South Korea Cosmetics Products Market Overview

- The South Korea Cosmetics Products Market is valued at USD 17.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for multifunctional and innovative skincare and beauty products, influenced by rising consumer awareness regarding personal grooming, the impact of social media on beauty trends, and the popularity of K-beauty culture. The market has seen a significant shift towards premium, organic, and cruelty-free products, reflecting changing consumer preferences and a heightened focus on product safety and ethical sourcing .

- Seoul, Busan, and Incheon are the dominant cities in the South Korea Cosmetics Products Market. Seoul, as the capital, serves as a hub for innovation and trends, attracting both local and international brands. Busan, with its bustling port, facilitates the import and export of cosmetic products, while Incheon is known for its duty-free shopping, making it a key player in the retail landscape .

- In 2023, the South Korean government implemented regulations to enhance the safety and efficacy of cosmetic products. This includes mandatory safety assessments for new ingredients, stricter labeling requirements, and the promotion of personalized and functional cosmetics through technology-driven initiatives. These regulations aim to protect public health and promote consumer confidence in cosmetic products .

South Korea Cosmetics Products Market Segmentation

By Type:The market is segmented into various types, including Skincare, Makeup, Haircare, Fragrance, Personal Care, Men's Grooming, Oral Care, and Others. Among these, Skincare products dominate the market due to the increasing focus on skin health, the popularity of K-beauty trends, and the demand for multifunctional and dermatologically advanced formulations. Consumers are increasingly investing in high-quality skincare products that promise effective results, leading to a surge in demand for serums, moisturizers, masks, and products incorporating biotechnology and natural ingredients .

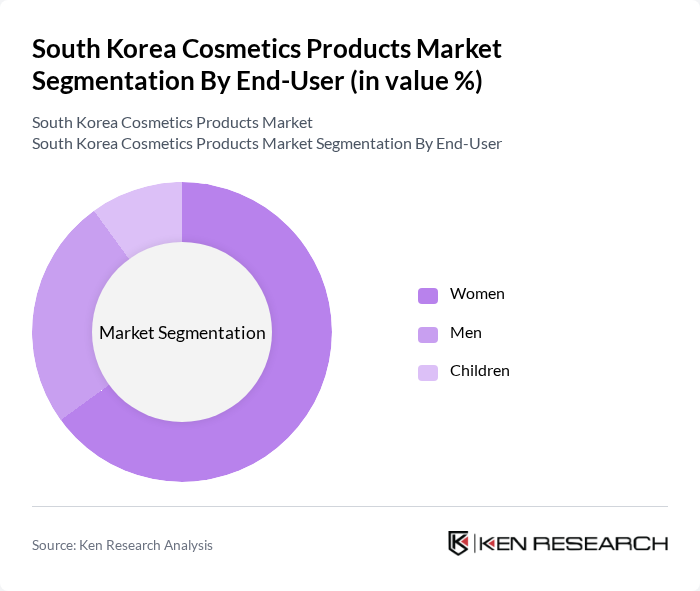

By End-User:The market is segmented by end-user into Women, Men, and Children. Women represent the largest segment, driven by their higher spending on beauty and personal care products. The increasing awareness of skincare routines, influence of beauty influencers on social media platforms, and the rise of e-commerce have significantly contributed to the growth of this segment. Men’s grooming is also expanding, supported by a growing acceptance of male beauty routines and targeted product launches .

South Korea Cosmetics Products Market Competitive Landscape

The South Korea Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amorepacific Corporation, LG Household & Health Care Ltd., Innisfree, Etude House, Missha (Able C&C Co., Ltd.), The Face Shop, Skinfood, Holika Holika (Enprani Co., Ltd.), Nature Republic, Clio Cosmetics, Laneige, Sulwhasoo, Aritaum, Dr. Jart+ (Have & Be Co., Ltd.), COSRX, Banila Co., TonyMoly Co., Ltd., Mediheal (L&P Cosmetic Co., Ltd.), Enbioscience, Minu Story, Cosvision contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Cosmetics Products Market Industry Analysis

Growth Drivers

- Rising Demand for K-Beauty Products:The South Korean cosmetics market is experiencing a surge in demand for K-beauty products, with sales reaching approximately $12 billion in future. This growth is driven by the global popularity of K-beauty trends, which emphasize innovative formulations and unique ingredients. The increasing interest in skincare routines, particularly among millennials and Gen Z consumers, has led to a 17% year-on-year increase in K-beauty product exports, highlighting the international appeal of these products.

- Increasing Online Sales Channels:E-commerce has become a significant growth driver in the South Korean cosmetics market, with online sales accounting for over $5 billion in future. The rise of digital platforms, including social media and beauty e-commerce sites, has facilitated direct-to-consumer sales, allowing brands to reach a broader audience. The COVID-19 pandemic accelerated this trend, with online sales growing by 35% in future, as consumers shifted towards convenient shopping options and digital engagement.

- Expansion of Eco-Friendly Products:The demand for eco-friendly cosmetics is on the rise, with the market for sustainable beauty products valued at approximately $2 billion in future. Consumers are increasingly prioritizing environmentally conscious brands, leading to a 25% increase in sales of eco-friendly products. This trend is supported by government initiatives promoting sustainability, as well as consumer awareness campaigns highlighting the importance of reducing plastic waste and using natural ingredients in cosmetics.

Market Challenges

- Intense Competition:The South Korean cosmetics market is characterized by fierce competition, with over 1,200 brands vying for market share. This saturation has led to price wars and aggressive marketing strategies, making it challenging for new entrants to establish themselves. Established brands dominate the market, with the top five companies accounting for nearly 65% of total sales in future, creating significant barriers for smaller players and startups.

- Regulatory Compliance Costs:Compliance with stringent regulations poses a significant challenge for cosmetics manufacturers in South Korea. The costs associated with meeting safety and ingredient regulations can exceed $600,000 annually for mid-sized companies. Additionally, the need for continuous testing and certification of products adds to operational expenses, which can hinder innovation and limit the ability of companies to respond quickly to market trends.

South Korea Cosmetics Products Market Future Outlook

The South Korean cosmetics market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing focus on personalized skincare solutions and the integration of AI in product recommendations are expected to reshape the retail landscape. Additionally, the rise of clean beauty and sustainable practices will likely influence product development, as brands strive to meet the demands of environmentally conscious consumers. Overall, the market is set to adapt and thrive amid changing dynamics and consumer expectations.

Market Opportunities

- Growth in Male Grooming Products:The male grooming segment is rapidly expanding, with sales projected to reach $1.2 billion in future. This growth is driven by changing societal norms and increased awareness of personal care among men, presenting a lucrative opportunity for brands to develop targeted products catering to this demographic.

- Expansion into Emerging Markets:South Korean cosmetics brands are increasingly looking to expand into emerging markets, particularly in Southeast Asia, where demand for beauty products is rising. With a combined population of over 700 million, these markets present significant growth potential, as local consumers seek high-quality and innovative beauty solutions.