Region:Europe

Author(s):Shubham

Product Code:KRAA1120

Pages:95

Published On:August 2025

By Type:

The Turkey Cold Chain Solutions Market is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring & Tracking Systems, and Value-Added Services. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for fresh produce, dairy, and pharmaceuticals. The rise of e-commerce and the expansion of Turkey's role as a regional logistics hub have significantly boosted the need for efficient refrigerated transport solutions, as consumers and businesses expect timely delivery of perishable goods. Cold Storage Facilities follow closely, as they are essential for maintaining the quality and safety of temperature-sensitive products, especially in the context of growing agricultural exports and pharmaceutical distribution .

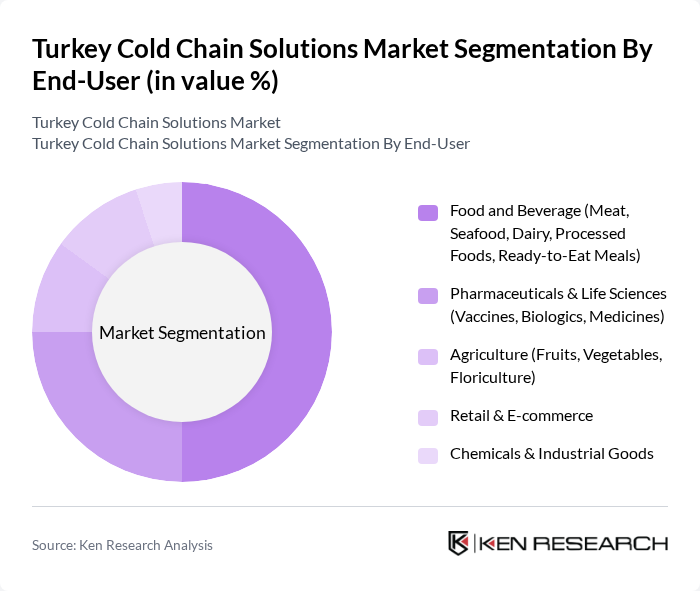

By End-User:

The end-user segmentation of the Turkey Cold Chain Solutions Market includes Food and Beverage, Pharmaceuticals & Life Sciences, Agriculture, Retail & E-commerce, and Chemicals & Industrial Goods. The Food and Beverage sector is the dominant end-user, driven by the increasing consumption of perishable goods, the growth of organized retail, and the rising trend of online grocery shopping. The Pharmaceuticals & Life Sciences sector is also significant, as it requires stringent temperature control for vaccines, biologics, and other sensitive products. The rise of e-commerce and Turkey's expanding agricultural exports have further amplified the demand for cold chain solutions across these sectors .

The Turkey Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netlog Logistics, Omsan Lojistik, Borusan Lojistik, Taha Kargo, Horoz Logistics, Mars Logistics, Ekol Logistics, Sertrans Logistics, Barsan Global Logistics, Kuehne + Nagel, DB Schenker, DHL Supply Chain, CEVA Logistics, Sutas (Süta? Süt Ürünleri A.?.), and Tat G?da Sanayi A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey cold chain solutions market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT and automation technologies is expected to enhance operational efficiency and reduce waste. Additionally, as sustainability becomes a priority, companies are likely to adopt eco-friendly practices, aligning with global trends. These developments will create a more resilient cold chain infrastructure, ensuring that Turkey can meet the growing demand for perishable goods while maintaining high safety standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport (Road, Rail, Air, Sea) Cold Storage Facilities (Chilled, Frozen, Blast Freezers) Temperature-Controlled Packaging Monitoring & Tracking Systems (IoT, Data Loggers, Blockchain-enabled) Value-Added Services (Sorting, Labeling, Repacking) |

| By End-User | Food and Beverage (Meat, Seafood, Dairy, Processed Foods, Ready-to-Eat Meals) Pharmaceuticals & Life Sciences (Vaccines, Biologics, Medicines) Agriculture (Fruits, Vegetables, Floriculture) Retail & E-commerce Chemicals & Industrial Goods |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL, 4PL) E-commerce Fulfillment Others |

| By Application | Food Preservation & Safety Vaccine & Pharmaceutical Distribution Fresh Produce Handling Meat, Seafood, and Dairy Logistics Others |

| By Sales Channel | Online Sales Retail Outlets Wholesale Distributors Direct to Consumer (D2C) Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Export Promotion Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Management | 80 | Logistics Coordinators, Regulatory Affairs Managers |

| Retail Cold Storage Solutions | 60 | Operations Managers, Inventory Control Specialists |

| Technology Providers for Cold Chain | 50 | Product Managers, Business Development Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

The Turkey Cold Chain Solutions Market is valued at approximately USD 2.0 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as advancements in logistics technology.