SEA Used Car Market Outlook to 2028

Region:Asia

Author(s):Khushi Khatreja

Product Code:KR1464

December 2024

85

About the Report

SEA Used Car Market Overview

- The Southeast Asia used car market is valued at approximately USD 100 billion, based on a five-year historical analysis. The markets growth is driven by increasing affordability of pre-owned vehicles, advancements in online sales platforms, and the widespread availability of financing options. Consumers in emerging economies across Southeast Asia are opting for used cars due to cost-effectiveness and the convenience of online marketplaces offering transparent deals and warranty options.

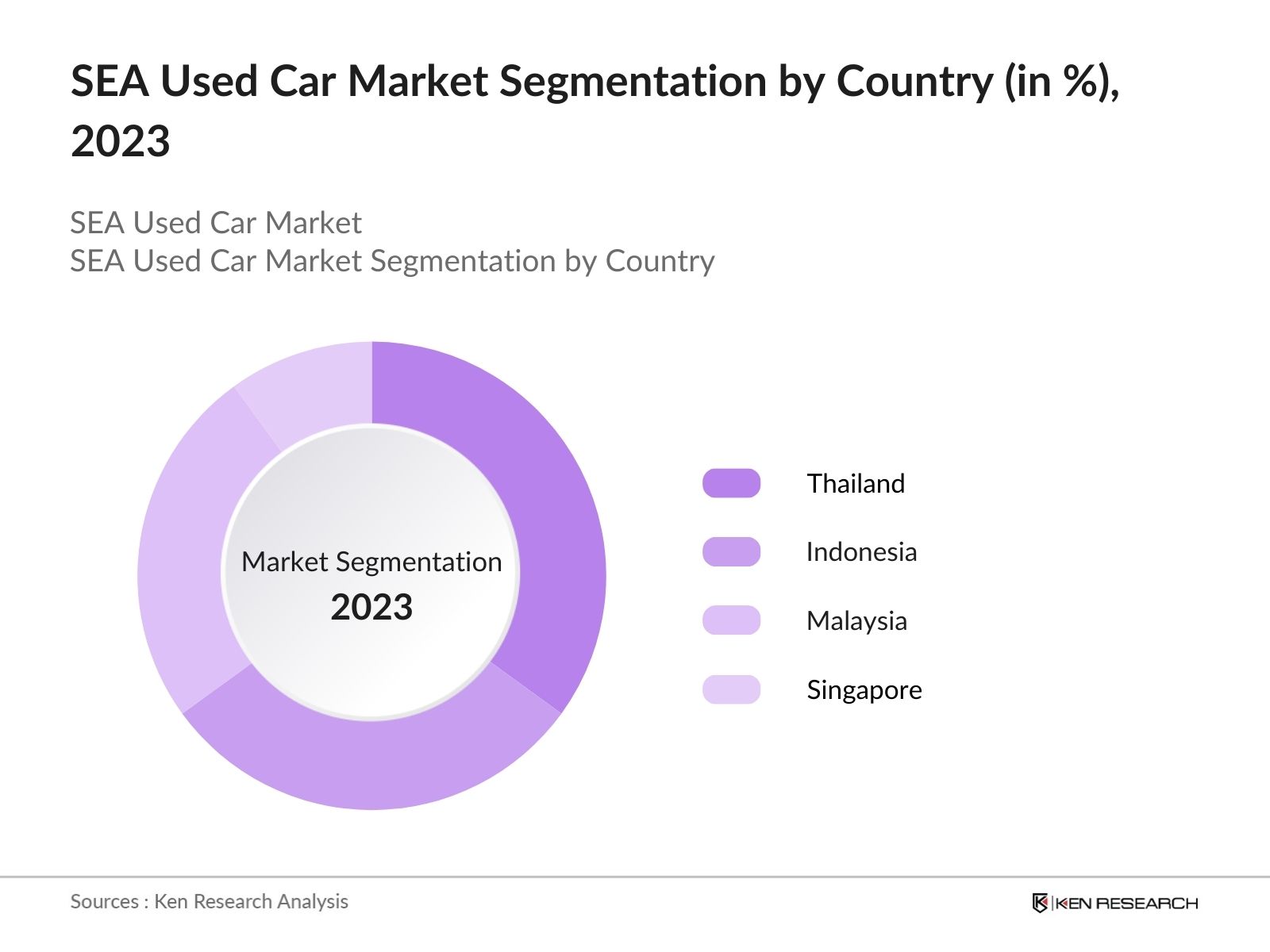

- Indonesia and Thailand dominate the market due to their large automotive ecosystems and established consumer base. Indonesia benefits from a growing middle class and urbanization, while Thailand is recognized for its robust vehicle manufacturing sector and the popularity of certified pre-owned vehicles. The demand in these countries is further bolstered by the availability of financing solutions and the cultural preference for vehicle ownership.

- Vehicle Scrappage Policyintroduced in several countries, particularly inThailandandIndonesia aims to phase out older, polluting vehicles and promote the adoption of newer, cleaner alternatives, including used cars. The policy provides financial incentives for consumers to trade in their old vehicles, which helps reduce the number of older cars on the road and encourages the purchase of used cars that meet stricter environmental standards.

SEA Used Car Market Segmentation

SEA Used Car Market is segmented by business model and country:

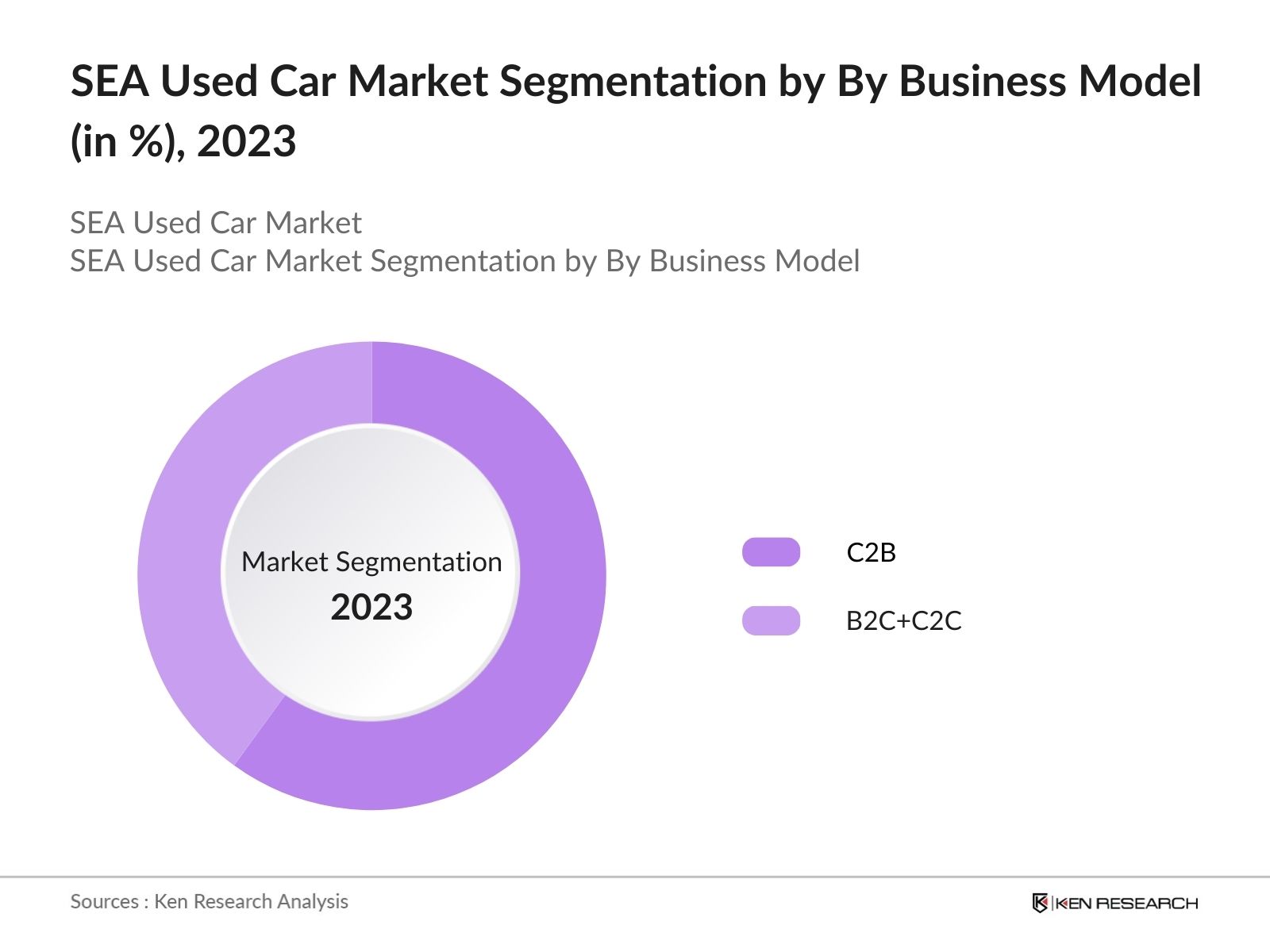

- By Business Model: The Southeast Asia used car market is segmented by business model into C2B and B2C+C2C. The C2B channel dominates the market due to its streamlined process, enabling car owners to sell directly to online platforms, which subsequently distribute the inventory to dealers via bidding or standard sales methods. The B2C+C2C model, while secondary, remains critical, with B2C being a preferred choice for consumers due to additional benefits like after-sales services, warranties, and financing options. In contrast, the C2C segment faces limitations due to a lack of these services.

- By Country: The Southeast Asia used car market is segmented by country into Indonesia, Thailand, Malaysia, Singapore. Thailand leads the market in terms of both sales value and volume, driven by a mature automotive ecosystem and high consumer demand for pre-owned vehicles. Malaysia significantly contributes to the online used car market, fueled by widespread internet penetration and the growth of digital marketplaces. Other countries like Indonesia and the Philippines exhibit steady growth due to rising urbanization and increased middle-class income levels.

SEA Used Car Market Competitive Landscape

The market is characterized by the presence of established players such as Carsome, Carro, and OLX Autos, alongside local dealerships and unorganized vendors. These players dominate through strong online platforms, partnerships with banks for financing, and AI-enabled tools for vehicle inspections, making the buying and selling process seamless.

SEA Used Car Industry Analysis

Market Growth Drivers

- Growing Preference for Private Transportation: Rising disposable incomes across Southeast Asia are leading consumers to favor private vehicles over public transport. As financial stability improves, many individuals are seeking personal mobility solutions, particularly in regions with higher GDP per capita. The average monthly disposable income in 2023 was around MYR 5,000 in Malaysia, which is expected to rise as economic growth continues.

- Impact of Online Platforms and Digital Transactions: The rise of online technologies is revolutionizing the used car market by improving consumer access to digital platforms for buying and selling vehicles. As internet penetration increases, more consumers are engaging in online transactions, streamlining the purchasing process and appealing to tech-savvy buyers. In 2023, the internet penetration rates in Southeast Asia show a significant trend towards increased connectivity, translating to approximately 490 millioninternet users across the region.

- Government Initiatives for Electrification: Governments across Southeast Asia are promoting the electrification of vehicle fleets and phasing out petrol/diesel cars to reduce carbon emissions. This shift is expected to drive demand for used vehicles as consumers seek cost-effective alternatives to new electric vehicles, thereby increasing the supply of used cars in the market.

Market Challenges

- Unorganized Market Structure: A significant portion of the used car market in Southeast Asia is unorganized, with many transactions occurring through independent dealers or peer-to-peer sales. This lack of structure often results in inconsistent pricing and quality standards, leading to consumer distrust. For example, in countries like India and Thailand, unregulated dealers frequently do not provide warranties, and some engage in malpractices such as concealing vehicle damage through superficial repairs. This environment creates apprehension among buyers, which can stifle market growth.

- Lack of Regularization and Consumer Protection: The absence of regulatory frameworks governing used car sales exacerbates the challenges faced by consumers. Without proper regulations, buyers are vulnerable to scams and misrepresentations regarding vehicle conditions. For instance, many consumers fear purchasing "lemons"vehicles with hidden defectsdue to insufficient transparency in the sales process. This issue highlights the need for stronger consumer protection laws to foster trust and encourage more transactions in the used car market.

SEA Used Car Future Market Outlook

Over the next five years, the Southeast Asia used car market is expected to experience significant growth, due to rapid urbanization, growing acceptance of online platforms, and increased preference for sustainable transportation alternatives. The rise in demand for electric and hybrid pre-owned vehicles and government support for emission reduction will also propel market growth. Emerging markets in Vietnam and the Philippines are expected to play a vital role in expanding the market.

Future Market Opportunities

- Shift from Two-Wheelers to Four-Wheelers: As Southeast Asia's economy continues to grow, there is a significant transition from two-wheeled vehicles to four-wheeled cars. This shift is driven by increasing disposable incomes and a growing working population that seeks personal mobility. For instance, many consumers in urban areas are now prioritizing the convenience and comfort of cars, creating a larger market for used vehicles as they look for affordable options amidst rising new car prices.

- Growing Demand for Eco-Friendly Vehicles: With increasing awareness of environmental issues, there is a rising demand for eco-friendly vehicles, including electric and hybrid cars. As governments in Southeast Asia promote the electrification of vehicle fleets, consumers are likely to turn to used electric vehicles as more affordable alternatives to new models. This trend not only supports sustainability but also opens up new segments within the used car market, particularly for those looking to transition to greener options without the high upfront costs.

Scope of the Report

|

Segment |

Sub-Segments |

|

Vehicle Type |

Hatchback- Sedan- Sports Utility Vehicle (SUV) Multi-Purpose Vehicle (MPV) |

|

Sales Channel |

Online Offline |

|

Presence in Market |

Retail Wholesale |

|

Business Model |

C2B (Consumer-to-Business) B2C (Business-to-Consumer) C2C (Consumer-to-Consumer) |

|

Vehicle Source |

Trade-ins Fleet Sales Individual Sellers |

|

Fuel Type |

Gasoline Diesel Electric Hybrid |

|

Country |

Indonesia Thailand Malaysia Singapore |

|

Vehicle Age |

Less than 3 years 35 years More than 5 years |

|

End User |

Private Buyers Fleet Operators |

|

Inspection Type |

Certified pre-owned Non-Certified |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Land Transport Authority, Department of Land Transport Thailand)

Automotive Manufacturers

Online Used Car Marketplaces

Financial Institutions and Banks

Fleet Management Companies

Automotive Inspection and Certification Companies

E-commerce Solution Providers

Companies

Players mentioned in the report:

Carsome

Carro

OLX Autos

Mobil88

MyTukar

iCar Asia

BeliMobilGue.co.id

Carmudi

AutoDeal

Chobrod

One2Car

Carlist.my

Motortrader

MyMotor

Mobil123

Table of Contents

1. SEA Used Car Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. SEA Used Car Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. SEA Used Car Market Analysis

3.1. Growth Drivers

3.1.1. Growing Preference for Private Transportation

3.1.2. Impact of Online Platforms and Digital Transactions

3.1.3. Economic Growth and Expanding Middle Class

3.1.4. Availability of Financing Options

3.2. Market Challenges

3.2.1. Unorganized Market Structure

3.2.2. Lack of Regularization and Consumer Protection

3.2.3. Competition from New Car Sales

3.3. Opportunities

3.3.1. Shift from Two-Wheelers to Four-Wheelers

3.3.2. Growing Demand for Eco-Friendly Vehicles

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Integration of AI in Online Platforms

3.4.2. Subscription-Based Ownership Models

3.4.3. Increased Focus on Certified Pre-Owned Vehicles

3.5. Government Regulations

3.5.1. Import Policies for Used Vehicles

3.5.2. Emission Standards Compliance

3.5.3. Taxation Policies Affecting Used Cars

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. SEA Used Car Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Hatchback

4.1.2. Sedan

4.1.3. Sports Utility Vehicle (SUV)

4.1.4. Multi-Purpose Vehicle (MPV)

4.2. By Vendor Type (In Value %)

4.2.1. Organized

4.2.2. Unorganized

4.3. By Fuel Type (In Value %)

4.3.1. Gasoline

4.3.2. Diesel

4.3.3. Electric

4.3.4. Hybrid

4.4. By Sales Channel (In Value %)

4.4.1. Online

4.4.2. Offline

4.5. By Country (In Value %)

4.5.1. Indonesia

4.5.2. Thailand

4.5.3. Malaysia

4.5.4. Singapore

5. SEA Used Car Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Carsome

5.1.2. Carro

5.1.3. OLX Autos

5.1.4. MUV

5.1.5. Mobil88

5.1.6. Mobil123

5.1.7. MyMotor

5.1.8. MyTukar

5.1.9. Carmudi

5.1.10. AutoDeal

5.1.11. Carlist.my

5.1.12. iCar Asia

5.1.13. BeliMobilGue.co.id

5.1.14. One2Car

5.1.15. Chobrod

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Online Presence, Service Offerings, Customer Reviews)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. SEA Used Car Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. SEA Used Car Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. SEA Used Car Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Vendor Type (In Value %)

8.3. By Fuel Type (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Country (In Value %)

9. SEA Used Car Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Major Players and Market Segmentation

Identification of key players in the Southeast Asia (SEA) used car market, including OEMs (Original Equipment Manufacturers), online marketplaces (e.g., Carsome, OLX, Carro), dealerships, and auction platforms. Categorization of their product offerings by vehicle type (e.g., passenger cars, SUVs, commercial vehicles, and luxury vehicles), source (e.g., certified pre-owned (CPO), non-CPO, direct sellers), end-user (e.g., individual buyers, fleet operators, ride-hailing services), and age of vehicle (<3 years, 35 years, >5 years). Market size is calculated using credible sources such as government reports, industry associations (e.g., ASEAN Automotive Federation), and corporate filings. Additional insights are obtained from automotive market research reports, trade publications, and online platforms to ensure comprehensive product mapping and competitive analysis.

Step 2: CATI (Computer-Assisted Telephonic Interviews)

Conduct CATIs with key stakeholders, including executives from used car marketplaces, dealerships, fleet operators, ride-hailing service representatives, and financial institutions offering car loans and insurance. These interviews aim to uncover market dynamics across SEA countries (e.g., Indonesia, Thailand, Malaysia, Vietnam, Philippines), consumer behavior, pricing trends, residual value analysis, financing options, and the impact of online platforms. Stakeholders also provide insights into regional demand variations, adoption of CPO programs, and preferences for specific brands and vehicle types.

Step 3: Exhaustive Secondary Research

A Bottom-Up approach is employed to analyze market segmentation by vehicle type, source, and end-user categories. Data from market research reports, government publications, and trade associations (e.g., local automotive boards) is utilized to refine segmentation shares. Secondary research also evaluates trends in EV penetration, digital marketplace growth, and online sales adoption in the used car market. Regional factors such as economic growth, urbanization, regulatory policies, and cultural preferences are incorporated. Import/export records and vehicle registration statistics are analyzed for additional validation.

Step 4: Bottom-Up Market Estimation Approach

Market size estimation and segmentation shares are calculated using a Bottom-Up methodology. Validation includes interviews with industry experts, dealership managers, and online marketplace executives to cross-check findings. Proxy variables such as vehicle ownership rates per 1,000 people, urban population growth, disposable income trends, and financing penetration rates are incorporated. Market drivers and restraints are analyzed, considering factors such as increasing digital adoption, affordability concerns, taxation policies, and competition from informal sellers. Demographic, economic, and automotive sector indicators are integrated to align market size projections with industry trends and macroeconomic conditions.

Frequently Asked Questions

01. How big is the Southeast Asia Used Car Market?

The Southeast Asia used car market is valued at USD 100 billion, driven by increasing affordability and the rise of online platforms offering convenient and transparent transactions.

02. What are the challenges in the Southeast Asia Used Car Market?

Challenges in Southeast Asia used car market include lack of transparency in pricing for offline channels, competition from new car sales, and regulatory variations across countries.

03. Who are the major players in the Southeast Asia Used Car Market?

Key players in Southeast Asia used car market include Carsome, Carro, OLX Autos, Mobil88, and MyTukar, known for their robust online platforms and customer-focused services.

04. What drives the growth of the Southeast Asia Used Car Market?

Growth in Southeast Asia used car market is propelled by rising middle-class income, digitalization of transactions, and increased demand for affordable pre-owned vehicles.

05. Which vehicle type is most popular in the Southeast Asia Used Car Market?

SUVs are currently the most popular in Southeast Asia used car market due to their spacious interiors and ability to perform on varied terrains, appealing to families and professionals alike.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.