UAE Bus and Electric Bus Market Outlook to 2030

Region:Middle East

Author(s):Khushi Khatreja

Product Code:KR1458

December 2024

90

About the Report

UAE Bus and Electric Bus Market Overview

- The UAE Bus and Electric Bus Market is valued at AED 5 Bn. The market is primarily driven by government initiatives to enhance public transportation systems and growing urbanization. The push for eco-friendly buses, alongside government projects, has further supported the market's growth.

- Dubai, Abu Dhabi, and Sharjah are the dominant cities driving the bus market in the UAE. Dubai, in particular, stands out due to its substantial population and infrastructure development, contributing to its strong market share. Dubais RTA has invested significantly in bus fleets and routes, making it a key city for bus sales and services.

- The UAE launched its Net Zero 2050 strategic initiative in 2021, aiming to be the first nation in the MENA region to attain net-zero emissions by 2050. This initiative aligns with the Paris Agreement, which urges countries to develop long-term strategies for reducing greenhouse gas emissions and to keep the global temperature rise below 1.5 degrees Celsius compared to pre-industrial levels.

UAE Bus and Electric Bus Market Segmentation

The UAE Bus and Electric Bus Market is segmented by various factors like end-user, fuel type, region, etc.

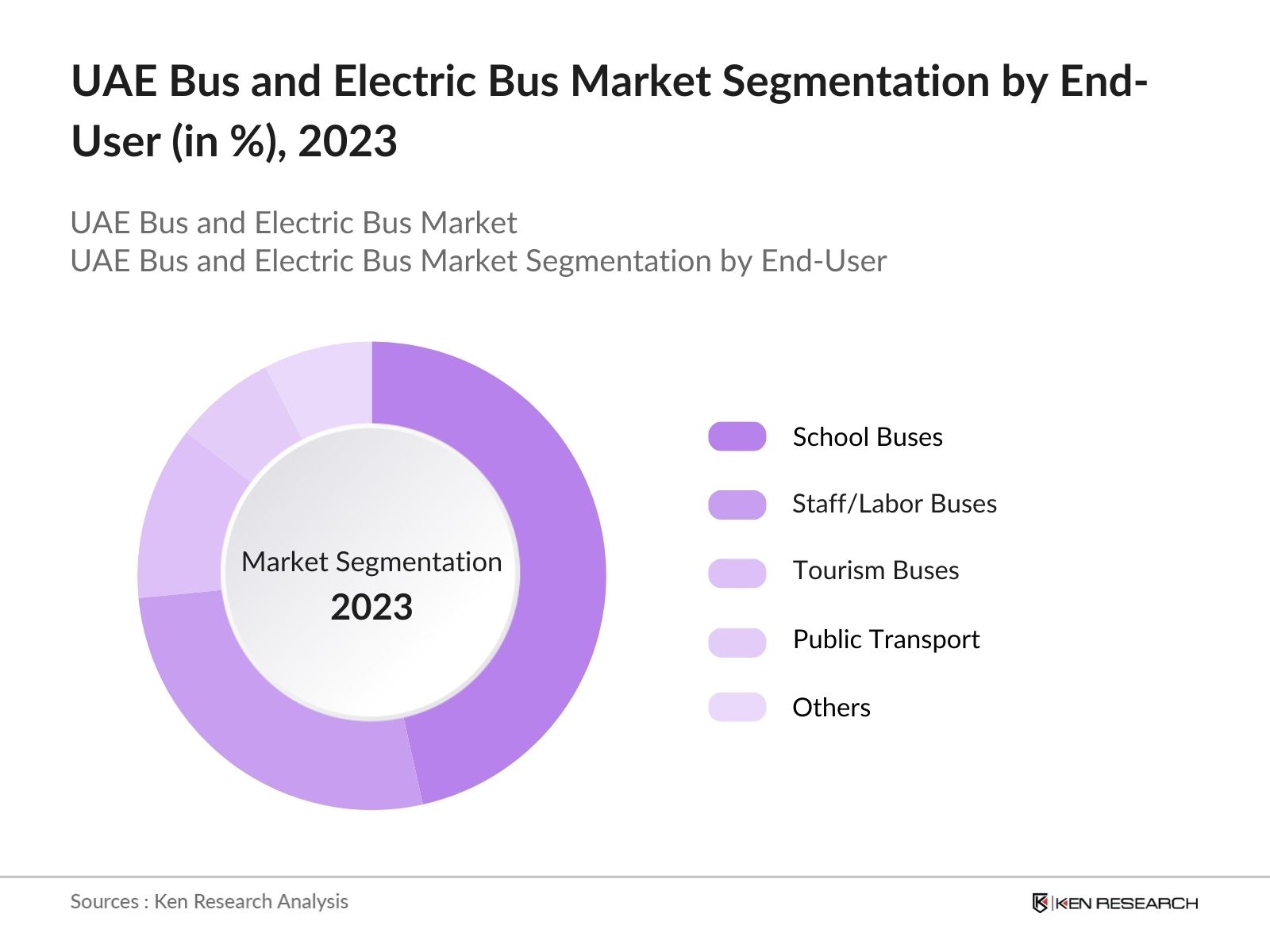

- By End-User: The UAE Bus and Electric Bus Market is segmented by end-user into school, staff/labor, tourism, public, and others. The school bus segment holds the dominant share due to the continued high demand for school transportation services. The UAE's increasing population, particularly in cities like Dubai and Abu Dhabi, has led to a higher demand for safe, reliable, and efficient school transportation.

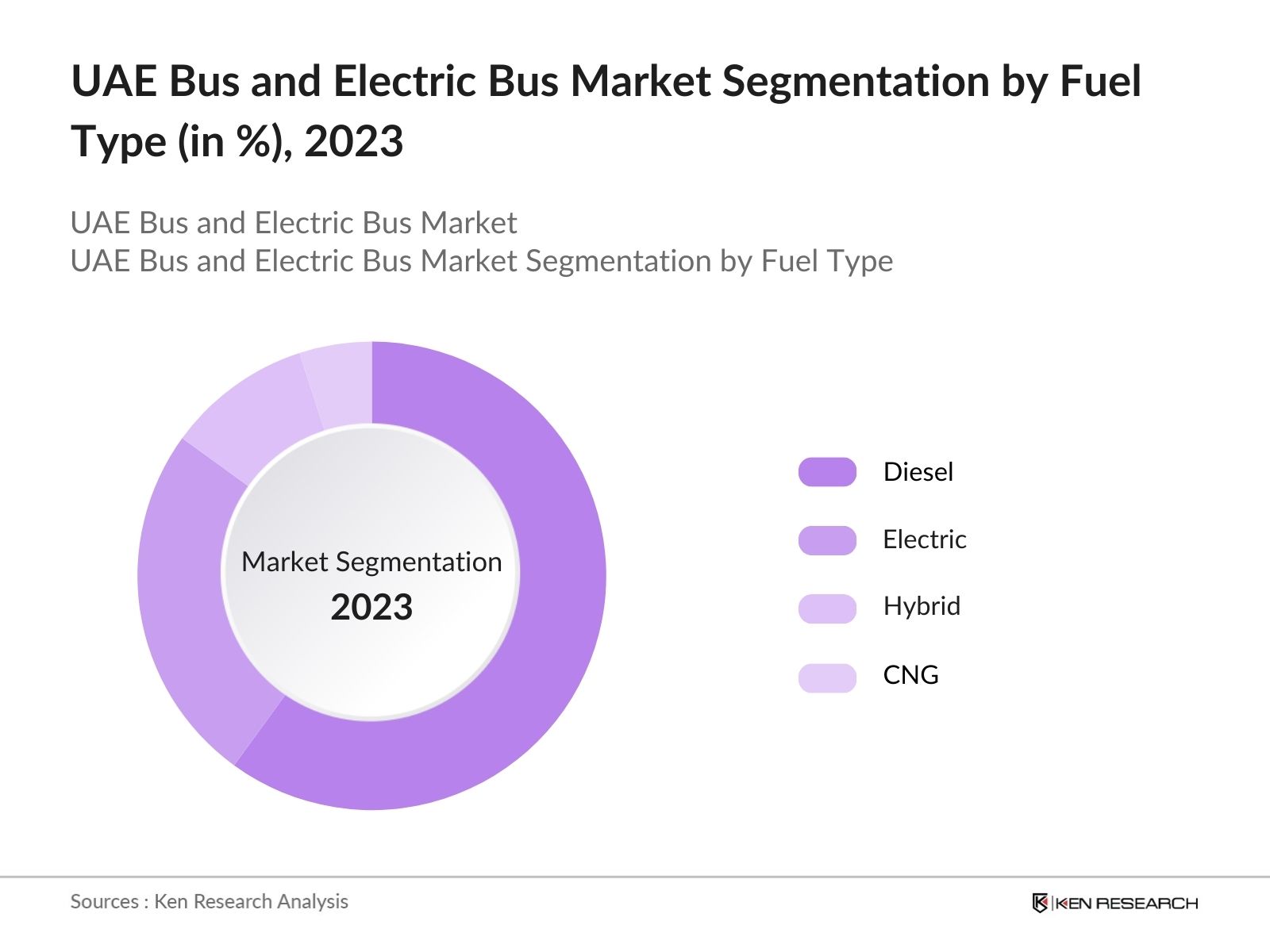

- By Fuel type: The UAE Bus and Electric Bus Market can be segmented by fuel type into the following categories: diesel, electric, hybrid, and CNG (compressed natural gas). The diesel segment continues to hold the largest market share largely due to the longstanding use of diesel buses and their cost-effectiveness. However, electric buses have gained considerable market share driven by the UAE's focus on green transport and sustainable energy solutions.

- By region: The UAE Bus and Electric Bus Market is segmented by region into the following emirates: Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al-Quwain, Fujairah, and Ras Al Khaimah. As the largest city and economic hub of the UAE, Dubai's extensive public transportation network, including the Dubai Metro and numerous bus routes, contributes to its dominant market share. The Roads and Transport Authority (RTA) has been instrumental in expanding and modernizing the bus fleet to meet the growing demand.

UAE Bus and Electric Bus Market Competitive Landscape

The bus and electric bus market in the UAE is witnessing significant growth, driven by the increasing demand for efficient public transportation solutions. Major manufacturers such as MAN Truck & Bus, Mercedes-Benz, Volvo, Scania, and Iveco are well-positioned to capitalize on this trend due to their extensive experience in producing high-quality commercial vehicles.

UAE Bus and Electric Bus Industry Analysis

Market Growth Drivers

- Increased Tourism and Major Events: The UAE, particularly Dubai and Abu Dhabi, is a global tourism hub, hosting millions of visitors each year. In 2023, Dubai welcomed around 14.36 million international visitors, significantly pushing the demand for public transportation options, including buses. Major events such as Expo 2020 (which extended into 2022) and ongoing cultural festivals have further increased the need for efficient transport solutions to accommodate tourists.

- Growing Urban Population and Public Transport Demand: The UAE's urban population is rapidly increasing, leading to higher demand for efficient public transportation solutions. In 2023, the population of Dubai alone reached approximately 3.5 million, with projections suggesting it could surpass 5 million by 2030. This demographic shift is driving investments in public transport infrastructure, including buses, to accommodate the rising commuter base.

- Technological Advancements and Smart City Integration: The integration of smart technologies into the bus system is enhancing operational efficiency and improving passenger experience. In 2023, the RTA implemented a new smart bus system featuring real-time tracking and automated fare collection. This technology not only streamlines operations but also encourages more residents to utilize public transport.

Market Challenges

- Harsh Climate Impacting Battery Performance: The extreme temperatures in the UAE can majorly affect the performance and lifespan of electric bus batteries. High ambient temperatures can lead to reduced efficiency, shorter operational ranges, and increased maintenance costs. In 2023, it was reported that battery performance could decrease by up to 30% in extreme heat conditions, which poses a substantial challenge for electric bus operators.

- Public Acceptance and Integration into Existing Systems: Despite the environmental benefits of electric buses, public acceptance remains a hurdle. Many residents are accustomed to traditional diesel buses and may be hesitant to switch to new technologies. Additionally, integrating electric buses into existing public transportation systems requires substantial changes in operations and infrastructure.

UAE Bus and Electric Bus Future Market Outlook

The outlook for the UAE Bus and Electric Bus Market, particularly regarding electric buses, is highly optimistic being driven by technological innovations, strong government support for sustainability initiatives, and increasing urbanization, the market is poised for robust growth. The combination of these factors positions the UAE as a leader in the transition towards cleaner and more efficient public transportation solutions in the region.

Market Opportunities

- Integration of Renewable Energy Sources: The UAE's abundant solar energy resources present a significant opportunity to power electric buses sustainably. The "Shams Dubai" initiative aims for 25% of Dubai's energy needs to come from solar power by 2030, aligning perfectly with the deployment of electric vehicles. Innovations in energy storage technologies can further support the efficient use of renewable energy for public transportation systems.

- Technological Innovations in Electric Bus Design: The ongoing advancements in battery technology and smart transportation solutions are key drivers for the electric bus market. Battery Electric Vehicles (BEVs) are currently leading the market due to their proven track record in emissions reduction. The UAE's commitment to smart city initiatives allows for the integration of electric buses with advanced traffic management systems, optimizing routes and reducing energy consumption.

Scope of the Report

|

Segment |

Sub-Segments |

|

End-User Segment |

School Buses Staff/Labor Buses Tourism Buses Public Transport Others |

|

Application |

Scheduled Bus Transport Scheduled Coach Transport School Transport Private Hire Tourism |

|

Fuel Type |

Diesel Electric Hybrid Compressed Natural Gas (CNG) |

Products

Key Target Audience

Bus OEMs (Original Equipment Manufacturers)

Electric Vehicle (EV) Manufacturers

Government and Regulatory Bodies (RTA, DoT etc.)

Fleet Operators

Electric Vehicle Charging Infrastructure Providers

Investors and Financial Institutions

Public Transport Authorities and Operators

Bus Distributors and Dealerships

Consulting Firms

Suppliers and Vendors

Academia and Research Institutions

Sustainability Advocates and NGOs

Companies

Players Mentioned in the report

Ashok Leyland

Mercedes-Benz

Volvo Buses

Hafilat Industries LLC

Yutong Bus Co., Ltd.

Scania AB

MAN Truck & Bus Middle East FZE

Hyundai Motor Company

BYD Motors Inc.

King Long United Automotive Industry Co., Ltd.

Cummins Inc.

Tata Motors

Faurecia

Siemens AG

Alstom

Lionsgate Motors

NFI Group

Proterra

Geely Group

Isuzu Motors Ltd.

Table of Contents

1. Executive Summary

1.1 Executive Summary of UAE Bus and Electric Bus Market

2. Market Overview and Background

2.1 UAE Country Profile

2.2 UAE Mobility Analysis

2.3 Global Benchmarking: Electric Mobility Readiness in UAE

2.4 Overview of EV Market in UAE

2.5 EV Adoption Trends in UAE

2.6 EV Charging Infrastructure in UAE

2.6.1 EV Charging Stations across UAE

2.6.2 Types of EV Charging Stations in UAE

3. Regulatory Environment

3.1 Steps Towards Sustainability

3.2 Certificate of Conformity

3.3 Distribution Channel

3.4 School Bus Regulations

3.5 Regulation for Transport Activities

3.6 UAE COP28: Major Announcements

3.7 UAE COP28: Major Developments

3.8 Challenges for Adoption of Electric Buses

3.9 Drivers for Adoption of Electric Buses

4. Market Size and Future Potential

4.1 Ecosystem: Major Supply-Side and Demand-Side Players

4.2 Ecosystem Major Bus OEMs and Distributors

4.3 Timeline of Electric Buses in UAE

4.4 EV Charging Infrastructure of Buses in UAE

4.5 Industry Analysis: Trends and Challenges

4.6 UAE Bus and Electric Bus Market Sizing, 2018-2023

4.7 UAE Bus and Electric Bus Market Sizing, 2023-2023

4.8 Market Segmentation by Type of Bus, 2023-2030

5. Market Fuel Type Analysis

5.1 Market Segmentation by Fuel Type, 2023

5.2 Emission Norms and Efficiency Standards

5.3 Global TCO Analysis Financial Implications

5.4 Market Segmentation by Fuel Type, 2030

5.5 Shift Towards Greener Alternatives and Electric Bus Development

6. Market Segment and Life Usage Analysis

6.1 Market Segmentation by End-Users, 2023-2030

6.2 Cross-Comparison of Major End-Users

6.3 Future Adoption of EV Technology

7. Competition Landscape

7.1 Market Share of Major Bus OEMs in UAE (by Fleet Size), 2023

7.2 Presence of Major Players across End-User Segments

7.3 Cross-Comparison of Top Bus OEMs in UAE (Fleet UIO, Business Model, Product Offerings, Pricing, Distribution, Avg. TCO, Avg. Profitability, Technology, USP)

7.4 Market Share of Major Electric Bus OEMs in UAE (By Fleet Size), 2023

7.5 Cross-Comparison of Major Electric Buses in UAE (Dimensions, Max. Speed, Battery, Range, Seats, Charging, Technology)

7.6 Cross-Comparison of Top Electric Bus OEMs in UAE (Market Share, Fleet Size, Business Model, Product Offering, Pricing, Distribution, Technology, Infrastructure)

8. Market OEM Strategies

8.1 Identifying OEMs for Partnership and Strategies

8.2 Cross-Comparison of Top Global OEMs from India, China, and Turkey (Countries of Operation, Product Offering, Service Offering, Business Model, Pricing, Technology, USP, Partnerships, Recent Developments, Future Expansion, Sales, Market Share)

8.3 Overview of OEM Strategies Deployed across the Middle East

8.4 OEM Strategies (Global Models, Local Models, Market Entry Strategies, Funding Strategy, Innovation Collaborations, Future Plans, and Roadmap)

9. Market Purchase and Financing Models

9.1 Financing Penetration in UAE Bus and Electric Bus Market

9.2 Restrictions and Eligibility

9.3 Cross-Comparison of Major Banks

9.4 Examination of Leasing

10. Market Aftersales

10.1 Revenue Streams and Business Models

10.2 Maintenance Models and Contracts

10.3 Volvo Maintenance Contracts

10.4 Service Levels in the Industry

10.5 Aftermarket Sales

10.6 Typical Infrastructure Required in a Workshop

10.7 Maintenance Cross-Comparison Between Diesel and Electric Buses

11. Market Entry Strategy Recommendations

11.1 Future Development of UAE Electric Bus Market

11.2 Whitespace Analysis

11.3 Market Entry Strategy: Organic Entry

11.4 Market Entry Strategy: Inorganic Entry

11.5 Market Entry Strategy: Market Positioning Tactics

11.6 Emerging Financial Models for Financing Electric Buses

11.7 Potential Financial Models for Financing Electric Buses

11.8 Evaluating Risks and Mitigation Strategies

11.9 Long-Term Strategy Roadmap

12. Industry Speaks

12.1 Interview with Rajesh Narayanan Exports Manager at Ashok Leyland

12.2 Interview with Business Excellence Manager from one of the Leading Dealerships

12.3 Interview with EV Head from one of the Leading Dealerships

12.4 Interview with Founder of a Leading Mobility Group

13. Market Research Methodology

13.1 Market Definitions and Assumptions

13.2 Abbreviations Used

13.3 Market Sizing Approach

13.4 Consolidated Research Approach

13.5 Sample Size Inclusion

13.6 Research Limitations and Conclusion

Contact Us DisclaimerResearch Methodology

Step 1: Identification of Major Players and Product Mapping:

Identification of major players operating in the UAE Bus and Electric Bus Market and mapping their product offerings across various bus types (e.g., electric buses, diesel buses, hybrid buses, and CNG buses). The Gross Written Premium (GWP) Market has been calculated using data obtained from relevant industry sources, including government reports, public transport authorities (such as RTA), and bus manufacturers' sales data. Additionally, industry publications, market research reports, and product-specific data releases have been considered.

Step 2: CATI (Computer-Assisted Telephonic Interviews):

Conduct CATIs with key stakeholders, including C-level executives, fleet operators, bus manufacturers, government representatives (from entities such as RTA and Ministry of Transport), and infrastructure providers. These interviews aim to understand the market trends, pricing, and margins based on different types of buses (electric, diesel, hybrid, and CNG). Conduct exhaustive secondary research to ascertain the average margins for each bus type and estimate the market size of the UAE Bus and Electric Bus Market.

Step 3: Exhaustive Secondary Research:

Our team adopted a Bottom-Up approach to evaluate the segmentation shares, including bus type, fuel type, end-user segment (public transport, school buses, tourism, corporate fleets), and regional shares. Market size and segmentation shares were cross-checked with industry statistics, including fleet operator revenues, bus sales data from OEMs, and public transport authority records (e.g., RTA). Secondary research also considered the penetration of electric buses, bus fleet size, and adoption of new technologies.

Step 4: Bottom-Up Market Estimation Approach:

Conduct additional levels of sanity checking from industry veterans, bus fleet operators, and key stakeholders (e.g., transport managers, local distributors, bus OEMs). Leverage proxy variables such as the number of buses operating in major UAE cities, the adoption rate of electric buses, and average bus fleet size. Other demographic and economic indicators such as government incentives, transport policies, and public-private partnerships are also considered to refine the market size estimates.

Frequently Asked Questions

01. How big is the UAE Bus and Electric Bus Market?

The UAE Bus and Electric Bus Market, valued at AED 5 billion, is driven by factors such as urbanization, government investments in public transport infrastructure, and the growing adoption of electric buses.

02. What are the challenges in the UAE Bus and Electric Bus Market?

Challenges in the UAE Bus and Electric Bus Market include high infrastructure costs, regulatory hurdles, limited adoption of electric buses in certain regions, and the need for modernization of public transport systems.

03. Who are the major players in the UAE Bus and Electric Bus Market?

Key players in the UAE Bus and Electric Bus Market include Ashok Leyland, Mercedes-Benz, Volvo Buses, Hafilat Industries LLC, Yutong Bus Co., Ltd., and Scania AB. These companies dominate due to their strong market presence, wide product offerings.

04. What are the growth drivers of the UAE Bus and Electric Bus Market?

The UAE Bus and Electric Bus Market is driven by factors such as rapid urbanization, government investments in sustainable public transport (including electric buses), initiatives to support smart city infrastructure, and growing tourism demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.