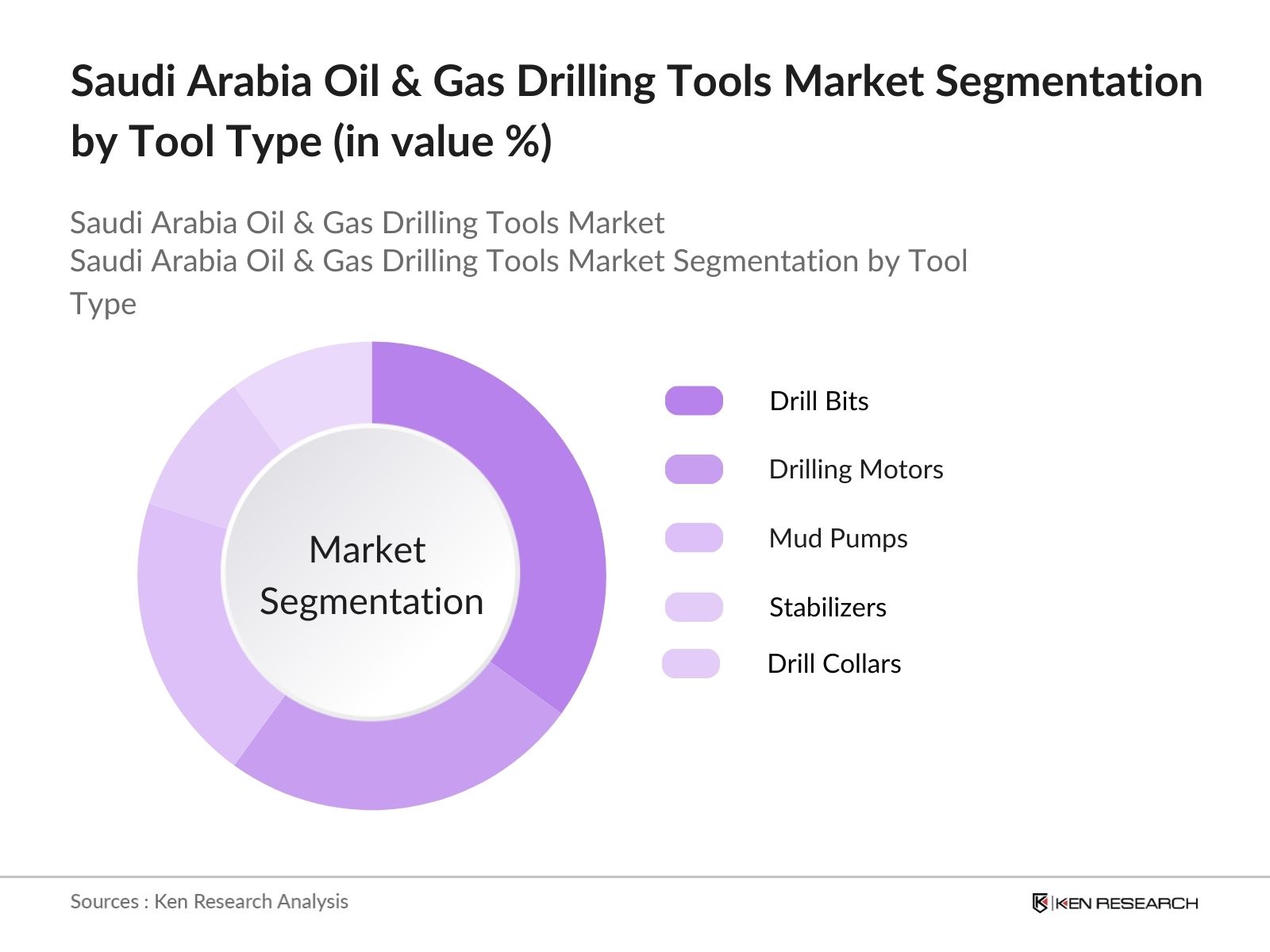

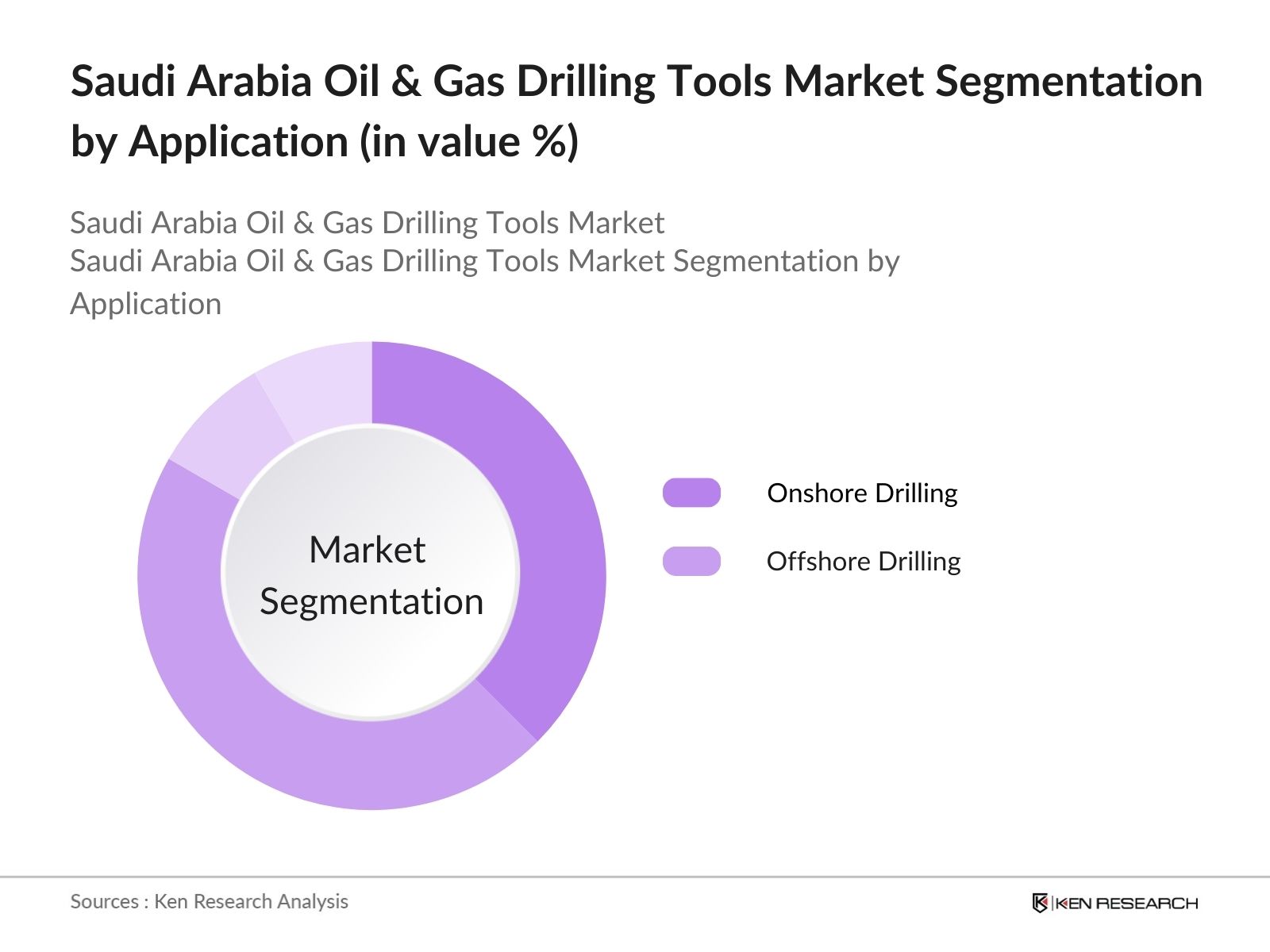

The Saudi Arabia Oil & Gas Drilling Tools market is segmented by tool type and by application.

- By Tool Type: The Saudi Arabia Oil & Gas Drilling Tools market is segmented by tool type into drill bits, drilling motors, mud pumps, stabilizers, and drill collars. Drill bits hold a dominant market share due to their essential role in breaking down geological formations and the frequent replacement required due to wear and tear. The technological advancements in bit materials, such as diamond and tungsten carbide, have enhanced drilling efficiency, making this sub-segment particularly significant in deeper and more complex drilling operations.

- By Application: The Saudi Arabia Oil & Gas Drilling Tools market is also segmented by application into onshore and offshore drilling. Offshore drilling dominates the market share, driven by the countrys push to develop offshore fields like the Arabian Gulf and the Red Sea. Offshore drilling requires specialized tools that can withstand harsher environments and greater depths, further driving the demand for advanced equipment and tools.

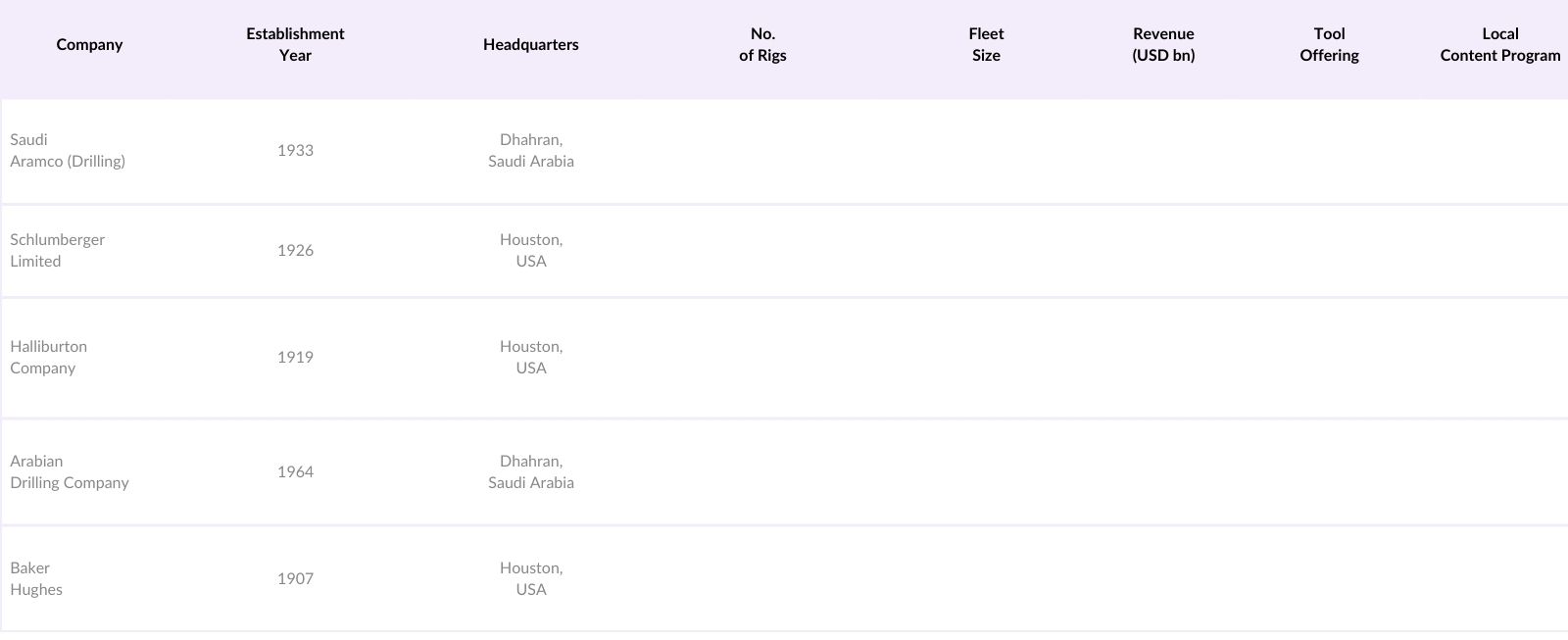

Saudi Arabia Oil & Gas Drilling Tools Market Competitive Landscape

The Saudi Arabia Oil & Gas Drilling Tools market is dominated by a mix of local and international companies. Major players include global oilfield services firms and local manufacturers benefiting from the government's push for localization. This consolidation reflects the influence of key players and their investments in advanced technology and local content initiatives.

Saudi Arabia Oil & Gas Drilling Tools Industry Analysis

Growth Drivers

- Increase in Oil Exploration Activities (New Discoveries, Technological Advancements): Saudi Arabia continues to intensify its oil exploration efforts due to increasing energy demands. In 2022, Saudi Aramco announced significant new oil discoveries in the northern regions of the kingdom, further reinforcing its global leadership in energy reserves. These discoveries were made possible through advanced drilling technologies, such as 3D seismic imaging and automated rigs, which have enabled deeper and more precise drilling operations. Saudi Arabia holds the second-largest proven oil reserves, approximately 267 billion barrels, driving further exploration initiatives. These technological advancements are crucial in uncovering untapped reserves.

- Expansion of Oilfield Infrastructure: Saudi Arabia has heavily invested in oilfield infrastructure to support the increasing demand for energy and expand production capabilities. As part of Vision 2030, Saudi Aramco is ramping up its oil production to sustain long-term global energy supply. The company plans to boost its maximum sustainable capacity from 12 million barrels per day to 13 million barrels per day by 2025, with a focus on expanding infrastructure at key fields such as the Ghawar and Safaniya oilfields. This infrastructure investment strengthens the kingdom's position as the largest oil exporter globally.

- Favorable Government Policies (Vision 2030, Energy Mix, Local Content Initiatives): Saudi Arabia's Vision 2030 and its focus on local content development have significantly impacted the oil and gas drilling tools market. The In-Kingdom Total Value Add (IKTVA) program mandates that 70% of the oil sector's value chain should be locally sourced by 2025. This policy has led to increased investment in local manufacturing of drilling tools, creating opportunities for local companies and reducing reliance on imports. Additionally, the Saudi government is diversifying its energy mix, including developing gas resources and reducing oil dependence, to ensure energy security.

Market Challenges

- Fluctuating Crude Oil Prices: Oil price volatility has been a long-standing challenge for Saudi Arabias oil and gas sector. In 2023, global oil prices fluctuated between USD 70 and USD 90 per barrel, causing uncertainty in investment decisions related to oil exploration and drilling projects. The unpredictable nature of crude oil prices affects the profitability of oil extraction projects, leading to hesitation in adopting costly advanced drilling technologies. These price fluctuations are driven by global geopolitical tensions, supply-demand imbalances, and shifts in energy policies in major importing nations.

- High Cost of Advanced Drilling Tools and Technologies: The oil and gas drilling industry faces challenges with the high capital investment required for advanced drilling tools. In Saudi Arabia, the adoption of technologies such as automated drilling rigs and horizontal drilling equipment involves significant costs. For instance, automated drilling systems can cost upwards of USD 10 million per rig, making it a costly endeavor for companies looking to modernize operations. High costs often deter smaller firms from adopting these technologies, limiting market expansion.

Saudi Arabia Oil & Gas Drilling Tools Market Future Outlook

Over the next five years, the Saudi Arabia Oil & Gas Drilling Tools market is expected to experience sustained growth driven by increased offshore exploration and development. Government initiatives, such as Vision 2030, will promote localization in oilfield services, leading to investments in drilling tools manufacturing and the adoption of advanced technologies. Furthermore, the continued expansion of national energy companies like Saudi Aramco into deeper and more technically challenging reservoirs will require specialized tools, ensuring robust demand in the near future.

Market Opportunities

- Investment in Offshore Drilling Projects: Saudi Arabia is increasingly investing in offshore oil drilling to tap into untapped reserves in the Red Sea and Arabian Gulf. Saudi Aramco announced plans to explore new offshore fields, contributing to the nation's goal of expanding its crude oil production capacity. In 2022, offshore oil accounted for approximately 30% of the kingdom's oil production, and investments in offshore drilling are expected to further increase. This shift towards offshore exploration presents lucrative opportunities for companies specializing in deepwater and ultra-deepwater drilling technologies.

- Adoption of Automated Drilling Technologies: The increasing adoption of automated drilling technologies in Saudi Arabia is revolutionizing the oil and gas sector. Saudi Aramco has introduced automated drilling systems, significantly reducing drilling time and improving operational efficiency. Automated rigs are expected to enhance well productivity, with automated systems now accounting for 15% of all drilling operations in Saudi oilfields. This automation offers an opportunity for tool manufacturers and service providers to introduce innovative, AI-driven technologies that support smarter and more efficient drilling operations.

Scope of the Report

|

Drill Bits Drilling Motors Mud Pumps Stabilizers Drill Collars |

|

|

By Application |

Onshore Drilling Offshore Drilling |

|

By Drilling Technology |

Vertical Drilling Horizontal Drilling Directional Drilling Extended Reach Drilling |

|

By Material Type |

Steel-Based Tools Diamond-Based Tools Carbide-Based Tools |

|

By Region |

North East West South |

Products

Key Target Audience

Drilling Contractors

Oilfield Service Providers

Oil & Gas Producers (Saudi Aramco, Chevron)

Equipment Manufacturers

Government and Regulatory Bodies (Saudi Ministry of Energy, IKTVA Program)

Investments and Venture Capitalist Firms

Offshore Drilling Companies

Oilfield Technology Providers

Companies

List of Major Players

Saudi Aramco (Drilling Tools Division)

Schlumberger Limited

Halliburton Company

Baker Hughes

Arabian Drilling Company

Weatherford International

National Oilwell Varco

Nabors Industries

Cameron International

Superior Energy Services

Precision Drilling

Oman Drilling Systems

Saipem S.p.A.

Petrofac Limited

Seadrill Limited

Table of Contents

1. Saudi Arabia Oil & Gas Drilling Tools Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Market Lifecycle, Key Players, Technology Adoption)

1.3. Market Growth Rate (Drilling Activity, Oilfield Expansion, Well Counts)

1.4. Market Segmentation Overview

2. Saudi Arabia Oil & Gas Drilling Tools Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Drilling Rigs Addition, Joint Ventures, Production Capacity)

3. Saudi Arabia Oil & Gas Drilling Tools Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Oil Exploration Activities (New Discoveries, Technological Advancements)

3.1.2. Expansion of Oilfield Infrastructure

3.1.3. Favorable Government Policies (Vision 2030, Energy Mix, Local Content Initiatives)

3.1.4. Rising Demand for Energy in Industrial Sectors

3.2. Market Challenges

3.2.1. Fluctuating Crude Oil Prices

3.2.2. High Cost of Advanced Drilling Tools and Technologies

3.2.3. Stringent Environmental Regulations

3.2.4. Scarcity of Skilled Workforce

3.3. Opportunities

3.3.1. Investment in Offshore Drilling Projects

3.3.2. Adoption of Automated Drilling Technologies

3.3.3. Collaboration with Global Oilfield Service Providers

3.3.4. Government Incentives for Local Manufacturing

3.4. Trends

3.4.1. Deployment of Smart Drilling Technologies (Sensors, AI, IoT in Drilling)

3.4.2. Shift Towards Horizontal Drilling

3.4.3. Integration of Renewable Energy in Oil & Gas Operations

3.4.4. Rise in Customized Drilling Solutions

3.5. Government Regulation

3.5.1. Vision 2030 (Impact on Local Manufacturing and Employment)

3.5.2. Saudi Energy Ministry Directives

3.5.3. Local Content Mandates (IKTVA Program)

3.5.4. HSE (Health, Safety, and Environment) Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem (Local and International Players)

4. Saudi Arabia Oil & Gas Drilling Tools Market Segmentation

4.1. By Tool Type (In Value %)

4.1.1. Drill Bits

4.1.2. Drilling Motors

4.1.3. Mud Pumps

4.1.4. Stabilizers

4.1.5. Drill Collars

4.2. By Application (In Value %)

4.2.1. Onshore Drilling

4.2.2. Offshore Drilling

4.3. By Drilling Technology (In Value %)

4.3.1. Vertical Drilling

4.3.2. Horizontal Drilling

4.3.3. Directional Drilling

4.3.4. Extended Reach Drilling

4.4. By Material Type (In Value %)

4.4.1. Steel-Based Tools

4.4.2. Diamond-Based Tools

4.4.3. Carbide-Based Tools

4.5. By Region (In Value %)

4.5.1. Eastern Province

4.5.2. Central Province

4.5.3. Western Province

5. Saudi Arabia Oil & Gas Drilling Tools Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Schlumberger Limited

5.1.2. Halliburton Company

5.1.3. Baker Hughes

5.1.4. National Oilwell Varco

5.1.5. Weatherford International

5.1.6. Arabian Drilling Company

5.1.7. Saudi Aramco (Drilling Tools Division)

5.1.8. Cameron International

5.1.9. Nabors Industries

5.1.10. Oman Drilling Systems

5.1.11. Superior Energy Services

5.1.12. Precision Drilling

5.1.13. Saipem S.p.A.

5.1.14. Petrofac Limited

5.1.15. Seadrill Limited

5.2. Cross Comparison Parameters (Tool Fleet Size, Operational Countries, No. of Active Drilling Rigs, Revenue from Drilling Equipment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Oil & Gas Drilling Tools Market Regulatory Framework

6.1. Compliance with Saudi Energy Directives

6.2. Environmental Regulations for Drilling Operations

6.3. Local Content Certification (IKTVA Requirements)

7. Saudi Arabia Oil & Gas Drilling Tools Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Oil & Gas Drilling Tools Future Market Segmentation

8.1. By Tool Type (In Value %)

8.2. By Application (In Value %)

8.3. By Drilling Technology (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Oil & Gas Drilling Tools Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we developed a comprehensive ecosystem map outlining the major stakeholders in the Saudi Arabia Oil & Gas Drilling Tools Market. This involved leveraging extensive desk research and proprietary databases to gather insights into the critical factors shaping market demand and dynamics. Key variables such as drilling activity, well counts, and technological adoption were identified.

Step 2: Market Analysis and Construction

During this phase, historical data was compiled to understand market trends over the last five years. This data provided a baseline for analyzing the current state of the market, including key trends such as the rise in offshore drilling. The analysis was supported by company reports, drilling activity statistics, and regional demand analysis.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market drivers and trends were developed and validated through discussions with industry experts. Computer-assisted telephone interviews (CATIs) with oilfield service providers and drilling tool manufacturers offered valuable insights that were instrumental in verifying the market data.

Step 4: Research Synthesis and Final Output

Finally, data was synthesized and cross-referenced with interviews from industry experts. This ensured a reliable, accurate, and detailed analysis of the Saudi Arabia Oil & Gas Drilling Tools Market, providing a clear understanding of the markets current and future potential.

Frequently Asked Questions

01. How big is Saudi Arabia Oil & Gas Drilling Tools Market?

The Saudi Arabia Oil & Gas Drilling Tools market is valued at USD 163 million, driven by extensive oil production activities and the expansion of offshore drilling operations.

02. What are the challenges in the Saudi Arabia Oil & Gas Drilling Tools Market?

Challenges in this Saudi Arabia Oil & Gas Drilling Tools market include fluctuating oil prices, high capital expenditure required for advanced drilling tools, and stringent environmental regulations that impact operations.

03. Who are the major players in the Saudi Arabia Oil & Gas Drilling Tools Market?

Key players in Saudi Arabia Oil & Gas Drilling Tools market include Saudi Aramco, Schlumberger, Halliburton, Baker Hughes, and Arabian Drilling Company. These companies dominate the market due to their extensive drilling operations and significant investments in technology.

04. What are the growth drivers of the Saudi Arabia Oil & Gas Drilling Tools Market?

Growth in this Saudi Arabia Oil & Gas Drilling Tools market is propelled by increased exploration activities, the expansion of offshore oilfields, and government policies promoting local content manufacturing.

05. What are the future prospects for Saudi Arabia Oil & Gas Drilling Tools Market?

The Saudi Arabia Oil & Gas Drilling Tools market is expected to grow steadily, supported by government initiatives, such as Vision 2030, and the increased adoption of advanced drilling technologies for offshore exploration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.