UAE Egg Processing Market Outlook to 2030

Region:Middle East

Author(s):Samanyu

Product Code:KROD4990

October 2024

84

About the Report

UAE Egg Processing Market Overview

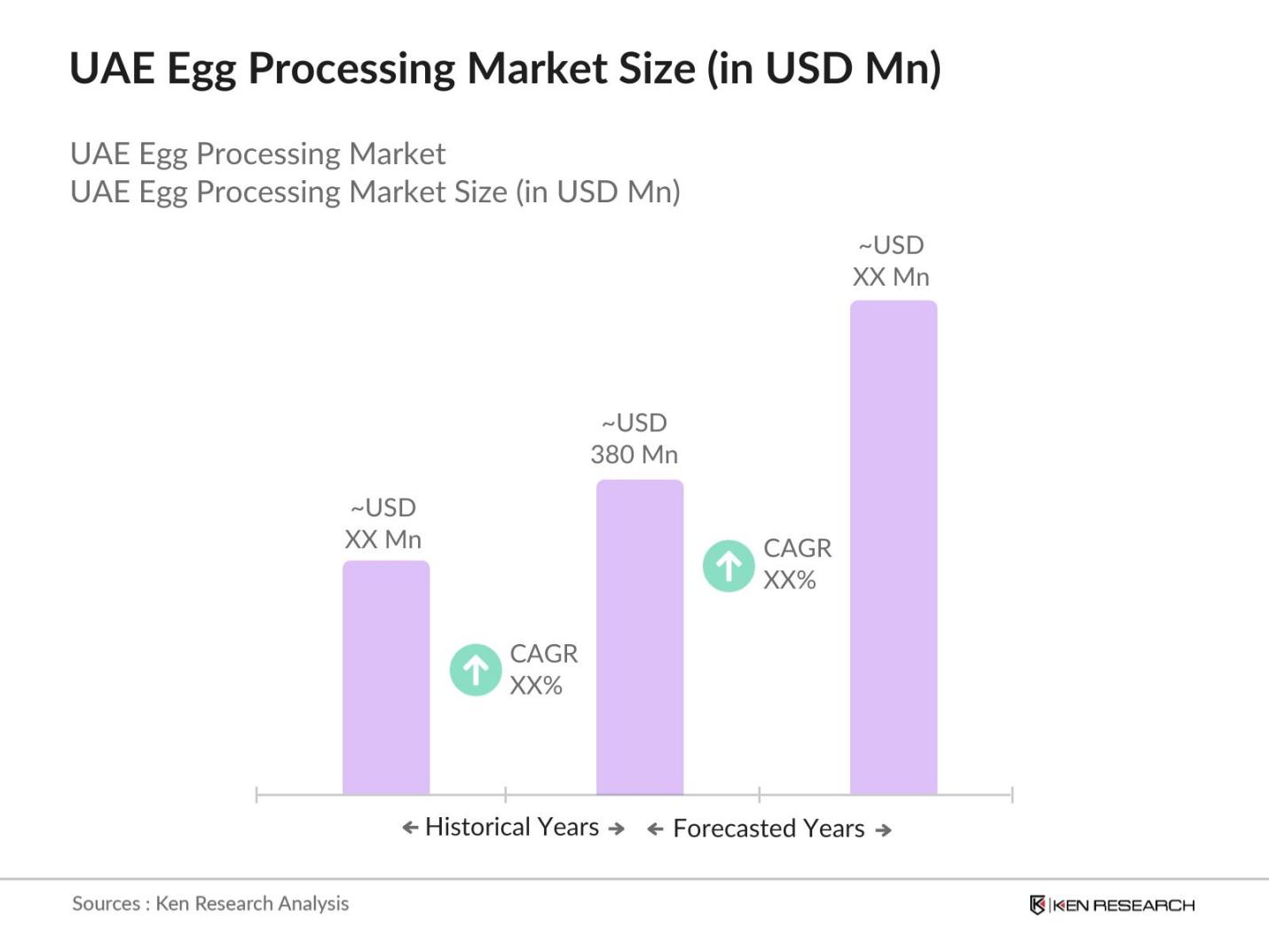

- The UAE Egg Processing market is valued at USD 380 Mn, based on a five-year historical analysis. This market has seen consistent growth driven by the rising demand for processed egg products in the foodservice industry, especially in the bakery, confectionery, and ready-to-eat meal sectors. Increasing urbanization, evolving consumer preferences for convenience foods, and advancements in egg processing technologies have contributed to this market size. Moreover, the country's robust import-export policies and favorable trade relations within the GCC further stimulate growth in the sector.

- The dominance in the market is led by cities such as Dubai and Abu Dhabi. These cities are at the forefront due to their advanced food processing industries, access to modern technologies, and a high concentration of end-user industries like hotels, restaurants, and cafes (HORECA). Additionally, these cities have well-developed infrastructure and logistics networks, which help streamline the supply chain for egg processing, leading to a stronger market presence.

- The UAE has stringent food safety regulations that require egg processors to implement comprehensive quality control and traceability systems. The UAE Food Safety Law, introduced in 2016, mandates that all food producers, including egg processors, must maintain full traceability from farm to fork. In 2023, the UAE Ministry of Climate Change and Environment (MOCCAE) reported that over 93% of food producers in the country had adopted traceability measures. This ensures that all processed egg products meet safety standards, reducing the risk of foodborne illnesses.

UAE Egg Processing Market Segmentation

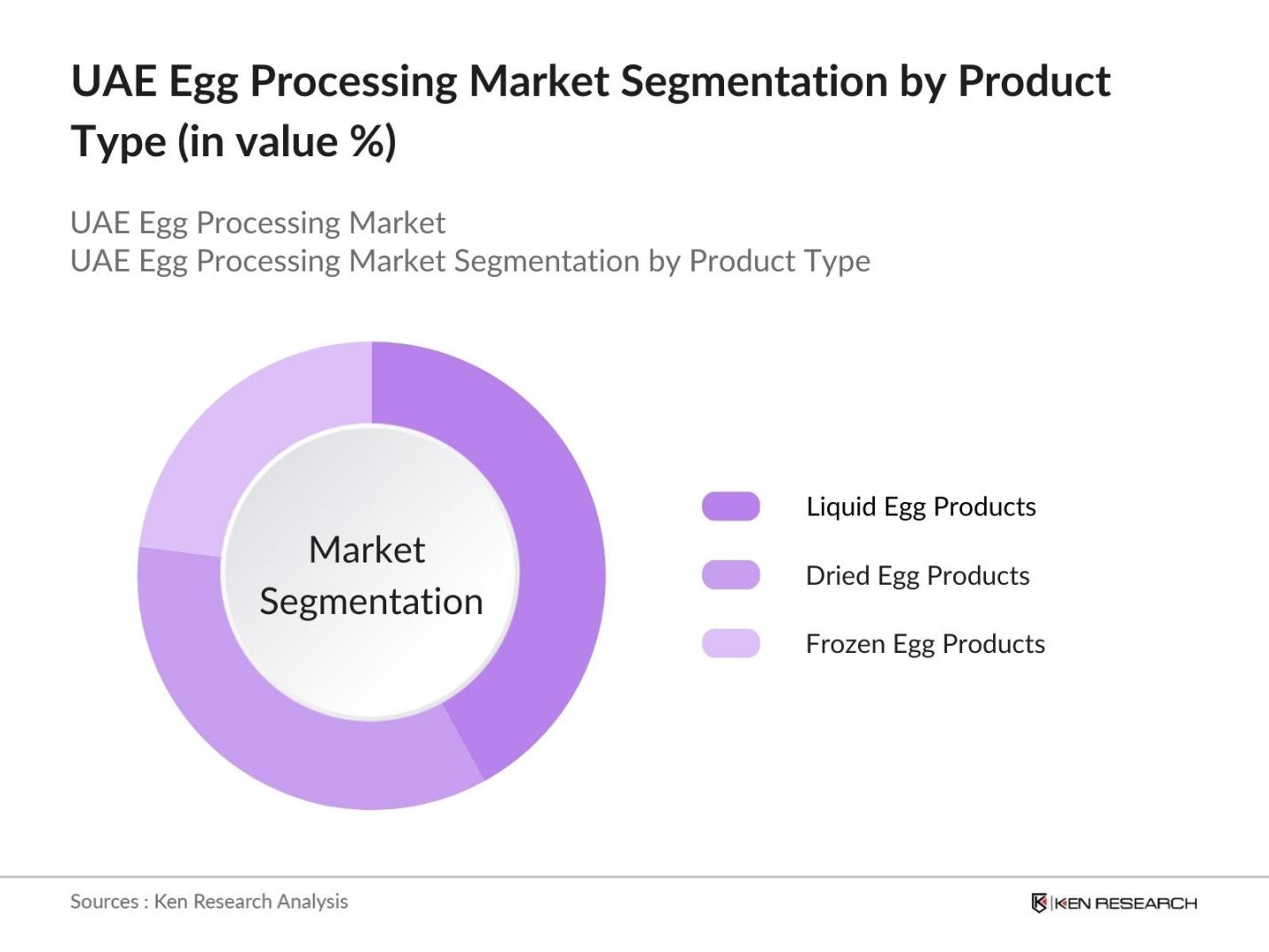

By Product Type: The market is segmented by product type into liquid egg products, dried egg products, and frozen egg products. Recently, liquid egg products have captured a dominant market share in the UAE due to their widespread use in commercial kitchens, bakeries, and foodservice applications. Liquid egg products are favored for their ease of use, consistency, and minimal preparation time, making them ideal for bulk use in the food industry. The growing demand for pre-prepared and processed foods further fuels the expansion of this sub-segment.

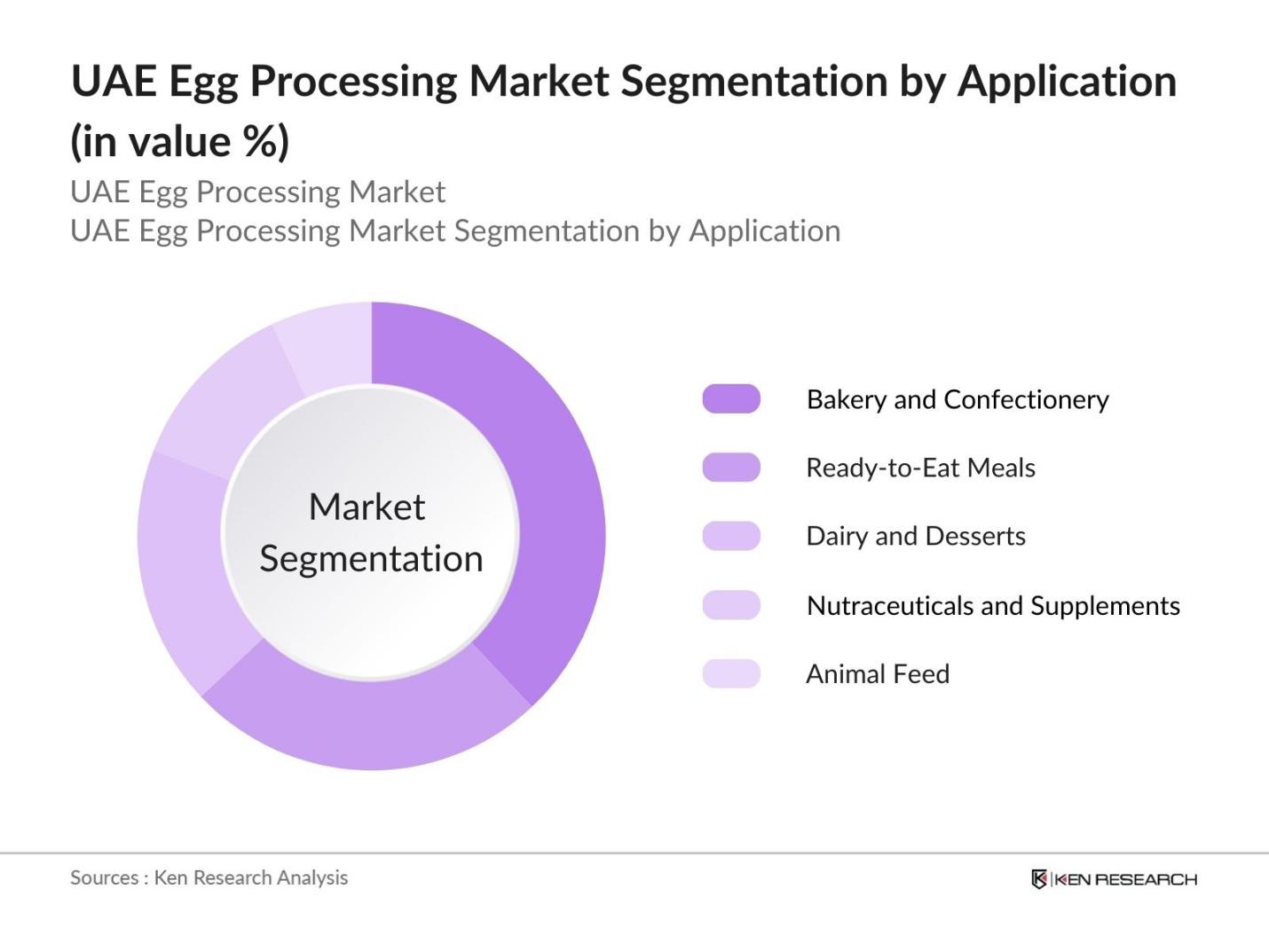

By Application: The market is segmented by application into bakery and confectionery, ready-to-eat meals, dairy and desserts, nutraceuticals and supplements, and animal feed. Among these, bakery and confectionery applications hold the highest market share. The dominance of this sub-segment can be attributed to the significant role of eggs as a primary ingredient in baked goods, such as cakes, pastries, and bread. Furthermore, the expanding bakery industry in the UAE, driven by growing tourism and an increasing number of cafes and restaurants, contributes to the strong demand for processed egg products.

UAE Egg Processing Market Competitive Landscape

The UAE Egg Processing Market is characterized by the presence of a few dominant local players and multinational corporations. The market is primarily consolidated, with key players having influence over the supply chain, distribution channels, and processing technologies. Companies such as Emirates Modern Poultry Co. and Al Jazira Poultry Farm LLC dominate the market due to their extensive production capabilities and wide distribution networks, both domestically and across the GCC.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

Production Capacity |

Distribution Network |

Market Strategy |

|

Emirates Modern Poultry Co |

1994 |

Dubai, UAE |

||||||

|

Al Jazira Poultry Farm LLC |

1999 |

Abu Dhabi, UAE |

||||||

|

Sanovo Technology Group |

1960 |

Odense, Denmark |

||||||

|

Noble Foods Ltd. |

1920 |

Edinburgh, UK |

||||||

|

Interovo Egg Group |

1972 |

Aalten, Netherlands |

UAE Egg Processing Industry Analysis

Growth Drivers

-

Increasing Demand for Processed Food: The increasing demand for processed foods, including egg-based products like egg powder and convenience meals, has driven the egg processing market in the UAE. The nation's growing urban population projected to surpass 9.7 million in 2024, according to World Bank data has led to a surge in the consumption of ready-to-eat products. The UAEs food consumption was valued at 50 million metric tons in 2022, with processed eggs forming a significant part due to their longer shelf life, ease of storage, and application in industries such as bakery and confectionery.

- Health Consciousness: The increasing focus on health and nutrition in the UAE has fueled demand for processed eggs, known for their high protein, vitamins, and essential amino acids. The UAE ranks high in the Middle East in terms of obesity rates, prompting a shift towards healthier food options. Processed eggs, particularly liquid egg whites, are popular among health-conscious consumers, with 6% of the adult population in the UAE adopting high-protein diets according to IMF data. This is in line with a global trend that has witnessed a 4.5% increase in protein-based food consumption between 2020 and 2023.

- Export Potential: The UAEs strategic location and strong trade ties with Gulf Cooperation Council (GCC) countries offer significant export potential for processed egg products. The UAE exported $2.8 billion worth of food products to GCC countries in 2023, with processed eggs forming a part of this trade. Favorable trade agreements, such as the UAE-Saudi Arabia bilateral trade agreement, have helped boost egg product exports. Additionally, the UAEs zero-tariff policy with GCC nations and participation in free trade agreements with over 22 countries have enhanced export opportunities for processed food industries, including egg processing.

Market Challenges

-

High Initial Investment Costs: High capital expenditure is a significant challenge in the egg processing industry in the UAE. Egg processing plants require advanced equipment, such as pasteurizers and separators, which can cost upwards of $1.5 million per facility, based on current estimates from IMF data. Furthermore, integrating automation technologies, crucial for maintaining efficiency and quality standards, increases operational costs. These costs can be prohibitive, especially for smaller businesses, making it difficult for new entrants to establish processing plants without significant financial backing.

- Regulatory Challenges: The UAEs stringent regulatory environment presents challenges for the egg processing market. Compliance with Halal certification standards, which mandate specific processing methods, adds to operational complexity. The UAEs Halal certification processes are managed by the Emirates Authority for Standardization and Metrology (ESMA), and all processed egg products must adhere to these standards to be sold in the country. Additionally, UAE food safety regulations, which mandate rigorous quality checks and traceability, require producers to invest in compliance systems, adding to operational costs.

UAE Egg Processing Market Future Outlook

The UAE Egg Processing Market is expected to experience robust growth over the next five years. This growth is driven by increased consumer demand for convenience and ready-to-eat foods, particularly in urban centers like Dubai and Abu Dhabi. In addition, advancements in egg processing technologies, such as improved pasteurization and dehydration methods, will enhance the quality and shelf-life of processed egg products, making them more attractive to both foodservice operators and retail consumers. Furthermore, government support for local food production and initiatives aimed at enhancing food security will likely bolster domestic egg processing activities.

Future Market Opportunities

-

Technological Advancements: Technological advancements in egg processing, including pasteurization and packaging innovations, present significant growth opportunities. Pasteurization methods like High-Pressure Pasteurization (HPP) have improved the safety and shelf-life of egg products, making them more attractive for export. Furthermore, sustainable packaging innovations, such as biodegradable cartons, appeal to the UAEs growing environmentally-conscious consumer base. Technological innovation has also enhanced traceability in the supply chain, with smart packaging that allows consumers to track the origins of their food, in compliance with UAE food safety laws.

- E-commerce Growth: The UAEs e-commerce sector has experienced rapid growth, with online retail sales exceeding $17 billion in 2023. The increasing consumer preference for purchasing food products online offers significant opportunities for processed egg manufacturers to expand their direct-to-consumer channels. Major e-commerce platforms like Amazon.ae and Noon.com have facilitated the sale of egg-based products such as egg powder and liquid eggs directly to consumers. The convenience of home delivery, combined with increased internet penetration of 94% of the population uses the internet has fueled e-commerce expansion.

Scope of the Report

|

By Product Type |

Liquid Egg Products Dried Egg Products Frozen Egg Products |

|

By Application |

Bakery and Confectionery Ready-to-Eat Meals Dairy and Desserts Nutraceuticals and Supplements Animal Feed |

|

By Distribution Channel |

Direct Sales Retail Chains E-commerce |

|

By Process Type |

Pasteurization Spray Drying Freezing Dehydration |

|

By Region |

Abu Dhabi Dubai Sharjah Northern Emirates |

Products

Key Target Audience

Foodservice Providers (Hotels, Restaurants, and Cafes - HORECA)

Processed Food Manufacturers

Bakery and Confectionery Producers

Nutraceutical and Supplement Manufacturers

Banks and Financial Institutes

Government and Regulatory Bodies (UAE Food and Agriculture Organization)

Investments and Venture Capitalist Firms

Animal Feed Producers

Companies

Players Mentioned in the Report:

Emirates Modern Poultry Co.

Al Jazira Poultry Farm LLC

Noble Foods Ltd.

Interovo Egg Group

Sanovo Technology Group

Ovostar Union

Bouwhuis Enthoven

Cal-Maine Foods, Inc.

Rose Acre Farms

Eurovo S.r.l.

Rembrandt Enterprises, Inc.

DEPS B.V.

Igreca

Dutch Egg Powder Solutions BV

Dava Foods

Table of Contents

1. UAE Egg Processing Market Overview

1.1. Definition and Scope (Processing Methods, Product Types)

1.2. Market Taxonomy (Egg Products, Distribution Channels, Applications)

1.3. Market Growth Rate (CAGR, Volume Growth, Demand Dynamics)

1.4. Market Segmentation Overview (Product Type, Application, Distribution Channel, Process Type, Region)

2. UAE Egg Processing Market Size (In USD Mn)

2.1. Historical Market Size (Market Performance, Sales Volume)

2.2. Year-On-Year Growth Analysis (Demand Fluctuations, Export Trends)

2.3. Key Market Developments and Milestones (Technological Advancements, New Entrants, Investments)

3. UAE Egg Processing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Processed Food (Demand for Egg Powder, Convenience Products)

3.1.2. Health Consciousness (Nutritional Benefits of Processed Eggs)

3.1.3. Rise in Foodservice Industry (HORECA Demand, Ready-to-Eat Products)

3.1.4. Export Potential (GCC Trade Relations, Free Trade Agreements)

3.2. Restraints

3.2.1. High Initial Investment Costs (Processing Equipment, Automation)

3.2.2. Regulatory Challenges (Halal Certification, UAE Food Safety Standards)

3.2.3. Supply Chain Issues (Raw Egg Availability, Storage Requirements)

3.3. Opportunities

3.3.1. Expansion into Bakery and Confectionery (High-Protein Ingredients, Egg Yolk Demand)

3.3.2. Technological Advancements (Pasteurization, Packaging Innovations)

3.3.3. E-commerce Growth (Direct-to-Consumer Egg Products, Online Retail)

3.4. Trends

3.4.1. Adoption of Sustainable Practices (Zero-Waste Processing, Packaging Sustainability)

3.4.2. Focus on Protein-Rich Diets (Protein Powder Market, Sports Nutrition)

3.4.3. Growth of Functional and Fortified Products (Vitamin-Enriched, Omega-3 Enriched Eggs)

3.5. Government Regulations

3.5.1. UAE Food Safety Law Compliance (Quality Control, Traceability)

3.5.2. Halal Certification Requirements (Halal Processing Standards)

3.5.3. Export and Import Regulations (Tariffs, Quotas)

3.5.4. Subsidies for Local Processing Facilities (Government Funding, Local Sourcing Initiatives)

3.6. SWOT Analysis (Market Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Suppliers, Distributors, End-Users, Regulatory Bodies)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry)

3.9. Competitive Ecosystem (Local Players, Multinational Companies, Joint Ventures)

4. UAE Egg Processing Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Liquid Egg Products

4.1.2. Dried Egg Products

4.1.3. Frozen Egg Products

4.2. By Application (In Value %)

4.2.1. Bakery and Confectionery

4.2.2. Ready-to-Eat Meals

4.2.3. Dairy and Desserts

4.2.4. Nutraceuticals and Supplements

4.2.5. Animal Feed

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Sales

4.3.2. Retail Chains

4.3.3. E-commerce

4.4. By Process Type (In Value %)

4.4.1. Pasteurization

4.4.2. Spray Drying

4.4.3. Freezing

4.4.4. Dehydration

4.5. By Region (In Value %)

4.5.1. Abu Dhabi

4.5.2. Dubai

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE Egg Processing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Emirates Modern Poultry Co.

5.1.2. Al Jazira Poultry Farm LLC

5.1.3. Noble Foods Ltd.

5.1.4. Interovo Egg Group

5.1.5. Sanovo Technology Group

5.1.6. Ovostar Union

5.1.7. Bouwhuis Enthoven

5.1.8. Cal-Maine Foods, Inc.

5.1.9. Rose Acre Farms

5.1.10. Eurovo S.r.l.

5.1.11. Rembrandt Enterprises, Inc.

5.1.12. DEPS B.V.

5.1.13. Igreca

5.1.14. Dutch Egg Powder Solutions BV

5.1.15. Dava Foods

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Processing Capacity)

5.3. Market Share Analysis (Key Competitors, Market Penetration)

5.4. Strategic Initiatives (Partnerships, Product Innovations)

5.5. Mergers and Acquisitions (Industry Consolidation, Key Deals)

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Venture Capital Funding (Notable Investments, Start-up Support)

5.8. Government Grants (Local Production Support, Funding Initiatives)

5.9. Private Equity Investments (Investment Rounds, Market Impact)

6. UAE Egg Processing Market Regulatory Framework

6.1. Food Safety Regulations (Compliance, Certifications)

6.2. Halal Certification Process (Requirements, Audits)

6.3. Import and Export Regulations (Tariffs, Customs Duties)

7. UAE Egg Processing Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Demand Forecast, Growth Trajectories)

7.2. Key Factors Driving Future Market Growth (Emerging Trends, Consumer Preferences)

8. UAE Egg Processing Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Process Type (In Value %)

8.5. By Region (In Value %)

9. UAE Egg Processing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Market Opportunity, Addressable Market)

9.2. Customer Cohort Analysis (Consumer Preferences, Usage Patterns)

9.3. Marketing Initiatives (Branding, Digital Marketing, Awareness Campaigns)

9.4. White Space Opportunity Analysis (Untapped Markets, Growth Areas)

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE Egg Processing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the UAE Egg Processing Market. This includes assessing market penetration, the ratio of processing plants to raw egg suppliers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple egg processing companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the UAE Egg Processing Market.

Frequently Asked Questions

01 How big is the UAE Egg Processing Market?

The UAE Egg Processing Market is valued at USD 380 Mn, driven by the increasing demand for processed food products in the foodservice sector and the growing adoption of convenient, ready-to-use egg products.

02 What are the challenges in the UAE Egg Processing Market?

Challenges in USE egg processing market include high initial investment costs for advanced processing technologies, regulatory hurdles related to food safety and Halal certification, and supply chain issues such as fluctuating raw egg availability.

03 Who are the major players in the UAE Egg Processing Market?

Key players in UAE egg processing market include Emirates Modern Poultry Co., Al Jazira Poultry Farm LLC, Sanovo Technology Group, Noble Foods Ltd., and Interovo Egg Group. These companies dominate due to their strong production capacities, technological expertise, and robust distribution networks.

04 What are the growth drivers of the UAE Egg Processing Market?

Growth drivers in UAE egg processing market include the rising demand for processed egg products in bakeries and confectioneries, the expanding foodservice industry in urban centers, and technological advancements in egg processing methods such as pasteurization and spray drying.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.