UAE Electric Vehicle (EV) Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD5191

December 2024

92

About the Report

UAE EV Market Overview

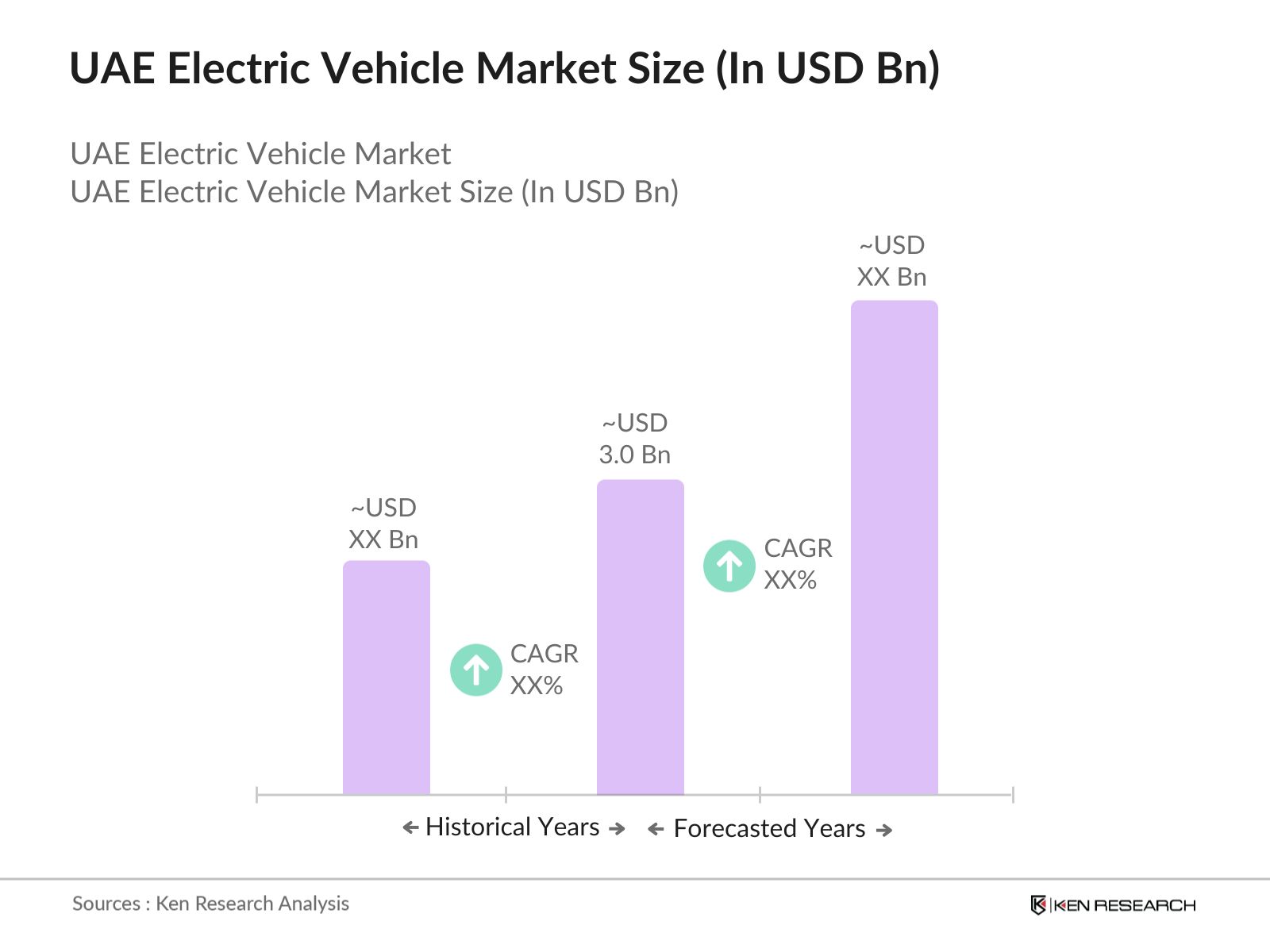

- The UAE Electric Vehicle (EV) market is valued at USD 3.0 billion, primarily driven by supportive government policies, rising environmental awareness, and the expanding infrastructure for EVs across the country. The market shows steady growth as more consumers opt for sustainable transport options, fueled by attractive incentives and an increase in charging stations. Contributing factors such as technological advancements in battery efficiency and a strong push towards reducing carbon emissions underscore the markets potential, positioning the UAE as a promising hub for EV adoption in the region.

- Key demand centers in the UAE EV market include Dubai and Abu Dhabi. Dubai leads due to its proactive approach in establishing extensive EV infrastructure, including public and residential charging stations. Meanwhile, Abu Dhabi benefits from government-led sustainability initiatives and a rising trend toward EV adoption among environmentally conscious consumers. The strategic emphasis on eco-friendly transportation solutions in these cities further bolsters their role as dominant players within the UAE EV market.

- The UAE has implemented strict emission standards to reduce transportation-related pollution. The standards require all new vehicles to meet specific emissions benchmarks, directly impacting vehicle manufacturers and promoting the adoption of cleaner technologies. Such regulations aim to reduce urban air pollution, supporting the shift to EVs in line with the UAEs emission reduction commitments.

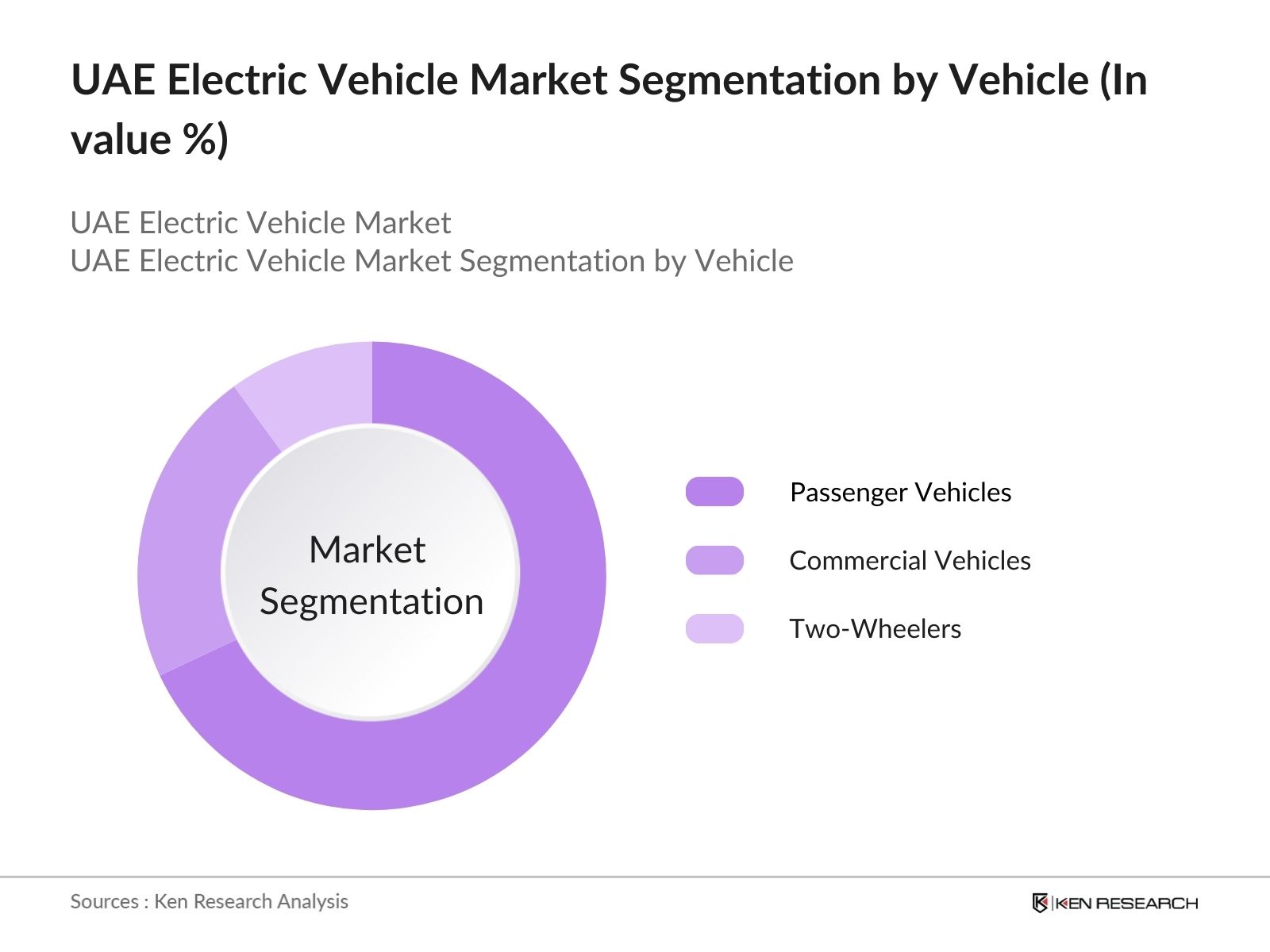

UAE EV Market Segmentation

- By Vehicle Type: The market is segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. Passenger vehicles currently hold the largest market share in this category due to the increasing interest from environmentally aware consumers. The UAE governments incentives and subsidies for individual EV ownership have driven demand in this segment, along with the high availability of residential charging facilities. Passenger EVs align with UAE's sustainability goals, making them a popular choice among urban dwellers seeking green alternatives to traditional vehicles.

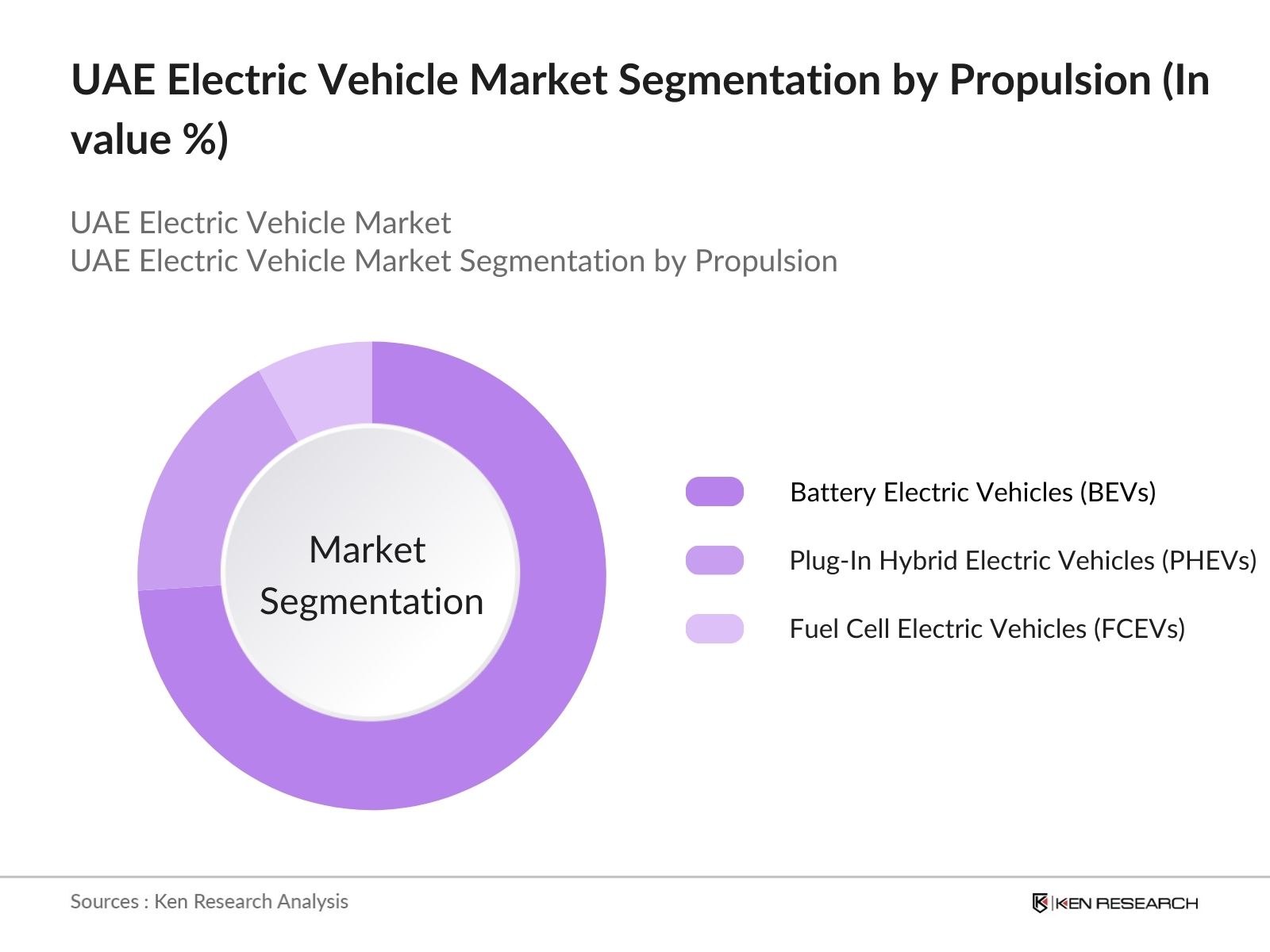

- By Propulsion Type: The market is segmented by propulsion type into Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). BEVs dominate this segment due to their zero-emission benefits and strong government backing, which includes financial incentives and tax exemptions. The UAEs commitment to reducing its carbon footprint and the increasing availability of fast-charging infrastructure make BEVs the most preferred option for both consumers and businesses, reinforcing their strong market presence.

UAE EV Market Competitive Landscape

The UAE Electric Vehicle market is dominated by several key players, including global brands and regional leaders. These companies leverage their robust technological advancements, extensive distribution channels, and brand reputation to maintain a stronghold in the market. Tesla, Nissan, and BMW, among others, benefit from strategic alliances, innovative R&D, and comprehensive market coverage.

UAE EV Market Analysis

Growth Drivers

- Government Incentives and Policies: The UAE government has introduced several initiatives to accelerate EV adoption, with direct incentives, regulatory support, and reduced tariffs for EV buyers. In Dubai, the Road and Transport Authority (RTA) has launched a program offering EV users free public parking, toll exemptions, and reduced registration fees. The governments EV initiatives align with the UAEs broader Net Zero by 2050 strategy, aiming for cleaner energy integration. Additionally, authorities have invested over 10 billion AED in renewable projects to support EV growth, boosting the adoption rate across the region.

- Fuel Cost Savings (Cost Comparison with ICE Vehicles): Electric vehicles offer significant fuel cost savings compared to internal combustion engine (ICE) vehicles. Average annual fuel expenses for an ICE vehicle in the UAE can reach 8,000 AED, whereas an EV consumes around 2,500 AED in electricity per year, saving over 5,500 AED for UAE drivers. This cost advantage supports the shift toward EVs, particularly as oil prices fluctuate. The financial benefit of lower fuel costs makes EVs appealing for both private and commercial users, driving market adoption.

- Sustainability Goals and Emissions Reduction: The UAE aims to cut emissions substantially in the next decade to meet environmental targets outlined in the Paris Agreement, and EV adoption is crucial in achieving this goal. EVs emit zero tailpipe emissions, contributing to improved air quality in urban centers like Abu Dhabi and Dubai, where transportation emissions constitute a significant portion of pollution. This focus on sustainability is driving regulatory and infrastructure investments in the EV sector, enhancing its long-term growth.

Challenges

- High Initial Costs: Despite incentives, the initial cost of EVs remains a barrier for some consumers. The higher cost of electric vehicles compared to conventional cars can deter middle-income consumers from transitioning to EVs. The cost of an EV remains a significant challenge, with prices higher than comparable ICE models. Limited financial accessibility for middle-income consumers necessitates more robust financial mechanisms to encourage wider adoption.

- Limited Model Availability: The UAE EV market faces a limited range of models available for purchase, restricting consumer choice. This limitation, combined with longer wait times for new models, poses a challenge for market growth. The range of EV models in the UAE is limited compared to ICE vehicles, restricting consumer choice. Local regulations and certification requirements add complexity, slowing the expansion of model diversity.

UAE EV Market Future Outlook

The UAE Electric Vehicle market is expected to witness strong growth as consumer awareness and government support continue to expand. The shift toward greener energy solutions aligns with the UAEs commitment to sustainability. Additionally, advancements in battery technology and the integration of renewable energy in EV infrastructure are expected to strengthen market growth. The UAEs vision for smart and sustainable cities further encourages EV adoption, establishing a favorable environment for the markets future expansion.

Future Market Opportunities

- Technological Advancements in Battery Efficiency: Technological improvements in battery storage are advancing EV viability. New battery designs have reduced charging time and increased range capacities substantially. In 2024, local R&D partnerships have focused on solid-state batteries, expected to extend the average EV range to 400 km. These advancements could address key challenges around range and charging, boosting market growth.

- Cross-Industry Collaborations (Energy and Automotive): Collaboration between the energy and automotive sectors is driving the UAE's EV market expansion. Utility companies and automakers are working on initiatives to integrate renewable energy sources into EV charging networks. DEWA has collaborated with Tesla on solar-powered EV charging stations, a model expected to power major of all EV charging stations by the end of 2025. These partnerships support infrastructure development, driving EV adoption further.

Scope of the Report

|

By Vehicle Type |

Passenger Vehicles |

|

By Propulsion Type |

Battery Electric Vehicles (BEVs) |

|

By Battery Capacity |

Less than 50 kWh |

|

By Charging Infrastructure |

Slow Charging (AC) |

|

By Region |

Dubai |

Products

Key Target Audience

EV Manufacturers

Component Suppliers

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Energy and Infrastructure, Dubai Electricity and Water Authority)

Battery Technology Providers

Automobile Dealerships

Renewable Energy Companies

Companies

Players Mentioned in the Report

Tesla

Nissan

BMW

Chevrolet

BYD

Audi

Hyundai

Ford

Kia

Renault

Mercedes-Benz

Lucid Motors

Fisker Inc.

Volkswagen

Toyota

Table of Contents

1. UAE EV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. UAE EV Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. UAE EV Market Analysis

3.1. Growth Drivers

3.1.1. Government Incentives and Policies

3.1.2. Fuel Cost Savings (Cost Comparison with ICE Vehicles)

3.1.3. Sustainability Goals and Emissions Reduction

3.1.4. Rise in Charging Infrastructure

3.2. Market Challenges

3.2.1. High Initial Purchase Cost

3.2.2. Limited Model Availability

3.2.3. Range Anxiety and Charging Speed Concerns

3.3. Opportunities

3.3.1. Technological Advancements in Battery Efficiency

3.3.2. Cross-Industry Collaborations (Energy and Automotive)

3.3.3. Growth in Renewable Energy Integration

3.4. Trends

3.4.1. Emergence of Autonomous EVs

3.4.2. Shift Toward Subscription-Based Ownership Models

3.4.3. Investment in Smart Charging and V2G (Vehicle-to-Grid) Technologies

3.5. Regulatory Framework

3.5.1. UAE EV Roadmap and Vision 2030

3.5.2. Emission Reduction Standards

3.5.3. Public-Private Partnerships for Infrastructure Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. UAE EV Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.1.3. Two-Wheelers

4.2. By Propulsion Type (In Value %)

4.2.1. Battery Electric Vehicles (BEVs)

4.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

4.2.3. Fuel Cell Electric Vehicles (FCEVs)

4.3. By Battery Capacity (In Value %)

4.3.1. Less than 50 kWh

4.3.2. 50100 kWh

4.3.3. Above 100 kWh

4.4. By Charging Infrastructure Type (In Value %)

4.4.1. Slow Charging (AC)

4.4.2. Fast Charging (DC)

4.5. By Region (In Value %)

4.5.1. Dubai

4.5.2. Abu Dhabi

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE EV Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla

5.1.2. Nissan

5.1.3. BYD

5.1.4. BMW

5.1.5. Chevrolet

5.1.6. Toyota

5.1.7. Kia

5.1.8. Audi

5.1.9. Hyundai

5.1.10. Renault

5.1.11. Mercedes-Benz

5.1.12. Volkswagen

5.1.13. Ford

5.1.14. Lucid Motors

5.1.15. Fisker Inc.

5.2. Cross Comparison Parameters (Market Share, Production Capacity, Model Variants, Headquarters Location, Total Workforce, R&D Investments, Annual Revenue, Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Private Equity Investments

5.9. Venture Capital Funding

6. UAE EV Market Regulatory Framework

6.1. Certification and Compliance Standards

6.2. EV Registration and Taxation Policies

6.3. Safety and Emission Norms

7. UAE EV Future Market Size (In USD Bn)

7.1. Future Market Size Analysis

7.2. Key Factors Influencing Future Growth

8. UAE EV Market Future Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Propulsion Type (In Value %)

8.3. By Battery Capacity (In Value %)

8.4. By Charging Infrastructure Type (In Value %)

8.5. By Region (In Value %)

9. UAE EV Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategy

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the UAE EV market, capturing the interactions among various stakeholders such as manufacturers, suppliers, and regulatory bodies. This step is backed by comprehensive desk research, leveraging proprietary databases to compile insights into market dynamics and variable factors.

Step 2: Market Analysis and Construction

This step entails analyzing historical data on the UAE EV market, including the growth patterns of EV adoption and infrastructure development. The analysis focuses on revenue generation metrics, penetration rates, and product performance to ensure a reliable foundation for the reports conclusions.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, preliminary hypotheses are validated through industry expert interviews. These consultations with representatives from prominent EV companies and regulatory bodies provide practical insights, which further reinforce the accuracy of data analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing findings from multiple sources to produce an exhaustive report. Interaction with EV manufacturers ensures precise insights on product segments, sales performance, and consumer trends, solidifying the reports integrity and relevance for industry stakeholders.

Frequently Asked Questions

01 How big is the UAE EV market?

The UAE Electric Vehicle market is valued at USD 3.0 billion, driven by supportive government initiatives and growing consumer awareness about sustainable transportation.

02 What are the challenges in the UAE EV market?

The UAE EV market faces challenges including high initial costs, limited model variety, and concerns over charging infrastructure, which can hinder widespread adoption.

03 Who are the major players in the UAE EV market?

Key players in the UAE EV market include Tesla, Nissan, BMW, Chevrolet, and BYD, all benefiting from established brand loyalty and comprehensive market strategies.

04 What are the growth drivers of the UAE EV market?

Key growth drivers in the UAE Electric Vehicle market include government incentives, advanced charging infrastructure, and a strong push towards environmental sustainability, which encourages EV adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.