Spain Lubricants Market Outlook to 2027

Driven by Booming Automotive, Advancements in Lubricant Technologies along with expansion in manufacturing sector

Region:Europe

Author(s):Vanshika Goyal

Product Code:KR1437

April 2024

81

About the Report

Market Overview:

The Spanish lubricants market has a significant size and has exhibited steady growth over the years. This growth can be attributed to various factors like increased vehicle sales, expansion in industrial activities, and advancements in lubricant formulations. The market includes segments like automotive lubricants, industrial lubricants, marine lubricants, and others. Automotive lubricants contains a substantial portion of the market, driven by the extensive automotive sector in Spain.

Automotive includes engine oils, transmission fluids, and hydraulic fluids necessary for vehicle maintenance and servicing. Additionally, industrial lubricants cater to the needs of manufacturing, construction, and mining sectors. In these industries, machinery and equipment demand lubrication for maximum performance. The automotive sector which includes manufacturers like SEAT, Renault, and Volkswagen, significantly influences lubricant demand in Spain. Moreover, industrial activities across various sectors contribute to the market's growth trajectory. Environmental regulations also play a role, prompting a shift towards eco-friendly lubricants such as bio-based and synthetic formulations.

The lubricant market in Spain is moderately consolidated with a few major players dominating a significant portion of the market share. Companies like Repsol, Cepsa, and BP are among the key players in this market. However, there are smaller and regional players contributing to the overall market landscape as well.

Spain Lubricants Market Analysis

- The market experienced an increasing trend during the growing period between 2000-2021 with consumption peaking in 2005 at nearly 690 Mn Liters.

- In 2008 and in 2020, market got hit with two global events GFC and Covid, respectively which damaged consumption in both years.

- 2022 is the recovery year in Spain’s lubricant market with sales in 2022 closing on with pre-covid levels from lows of 457.7 Mn Liters to 498.3 Mn Liters.

- Technological advancement with launch of biodegradable lubricants offers sustainable growth and reduction in carbon emissions.

- Growth is expected in terms of new products that are sustainable and eco-friendly as well as new product portfolio for Electric Vehicles.

Key Trends by Market Segment:

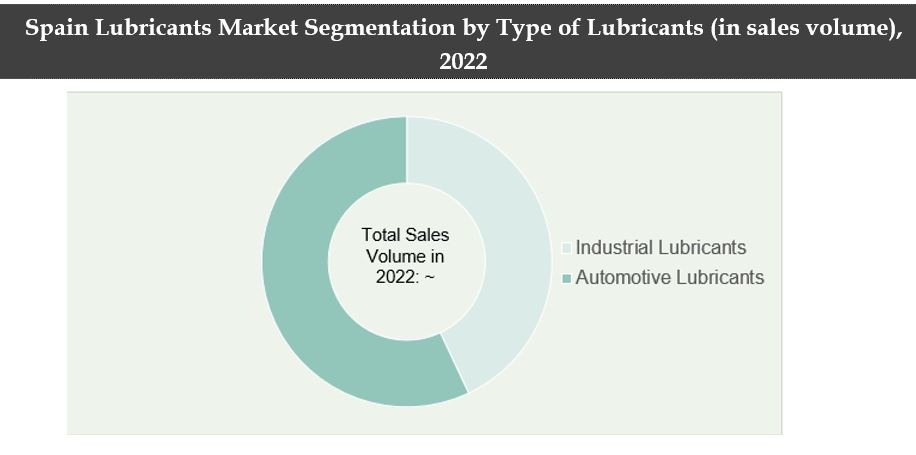

By Type of Lubricants: In 2022, Spain Lubricants market is segmented by type i.e., Industrial & Automotive Lubricants. Automotive Lubricants are dominating the market & overall contributes more than half of sales. Spain contains significant number of automobiles on its roads, ranging from passenger cars to commercial vehicles. The high ownership and extensive usage of vehicles contribute to a continuous demand for automotive lubricants.

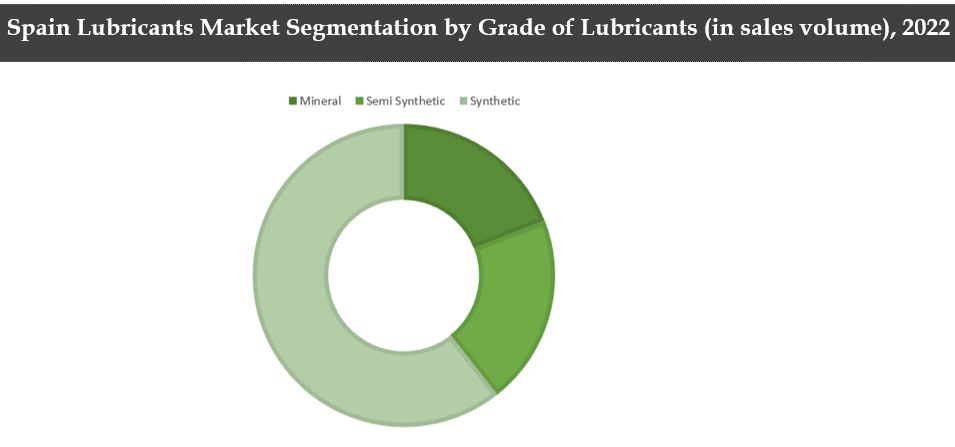

By Grade: In 2022, Spain Lubricant market is segmented by grade into Mineral, Semi-Synthetic & Synthetic. The synthetic segment dominates more than half of contribution to this segment. The preference for synthetic lubricants is due to their superior performance characteristics compared to mineral or semi-synthetic alternatives. Synthetic lubricants offer better thermal stability, resistance to oxidation, wider temperature tolerance, and improved lubrication efficiency. Additionally, they provide longer service intervals, reducing maintenance costs for users over time.

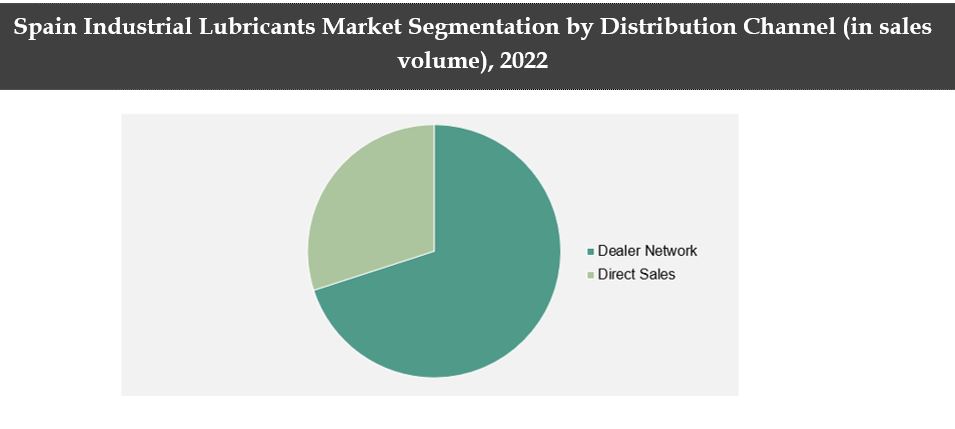

By Distribution Channel: In 2022, this segment is divided into direct sales & dealer network. Dealer network forms a significant majority of overall contribution. In the industrial segment, dealer networks offer high discounts, increased product choices & for small requirements, dealer networks are suitable. Hence, they dominate the market. Industrial lubricants needed for mining and construction are usually sold through dealer network.

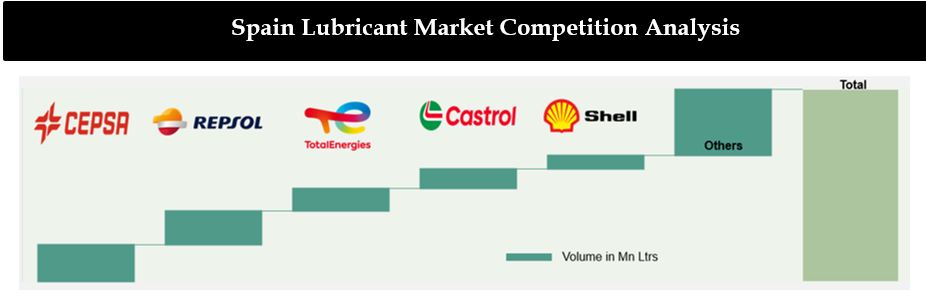

Competitive Landscape:

Major Players in Spain Lubricants Market

- CEPSA and Repsol are the market leaders, hold the more than one-third of the market share at 36.5% based on sales volume in 2022, which contributes their position in a moderately consolidated market.

- CEPSA has established itself as a leader in the lubricant market in Spain. Total Energies and Castrol have shown that they have the capability to reach there.

- Players have acquired their strength in the market by rooting strong distribution network along with focus on new launches for biodegradable lubricants.

- Out of total refineries, Repsol consists of 4 refineries and CEPSA has 3 and ASESA refinery is held by both.

- CEPSA consists of the largest distribution network with 200+ grades and a wide range of automotive and industrial lubricants.

Recent Developments:

- January 2022: ExxonMobil Corporation was organized alongside three business lines: ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- June 2021: Total Energies and Stellantis group renewed their partnership for cooperation across different segments. Partnerships with Peugeot, Citroën, and DS Automobiles & the new collaboration extends to Opel, and Vauxhall as well.

- April 2021: Texaco Lubricants introduced three new engine oils within the successful Texaco Havoline ProDS range with manufacturer approvals. These have been designed to provide enhanced wear protection even with a lubricant layer of 2 microns.

Future Outlook:

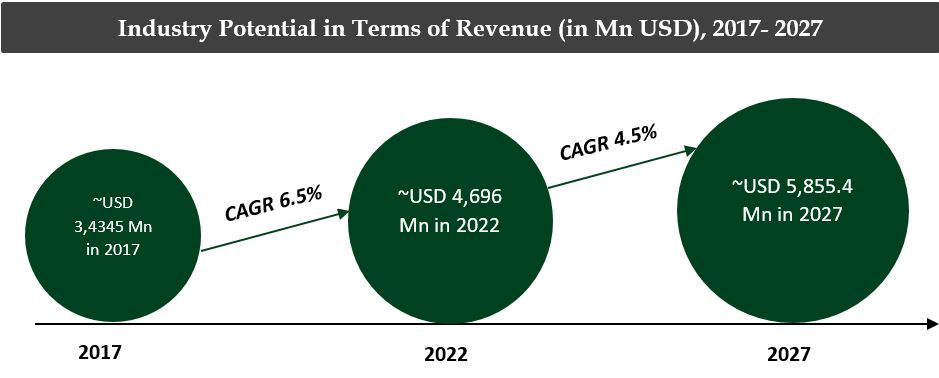

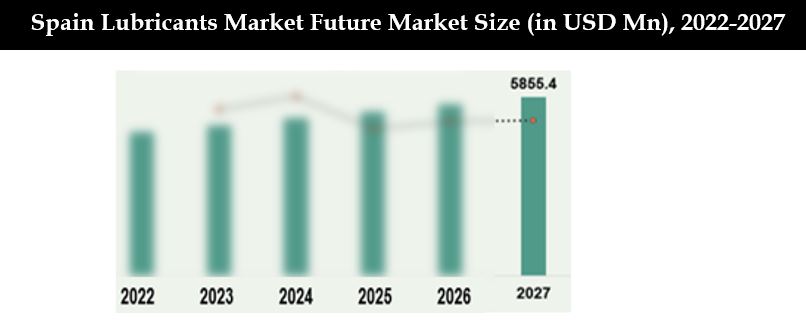

- Spain lubricant market revenue is expected to grow at a CAGR of 4.5% due to a rise in demand.

- Revenue is expected to rise owning to the rising sales volume in passenger cars and increasing average prices.

- Due to increase in synthetic oils usage and launching of new sustainable lubricants price is expected to rise during next 5 years

- Demand for industrial lubricants in Food Industry is projected to grow at a CAGR of 3%, due to transformation towards digitalization and sustainability to adapt climate change. Spain has become one of the few Food Tech nations, developing an enterprising ecosystem across the entire agri-food value chain.

- Post 2023, the Lubricants market is expected to grow due to growing demand for automobiles and increasing demand for zero-emission producing vehicles in Spain.

Scope of the Report

|

Spain Lubricants Market Segmentation |

|

|

By Lubricant Type |

Industrial Lubricants Automotive Lubricants |

|

By Grade |

Mineral Semi-Synthetic Synthetic |

|

Spain Automotive Lubricants Market Segmentation |

|

|

By Lubricant Type |

Passenger Vehicle Motor Oil​ Heavy-Duty Diesel Engine Oil​ Transmission Fluids​ Gear Oils​ Greases​ Hydraulic oils & Coolant​ |

|

By End Users |

Passenger​ Vehicle Commercial​ Vehicle Aviation Marine Motorcycle ​ |

|

By Distribution Channel |

OEM Workshops/service Stations/Local workshops​ Dealer Network​ Supermarkets/​Hypermarkets​ Online |

|

Spain Industrial Lubricants Market Segmentation |

|

|

By Lubricant Type |

Hydraulic Fluid Metal Working Fluid Turbine and Textile Oil Gear Oil Greases |

|

By End Users |

Construction & Mining Transport Equipment & Machinery Food Industry Chemical (including Petrochemical) Textile & Leathers Others |

|

By Distribution Channel |

Direct Sales Dealers Network |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors & Financial Institutions

Lubricant Manufacturers & Suppliers

Government Entity

Trade Associations & Industry Groups

Automotive Industry

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

CEPSA

Motul

Castrol

Q8 Oils

Fuchs

Petronas

Eni

Mobil

Total Energies

Shell Lubricants

Olipes

Repsol

Table of Contents

1. Executive Summary

1.1 Executive Summary for Spain Lubricants Market, 2017-2027

2. Country Overview of Spain

2.1 Country Overview, 2022

2.2 Major Crude Oil Refineries in Spain, 2022

3. Spain Trade and Automotive Industry Analysis

3.1Spain Trade Analysis

3.2 Spain Automotive Industry, 2022

3.3 Harvey ball analysis of Lubricants companies in Europe

4. Spain Lubricants Market Overview

4.1 Ecosystem of major Entities in Spain Lubricants Market

4.2 Business Cycle and Genesis of Spain Lubricants Market

4.3 Value Chain Analysis for Spain Lubricants Market

4.4 Market Size of Spain Lubricants by Revenue and Average Price, 2017-2022

4.5 Market Size of Spain Lubricants by Sales Volume, 2017-2022

5. Spain Lubricants Market sizing and Segmentation

5.1 Segmentation by Type of Lubricants, 2022

5.2 Segmentation by Grade of Lubricants, 2022

6. Spain Automotive Lubricants Market Segmentation, 2022

6.1 By Type of Automotive Lubricants, 2022

6.2 By End Use of Automotive Lubricants, 2022

6.3 By Distribution Channel of Automotive Lubricants, 2022

7. Spain Industrial Lubricants Market Segmentation, 2022

7.1 By Type of Industrial Lubricants, 2022

7.2 By End Use of Industrial Lubricants, 2022

7.3 By Distribution Channel of Industrial Lubricants, 2022

8. Industry Analysis of Spain Lubricants Market

8.1 SWOT Analysis for Spain Lubricants Market

8.2 Growth Drivers in Spain Lubricants Market

8.3 Issues and Challenges in Spain Lubricants Market

8.4 Spain Lubricants Market Regulations

9. End User Analysis of Industrial Lubricants Market

9.1 Decision Making Parameters of Automotive and Industrial Lubricants End-Users in Spain

9.2 Vendor Evaluation and Selection Process in Spain Lubricants Market

9.3 Factors Affecting Vendor Selection Process

10. Competition Framework of Spain Lubricants Market

10.1 Market Share of Major Manufacturers in Spain Lubricants Market, 2022

10.2 Competitive Landscape using Gartner’s Magic Quadrant Framework

10.3 Strength and Weakness of major players in Spain Lubricants Market

10.4 Cross-Comparison of Major Players Operating in the Spain Lubricants Market Basis

11. Future Outlook of Spain Lubricants Market, 2022-2027

11.1 Future Market Sizing and Average Price analysis of Spain Lubricants Market, 2022-2027

11.2 Market Sizing Analysis of Spain on the basis of Sales Volume, 2022-2027

11.3 Future Spain Lubricants Market Segmentation by Type and Grade, 2027

12. Future Outlook of Spain Automotive Lubricants Market, 2022-2027

12.1 Future Spain Automotive Lubricants Market Segmentation by Type, 2027

12.2 Operational Parameters

13. Future Outlook of Spain Industrial Lubricants Market, 2022-2027

13.1 Future Spain Industrial Lubricants Market Segmentation by End use, 2027

13.2 Future Spain Industrial Lubricants Market Segmentation by Type and

Distribution Channel, 2027

14. Industry Speaks and Analyst Recommendations

14.1 Marketing and Sales Channel Strategies for Automotive & Industrial Lubricants Providers

14.2 Companies looking to capture value growth can pull several levers

14.3 Introduction of E-Fluid in Spain

14.4 Introduction of E-Commerce in Spain

15. Research Methodology

15.1 Market Definitions and Assumptions

15.2 Abbreviations used

15.3 Market Sizing Approach

15.4 Consolidated Research Approach

15.5 Sample size limitations and Future Conclusion

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on lubricants market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Spain Lubricants market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple lubricants providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from lubricant providers.

Frequently Asked Questions

01 How big is Spain Lubricants Market?

The Spain Lubricants Market was valued at ~USD 4696 Mn in 2022.

02 What are the Key Factors Driving Spain Lubricants Market?

Shift from semi-synthetic & synthetic oils from mineral oils & emergence of eco-friendly lubricants are likely to fuel the growth in Spain Lubricants Market.

03 Who are the Key Players in Spain Lubricants Market?

CEPSA, Repsol, Total Energies, Castrol are some of the key players in Spain Lubricants Market

04 What is the Future Growth Rate of Spain Lubricants Market?

Spain Lubricants Market is expected to reach ~USD 5855.4 Mn by 2027.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.