Türkiye Lubricants Market Outlook to 2028

Driven by Increasing Automotive Sales along with Manufacturing & Construction Activities

Region:Europe

Author(s):Deepakshi Chaudhary

Product Code:KR1438

April 2024

84

About the Report

Market Overview:

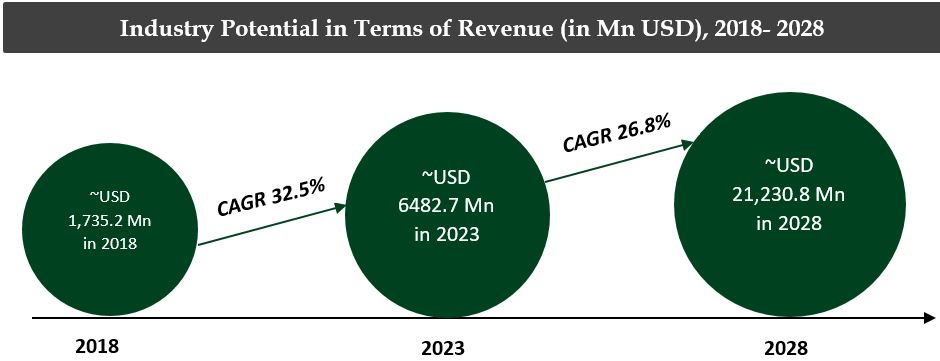

Türkiye’s lubricants market is experiencing steady growth, driven primarily by industrial activities, automotive sector developments, and increasing demand for lubricants in various applications. The market size is increasing which reflects the growing demand for lubricants across different industries. Türkiye has a significant automotive manufacturing industry, with several major manufacturers producing vehicles for domestic consumption and export. The automotive sector is a key driver of lubricant demand in Türkiye as lubricants are essential for vehicle maintenance and operation.

Lubricants are used in various industries like manufacturing, construction, mining, and agriculture. The growth of these sectors contributes to the demand for lubricants for machinery and equipment maintenance. Regulatory standards and environmental concerns are influencing the types of lubricants used in the market. Compliance with environmental regulations & adopting eco-friendly lubricants have been the emerging trends in the industry. Lubricants are distributed through various channels that is, direct sales, distributors, retailers, and online platforms. The efficiency of distribution networks and availability of products across different regions influence market penetration.

The lubricants market in Turkiye is a moderately consolidated market. Several companies dominate a significant portion of the market share, including companies like Shell, Total, Castrol among others. These major players often have extensive distribution networks, brand recognition, and diverse product portfolios, which gives them a stronghold in the market.

Türkiye Lubricants Market Analysis

- Inception of the lubricants market in Türkiye was in 1940 by Petrol Ofisi. Oil was first discovered at Raman-1 Well in Batman.

- Presently, the Türkiye Lubricant Market is at growth stage with establishment of many national and international companies such as Shell, Castrol, Total Energies and more.

- Türkiye is witnessing growing demand for specialized industrial lubricants which is tailored for specific applications in manufacturing.

- Synthetic lubricants are gaining popularity in the industry due to their ability to withstand extreme temperatures and provide better efficiency.

- The market is witnessing a sharper focus on sustainability which drives the demand for eco-friendly lubricants.

Key Trends by Market Segment:

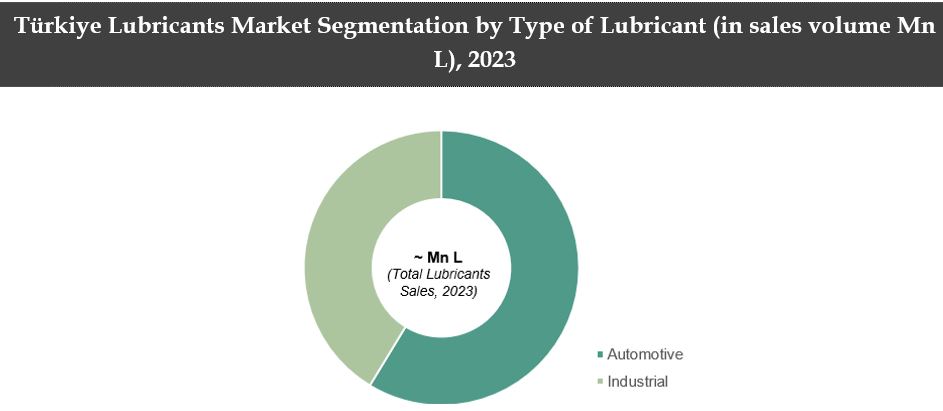

By Type of Lubricants: In 2023, Türkiye Lubricants market is segmented by type into Industrial & Automotive. Out of these, Automotive segment dominates the market in Türkiye with a significant share of overall contribution. Türkiye has a considerable number of vehicles on its roads, including both passenger cars and commercial vehicles. With a large fleet of automobiles, there is a consistent demand for automotive lubricants to keep these vehicles running smoothly.

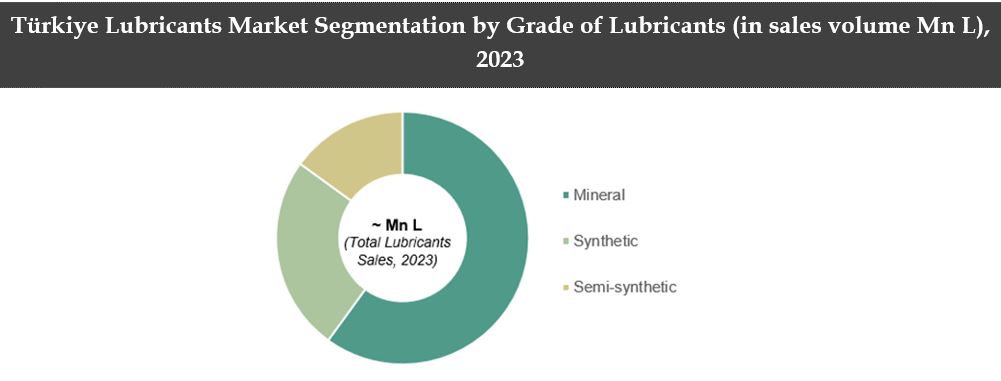

By Grade of Lubricants: In 2023, Türkiye Lubricants market has been segmented into Mineral, Synthetic & Semi-Synthetic. Mineral-based lubricants dominate the market with a significant portion of overall contribution. Mineral-based lubricants are usually less expensive to produce compared to synthetic or semi-synthetic lubricants. This makes them more accessible to a wider range of consumers, including individual vehicle owners and small businesses. Along with its widespread compatibility, the mineral segment continues to grow.

Competitive Landscape:

Major Players in Turkiye Lubricants Market

- Türkiye's Lubricants Market is in its growing phase with leaders commanding a larger market share. Players in this market compete on various fronts which includes Product, Price, and Service.

- Petrol Ofisi, BP Castrol and Total Energies collectively accounted for more than 60% of the total market share in the market.

- Despite being the leader in the market, Petrol Ofisi falls behind in the Industrial Lubricant Segment, as Castrol BP consolidates its position in both the segments, amongst the giant players.

- Lubricants in Türkiye have a history from 1900s and 3 global players: Total Energies, Shell and Castrol BP, based out of Europe contribute the most annual revenue of more than $300 Mn.

Recent Developments:

-

-

- January 2022: ExxonMobil Corporation restructured its organization, implementing a new framework that divided the company into three separate business lines: ExxonMobil Upstream Company, ExxonMobil Product Solutions, and ExxonMobil Low Carbon Solutions, starting from April 1, 2022.

- September 2021: Total Türkiye Pazarlama and Nissan Türkiye signed a new agreement wherein Nissan Türkiye is expected to deliver Nissan Genuine Engine Oils to its Turkish clients for the next three years. Nissan Genuine Engine Oils are created with the help of TotalEnergies' lubricant expertise.

- March 2021: Castrol announced the launch of Castrol ON i.e. a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases. This range is specifically designed for electric vehicles.

-

Future Outlook:

-

-

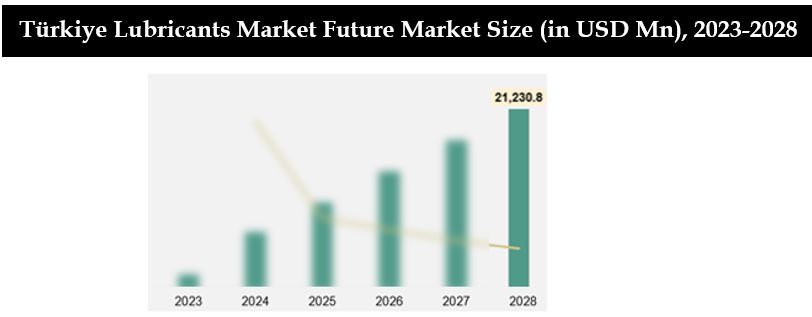

- Türkiye Lubricants Market is projected to reach $ 21.2 Bn revenue in 2028, driven by high inflationary tendencies and growth in manufacturing and construction sectors.

- Oil demand is expected to continue to expand over 2023-2028 in Türkiye to fulfill the consumption requirements of industrial and automotive sectors by processing mineral oils into semi-synthetic and synthetic oils.

- The market is expected to witness enhancing use of synthetic lubricants over long term, due to the growing awareness of people to switch to better quality lube oils for long term protection of the engines. Specialized EV fluids will gain popularity with increasing EVs in the country.

- The market is also seeing adoption of automation and Industry 4.0 principles in automated machinery, robotics, and smart manufacturing processes.

- Synthetic based lubricants are expected to continue gaining popularity and secure more than 40% of the market share by 2028.

-

Scope of the Report

|

Türkiye Lubricants Market Segmentation |

|

|

By Lubricant Type |

Automotive Lubricants Industrial Lubricants |

|

By Grade |

Mineral Semi-Synthetic Synthetic |

|

Türkiye Automotive Lubricant Market |

|

|

By Lubricant Type |

Passenger Vehicle Motor Oil Heavy-Duty Diesel Engine Oil Gear & Transmission Fluids Greases Hydraulic Oils |

|

By End-User |

Passenger Cars Commercial Vehicles Motor Cycles Marine Others (Aviation) |

|

By Distribution Channel |

Online (E-commerce) Dealer Network OEM Workshops/ Service Stations Supermarkets & Hypermarkets |

|

Türkiye Industrial Lubricants Market |

|

|

By Type of Lubricants |

Process Oils Hydraulic Fluids Transformer Oils Metalworking Fluids Gear Oil Others (Turbine Oil, Compressor Oil, Textile Oil, Grease etc.) |

|

By End User |

Passenger Cars Commercial Vehicles Motor Cycles Marines Others (Aviation) |

|

By Distribution Channel |

Direct Manufacturer Sales Dealer Network Sales |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors & Financial Institutions

Manufacturers & Distributors

Lubricant Manufacturers

Government & Regulatory Authorities

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Petrol Ofisi

The Shell Company

Bp - Castrol

Total Energies

Opet Fuchs

Table of Contents

1. Executive Summary

1.1 Executive Summary for Türkiye Lubricants Market, 2018-2028

2. Country Overview of Türkiye

2.1 Country Demographics, 2023

2.2 Türkiye Automotive Market, 2023

2.3 Türkiye Industrial Market, 2023

3. Türkiye Lubricants Market Overview

3.1 Supply Ecosystem of Major Entities in Türkiye Lubricants Market

3.2 Demand Ecosystem of Major Entities in Türkiye Lubricants Market

3.3 Business Cycle and Genesis of Türkiye Lubricants Market

3.4 Timeline of major Players in Türkiye Lubricants Market

3.5 Value Chain Analysis of Türkiye Lubricants Market

3.6 Market Sizing Analysis of Türkiye Lubricants Market, 2018-2023

3.7 Market Segmentation by Lubricant Type, 2018-2023

3.8 Market Segmentation by Lubricant Grade Type, 2018-2023

4. Türkiye Automotive Lubricants Market Segmentation, 2023

4.1 Automotive Lubricants Market Overview, 2023

4.2 By Type of Automotive Lubricants on the basis of Sales and Volume, 2023

4.3 By End Use of Automotive Lubricants on the basis of Sales and Volume, 2023

4.4 By Distribution Channel of Automotive Lubricants on the basis of Sales and Volume, 2023

5. Türkiye Industrial Lubricants Market Segmentation, 2023

5.1 Industrial Lubricants Market Overview, 2023

5.2 By Type of Industrial Lubricants on the basis of Sales and Volume, 2023

5.3 By End Use of Industrial Lubricants on the basis of Sales and Volume, 2023

5.4 By Distribution Channel of Industrial Lubricants on the basis of Sales and Volume, 2023

6. End User Analysis of Türkiye Lubricants Market

6.1 End User Analysis of Türkiye Lubricants Market

6.2 Sectoral End User Analysis of Türkiye Lubricants Market

6.3 End Users Pain Points in Türkiye Lubricants Market

6.4 Vendor Evaluation and Selection process in Türkiye Market

6.5 Factors Affecting Vendor Selection Process

6.6 Decision Making Parameters of Automotive Lubricant End-Users in Türkiye Lubricants Market

6.7 Decision Making Parameters of Industrial Lubricant End-Users in Türkiye Lubricants Market

7. Industry Analysis of Türkiye Lubricants Market

7.1 SWOT Analysis for Türkiye Lubricants Market

7.2 Porter’s Five Forces Analysis of Türkiye Lubricants Market

7.3 Growth Drivers in Türkiye Lubricants Market

7.4 Bottlenecks and Challenges in Türkiye Lubricants Market

7.5 Trends and Developments in Türkiye Lubricants Market

7.6 Türkiye Lubricants Market Regulations

8. Competitive Framework of Türkiye Lubricants Market

8.1 Competitive Landscape

8.2 Market Share of Major Manufacturers in Türkiye Lubricants Market, 2023

8.3 Market Share of Major Manufacturers in Türkiye Automotive and Industrial Lubricants Market, 2023

8.4 Strength and Weakness of Major Manufacturers in Türkiye Lubricants Market, 2023

8.5 Average Price by Grade Type of Automotive Lubricants Manufacturers, 2023

8.6 Average Price by Lubricant Type of Industrial Lubricants Manufacturers, 2023

8.7 Cross Comparison of Major Players in Türkiye Industrial Lubricant Market, 2023

9. Future Outlook and Projections for Türkiye Lubricant Market, 2023-2028

9.1 Market Sizing Analysis of Türkiye Lubricants Market, 2023-2028

9.2 Market Segmentation by Lubricant Type and Grade, 2023-2028

9.3 Market Sizing Analysis of Automotive Lubricants, 2023-2028

9.4 Market Segmentation of Automotive Lubricants by Type andÂ

9.5 End Use on the Basis of Sales Volume, 2028

9.6 Market Segmentation of Automotive Lubricants by DistributionÂ

9.7 Channel on the Basis of Sales Volume, 2028

9.8 Market Sizing Analysis of Industrial Lubricants, 2023-2028

9.9 Market Segmentation of Industrial Lubricants by Type andÂ

End Use on the Basis of Sales Volume, 2028

9.10 Market Segmentation of Industrial Lubricants by Distribution ChannelÂ

on the Basis of Sales Volume, 2028

10. Market Opportunity and Analyst Recommendations

10.1 Companies Looking to Capture Value Growth Can Pull Several Levers

10.2 Marketing and Sales Channel Strategies for Automotive and Industrial Lubricant Providers

Industry SpeaksÂ

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations used

11.3Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Sample size InclusionÂ

11.6 Limitations and Future Conclusion

Disclaimer Contact UsResearch Methodology

Step: 1Â Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on lubricants market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Türkiye Lubricants market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple lubricants providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from dairy food providers.

Frequently Asked Questions

01 How big is Türkiye Lubricants Market?

Türkiye Lubricants Market was valued at ~USD 6482.7 Mn in 2023.

02 What are the Key Factors Driving Türkiye Lubricants Market?

Shift to synthetic based lubricants & rising oil production are likely to fuel the growth in Türkiye Lubricants Market.

03 Who are the Key Players in Türkiye Lubricants Market?

Castrol, TotalEnergies, Petrol Ofisi are some of the key players in the Türkiye Lubricants Market

04 What is the Future Growth Rate of the Türkiye Lubricants Market?

Türkiye Lubricants Market is expected to reach ~USD 21,230.8 Mn by 2028.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.