UAE Architectural Lighting Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD5146

December 2024

86

About the Report

UAE Architectural Lighting Market Overview

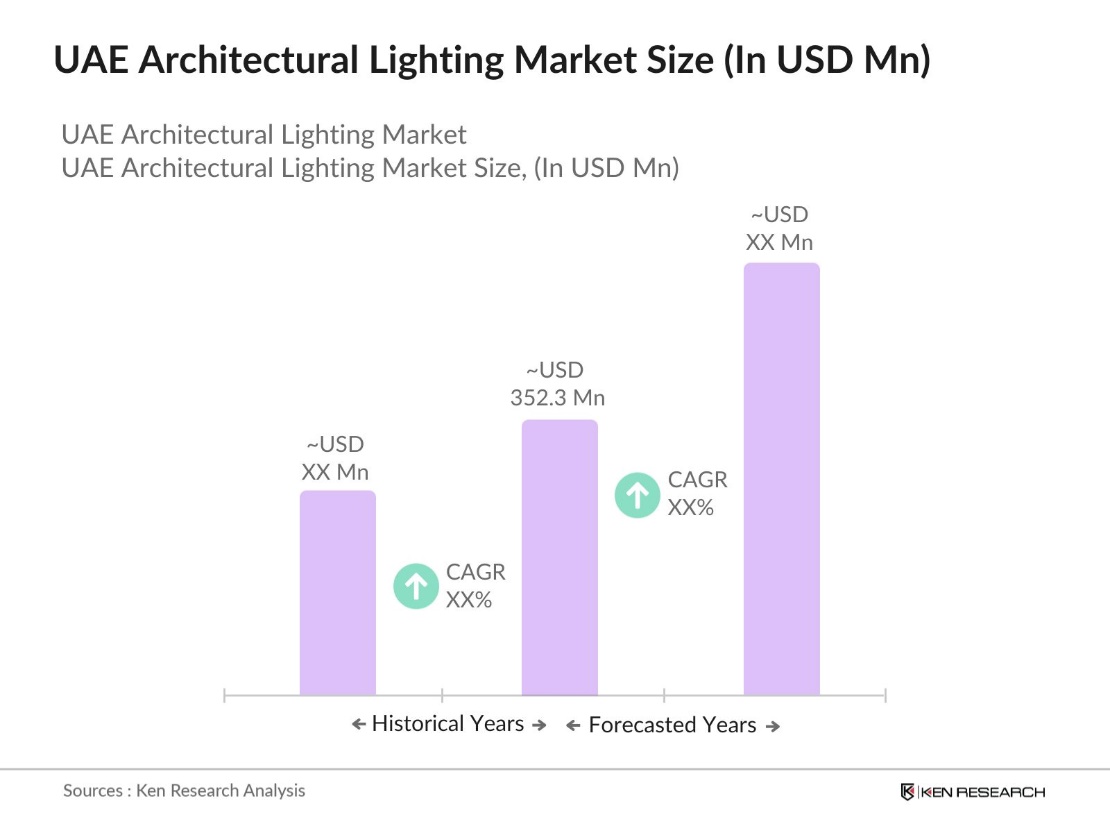

- The UAE Architectural Lighting Market is valued at USD 352.3 million, based on a five-year historical analysis. This market growth is driven by a combination of factors, including rapid urbanization, growing smart city initiatives, and a surge in infrastructural developments, particularly in Dubai and Abu Dhabi. Energy-efficient solutions, including LED lighting, and the adoption of smart lighting technologies have also propelled market demand, with government-backed projects in public infrastructure acting as major catalysts.

- The market is predominantly driven by cities such as Dubai, Abu Dhabi, and Sharjah. Dubais dominance stems from its large-scale urban projects and its role as a global commercial hub. In Abu Dhabi, the focus on sustainable development and green building standards contributes significantly to the growth of architectural lighting. Sharjah is witnessing rapid development in public spaces, reinforcing its role as a key player in the market.

- The UAE's 2050 net-zero initiative focuses on reducing emissions across six key sectors: industry, power, transport, buildings, waste, and agriculture. The strategy includes over 25 programs, emphasizing renewable energy, energy efficiency, sustainable transport systems, green building materials, and carbon capture technologies. For industries, the focus is on lowering emissions through alternative materials and enhanced carbon capture. The UAE aims to cut total greenhouse gas emissions by 19% by 2030, with a long-term goal of net-zero by 2050.

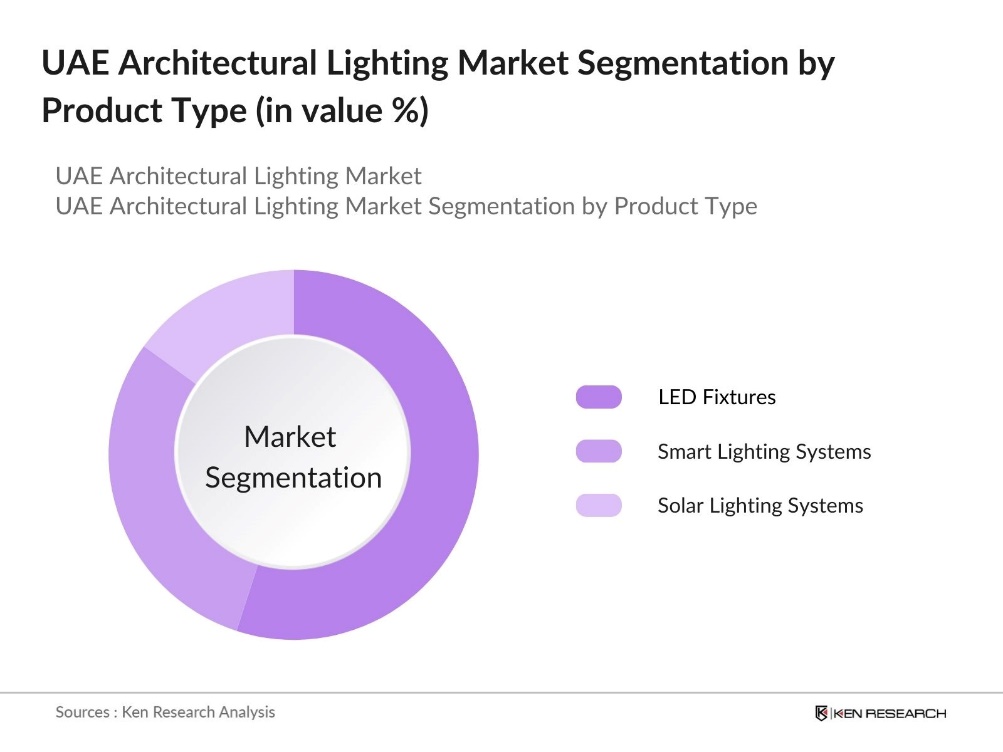

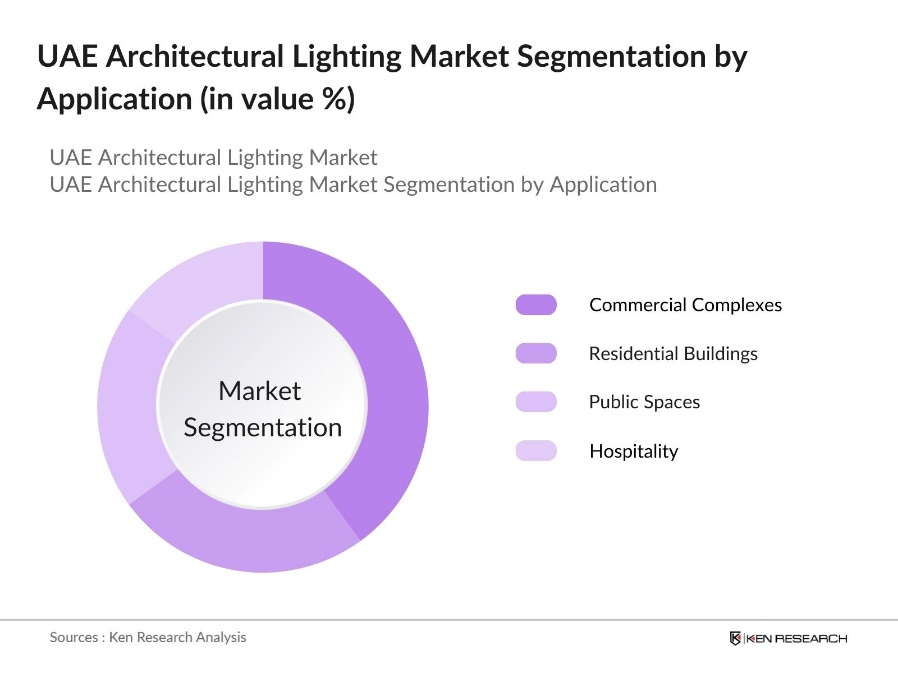

UAE Architectural Lighting Market Segmentation

By Product Type: The UAE architectural lighting market is segmented by product type into LED fixtures, smart lighting systems, and solar lighting systems. Recently, LED fixtures have had a dominant market share in the UAE architectural lighting market. This dominance is primarily due to their energy efficiency, longer lifespan, and lower environmental impact compared to traditional lighting systems. Moreover, the government's focus on sustainability and green building certifications has incentivized the adoption of LED lighting in both public and private projects.

By Application: The UAE architectural lighting market is segmented by application into residential buildings, commercial complexes, public spaces, and hospitality. Commercial complexes hold the largest share in the market due to ongoing infrastructural developments and high demand for modernized, energy-efficient architectural lighting solutions in office buildings and shopping malls. The increasing number of commercial real estate projects across Dubai and Abu Dhabi, in line with the UAEs Vision 2030, has further cemented this segment's dominance.

UAE Architectural Lighting Market Competitive Landscape

The market is dominated by a combination of international and regional players that offer a wide range of lighting solutions. Global companies such as Philips Lighting and Osram GmbH are key players, offering cutting-edge technologies and smart lighting solutions. These companies are known for their strong distribution networks, innovative products, and high-quality standards. The competition is further intensified by the presence of regional players who specialize in local market needs and government projects.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

R&D Investment |

Sustainability Initiatives |

Market Penetration |

Key Clients |

Regional Projects |

|

Philips Lighting |

1891 |

Amsterdam, Netherlands |

||||||

|

Osram GmbH |

1919 |

Munich, Germany |

||||||

|

Zumtobel Group |

1950 |

Dornbirn, Austria |

||||||

|

Fagerhult Group |

1945 |

Habo, Sweden |

||||||

|

Signify N.V. |

2018 |

Eindhoven, Netherlands |

UAE Architectural Lighting Industry Analysis

Growth Drivers

- Rise in Smart City Initiatives: The UAE government has been heavily investing in smart city initiatives, driving demand for architectural lighting. The Dubai Municipality has partnered with Philips to launch the "Dubai Lamp initiative," which aims to install two million energy-efficient LED lamps across the city, with plans to expand this to ten million by 2021. The widespread deployment of smart lighting in public spaces, streets, and buildings reflects this growth, directly impacting the architectural lighting market in the region.

- Government Infrastructure Projects: The UAE's infrastructure development, particularly in residential, commercial, and public spaces, is fueling growth in the architectural lighting market, with an emphasis on aesthetics and energy efficiency. Major projects in airports, highways, and tourism hubs are increasing demand for advanced lighting solutions, while Dubai's Winter 2024 design trends focus on sustainability, with developers prioritizing eco-friendly, energy-efficient designs that meet Green Building Certifications.

- Increasing Demand for Energy-Efficient Lighting: Energy-efficient lighting is a top priority in the UAE as the country seeks to reduce its carbon footprint and improve sustainability. The government is promoting the use of energy-efficient lighting, particularly LED systems, in both commercial and residential developments. These lighting solutions are designed to reduce electricity consumption and align with national sustainability goals. As part of the broader Energy Strategy 2050, the UAE aims to increase the adoption of clean energy and energy-efficient technologies in infrastructure projects, making energy-efficient architectural lighting a critical component of this initiative.

Market Challenges

- High Installation Costs: The upfront costs associated with architectural lighting systems remain a significant challenge in the UAE. Advanced lighting technologies, including LEDs and smart lighting controls, often require complex and costly installation processes. These expenses can discourage small and medium-sized enterprises from adopting energy-efficient lighting solutions, particularly during the early stages of a project. Additionally, specialized labor and equipment add to the overall installation costs, making it difficult for smaller projects to justify the investment.

- Regulatory Challenges: Architectural lighting in the UAE encounters regulatory challenges due to differing standards across various emirates. The lack of a unified national standard for energy efficiency and lighting regulations has led to compliance difficulties for manufacturers and installers. While some emirates, such as Abu Dhabi and Dubai, have established specific guidelines, others may have distinct regulations, creating fragmentation in the market.

UAE Architectural Lighting Market Future Outlook

The UAE Architectural Lighting Market is expected to witness steady growth over the next five years, driven by several key factors. These include continued government investments in smart city projects, increasing adoption of energy-efficient and sustainable lighting systems, and the expansion of both residential and commercial infrastructure. The integration of smart technologies like IoT in lighting solutions will play a pivotal role in enhancing energy management and reducing costs, further contributing to the growth of the market.

Market Opportunities

- Green Buildings and Sustainability Certifications: The growing emphasis on green building initiatives in the UAE presents significant opportunities for architectural lighting solutions that align with sustainability certifications. Programs like LEED (Leadership in Energy and Environmental Design) and Estidama in Abu Dhabi promote energy-efficient practices in building construction, encouraging the use of advanced lighting systems. These certifications often require the integration of LED or solar-powered lighting, fostering demand for sustainable and energy-efficient solutions.

- Growing Demand for Smart Architectural Lighting: Smart lighting systems are increasingly becoming essential to modern architectural design, especially in the UAE's luxury real estate and hospitality sectors. Automated lighting, integrated with Internet of Things (IoT) technologies, offers features like motion detection, energy efficiency monitoring, and remote control, enhancing convenience and sustainability. This rising trend supports the UAEs broader vision for smart urban environments.

Scope of the Report

|

Product Type |

LED Fixtures Smart Lighting Systems Solar Lighting Systems |

|

Application |

Residential Buildings Commercial Complexes Public Spaces Hospitality |

|

Technology |

LED Technology Fluorescent Technology Halogen Technology |

|

Installation Type |

Interior Lighting Exterior Lighting |

|

Region |

Abu Dhabi Dubai Sharjah Northern Emirates |

Products

Key Target Audience

Facility Management Companies

Property Management Firms

Event Management Companies

Corporate Real Estate Management Firms

Government and Regulatory Bodies (Dubai Municipality, Abu Dhabi Department of Energy)

Investments and venture capital firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Philips Lighting

Osram GmbH

Fagerhult Group

Zumtobel Group

Signify N.V.

General Electric

Acuity Brands Lighting

Cree Inc.

Hubbell Lighting

Thorlux Lighting

Eagle Lighting

Ligman Lighting

Trilux Lighting

Schreder Group

NVC Lighting Technology

Table of Contents

1. UAE Architectural Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Architectural Lighting Systems and Components Overview

1.4. Industry and Market Growth Rate

1.5. Market Segmentation Overview

2. UAE Architectural Lighting Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. UAE Architectural Lighting Market Analysis

3.1. Growth Drivers (Urbanization, Infrastructure Development, Smart Cities)

3.1.1. Rise in Smart City Initiatives

3.1.2. Government Infrastructure Projects

3.1.3. Increasing Demand for Energy-Efficient Lighting

3.2. Market Challenges (High Initial Costs, Supply Chain Issues, Lack of Standardization)

3.2.1. High Installation Costs

3.2.2. Regulatory Challenges

3.2.3. Technological Limitations

3.3. Opportunities (Sustainability, Green Building Certification, Smart Lighting Systems)

3.3.1. Green Buildings and Sustainability Certifications

3.3.2. Growing Demand for Smart Architectural Lighting

3.3.3. Integration with IoT

3.4. Trends (LEDs, Smart Lighting, Minimalist Design, Solar Integration)

3.4.1. Adoption of LED-based Solutions

3.4.2. Solar-Powered Lighting Systems

3.4.3. Smart Architectural Lighting Integration

3.5. Government Regulations (Energy Efficiency Standards, Building Codes)

3.5.1. UAE Energy Efficiency Lighting Regulations

3.5.2. Green Building Regulations

3.5.3. Regulatory Standards for Public Lighting Projects

3.6. Competitive Landscape

3.6.1. Key Competitors Overview

3.6.2. Porters Five Forces Analysis

4. UAE Architectural Lighting Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. LED Fixtures

4.1.2. Smart Lighting Systems

4.1.3. Solar Lighting Systems

4.2. By Application (In Value %)

4.2.1. Residential Buildings

4.2.2. Commercial Complexes

4.2.3. Public Spaces

4.2.4. Hospitality

4.3. By Technology (In Value %)

4.3.1. LED Technology

4.3.2. Fluorescent Technology

4.3.3. Halogen Technology

4.4. By Installation Type (In Value %)

4.4.1. Interior Lighting

4.4.2. Exterior Lighting

4.5. By Region (In Value %)

4.5.1. Abu Dhabi

4.5.2. Dubai

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE Architectural Lighting Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Lighting

5.1.2. Zumtobel Group

5.1.3. Osram GmbH

5.1.4. Fagerhult Group

5.1.5. General Electric

5.1.6. Acuity Brands Lighting

5.1.7. Cree Inc.

5.1.8. Hubbell Lighting

5.1.9. Thorlux Lighting

5.1.10. Signify N.V.

5.1.11. Eagle Lighting

5.1.12. Ligman Lighting

5.1.13. Trilux Lighting

5.1.14. Schreder Group

5.1.15. NVC Lighting Technology

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Range, Innovation Capabilities, Client Base, Market Presence, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Expansion Analysis

5.7. Private Equity Investments

5.8. Government Contracts and Tenders

6. UAE Architectural Lighting Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Certification Processes

6.3. Regulatory Approvals for New Installations

7. UAE Architectural Lighting Future Market Size (In USD Mn)

7.1. Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. UAE Architectural Lighting Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Installation Type (In Value %)

8.5. By Region (In Value %)

9. UAE Architectural Lighting Market Analysts Recommendations

9.1. Customer Cohort Analysis

9.2. Strategic Marketing Initiatives

9.3. Competitive Positioning Recommendations

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables influencing the UAE Architectural Lighting Market. This is achieved through extensive desk research and a thorough examination of government regulations, key players, and industry stakeholders to understand the market dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data for the UAE Architectural Lighting Market, including sales revenue, the penetration rate of energy-efficient lighting systems, and technological advancements. We also study the markets segmentation to understand the competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses will be validated through consultations with industry experts. Telephone interviews and surveys are conducted with professionals in the architectural lighting industry, allowing us to cross-validate the data collected.

Step 4: Research Synthesis and Final Output

The final phase consolidates the gathered data, with inputs from lighting manufacturers and distributors in the UAE. This ensures that the data on market size, segmentation, and key trends are accurate and actionable for business decisions.

Frequently Asked Questions

01. How big is the UAE Architectural Lighting Market?

The UAE Architectural Lighting Market is valued at USD 352.3 million, driven by large-scale government infrastructure projects and the rising demand for energy-efficient and smart lighting solutions.

02. What are the major challenges in the UAE Architectural Lighting Market?

Challenges in UAE Architectural Lighting Market include the high installation costs of energy-efficient systems, regulatory hurdles in building codes, and the complexities of integrating smart lighting technologies into existing infrastructure.

03. Who are the key players in the UAE Architectural Lighting Market?

Major players in UAE Architectural Lighting Market include Philips Lighting, Osram GmbH, Fagerhult Group, Zumtobel Group, and Signify N.V. These companies lead the market due to their innovation in energy efficiency and smart lighting technologies.

04. What is driving growth in the UAE Architectural Lighting Market?

The UAE Architectural Lighting Market is propelled by government investments in smart city projects, increasing adoption of LED lighting, and growing awareness of sustainable building solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.