UAE Cold Chain Market Outlook to 2027

Driven by rising consumption of dairy, meat and seafood, smooth domestic and international connectivity and automation in warehouses

Region:Middle East

Author(s):Hiteshi Kaul and Anoushka Chawla

Product Code:KR1361

July 2023

128

About the Report

Market Overview:

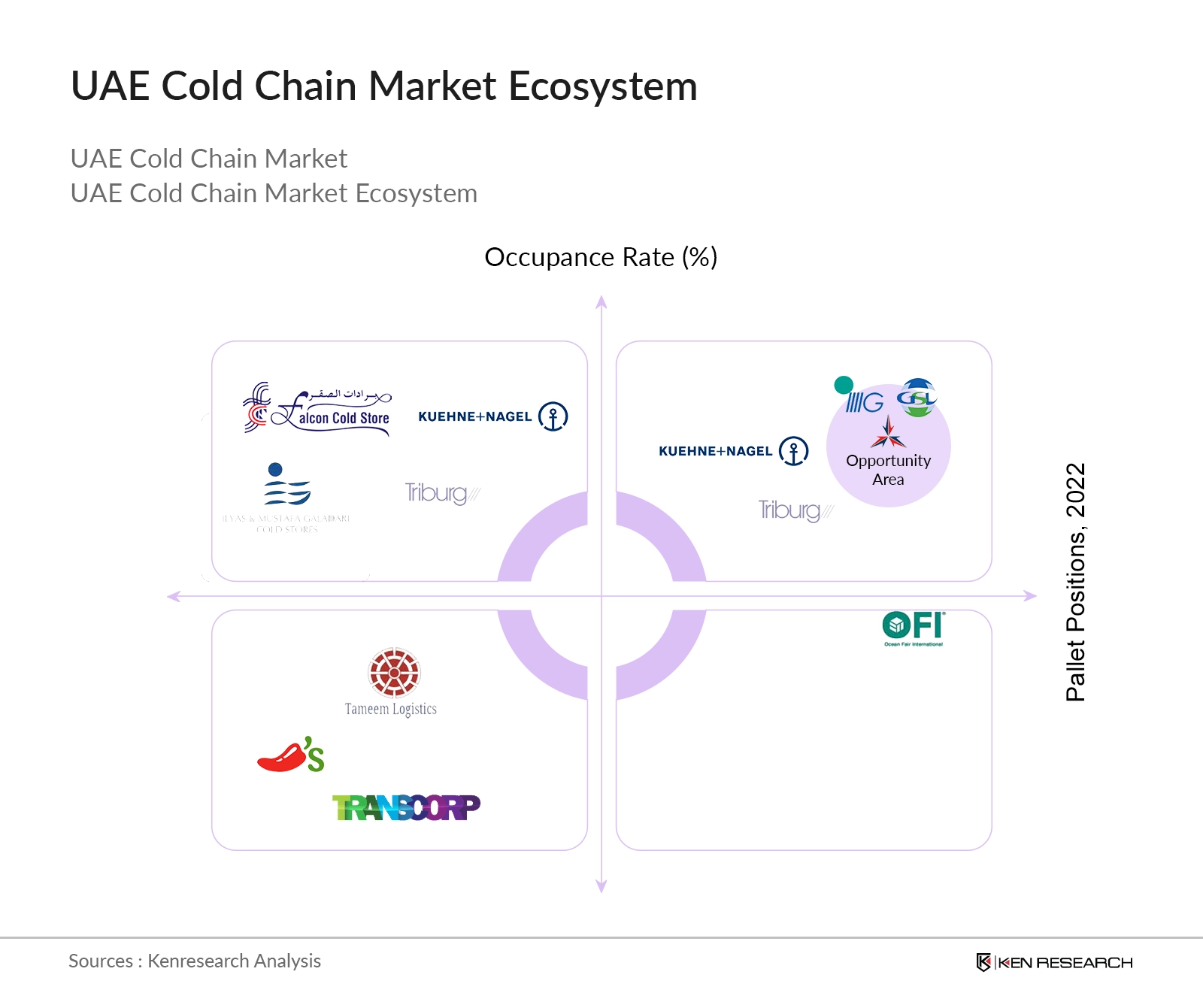

A highly fragmented market with immense growth potential UAE’s Cold Chain market is being driven bychange in major players such as GSL and Mohebi compete on total pallets, average price per pallet and client base. Rise of the Hospitality Industry in UAE is believed to cause a boom in demand for cold storage and cold transport​ services.

The total addressable market in for cold chain in UAE market has been expanding. Regarding logistics infrastructure, UAE has made a lot of breakthrough progress, especially in the investment and development of seaports. There has been increase in the demand of cold transport in UAE owning to rising consumption of perishable products which need to be kept at a stable temperature.

UAE Cold Chain Market Analysis

- The Cold chain market is highly fragmented in UAE with more than 90 cold storage & transportation players enabling the market to transform over the years.

- Increase in the demand of cold transport in UAE owning to rising consumption of perishable products which need to be kept at a stable temperature.

- The UAE Cold Chain market is currently in the growing phase owing to rising collaboration with logistics providers and geographic advantage.

- Rise of the Hospitality Industry in UAE is believed to cause a boom in

Key Trends by Market Segment:

By Type: The UAE Cold Chain market is segmented by type into cold storage & cold transport market. The Cold storage segment registered a robust growth rate when compared to the cold transport segment owing to increase rising consumption of meat and seafood and government and foreign investments.

By Temperature Range: The UAE Cold Chain Market is segmented by temperature range into chilled, ambient, frozen. The chilled food registered the highest market share when compared to the other segmented owing rise in demand for sea food.

Competitive Landscape:

- The key players of the cold chain market are opting for automated system because it increases accuracy and productivity.

- UAE Cold Chain market is a highly fragmented with Mohebi Logistics, FI are dominating the market.

- Seafood, meat, fruits, and dairy are the among the most prominent industries catered by the t.

- GSL, Mohebi and INL are capitalizing the market in the opportunity area and are competing on occupancy rates and pallet size.

Recent Developments:

- April 2022: At the 16th annual Logistics Middle East Awards hosted at the Grosvenor House in Dubai, United Arab Emirates, GAC Dubai was recognized as the FMCG Supply Chain of the Year winner for its outstanding service to the region's dynamic Fast Moving Consumer Goods (FMCG) industry.

- March 2022: The first Integrated Logistics Center of Maersk, a business that specializes in integrated container logistics, was established in Dubai, United Arab Emirates. Fast-moving consumer goods (FMCG), technology, cars, retail and leisure, petrochemicals, and other industries will all be represented in the facility's vast range of products. The location of the building is ideal, providing easy access to the Al Maktoum International Airport and seaport operations. This will make it possible for the facility to serve both customers who need air cross-docking and those who are shipping LCL cargo.

Future Outlook:

- UAE Cold Chain Market is expected to grow at the rate of 4.6% in the forecast period 2022-2027

- UAE Cold Chain Market Revenues are expected to be dominated by Cold Storage with over 50% share in 2027

- Revenue in UAE Cold Chain Market is expected to grow with a CAGR of 4.8% till 2027 due to rising grocery spending and demand for small and medium storages.

Scope of the Report

|

UAE Cold Chain Market Segmentation |

|

|

By Market Type |

Cold Storage Cold Transport |

|

By End User |

Pharmaceuticals and Vaccines Fruits and Vegetables Dairy Products Meat Processed foods Seafood Ice cream and frozen desserts Others |

|

By Provider Type |

3PL 2PL |

|

UAE Cold Storage Market Segmentations |

|

|

By Temperature Range |

Chilled Frozen |

|

By Major Cities |

Dubai Abu Dhabi Sharjah Others |

|

UAE Cold Transport Market Segmentation |

|

|

By Mode of Transportation |

Land Sea Air |

|

By Location |

International Domestic |

|

By Type |

Long Haul (First + Mid Mile) Short Haul (Last Mile) |

|

By Temperature Range |

Chilled Frozen |

|

By Vicinity |

Inter-City Intra-City |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Agricultural & Sea food Producers

Importers & Exporters

E-Commerce & Online Grocery Platforms

Retail & Super market Chains

Pharmaceutical & Healthcare Companies

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

UAE Cold Chain Market (Cold Storage Companies)

FI

Mohebi Logistics

CEVA Logistics

RSA Global

UAE Cold Chain Market (Cold Transportation Companies)

Tribug

Transcorp

Badami Logistics

Tameem Logistics

Table of Contents

1. Executive Summary

1.1 Executive Summary of UAE Cold Chain Market

2. Country Overview

2.1 Socioeconomic Profile, 2022

2.2 UAE Population Analysis, 2021

3. Infrastructure and Logistics Overview of UAE

3.1 Infrastructure Overview of UAE

3.2 Free zones in UAE

3.3 Sea Transport Overview

3.4 Air Transport Overview

3.5 Road Transport Overview

3.6 Rail Transport Overview

3.7 Overview of Logistics Industry

3.8 Roadblocks in Efficient Container Flow Mobilization

3.9 Digital Levers for an Evolved Interconnected Ports Network

4. UAE Cold Chain Market Overview

4.1 UAE Cold Chain Industry Ecosystem

4.2 Business Cycle and Genesis of UAE Cold Chain Market

4.3 Value Chain of UAE Cold Chain Industry

4.4 Major Challenges in UAE Cold Chain Market Value Chain

4.5 Existing Technologies in UAE Cold Chain Market

Seasonality Trends in Industry

4.6 UAE Cold Chain Market Size, 2022

4.7 UAE Cold Chain Market Size Including Ambient Revenue, 2017-2022

4.8 UAE Cold Chain Market Segmentation by Type of Service (Including Ambient Revenue), 2017-2022

4.9 UAE Cold Chain Market Size, 2017-2022

4.10 UAE Cold Chain Market Segmentation by Type of Service, 2017-2022

4.11 UAE Cold Chain Market Segmentation by Ownership, 2022

4.12 Cold Chain Market Segmentation by End Users, 2022

5. UAE Cold Storage Market Overview

5.1 UAE Cold Storage Supply Side Ecosystem

5.2 UAE Cold Storage Market Size by Revenue and Pallets, 2017-2022

5.3 UAE Cold Storage Market Price and Occupancy Rates, 2017-2022

5.4 UAE Cold Storage Market Segmentation by Temperature Range, 2022

5.5 UAE Cold Storage Market Segmentation by Regions, 2022

5.6 Demand Supply Scenario of UAE Cold Storage Market

6. UAE Cold Transport Market Overview

6.1 Value Chain Analysis of UAE Cold Transport Market

6.2 UAE Cold Transport Market Size, 2017-2022

6.3 UAE Cold Transport Market Segmentation by Mode of Transport, 2022

6.4 UAE Cold Transport Market Segmentation by Location and Vicinity, 2022

6.5 UAE Cold Transport Market Segmentation by Type and Temperature Range, 2022

7. UAE Cold Chain Market Competition Landscape

7.1 Market Positioning Analysis of Major Cold Chain Players in UAE

7.2 Market Share of Major Cold Storage Players in UAE

7.3 Operational Cross Comparison of Major Cold Chain Players in UAE

7.4 Cross Comparison of 3 Major Retailers in UAE

8. UAE Cold Chain Industry Analysis

8.1 SWOT Analysis of UAE Cold Chain Market

8.2 Growth drivers of UAE Cold Chain Market

8.3 Trends and Developments in the UAE Cold Chain Market

8.4 Issues and Challenges in the UAE Cold Chain Market

8.5 Emerging Technologies in UAE Cold Chain Market

8.6 Technological Advancements in the UAE Cold Chain Market

8.7 Government Regulations

8.8 Initiatives for the Growth of Logistics in the UAE

9. End User Analysis

9.1 End User Industry: Fresh Fruit & Vegetables and Dairy & Poultry

9.2 End User Industry: Pharmaceuticals and Meat & Seafood

9.3 End User Industry: Ice Cream, Frozen Desserts and Confectionary

9.4 Key Temperature Controlled Products with different Shelf Lives

9.5 In-Depth Analysis for Cold Storage in the UAE

10. Profitability and Operating Model of a Cold Storage in JAFZA

10.1 Key Model Assumptions

10.2 Capital Expenditure

10.3 Operating Model

10.4 Cost Component Analysis

10.5 Breakdown of Revenue

10.6 Revenue and EBT Bridge

11. Future Outlook of UAE Cold Chain Industry

11.1 UAE Cold Chain Market Size including Ambient Revenue, 2022-2027

11.2 UAE Cold Chain Market Segmentation by Type of Service, 2022-2027 (including Ambient Revenue)

11.3 UAE Cold Chain Market Size, 2022-2027

11.4 UAE Cold Chain Market Segmentation by Type of Service, 2027

11.5 UAE Cold Chain Market Segmentation by End Users and by Ownership, 2027

11.6 UAE Cold Storage Market Size by Revenue and Pallets, 2022-2027

11.7 UAE Cold Storage Market Price and Occupancy Rates, 2022-2027

11.8 UAE Cold Storage Market Segmentation by Temperature Range and By Region, 2022

11.9 UAE Cold Transport Market Size, 2022-2027

11.10 UAE Cold Transport Segmentation by Mode of Transport, Vicinity and Location, 2027

11.11 UAE Cold Transport Market Segmentation by Type and by Temperature Range, 2027

12. Analyst Recommendations

12.1 Analysis of Occupancy Rates

12.2 Automated Pallets in UAE Cold Storage Market, 2022

12.3 Recommendations to set up a Cold Chain Unit in UAE

12.4 End User and Business Model Recommendations

12.5 Best Practices to Improve Operations

12.6 Next Phase

13. Research Methodology

13.1 Market Definitions, Assumptions and Abbreviations

13.2 Market Sizing and Consolidated Research Approach

13.3 Sample Size Inclusion, Limitations and Future Conclusion

14. Disclaimer

15. Contact Us

Research Methodology

Step :1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step :2 Market Building:

Collating statistics on UAE Cold Chain market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for UAE Cold Chain market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step :3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step :4 Research output:

Our team will approach multiple UAE Cold Chain market providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from cold chain service providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The UAE Cold Chain Market is covered from 2017–2022 in this report, including a forecast for 2022-2027.

02 What is the Future Growth Rate of the UAE Cold Chain Market?

The UAE Cold Chain Market is expected to witness a CAGR of ~4.8% over the next 3 years.

03 What are the Key Factors Driving the UAE Cold Chain Market?

Rising Meat and Seafood Consumption and Increasing Awareness of Applying Cold Chain in Protecting Foods in UAE are likely to fuel the growth in the UAE Cold Chain Market.

04 Which is the Largest Market Type Segment within the UAE Cold Chain Market?

The Cold Storage type segment held the largest share of the UAE Cold Chain Market

05 Who are the Key Players in the UAE Cold Chain Market?

CEVA Logistics, are some of the key players in the Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.