Southeast Asia Personal Protective Equipment Market

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10773

November 2024

88

About the Report

Southeast Asia Personal Protective Equipment Market Overview

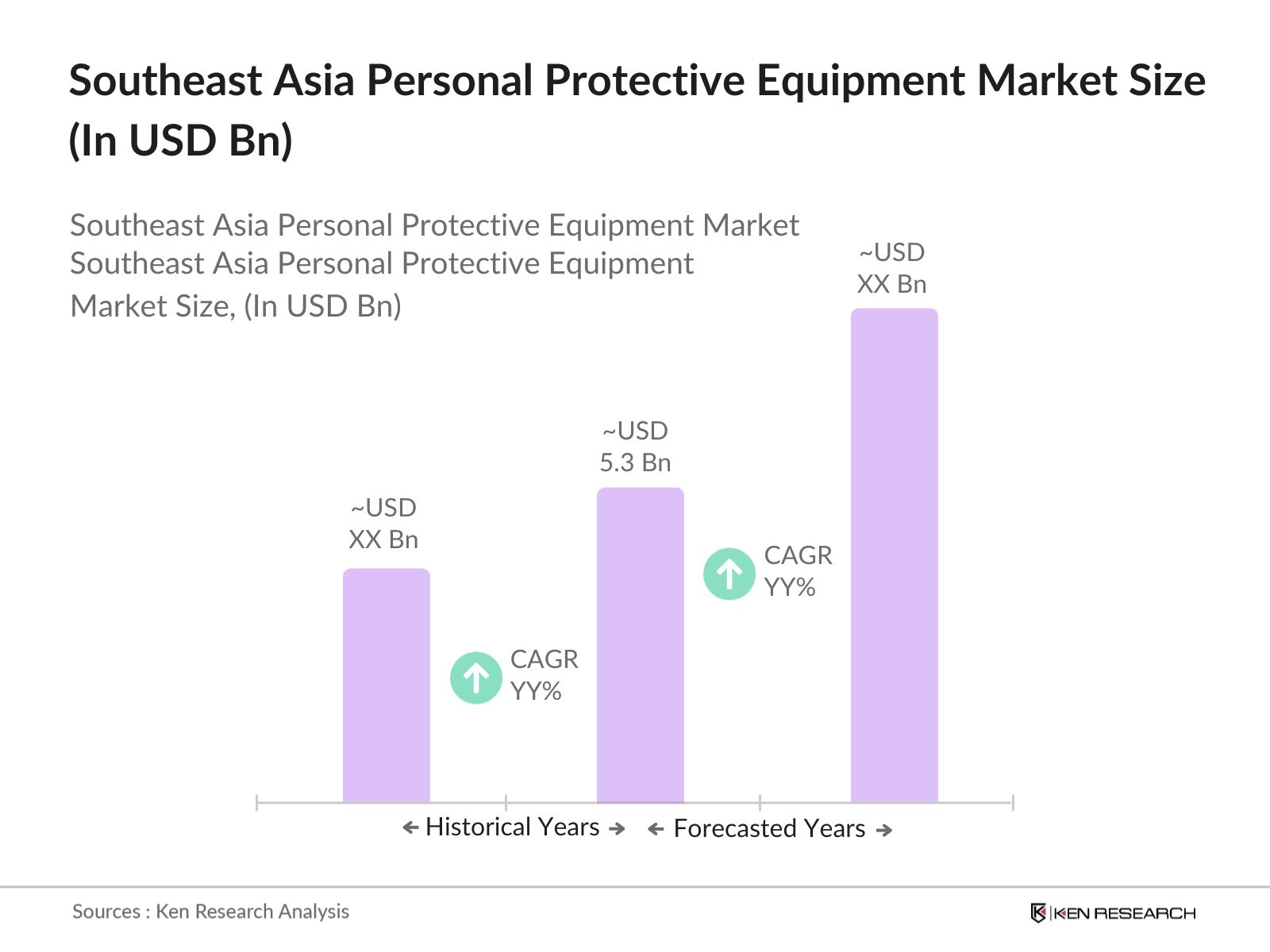

- The Southeast Asia Personal Protective Equipment (PPE) market is valued at USD 5.3 billion, based on a five-year historical analysis, with growth primarily driven by increasing safety regulations, industrial expansion, and rising awareness of worker safety. The need for PPE across industries like construction, manufacturing, and healthcare has led to increased demand for various protective equipment. Additionally, regulatory frameworks mandating safety compliance in workplaces further fuel the market's expansion as companies invest in advanced and reliable PPE solutions.

- In Southeast Asia, countries such as Indonesia, Malaysia, and Thailand dominate the PPE market due to their large industrial bases and stringent safety regulations. Indonesias manufacturing and construction sectors are substantial contributors to PPE demand, while Malaysia's focus on worker safety compliance and robust healthcare sector further drive the market. Thailand's industrial growth also contributes significantly, making these countries dominant players in the Southeast Asia PPE market.

- Governments in Southeast Asia have allocated close to 1 billion USD towards national safety programs specifically targeting the manufacturing and construction sectors. These programs mandate strict safety protocols and training for companies to follow, indirectly boosting PPE demand. For example, the Philippines' Department of Labor has launched initiatives that require over 50,000 manufacturing firms to comply with enhanced safety standards, increasing the need for PPE.

Southeast Asia Personal Protective Equipment Market Segmentation

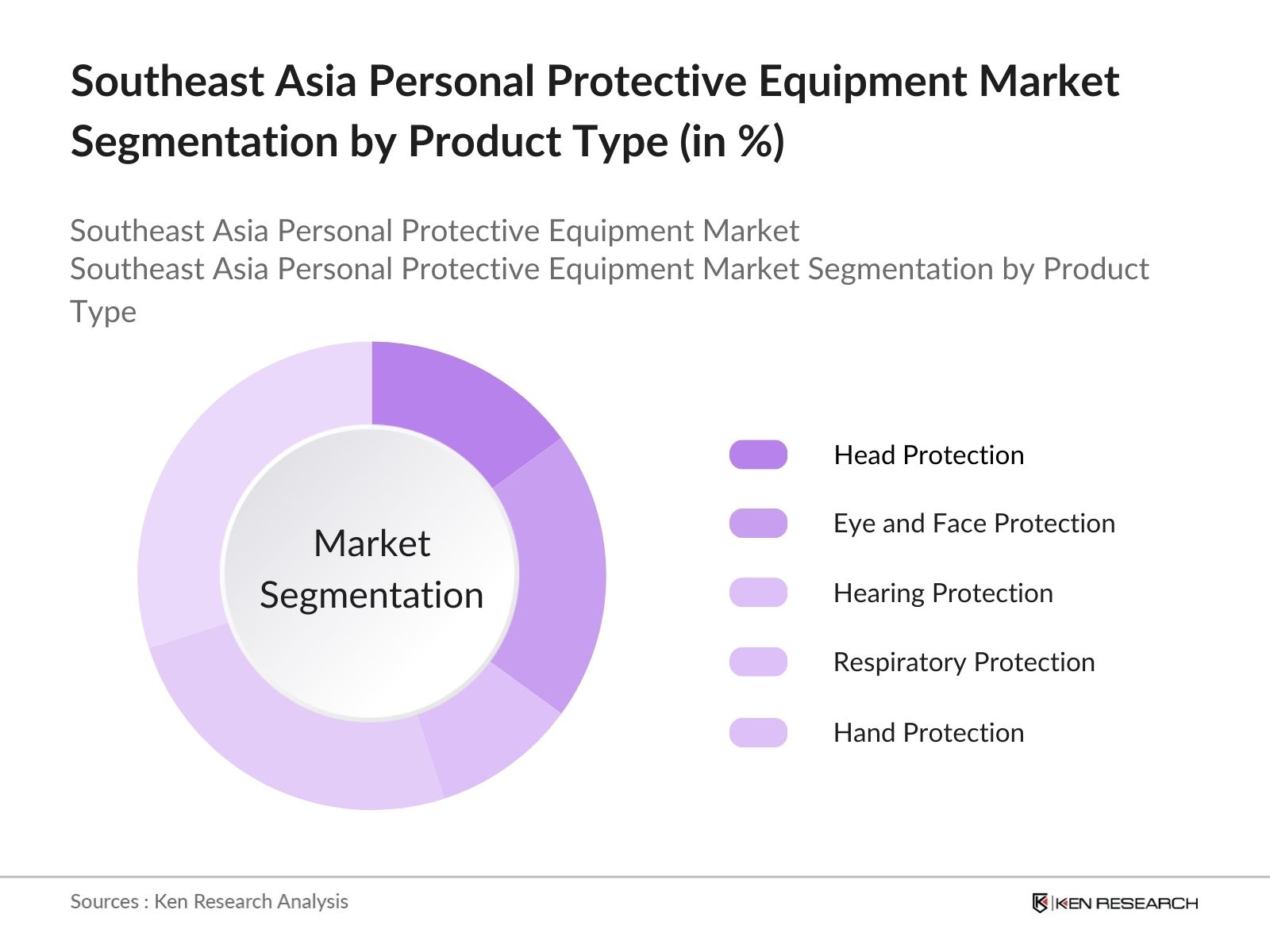

By Product Type: The market is segmented by product type into Head Protection, Eye and Face Protection, Hearing Protection, Respiratory Protection, and Hand Protection. Among these, Hand Protection leads the market share under this segmentation due to its widespread use across sectors like healthcare, manufacturing, and construction. Industries prioritize hand safety to reduce incidents of workplace injuries, leading to high demand for gloves and other hand-protective equipment.

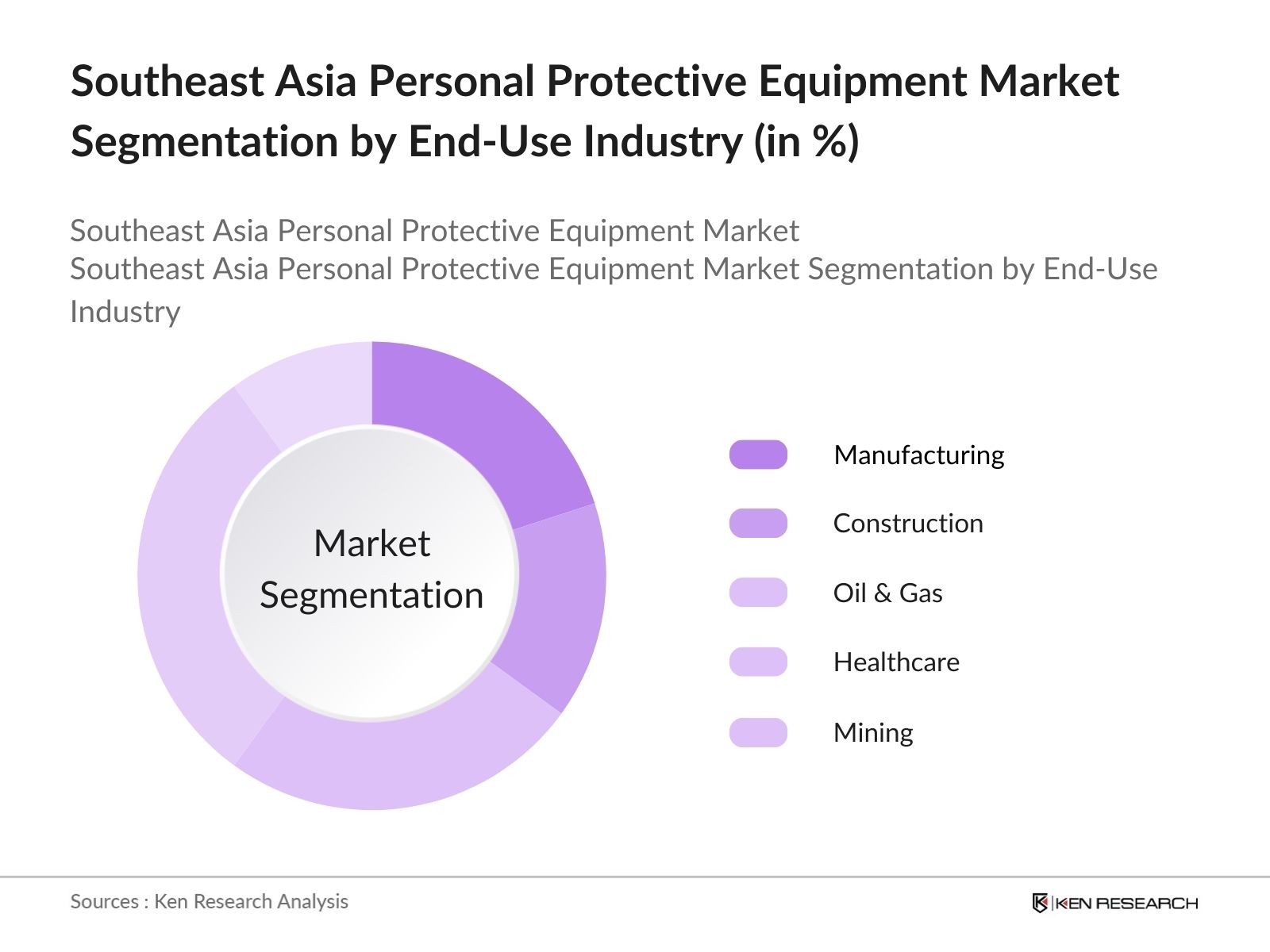

By End-Use Industry: The market is also segmented by end-use industry into Manufacturing, Construction, Oil & Gas, Healthcare, and Mining. The Healthcare segment dominates under this segmentation, primarily driven by the demand for infection control PPE, such as gloves and masks, especially in response to heightened health and safety standards. The continuous expansion of healthcare facilities and increased patient care requirements contribute to this demand.

Southeast Asia Personal Protective Equipment Market Competitive Landscape

The market is dominated by a few prominent players who leverage their global presence and extensive distribution networks to capture market share. Leading companies include multinational brands as well as regional players, with the competitive landscape shaped by factors such as product innovation, pricing strategies, and customer service quality.

Southeast Asia Personal Protective Equipment Market Analysis

Market Growth Drivers

- Rising Construction Activities and Industrial Expansion: The Southeast Asia region is witnessing an increase in infrastructure projects, with construction investments estimated to exceed 850 billion USD across various countries in 2024. This surge in infrastructure development has led to a corresponding increase in demand for personal protective equipment (PPE) for construction and industrial workers.

- Stringent Workplace Safety Regulations: Government regulations across Southeast Asia are becoming stricter, mandating higher safety standards in industries like oil and gas, mining, and manufacturing. For example, Malaysia and Thailand collectively imposed over 12,000 workplace safety inspections in 2023, and fines imposed for non-compliance exceeded 1.5 million USD.

- Growing Healthcare Sector and Pandemic Preparedness: The Southeast Asian healthcare sector is projected to grow with increased funding, with countries like the Philippines and Malaysia collectively investing around 10 billion USD in healthcare infrastructure in 2024. As the demand for healthcare workers rises, so does the need for protective gear such as masks, gowns, and gloves to maintain hygiene and prevent contamination.

Market Challenges

- High Cost of Quality PPE Equipment: The average cost of high-quality PPE, including respiratory masks and chemical-resistant suits, has risen by 10-15 USD per unit due to supply chain constraints. This increase in cost places a burden on companies, particularly SMEs, which may struggle to afford such protective equipment. As a result, many firms opt for low-cost, substandard PPE, which could potentially affect worker safety and compliance rates in the region.

- Supply Chain Disruptions Affecting PPE Availability: Ongoing geopolitical tensions and logistical issues have disrupted the supply of essential PPE materials. Southeast Asia's reliance on PPE imports, particularly from countries like China and India, has created supply volatility, with delivery lead times extending from 30 to 45 days in 2024. This delay affects companies' ability to maintain a steady inventory, which in turn impacts worker safety in industries that require a constant supply of PPE.

Southeast Asia Personal Protective Equipment Market Future Outlook

Over the next five years, the Southeast Asia PPE industry is expected to exhibit substantial growth due to increasing workplace safety regulations, heightened demand for infection control PPE, and technological advancements in personal protection equipment.

Future Market Opportunities

- Increased Adoption of Smart PPE Solutions: The demand for smart PPE, such as helmets with health monitoring sensors, is anticipated to grow rapidly. The Southeast Asia market is expected to reach over 2 million smart PPE units by 2029. As industries prioritize workplace safety, smart PPE products that enhance real-time monitoring of workers health and environmental conditions are likely to see significant adoption, especially in construction and oil sectors.

- Growth of Sustainable PPE Products: With the global push towards sustainability, eco-friendly PPE products are set to gain traction. By 2029, Southeast Asia is projected to produce nearly 1.5 million units of biodegradable PPE, driven by companies efforts to reduce environmental impact. This trend aligns with government support for sustainable development, as more eco-conscious PPE products emerge in response to growing demand for environmentally responsible options.

Scope of the Report

|

Product Type |

Head Protection Equipment |

|

End-Use Industry |

Manufacturing |

|

Distribution Channel |

Direct Sales |

|

Material Type |

Leather |

|

Region |

Indonesia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Manufacturers and Distributors in PPE industry

Healthcare Facilities and Hospitals

Construction and Real Estate Companies

Oil & Gas Firms

Government and Regulatory Bodies (Ministry of Labor, Occupational Safety Agencies)

Mining and Industrial Safety Contractors

Investor and Venture Capitalist Firms

Logistics and Transportation Companies

Companies

3M Company

Honeywell International Inc.

Ansell Ltd.

MSA Safety Inc.

DuPont de Nemours, Inc.

Kimberly-Clark Corporation

Delta Plus Group

Alpha Pro Tech, Ltd.

Lakeland Industries, Inc.

COFRA S.r.l.

Table of Contents

1. Southeast Asia Personal Protective Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. Southeast Asia Personal Protective Equipment Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. Southeast Asia Personal Protective Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Workplace Safety Regulations

3.1.2 Rising Awareness of Worker Health and Safety

3.1.3 Technological Advancements in PPE

3.1.4 Expansion in Construction and Manufacturing Sectors

3.2 Market Challenges

3.2.1 High Cost of Advanced PPE

3.2.2 Counterfeit PPE Products

3.2.3 Lack of PPE Compliance in Small Enterprises

3.3 Opportunities

3.3.1 Demand for Specialized PPE in Emerging Sectors

3.3.2 Growth in E-commerce Distribution Channels

3.3.3 Strategic Partnerships and Innovations

3.4 Trends

3.4.1 Integration of Smart PPE and IoT

3.4.2 Shift towards Eco-Friendly and Sustainable PPE

3.4.3 Rising Focus on Ergonomically Designed PPE

3.5 Government Regulation

3.5.1 Safety Standards and Compliance Regulations

3.5.2 National Safety Initiatives and Incentives

3.5.3 Import Tariffs and Export Policies

3.6 Competitive Ecosystem

3.7 Stakeholder Analysis

3.8 Porters Five Forces Analysis

4. Southeast Asia Personal Protective Equipment Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Head Protection Equipment

4.1.2 Eye and Face Protection

4.1.3 Hearing Protection

4.1.4 Respiratory Protection

4.1.5 Hand Protection

4.2 By End-Use Industry (In Value %)

4.2.1 Manufacturing

4.2.2 Construction

4.2.3 Oil and Gas

4.2.4 Healthcare

4.2.5 Mining

4.3 By Distribution Channel (In Value %)

4.3.1 Direct Sales

4.3.2 Distributor Sales

4.3.3 E-commerce

4.4 By Material Type (In Value %)

4.4.1 Leather

4.4.2 Polyurethane (PU)

4.4.3 Polyethylene (PE)

4.4.4 Rubber and Plastics

4.5 By Region (In Value %)

4.5.1 Indonesia

4.5.2 Malaysia

4.5.3 Thailand

4.5.4 Vietnam

4.5.5 Philippines

5. Southeast Asia Personal Protective Equipment Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 3M Company

5.1.2 Honeywell International Inc.

5.1.3 Ansell Ltd.

5.1.4 MSA Safety Inc.

5.1.5 Kimberly-Clark Corporation

5.1.6 DuPont de Nemours, Inc.

5.1.7 Delta Plus Group

5.1.8 Alpha Pro Tech, Ltd.

5.1.9 Lakeland Industries, Inc.

5.1.10 COFRA S.r.l.

5.1.11 Sioen Industries NV

5.1.12 Radians, Inc.

5.1.13 Protective Industrial Products, Inc.

5.1.14 Uvex Safety Group

5.1.15 Moldex-Metric, Inc.

5.2 Cross Comparison Parameters (Employee Base, Headquarters Location, Annual Revenue, Market Share, Innovation Index, Product Portfolio Breadth, Market Reach, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

6. Southeast Asia Personal Protective Equipment Market Regulatory Framework

6.1 Workplace Safety Standards

6.2 Certification and Compliance Processes

6.3 Import-Export Regulations

6.4 Government Support Programs

7. Southeast Asia Personal Protective Equipment Future Market Size (In USD Bn)

7.1 Market Size Projections

7.2 Key Drivers for Future Growth

8. Southeast Asia Personal Protective Equipment Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-Use Industry (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Material Type (In Value %)

8.5 By Region (In Value %)

9. Southeast Asia Personal Protective Equipment Market Analysts Recommendations

9.1 Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2 Market Entry Strategies

9.3 White Space Opportunities

9.4 Strategic Positioning for Competitive Advantage

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves a detailed mapping of the ecosystem, identifying major stakeholders and influencers in the Southeast Asia PPE market. Utilizing secondary databases and proprietary data sources, we defined critical market dynamics and product categories.

Step 2: Market Analysis and Construction

In this stage, we gathered and analyzed historical market data on revenue generation, market penetration, and sector-wise adoption of PPE products. This phase included examining PPE requirements across various industries and calculating market shares.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry professionals and stakeholders via computer-assisted telephone interviews (CATIs), providing operational and financial insights to support data accuracy.

Step 4: Research Synthesis and Final Output

The final phase included synthesizing data from PPE manufacturers, ensuring a comprehensive understanding of the market. This step involved validation through bottom-up approaches and a thorough review of primary sources, culminating in an accurate market analysis.

Frequently Asked Questions

1. How big is the Southeast Asia Personal Protective Equipment market?

The Southeast Asia PPE market is valued at USD 5.3 billion, with growth driven by regulatory safety mandates, industrial expansion, and rising worker safety awareness.

2. What are the main challenges in the Southeast Asia Personal Protective Equipment market?

Challenges in the Southeast Asia PPE market include high costs associated with advanced PPE, limited compliance among smaller enterprises, and counterfeit products impacting market integrity.

3. Who are the major players in the Southeast Asia Personal Protective Equipment market?

Leading players in the Southeast Asia PPE market include 3M, Honeywell, Ansell, MSA Safety, and DuPont. These companies dominate due to strong distribution networks, diverse product portfolios, and significant R&D investments.

4. What are the primary growth drivers of the Southeast Asia Personal Protective Equipment market?

Key drivers in the Southeast Asia PPE market include stringent safety regulations, industrial and infrastructure expansion, and increasing demand for infection control PPE in healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.