Region:Europe

Author(s):Shubham

Product Code:KRAA5471

Pages:97

Published On:September 2025

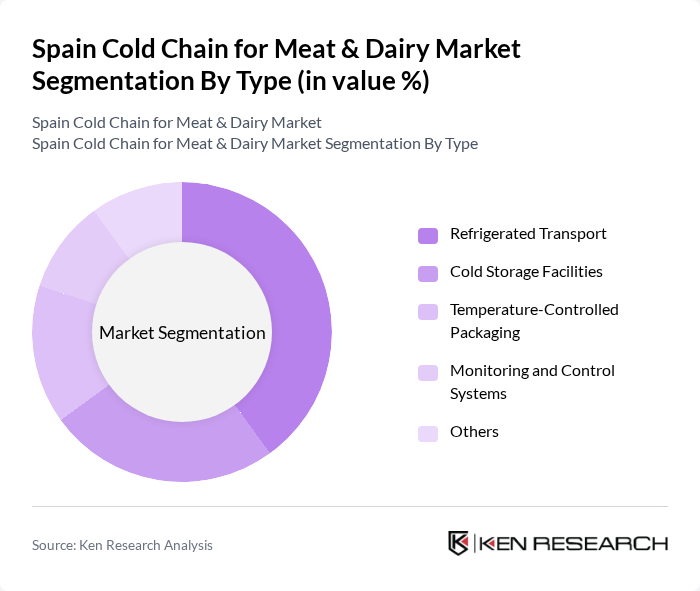

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring and Control Systems, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for efficient logistics solutions that ensure the timely delivery of perishable goods. The rise in e-commerce and home delivery services has further amplified the need for reliable refrigerated transport solutions.

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Wholesalers and Distributors, and Direct Consumers. Retail Chains dominate this segment as they require efficient cold chain solutions to maintain the quality of perishable products. The growing trend of organized retailing and the increasing number of supermarkets and hypermarkets have significantly contributed to the demand for cold chain logistics in this sector.

The Spain Cold Chain for Meat & Dairy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Fuertes, Campofrío Food Group, Lactalis Ingredients, Grupo Leche Pascual, COVAP, Grupo Siro, Frigoríficos de Navarra, Aguas de Mondariz, El Pozo Alimentación, Calidad Pascual, TGT Logistics, Transcoma, Logística Frigorífica, Grupo Aguas de Valencia, Frigotrans contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for meat and dairy in Spain appears promising, driven by technological advancements and evolving consumer preferences. The integration of IoT and automation is expected to enhance operational efficiency, while sustainable practices will gain traction as consumers demand environmentally friendly solutions. Additionally, the focus on traceability and transparency will likely shape supply chain strategies, ensuring that businesses can meet regulatory requirements and consumer expectations effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring and Control Systems Others |

| By End-User | Retail Chains Food Service Providers Wholesalers and Distributors Direct Consumers |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Meat Products Dairy Products Processed Foods Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Chain Investments Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Cold Chain | 100 | Operations Managers, Supply Chain Coordinators |

| Dairy Product Distribution | 80 | Logistics Directors, Quality Assurance Managers |

| Cold Storage Facilities | 70 | Facility Managers, Inventory Control Specialists |

| Transportation Services for Perishables | 90 | Fleet Managers, Compliance Officers |

| Retail Cold Chain Management | 60 | Store Managers, Procurement Officers |

The Spain Cold Chain for Meat & Dairy Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increasing consumer demand for fresh and high-quality meat and dairy products, as well as heightened awareness regarding food safety.