Saudi Arabia Vaccine Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD2875

November 2024

94

About the Report

Saudi Arabia Vaccine Market Overview

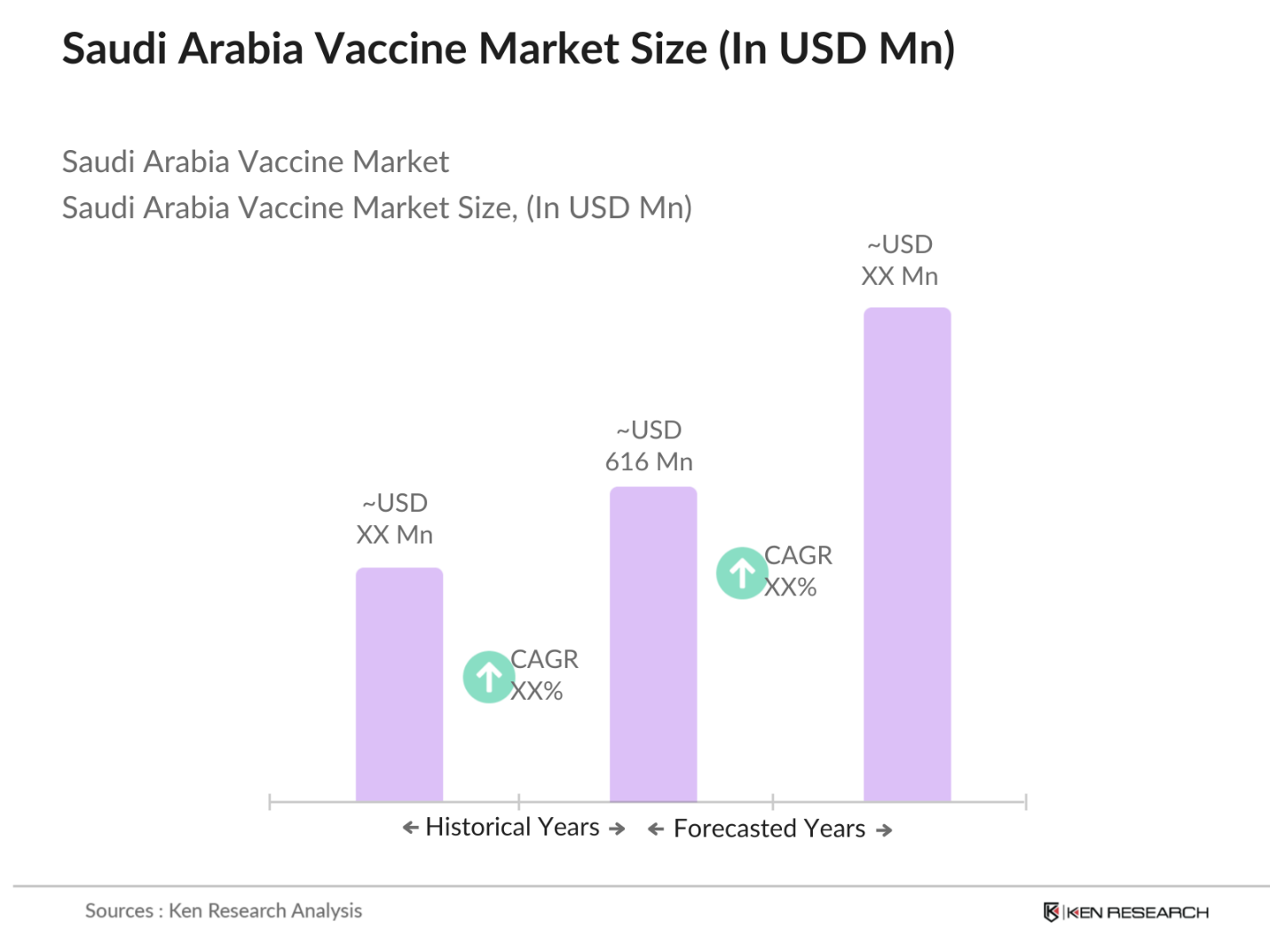

- The Saudi Arabia vaccine market, valued at approximately USD 616 million, is significantly driven by government initiatives in immunization programs and rising healthcare expenditure. The Saudi Ministry of Health has allocated substantial funds to enhance vaccine accessibility and affordability, contributing to consistent market growth. Notably, the Kingdoms emphasis on preventive healthcare and high immunization rates have catalyzed expansion in the vaccine sector, with strong demand observed across various disease categories.

- Dominance within the Saudi Arabia vaccine market is primarily seen in metropolitan areas like Riyadh, Jeddah, and Dammam, where well-developed healthcare infrastructure and higher population densities facilitate extensive vaccination coverage. Additionally, Riyadh's prominence is bolstered by numerous healthcare facilities and government headquarters, driving demand through large-scale immunization campaigns. These urban centers benefit from a higher concentration of healthcare providers, thereby enabling efficient vaccine distribution.

- The National Immunization Program in Saudi Arabia covers over 95% of the target population, reaching 6 million people annually. In 2024, the program expanded to include adult immunizations and high-risk groups. This comprehensive coverage, supported by a strong government framework, ensures Saudi citizens protection against preventable diseases.

Saudi Arabia Vaccine Market Segmentation

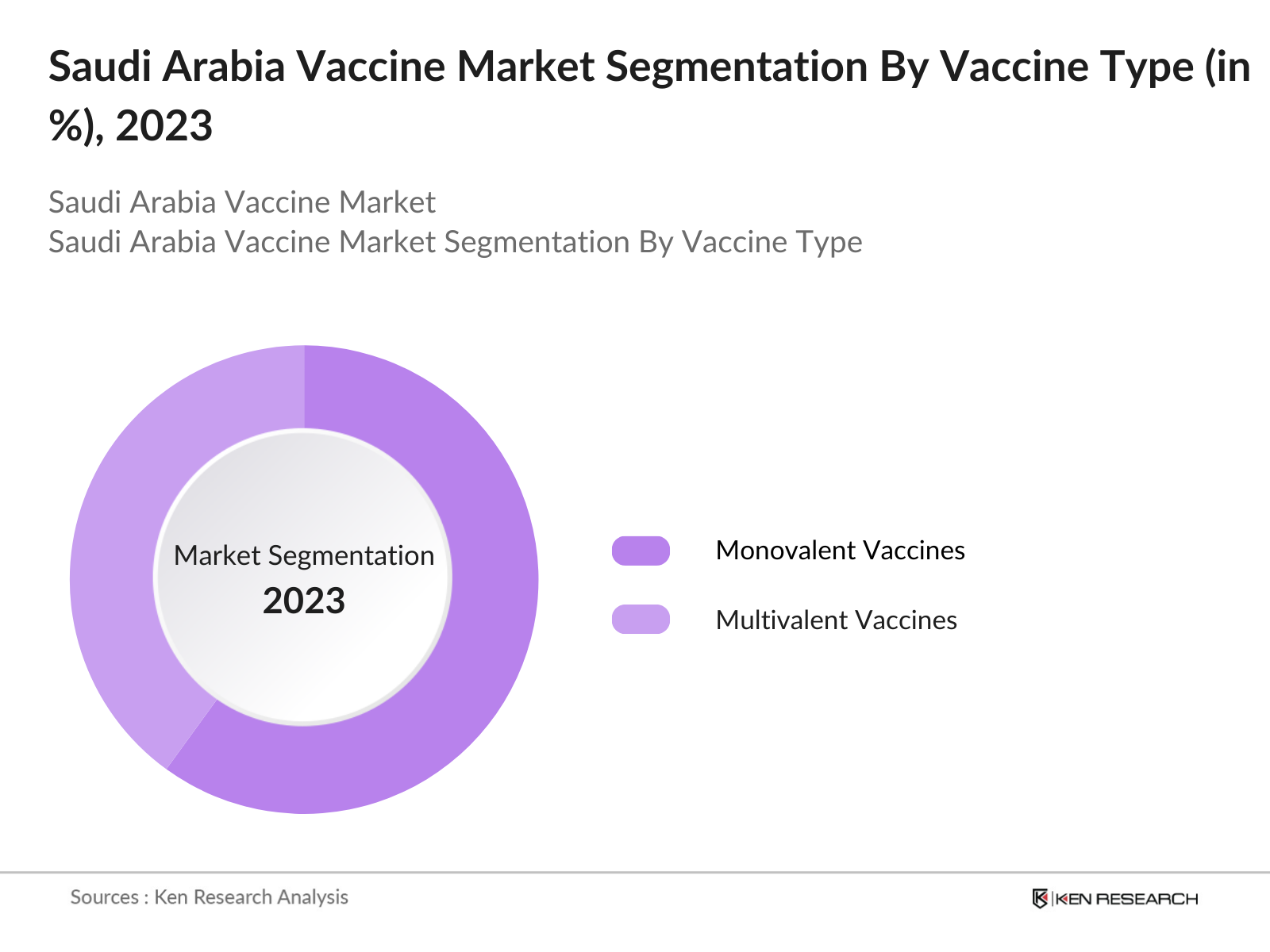

By Vaccine Type: Saudi Arabias vaccine market is segmented by vaccine type into monovalent and multivalent vaccines. Recently, monovalent vaccines hold a dominant market share due to targeted immunization campaigns focusing on specific diseases like influenza and hepatitis. Monovalent vaccines are preferred for their effectiveness against singular diseases, aligning with government initiatives focused on addressing high-prevalence diseases through targeted immunization efforts.

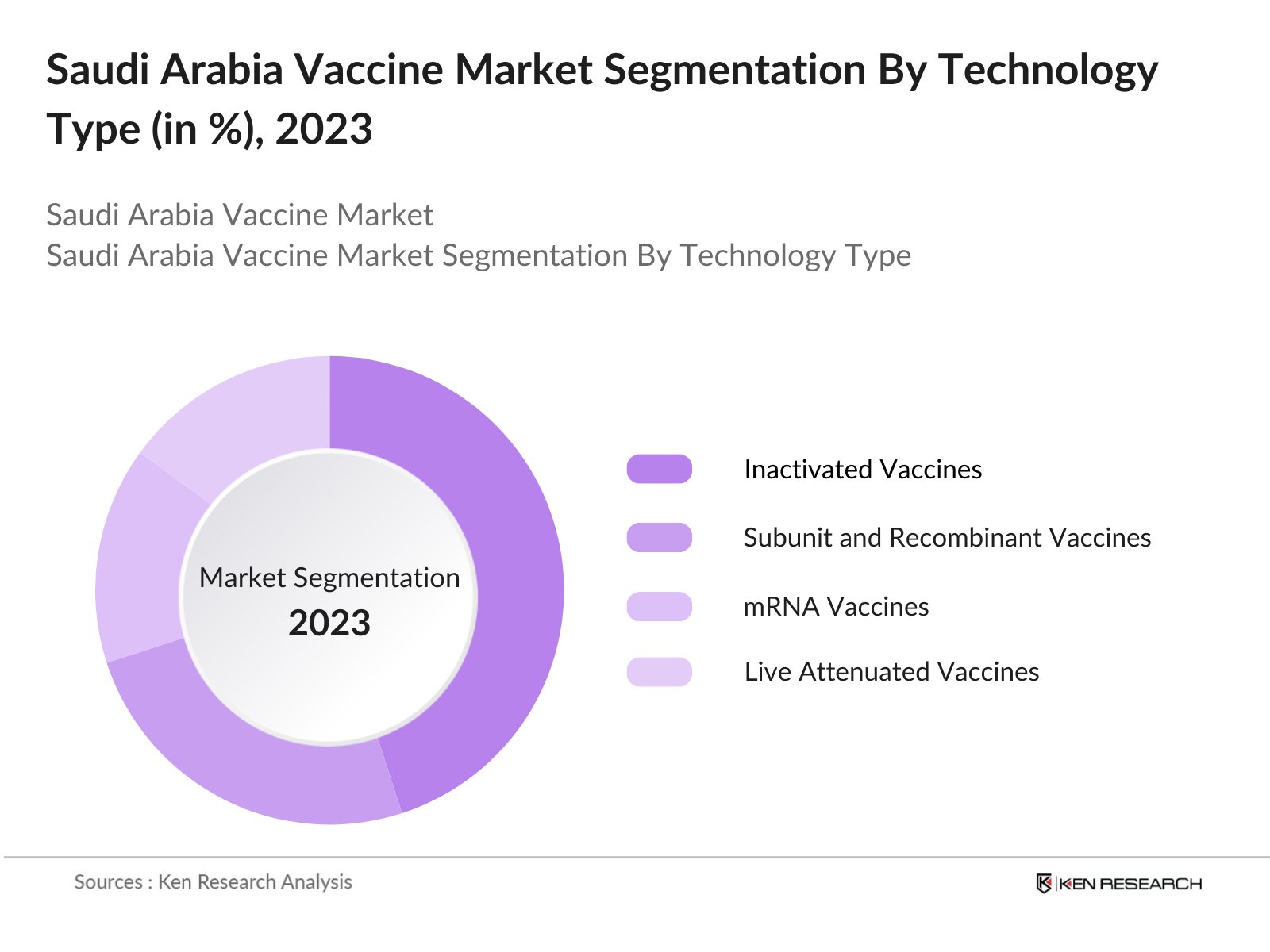

By Technology: Within the technology segment, the Saudi vaccine market is divided into live attenuated, inactivated, subunit, recombinant, and mRNA vaccines. Inactivated vaccines have a significant share due to their wide application in preventing prevalent infectious diseases without the risks associated with live vaccines. Government support for safe and stable immunization methods further drives the demand for inactivated vaccines, which are extensively used in both pediatric and adult immunization programs.

Saudi Arabia Vaccine Market Competitive Landscape

The Saudi vaccine market is characterized by the presence of both global and regional players, with significant contributions from key international pharmaceutical companies. The market landscape is influenced by established companies that have secured approvals and distribution channels across the region, often in collaboration with government bodies to meet immunization targets. Leading players with dedicated R&D efforts, like Pfizer and Moderna, play a significant role in the market's competitive dynamics.

Saudi Arabia Vaccine Industry Analysis

Growth Drivers

- Government Immunization Programs: The Saudi Arabian governments National Immunization Program covers millions of children annually, ensuring access to vaccines for preventable diseases. In 2023, the program expanded to include newer vaccines such as meningococcal and pneumococcal for infants, protecting over 6 million children nationwide. Additionally, government health spending under the Vision 2030 initiative allocated substantial resources for immunization expansion, marking a 30% increase in vaccine funding from 2022 to 2024. Saudi Arabias Ministry of Health (MOH) reports strong immunization coverage levels of up to 97% in select age groups, helping curb outbreaks of diseases like measles and polio.

- Rising Prevalence of Infectious Diseases: Saudi Arabia faces rising infectious disease rates due to its large pilgrimage population, which brings people from over 180 countries annually. This influx of people has led to increased instances of MERS-CoV and influenza. In 2024, MOH recorded over 12,000 flu-related hospitalizations and focused on increased vaccination campaigns to address these trends. The spike in influenza, MERS, and other infections is accelerating vaccine demand, particularly for seasonal influenza and meningococcal vaccines.

- Technological Advancements in Vaccine Development: Saudi Arabias commitment to vaccine technology is evident in its adoption of mRNA technology. In 2023, the Saudi Food and Drug Authority (SFDA) approved advanced mRNA vaccines for influenza and respiratory syncytial virus (RSV). The SFDA also partnered with local biotech firms to explore regionally adapted vaccines for MERS-CoV and RSV, aiming for enhanced efficacy. Additionally, partnerships with international biotech companies in Riyadh aim to bring cutting-edge vaccine R&D to the country, fostering local development and self-reliance.

Market Challenges

- High Dependency on Vaccine Imports: Saudi Arabia imports approximately 85% of its vaccines, with a limited local production capacity. The lack of in-country manufacturing infrastructure restricts quick access to emergency vaccines and limits control over supply chains. The ongoing reliance on imports from Europe and the U.S. makes the country vulnerable to global supply chain disruptions, affecting timely vaccine distribution.

- Regulatory Hurdles: Saudi Arabia has strict regulatory frameworks for vaccine approvals, with the SFDA requiring extensive testing and quality assessments. The approval timeline can take up to 18 months, causing delays in introducing new vaccines, especially for imported products. This complex regulatory process, while ensuring safety, can delay market entry for innovative vaccines and prevent timely responses to emerging health crises.

Saudi Arabia Vaccine Market Future Outlook

Over the next five years, the Saudi Arabia vaccine market is projected to grow steadily, supported by continuous government investments, advancements in vaccine technologies, and a focus on localized vaccine production. The Kingdom's commitment to preventive healthcare aligns with Vision 2030s objectives, emphasizing increased healthcare accessibility and advanced immunization coverage to protect public health. With expanding partnerships between the government and private pharmaceutical firms, Saudi Arabia's vaccine market is positioned for notable expansion, particularly in urban centers.

Opportunities

- Expansion of Local Vaccine Manufacturing: Saudi Arabia is investing in local vaccine manufacturing to reduce import dependence. In 2023, the government allocated SAR 10 billion towards establishing manufacturing facilities for key vaccines. Partnerships with foreign firms are fostering technology transfer, helping build local expertise and capabilities. This development promises increased self-sufficiency and could result in cost reductions and faster vaccine availability.

- Public-Private Partnerships: Public-private partnerships (PPPs) are gaining traction, with new initiatives like the Riyadh Vaccine Collaboration, which aims to leverage private sector expertise in vaccine distribution. PPPs have enabled improved vaccine reach and distribution, with approximately 5 million additional doses distributed in 2023. This collaboration aligns with the broader Vision 2030 agenda, which emphasizes private sector engagement in healthcare services.

Scope of the Report

|

Product Type |

Monovalent Vaccines |

|

Technology |

Live Attenuated Vaccines |

|

Disease Indication |

Influenza |

|

End User |

Pediatric |

|

Distribution Channel |

Hospital Pharmacies |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Health and Medical Organizations

Pharmaceutical Manufacturing Industries

Public Health Authorities (Saudi Ministry of Health, SFDA)

Immunization Program Companies

Vaccine Distributor Companies

Healthcare Providers (Private Hospitals and Clinics)

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministries of Health and Planning)

Companies

Players Mentioned in the Report

Pfizer

GlaxoSmithKline (GSK)

Moderna

AstraZeneca

Serum Institute of India

Sinovac Biotech

BioNTech

Merck & Co.

Bharat Biotech

CSL Limited

Table of Contents

1. Saudi Arabia Vaccine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Vaccine Market Size (In SAR Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Vaccine Market Analysis

3.1 Growth Drivers

3.1.1 Government Immunization Programs

3.1.2 Rising Prevalence of Infectious Diseases

3.1.3 Technological Advancements in Vaccine Development

3.1.4 Increasing Healthcare Expenditure

3.2 Market Challenges

3.2.1 High Dependency on Vaccine Imports

3.2.2 Regulatory Hurdles

3.2.3 Cold Chain Logistics Constraints

3.3 Opportunities

3.3.1 Expansion of Local Vaccine Manufacturing

3.3.2 Public-Private Partnerships

3.3.3 Development of Halal Vaccines

3.4 Trends

3.4.1 Adoption of mRNA Vaccine Technology

3.4.2 Integration of Digital Health Platforms

3.4.3 Focus on Vaccine Research and Development

3.5 Government Initiatives and Health Regulations

3.5.1 National Immunization Program

3.5.2 Vision 2030 Health Objectives

3.5.3 SFDA Vaccine Approval Processes

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Saudi Arabia Vaccine Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Monovalent Vaccines

4.1.2 Multivalent Vaccines

4.2 By Technology (In Value %)

4.2.1 Live Attenuated Vaccines

4.2.2 Inactivated Vaccines

4.2.3 Subunit, Recombinant, Polysaccharide, and Conjugate Vaccines

4.2.4 Toxoid Vaccines

4.2.5 mRNA Vaccines

4.3 By Disease Indication (In Value %)

4.3.1 Influenza

4.3.2 Hepatitis

4.3.3 Human Papillomavirus (HPV)

4.3.4 Meningococcal Diseases

4.3.5 Pneumococcal Diseases

4.3.6 COVID-19

4.4 By End User (In Value %)

4.4.1 Pediatric

4.4.2 Adult

4.5 By Distribution Channel (In Value %)

4.5.1 Hospital Pharmacies

4.5.2 Retail Pharmacies

4.5.3 Institutional Sales

5. Saudi Arabia Vaccine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Sanofi

5.1.2 GlaxoSmithKline (GSK)

5.1.3 Pfizer

5.1.4 Merck & Co.

5.1.5 Novartis

5.1.6 AstraZeneca

5.1.7 Johnson & Johnson

5.1.8 Serum Institute of India

5.1.9 CSL Limited

5.1.10 Bharat Biotech

5.1.11 Moderna

5.1.12 Sinovac Biotech

5.1.13 BioNTech

5.1.14 Sinopharm

5.1.15 Takeda Pharmaceutical Company

5.2 Cross Comparison Parameters (Market Share, Product Portfolio, Regional Presence, R&D Investment, Manufacturing Capacity, Strategic Partnerships, Regulatory Approvals, Revenue Growth)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Saudi Arabia Vaccine Market Regulatory Framework

6.1 SFDA Guidelines and Compliance

6.2 Vaccine Registration and Approval Process

6.3 Import and Export Regulations

6.4 Cold Chain Management Standards

7. Saudi Arabia Vaccine Future Market Size (In SAR Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Vaccine Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Disease Indication (In Value %)

8.4 By End User (In Value %)

8.5 By Distribution Channel (In Value %)

9. Saudi Arabia Vaccine Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step entails mapping out the vaccine ecosystem within Saudi Arabia, focusing on stakeholders like vaccine producers, regulatory authorities, and healthcare providers. Secondary data is gathered from credible sources, identifying factors that influence market demand and regulatory compliance.

Step 2: Market Analysis and Construction

Historical data on Saudi Arabia's vaccine consumption and production is compiled to assess market trends. This phase involves an evaluation of vaccine adoption rates and major revenue drivers across different product types and technologies.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with key players and healthcare specialists in Saudi Arabia, gathering insights on operational, regulatory, and technological trends directly from industry professionals.

Step 4: Research Synthesis and Final Output

A consolidated analysis is prepared by verifying the findings through data cross-verification. Final insights are structured to reflect an accurate and comprehensive perspective on the Saudi Arabia vaccine market, ensuring reliability in projected trends.

Frequently Asked Questions

1. How big is the Saudi Arabia Vaccine Market?

The Saudi Arabia vaccine market is valued at approximately USD 616 million, largely driven by government initiatives and increased healthcare spending to support widespread immunization.

2. What are the main challenges in the Saudi Arabia Vaccine Market?

Challenges include dependency on imported vaccines, logistical complexities in cold chain management, and stringent regulatory requirements which can delay product approvals.

3. Who are the major players in the Saudi Arabia Vaccine Market?

Major players include Pfizer, GlaxoSmithKline (GSK), Moderna, AstraZeneca, and Serum Institute of India, each contributing significantly to the market through innovative vaccines and partnerships with the government.

4. What drives the Saudi Arabia Vaccine Market?

Key drivers include government-supported immunization programs, the rise of healthcare infrastructure, and technological advancements in vaccine production and distribution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.