Saudi Arabia Salt Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD3464

November 2024

86

About the Report

Saudi Arabia Salt Market Overview

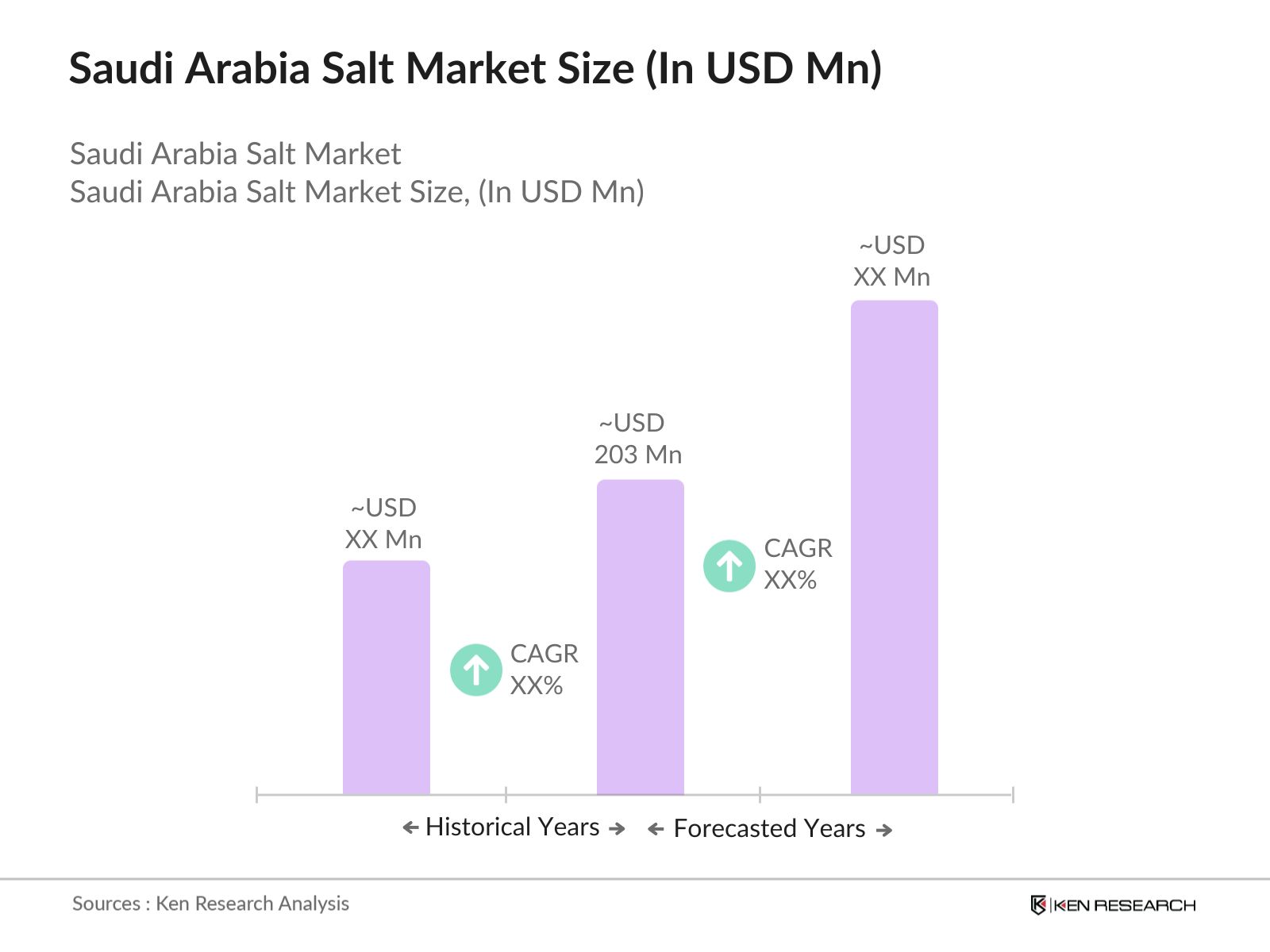

- The Saudi Arabia Salt Market is valued at USD 203 million, driven by its extensive use across various industries, including chemical processing, food preservation, and water treatment. The countrys strategic geographical location and access to both the Red Sea and the Persian Gulf allow for efficient salt extraction and export. Additionally, government initiatives promoting the production of industrial salts for domestic use and export have played a critical role in shaping the market's growth. Reliable data from Saudi governmental sources indicate robust market activity supported by ongoing industrial expansion and infrastructural development.

- Key cities like Jeddah, Riyadh, and Dammam dominate the salt market due to their industrial capacity and proximity to coastal salt extraction operations. Jeddah, in particular, benefits from its extensive port infrastructure, enabling large-scale salt exports. Riyadh, being the commercial hub of Saudi Arabia, drives significant demand for industrial salts used in the manufacturing and chemical sectors. This geographic dominance is attributed to well-developed infrastructure and proximity to both extraction sites and key markets for distribution.

- The Saudi Food and Drug Authority (SFDA) has implemented strict standards for salt used in food products, focusing on sodium content and purity. In 2023, the SFDA revised its guidelines to reduce the permissible sodium levels in processed foods, aligning with global health recommendations. These regulations aim to promote healthier consumption patterns and ensure that the salt used in food processing meets stringent quality standards. Producers must comply with these regulations to maintain market access and avoid penalties.

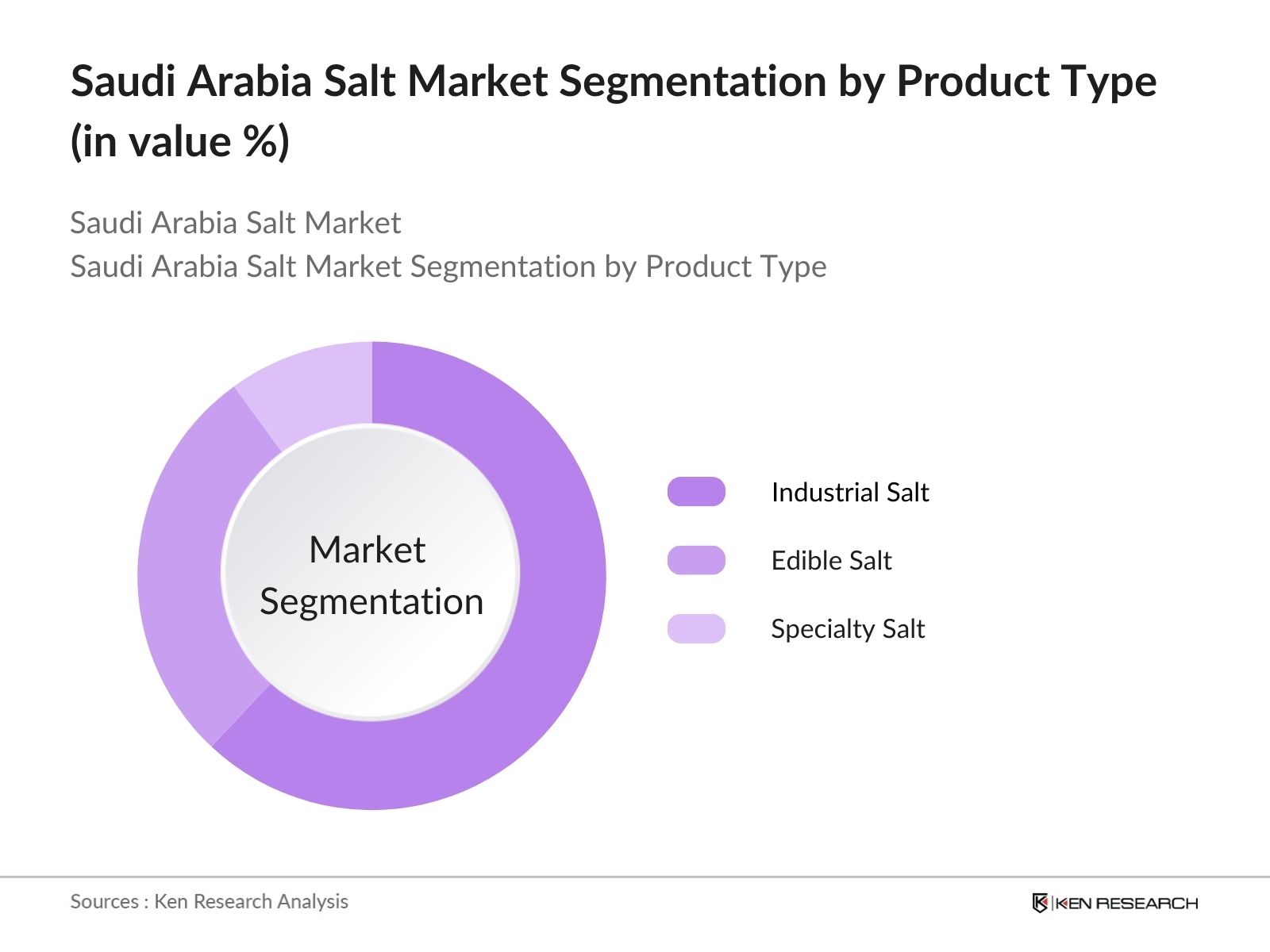

Saudi Arabia Salt Market Segmentation

- By Product Type: The market is segmented by product type into Industrial Salt, Edible Salt, and Specialty Salt. Industrial salt, widely used in sectors like chemical manufacturing and de-icing, has been the dominant sub-segment due to the extensive use of salt in industries like petrochemical processing and wastewater treatment. The demand for industrial salt continues to surge with the increasing number of industrial projects under the governments Vision 2030 plan.

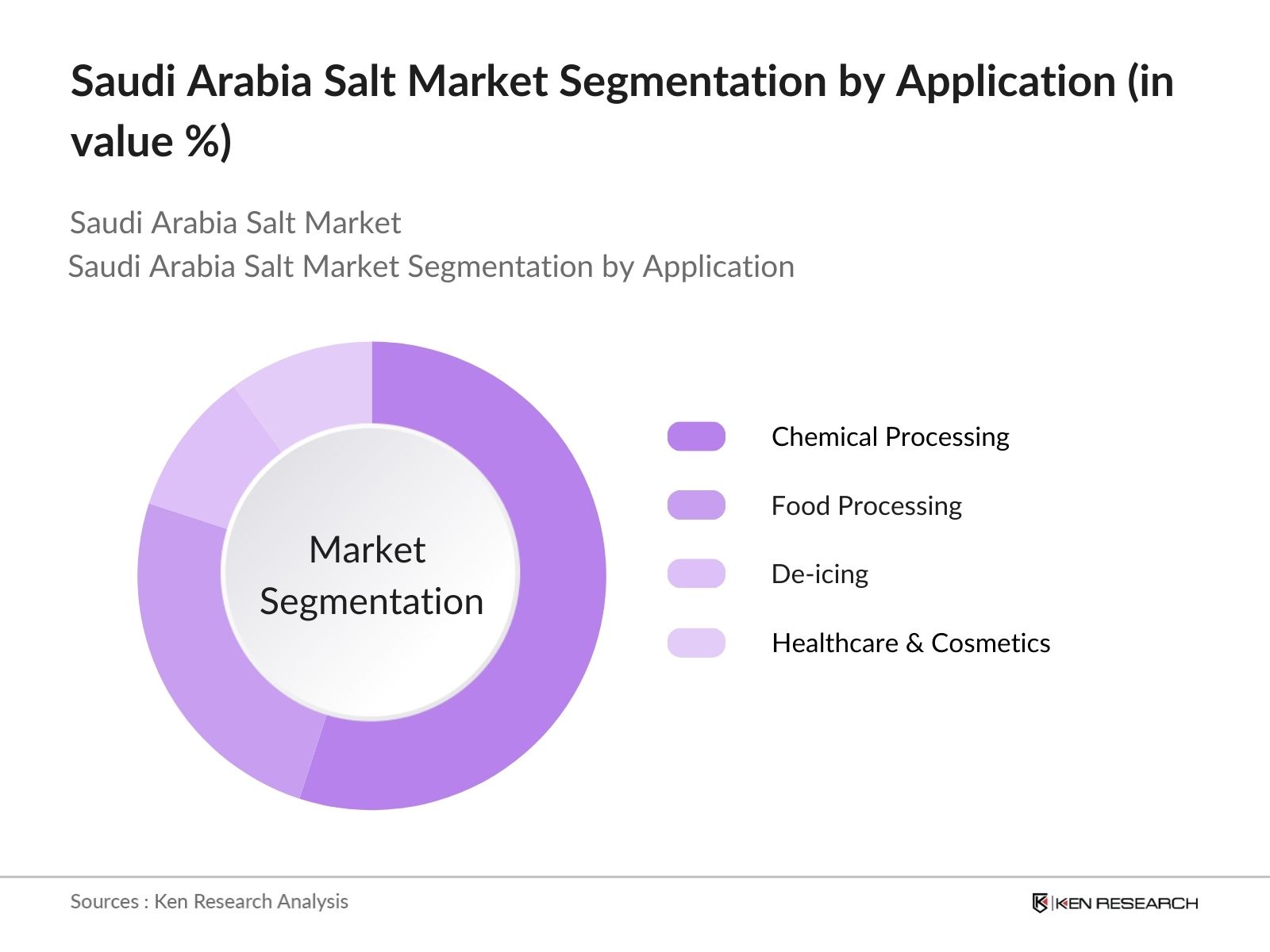

- By Application: The salt market is also segmented by application into Chemical Processing, Food Processing, De-icing, and Healthcare & Cosmetics. Chemical processing remains the leading sub-segment as industrial salt is an essential raw material in producing chlorine, caustic soda, and soda ash, which are crucial for numerous manufacturing processes. This dominance is due to the vast chemical industry in Saudi Arabia and its reliance on locally sourced raw materials.

Saudi Arabia Salt Market Competitive Landscape

The Saudi Arabia Salt Market is primarily dominated by a few key players who control significant shares in production and distribution. Companies like the Saudi Saline Water Conversion Corporation (SWCC) lead the market, leveraging government support and large-scale infrastructure. International players such as Tata Salt and Cargill Incorporated also maintain a strong presence through their involvement in industrial salt production.

The competitive landscape highlights the concentrated nature of the market, where a few players hold a majority of the market share due to established supply chains, government contracts, and extensive infrastructure investments.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Product Portfolio |

Market Share (%) |

Revenue (USD Mn) |

Geographic Focus |

Strategic Partnerships |

Production Capacity |

|

Saudi Saline Water Conversion Corp. |

1974 |

Riyadh |

|||||||

|

Tata Salt |

1983 |

India |

|||||||

|

Cargill Incorporated |

1865 |

U.S. |

|||||||

|

K+S AG |

1889 |

Germany |

|||||||

|

Al Kout Industrial Projects Co. |

1983 |

Kuwait |

Saudi Arabia Salt Industry Analysis

Market Growth Drivers

- Rising Demand for Industrial Salt (Chemical Manufacturing, De-icing): The demand for industrial salt in Saudi Arabia is seeing a surge, driven by its critical role in chemical manufacturing and de-icing applications. In 2023, Saudi Arabia produced 3.5 million tons of salt, primarily used in chemical industries like chlor-alkali production and soda ash manufacturing, which are essential for manufacturing detergents, glass, and other industrial chemicals. Additionally, the salt demand for de-icing roads in colder neighboring regions such as Jordan and northern areas is rising, contributing to regional exports. Saudi Arabias growing trade relations with GCC countries also boost export numbers significantly, pushing the demand further.

- Growing Use in Food Preservation and Flavors (Food Processing, Culinary Uses): Salt plays a fundamental role in Saudi Arabias food processing industry, with growing use in food preservation and flavoring, which has driven demand up. In 2023, the food industry accounted for over 20% of the total salt consumption in Saudi Arabia. This trend is fueled by the rising consumption of processed foods and the expanding quick-service restaurant (QSR) industry. Saudi Arabias growing urbanization and lifestyle changes have resulted in an increased reliance on packaged and preserved foods, directly impacting the demand for salt in food processing and culinary applications.

- Expansion of Salt-Based Health Products (Cosmetic, Bath Salts): The health and wellness sector in Saudi Arabia is increasingly incorporating salt-based products, especially in cosmetics and therapeutic bath salts. As of 2022, there was a significant rise in the use of salt-based beauty and skincare products, particularly driven by consumer demand for natural and organic ingredients. Saudi Arabia's cosmetics market was valued at around $2 billion in 2023, with salt-based exfoliants and bath salts being a popular segment. This expansion is supported by Saudi Arabias focus on diversifying its economy through non-oil industries, encouraging growth in health and wellness products.

Market Challenges

- Volatility in Raw Material Costs (Energy Costs, Production Input): One of the major challenges faced by Saudi Arabia's salt industry is the volatility of raw material costs, especially energy, which is a component in salt production. In 2022, Saudi Arabias electricity tariffs increased by 10%, impacting energy-intensive industries like salt extraction and purification. These fluctuations in energy prices add unpredictability to production costs, making it harder for producers to maintain stable profit margins. Furthermore, the rising cost of other production inputs, such as labor and packaging materials, contributes to increased operational expenses.

- Environmental Impact of Salt Extraction (Sustainability Challenges): The environmental impact of large-scale salt extraction has raised sustainability concerns in Saudi Arabia, particularly regarding water usage and land degradation. Salt production, especially through solar evaporation, requires vast amounts of water, which is a scarce resource in the region. In 2023, the country faced heightened scrutiny over the ecological footprint of salt mining, with reports indicating that it contributes to soil salinization and the disruption of local ecosystems. This has led to calls for more sustainable and eco-friendly production techniques to mitigate the environmental risks associated with salt extraction.

Saudi Arabia Salt Market Future Outlook

Over the next five years, the Saudi Arabia Salt Market is expected to experience substantial growth due to increasing demand across the industrial, food processing, and healthcare sectors. Continuous advancements in salt production technologies, the expansion of desalination projects, and the growing trend toward specialty salts for health and wellness purposes are key factors driving this growth. In particular, the countrys industrial sector is anticipated to increase its consumption of salt for chemical processing, spurred by government initiatives under Vision 2030.

Moreover, rising investments in renewable energy for salt extraction and processing will likely create more sustainable production methods, reducing the environmental footprint of the salt industry. This, coupled with a growing demand for low-sodium alternatives and specialty salts, offers exciting opportunities for expansion.

Market Opportunities

- Technological Advancements in Salt Purification: Advancements in salt purification technology offer new opportunities for Saudi Arabia's salt industry. Modern purification processes, such as membrane filtration and ion-exchange, can improve the quality of industrial and food-grade salt by reducing impurities. In 2023, several Saudi producers began investing in advanced salt refining technologies to meet higher purity standards required by the pharmaceutical and food industries. These innovations not only enhance product quality but also improve efficiency, reducing water and energy consumption during production.

- Investment in Renewable Energy for Salt Production (Solar, Wind): Saudi Arabia's Vision 2030 includes significant investments in renewable energy, which presents an opportunity for the salt industry to reduce its carbon footprint. By leveraging solar and wind power, salt producers can lower their reliance on fossil fuels and reduce energy costs. In 2023, renewable energy projects in Saudi Arabia generated over 5,000 MW, with some salt production facilities already transitioning to solar-powered evaporation methods. These initiatives align with global sustainability trends and provide a competitive advantage for producers focused on eco-friendly practices

Scope of the Report

|

||

|

By Distribution Channel |

Chemical Processing Food Processing De-icing Healthcare and Cosmetics |

|

|

By Application |

|

|

|

By Consumer Group |

Direct Sales Retail Online Sales |

|

|

By Region |

North East West South |

Products

Key Target Audience

Industrial Salt Manufacturers

Chemical Processing Companies

Food Processing Enterprises

Healthcare and Cosmetic Companies

Government and Regulatory Bodies (Saudi Food and Drug Authority, Saudi Standards, Metrology and Quality Organization)

Export and Trade Organizations

Investors and Venture Capitalist Firms

Industrial Equipment Providers

Companies

Major Players in the Saudi Arabia Salt Market

Saudi Saline Water Conversion Corporation (SWCC)

Tata Salt

Cargill Incorporated

K+S AG

Al Kout Industrial Projects Co.

Mitsui & Co., Ltd.

ICL Group Ltd.

Compass Minerals

Nouryon

Morton Salt

China National Salt Industry Corporation (CNSIC)

Salinen Austria AG

Socit Nationale d'Exploitation et de Distribution des Eaux (SONEDE)

Salt International

Al Ghadeer Group

Table of Contents

1. Saudi Arabia Salt Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Salt Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Salt Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Industrial Salt (Chemical Manufacturing, De-icing)

3.1.2. Growing Use in Food Preservation and Flavors (Food Processing, Culinary Uses)

3.1.3. Expansion of Salt-Based Health Products (Cosmetic, Bath Salts)

3.1.4. Increasing Export Demand from Neighboring Countries (GCC Trade)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Costs (Energy Costs, Production Input)

3.2.2. Environmental Impact of Salt Extraction (Sustainability Challenges)

3.2.3. Competition from International Markets (Imports)

3.3. Opportunities

3.3.1. Technological Advancements in Salt Purification

3.3.2. Investment in Renewable Energy for Salt Production (Solar, Wind)

3.3.3. Growing Demand for Low-Sodium Alternatives (Health Trends)

3.4. Trends

3.4.1. Increasing Use of Specialty Salts (Sea Salt, Himalayan Salt)

3.4.2. Adoption of Sustainable Production Techniques (Eco-friendly Solutions)

3.4.3. Innovative Packaging Solutions for Retail Salt (Consumer Packaging)

3.5. Government Regulation

3.5.1. Saudi Food and Drug Authority (SFDA) Salt Standards

3.5.2. Import/Export Regulations (Customs Tariffs, Trade Agreements)

3.5.3. Environmental Policies for Salt Extraction (Sustainable Practices)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Producers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Saudi Arabia Salt Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Industrial Salt (Inorganic Chemicals, Water Treatment)

4.1.2. Edible Salt (Table Salt, Sea Salt)

4.1.3. Specialty Salt (Low-Sodium, Himalayan)

4.2. By Application (In Value %)

4.2.1. Chemical Processing

4.2.2. Food Processing

4.2.3. De-icing

4.2.4. Healthcare and Cosmetics

4.3. By End-User (In Value %)

4.3.1. Industrial

4.3.2. Residential

4.3.3. Commercial (Hotels, Restaurants)

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Retail (Supermarkets, Hypermarkets)

4.4.3. Online Sales

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. Saudi Arabia Salt Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Saudi Saline Water Conversion Corporation (SWCC)

5.1.2. Al Kout Industrial Projects Company

5.1.3. Tata Salt

5.1.4. ICL Group Ltd.

5.1.5. Cargill Incorporated

5.1.6. Mitsui & Co., Ltd.

5.1.7. K+S AG

5.1.8. Nouryon

5.1.9. Compass Minerals

5.1.10. China National Salt Industry Corporation (CNSIC)

5.1.11. Morton Salt

5.1.12. Al Ghadeer Group

5.1.13. Salinen Austria AG

5.1.14. Socit Nationale d'Exploitation et de Distribution des Eaux (SONEDE)

5.1.15. Salt International

5.2 Cross Comparison Parameters (Number of Employees, Revenue, Market Presence, Product Portfolio, Production Capacity, Geographic Focus, R&D Investments, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Salt Market Regulatory Framework

6.1. Saudi Standards, Metrology and Quality Organization (SASO) Guidelines

6.2. Environmental Compliance for Salt Extraction

6.3. Certification Processes for Edible Salt

7. Saudi Arabia Salt Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Salt Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Salt Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the ecosystem of the Saudi Arabia Salt Market by identifying key stakeholders and trends through comprehensive desk research. Databases such as proprietary market intelligence and governmental resources were utilized to gather critical market-level data.

Step 2: Market Analysis and Construction

In this stage, historical market data was compiled to assess salt production, consumption patterns, and industry output. The data was analyzed using bottom-up and top-down methodologies to ensure precision in market estimates, particularly focusing on industrial and food-grade salt consumption.

Step 3: Hypothesis Validation and Expert Consultation

A series of in-depth interviews were conducted with market experts from industrial and food processing sectors to validate the findings. These interviews helped confirm production levels, market trends, and future expectations for the salt industry.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all collected data and insights into a coherent market report, ensuring accuracy and validation from multiple sources. This process involved cross-referencing data from primary interviews and secondary research to create a complete and reliable market analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia Salt Market?

The Saudi Arabia Salt Market is valued at USD 203 million. This growth is driven by the country's increasing industrial demand and its strategic position as a regional exporter of salt.

02. What are the challenges in the Saudi Arabia Salt Market?

The key challenges in Saudi Arabia Salt Market include fluctuating raw material costs, environmental concerns related to salt extraction, and growing competition from international markets, particularly imports.

03. Who are the major players in the Saudi Arabia Salt Market?

Major players in Saudi Arabia Salt Market include Saudi Saline Water Conversion Corporation, Tata Salt, Cargill Incorporated, K+S AG, and Al Kout Industrial Projects Co., all of which dominate due to their large-scale production capacities and regional influence.

04. What are the growth drivers of the Saudi Arabia Salt Market?

The Saudi Arabia Salt Market is driven by increasing demand for industrial salt in chemical processing, rising use of salt in food preservation, and expanding exports to neighboring Gulf countries.

05. What are the trends in the Saudi Arabia Salt Market?

Trends in Saudi Arabia Salt Market include the adoption of renewable energy for salt production, a growing shift toward specialty salts like low-sodium varieties, and technological advancements in purification processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.