UAE Fire Protection Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi

Product Code:KROD2460

December 2024

85

About the Report

UAE Fire Protection System Market Overview

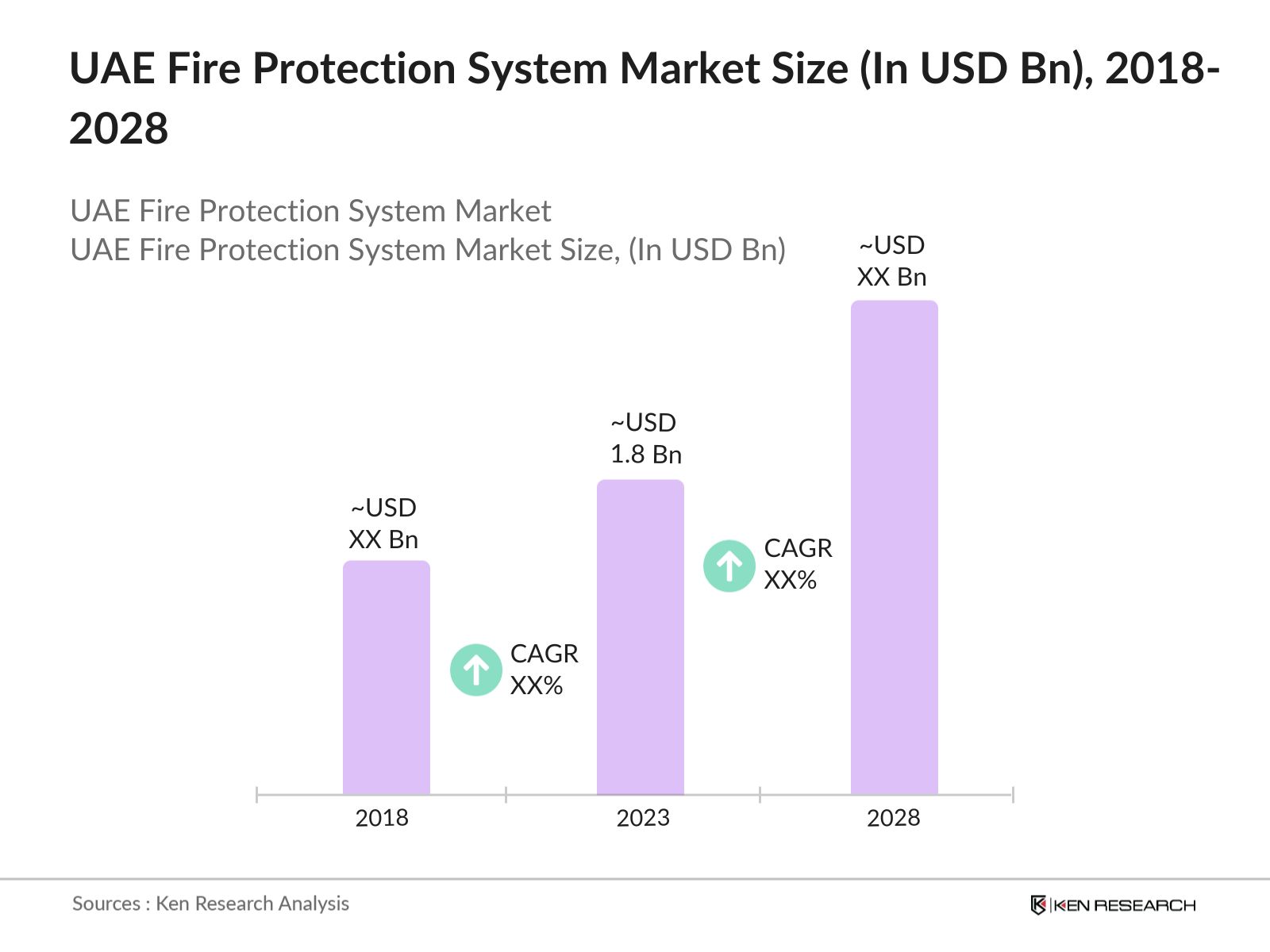

- The UAE Fire Protection System Market was valued at USD 1.8 billion in 2023. The market is driven by stringent safety regulations, increasing construction activities, and the growth of high-rise buildings. These factors necessitate the implementation of advanced fire protection systems, boosting market growth. The governments focus on safety standards further propels the market by mandating fire protection installations in residential, commercial, and industrial buildings.

- Key players in the UAE Fire Protection System Market include Tyco Fire Products LP, Honeywell International Inc., Siemens AG, UTC Fire & Security, and NAFFCO FZCO. These companies are leaders due to their extensive product portfolios, strong market presence, and continuous innovation in fire protection technologies, providing solutions that comply with local regulations and standards.

- A significant recent development in the UAE Fire Protection System Market was the introduction of NAFFCO's new intelligent fire alarm system in 2023. This system integrates with smart building technologies, offering real-time monitoring and advanced response mechanisms. The launch has enhanced NAFFCO's market position by addressing the growing demand for smart fire safety solutions across the region.

- Dubai and Abu Dhabi dominate the UAE Fire Protection System Market. Dubai leads due to its rapid urbanization and numerous high-rise buildings, which require sophisticated fire safety systems. Abu Dhabi follows closely with substantial investments in infrastructure and construction, driven by the citys ambition to become a global business hub, contributing to the demand for advanced fire protection solutions.

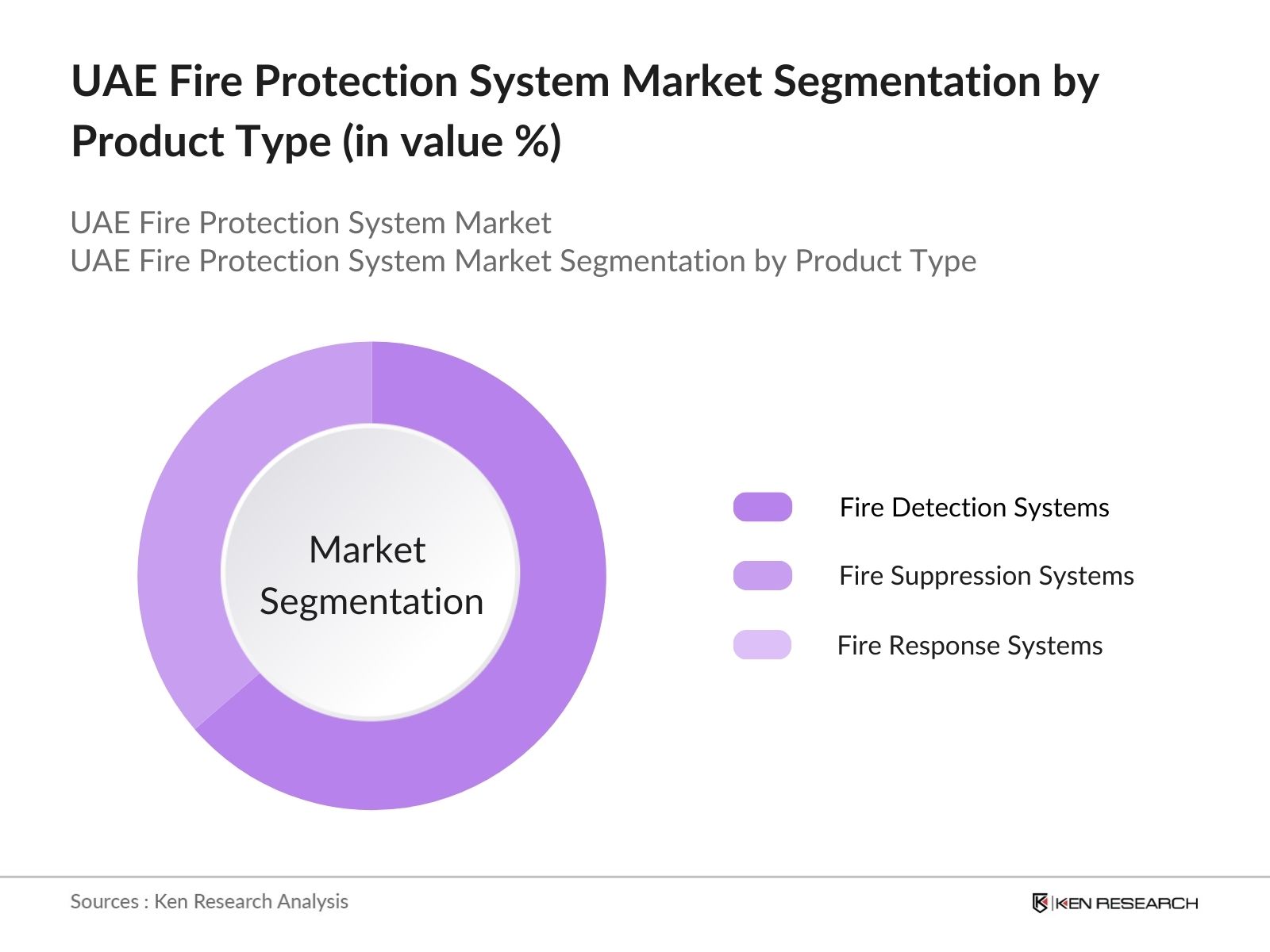

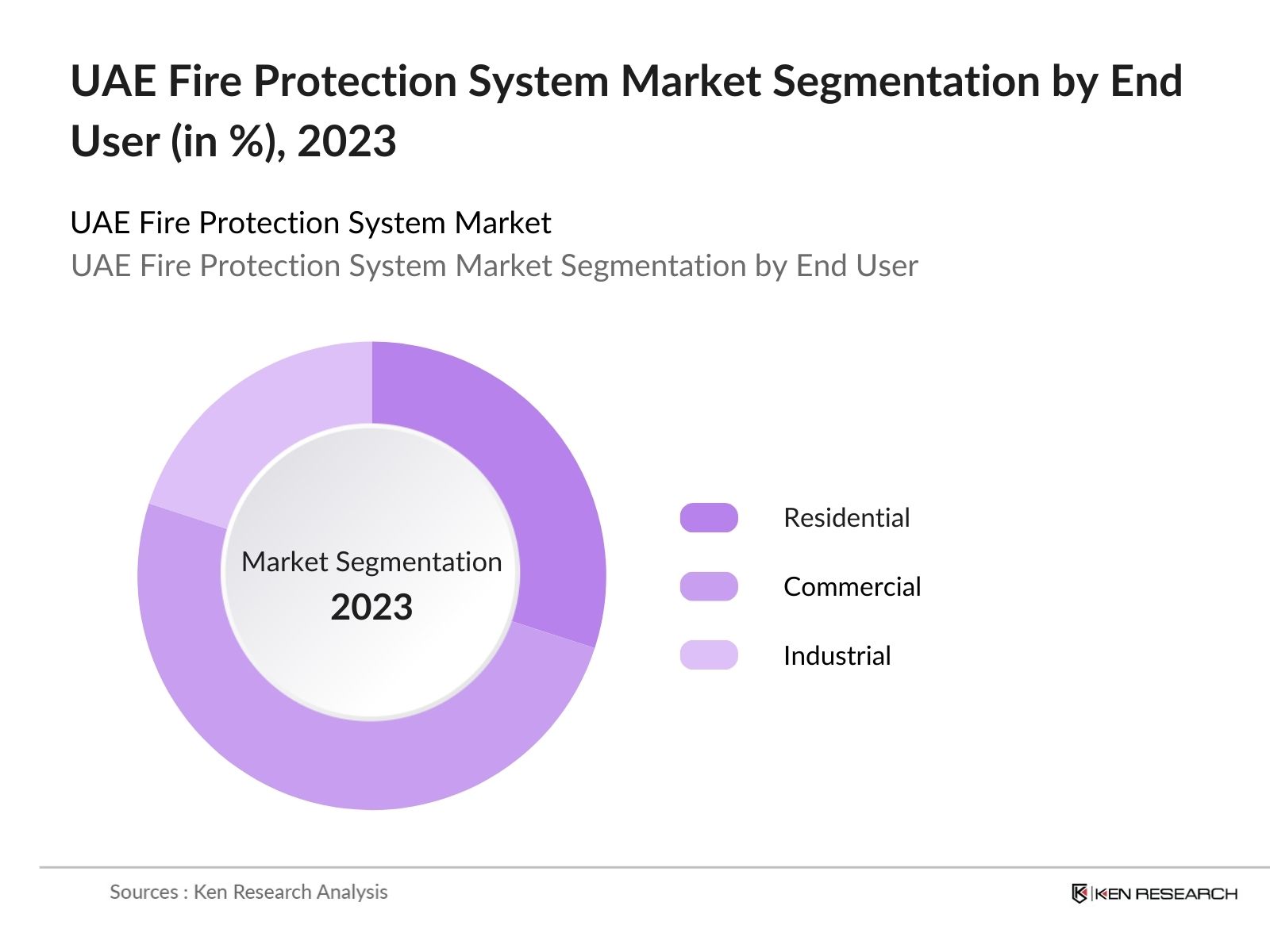

UAE Fire Protection System Market Segmentation

By Product Type: The UAE Fire Protection System Market is segmented by product type into fire detection systems, fire suppression systems, and fire response systems. In 2023, fire detection systems held the dominant market share due to their widespread application across residential, commercial, and industrial sectors. The importance of early fire detection in preventing fire-related damages has increased the demand for these systems. Additionally, advancements in detection technologies, such as smoke detectors and heat sensors, contribute to the segments dominance.

By End-User: The market is segmented by end-user into residential, commercial, and industrial sectors. The commercial sector dominated the market share in 2023, driven by the high concentration of commercial buildings, shopping malls, hotels, and office spaces in Dubai and Abu Dhabi. The need for compliance with strict fire safety regulations and the emphasis on protecting assets and lives make the commercial sector the largest consumer of fire protection systems in the UAE.

By Region: The UAE Fire Protection System Market is regionally segmented into Dubai, Abu Dhabi, Sharjah, and other emirates. Dubai held the largest market share in 2023, attributed to its extensive construction activities and numerous high-rise buildings. The citys commitment to becoming a smart city has also led to the integration of advanced fire protection systems in new projects, further solidifying its market position.

UAE Fire Protection System Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Tyco Fire Products LP |

1918 |

United States |

|

Honeywell International Inc. |

1906 |

United States |

|

Siemens AG |

1847 |

Germany |

|

UTC Fire & Security |

1934 |

United States |

|

NAFFCO FZCO |

1991 |

UAE |

UAE Fire Protection System Market Analysis

Growth Drivers

- Increasing Construction Activities and High-Rise Buildings: The UAE's construction sector has been a significant driver of the fire protection system market. In 2023, the UAE saw an influx of new construction projects, many of which were high-rise buildings and large commercial complexes in Dubai and Abu Dhabi. The total investment in these projects,, underscoring the growing demand for comprehensive fire protection systems to ensure the safety of residents and assets. This demand is supported by the UAE's focus on becoming a global business hub, leading to the continuous expansion of the commercial real estate market, which necessitates stringent fire safety measures.

- Stringent Fire Safety Regulations and Compliance Requirements: The UAE government has implemented rigorous fire safety regulations to protect life and property. The Civil Defenses UAE Fire and Life Safety Code, revised in 2022, mandates all residential and commercial buildings to install certified fire protection systems. The 2022 data from the Dubai Civil Defense reported a 35% increase in the number of compliance inspections compared to 2022, emphasizing the enforcement of these regulations.

- Growing Awareness and Demand for Advanced Fire Safety Technologies: There is a growing awareness in the UAE about the importance of advanced fire safety technologies, driven by high-profile fire incidents over the past decade. In 2023, over 500 fire incidents were recorded in the UAE, causing significant economic losses. In 2024, NAFFCO FZCO reported a 20% increase in sales of their intelligent fire alarm systems, demonstrating a market shift towards more sophisticated fire safety solutions.

Challenges

- High Costs of Advanced Fire Protection Systems: The adoption of advanced fire protection systems in the UAE is often hindered by their high costs. This cost is a significant burden for smaller businesses and residential property owners, particularly in regions outside of Dubai and Abu Dhabi, where economic constraints are more pronounced. Despite the potential benefits, the high initial investment and ongoing maintenance costs deter some stakeholders from upgrading to more advanced fire protection solutions.

- Limited Awareness and Expertise in Fire Safety Among Small Businesses: Although larger corporations and high-rise buildings have embraced advanced fire protection systems, small and medium-sized enterprises (SMEs) often lack awareness and expertise in fire safety. This gap in knowledge and preparedness poses a significant challenge to the market, as SMEs represent a substantial portion of the UAEs economic landscape. The lack of fire safety infrastructure in these businesses increases the risk of fire incidents and reduces overall market demand.

Government Initiatives

- Safer Cities 2023 Initiative: In 2023, the UAE government launched the Safer Cities 2023 initiative, aimed at enhancing fire safety standards across urban areas. This initiative mandates the installation of advanced fire protection systems in all new residential and commercial buildings. The program also includes retrofitting older buildings with modern fire safety equipment, backed by a government investment of AED 1 billion. The initiative aims to reduce fire incidents by 30% by the end of 2025, ensuring safer living and working environments for UAE residents.

- Dubai Civil Defense Smart Fire Safety Program (2022): The Dubai Civil Defense introduced the Smart Fire Safety Program in 2022 to promote the integration of smart technologies in fire protection systems. As part of this program, over 1,200 buildings in Dubai were equipped with smart fire safety systems by 2024, showcasing the government's commitment to leveraging technology for improved fire safety outcomes.

UAE Fire Protection System Market Future Outlook

The UAE Fire Protection System Market is expected to witness substantial growth over the next five years, driven by ongoing urbanization and the expansion of the construction sector. The market is poised to benefit from the increasing adoption of smart fire protection systems, supported by government initiatives aimed at enhancing safety standards. By 2028, the market is projected to reach new heights, with continued investments in advanced technologies and the integration of fire safety systems in all new and existing infrastructure projects. The market's future outlook is also bolstered by the UAEs commitment to becoming a global leader in smart cities, where advanced fire safety technologies play a critical role.

Future Trends

- Integration of AI and IoT in Fire Protection Systems: The future of the UAE Fire Protection System Market will see increased integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies. These advancements will enable real-time monitoring, predictive maintenance, and automated responses to fire incidents, significantly enhancing the efficiency and effectiveness of fire safety systems across residential, commercial, and industrial sectors.

- Growth of Eco-Friendly Fire Suppression Solutions: There will be a growing emphasis on eco-friendly fire suppression solutions in the UAE, driven by environmental concerns and regulatory requirements. The market is expected to shift towards the use of green fire suppression agents, such as water mist and inert gases, which have a lower environmental impact compared to traditional chemical-based systems.

Scope of the Report

|

By End User |

Residential Commercial Industrial |

|

By Product Type |

Fire Detection Systems Fire Suppression Systems Fire Response Systems |

|

By Region |

Dubai Abu Dhabi Sharjah Other Emirates |

Products

Key Target Audience

Commercial Building Owners and Operators

Industrial Facilities (Oil & Gas, Manufacturing, Power Plants)

Construction Companies and Contractors

Fire Protection System Integrators

Real Estate Developers

Facility Management Companies

Hospitality Sector (Hotels, Resorts, Malls)

Healthcare Institutions (Hospitals, Clinics)

Firefighting and Safety Equipment Distributors and Retailers

Investors and Venture capitalists

Government Agencies and Regulatory Bodies (DCD, ESMA etc.)

Companies

Major Players

NAFFCO (National Fire Fighting Manufacturing Company)

Emirates Fire Fighting Equipment Factory (FIREX)

Falcon Fire Fighting Equipment LLC

Dutco Tennant LLC

Gulf Security Equipment LLC

Fike Corporation

SFFECO Global

Tyco Fire & Security UAE

Concorde Corodex Group

UTC Climate, Controls & Security (Carrier Middle East)

Hochiki Middle East FZE

Honeywell Middle East

Bristol Fire Engineering

Zeta Alarm Systems

Siemens Building Technologies

Table of Contents

UAE Fire Protection System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

UAE Fire Protection System Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

UAE Fire Protection System Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Construction Activities

3.1.2. Stringent Fire Safety Regulations

3.1.3. Growing Awareness and Demand for Advanced Fire Safety Technologies

3.2. Restraints

3.2.1. High Costs of Advanced Fire Protection Systems

3.2.2. Limited Awareness and Expertise in Fire Safety Among Small Businesses

3.2.3. Supply Chain Disruptions and Material Shortages

3.3. Opportunities

3.3.1. Smart City Initiatives

3.3.2. Expansion in High-Risk Industries

3.3.3. Adoption of AI and IoT Technologies

3.4. Trends

3.4.1. Integration of AI and IoT in Fire Protection Systems

3.4.2. Growth of Eco-Friendly Fire Suppression Solutions

3.4.3. Expansion of Fire Safety in Smart Cities Initiatives

3.5. Government Regulation

3.5.1. Safer Cities 2023 Initiative

3.5.2. Dubai Civil Defense Smart Fire Safety Program

3.5.3. UAE Vision 2024 Fire Safety Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

UAE Fire Protection System Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Fire Detection Systems

4.1.2. Fire Suppression Systems

4.1.3. Fire Response Systems

4.2. By End-User (in Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (in Value %)

4.3.1. Dubai

4.3.2. Abu Dhabi

4.3.3. Sharjah

4.3.4. Other Emirates

UAE Fire Protection System Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Tyco Fire Products LP

5.1.2. Honeywell International Inc.

5.1.3. Siemens AG

5.1.4. UTC Fire & Security

5.1.5. NAFFCO FZCO

5.1.6. Johnson Controls

5.1.7. Bosch Security Systems

5.1.8. Securiton AG

5.1.9. Gulf Fire Systems

5.1.10. Viking Group Inc.

5.1.11. Kidde Fire Systems

5.1.12. Fike Corporation

5.1.13. Advanced Electronics Company

5.1.14. Firex

5.1.15. Concorde-Corodex Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

UAE Fire Protection System Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

UAE Fire Protection System Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

UAE Fire Protection System Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

UAE Fire Protection System Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Technology (in Value %)

9.4. By Region (in Value %)

UAE Fire Protection System Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the key stakeholders in the UAE Fire Protection Market, identifying major players such as fire safety equipment suppliers, government regulatory bodies, construction companies, and end users (industrial, commercial, and residential sectors). Critical factors influencing the market include government regulations, building safety codes, advancements in fire detection technologies, and environmental concerns regarding fire safety systems. Desk research will focus on regulations set by UAE Civil Defence, the role of safety standards, consumer attitudes toward fire safety, and emerging technologies in fire protection.

Step 2: Market Analysis and Construction

This phase will analyze historical data, including the penetration of fire protection systems across various sectors such as commercial buildings, residential complexes, and industrial setups. Key metrics such as market size, system adoption rates, revenue from fire protection services, and brand usage patterns will be evaluated. This stage will also assess the installation and maintenance trends for fire safety equipment like sprinklers, fire alarms, extinguishers, and suppression systems in the UAE. The data will help construct a market model that maps current demand and competition in the region.

Step 3: Hypothesis Validation and Expert Consultation

The initial hypotheses about growth drivers (such as increased urbanization, construction growth, and government regulations), challenges (e.g., high installation and maintenance costs), and opportunities (e.g., smart fire protection technologies) will be validated through consultations with industry experts. These include engineers, regulatory authorities, manufacturers of fire safety equipment, and fire safety consultants in the UAE. Interviews and expert insights will help refine the market dynamics and offer clarity on operational and technological trends that are shaping the future of the market.

Step 4: Research Synthesis and Final Output

The final phase will compile and synthesize all verified data, including inputs from stakeholders, industry reports, expert interviews, and real-time market monitoring. The analysis will highlight key trends, actionable insights, and recommendations to address market opportunities, challenges, and growth drivers. A detailed and actionable market report will be provided to ensure stakeholders have a comprehensive understanding of the current state and future potential of the UAE Fire Protection Market.

Frequently Asked Questions

How big is the UAE Fire Protection System Market?

The UAE Fire Protection System Market was valued at USD 1.8 Billion in 2023. The market's growth is driven by stringent fire safety regulations, increasing construction activities, and the integration of advanced fire safety technologies.

What are the challenges in the UAE Fire Protection System Market?

Challenges in the UAE Fire Protection System Market include high costs associated with advanced fire protection systems, limited awareness and expertise in fire safety among small businesses, and supply chain disruptions affecting the availability of critical components.

Who are the major players in the UAE Fire Protection System Market?

Major players in the UAE Fire Protection System Market include Tyco Fire Products LP, Honeywell International Inc., Siemens AG, UTC Fire & Security, and NAFFCO FZCO. These companies lead due to their extensive product offerings, strong market presence, and commitment to innovation.

What are the growth drivers of the UAE Fire Protection System Market?

The UAE Fire Protection System Market is driven by the increasing construction activities in the UAE, stringent fire safety regulations enforced by the government, and growing awareness of the importance of advanced fire safety technologies. These factors contribute to the demand for comprehensive fire protection systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.