UAE Agriculture Tractor Market Outlook to 2030

Region:Middle East

Author(s):Samanyu

Product Code:KROD5186

October 2024

87

About the Report

UAE Agriculture Tractor Market Overview

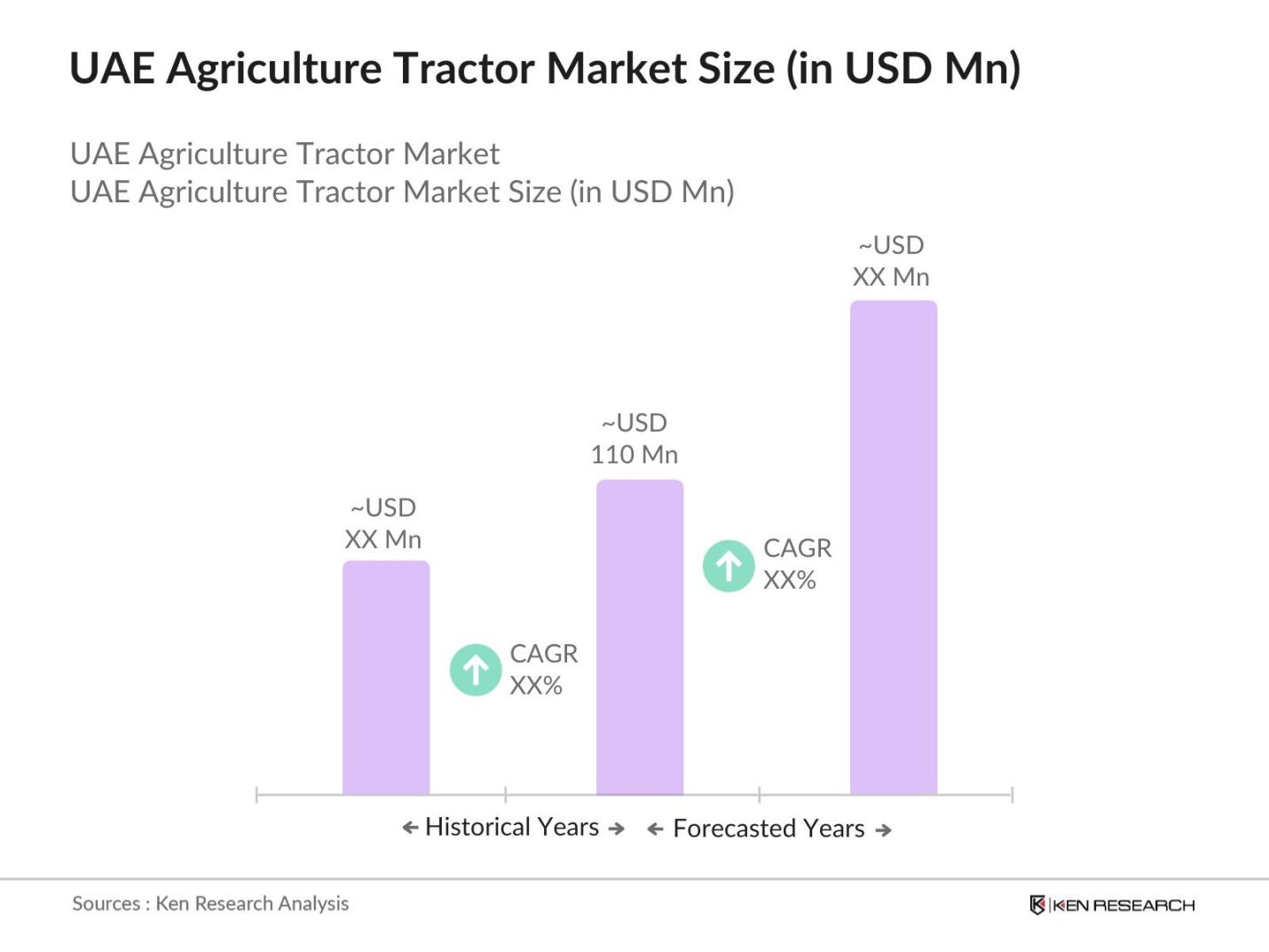

- The UAE Agriculture Tractor market is valued at USD 110 Mn, driven by increased mechanization in farming operations, government support for modernizing agriculture, and a rise in demand for efficient farming equipment. The UAE has been prioritizing agricultural development, especially in arid regions, by promoting advanced technologies that enhance productivity. The growing need for food security and self-sufficiency is encouraging local farmers to adopt mechanized farming practices, contributing significantly to market growth.

- The growth in the industry is driven by increased mechanization in farming operations, government support for modernizing agriculture, and a rise in demand for efficient farming equipment. The UAE has been prioritizing agricultural development, especially in arid regions, by promoting advanced technologies that enhance productivity. The growing need for food security and self-sufficiency is encouraging local farmers to adopt mechanized farming practices, contributing significantly to market growth.

- Multi-functional tractors, capable of handling a wide range of agricultural tasks, are becoming more popular in the UAE. By 2023, over 40% of tractors sold in the UAE were designed for multiple applications, such as plowing, planting, and harvesting, reducing the need for additional machinery. The use of these tractors helps farmers in the UAE maximize efficiency and reduce operational costs, which is particularly beneficial for small-scale farmers who need to make the most of limited resources.

UAE Agriculture Tractor Market Segmentation

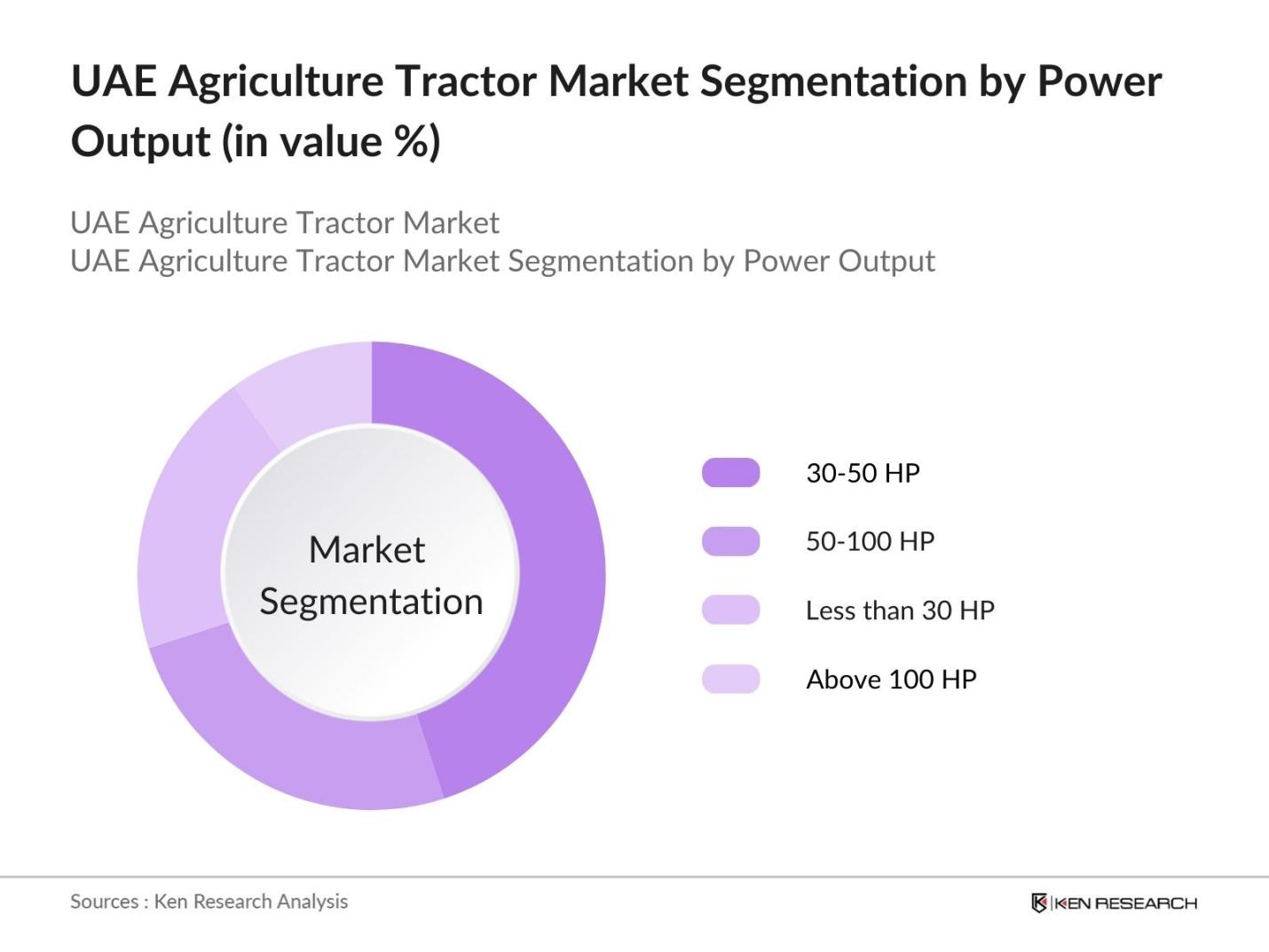

By Power Output: The market is segmented by power output into less than 30 HP, 30-50 HP, 50-100 HP, and above 100 HP. Recently, tractors with 30-50 HP have dominated the market share due to their versatility and suitability for small to medium-sized farming operations. These tractors are widely preferred by local farmers as they strike the right balance between cost and functionality, providing adequate power for various farming tasks while remaining affordable.

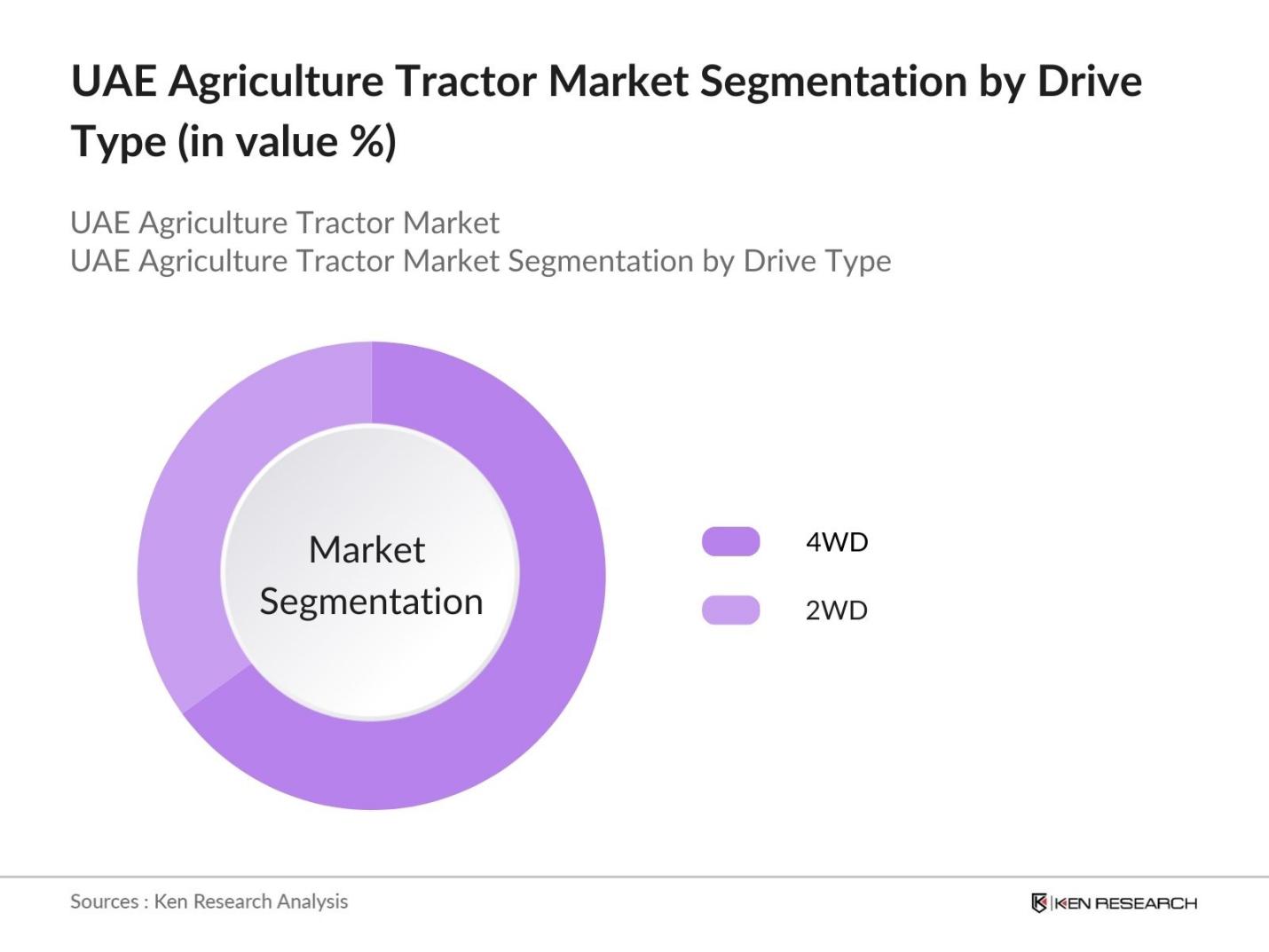

By Drive Type: The market is further segmented by drive type into two-wheel drive (2WD) and four-wheel drive (4WD). Four-wheel drive tractors are witnessing a growing dominance in the market, primarily because of their superior performance in rough terrains and their ability to handle heavy loads. Given the UAEs often challenging terrain and the increasing focus on large-scale farming projects, 4WD tractors are becoming essential for agricultural operators.

UAE Agriculture Tractor Market Competitive Landscape

The UAE agriculture tractor market is characterized by a mix of local and international players, each bringing unique capabilities and product offerings. The market is dominated by both global giants like John Deere and local players such as Al Ghandi Auto. These companies leverage their extensive dealer networks and diverse product ranges to meet the diverse needs of the UAEs agricultural sector.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Manufacturing Units |

Key Products |

Key Clients |

Partnerships |

|

John Deere |

1837 |

USA |

||||||

|

AGCO Corporation |

1990 |

USA |

||||||

|

Al Ghandi Auto |

1962 |

UAE |

||||||

|

Mahindra & Mahindra |

1945 |

India |

||||||

|

Kubota Corporation |

1890 |

Japan |

UAE Agriculture Tractor Industry Analysis

Growth Drivers

-

Increased Mechanization in Farming: The UAE has been intensifying mechanization in agriculture to optimize productivity amidst limited arable land and water scarcity. The World Bank reports that the UAEs agricultural land per capita is approximately 0.05 hectares, creating a need for efficiency-enhancing technologies such as tractors. In 2022, the UAE government facilitated the import of over 1,500 units of advanced tractors to support mechanized farming. This growth is aligned with the UAEs strategic goal to bolster food security by reducing its dependency on food imports, which accounted for around 85% of the countrys food consumption in 2023, as reported by the FAO.

- Government Subsidies for Modern Farming Equipment: The UAE government offers subsidies on modern agricultural equipment to encourage farmers to adopt more efficient machinery, including tractors. The Ministry of Climate Change and Environment (MOCCAE) in 2023 allocated AED 100 million for subsidies on agricultural technologies, including tractors, as part of their plan to modernize the sector. This support has resulted in a notable increase in tractor imports by approximately 20% between 2022 and 2024, as per government trade data, enabling farmers to reduce labor costs and improve crop yields.

- Rising Demand for Efficient Agricultural Output: With limited arable land and growing food demand due to a rising population projected to reach 10.5 million by the end of 2024 according to the UAE Federal Competitiveness and Statistics Authority there is increased pressure on the agricultural sector to enhance productivity. Tractors equipped with precision farming technologies help farmers optimize land use and crop yields. By 2023, over 60% of UAE's agricultural land was cultivated using mechanized equipment, a rise from 40% in 2020, indicating a strong move towards efficient agricultural practices.

Market Challenges

-

High Initial Investment: The acquisition cost of advanced tractors and other agricultural machinery remains a significant barrier, with tractors priced between AED 150,000 and AED 300,000 for mid-range models in 2024. This upfront investment is difficult for smaller farming enterprises, especially considering that average farm sizes in the UAE are less than 3 hectares, as reported by the MOCCAE. The high costs deter many farmers from modernizing their equipment, despite government subsidies, which only partially offset the financial burden.

- Lack of Skilled Operators: Although mechanization is increasing, a shortage of skilled tractor operators has limited the efficiency gains in UAE agriculture. According to the Dubai Statistics Center, over 70% of farm labor is foreign, often lacking specific training for modern agricultural machinery. In 2023, the MOCCAE initiated a program to train 500 local operators, but the demand for skilled labor far exceeds supply, hindering the widespread adoption of advanced tractors. Without adequate training programs, farmers face difficulties in optimizing the performance of their equipment.

UAE Agriculture Tractor Market Future Outlook

Over the next five years, the UAE agriculture tractor market is expected to show strong growth, driven by continuous government support for mechanization, innovations in agricultural practices, and increasing demand for sustainable farming solutions. The introduction of electric and autonomous tractors is anticipated to further revolutionize the sector, making farming more efficient and eco-friendlier. The integration of AI and IoT in farming operations will create new opportunities for precision farming, encouraging the use of advanced tractor models.

Future Market Opportunities

-

Emerging Smart Farming Technologies: Smart farming technologies, such as GPS-guided tractors, are gaining traction in the UAE. In 2023, over 30% of the new tractors sold in the country were equipped with GPS and other precision farming features, helping farmers reduce fuel consumption by up to 15%, according to the UAE Ministry of Energy and Infrastructure. The integration of these technologies enhances operational efficiency, enabling farmers to manage their land more effectively, which is crucial in a country where only 0.5% of the land is suitable for farming, as per World Bank data.

- Expansion into Precision Agriculture: Precision agriculture is increasingly being adopted in the UAE, with several initiatives supporting the use of data-driven tools for farming. By 2024, the government aims to introduce precision farming techniques on 50% of agricultural land, according to the MOCCAE. This shift towards data-based farming has spurred demand for advanced tractors capable of operating within these high-tech systems. The FAO reported that farmers using precision agriculture techniques have seen productivity increase by up to 30%, indicating the potential for significant efficiency gains across the sector.

Scope of the Report

|

By Power Output |

Less than 30 HP 30-50 HP 50-100 HP Above 100 HP |

|

By Drive Type |

Two-Wheel Drive (2WD) Four-Wheel Drive (4WD) |

|

By Engine Capacity |

Less than 1000 cc 1000-2000 cc Above 2000 cc |

|

By Application |

Plowing Tilling Harvesting Other Agricultural Applications |

|

By Region |

Abu Dhabi Dubai Sharjah Northern Emirates |

Products

Key Target Audience

Farmers and Agricultural Cooperatives

Agriculture Equipment Distributors and Dealers

Large-Scale Farming Enterprises

Government and Regulatory Bodies (Ministry of Climate Change and Environment, Abu Dhabi Agriculture and Food Safety Authority)

Investment and Venture Capitalist Firms

Banks and Financial Institutes

Tractor Manufacturers

Agro-Technology Providers

Agribusiness Corporations

Companies

Players Mentioned in the Report:

John Deere

AGCO Corporation

Al Ghandi Auto

Mahindra & Mahindra

Kubota Corporation

CNH Industrial

Massey Ferguson

CLAAS Group

Yanmar Holdings Co. Ltd.

Foton Lovol International

SDF Group

Escorts Limited

Tafe

New Holland

Deutz-Fahr

Table of Contents

1. UAE Agriculture Tractor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Types, Power Output, Drive Type)

1.3. Market Growth Rate (CAGR, Year-on-Year Growth)

1.4. Market Segmentation Overview (Power Output, Drive Type, Engine Capacity, Application, Region)

2. UAE Agriculture Tractor Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. UAE Agriculture Tractor Market Analysis

3.1. Growth Drivers

3.1.1. Increased Mechanization in Farming

3.1.2. Government Subsidies for Modern Farming Equipment

3.1.3. Rising Demand for Efficient Agricultural Output

3.2. Restraints

3.2.1. High Initial Investment

3.2.2. Lack of Skilled Operators

3.2.3. Unstable Commodity Prices

3.3. Opportunities

3.3.1. Emerging Smart Farming Technologies (GPS, Precision Farming)

3.3.2. Expansion into Precision Agriculture

3.3.3. Introduction of Electric Tractors

3.4. Trends

3.4.1. Integration of Advanced Technology (Automation, AI, IoT)

3.4.2. Shift Towards Sustainable Agriculture Practices

3.4.3. Increased Adoption of Multi-Functional Tractors

3.5. Government Regulations and Policies

3.5.1. Agricultural Subsidy Programs

3.5.2. Equipment Certification and Safety Regulations

3.5.3. UAE Vision 2030 and Agricultural Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Farmers, Tractor Manufacturers, Distributors, Government Agencies)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. UAE Agriculture Tractor Market Segmentation

4.1. By Power Output (In Value %)

4.1.1. Less than 30 HP

4.1.2. 30-50 HP

4.1.3. 50-100 HP

4.1.4. Above 100 HP

4.2. By Drive Type (In Value %)

4.2.1. Two-Wheel Drive (2WD)

4.2.2. Four-Wheel Drive (4WD)

4.3. By Engine Capacity (In Value %)

4.3.1. Less than 1000 cc

4.3.2. 1000-2000 cc

4.3.3. Above 2000 cc

4.4. By Application (In Value %)

4.4.1. Plowing

4.4.2. Tilling

4.4.3. Harvesting

4.4.4. Other Agricultural Applications

4.5. By Region (In Value %)

4.5.1. Abu Dhabi

4.5.2. Dubai

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE Agriculture Tractor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Al Ghandi Auto

5.1.2. AGCO Corporation

5.1.3. CNH Industrial

5.1.4. John Deere

5.1.5. Mahindra & Mahindra

5.1.6. Massey Ferguson

5.1.7. Kubota Corporation

5.1.8. Tafe

5.1.9. Yanmar Holdings Co. Ltd.

5.1.10. CLAAS Group

5.1.11. New Holland

5.1.12. Deutz-Fahr

5.1.13. Foton Lovol International

5.1.14. SDF Group

5.1.15. Escorts Limited

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share, Manufacturing Units)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. UAE Agriculture Tractor Market Regulatory Framework

6.1. Agricultural Equipment Standards

6.2. Emissions and Environmental Compliance

6.3. Certification Processes

7. UAE Agriculture Tractor Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. UAE Agriculture Tractor Future Market Segmentation

8.1. By Power Output (In Value %)

8.2. By Drive Type (In Value %)

8.3. By Engine Capacity (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. UAE Agriculture Tractor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified the key variables that influence the UAE Agriculture Tractor Market. Through comprehensive desk research and leveraging proprietary databases, we established an ecosystem map of all stakeholders, including manufacturers, distributors, and end users. This helped in outlining the market dynamics and identifying critical variables for analysis.

Step 2: Market Analysis and Construction

Historical data pertaining to market growth, tractor sales, and regional penetration was analyzed. We reviewed the impact of government initiatives, farming practices, and technological advancements in tractor models. The assessment also covered the ratio of small-scale to large-scale farming operations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through expert consultations. In-depth interviews were conducted with senior executives from tractor manufacturers, farming associations, and agricultural cooperatives. These interviews provided granular insights into the operational challenges, sales patterns, and customer preferences in the UAE.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research findings from multiple sources, including market experts and statistical databases. This ensured a well-rounded and accurate representation of the market, enabling us to provide reliable data-driven insights for our clients.

Frequently Asked Questions

01. How big is the UAE Agriculture Tractor Market?

The UAE agriculture tractor market is valued at USD 110 million, driven by increasing mechanization in farming and government efforts to modernize agricultural practices.

02. What are the challenges in the UAE Agriculture Tractor Market?

Challenges in UAE agriculture tractor market include high upfront costs of modern tractors, lack of skilled operators, and the limited availability of financing options for small farmers.

03. Who are the major players in the UAE Agriculture Tractor Market?

Key players in UAE agriculture tractor market include John Deere, AGCO Corporation, Al Ghandi Auto, Mahindra & Mahindra, and Kubota Corporation, which dominate due to their robust dealer networks and diverse product portfolios.

04. What are the growth drivers of the UAE Agriculture Tractor Market?

The UAE agriculture tractor market is driven by increasing demand for food security, government subsidies for modern equipment, and advancements in farming technology such as precision agriculture.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.