Saudi Arabia Travel Insurance Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD1202

November 2024

83

About the Report

Saudi Arabia Travel Insurance Market Overview

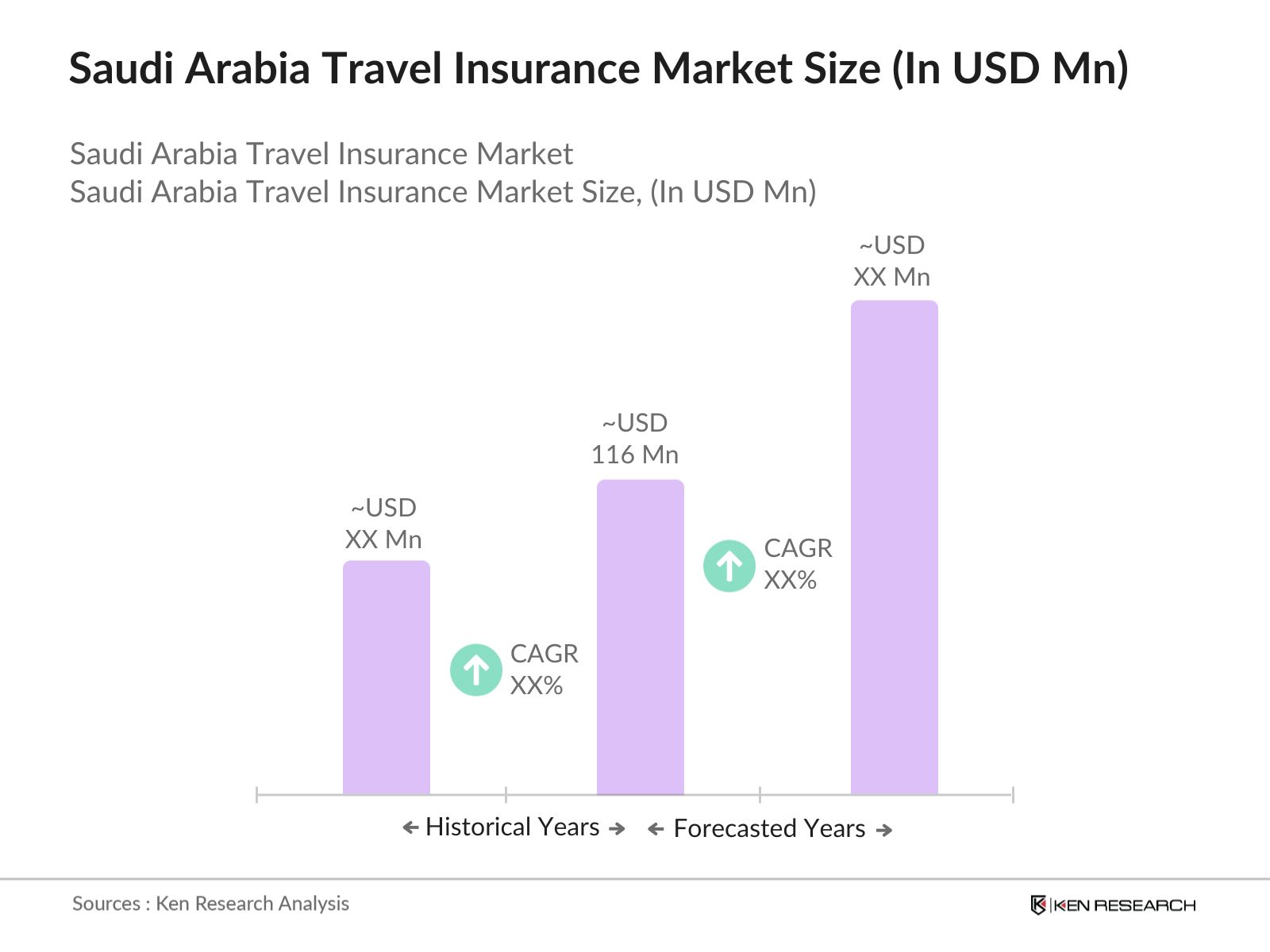

The Saudi Arabia travel insurance market is valued at USD 116 million, based on a five-year historical analysis. This market's growth is primarily driven by the increasing number of international travelers, particularly for religious tourism like Hajj and Umrah. Government regulations that mandate travel insurance for foreign visitors and pilgrims significantly contribute to this growth, as well as rising awareness about the importance of travel safety and medical coverage abroad. Dominant regions in this market include cities like Riyadh, Jeddah, and Dammam, as well as the major religious sites of Makkah and Medina. These cities lead the market due to the high volume of inbound and outbound travel, especially for religious purposes. Makkah and Medina, as pilgrimage destinations, have seen an increased demand for travel insurance due to mandatory policies for visa issuance, making these cities focal points for the insurance market.SAMA plays a key regulatory role in ensuring that travel insurance policies in Saudi Arabia meet strict standards for consumer protection and policy transparency. In 2024, SAMA enforced new guidelines requiring travel insurers to offer clear and detailed policy information, ensuring travelers are well-informed about coverage and exclusions. This regulatory framework strengthens consumer trust in travel insurance and encourages broader market adoption.

Dominant regions in this market include cities like Riyadh, Jeddah, and Dammam, as well as the major religious sites of Makkah and Medina. These cities lead the market due to the high volume of inbound and outbound travel, especially for religious purposes. Makkah and Medina, as pilgrimage destinations, have seen an increased demand for travel insurance due to mandatory policies for visa issuance, making these cities focal points for the insurance market.SAMA plays a key regulatory role in ensuring that travel insurance policies in Saudi Arabia meet strict standards for consumer protection and policy transparency. In 2024, SAMA enforced new guidelines requiring travel insurers to offer clear and detailed policy information, ensuring travelers are well-informed about coverage and exclusions. This regulatory framework strengthens consumer trust in travel insurance and encourages broader market adoption.

Saudi Arabia Travel Insurance Market Segmentation

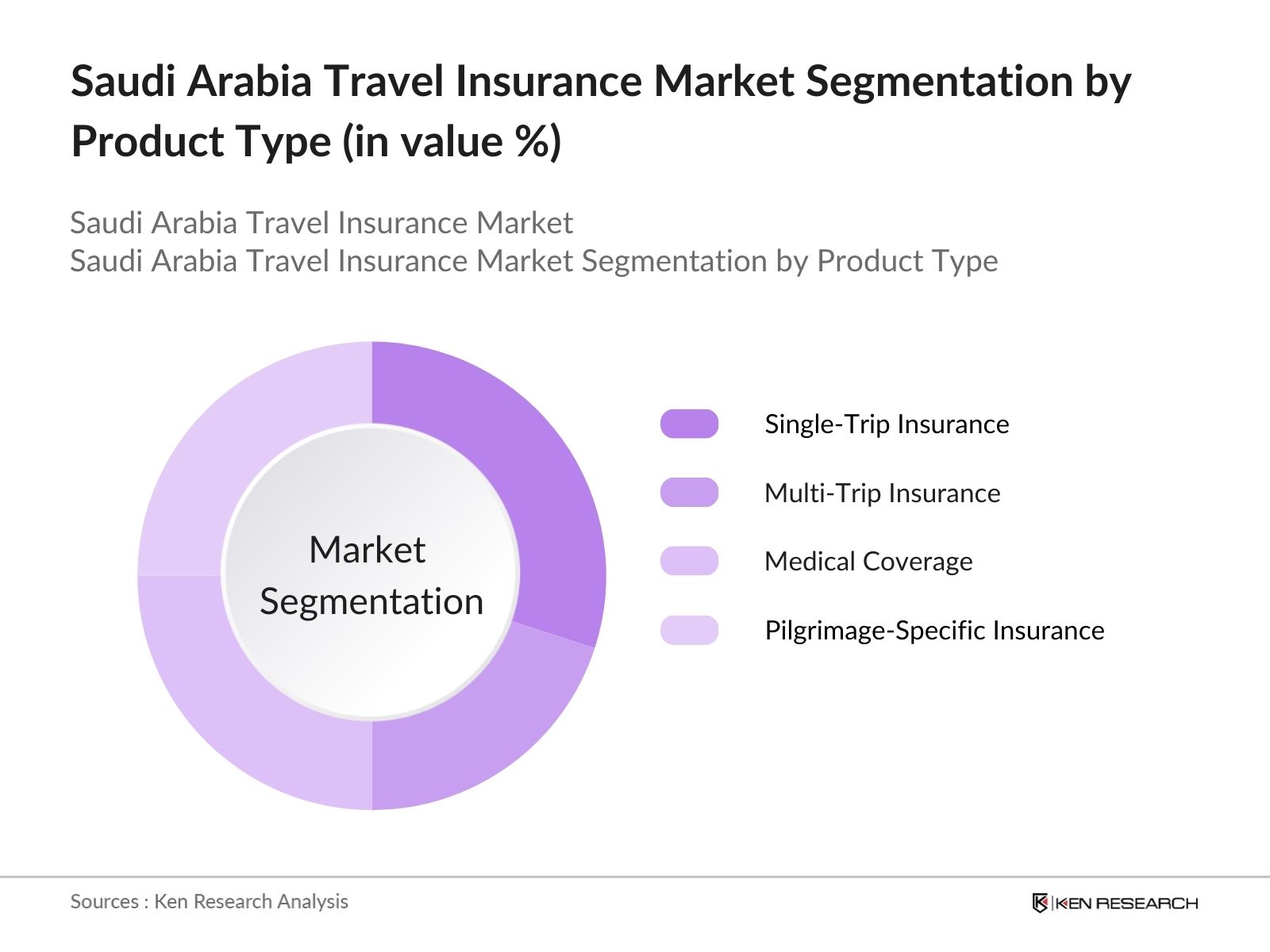

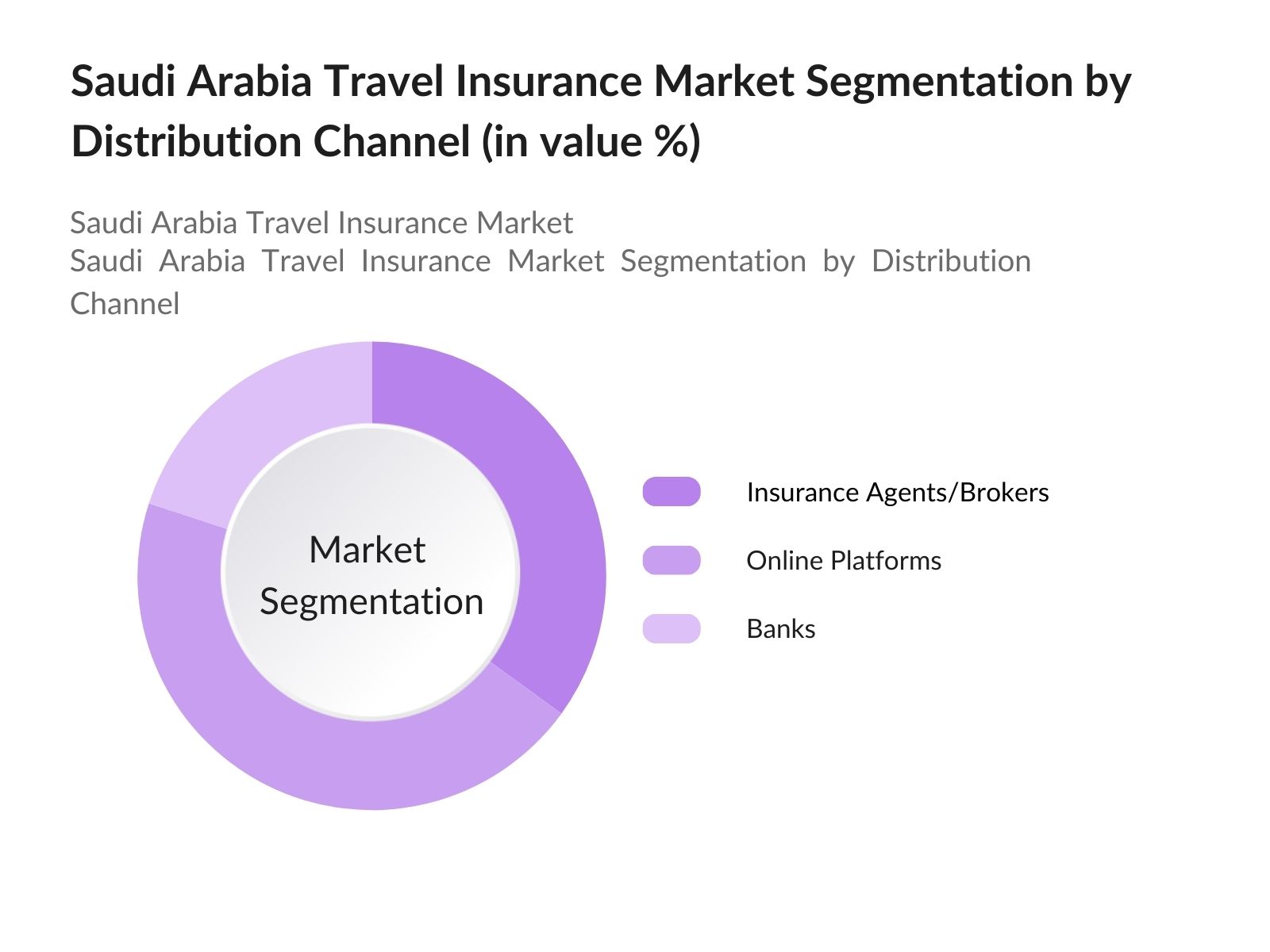

The Saudi Arabia travel insurance market is segmented by product type and by distribution channels.

- By Product Type: The Saudi Arabia travel insurance market is segmented by product type into single-trip insurance, multi-trip insurance, medical coverage, and pilgrimage-specific insurance. Among these, pilgrimage-specific insurance holds a dominant market share due to the countrys large volume of religious travelers, particularly for Hajj and Umrah. The Saudi government mandates travel insurance for pilgrims, driving significant demand. Additionally, these insurance packages are tailored to cover specific risks such as health emergencies, accidents, and trip cancellations related to pilgrimage travel.

- By Distribution Channel: The market is also segmented by distribution channels into insurance agents, online platforms, and banks. Online platforms are dominating this segment with the highest market share, primarily because of the convenience they offer to travelers. Many tech-savvy consumers prefer purchasing travel insurance digitally due to ease of access, instant policy issuance, and the ability to compare plans. This shift towards digitalization is further accelerated by the rise in mobile app usage and integration with travel booking platforms.

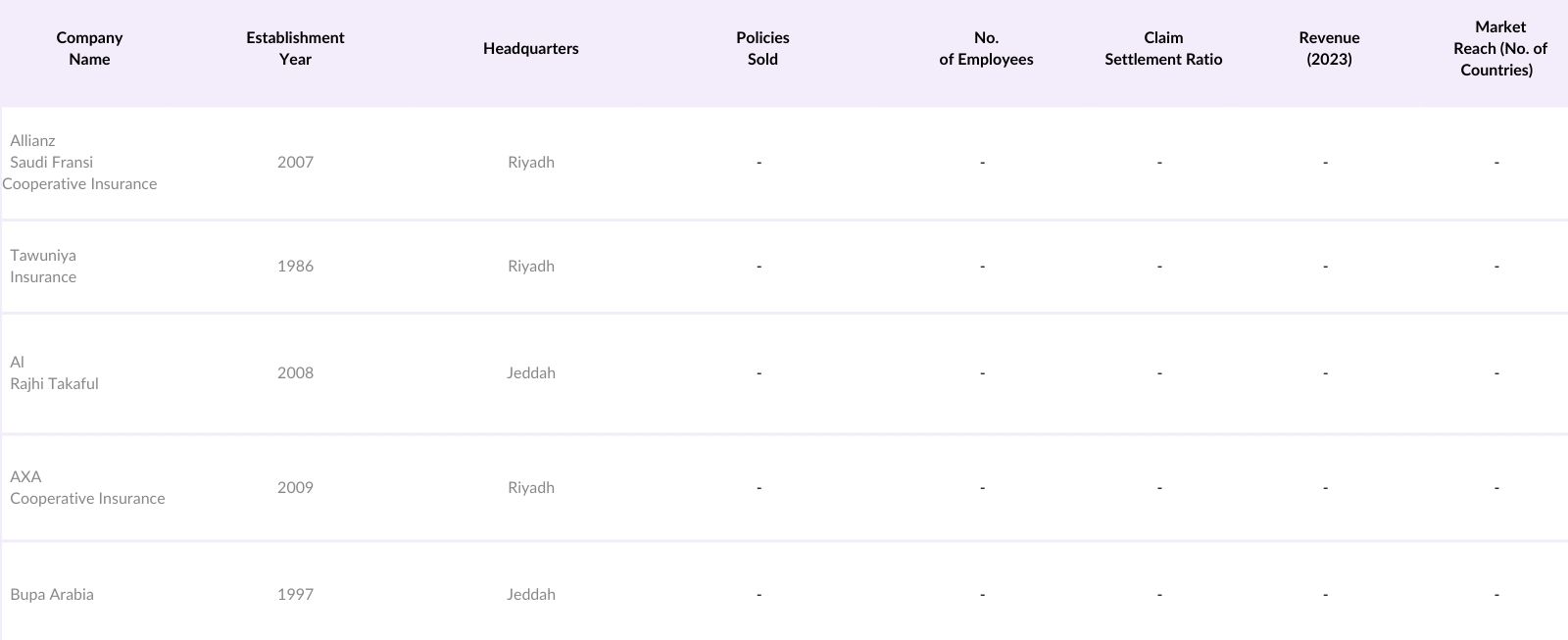

Saudi Arabia Travel Insurance Market Competitive Landscape

The Saudi Arabia travel insurance market is moderately consolidated, with several key players dominating the market. These companies are competing on the basis of comprehensive coverage options, pricing, customer service, and digital platform integration. Companies like Tawuniya and Allianz Saudi Fransi Cooperative Insurance have established significant market influence due to their partnerships with airlines and travel agencies, as well as their robust policy offerings specifically designed for pilgrimage-related travel.

Saudi Arabia Travel Insurance Market Analysis

Growth Drivers

- Increase in International Travel: In 2024, Saudi Arabia has seen significant growth in international travel, driven by the easing of global travel restrictions and increasing tourism initiatives such as Vision 2030. According to the World Bank, Saudi Arabian residents made 10.2 million outbound trips in 2023. This rise in international travel has led to a growing demand for travel insurance as a necessary safety measure. Government data from the General Authority for Statistics (GASTAT) shows a strong correlation between increased travel and the uptake of insurance policies, highlighting the importance of protection against unforeseen incidents abroad.

- Government Regulations on Mandatory Travel Insurance: The Saudi Arabian Monetary Authority (SAMA) has enforced regulations making travel insurance mandatory for obtaining travel visas, particularly for visitors going on Umrah or Hajj. This regulatory push is evident in visa application statistics, where over 5 million Umrah visas were issued in 2022. As of 2024, this policy has significantly increased travel insurance adoption, ensuring that travelers are protected against health emergencies and other travel-related risks, reducing the financial burden on individuals and the healthcare system.

- Rising Awareness of Travel Safety and Health: In 2024, the growing awareness of travel safety, including health coverage and trip protection, has contributed to the increased purchase of travel insurance. A report by the Saudi Ministry of Health highlights that 2.8 million travelers required medical assistance abroad in 2023, reinforcing the need for comprehensive insurance. Travelers are becoming increasingly aware of the risks involved in international travel, especially concerning health emergencies, lost luggage, or trip cancellations, leading to a steady rise in travel insurance policies.

Market Challenges

- Price Sensitivity Among Travelers: Saudi Arabian travelers, particularly those from middle-income groups, often show high sensitivity to the cost of travel insurance. A report from GASTAT in 2023 highlighted that nearly 40% of travelers prioritize price over coverage when selecting insurance, which limits the uptake of comprehensive policies. This price sensitivity can hinder the growth of premium travel insurance packages, as many travelers opt for basic coverage or forego insurance altogether, especially for short trips to neighboring countries.

- Limited Awareness in Non-Mandated Travel Segments: While mandatory travel insurance for Hajj and Umrah has driven significant adoption, awareness remains low in other travel segments, such as leisure or business travel. Data from the Saudi Tourism Authority shows that only 25% of outbound travelers in 2023, excluding pilgrimage, purchased travel insurance. This gap in awareness, especially in non-mandatory travel categories, presents a challenge for insurers trying to expand their market reach.

Saudi Arabia Travel Insurance Market Future Outlook

Over the next five years, the Saudi Arabia travel insurance market is expected to experience robust growth driven by increasing international tourism and the continued development of religious tourism initiatives, particularly under Vision 2030. Technological advancements, including AI and blockchain integration into the travel insurance process, are also set to boost efficiency in policy issuance and claims management, creating a more seamless customer experience. Additionally, expanding awareness of health and travel risks, as well as the ease of access to insurance through digital platforms, will support market expansion.

Market Opportunities

- Emerging Tourism Initiatives (e.g., Vision 2030): Saudi Arabia's Vision 2030 initiative aims to attract 100 million visitors annually by 2030, which opens up vast opportunities for the travel insurance market. As of 2023, tourism spending reached $19 billion, with travel insurance emerging as a key component of the travel ecosystem. This growing influx of tourists, driven by mega-projects like NEOM and Al-Ula, creates a substantial demand for specialized insurance packages tailored to both inbound and outbound travelers.

- Growth in Digital and Mobile Insurance Channels: With the rapid penetration of mobile and internet usage in Saudi Arabia, travel insurance providers have a prime opportunity to expand their digital and mobile channels. In 2023, mobile internet penetration reached 97%, and over 60% of insurance purchases were made through mobile apps or websites. This digital shift is expected to continue in 2024, providing insurers with a cost-effective way to reach tech-savvy consumers and increase policy sales.

Scope of the Report

|

Single-Trip Travel Insurance Annual Multi-Trip Insurance Medical Expense Coverage Pilgrimage-Specific Insurance |

|

|

By Application |

Leisure Travel Business Travel Study Travel |

|

By Distribution Channel |

Insurance Agents/Brokers Online Platforms Banks |

|

By Age Group |

Below 30 Years 0-50 Years Above 50 Years |

|

By Region |

North East West South |

Products

Key Target Audience

Travel Agencies

Government and Regulatory Bodies (Saudi Arabian Monetary Authority, Ministry of Hajj and Umrah)

Insurance Providers

Online Travel Aggregators

Airlines

Health Insurance Brokers

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Companies

Major Players in the Market

Allianz Saudi Fransi Cooperative Insurance

Tawuniya Insurance

Al Rajhi Takaful

AXA Cooperative Insurance

Bupa Arabia

Gulf Union Cooperative Insurance

MedGulf

Malath Insurance

Walaa Cooperative Insurance

Solidarity Saudi Takaful

Chubb Arabia Cooperative Insurance

United Cooperative Assurance (UCA)

Arabian Shield Cooperative Insurance

SAICO Cooperative Insurance

Salama Cooperative Insurance

Table of Contents

1. Saudi Arabia Travel Insurance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Industry Trends

1.4. Market Segmentation Overview

2. Saudi Arabia Travel Insurance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones

3. Saudi Arabia Travel Insurance Market Analysis

3.1. Growth Drivers

3.1.1. Increase in International Travel

3.1.2. Government Regulations on Mandatory Travel Insurance

3.1.3. Rising Awareness of Travel Safety and Health

3.1.4. Expansion of Online Platforms for Policy Purchase

3.2. Market Challenges

3.2.1. Price Sensitivity Among Travelers

3.2.2. Limited Awareness in Non-Mandated Travel Segments

3.2.3. Fraudulent Insurance Claims

3.3. Opportunities

3.3.1. Emerging Tourism Initiatives (e.g., Vision 2030)

3.3.2. Growth in Digital and Mobile Insurance Channels

3.3.3. Introduction of Specialized Travel Insurance Packages (Pilgrimage, Adventure Travel)

3.4. Trends

3.4.1. Use of Blockchain for Policy Issuance and Claims

3.4.2. Integration of AI in Customer Service and Claim Management

3.4.3. Increasing Customization of Travel Insurance Plans

3.5. Government Regulations

3.5.1. Saudi Arabian Monetary Authority (SAMA) Regulations

3.5.2. Hajj and Umrah Pilgrimage Travel Insurance Mandates

3.5.3. Visa Requirements for Mandatory Travel Insurance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Saudi Arabia Travel Insurance Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Single-Trip Travel Insurance

4.1.2. Annual Multi-Trip Insurance

4.1.3. Medical Expense Coverage

4.1.4. Pilgrimage-Specific Insurance

4.2. By Application (In Value %)

4.2.1. Leisure Travel

4.2.2. Business Travel

4.2.3. Study Travel

4.3. By Distribution Channel (In Value %)

4.3.1. Insurance Agents/Brokers

4.3.2. Online Platforms

4.3.3. Banks

4.4. By Age Group (In Value %)

4.4.1. Below 30 Years

4.4.2. 30-50 Years

4.4.3. Above 50 Years

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Saudi Arabia Travel Insurance Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Allianz Saudi Fransi Cooperative Insurance

5.1.2. Tawuniya Insurance

5.1.3. Al Rajhi Takaful

5.1.4. AXA Cooperative Insurance

5.1.5. Bupa Arabia

5.1.6. Gulf Union Cooperative Insurance

5.1.7. MedGulf

5.1.8. Malath Insurance

5.1.9. Walaa Cooperative Insurance

5.1.10. Solidarity Saudi Takaful

5.1.11. Salama Cooperative Insurance

5.1.12. Chubb Arabia Cooperative Insurance

5.1.13. United Cooperative Assurance (UCA)

5.1.14. Arabian Shield Cooperative Insurance

5.1.15. SAICO Cooperative Insurance

5.2. Cross Comparison Parameters (No. of Policies, Market Share %, Distribution Channel, No. of Employees, Claim Settlement Ratio, Profitability, Product Offerings, Customer Retention Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives by Competitors

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Subsidies and Support Programs

6. Saudi Arabia Travel Insurance Market Regulatory Framework

6.1. SAMA Compliance Standards

6.2. Licensing and Registration Procedures for Insurers

6.3. Policyholder Rights and Protection Measures

6.4. Visa and Travel Insurance Requirements

6.5. Certifications and Accreditation Processes for Travel Insurers

7. Saudi Arabia Travel Insurance Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Saudi Arabia Travel Insurance Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Travel Insurance Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Digital Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step of the research involved mapping all major stakeholders in the Saudi Arabia Travel Insurance Market. This was achieved through extensive desk research, combining secondary and proprietary databases to gather comprehensive data on market trends, regulations, and key players.

Step 2: Market Analysis and Construction

We compiled historical data for the Saudi travel insurance market, evaluating policy penetration, consumer behavior, and major revenue drivers. Additionally, the data collected on travel insurance usage was validated against government databases and industry reports.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations were carried out through interviews with representatives from major insurance companies and regulatory bodies. This helped refine our understanding of market dynamics, policy demands, and future growth drivers, thereby ensuring accuracy in our findings.

Step 4: Research Synthesis and Final Output

The final stage involved compiling detailed insights on product segments, policy offerings, and customer preferences. Multiple validation checks were applied to ensure a comprehensive and accurate market report, taking into account both top-down and bottom-up approaches.

Frequently Asked Questions

01. How big is the Saudi Arabia Travel Insurance Market?

The Saudi Arabia travel insurance market is valued at USD 116 million, driven by the growing number of international travelers, particularly for Hajj and Umrah, as well as the government's regulatory mandate on travel insurance.

02. What are the challenges in the Saudi Arabia Travel Insurance Market?

The Saudi Arabia travel insurance market faces challenges such as price sensitivity among consumers, limited awareness of insurance options outside religious tourism, and fraudulent insurance claims that affect both insurers and policyholders.

03. Who are the major players in the Saudi Arabia Travel Insurance Market?

Major players in the Saudi Arabia travel insurance market include Allianz Saudi Fransi Cooperative Insurance, Tawuniya Insurance, Al Rajhi Takaful, AXA Cooperative Insurance, and Bupa Arabia, all known for their robust policy offerings and strong market presence.

04. What are the growth drivers of the Saudi Arabia Travel Insurance Market?

Key growth drivers in Saudi Arabia travel insurance market include the increasing volume of international travelers, mandatory insurance policies for religious pilgrims, the rise of digital platforms offering insurance, and enhanced awareness of travel health and safety risks.

05. What opportunities exist in the Saudi Arabia Travel Insurance Market?

Opportunities in Saudi Arabia travel insurance market include the expansion of pilgrimage-specific insurance products, the growth of mobile platforms for policy purchases, and the increasing demand for specialized insurance coverage for adventure travel and business travelers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.