Singapore Retail Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD935

July 2024

100

About the Report

Singapore Retail Market Overview

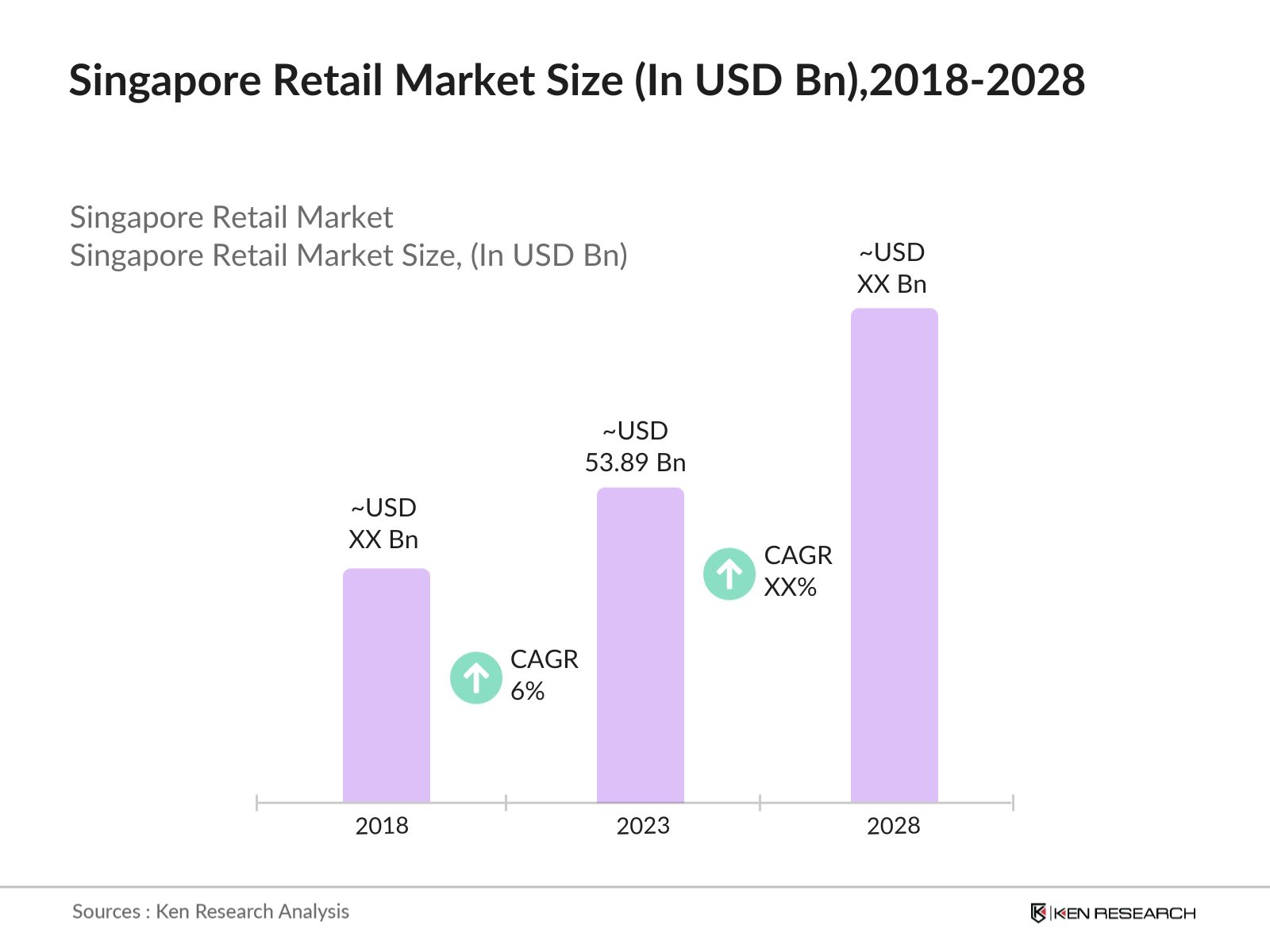

- The Singapore retail market was valued at USD 53.89 billion in 2023. The market witnessed steady growth with a CAGR of 6% from 2018 to 2023. This underscores the market's resilience and adaptability to changing consumer behavior and economic conditions.

- Prominent players in the Singapore retail market include Dairy Farm International Holdings, Sheng Siong Group, NTUC FairPrice, Mustafa Centre, and Courts Singapore. These companies dominate the market due to their extensive product ranges, strong brand loyalty, and strategic locations.

- NTUC FairPrice's ongoing digital transformation efforts, such as the development of their online grocery platform, implementation of automation and AI-powered features like "Scan-and-Go", and the company's focus on providing a seamless omnichannel experience.

Singapore Retail Current Market Analysis:

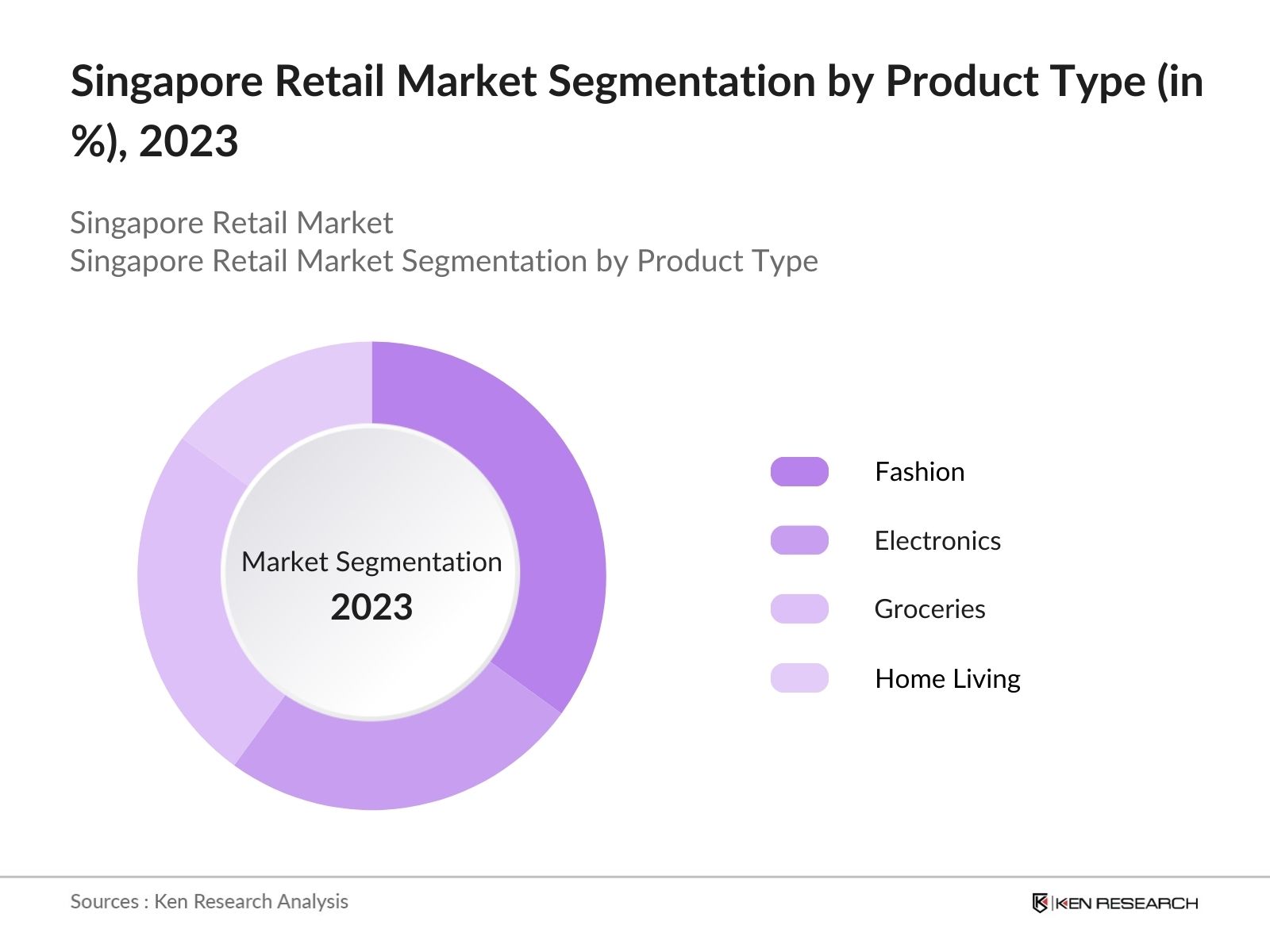

- The Singapore retail market is experiencing vigorous growth, fashion and apparel dominate the retail market, followed by electronics and groceries. The luxury goods market remains significant, particularly because of the e-commerce sector, which has seen a substantial boost due to the pandemic. In 2022, e-commerce sales reached USD 7.5 billion in Singapore.

- Consumers in Singapore prefer brands that offer quality, convenience, and a seamless shopping experience, electronics particularly smartphones and laptops, are among the bestselling products in Singapore. With a high smartphone penetration rate of 90%, the demand for these gadgets is driven by the necessity for remote working tools and continuous technological advancements.

- Central region, particularly Orchard Road, is the dominant retail hub, accounting for approx. one third of retail sales. Its strategic location, high foot traffic, and concentration of luxury brands make it a prime shopping destination for Singapore locals and tourists.

Singapore Retail Market Segmentation

By Product Type: In the Singapore retail market segmentation by product type is divided into fashion, electronics, groceries and home living. In 2023, fashion remains the dominant segment within the Singapore retail market. This dominance is attributed to the diverse consumer base that prioritizes fashion as a key aspect of their lifestyle. Frequent fashion seasons ensure a steady stream of new product releases.

By Distribution Channel: In 2023, the Singapore retail market segmentation by distribution channel is divided into Online, Supermarkets, Department Stores and Specialty Stores. In 2023, online retail channels have gushed ahead due to the unparalleled convenience they offer. The pandemic played a significant role in accelerating the shift towards online shopping, as safety concerns and restrictions limited physical store visits.

By Region: In the Singapore retail market segmentation by region is divided into North, South, East and West. In 2023, Southern region dominates the retail market due to its strategic location in the Central Business District (CBD) and major tourist attractions like Marina Bay Sands and Sentosa. The influx of high-spending tourists and affluent local consumers drives luxury and high-end retail sales, making it a retail powerhouse.

Singapore Retail Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

NTUC FairPrice |

1973 |

Singapore |

|

Dairy Farm Int. |

1886 |

Hong Kong |

|

Sheng Siong |

1985 |

Singapore |

|

Harvey Norman |

1961 |

Australia |

|

Courts |

1974 |

Singapore |

- Sheng Siong's Expansion: Sheng Siong's opening of two new stores in 2023, bringing its total to 68 outlets, targets the burgeoning demand in Singapore's suburban areas. This expansion enhances accessibility for a wider customer base, solidifying its market presence in local retail competition.

- Dairy Farm International's AI Customer Service Platform: Dairy Farm International's introduction of an AI-driven customer service platform in 2023 revolutionizes personalized shopping experiences in Singapore's retail sector. This innovation aims to boost customer satisfaction and operational efficiency.

- Harvey Norman's Sustainability Initiative: Harvey Norman's 2023 commitment to reduce carbon emissions by 20% by 2025 aligns with global environmental goals and addresses rising consumer preferences for sustainability in Singapore's retail market. This initiative underscores the brand's dedication to eco-friendly practices.

Singapore Retail Industry Analysis

Singapore Retail Market Growth Drivers

- Tourism Boom: Tourist spending on retail in Singapore has increased reaching $26.0 billion in 2023, highlighting the pivotal role of tourism in the retail market. Events such as the Singapore Grand Prix and cultural festivals attract millions of international visitors annually, significantly boosting retail sales. Tourists contribute substantially to luxury retail and souvenir purchases.

- Ongoing Digital Transformation: Singapore's Smart Nation initiative has spurred rapid digitalization in the retail sector. The adoption of digital payment systems and e-commerce platforms has grown by 20% annually since 2018. This transformation has improved convenience for consumers and expanded market reach for retailers.

- Infrastructure Development: Ongoing infrastructure projects, including the expansion of Mass Rapid Transit (MRT) lines and the development of iconic shopping destinations like Jewel Changi Airport, have significantly enhanced accessibility to retail outlets across Singapore. These developments attract both local residents and tourists, boosting footfall and retail spending in strategic locations.

Singapore Retail Market Challenges

- High Operational Costs: Retailers in Singapore contend with exorbitant rental expenses, particularly in prime locations like Orchard Road, where rents reached USD 430 per square foot per month in 2023. This high cost of leasing retail space squeezes profit margins and challenges sustainability for businesses.

- E-commerce Competition: The rapid growth of e-commerce has intensified competition for traditional brick-and-mortar stores in Singapore. To remain competitive, traditional retailers are investing in omnichannel strategies, integrating online platforms with physical stores to enhance customer experience and retain market share.

- Changing Consumer Preferences: Singaporean consumers are increasingly prioritizing sustainability and ethical sourcing when making purchasing decisions. There is a growing willingness among consumers to pay a premium for eco-friendly products, reflecting broader global trends towards environmental consciousness. Retailers must adapt their product offerings and operational practices.

Singapore Retail Market Government Initiatives

- Digital Economy Framework: The Digital Economy Framework in Singapore supports retailers in integrating advanced technologies, with more than 5.3 million internet users in Singapore in 2023, this framework is fostering digital transformation and innovation. This framework is pivotal in driving the growth of e-commerce, it encourages retailers to adopt digital solutions.

- Support for SMEs Go Digital: The Go Digital initiative has benefited SMEs in Singapore by facilitating their digital transformation. This support enables SMEs to modernize their operations, enhancing efficiency and competitiveness in the retail market. By leveraging digital technologies, SMEs can streamline processes, improve customer experience, and compete effectively with larger players.

- Tax Incentives: Singapore offers tax incentives to encourage retailers to invest in new technologies and enhance their competitiveness. The Productivity Solutions Grant, for instance, provides up to 70% funding support for the adoption of IT solutions and equipment. These incentives reduce the financial barrier for retailers looking to upgrade their technological capabilities, fostering innovation and productivity in the sector.

Singapore Retail Market Future Outlook:

The retail market is expected to grow exponentially by 2028. This growth is driven by technological advancements, changing consumer preferences, and government support.

Future Trends

- Grants and Subsidies for SMEs: Programs like SMEs Go Digital have assisted over SMEs in modernizing their operations. This support will enable SMEs to leverage digital technologies for improving efficiency and customer engagement, allowing them to compete effectively with larger retailers.

- Productivity Solutions Grant: The Productivity Solutions Grant offers up to 70% funding support for adopting IT solutions and equipment by retailers in Singapore. These incentives will encourage investments in new technologies, boosting operational productivity and competitiveness.

- Efforts to Revive Tourism: In 2022, tourism receipts amounted to USD 23.7 billion, underscoring the sector's importance to the economy and its potential for future growth. Events, such as the Singapore Food Festival and the Great Singapore Sale will draw substantial international visitor spending in the coming years too.

Scope of the Report

|

By Product Type |

Fashion Electronics Groceries Home & living |

|

By Distribution Channel |

Online Supermarkets Department Stores Specialty Stores |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Retail Companies

E-commerce Platforms

Singapore Supermarket Chains

Retail Associations and Trade Bodies

Banking and Financial Institutions

Enterprise Singapore (ESG)

Urban Redevelopment Authority (URA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Olam International

PT Mayora Indah Tbk

PT Kalbe Farma Tbk

GarudaFood

Dua Kelinci

Nut Walker

Tong Garden

Indomaret

Alfamart

Cedea Seaweed

juve

Heavenly Blush

Lemonilo

Fitbar

Tropicana Slim

Table of Contents

1. Singapore Retail Market Overview

1.1 Singapore Retail Market Taxonomy

2. Singapore Retail Market Size (in USD Bn), 2018-2023

3. Singapore Retail Market Analysis

3.1 Singapore Retail Market Growth Drivers

3.2 Singapore Retail Market Challenges and Issues

3.3 Singapore Retail Market Trends and Development

3.4 Singapore Retail Market Government Regulation

3.5 Singapore Retail Market SWOT Analysis

3.6 Singapore Retail Market Stake Ecosystem

3.7 Singapore Retail Market Competition Ecosystem

4. Singapore Retail Market Segmentation, 2023

4.1 Singapore Retail Market Segmentation by Product Type (in %), 2023

4.2 Singapore Retail Market Segmentation by Distribution Channel (in %), 2023

4.3 Singapore Retail Market Segmentation by Region (in %), 2023

5. Singapore Retail Market Competition Benchmarking

5.1 Singapore Retail Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Singapore Retail Market Future Market Size (in USD Bn), 2023-2028

7. Singapore Retail Market Future Market Segmentation, 2028

7.1 Singapore Retail Market Segmentation by Product Type (in %), 2028

7.2 Singapore Retail Market Segmentation by Distribution Channel (in %), 2028

7.3 Singapore Retail Market Segmentation by Region (in %), 2028

8. Singapore Retail Market Analysts’ Recommendations

8.1 Singapore Retail Market TAM/SAM/SOM Analysis

8.2 Singapore Retail Market Customer Cohort Analysis

8.3 Singapore Retail Market Marketing Initiatives

8.4 Singapore Retail Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2 Market Building:

Collating statistics on the Singapore Retail Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Singapore Retail Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple retail product manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Singapore Retail Companies and E-commerce Platforms.

Frequently Asked Questions

01 How big is the Singapore retail market?

The global retail market is valued at USD 53.89 billion in 2023. This substantial market size highlights the sector's resilience and adaptability to changing consumer behaviors and economic conditions.

02 Who are the key players in the Singapore retail market?

Major players in the Singapore retail market include Dairy Farm International Holdings, Sheng Siong Group, NTUC FairPrice, Mustafa Centre, and Courts Singapore. These companies dominate the market with their extensive retail networks, diverse product offerings, and strong brand presence.

03 What are the growth drivers in the Singapore retail market?

Key drivers of the Singapore retail market growth include rising disposable incomes, increasing urbanization, technological advancements, and a robust e-commerce infrastructure. Government initiatives supporting digitalization and business innovation also play a significant role.

04 What are the challenges in the Singapore Retail market?

The Singapore retail market faces challenges such as high operational costs, labor shortages and rising wages adding additional financial pressure. Furthermore, intense e-commerce competition forces traditional stores to innovate. Also, changing consumer preferences towards sustainability demands significant adaptation from retailers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.