Region:Asia

Author(s):Shubham

Product Code:KRAB0825

Pages:83

Published On:August 2025

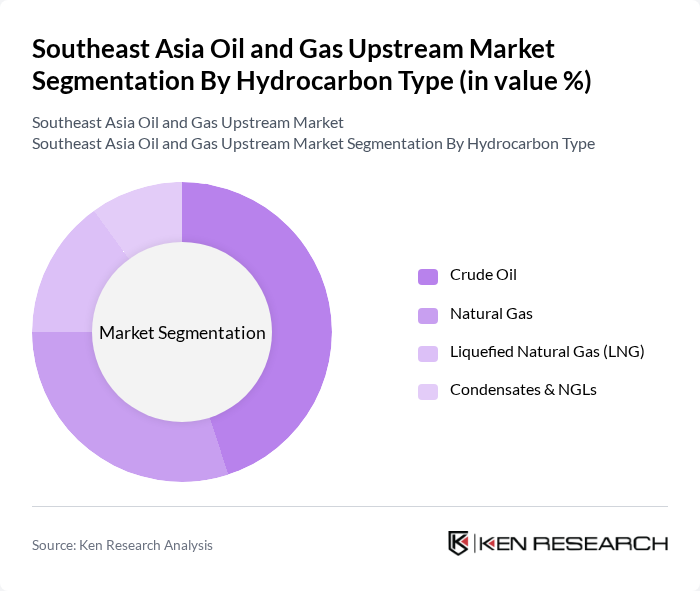

By Hydrocarbon Type:The hydrocarbon type segmentation includes crude oil, natural gas, liquefied natural gas (LNG), and condensates & NGLs. Crude oil remains the dominant subsegment due to its extensive use in transportation and industrial applications, supported by the region’s large automotive and manufacturing sectors. Natural gas is gaining traction as a cleaner alternative, particularly for power generation and residential use, with regional gas demand projected to outpace oil and coal as countries like Malaysia, Thailand, and Vietnam expand gas infrastructure to support economic growth and energy transition .

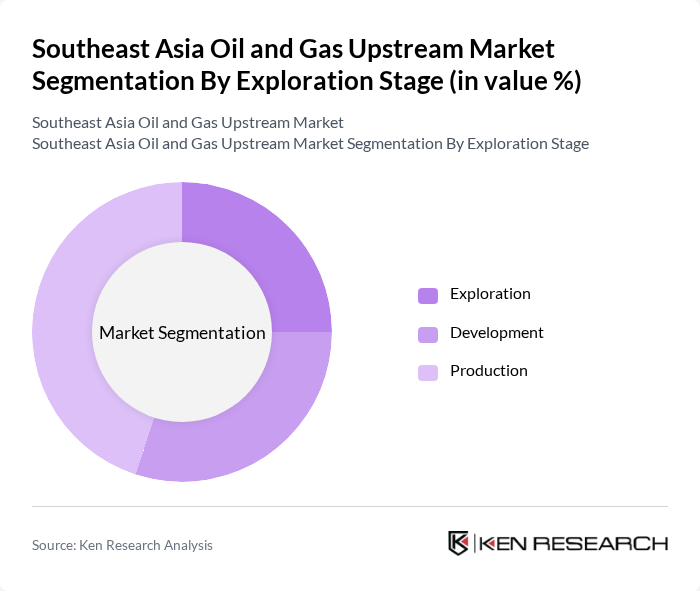

By Exploration Stage:The exploration stage segmentation encompasses exploration, development, and production. The production subsegment is currently leading the market, driven by the need to meet rising energy demands across the region. As existing fields mature, companies are investing in enhanced recovery and digital technologies to optimize production efficiency. Development activities remain significant, preparing new fields for future production and ensuring a steady supply of hydrocarbons .

The Southeast Asia Oil and Gas Upstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroliam Nasional Berhad (PETRONAS), PTT Exploration and Production Public Company Limited (PTTEP), Chevron Corporation, Exxon Mobil Corporation, TotalEnergies SE, ConocoPhillips, Shell plc, Repsol S.A., Eni S.p.A., China National Offshore Oil Corporation (CNOOC), Woodside Energy Group Ltd, Santos Limited, OMV Aktiengesellschaft, Hess Corporation, INPEX Corporation, PT Pertamina (Persero), MedcoEnergi, and Mubadala Energy contribute to innovation, geographic expansion, and service delivery in this space.

The Southeast Asia oil and gas upstream market is poised for significant transformation as it navigates the dual pressures of increasing energy demand and environmental sustainability. In future, the integration of renewable energy sources alongside traditional oil and gas operations is expected to reshape the industry landscape. Additionally, advancements in exploration technologies will enhance resource recovery, while government initiatives will likely foster a more stable investment climate, encouraging both local and foreign participation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Hydrocarbon Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Condensates & NGLs |

| By Exploration Stage | Exploration Development Production |

| By Location | Onshore Offshore (Shallow Water) Offshore (Deepwater/Ultra-deepwater) |

| By Country/Region | Indonesia Malaysia Vietnam Thailand Brunei Philippines Singapore Rest of Southeast Asia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Exploration and Production Companies | 120 | CEOs, Operations Managers, Geologists |

| Regulatory Bodies and Government Agencies | 60 | Policy Makers, Regulatory Analysts |

| Service Providers and Contractors | 50 | Project Managers, Business Development Executives |

| Environmental and Sustainability Experts | 40 | Environmental Managers, Compliance Officers |

| Financial Analysts and Investors | 45 | Investment Analysts, Portfolio Managers |

The Southeast Asia Oil and Gas Upstream Market is valued at approximately USD 50 billion, driven by increasing energy demand, technological advancements, and significant investments in exploration and production activities across the region.