South America Boat and Ship MRO Market Outlook to 2030

Region:Central and South America

Author(s):Yogita Sahu

Product Code:KROD4721

December 2024

94

About the Report

South America Boat and Ship MRO Market Overview

- The South America Boat and Ship MRO market is valued at USD 1.9 billion, driven by the expansion of maritime trade, increased offshore exploration, and aging fleets requiring extensive maintenance. The rising demand for eco-friendly and technologically advanced MRO solutions is reshaping the market. Furthermore, increased government investments in naval infrastructure and technological integration in MRO processes are acting as key enablers for market growth.

- Brazil and Chile dominate the market due to their strategic location along major trade routes and robust maritime infrastructure. Brazil, with its extensive coastline and burgeoning offshore oil and gas activities, is a central hub for vessel maintenance. Chile's dominance is attributed to its modernized shipyards and efficient drydock facilities catering to both local and international vessels.

- The Brazilian government has introduced tax incentives to stimulate the maritime MRO sector. The Ministry of Finance announced a reduction in import duties for ship repair materials, saving companies approximately $200 million annually. This initiative aims to enhance the competitiveness of local MRO providers and attract foreign investments.

South America Boat and Ship MRO Market Segmentation

By MRO Type: The market is segmented into engine MRO, component MRO, dry dock MRO, modifications, and others. Engine MRO holds a dominant share due to the critical importance of engine performance and longevity in maritime operations. Engine maintenance ensures fuel efficiency and adherence to environmental regulations, making it a pivotal segment.

By Vessel Type: The market is segmented into boats, yachts, commercial vessels, naval vessels, and others. Commercial Vessels lead the segment as they require frequent and intensive maintenance due to their continuous operations in cargo and passenger transport. Their large fleet size also contributes significantly to this segment's dominance.

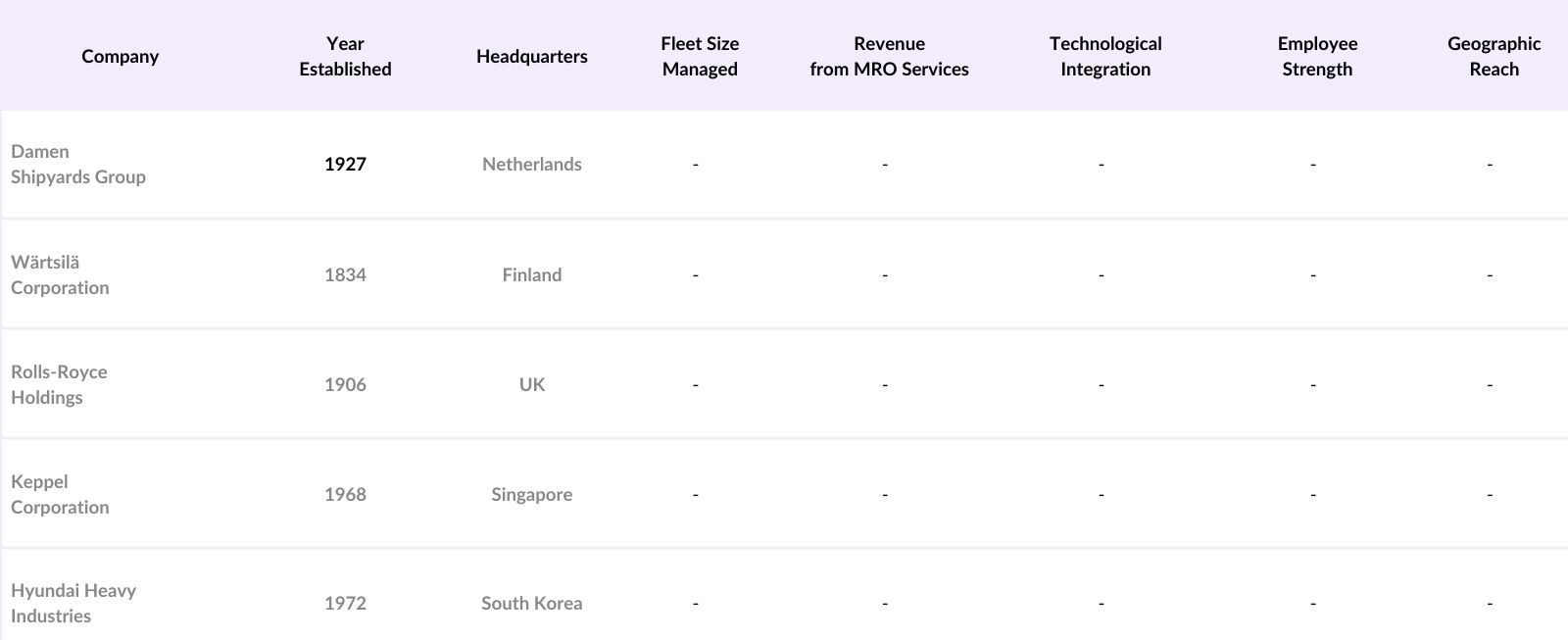

South America Boat and Ship MRO Market Competitive Landscape

The market is consolidated with a mix of regional and global players. Companies are leveraging advancements in predictive maintenance and digital solutions to stay competitive.

South America Boat and Ship MRO Market Analysis

Market Growth Drivers

- Expansion of Maritime Trade Routes: The South American maritime sector is experiencing growth due to the expansion of trade routes. In 2023, the Panama Canal Authority reported a record transit of 13,000 vessels, facilitating over 500 million tons of cargo. This surge underscores the canal's pivotal role in global shipping and its impact on regional MRO services.

- Aging Fleet Requiring Maintenance: The average age of commercial vessels operating in South American waters has reached 20 years, as per the International Maritime Organization. This aging fleet necessitates extensive maintenance, repair, and overhaul (MRO) services to ensure safety and compliance with international standards.

- Government Investments in Naval Infrastructure: South American governments are investing heavily in naval infrastructure to bolster maritime capabilities. Chile's Ministry of Defense announced a $1.5 billion investment plan to modernize its naval fleet and associated maintenance facilities. Similarly, Argentina has allocated $800 million towards upgrading shipyards and enhancing MRO capabilities, aiming to support both military and commercial maritime operations.

Market Challenges

- High Operational Costs: The maritime MRO sector in South America faces escalating operational costs. The International Chamber of Shipping reported that maintenance expenses for vessels have risen by 10% annually, with average costs reaching $2 million per vessel. Factors such as increased labor wages, higher material costs, and stringent environmental regulations contribute to this financial burden on MRO providers.

- Skilled Labor Shortage: There is a notable shortage of skilled labor in the maritime MRO industry. The South American Maritime Training Institute highlighted a deficit of 5,000 qualified marine engineers and technicians. This gap affects the quality and efficiency of maintenance services, leading to potential delays and increased operational risks for vessel operators.

South America Boat and Ship MRO Market Future Outlook

The South America Boat and Ship MRO industry is expected to see robust growth, fueled by technological advancements, increased focus on eco-friendly maintenance solutions, and the rising demand for predictive maintenance.

Future Market Opportunities

- Increased Integration of Predictive Maintenance Technologies: Over the next five years, predictive maintenance will revolutionize the South American MRO market. Major players are expected to invest over $200 million in AI-driven monitoring systems, enabling real-time diagnostics and reducing maintenance downtimes by 20%. Brazil's naval fleet modernization program is a key driver of this trend, emphasizing advanced predictive tools to ensure operational efficiency.

- Growth in Green and Sustainable MRO Practices: Environmental regulations will accelerate the adoption of eco-friendly MRO solutions. By 2028, 60% of shipyards in South America are forecasted to implement green technologies, reducing hazardous emissions by 50,000 tons annually. Countries like Peru and Chile are expected to lead this shift with government-backed incentives for sustainable practices.

Scope of the Report

|

By MRO Type |

Engine MRO |

|

Component MRO |

|

|

Dry Dock MRO |

|

|

Modifications |

|

|

Other MRO Types |

|

|

By Vessel Type |

Boats |

|

Yachts |

|

|

Commercial Vessels |

|

|

Naval Vessels |

|

|

Other Vessel Types |

|

|

By Application |

Repair |

|

Overhaul |

|

|

Maintenance |

|

|

By Service Provider |

OEM Service Providers |

|

Third-Party Service Providers |

|

|

In-House Maintenance Providers |

|

|

By Region |

North |

|

East |

|

|

West |

|

|

South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Vessel Operators and Owners

Offshore Oil and Gas Companies

Naval Defense Agencies (Brazilian Navy, Chilean Navy)

Shipyards and Drydock Providers

OEM Service Providers

Third-Party Maintenance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (IMO, MARPOL Authorities)

Companies

Players Mentioned in the Report:

Damen Shipyards Group

Wrtsil Corporation

Rolls-Royce Holdings PLC

Keppel Corporation

Hyundai Heavy Industries

Mitsubishi Heavy Industries Marine Machinery

Fincantieri S.p.A.

Kongsberg Gruppen

MTU Friedrichshafen GmbH

ABB Ltd

Table of Contents

1. South America Boat and Ship MRO Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. South America Boat and Ship MRO Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. South America Boat and Ship MRO Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Maritime Trade Routes

3.1.2. Aging Fleet Requiring Maintenance

3.1.3. Technological Advancements in MRO Services

3.1.4. Government Investments in Naval Infrastructure

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Skilled Labor Shortage

3.2.3. Regulatory Compliance Hurdles

3.3. Opportunities

3.3.1. Adoption of Digital MRO Solutions

3.3.2. Growth in Offshore Oil and Gas Exploration

3.3.3. Development of Eco-Friendly Maintenance Practices

3.4. Trends

3.4.1. Integration of IoT in Maintenance Processes

3.4.2. Shift Towards Predictive Maintenance Models

3.4.3. Collaboration with International MRO Providers

3.5. Government Regulations

3.5.1. Environmental Compliance Standards

3.5.2. Safety and Operational Guidelines

3.5.3. Incentives for Local MRO Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. South America Boat and Ship MRO Market Segmentation

4.1. By MRO Type (Value %)

4.1.1. Engine MRO

4.1.2. Component MRO

4.1.3. Dry Dock MRO

4.1.4. Modifications

4.1.5. Other MRO Types

4.2. By Vessel Type (Value %)

4.2.1. Boats

4.2.2. Yachts

4.2.3. Commercial Vessels

4.2.4. Naval Vessels

4.2.5. Other Vessel Types

4.3. By Application (Value %)

4.3.1. Repair

4.3.2. Overhaul

4.3.3. Maintenance

4.4. By Service Provider (Value %)

4.4.1. OEM Service Providers

4.4.2. Third-Party Service Providers

4.4.3. In-House Maintenance Providers

4.5. By Region (Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. South America Boat and Ship MRO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Damen Shipyards Group

5.1.2. Rolls-Royce Holdings PLC

5.1.3. Wrtsil Corporation

5.1.4. ABB Ltd

5.1.5. GE Marine

5.1.6. MAN Energy Solutions

5.1.7. Hyundai Heavy Industries

5.1.8. Mitsubishi Heavy Industries Marine Machinery & Equipment

5.1.9. Kongsberg Gruppen

5.1.10. MTU Friedrichshafen GmbH

5.1.11. Naval Group

5.1.12. Fincantieri S.p.A.

5.1.13. STX Offshore & Shipbuilding

5.1.14. Huntington Ingalls Industries

5.1.15. Keppel Corporation

5.2. Cross Comparison Parameters

- Fleet Size Managed

- Regional Presence

- Revenue Contribution by MRO Services

- Number of Employees in MRO Operations

- Technology Adoption Rate

- Customer Retention Rate

- Maintenance Downtime Optimization

- Environmental Compliance Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. South America Boat and Ship MRO Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. South America Boat and Ship MRO Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. South America Boat and Ship MRO Future Market Segmentation

8.1. By MRO Type

8.2. By Vessel Type

8.3. By Application

8.4. By Service Provider

8.5. By Region

9. South America Boat and Ship MRO Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map was developed to identify stakeholders, including vessel operators, MRO providers, and regulatory bodies. Data was collected through secondary research using industry databases and proprietary resources.

Step 2: Market Analysis and Construction

Historical data on vessel maintenance patterns and fleet size was analyzed. Data validation was performed to ensure reliability of revenue estimates and market segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from shipyards, naval organizations, and MRO service providers.

Step 4: Research Synthesis and Final Output

The final analysis synthesized insights from shipbuilders, MRO firms, and naval bodies, ensuring a comprehensive understanding of the South America Boat and Ship MRO market.

Frequently Asked Questions

01. How big is the South America Boat and Ship MRO Market?

The South America Boat and Ship MRO market is valued at USD 1.9 billion, driven by increasing demand for efficient maintenance solutions and aging fleets.

02. What are the challenges in the South America Boat and Ship MRO Market?

Challenges in the South America Boat and Ship MRO market include high operational costs, a shortage of skilled labor, and stringent compliance with international maritime regulations.

03. Who are the major players in the South America Boat and Ship MRO Market?

Key players in the South America Boat and Ship MRO market include Damen Shipyards Group, Wrtsil Corporation, Rolls-Royce Holdings PLC, Keppel Corporation, and Hyundai Heavy Industries.

04. What are the growth drivers of the South America Boat and Ship MRO Market?

Growth in the South America Boat and Ship MRO market is driven by the expansion of offshore oil and gas activities, increased maritime trade, and the need for technologically advanced maintenance solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.