UAE AI Engineering Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD5025

October 2024

82

About the Report

UAE AI Engineering Market Overview

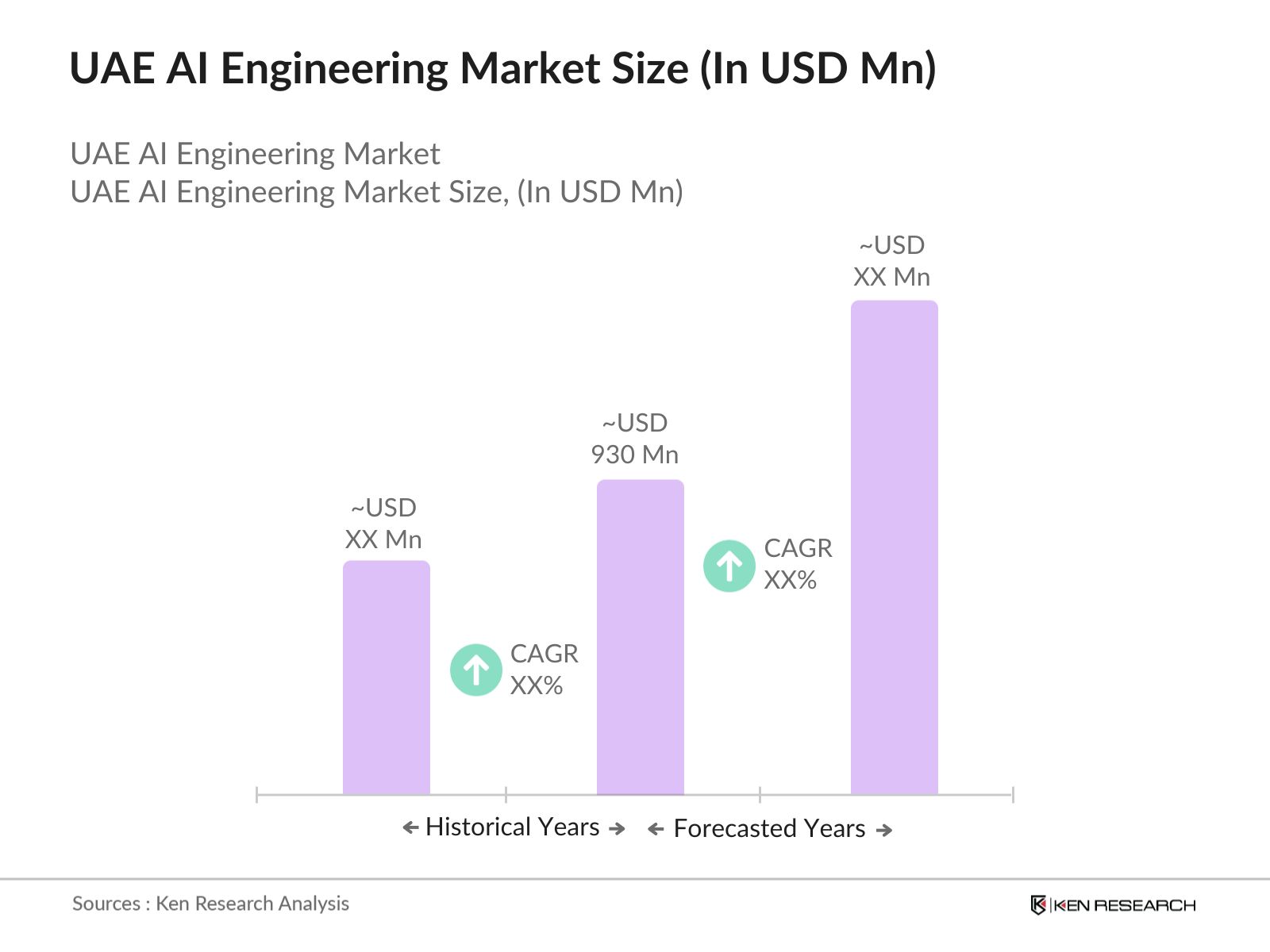

- The UAE AI Engineering market is valued at USD 930 million. The market is driven by a series of governmental initiatives and a focus on AI as a key pillar for future economic development. The UAE's National Artificial Intelligence Strategy 2031, coupled with increasing investment in AI by both the public and private sectors, are the primary drivers of this growth. The strategy aims to position the UAE as a global hub for AI, which has accelerated investments in AI-related infrastructure, software, and services across multiple industries, including healthcare, finance, and transportation.

- The UAE AI Engineering market is dominated by cities like Dubai and Abu Dhabi due to their advanced infrastructure, strategic economic positioning, and significant investments in smart city initiatives. Dubais Smart City project and Abu Dhabis AI Labs have both established these cities as leaders in the AI space. Their focus on digital transformation and creating a knowledge-based economy has helped attract global tech companies and startups alike, creating a thriving AI ecosystem.

- Predictive analytics powered by AI is becoming integral to business intelligence and risk management in the UAE. In 2023, UAE businesses in sectors such as finance, retail, and manufacturing increasingly adopted AI-powered analytics to optimize decision-making. For example, major banks in the UAE are leveraging AI for fraud detection and risk assessment. This trend supports the country's economic expansion, projected to reach $503 billion by 2024, as businesses capitalize on AI-driven insights.

UAE AI Engineering Market Segmentation

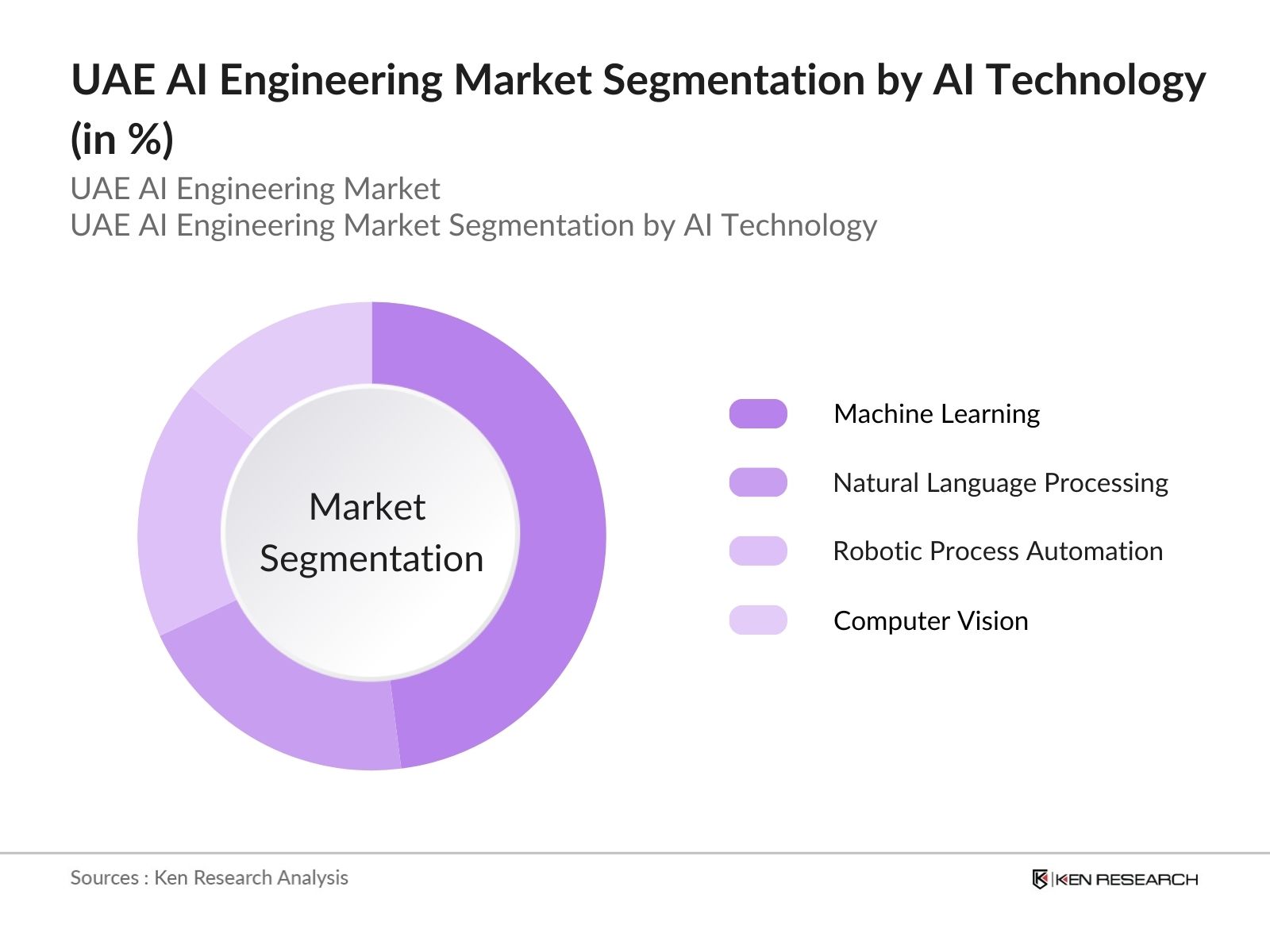

- By AI Technology: The UAE AI Engineering market is segmented by AI technology into machine learning, natural language processing (NLP), robotic process automation (RPA), computer vision, and deep learning. Machine learning holds a dominant market share due to its versatility and widespread adoption across multiple industries such as finance, healthcare, and e-commerce. It enables businesses to process large datasets and make informed decisions, enhancing operational efficiency. Sectors like banking use machine learning algorithms for fraud detection and predictive analytics, further solidifying its leading position in the market.

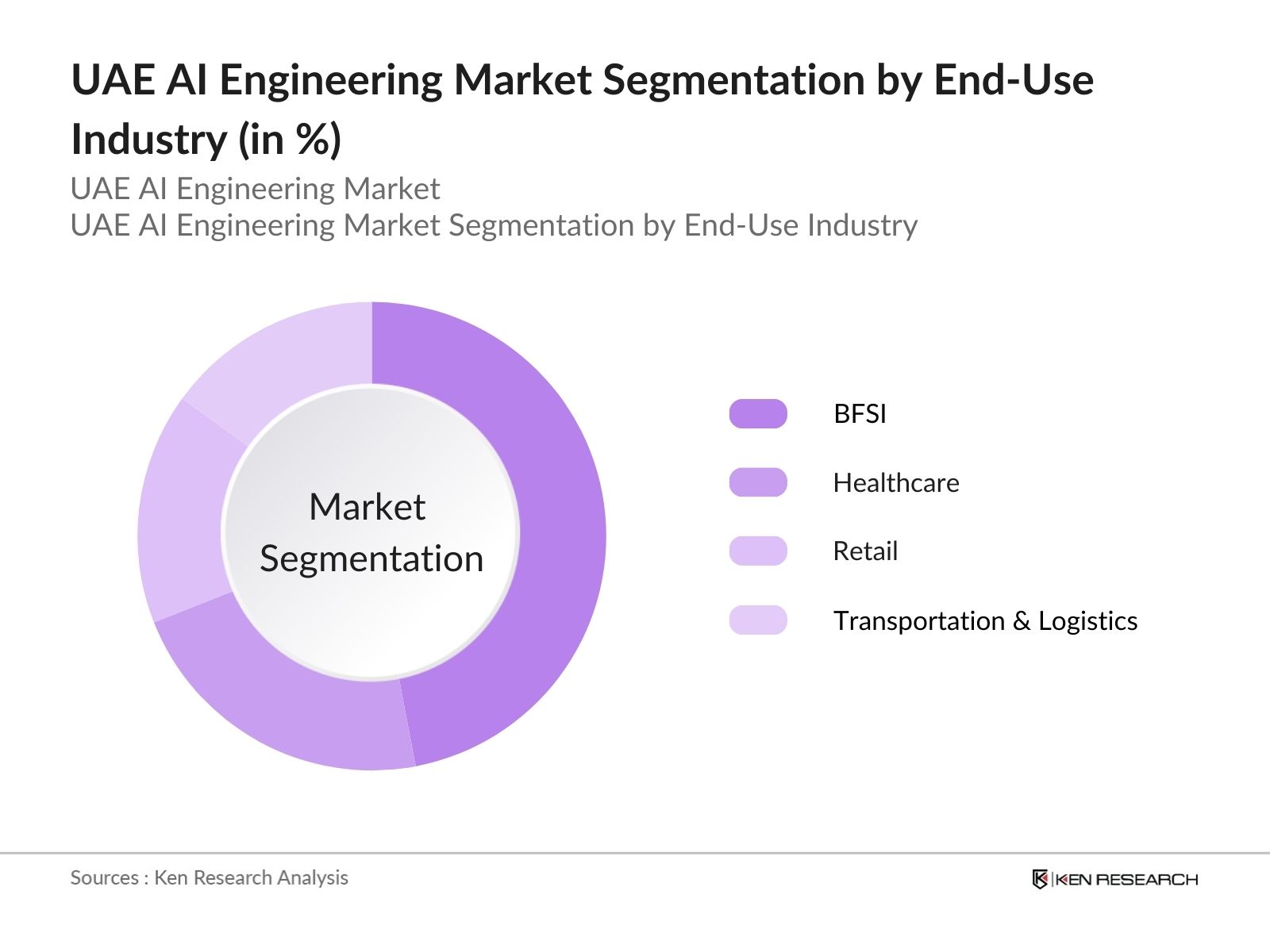

- By End-Use Industry: The UAE AI Engineering market is further segmented by end-use industry into banking, financial services, and insurance (BFSI), healthcare, retail, transportation & logistics, and telecommunications. BFSI dominates this segment, driven by the industry's heavy reliance on AI for automating customer service, enhancing cybersecurity measures, and improving fraud detection systems. AI has revolutionized how financial institutions engage with customers, personalize products, and streamline operations, contributing to its dominance.

UAE AI Engineering Market Competitive Landscape

The UAE AI Engineering market is consolidated with the presence of major global and regional players. The competitive landscape is marked by key players such as Microsoft UAE, IBM Middle East, and Google Cloud MENA, all of which offer a wide range of AI solutions tailored to the needs of the region. These companies have established strong partnerships with government bodies and private enterprises, solidifying their market dominance. Meanwhile, local players like DarkMatter Group focus on cybersecurity-related AI solutions, creating a competitive edge in the digital security space.

|

Company Name |

Establishment Year |

Headquarters |

AI Specialization |

Revenue |

R&D Investment |

Regional Offices |

Key Partnerships |

AI Ethics Compliance |

Employee Strength |

|

Microsoft UAE |

1991 |

Dubai |

|||||||

|

IBM Middle East |

1947 |

Dubai |

|||||||

|

Google Cloud MENA |

2010 |

Dubai |

|||||||

|

DarkMatter Group |

2015 |

Abu Dhabi |

|||||||

|

Accenture Middle East |

1996 |

Dubai |

UAE AI Engineering Industry Analysis

Market Growth Drivers

- UAE National AI Strategy 2031, Smart Dubai Initiatives: The UAE government has been actively promoting AI through initiatives like the UAE National AI Strategy 2031 and Smart Dubai, which aim to integrate AI across all sectors, boosting productivity and economic growth. By 2024, the UAE's AI-driven economy is expected to significantly benefit from these initiatives, with key industries such as healthcare, transportation, and infrastructure seeing rapid AI integration. For instance, Smart Dubai aims to transform 90% of government services into digital platforms, supporting efficiency. The IMF reports that the UAE's economy is projected to grow to $503 billion in 2024, driven by tech innovations.

- Increasing Investment in AI Technologies: AI-related investments have surged across both public and private sectors in the UAE, reflecting the nation's emphasis on becoming a global AI hub. According to the World Bank, UAE foreign direct investment inflows were $23 billion in 2023, with AI technology capturing a large share. The Abu Dhabi Investment Authority and Mubadala are two key players funding AI ventures. These investments support R&D, AI startups, and the development of local AI talent, fostering a favorable environment for technology growth.

- Digital Transformation across Industries: The UAEs digital transformation is reshaping multiple sectors, most notably banking, healthcare, and transportation. For example, the UAE Central Bank reports that 85% of financial transactions are now digital. Meanwhile, the healthcare sector is integrating AI to reduce patient care costs and improve diagnostics. The transportation sector is also seeing AI deployment in smart traffic management and autonomous vehicles, helping to support GDP growth, which reached $501 billion in 2023, according to IMF data.

Market Restraints

- Data Privacy and Security Regulations: Data privacy and security regulations in the UAE pose a challenge for AI deployment, as companies must comply with laws like the GDPR and UAEs local data protection frameworks. The UAE governments National Cybersecurity Strategy emphasizes safeguarding personal data, and in 2023, data-related violations resulted in fines of $10 million across industries. This presents a barrier to AI-driven businesses, especially in sectors like finance and healthcare, where stringent compliance is mandatory. Source

- Shortage of AI Talent and Expertise: A significant challenge for the UAEs AI market is the shortage of skilled AI professionals. According to the World Bank, while the country has made strides in education, the AI skills gap persists. As of 2023, only 20% of the required AI talent pool exists within the country, resulting in the need to import talent or rely on international partnerships. This challenge affects industries aiming for rapid AI adoption and innovation.

UAE AI Engineering Market Future Outlook

Over the next five years, the UAE AI Engineering market is expected to experience substantial growth due to continued government support, increasing AI adoption across industries, and advancements in machine learning, robotics, and data analytics. The UAE governments proactive approach to AI adoption, coupled with its aim to lead the region in AI development, will drive industry expansion and create opportunities for both established companies and emerging startups.

Market Opportunities

- Expansion of AI in SME Sectors: The UAE government is encouraging the adoption of AI among SMEs by offering financial support and grants. In 2023, the UAE launched a $500 million fund aimed at helping SMEs integrate AI into their operations. This presents a major growth opportunity for the AI market, as SMEs make up more than 94% of businesses in the UAE. Targeted AI solutions for SMEs will drive innovation and productivity in sectors like retail and logistics.

- AI in Healthcare and Smart Cities (AI in Diagnostics, Urban AI Innovations): AI is transforming healthcare in the UAE, particularly in diagnostics and treatment optimization. By 2023, over 60 hospitals in the UAE had integrated AI-based diagnostic tools to reduce human error and improve patient outcomes. Furthermore, AI plays a critical role in Smart Dubais urban innovation projects, with smart sensors and AI algorithms enhancing traffic management, energy use, and public services, driving economic efficiency across sectors

Scope of the Report

|

By AI Technology |

- Machine Learning |

|

By End-Use Industry |

- BFSI |

|

By Deployment Model |

- On-premise |

|

By Enterprise Size |

- Small and Medium Enterprises (SMEs) |

|

By Region |

- Dubai |

Products

Key Target Audience

Government and Regulatory Bodies (UAE Ministry of Artificial Intelligence, Dubai Smart Government, Abu Dhabi Digital Authority)

AI Technology Providers

AI Infrastructure Solution Companies

AI Software and Service Providers

Large Enterprises Implementing AI Solutions

Telecommunications Companies with AI Focus

Investments and Venture Capitalist Firms

Healthcare Organizations Utilizing AI Solutions

Companies

Players Mentioned in the Report:

Microsoft UAE

IBM Middle East

Google Cloud MENA

Amazon Web Services (AWS) MENA

Accenture Middle East

PwC AI and Data Analytics

SAP MENA

Oracle Middle East

Huawei UAE

DarkMatter Group

Abu Dhabi AI Labs

SAS Middle East

Cognizant UAE

Infosys MENA

Wipro MENA

Table of Contents

1. UAE AI Engineering Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Revenue Contribution, Industry Impact)

1.4. Market Segmentation Overview (End-Use Industries, AI Technologies, Deployment Models, Enterprise Size, Regions)

2. UAE AI Engineering Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Revenue, Demand Growth, Key Developments)

2.3. Key Market Developments and Milestones (AI Adoption Milestones, Investments, Regulatory Changes)

3. UAE AI Engineering Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (UAE National AI Strategy 2031, Smart Dubai Initiatives)

3.1.2. Increasing Investment in AI Technologies (Public & Private Sector Investments)

3.1.3. Digital Transformation across Industries (Banking, Healthcare, Transportation)

3.1.4. Demand for AI-powered Automation (RPA, NLP, Machine Learning Solutions)

3.2. Market Challenges

3.2.1. Data Privacy and Security Regulations (GDPR Compliance, Local Data Laws)

3.2.2. Shortage of AI Talent and Expertise (Skills Gap, Lack of Local Talent)

3.2.3. High Initial Investment Costs (AI Infrastructure Costs, ROI Concerns)

3.2.4. Integration with Legacy Systems (Technical Challenges in AI Integration)

3.3. Opportunities

3.3.1. Expansion of AI in SME Sectors (Government Grants, SME-focused AI Solutions)

3.3.2. AI in Healthcare and Smart Cities (AI in Diagnostics, Urban AI Innovations)

3.3.3. Cross-industry AI Collaboration (Partnerships Between Tech Firms and Traditional Industries)

3.4. Trends

3.4.1. Adoption of AI Ethics Frameworks (AI Governance, Ethical AI Practices)

3.4.2. Use of AI in Predictive Analytics (AI for Business Intelligence, Risk Assessment)

3.4.3. AI-as-a-Service (Cloud-based AI Solutions, Pay-as-you-go Models)

3.4.4. AI and IoT Convergence (AI-powered IoT Solutions, Smart Infrastructure)

3.5. Government Regulation

3.5.1. UAE AI Ethics Policy

3.5.2. AI Licensing Framework (AI Development Guidelines, Licensing Requirements)

3.5.3. National AI Legislation (Data Governance, AI-related Intellectual Property)

3.5.4. Cross-border AI Partnerships (International AI Collaboration, Trade Deals)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Tech Firms, Government Agencies, Private Investors)

3.8. Porters Five Forces (Supplier Bargaining Power, Threat of New Entrants, Competitive Rivalry)

3.9. Competitive Ecosystem

4. UAE AI Engineering Market Segmentation

4.1. By AI Technology (In Value %)

4.1.1. Machine Learning

4.1.2. Natural Language Processing (NLP)

4.1.3. Robotic Process Automation (RPA)

4.1.4. Computer Vision

4.1.5. Deep Learning

4.2. By End-Use Industry (In Value %)

4.2.1. Banking, Financial Services, and Insurance (BFSI)

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Transportation & Logistics

4.2.5. Telecommunications

4.3. By Deployment Model (In Value %)

4.3.1. On-premise

4.3.2. Cloud-based

4.4. By Enterprise Size (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Dubai

4.5.2. Abu Dhabi

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE AI Engineering Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Microsoft UAE

5.1.2. IBM Middle East

5.1.3. Google Cloud MENA

5.1.4. Amazon Web Services (AWS) MENA

5.1.5. Accenture Middle East

5.1.6. PwC AI and Data Analytics

5.1.7. SAP MENA

5.1.8. Oracle Middle East

5.1.9. Huawei UAE

5.1.10. DarkMatter Group

5.1.11. Abu Dhabi AI Labs

5.1.12. SAS Middle East

5.1.13. Cognizant UAE

5.1.14. Infosys MENA

5.1.15. Wipro MENA

5.2 Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Market Presence, AI Expertise, Industry Focus, Key Solutions, No. of Employees)

5.3 Market Share Analysis (Top Players Market Share, Competitive Landscape)

5.4 Strategic Initiatives (Product Launches, AI Research Collaborations, Strategic Partnerships)

5.5 Mergers and Acquisitions (Recent Deals, Market Impact, Consolidation)

5.6 Investment Analysis (AI Investments in the Region, Startups and Venture Capital)

5.7 Government Grants (AI Research Funding, Innovation Support)

5.8 Private Equity Investments (PE Firm Involvement, AI Company Investments)

6. UAE AI Engineering Market Regulatory Framework

6.1 AI Ethics Standards (Government Policies, Industry Guidelines)

6.2 Compliance Requirements (Data Protection Laws, Industry Certifications)

6.3 Certification Processes (ISO, AI Governance Certifications, Local Compliance)

7. UAE AI Engineering Future Market Size (In USD Mn)

7.1 Future Market Size Projections (Revenue Forecasts, AI Adoption Growth)

7.2 Key Factors Driving Future Market Growth (Government Initiatives, AI Advancements, Industry 4.0)

8. UAE AI Engineering Future Market Segmentation

8.1. By AI Technology (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Deployment Model (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Region (In Value %)

9. UAE AI Engineering Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives (AI-Specific Targeting, Industry Events)

9.4 White Space Opportunity Analysis (Niche Markets, Untapped Sectors)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all key stakeholders within the UAE AI Engineering market, including government agencies, private firms, and AI service providers. Extensive desk research is conducted using secondary sources such as government reports, market databases, and company financials to establish key market variables such as AI adoption rates and revenue generation.

Step 2: Market Analysis and Construction

This phase focuses on collecting historical market data, including AI penetration across sectors, the rise in AI-driven services, and revenue generation within different segments. Market saturation and the competitiveness of local versus international AI players are also assessed, ensuring a comprehensive market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth and potential disruptions are formulated and validated via industry expert interviews, including AI solution providers, local startups, and government representatives. Insights from these consultations refine the market data and help in creating a more nuanced report.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the findings from both primary and secondary research to produce a comprehensive analysis of the UAE AI Engineering market. This includes detailed forecasts, segmentation analysis, and actionable insights to assist stakeholders in making data-driven decisions.

Frequently Asked Questions

1. How big is the UAE AI Engineering Market?

The UAE AI Engineering market was valued at USD 930 million and continues to grow due to significant governmental support and private sector investments, establishing the country as a leader in AI adoption in the region.

2. What are the challenges in the UAE AI Engineering Market?

Key challenges include the shortage of skilled AI professionals, high initial implementation costs, and navigating strict data privacy and security regulations, which can hinder the full-scale deployment of AI solutions.

3. Who are the major players in the UAE AI Engineering Market?

Major players include Microsoft UAE, IBM Middle East, Google Cloud MENA, Amazon Web Services (AWS) MENA, and DarkMatter Group. These companies dominate the market through strategic partnerships, strong AI capabilities, and extensive regional presence.

4. What are the growth drivers of the UAE AI Engineering Market?

Growth drivers include government initiatives such as the UAE National AI Strategy 2031, the increasing use of AI in smart city projects, and widespread AI adoption across industries like healthcare, finance, and logistics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.