Saudi Arabia Tire Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD978

October 2024

98

About the Report

Saudi Arabia Tire Market Overview

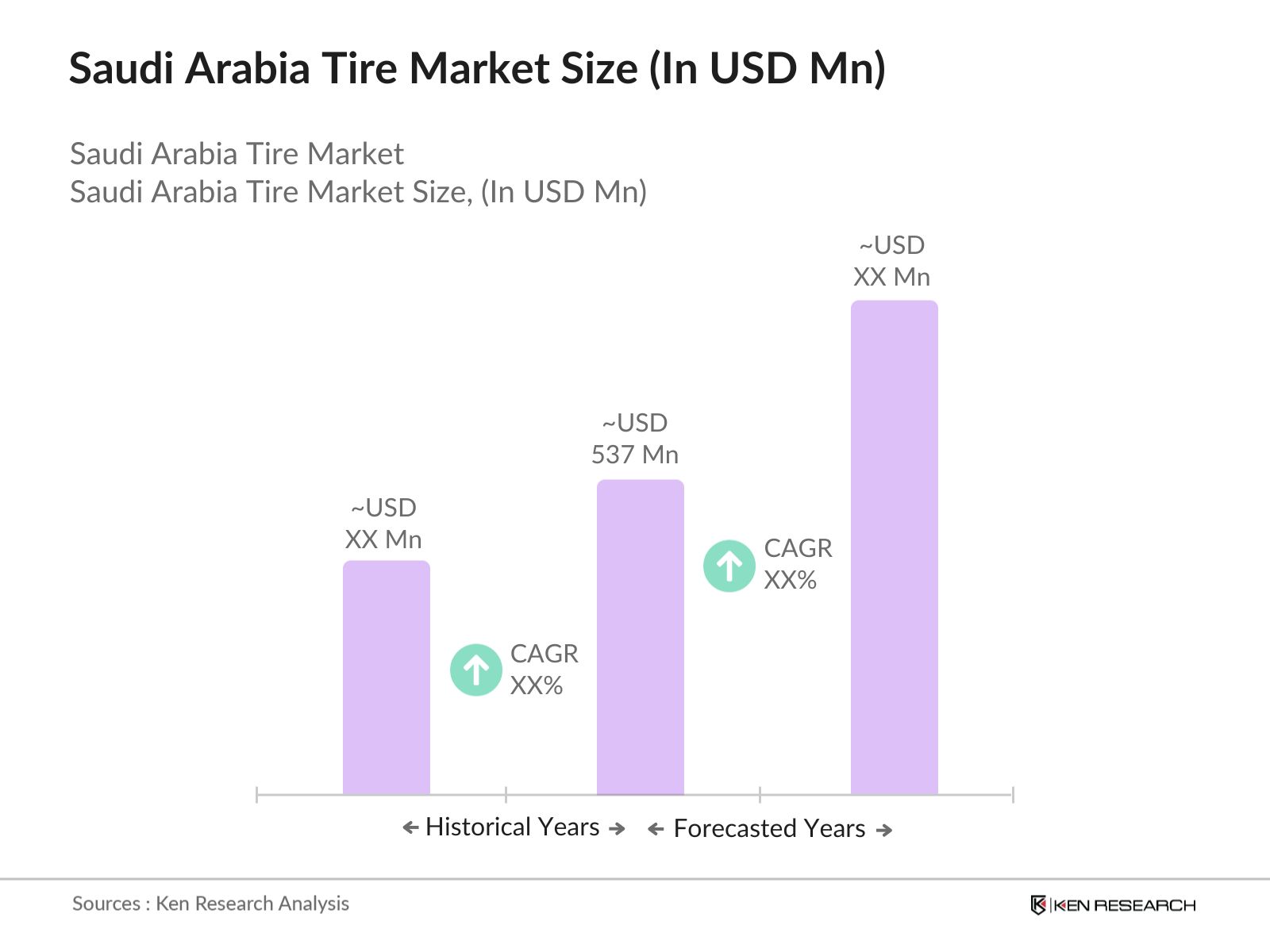

The Saudi Arabia tire market is valued at USD 537 million, reflecting its pivotal role in the nation's growing automotive sector. The market is largely driven by a rapidly increasing vehicle population, particularly in metropolitan areas, which has fueled demand for high-performance and durable tires. Additionally, the government's focus on improving road infrastructure and transportation networks has led to significant growth in tire demand for commercial vehicles. This expansion of road transport services, combined with rising consumer preferences for quality tires, has underpinned the markets growth.

Riyadh and Jeddah are the dominant cities in the Saudi Arabia tire market, with Riyadh being the capital and a central hub for commerce and logistics, while Jeddah serves as a key port city facilitating trade. The dominance of these cities is further bolstered by their high population density, increased vehicle usage, and superior infrastructure, which drive substantial tire sales. Furthermore, both cities are major contributors to the country's economic activity, making them significant centers of tire consumption.Fuel Efficiency and Carbon Emission Standards Saudi Arabia has implemented strict fuel efficiency and carbon emission standards that directly affect tire manufacturers. The Saudi Energy Efficiency Center (SEEC) enforces regulations requiring tires to meet certain rolling resistance criteria to reduce fuel consumption. In 2023, the government mandated that all new vehicles must meet specific carbon emission standards, which led to a rise in demand for energy-efficient tires that comply with these regulations.

Saudi Arabia Tire Market Segmentation

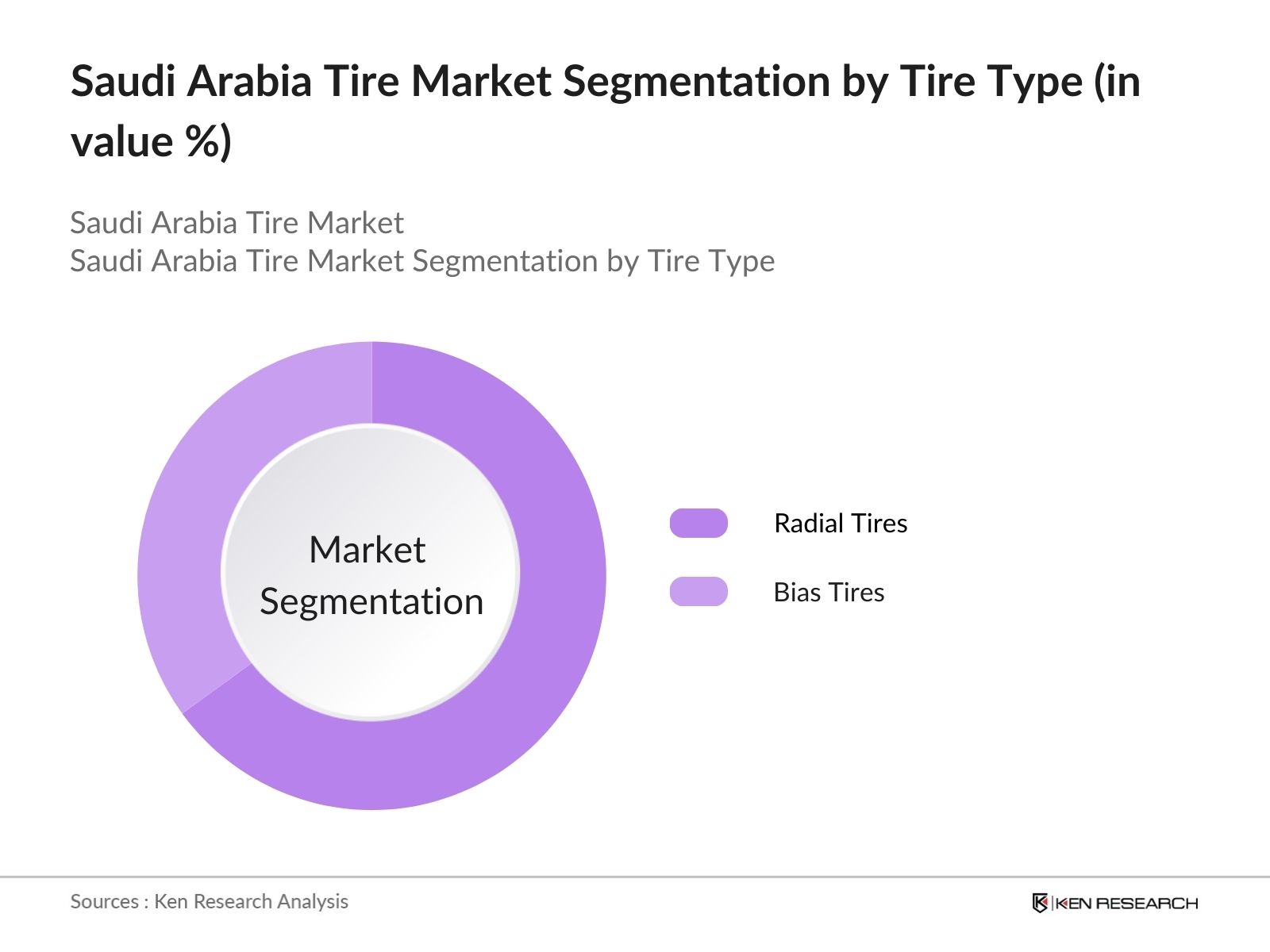

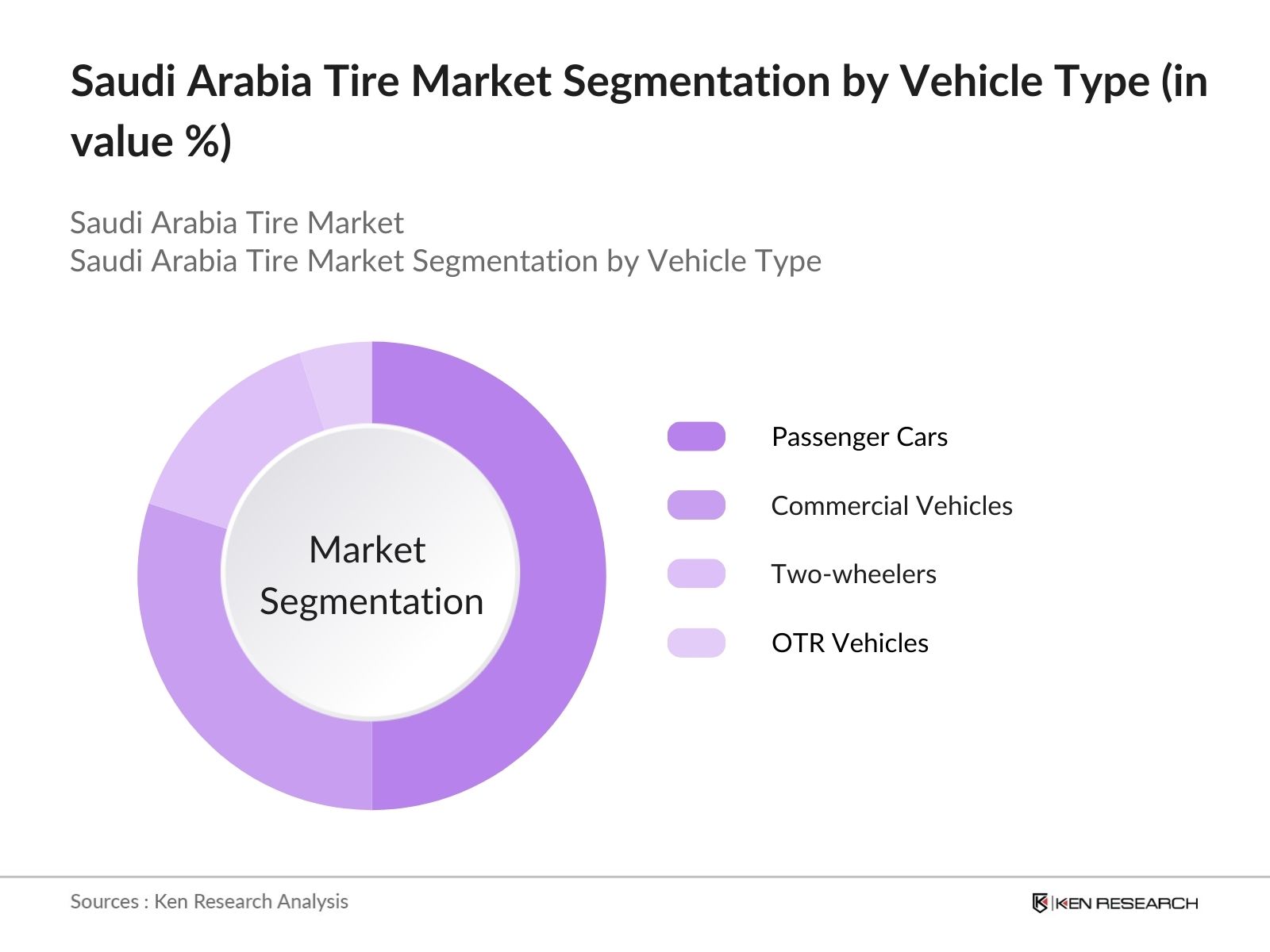

The Saudi Arabia tire market is segmented by tire type and by vehicle type.

- By Tire Type: The Saudi Arabia tire market is segmented by tire type into radial tires and bias tires. Radial tires dominate the market, accounting for over 65% of the market share in 2023. This dominance is attributed to their superior durability, better fuel efficiency, and enhanced performance compared to bias tires, making them the preferred choice for both passenger vehicles and commercial fleets. With an increasing focus on fuel efficiency and comfort, the demand for radial tires continues to grow across Saudi Arabia's urban and rural areas.

- By Vehicle Type: The Saudi Arabia tire market is also segmented by vehicle type into passenger cars, commercial vehicles, two-wheelers, and off-the-road (OTR) vehicles. Passenger cars lead the market with a share of 50% in 2023, driven by the increasing ownership of personal vehicles in urban regions like Riyadh and Jeddah. The rising affluence among Saudi consumers, combined with a growing interest in high-performance and luxury vehicles, has led to a substantial demand for premium tires in this segment. The commercial vehicle segment is also gaining traction, fueled by expanding logistics and transportation services.

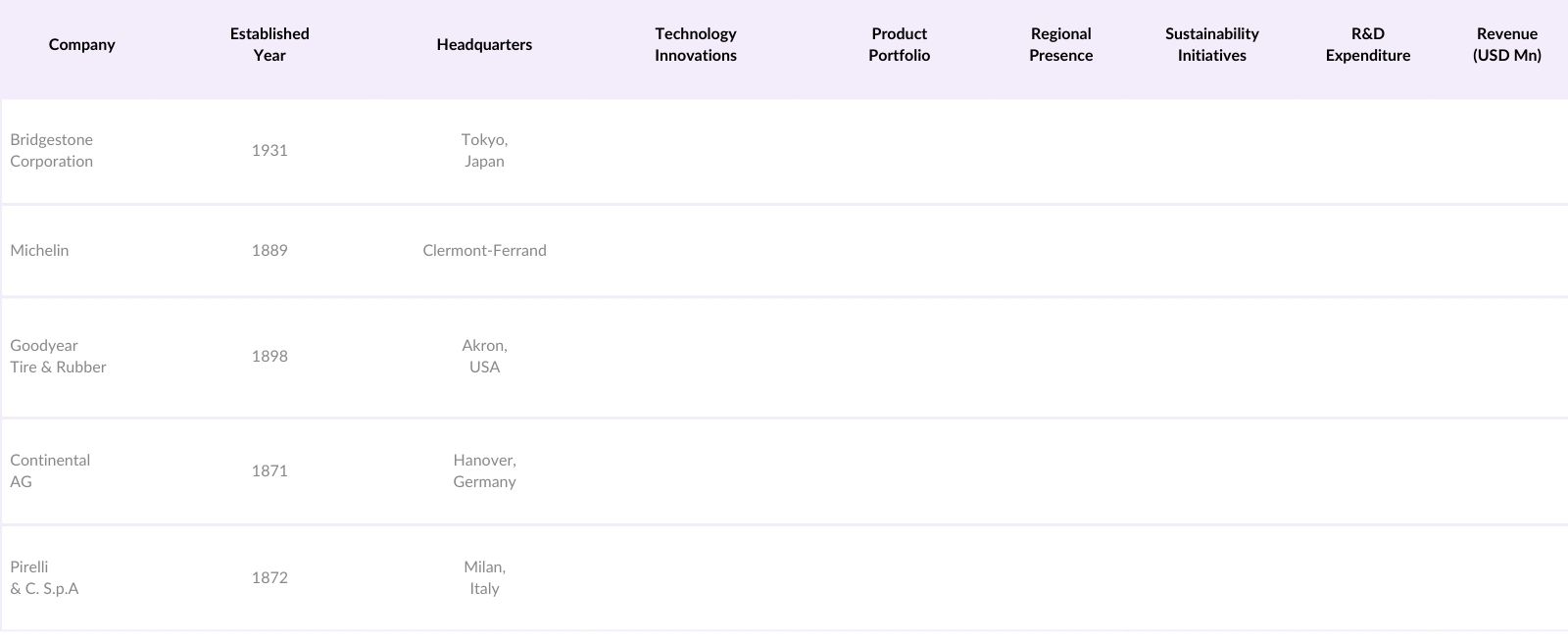

Saudi Arabia Tire Market Competitive Landscape

The Saudi Arabia tire market is dominated by a mix of international and regional players, each bringing unique technological advancements and distribution networks. The competitive landscape is shaped by the increasing consumer demand for high-quality tires, the emergence of eco-friendly tire technologies, and the growing number of vehicle registrations in the country. The Saudi Arabia tire market is highly competitive, with global giants like Bridgestone and Michelin leading the market alongside regional players. These companies compete on the basis of technological innovation, extensive distribution networks, and strong brand recognition. Their dominance is further strengthened by the increasing demand for premium tires and advanced tire technologies, such as smart tires and energy-efficient tires, which cater to the evolving consumer preferences in Saudi Arabia.

Saudi Arabia Tire Market Analysis

Growth Drivers

- Rising Automotive Industry, The Saudi Arabian automotive industry has seen steady growth due to increasing domestic demand for vehicles. In 2023, Saudi Arabia imported 543,000 new vehicles, driven by rising per capita income and government initiatives to diversify the economy under Vision 2030. This growth has directly fueled the tire market, as vehicle sales spur tire replacements and aftermarket services. The Ministry of Industry and Mineral Resources has reported increased investments in the automotive sector, leading to a greater need for high-quality tires, particularly in urban regions like Riyadh and Jeddah.

- Expanding Transportation and Logistics Sectors Saudi Arabias logistics and transportation sectors have witnessed significant growth, with the countrys strategic location acting as a hub for regional trade. In 2023, the logistics sector's value reached $36 billion, as reported by the Saudi Ministry of Transport and Logistic Services. The increase in freight traffic and commercial vehicle usage has driven the demand for durable tires, especially for trucks and heavy-duty vehicles. As Saudi Arabia continues its infrastructure development under Vision 2030, the tire market is expected to see increased demand across both commercial and consumer segments.

- Increasing Vehicle Parc Saudi Arabia's vehicle parc, which refers to the total number of vehicles in use, stood at over 11 million units in 2023, as per the General Authority for Statistics (GASTAT). The aging vehicle fleet necessitates tire replacements, creating a consistent demand for both new and replacement tires. This growing vehicle base is bolstered by the increasing urbanization rate, which reached 84% in 2023, according to the United Nations data, further driving tire consumption in both passenger and commercial vehicle categories.

Market Challenges

- Fluctuating Raw Material Prices Raw materials like rubber and synthetic polymers are essential for tire production. However, their prices have been volatile due to global supply chain disruptions. In 2023, the price of natural rubber increased by 15% from 2022, driven by reduced exports from key suppliers like Thailand and Indonesia, as reported by the International Rubber Study Group (IRSG). This fluctuation affects tire manufacturing costs, making it challenging for manufacturers in Saudi Arabia to maintain stable pricing while preserving profit margins.

- Stringent Environmental Regulations: The Saudi government has implemented stricter environmental regulations to reduce carbon emissions, which affect the tire industry. The National Environmental Strategy mandates that tire manufacturing must adhere to eco-friendly practices, limiting the use of certain raw materials and promoting recycling. By 2023, the Ministry of Environment, Water and Agriculture reported that compliance costs for tire manufacturers had risen by 8%, impacting production efficiency. These regulations also promote the use of retreaded and recycled tires, placing additional pressure on traditional tire manufacturers.

Saudi Arabia Tire Market Future Outlook

Over the next five years, the Saudi Arabia tire market is expected to witness considerable growth. This expansion will be driven by several key factors, including the government's continued investments in infrastructure development, the rise of electric vehicles (EVs), and growing consumer demand for eco-friendly and durable tire solutions. Additionally, technological advancements in tire manufacturing and the increased focus on sustainability are set to fuel further market growth. Tire manufacturers will likely invest heavily in research and development to cater to the evolving needs of Saudi consumers, particularly in urban regions where vehicle ownership is on the rise.

Market Opportunities

- Advancements in Tire Technology (Smart Tires, Run-flat Tires): Technological innovations such as smart tires and run-flat tires are gaining momentum in Saudi Arabia, especially among premium vehicle owners. In 2023, approximately 50,000 smart tires were sold in the country, equipped with sensors that monitor tire pressure, wear, and temperature, improving safety and performance. The Saudi market is seeing a rising demand for these advanced products, particularly in urban areas, where drivers value safety and convenience. The Ministry of Industry and Mineral Resources expects a 5% increase in technological adoption by tire manufacturers.

- Increasing Investments in Tire Recycling Programs In 2023, Saudi Arabia launched several tire recycling initiatives under the Saudi Green Initiative, aimed at reducing environmental waste and promoting circular economy practices. The National Recycling Center announced that over 2 million tires were recycled in 2023, contributing to sustainable tire disposal and raw material recovery. These programs are supported by government funding and private sector investments, providing opportunities for tire manufacturers to collaborate with recycling companies and introduce eco-friendly products into the market.

Scope of the Report

Products

Key Target Audience

Tire Manufacturers and Suppliers

Automotive OEMs (Original Equipment Manufacturers)

Retailers and Distributors of Tires

Logistics and Transportation Companies

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Automotive Service Providers

Investors and Venture Capitalist Firms

Commercial Fleet Operators

Companies

Players Mentioned in the Market:

Bridgestone Corporation

Michelin

Goodyear Tire & Rubber Company

Continental AG

Pirelli & C. S.p.A

Yokohama Rubber Company

Hankook Tire & Technology Co., Ltd.

Toyo Tire Corporation

Cooper Tire & Rubber Company

Kumho Tire

Apollo Tyres Ltd.

MRF Ltd.

ZC Rubber

Sumitomo Rubber Industries, Ltd.

Giti Tire

Table of Contents

Saudi Arabia Tire Market Overview

Definition and Scope

Market Taxonomy

Market Dynamics and Trends

Tire Demand Growth (Passenger, Commercial, Specialty Tires)

Market Segmentation Overview

Saudi Arabia Tire Market Size (In USD Mn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

Saudi Arabia Tire Market Analysis

Growth Drivers

Rising Automotive Industry

Expanding Transportation and Logistics Sectors

Increasing Vehicle Parc

Surge in Consumer Preference for High-performance Tires

Market Challenges

Fluctuating Raw Material Prices

Stringent Environmental Regulations

Counterfeit Products Penetration

Opportunities

Advancements in Tire Technology (Smart Tires, Run-flat Tires)

Increasing Investments in Tire Recycling Programs

Potential for Electric Vehicle Tire Development

Trends

Rising Demand for Eco-friendly Tires

Adoption of Tire Pressure Monitoring Systems (TPMS)

Growth in Online Tire Sales Platforms

Government Regulations

Fuel Efficiency and Carbon Emission Standards

Import and Export Tariffs

Vehicle Safety and Maintenance Policies

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

Saudi Arabia Tire Market Segmentation

By Tire Type (In Value %)

Radial Tires

Bias Tires

By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles

Two-wheelers

Off-the-road (OTR) Vehicles

By Distribution Channel (In Value %)

OEM (Original Equipment Manufacturer)

Aftermarket

By End-user (In Value %)

Personal Use

Industrial and Commercial Use

Agriculture

Mining

By Region (In Value %)

Riyadh

Jeddah

Eastern Province

Mecca

Medina

Saudi Arabia Tire Market Competitive Analysis

Detailed Profiles of Major Companies

Bridgestone Corporation

Michelin

Goodyear Tire & Rubber Company

Continental AG

Pirelli & C. S.p.A

Yokohama Rubber Company

Hankook Tire & Technology Co., Ltd.

Toyo Tire Corporation

Cooper Tire & Rubber Company

Kumho Tire

Apollo Tyres Ltd.

MRF Ltd.

ZC Rubber

Sumitomo Rubber Industries, Ltd.

Giti Tire

Cross Comparison Parameters

Market Share

Annual Revenue

Production Capacity

Number of Patents

Regional Presence

Technological Innovations

Product Portfolio

Sustainability Initiatives

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

Saudi Arabia Tire Market Regulatory Framework

Environmental Standards and Compliance

Import and Export Restrictions

Certification Requirements

Vehicle Safety and Inspection Standards

Saudi Arabia Tire Market Future Size (In USD Mn)

Future Market Size Projections

Key Factors Driving Future Market Growth

Saudi Arabia Tire Market Future Segmentation

By Tire Type (In Value %)

By Vehicle Type (In Value %)

By Distribution Channel (In Value %)

By End-user (In Value %)

By Region (In Value %)

Saudi Arabia Tire Market Analysts Recommendations

TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

White Space Opportunity Analysis

Marketing and Promotional Strategies

Strategic Partnerships and Collaborations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the entire Saudi Arabia tire market ecosystem. Extensive desk research was conducted to identify all major stakeholders, ranging from tire manufacturers to regulatory bodies. This phase also included the collection of industry-level data from a combination of secondary and proprietary databases to define critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Saudi Arabia tire market was compiled and analyzed. This included examining tire penetration rates, growth trends in different vehicle segments, and tire replacement rates. The revenue analysis of major market players was also conducted to ensure accuracy in market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts, such as senior executives from tire manufacturing firms and automotive service providers. These consultations provided invaluable insights into market trends, operational efficiencies, and key growth drivers.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data from desk research, market analysis, and expert consultations into a cohesive market report. The statistics were verified using a bottom-up approach, ensuring a thorough and validated analysis of the Saudi Arabia tire market.

Frequently Asked Questions

01. How big is Saudi Arabia Tire Market?

The Saudi Arabia tire market is valued at USD 537 million. This market size is driven by the increasing vehicle population, particularly in metropolitan regions such as Riyadh and Jeddah, and the growing demand for premium and durable tires.

02. What are the challenges in Saudi Arabia Tire Market?

Challenges in the Saudi Arabia tire market include fluctuating raw material prices, which affect profit margins for manufacturers, as well as the penetration of counterfeit products in the market. These factors pose significant hurdles to market growth.

03. Who are the major players in the Saudi Arabia Tire Market?

Key players in the Saudi Arabia tire market include Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Continental AG, and Pirelli & C. S.p.A. These companies dominate the market due to their strong distribution networks, advanced tire technologies, and established brand presence.

04. What are the growth drivers of Saudi Arabia Tire Market?

The Saudi Arabia tire market is primarily driven by the rising number of vehicles on the road, expanding infrastructure projects, and increasing consumer demand for high-quality tires. The government's focus on transportation development further fuels market growth.

05. What trends are shaping the Saudi Arabia Tire Market?

Key trends in Saudi Arabia tire market include the growing adoption of eco-friendly and smart tires, the rise of online tire sales platforms, and the increasing importance of tire recycling programs in response to environmental concerns. These trends are reshaping consumer preferences and the competitive landscape.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.