Singapore Wealth Management Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1965

June 2025

80

About the Report

Singapore Wealth Management Market Overview

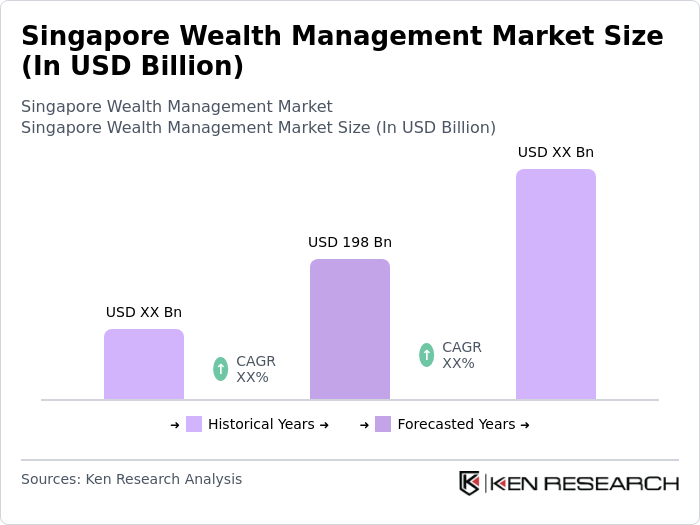

- The Singapore Wealth Management Market was valued at USD 198 billion, based on a five-year historical analysis. This growth is driven by increasing demand for professional financial advice, a robust regulatory framework, and technology-driven solutions. The market serves a sophisticated client base with 1,650 single-family offices operating in Singapore as of 2025.

- Singapore maintains its dominance through strategic advantages in financial infrastructure and regulatory excellence. The Monetary Authority of Singapore (MAS) continues to enhance frameworks for family offices and private wealth vehicles, attracting global high-net-worth individuals. Regional competitors like Hong Kong remain relevant but face increasing competition from Singapore's specialized wealth management ecosystem.

- Recent industry developments include BlackRock's 2023 partnership with Avaloq to enhance wealth management technology solutions, and UBS's strategic moves to strengthen its Asian wealth management capabilities through acquisitions The MAS maintains strict anti-money laundering controls while encouraging innovation through regulatory sandboxes

Singapore Wealth Management Market Segmentation

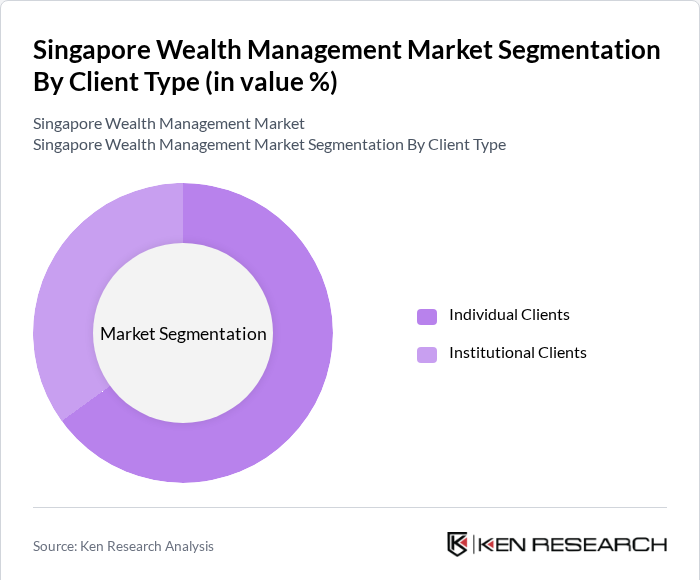

By Client Type: The market is segmented by client type into Individual Clients and Institutional Clients. Individual Clients hold majority of total wealth management AUM, driven by large pension funds, sovereign wealth vehicles, and endowments that allocate capital to Singapore-based managers seeking stable returns and strong regulatory frameworks. This segment’s dominance is underpinned by Singapore’s reputation as a secure financial hub and its robust regulatory oversight, which appeal to Individual mandates.

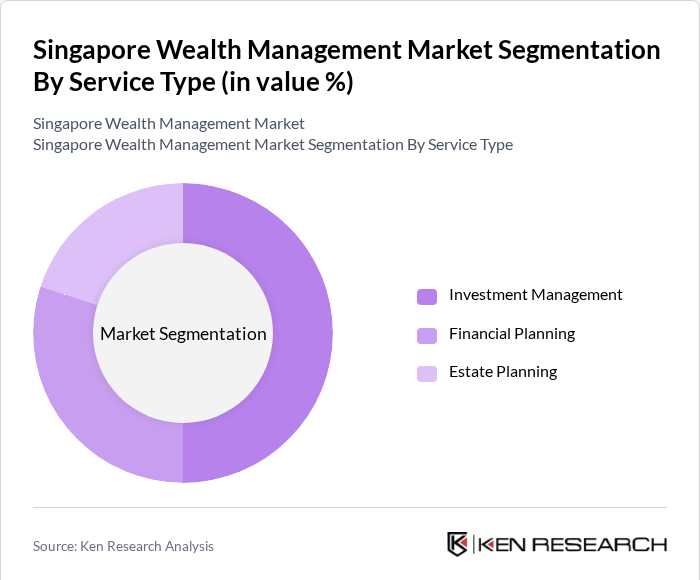

By Service Type: The market is segmented by service type into Investment Management, Estate Planning, and Tax Advisory. Investment Management commands the largest share, as Singapore’s wealth hub status attracts discretionary portfolio mandates, mutual fund sponsorships, and alternative asset allocations from both domestic and offshore clients. Leading private banks and independent asset managers leverage advanced research, AI-driven portfolio optimization, and multi-asset solutions to meet the growing demand for higher risk-adjusted returns.

Singapore Wealth Management Market Competitive Landscape

The market features global players like UBS and BlackRock, alongside domestic leaders DBS and OCBC. Competition intensifies with digital-first entrants offering automated portfolio management, though traditional banks maintain advantage in complex wealth structuring services. Recent technology partnerships have accelerated AI adoption for client risk profiling and portfolio optimization.

Singapore Wealth Management Market Industry Analysis

Growth Drivers

- Increasing High Net Worth Individuals (HNWIs) Population: The number of High Net Worth Individuals (HNWIs) in Singapore has been steadily increasing, with estimates indicating around 330,000 HNWIs in 2024, up from approximately 320,000 in 2023. This growth is supported by Singapore’s robust economy, favorable government policies, and its reputation as a stable and attractive hub for wealth accumulation. The city-state continues to attract wealthy individuals, with a net gain of about 3,500 HNWIs in 2024 due to migration and local wealth creation. This expanding affluent population drives greater demand for personalized wealth management services, as clients seek tailored investment strategies and comprehensive financial planning. Singapore’s strong regulatory framework, low-tax environment, and growing family office presence further enhance its appeal as a global wealth management center.

- Rising Demand for Personalized Financial Services: The rising demand for personalized financial services among affluent clients is a well-documented trend. In 2024, surveys and industry insights indicate that a significant majority of high-net-worth individuals (HNWIs) prefer tailored financial solutions addressing their unique goals and circumstances. This demand is driven by the need for customized investment strategies, estate planning, and tax advisory services. Wealth management firms are responding by enhancing their offerings through investments in advanced client relationship management technologies and upskilling advisors to deliver bespoke services. Additionally, the growing complexity of financial products and strategic asset allocation challenges further intensify clients’ desire for expert, personalized guidance to navigate their financial journeys effectively.

- Growth of Digital Wealth Management Solutions: The digital transformation of the wealth management industry is a key growth driver, reshaping service delivery. The adoption of robo-advisors and online investment platforms continues to expand, offering lower fees and greater accessibility to a wider client base. The COVID-19 pandemic accelerated this shift, prompting more clients to embrace digital financial solutions. Furthermore, advancements in artificial intelligence and data analytics are enabling firms to deliver more personalized, efficient services, improving client engagement and satisfaction. In Singapore, these trends reflect a broader move toward integrating technology to enhance wealth management experiences and operational efficiency.

Market Challenges

- Regulatory Compliance and Changes: The wealth management industry in Singapore faces significant challenges related to regulatory compliance. The Monetary Authority of Singapore (MAS) has implemented stringent regulations to ensure the integrity of the financial system, including the recent updates to the Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) guidelines. In 2024, compliance costs for wealth management firms increased by an rapidly, impacting profitability. Firms must invest in compliance infrastructure and training to meet these evolving standards, which can divert resources from client-facing activities. Additionally, the rapid pace of regulatory changes can create uncertainty, making it difficult for firms to adapt quickly and maintain compliance without incurring substantial costs.

- Intense Competition Among Financial Institutions: The Singapore wealth management market is characterized by intense competition, with numerous local and international players vying for market share. In 2024, the top five wealth management firms accounted for majority of the market, leaving smaller firms struggling to differentiate themselves. This competitive landscape has led to price wars and increased marketing expenditures, which can erode profit margins. Furthermore, the entry of fintech companies into the wealth management space has intensified competition, as these firms often offer innovative solutions at lower costs. Traditional wealth management firms must continuously innovate and enhance their service offerings to retain clients and attract new ones, which can be a significant challenge in such a crowded market.

Singapore Wealth Management Market Future Outlook

The Singapore wealth management market is poised for continued growth, driven by technological advancements and an increasing focus on sustainable investing. As firms adapt to changing client preferences and regulatory landscapes, the emphasis on personalized services and digital solutions will likely shape the future of the industry.

Market Opportunities

- Expansion of ESG Investment Strategies: The growing interest in Environmental, Social, and Governance (ESG) investing presents a significant opportunity for wealth management firms in Singapore. In 2024, ESG integration across managed assets continues to gain momentum, driven by rising investor awareness of sustainability, especially among younger generations prioritizing ethical investing. Regulatory initiatives, including upcoming mandatory climate disclosures, further support this shift. Wealth management firms can capitalize on this trend by developing ESG-focused products and strategies, attracting clients who value sustainability and responsible investment practices.

- Technological Advancements in Wealth Management: The rapid advancement of technology in the wealth management sector offers numerous opportunities for firms to enhance their service delivery and operational efficiency. In 2025, it is projected that investments in fintech solutions by wealth management farre anticipated to grow rapidly, focusing on areas such as artificial intelligence, blockchain, and data analytics. These technologies can streamline operations, improve client engagement, and provide more personalized investment strategies. By leveraging technology, firms can enhance their competitive edge, reduce costs, and improve client satisfaction.

Scope of the Report

| By Client Type |

Individual clients Institutional clients |

| By Service Type |

Investment management Estate planning Tax advisory |

| By Asset Class |

Equities Bonds Real Estate Alternative Investments |

| By Distribution Channel |

Direct Sales Online Platforms Financial Advisors |

| By Geographic Region |

Central Region East Region West Region North Region |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Monetary Authority of Singapore, Ministry of Finance)

Private Banks and Wealth Management Firms

Family Offices and High-Net-Worth Individuals

Insurance Companies

Pension Funds and Institutional Investors

Financial Technology (FinTech) Companies

Real Estate Investment Trusts (REITs)

Companies

Players Mentioned in the Report:

DBS Bank

OCBC Bank

Citibank

Standard Chartered

UBS

Lion City Wealth Advisors

Merlion Capital Management

Singapura Asset Strategies

Horizon Wealth Partners

Prosperity Financial Group

Table of Contents

1. Singapore Wealth Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Singapore Wealth Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Singapore Wealth Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing High Net Worth Individuals (HNWIs) Population

3.1.2. Rising Demand for Personalized Financial Services

3.1.3. Growth of Digital Wealth Management Solutions

3.2. Market Challenges

3.2.1. Regulatory Compliance and Changes

3.2.2. Intense Competition Among Financial Institutions

3.2.3. Economic Uncertainty and Market Volatility

3.3. Opportunities

3.3.1. Expansion of ESG Investment Strategies

3.3.2. Technological Advancements in Wealth Management

3.3.3. Increasing Interest in Alternative Investments

3.4. Trends

3.4.1. Shift Towards Digital and Robo-Advisory Services

3.4.2. Growing Focus on Sustainable Investing

3.4.3. Enhanced Client Engagement through Data Analytics

3.5. Government Regulation

3.5.1. Overview of Monetary Authority of Singapore (MAS) Guidelines

3.5.2. Anti-Money Laundering (AML) Regulations

3.5.3. Data Protection and Privacy Laws

3.5.4. Licensing Requirements for Wealth Management Firms

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Singapore Wealth Management Market Segmentation

4.1. By Client Type

4.1.1. Individual Clients

4.1.2. Institutional Clients

4.2. By Service Type

4.2.1. Investment Management

4.2.2. Estate Planning

4.2.3. Tax Advisory

4.3. By Asset Class

4.3.1. Equities

4.3.2. Bonds

4.3.3. Real Estate

4.3.4. Alternative Investments

4.4. By Distribution Channel

4.4.1. Direct Sales

4.4.2. Online Platforms

4.4.3. Financial Advisors

4.5. By Geographic Region

4.5.1. Central Region

4.5.2. East Region

4.5.3. West Region

4.5.4. North Region

5. Singapore Wealth Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DBS Bank

5.1.2. OCBC Bank

5.1.3. Citibank

5.1.4. Standard Chartered

5.1.5. UBS

5.1.6. Lion City Wealth Advisors

5.1.7. Merlion Capital Management

5.1.8. Singapura Asset Strategies

5.1.9. Horizon Wealth Partners

5.1.10. Prosperity Financial Group

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Client Retention Rate

5.2.4. Average Assets Under Management (AUM)

5.2.5. Service Diversification Index

5.2.6. Digital Adoption Rate

5.2.7. Customer Satisfaction Score

5.2.8. Compliance and Regulatory Adherence Score

6. Singapore Wealth Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Singapore Wealth Management Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Singapore Wealth Management Market Future Market Segmentation

8.1. By Client Type

8.1.1. Individual Clients

8.1.2. Institutional Clients

8.2. By Service Type

8.2.1. Investment Management

8.2.2. Estate Planning

8.2.3. Tax Advisory

8.3. By Asset Class

8.3.1. Equities

8.3.2. Bonds

8.3.3. Real Estate

8.3.4. Alternative Investments

8.4. By Distribution Channel

8.4.1. Direct Sales

8.4.2. Online Platforms

8.4.3. Financial Advisors

8.5. By Geographic Region

8.5.1. Central Region

8.5.2. East Region

8.5.3. West Region

8.5.4. North Region

9. Singapore Wealth Management Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Wealth Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore Wealth Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore Wealth Management Market.

Frequently Asked Questions

01. How big is the Singapore Wealth Management Market?

The Singapore Wealth Management Market is valued at USD 198 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Singapore Wealth Management Market?

Key challenges in the Singapore Wealth Management Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Singapore Wealth Management Market?

Major players in the Singapore Wealth Management Market include DBS Bank, OCBC Bank, Citibank, Standard Chartered, UBS, among others.

04. What are the growth drivers for the Singapore Wealth Management Market?

The primary growth drivers for the Singapore Wealth Management Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.