UAE Animal Feed Market Outlook to 2029

Region:Middle East

Author(s):Anmol, Namita

Product Code:KR1488

April 2025

80-100

About the Report

UAE Animal Feed Market Overview

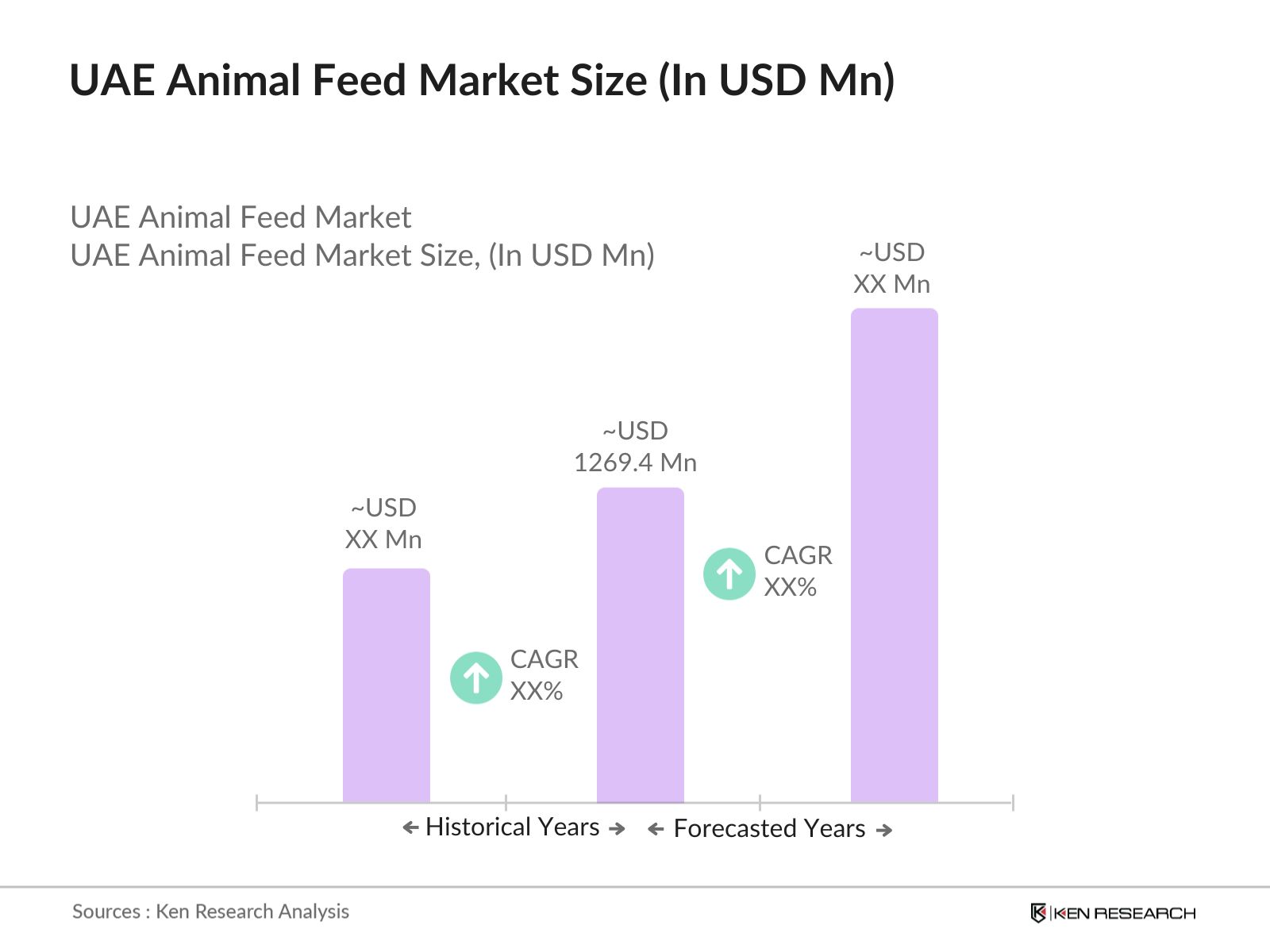

The UAE Animal Feed market is valued at USD 1269.4 million, based on a five-year historical analysis. This valuation reflects a robust compound annual growth rate driven by consistent expansion in poultry and livestock farming. The volume of animal feed consumption stood at 3.00 million tonnes, highlighting the demand intensity from meat production and pet food.

Abu Dhabi and Dubai lead the UAE animal feed market due to strong agri-food investment corridors, integrated feed mill operations, and high consumption of broiler and ruminant feed. Abu Dhabi hosts several government-backed facilities such as Agthia and Al Ghurair Foods with large-scale production of 10,000 MT poultry feed annually. Dubai, on the other hand, offers infrastructural benefits through logistics parks and dry ports for streamlined import of raw materials like soy and corn.

The Ministry of Climate Change and Environment (MOCCAE) mandates that all imported animal feed must be pre-registered with safety and nutritional documentation. Over 85% of feed imports are subjected to inspection under UAEs animal health regulations, and inspection is done at ports including Jebel Ali, KIZAD, and Fujairah Free Zone. Certification of origin, labelling in Arabic and English, and mandatory GMO-free declarations are enforced. In recent amendments, UAE Customs has added batch-level traceability under the 2024 Feed Standards Regulation.

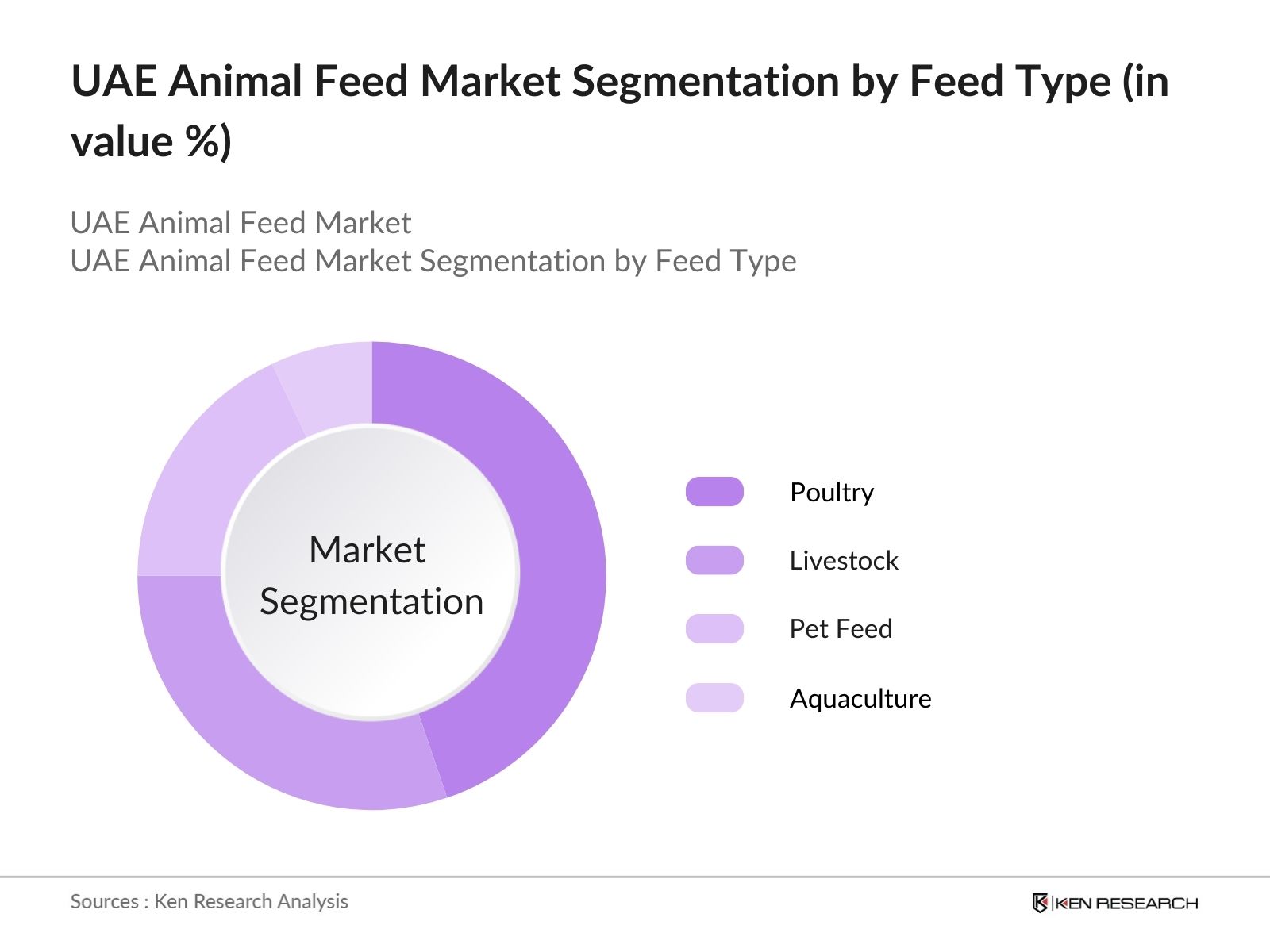

UAE Animal Feed Market Segmentation

By Feed Type: UAE Animal Feed market is segmented by feed type into poultry, livestock, pet feed and aquaculture. Poultry feed holds a dominant share due to higher demand for broiler meat, with investments in large-scale hatcheries and local feed production plants. These facilities support the countrys strategy to reduce import dependency and increase high-protein output for human and animal consumption.

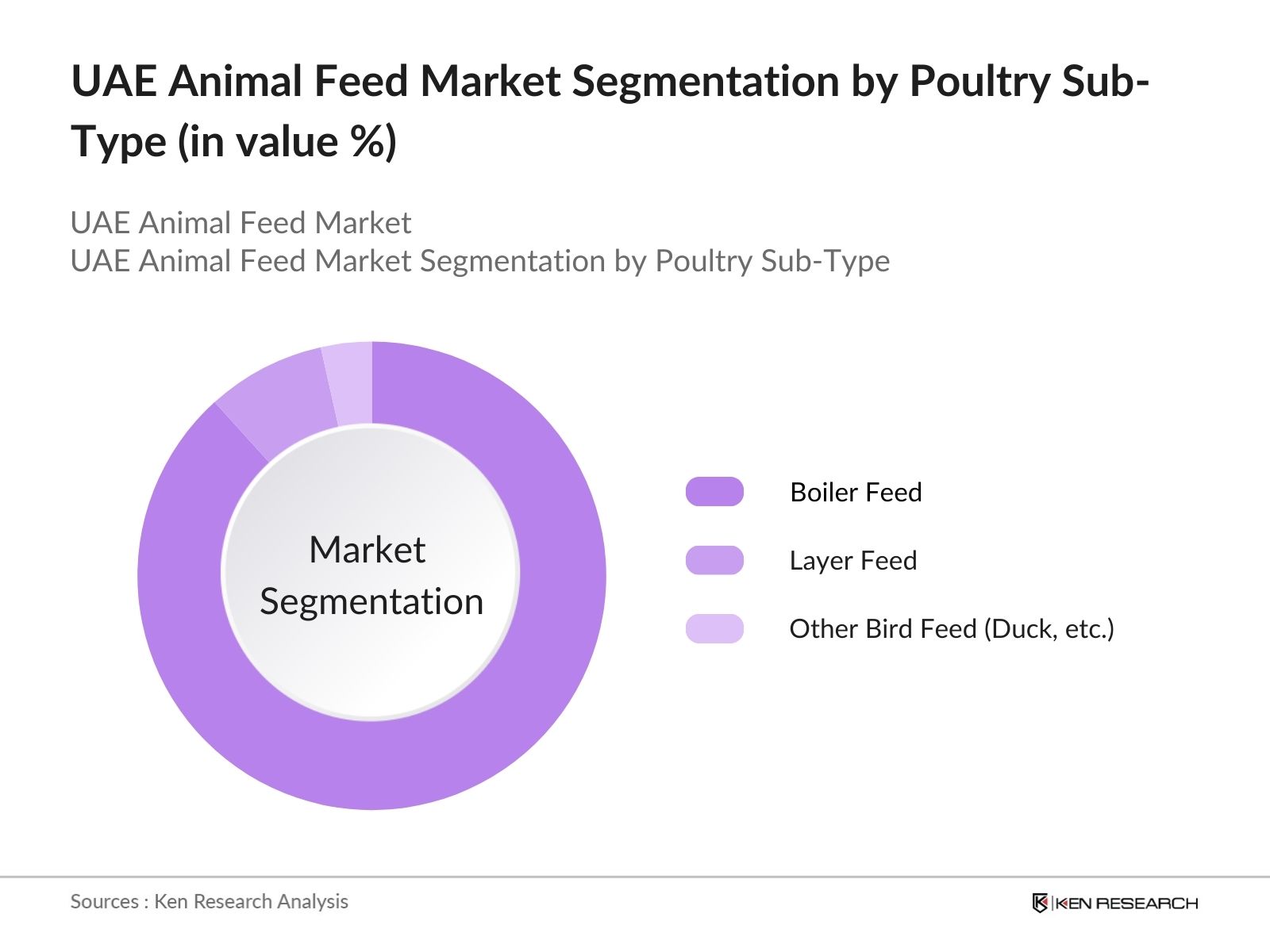

By Poultry Sub-Type: In UAE Animal Feed market is segmented by Poultry-Sub type into boiler feed, layer feed and Other bird feed in which broiler feed segment holds the majority of poultry feed share in UAE due to high-volume broiler meat production. With an output of 2,880 tons annually and hatcheries producing 10-million-day-old chicks, this feed is crucial for meeting rising chicken consumption. Additionally, poultry fats contribute as base ingredients for value-added feed solutions.

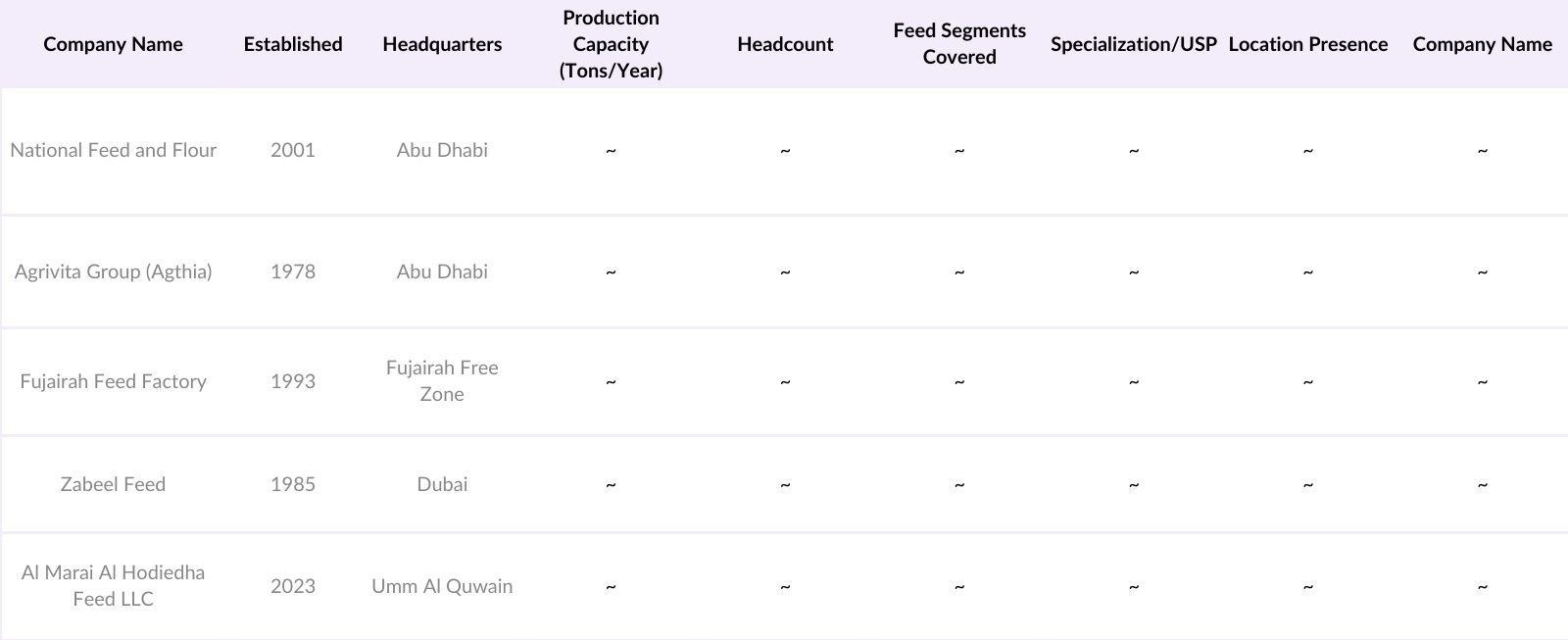

UAE Animal Feed Market Competitive Landscape

The UAE Animal Feed market is dominated by integrated regional producers supported by robust infrastructure, automated feed mills, and direct supply chains. Companies like National Feed and Agrivita lead in production capacity and cater to varied animal segments including poultry, livestock, and aquaculture. The use of customized feed formulations, compliance with UAE safety standards, and expansion in free zones contribute to their sustained market presence.

UAE Animal Feed Market Analysis

Growth Drivers

Rising Poultry Integration and Broiler Production: The UAE has strengthened its poultry infrastructure with major players producing over 10 million day-old chicks annually, and handling over 10,000 metric tons of poultry meat per year. This supports internal protein demand while reducing reliance on imports. As per the UAE Food Security Strategy 2051, such vertical integration reduces pressure on feed imports and accelerates domestic feed demand through efficient poultry-to-feed conversion chains.

Growing Livestock Base and National Food Focus: UAE's livestock population has expanded to over 2.2 million heads, driven by increased meat consumption and Emirati dietary preferences. With an annual demand for 400 metric tons of poultry-derived fats used as feed inputs, local livestock systems are increasingly integrated with feed production cycles. This push is reinforced by national programs that link animal husbandry growth with strategic food self-reliance.

Pet Food Demand from Urban Growth: There are 1.5 million registered pet animals in UAEs major emirates, led by Dubai and Abu Dhabi. Urban pet ownership growth is fueling the demand for pet-specific feed. Veterinary health product sales have grown steadily, with support from entities like ADAFSA for regulated formulations. The growing middle class, currently estimated at over 3 million people, is shifting toward higher-nutrition packaged pet food, boosting this segments feed demand.

Market Challenges

High Import Dependency on Raw Inputs: UAE imports over 90% of its animal feed ingredients including corn, soybean meal, and wheat from Brazil, Argentina, and India. Any geopolitical tension or logistics disruption results in immediate feed shortages. In 2023, Red Sea shipping delays and volatility in global grain markets directly impacted container movement for feedstuff, leading to extended lead times and variability in nutritional consistency in end feed products.

Rising Raw Material Conversion and Water Usage: The average water footprint for producing 1 kg of animal feed in arid climates like UAE ranges between 500 to 1,000 liters, significantly higher than temperate regions. Feed producers using alfalfa and corn require extensive irrigation setups. With the UAE facing annual rainfall levels of only 78 mm and groundwater reserves declining at 0.5 meters per year, local production faces environmental pressure.

UAE Animal Feed Market Future Outlook

Over the next five years, the UAE Animal Feed Market is expected to experience stable growth driven by strategic policy reforms and national food security initiatives. Investments are anticipated in aquaculture, camel feed, and integrated ruminant-poultry systems, supported by Vision 2030 and the National Food Security Strategy 2051. Rising demand for non-GMO and functional feed additives aligned with consumer preferences for ethically sourced animal products will further shape the markets trajectory.

Market Opportunities

Emerging Cold Chain Backbone in FMCG Logistics: Indias cold storage infrastructure is on a transformational path, with over 7 million metric tonnes of capacity already added and more in the pipeline, as supported by the Ministry of Food Processing Industries. As cold chain networks expand deeper into secondary and tertiary markets, the future of long-haul FMCG logistics will increasingly favor canned beverages. With advantages like lower refrigeration dependency, stackability, and minimal leakage risk, metal cans are poised to become the preferred packaging format for new-age distribution corridors.

Future-Ready Localization of Can Components: Indias packaging ecosystem is primed for a strategic leap. The Production Linked Incentive (PLI) schemes integration into packaging materials is catalyzing the setup of localized facilities for aluminum lids, tabs, and digitally printed sheets. As more canmakers invest in domestic component manufacturing, India is set to minimize its reliance on imported raw materials. This shift will significantly enhance supply chain responsiveness, optimize lead times, and pave the way for cost-efficient, high-speed production in the next phase of canned beverage growth.

Scope of the Report

|

By Type |

Poultry |

|

By Form |

Mash |

|

By Procurement Mode |

Import |

|

By Ingredient Type |

Cereal Grains |

Products

Key Target Audience

Poultry Hatchery Owners and Feed Mill Operators

Government and Regulatory Bodies (MOCCAE, ADFSA, ESMA)

Large Livestock & Aquaculture Farming Enterprises

Animal Feed Distributors & Warehousing Companies

Feed Additive & Premix Manufacturers

Veterinary Nutrition Companies

Investment and Venture Capitalist Firms

Pet Food and Specialized Feed Formulation Companies

Companies

Players Mentioned in the Report

National Feed and Flour

Agthia Group (Agrivita)

Fujairah Feed Factory

Zabeel Feed

Al Marai Al Hodiedha Feed Industry

Table of Contents

1. UAE Animal Feed Market Overview

1.1. Definition and Scope (Livestock Feed, Poultry Feed, Aquaculture Feed, Pet Feed)

1.2. Market Taxonomy (By Form, By Ingredient Type, By Procurement Mode)

1.3. Market Growth Rate (Volume and Value)

1.4. Market Segmentation Overview (Volume Share in Million Tonnes)

2. UAE Animal Feed Market Size (In USD Million and Million Tonnes)

2.1. Historical Market Size by Value

2.2. Historical Market Size by Volume

2.3. Growth Rate Analysis (YoY % Change)

2.4. Key Market Developments and Inflection Points

3. UAE Animal Feed Market Analysis

3.1. Growth Drivers

3.1.1. Expansion in Livestock Population

3.1.2. Government Initiatives & Sustainability Programs

3.1.3. Shift to High-Protein Feed Composition

3.1.4. National Food Security Strategy

3.2. Restraints

3.2.1. Heavy Dependence on Imports

3.2.2. Climate and Water Constraints

3.3. Opportunities

3.3.1. Localization of Feed Mills and Production

3.3.2. Adoption of Smart Feeding Technologies

3.4. Trends

3.4.1. Growth of Green & Sustainable Feed

3.4.2. Rise of Specialized Formulated Feed

3.4.3. Growth in Pet Ownership and Pet Nutrition

3.5. Government Regulations

3.5.1. Feed Registration and MOCCAE Mandates

3.5.2. Inspection and Sampling Policies

3.5.3. GMO Restrictions and Import Certifications

3.5.4. Packaging and Labelling Requirements

3.6. SWOT Analysis

3.7. Ecosystem Mapping (Feed Manufacturers, Distributors, Regulatory Bodies)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Key Players by Type of Feed)

4. UAE Animal Feed Market Segmentation

4.1. By Type (In Volume %)

4.1.1. Poultry

4.1.2. Livestock

4.1.3. Pet Feed

4.1.4. Aquaculture

4.2. By Form (In Volume %)

4.2.1. Mash

4.2.2. Pellets

4.2.3. Crumbles

4.2.4. Other

4.3. By Procurement Mode (In Volume %)

4.3.1. Import

4.3.2. Local

4.4. By Ingredient Type (In Volume %)

4.4.1. Cereal Grains

4.4.2. Oilseed Meals

4.4.3. Additives

4.4.4. Protein Sources

4.4.5. Fats & Oils

4.5. By End Use Segment (In Volume %)

4.5.1. Poultry Farmers

4.5.2. Livestock Farmers

4.5.3. Aquaculture

4.5.4. Camel & Horse Breeders

4.5.5. Pet Owners

5. UAE Animal Feed Market Competitive Analysis

5.1. Detailed Company Profiles

5.1.1. National Feed and Flour

5.1.2. Agrivita Group

5.1.3. Fujairah Feed Factory

5.1.4. Zabeel Feed

5.1.5. Al Marai Al Hodetha Feed

5.1.6. Al Ghurair Foods

5.1.7. Al Ain Farms

5.1.8. Al Ain Feed

5.1.9. ZADCO Feed

5.1.10. Al Mazrouei

5.1.11. Al Saqr Feed

5.1.12. Union Feed

5.1.13. Emirates Feed

5.1.14. Top Trading FZCO

5.1.15. Al Tannaf Feed

5.2. Cross Comparison Parameters

(Inception Year, Headcount, Production Capacity, Type of Feed Produced, Feed Form Handled, Business Segment Coverage, Unique Selling Proposition)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Facility Expansions

5.5. Joint Ventures and Strategic Partnerships

5.6. Investor Participation and Private Capital Inflows

5.7. Government Support and Feed Security Incentives

6. UAE Animal Feed Market Regulatory Landscape

6.1. MOCCAE Feed Import Policy

6.2. Emirates Authority for Standardization & Metrology (ESMA)

6.3. Sampling, Quality Testing & Veterinary Clearance

6.4. Certification, Safety and GMO-Free Norms

6.5. Animal Welfare Compliance and Packaging Guidelines

7. UAE Animal Feed Future Market Outlook

7.1. Future Market Size Projections (In USD Million and Tonnes)

7.2. Demand Forecast by Livestock and Poultry Growth

7.3. Projected Share of Domestic Feed Production

7.4. Investment Opportunities in Local Feed Mills

7.5. Technology-Driven Feed Solutions for 2030 Feed Security

8. UAE Animal Feed Market Analyst Recommendations

8.1. TAM, SAM, SOM Opportunity Mapping

8.2. Strategic Import Substitution Roadmap

8.3. Feed Optimization Frameworks

8.4. Local Manufacturing Cost Benefit Analysis

8.5. Regional Market Prioritization (Abu Dhabi, Dubai, Sharjah, Fujairah)

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map was created to identify feed manufacturers, importers, regulators, and end-users such as poultry farms and aquaculture centers. This was supported by government-agency published reports and proprietary interview transcripts.

Step 2: Market Analysis and Construction

Quantitative data was collected for volume (in million tonnes) and value (USD million) across all feed types. Ratios such as feed conversion efficiency and protein yield per category were calculated using validated production and supply chain metrics.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with feed mill managers, nutrition consultants, and government officials were conducted via CATI, validating assumptions related to feed production cycles, import logistics, and safety regulations.

Step 4: Research Synthesis and Final Output

The final output integrated government regulations, value chain logistics, and feed mill capacities. Primary data was verified using structured interviews and cross-referenced against declared production output and import documentation from feed mills.

Frequently Asked Questions

01. How big is the UAE Animal Feed Market?

The UAE Animal Feed market is valued at USD 1269.4 million and supported by a consumption volume of 3.00 million tonnes. the growth is led by poultry feed and pet nutrition demand and a shift towards localized feed manufacturing.

02. What are the challenges in the UAE Animal Feed Market?

The UAE Animal Feed market faces issues like high import dependency for corn and soy, high raw material costs, and strict regulatory compliance for imported feeds. climatic limitations also restrict domestic cultivation.

03. Who are the major players in the UAE Animal Feed Market?

key players of UAE Animal Feed market include national feed and flour, agthia group (agrivita), fujairah feed factory, zabeel feed, and al marai al hodiedha feed industry. these players dominate due to high production capacity, region-specific formulations, and automated facilities.

04. What are the growth drivers of the UAE Animal Feed Market?

UAE Animal Feed market growth is driven by expansion in poultry hatcheries, aquaculture investment under vision 2030, and government-led food security strategies like the national food security strategy 2051 supporting local feed industries.

05. Which feed type dominates the UAE Animal Feed Market?

poultry feed leads the UAE Animal Feed market owing to the countrys focus on self-sufficiency, high chicken meat demand, and operational integration from hatcheries to feed processing plants.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.