Saudi Arabia Ultrasound Devices Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD7503

November 2024

95

About the Report

Saudi Arabia Ultrasound Devices Market Overview

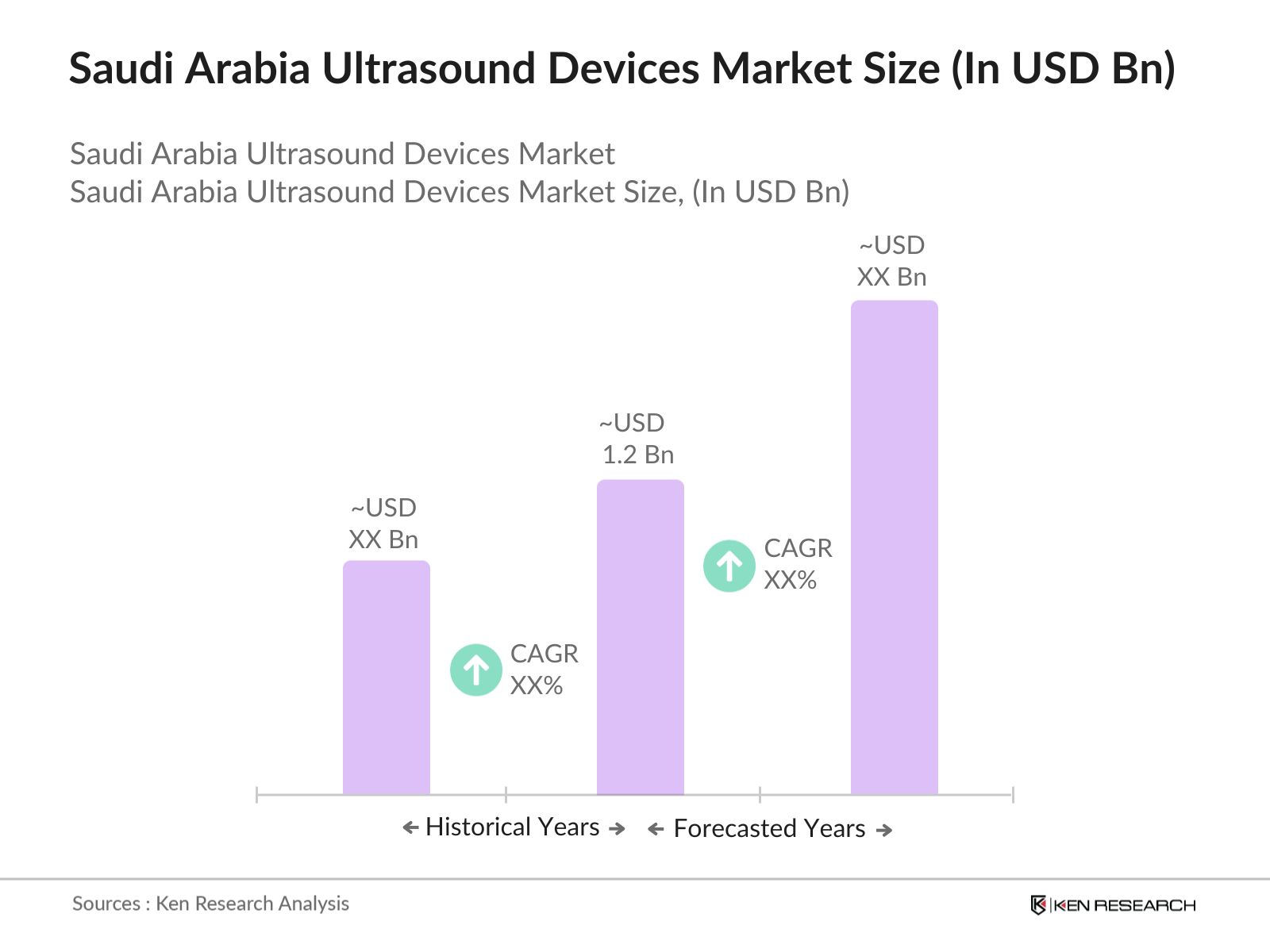

- The Saudi Arabia Ultrasound Devices market is valued at USD 1.2 billion, supported by increasing investments in healthcare infrastructure, government initiatives under Vision 2030, and rising prevalence of chronic diseases. The demand for diagnostic and therapeutic ultrasound devices is driven by the growing awareness of non-invasive diagnostic tools and the adoption of advanced technologies like 3D/4D imaging. Enhanced funding for public and private healthcare projects further bolsters this market's expansion.

- Central and Western regions of Saudi Arabia, particularly cities like Riyadh and Jeddah, dominate the ultrasound devices market due to their advanced healthcare infrastructure, high population density, and concentration of specialized medical facilities. These cities benefit from substantial government funding and host major hospitals, research centers, and diagnostic labs, which contribute to their prominence in the market.

- The SFDA has established comprehensive guidelines for the approval and regulation of medical devices, including ultrasound equipment. These regulations ensure that devices meet safety and efficacy standards before entering the market, thereby protecting patient health and maintaining the quality of healthcare services.

Saudi Arabia Ultrasound Devices Market Segmentation

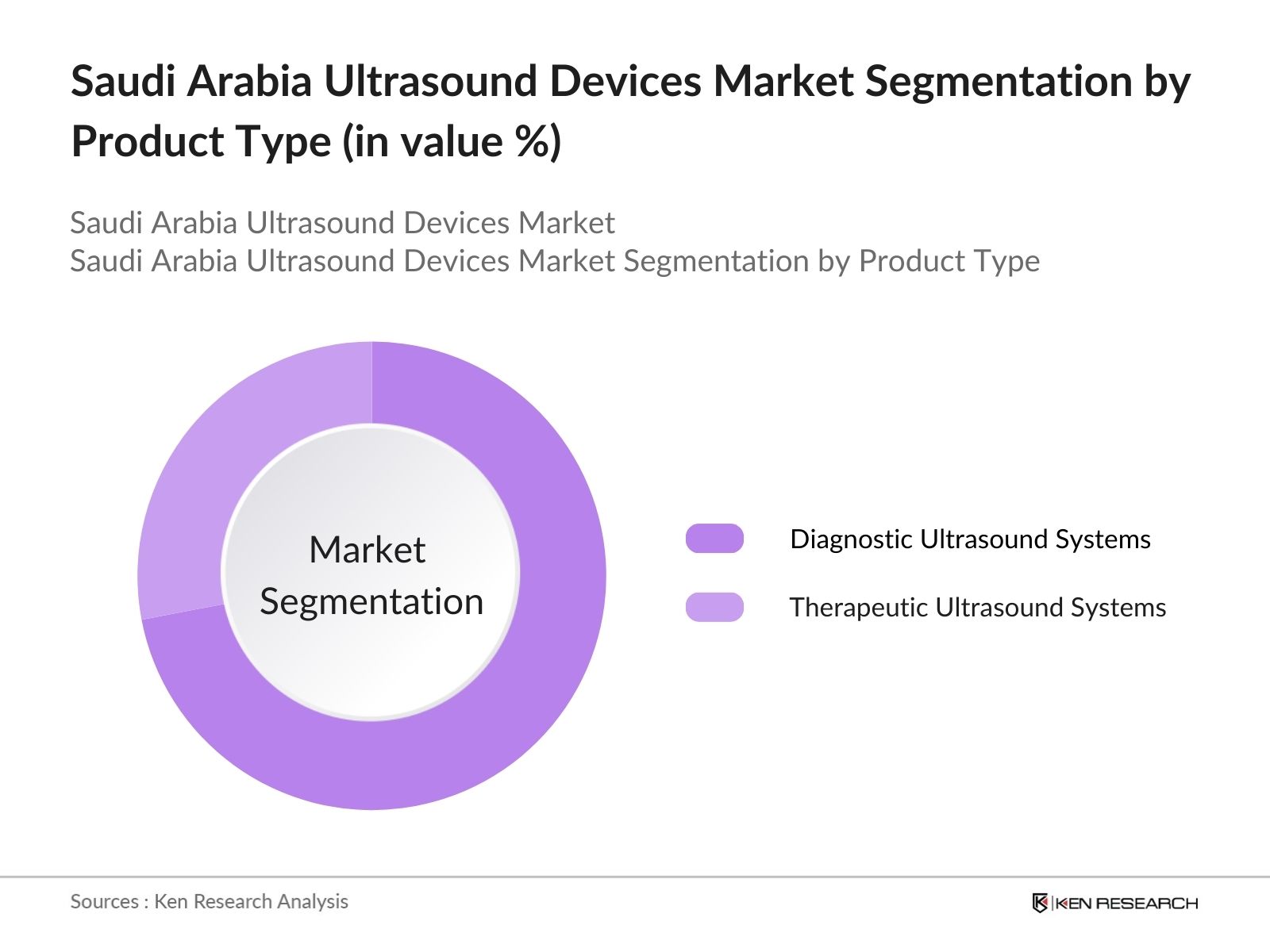

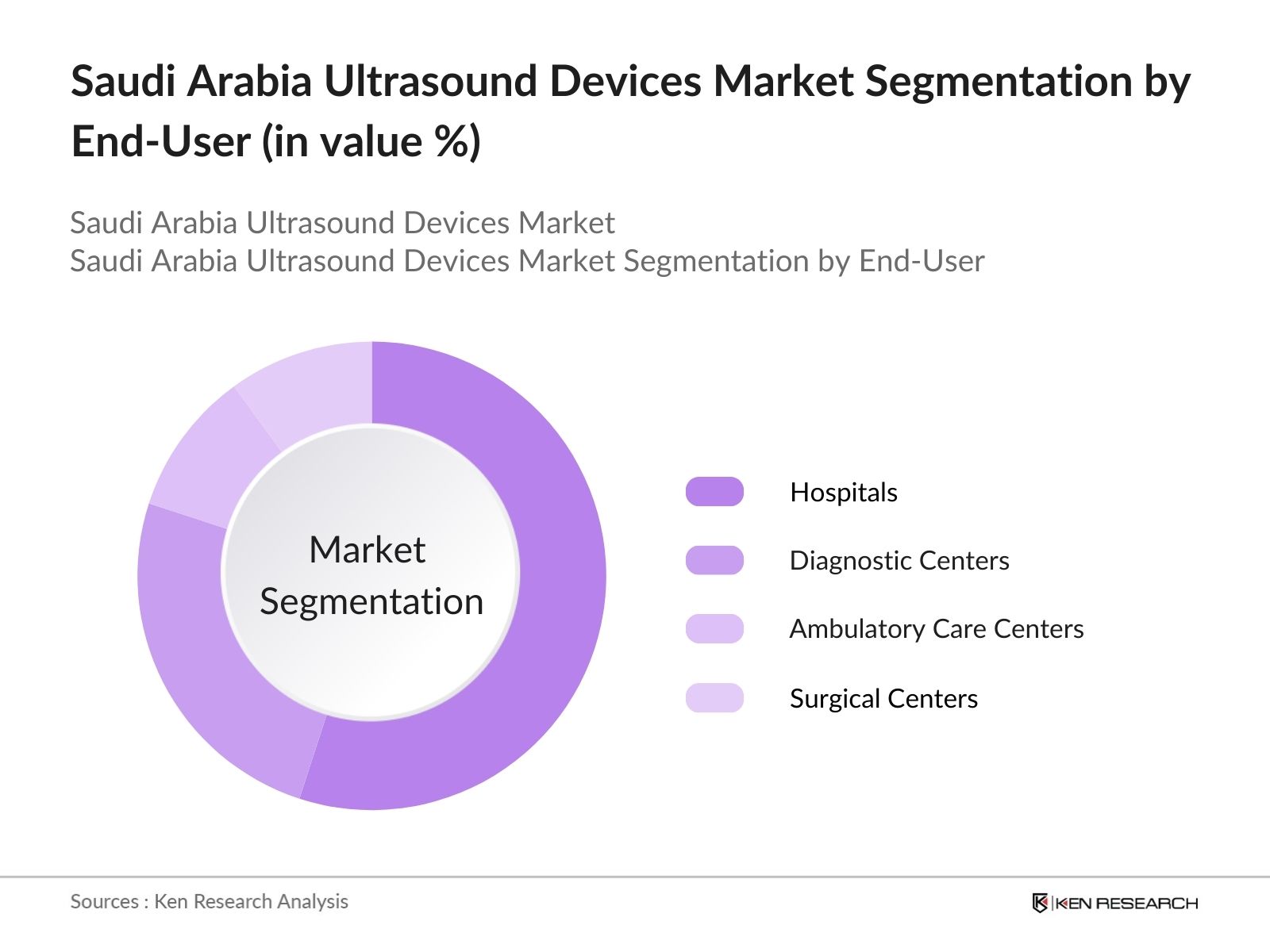

The Saudi Arabia Ultrasound Devices market is segmented by product type and by end-user.

- By Product Type: The Saudi Arabia Ultrasound Devices market is segmented by product type into diagnostic ultrasound systems and therapeutic ultrasound systems. Diagnostic ultrasound systems hold a dominant market share due to their widespread application in imaging, cardiology, obstetrics, and gynecology. Their ability to provide non-invasive, real-time imaging makes them indispensable in modern healthcare setups.

- By End-User: The market is segmented by end-user into hospitals, diagnostic centers, ambulatory care centers, surgical centers, and others. Hospitals account for the largest market share due to their comprehensive facilities, high patient inflow, and ability to invest in high-cost imaging equipment. The integration of cutting-edge technologies in hospital settings further strengthens their dominance.

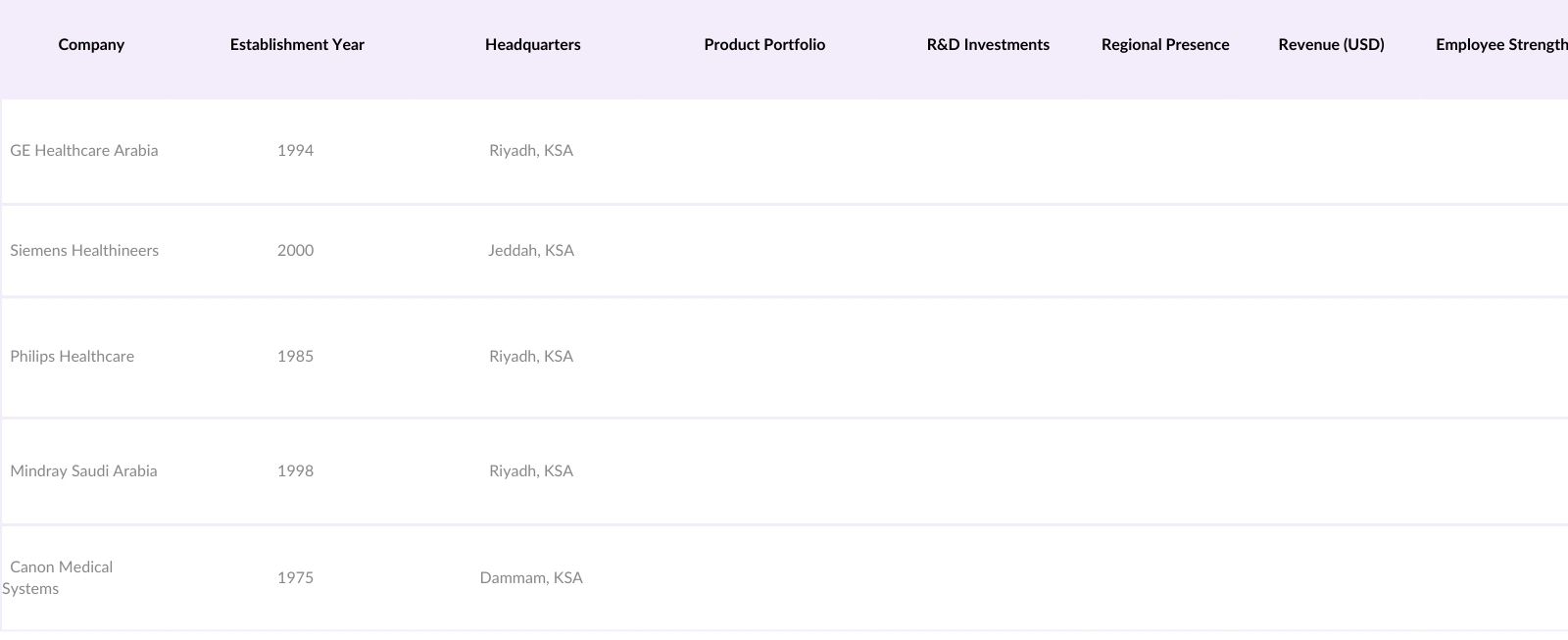

Saudi Arabia Ultrasound Devices Market Competitive Landscape

The Saudi Arabia Ultrasound Devices market is characterized by the dominance of both international and regional players. Leading companies drive innovation while capitalizing on distribution networks and customer trust. The market exhibits significant consolidation, with top firms leveraging their technological advancements and local partnerships.

Saudi Arabia Ultrasound Devices Market Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases such as cardiovascular ailments and cancer is a significant driver for the ultrasound imaging market. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for 17.9 million deaths annually. Additionally, the International Agency for Research on Cancer reported 19.3 million new cancer cases worldwide in 2020. The growing burden of these diseases necessitates advanced diagnostic tools like ultrasound imaging for early detection and management.

- Technological Advancements in Ultrasound Imaging: Continuous innovations in ultrasound technology, such as the development of 3D and 4D imaging, have enhanced diagnostic accuracy and expanded clinical applications. The integration of artificial intelligence (AI) has further improved image analysis and interpretation. For instance, AI algorithms can assist in detecting anomalies in ultrasound scans, thereby aiding radiologists in making more accurate diagnoses. These advancements have made ultrasound a more versatile and reliable diagnostic tool.

- Government Initiatives and Healthcare Infrastructure Development: Governments worldwide are investing in healthcare infrastructure to improve access to diagnostic services. For example, the Indian government launched the Ayushman Bharat scheme, aiming to provide healthcare coverage to over 500 million citizens. Such initiatives increase the demand for diagnostic equipment, including ultrasound devices, to cater to a larger patient population.

Market Challenges

- High Cost of Advanced Ultrasound Devices: Advanced ultrasound systems with features like 3D/4D imaging and AI integration are often expensive, making them less accessible to smaller healthcare facilities, especially in developing regions. The high initial investment and maintenance costs can be a barrier to adoption, limiting the market's growth potential.

- Limited Skilled Workforce: The effective use of sophisticated ultrasound equipment requires trained professionals. However, there is a shortage of skilled sonographers and radiologists in many regions, which hampers the optimal utilization of ultrasound technology. This gap in expertise can lead to diagnostic errors and reduced confidence in ultrasound imaging.

Saudi Arabia Ultrasound Devices Market Future Outlook

Over the next five years, the Saudi Arabia Ultrasound Devices market is anticipated to witness robust growth driven by continued government investments in healthcare infrastructure, increased adoption of AI-powered imaging, and a growing focus on telemedicine and point-of-care diagnostics. Rising demand for advanced portable ultrasound devices and emerging applications in cardiology and emergency medicine will further propel market expansion.

Market Opportunities

- Expansion into Rural and Underserved Areas: There is a significant opportunity to expand ultrasound services into rural and underserved regions where access to diagnostic imaging is limited. Deploying portable ultrasound devices can bridge the healthcare gap, providing essential diagnostic services to populations that previously lacked access.

- Integration of Artificial Intelligence in Ultrasound Imaging: The incorporation of AI into ultrasound imaging offers opportunities to enhance diagnostic accuracy and efficiency. AI algorithms can assist in image interpretation, detect subtle abnormalities, and reduce the variability in readings between different operators. This integration can lead to improved patient outcomes and streamlined workflows in healthcare settings.

Scope of the Report

|

Diagnostic Ultrasound Systems |

|||

|

By Portability |

Trolley/Cart-Based Ultrasound Devices |

||

|

By Display Type |

Colored Ultrasound Devices |

||

|

By Application |

Radiology |

||

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority - SFDA)

Hospitals and Healthcare Providers

Diagnostic Centers and Laboratories

Ambulatory and Surgical Centers

Equipment Manufacturers and Suppliers

Research and Development Organizations

Investment and Venture Capitalist Firms

Medical Training Institutes

Companies

Players Mention in the Report:

GE Healthcare Arabia

Siemens Healthineers

Philips Healthcare

Mindray Saudi Arabia

Canon Medical Systems

Hitachi Medical Systems

Hologic, Inc.

Fujifilm-Middle East

Samsung Medison Co.

Esaote SpA

Gulf Medical Co.

Al Faisaliah Medical Systems

Al Zahrawi Medical Supplies

Shimadzu Middle East

Al Maarefa Medical Supplies

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases

3.1.2. Technological Advancements in Ultrasound Imaging

3.1.3. Government Initiatives and Healthcare Infrastructure Development

3.1.4. Increasing Demand for Point-of-Care Diagnostics

3.2. Market Challenges

3.2.1. High Cost of Advanced Ultrasound Devices

3.2.2. Limited Skilled Workforce

3.2.3. Regulatory and Compliance Issues

3.3. Opportunities

3.3.1. Expansion into Rural and Underserved Areas

3.3.2. Integration of Artificial Intelligence in Ultrasound Imaging

3.3.3. Growth in Medical Tourism

3.4. Trends

3.4.1. Adoption of Portable and Handheld Ultrasound Devices

3.4.2. Increasing Use in Pre-hospital and Emergency Care

3.4.3. Development of 3D and 4D Imaging Technologies

3.5. Government Regulations

3.5.1. Saudi Food and Drug Authority (SFDA) Guidelines

3.5.2. National Health Transformation Program

3.5.3. Vision 2030 Healthcare Objectives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Market Segmentation

4.1. By Product Type (Value %)

4.1.1. Diagnostic Ultrasound Systems

4.1.2. Therapeutic Ultrasound Systems

4.2. By Portability (Value %)

4.2.1. Trolley/Cart-Based Ultrasound Devices

4.2.2. Compact/Handheld Ultrasound Devices

4.3. By Display Type (Value %)

4.3.1. Colored Ultrasound Devices

4.3.2. Black & White Ultrasound Devices

4.4. By Application (Value %)

4.4.1. Radiology

4.4.2. Cardiology

4.4.3. Obstetrics & Gynecology

4.4.4. Gastroenterology

4.4.5. Urology

4.4.6. Others

4.5. By End-User (Value %)

4.5.1. Hospitals

4.5.2. Diagnostic Centers

4.5.3. Ambulatory Care Centers

4.5.4. Surgical Centers

4.5.5. Others

4.6. By Distribution Channel (Value %)

4.6.1. Online

4.6.2. Offline

4.7. By Region (Value %)

4.7.1. South

4.7.2. West

4.7.3. North

4.7.4. East

5. Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. GE Healthcare Arabia Ltd.

5.1.2. Siemens Ltd Saudi Arabia

5.1.3. Philips Healthcare Saudi Arabia Ltd.

5.1.4. Hitachi Medical Systems Saudi Arabia

5.1.5. Mindray Saudi Arabia

5.1.6. Fujifilm-Middle East

5.1.7. Shimadzu Middle East & Africa FZE

5.1.8. Gulf Medical Co Ltd.

5.1.9. Hologic, Inc.

5.1.10. Canon Medical Systems Saudi Arabia

5.1.11. Esaote SpA

5.1.12. Samsung Medison Co., Ltd.

5.1.13. Al Faisaliah Medical Systems

5.1.14. Al Zahrawi Medical Supplies

5.1.15. Al Maarefa Medical Supplies

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters Location

5.2.3. Year of Establishment

5.2.4. Revenue

5.2.5. Product Portfolio

5.2.6. Market Share

5.2.7. Regional Presence

5.2.8. Strategic Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Regulatory Framework

6.1. Saudi Food and Drug Authority (SFDA) Regulations

6.2. Compliance Requirements for Medical Devices

6.3. Certification Processes and Standards

7. Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Product Type (Value %)

8.2. By Portability (Value %)

8.3. By Display Type (Value %)

8.4. By Application (Value %)

8.5. By End-User (Value %)

8.6. By Distribution Channel (Value %)

8.7. By Region (Value %)

9. Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

9.5. Go-to-Market Strategies

9.6. Product Differentiation Insights

9.7. Regional Market Entry Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We constructed an ecosystem map incorporating stakeholders, including healthcare providers, device manufacturers, and regulatory authorities, in the Saudi Arabia Ultrasound Devices Market. This step utilized proprietary databases and secondary research to determine critical market variables.

Step 2: Market Analysis and Construction

Comprehensive analysis of historical data was conducted to understand market penetration, device adoption rates, and revenue trends. This included evaluating service quality metrics to ensure precise revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through in-depth interviews with industry experts and practitioners, providing operational and financial insights. These insights were instrumental in refining market data.

Step 4: Research Synthesis and Final Output

Detailed insights from device manufacturers and healthcare providers were incorporated to verify and complement the analysis. This ensured an accurate and validated understanding of market dynamics.

Frequently Asked Questions

01. How big is the Saudi Arabia Ultrasound Devices market?

The Saudi Arabia Ultrasound Devices market is valued at USD 1.2 billion, supported by increasing demand for diagnostic and therapeutic imaging solutions and extensive healthcare investments.

02. What are the challenges in the Saudi Arabia Ultrasound Devices market?

Challenges include high costs of advanced imaging systems, lack of skilled professionals, and regulatory compliance hurdles.

03. Who are the major players in the Saudi Arabia Ultrasound Devices market?

Key players include GE Healthcare Arabia, Siemens Healthineers, Philips Healthcare, Mindray Saudi Arabia, and Canon Medical Systems, known for their innovative technologies and strong market presence.

04. What drives the Saudi Arabia Ultrasound Devices market?

The market is propelled by government initiatives, increased prevalence of chronic diseases, advancements in imaging technology, and growing demand for portable and point-of-care devices.

05. Which regions dominate the Saudi Arabia Ultrasound Devices market?

Central and Western regions, including Riyadh and Jeddah, dominate due to advanced healthcare facilities, high population density, and substantial public and private investments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.