UAE Logistics Market Outlook to 2028

Driven by rapidly growing E-Commerce industry, Cross-border trade Enhancement and Government Initiatives

Region:Middle East

Author(s):Rajat and Deepakshi

Product Code:KR1449

October 2024

140

About the Report

UAE Logistics Market Overview

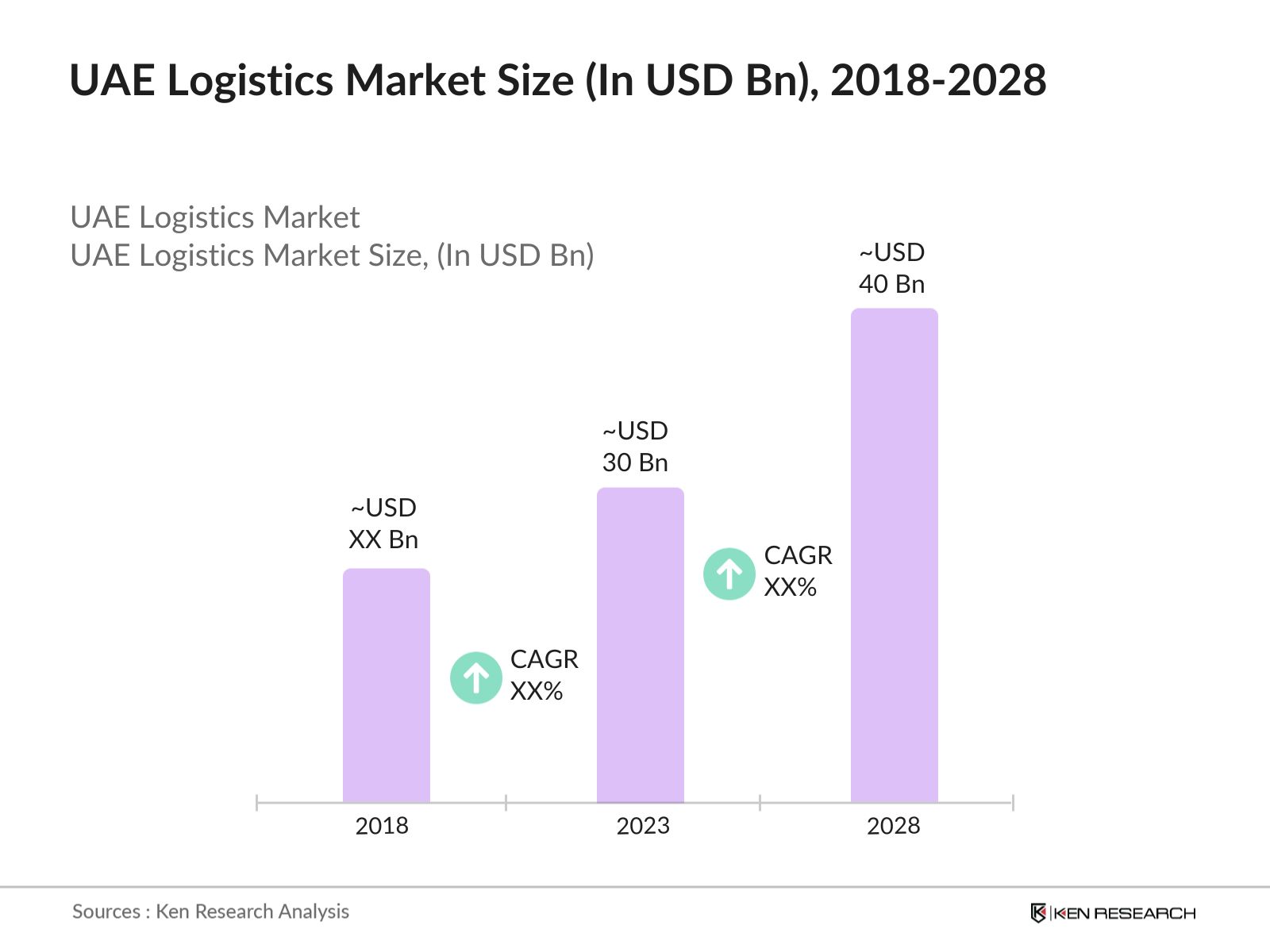

- The UAE logistics industry was valued at a market size of USD 30 billion in 2023. The growth is driven by the expanding pharmaceutical and e-commerce sectors, alongside advancements in technology and government initiatives enhancing infrastructure, particularly in freight forwarding, warehousing, and CEP segments.

- Key players in the UAE logistics market include Aramex, Emirates Post, DHL Express, FedEx, and UPS. These companies are pivotal due to their extensive networks, both domestically and internationally, and their ability to provide comprehensive logistics solutions, including express delivery, freight forwarding, and warehousing services.

- In 2023, Al-Futtaim Group launched its Aerospace Logistics division in the UAE. This new division is focused on providing specialized logistics services to the aerospace sector, including the handling and transportation of aircraft parts and components. Additionally, the group announced its commitment to delivering 50 percent of new energy vehicles and installing 10 percent of the charging stations in the UAE by 2030, demonstrating its focus on sustainability and innovation in the logistics sector.

- Dubai continues to dominate the UAE logistics market, accounting for major market share in 2023. The city's strategic location, world-class infrastructure, and comprehensive free trade zones, such as Jebel Ali Free Zone (JAFZA), make it the preferred logistics hub for regional and international companies. Dubai's logistics market is further bolstered by its strong air and sea connectivity, with Dubai International Airport and Jebel Ali Port being among the busiest cargo hubs in the world.

UAE Logistics Market Segmentation

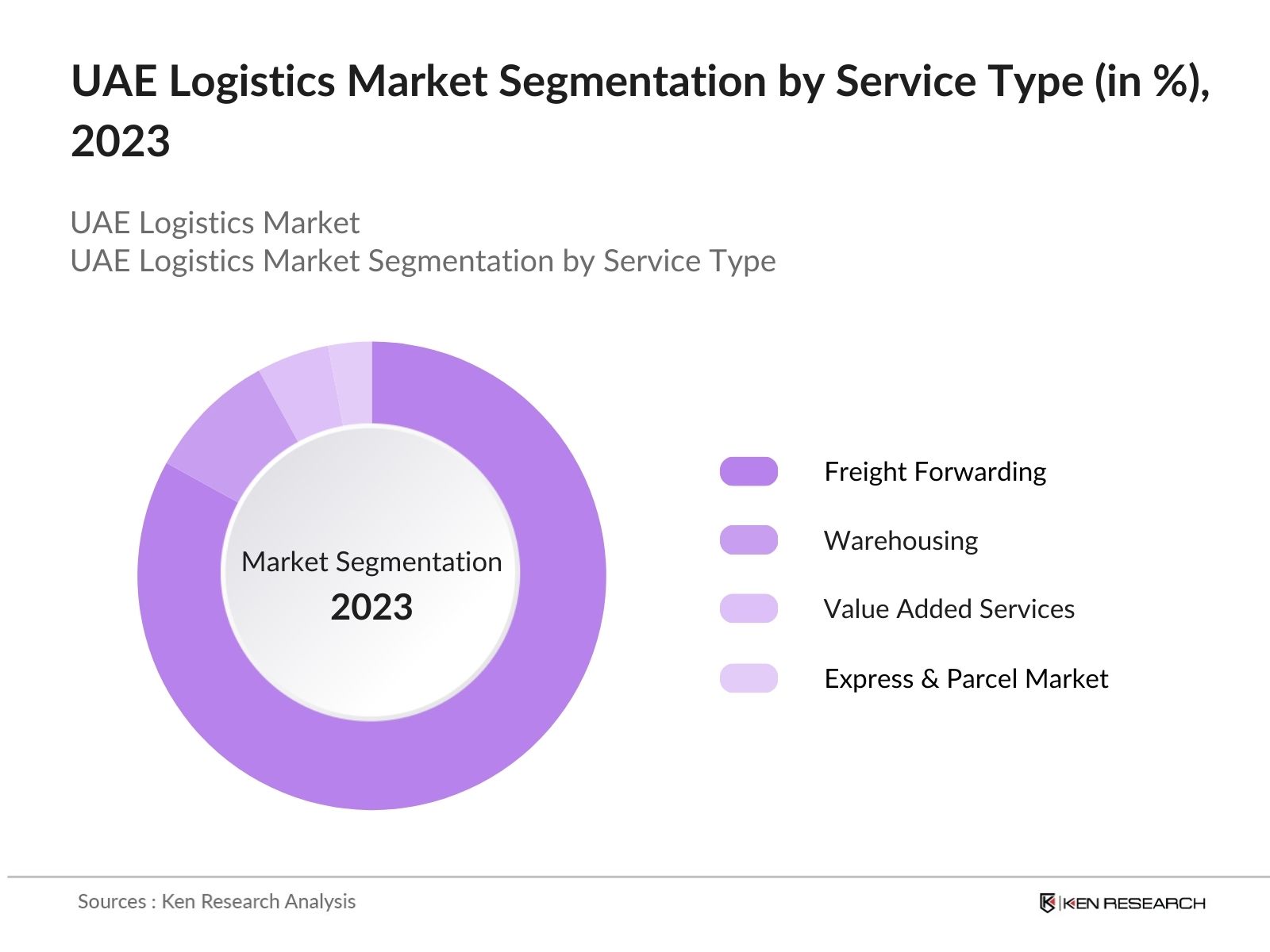

By Service Type: The UAE Logistics market is segmented by service type into freight forwarding, warehousing, value added services and express & parcel market. The Freight Forwarding segment is the dominant sector within the market in 2023. This segment's dominance is driven by the UAEs strategic position as a global trade hub, supporting extensive import and export activities. Its growth is bolstered by technological advancements and expanding infrastructure.

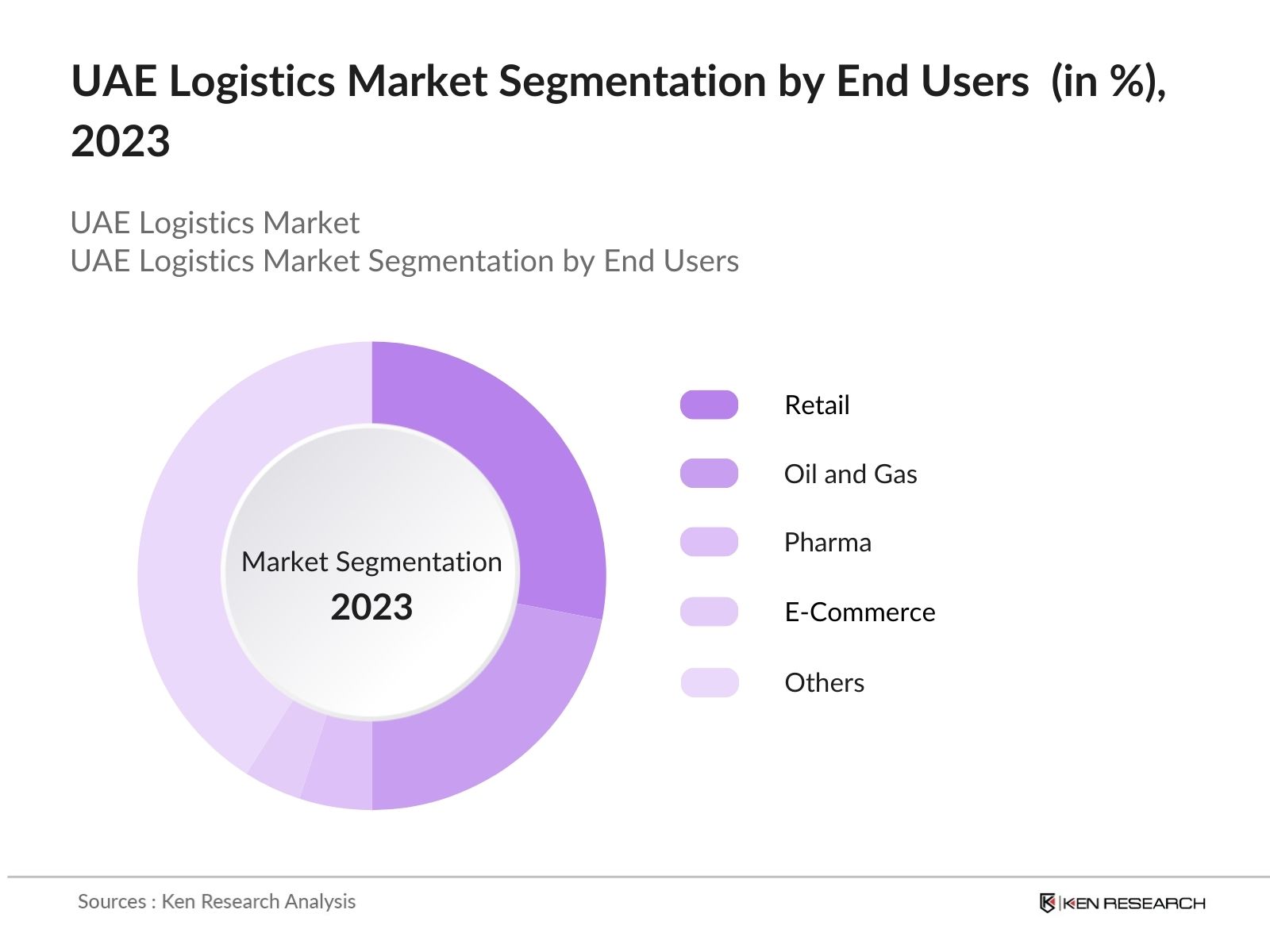

By End User: The UAE Logistics market is segmented by end user into retail, oil & gas, pharma, E-commerce and others. In 2023, retail sector dominthe market due to the surge in e-commerce activities and the presence of major international and regional retail brands. Increased consumer demand for fast delivery services and the expansion of retail networks in the UAE drive significant growth in logistics services, particularly in warehousing and last-mile delivery.

By Region: The UAE Logistics market is segmented by region into North, South, East and West UAE. In 2023, the North region is the dominant segment in market. This dominance is primarily due to the presence of major logistics hubs like Dubai and Sharjah, which have extensive port and airport facilities, free trade zones, and well-developed infrastructure that facilitate high volumes of cargo handling and efficient logistics operations.

UAE Logistics Market Competitive Landscape

|

Company |

Year of Establishment in UAE |

Headquarters |

|

Al Futtaim Logistics |

1980 |

Dubai |

|

Allied Transport |

1972 |

Dubai |

|

ATS World |

1991 |

Dubai |

|

Avalon Transport |

1994 |

Dubai |

|

CEVA Logistics |

2014 |

Dubai |

|

Danzas AEI (Owned by DHL) |

1989 |

Dubai |

- Al Futtaim Logistics: In 2023, Al-Futtaim group announced that it is the strategic e-mobility partner of the 2023 UN Climate Change Conference, known as COP28. Al-Futtaim funded Indian two-wheeler EV start-up, River. They launched its Aerospace Logistics division in the UAE, enhancing its capabilities in the specialized logistics sector.

- Allied Transport: Allied Transport, a leader in the MENA region for land transport, won the "Most Inspiring Road Transport Company" award at the TLME inspiration awards in Dubai in 2023. This recognition highlights their innovative approach and dedication to the logistics sector. They also partnered with Kuehne + Nagel for domestic and cross-border FTL deliveries, leveraging their extensive transport fleet to meet growing customer demands.

UAE Logistics Market Industry Analysis

UAE Logistics Market Growth Drivers

- Technological Adoption: The introduction and adoption of advanced technologies like AI, blockchain, and IoT are significantly influencing the logistics sector in the UAE. These technologies enhance service offerings and operational efficiency, with innovations like 5G Smart Warehouses leading to faster and more reliable logistics processes, making the UAE a leader in smart logistics solutions.

- Development of Logistics Hubs: The expansion and development of logistics and warehousing hubs, such as JAFZA and KEZAD, are critical drivers of growth. These hubs cater to the increasing demand for logistics services, driven by the UAE's position as a key trade hub, and are crucial in supporting the country's growing e-commerce and manufacturing sectors.

- Growth in Pharma and Manufacturing: The growing pharmaceutical and manufacturing industries in the UAE, supported by significant investments like AED 10 billion by the Abu Dhabi government, are driving the demand for specialized logistics services. This investment aims to more than double the manufacturing sector, increasing the need for efficient supply chain and distribution networks.

UAE Logistics Market Challenges

- Compliance Issues: The UAE's logistics sector faces significant challenges due to the ever-evolving regulatory environment. Industries such as food and pharmaceuticals, which are subject to stringent regulations, encounter added layers of compliance obligations. This complexity makes it increasingly difficult for businesses to keep pace with the latest customs and trade rules, thereby intensifying operational challenges.

- Shortage of Labor Force: The UAE logistics market is grappling with a critical shortage of skilled labor and resources. This scarcity has driven up operational costs, leading to project delays and hindering market growth. The problem is further exacerbated by budget constraints that limit access to essential financing and training programs, making it difficult for businesses to overcome the labor shortage.

UAE Logistics Market Government Initiatives

- Initiation of Rail Network: In 2023, Etihad Rail expanded its network by covering 900 km, connecting all seven emirates from Ghuweifat to Fujairah. This rail network is expected to accommodate 16 million passengers and transport 50 million tonnes of freight, significantly revolutionizing transportation within the UAE and improving the efficiency and capacity of the logistics sector.

- Jebel Ali Free Zone (JAFZA) Logistics Park: Dubais Jebel Ali Free Zone (JAFZA) has completed the first phase of its logistics park, spanning over 500,000 square feet with temperature-controlled warehouses and office space. The second phase, slated for completion in early 2025, will add an additional 250,000 square feet, further enhancing the storage capacity and infrastructure to support logistics activities in the region.

UAE Logistics Market Future Outlook

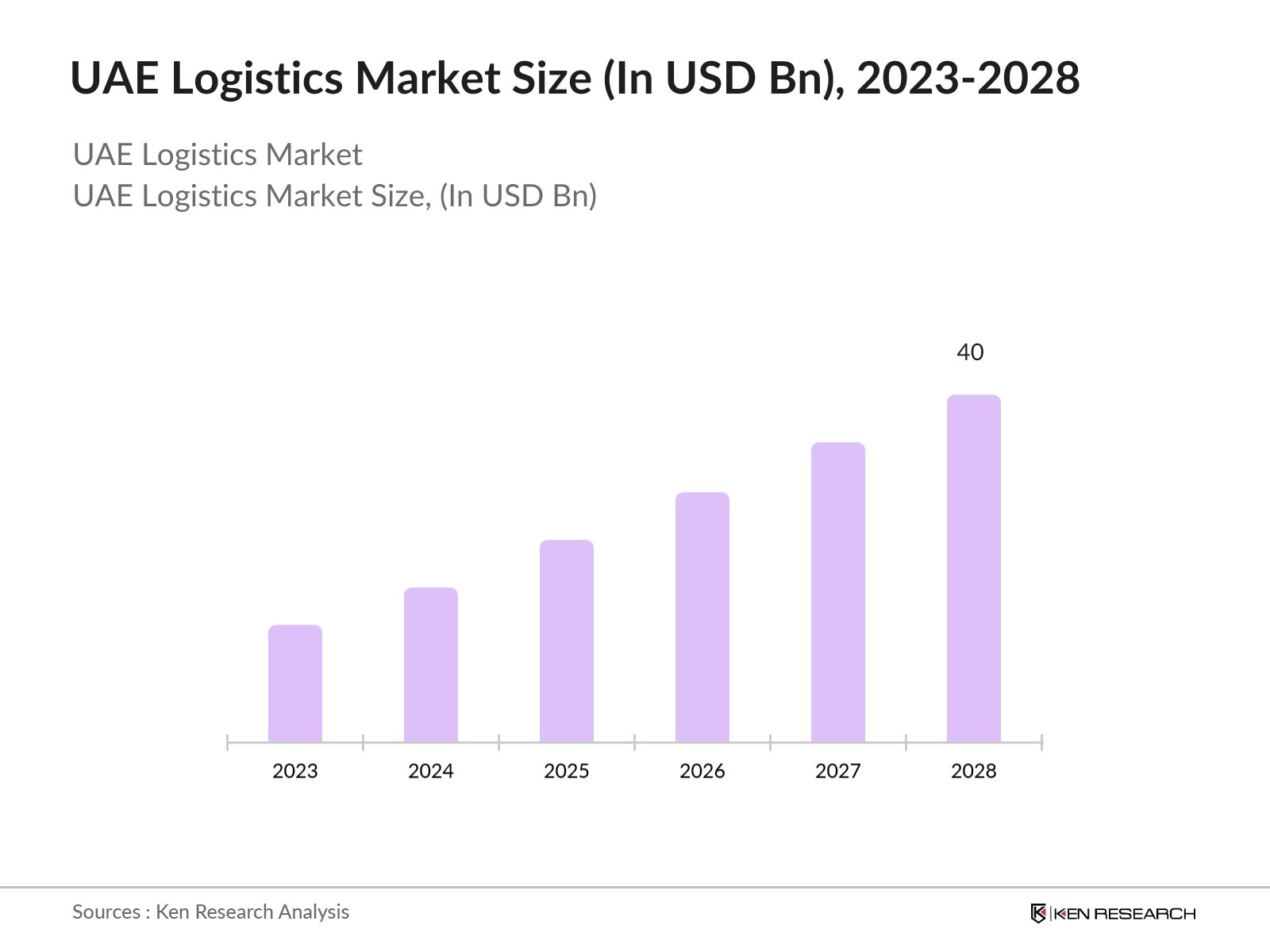

The UAE logistics market is expected to grow to USD 40 billion by 2028. Growth will be driven by the expansion of the e-commerce sector, increasing demand for pharmaceuticals, technological advancements, and government initiatives focused on improving infrastructure and logistics efficiency.

Future Market Trends

- Sustainability Initiatives: The UAE logistics market is increasingly focusing on sustainability, with companies adopting green logistics practices. This includes the use of electric vehicles, optimizing fuel efficiency, and reducing carbon emissions. Integrating sustainability into their operations will become a market trend.

- Expansion of Cargo Capabilities at Sharjah Airport: The development plans at Sharjah Airport, including the expansion of cargo terminals and increasing freight volume capacity by 30-50%, will transform the airport into a premier international cargo hub. This expansion will meet the growing demand for logistics services in the region, further boosting the UAE's position as a key logistics center.

Scope of the Report

|

By Service Type |

Freight Forwarding Warehousing Value Added Services Express & Parcel Market |

|

By End User |

Retail Oil & Gas Pharma E-Commerce Others |

|

By Region |

North South East West |

|

UAE Freight Market Segmentation |

|

|

By Type of Mode |

Sea Air Road |

|

By End User |

Retail Oil & Gas Pharma Others |

|

Sub Segmentation by UAE Warehousing Market |

|

|

By Business Model |

Industrial/warehouses CFS/ICD Warehouses Cold Storage Agriculture and Other Warehouses |

|

By End User |

Retail Oil & Gas Pharma E-Commerce Others (Automotive/FMCG Products) |

|

UAE CEP Market Segmentation |

|

|

By Shipment |

Domestic International |

|

By End User |

E-Commerce Retail Pharma Others |

Products

Key Target Audience:

Logistics Service Providers

Freight Forwarding Companies

Warehousing Companies

E-commerce Companies

Pharmaceutical Companies

Manufacturing Firms

Retail Chains

Ministry of Economy, UAE

Federal Customs Authority

Investors and Financial Institutions

Supply Chain Managers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Danzas

DB Schenker

UPS

Rhenus Logistics

CEVA Logistics

DHL

Kuehne + Nagel

DSV

Expeditors

Yusen Logistics

Flexigistic

NTDE Logistics

GAC

ATS Logistics

Al-Futtaim Logistics

Table of Contents

1. UAE Country Overview and Import/Export Scenario

1.1 Country Overview

1.2 Import and Export Scenario in UAE

2. Infrastructure Scenario in UAE

2.1 Overview of UAE’s Logistics Infrastructure

2.2 Logistics Infrastructure in UAE: Airports, Seaports, Rail Network and Road Network

2.3 Economic Zones in UAE

2.4 Infrastructural Developments in UAE

3. UAE Logistics Market

3.1 Executive Summary

3.2 Logistics Framework in UAE

3.3 Trends and Developments in Logistics Industry in UAE

3.4 SWOT Analysis

3.5 Issues & Challenges in UAE Logistics Market

3.6 Government Initiatives in the UAE Logistics Industry

3.7 Impact of Covid-19 in UAE

3.8 UAE Logistics Market Size by Revenue (USD Billion), 2018-2023

3.9 UAE Logistics Industry Future Market Size by Revenue (USD Billion), 2023-2028

3.10 UAE Logistics Market Segmentation by Type of End Users, 2023-2028

3.11 Value Added Services (VAS) Market Size by Revenue (USD Billion), 2018-2028

4. UAE Freight Market

4.1 Executive Summary

4.2 UAE Freight Market Overview

4.3 UAE Freight Market Size by Revenue (USD Billion), 2018-2023

4.4 Market Segmentation by Type of Mode (Sea, Air and Road) and By Type of End Users (Retail, Oil & Gas, Pharma and Others), 2023

4.5 UAE Freight Future Market Size & Segmentation by Revenue (USD Billion), 2023-2028

4.6 Freight Aggregator Market Value Chain Analysis

4.7 Digital Truck Aggregators Business Model

4.8 Major Challenges which have led to the rise of Digital Freight Platforms

4.9 Major Benefits of Digital Freight Aggregator Platforms

4.10 Digital Truck Aggregator in UAE- TruKKer

4.11 Digital Truck Aggregator in UAE- Trukkin

5. UAE Warehousing Market

5.1 Executive Summary

5.2 UAE Warehousing Ecosystem

5.3 Industry Life Cycle of UAE Warehousing Market

5.4 Trends & Developments in UAE Warehousing Market

5.5 Issues & Challenges in UAE Warehousing Market

5.6 Government Warehouse Rules and Procedures

5.7 Few Upcoming Warehousing Projects in UAE

5.8 Bonded Warehouses in UAE

5.9 UAE Warehousing Market Size by Revenue (USD Billion) and Segmentation by Business Model (Industrial, ICD, Cold Storage and Agricultural & Other Warehouses), 2018-2023

5.10 UAE Warehousing Market Segmentation by End Users (Retail, Pharma, E-Commerce, Oil & Gas and Others), 2023

5.11 Technological Innovations in Warehousing Industry

5.12 On-Demand Warehousing Solutions: Case Studies

5.13 Warehousing Market Future Market Size by Revenue and Future Market Segmentation by End Users (USD Billion), 2023-2028

6. UAE Express and E-Commerce Market

6.1 Executive Summary

6.2 Scenario of E-Commerce in UAE

6.3 UAE CEP Market Overview

6.4 UAE CEP Market Size by Revenue (USD Billion) and Market Segmentation By Domestic/International Shipments, 2018-2023

6.5 UAE CEP Future Market Size (USD Billion) & Segmentation by End Users (E-Commerce, Retail, Pharma and Others), 2023-2028

7. Competitive Scenario

7.1 Competition Scenario in Logistics Market in UAE

7.2 Cross Comparison between Major Logistics Companies

7.3 Cross Comparison between Major CEP Companies

7.4 Company Profiles of Major Logistics and CEP Companies in UAE

7.5 Competition Scenario in UAE by Type of Verticals, 2023

8. Analyst Recommendations

9. Research Methodology

9.1 Market Definitions and Assumptions

9.2 Abbreviations

9.3 Market Sizing Approach

9.4Consolidated Research Approach

9.5 Understanding Market Potential Through In-Depth Industry Interviews

9.6 Primary Research Approach

9.7 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step: 1 Market Building:

Collating statistics on in the UAE Logistics market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for in the UAE Logistics market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 2 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 3 Research Output:

Our team will approach multiple in the logistics companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from the logistics companies.

Frequently Asked Questions

01. How big is the UAE Logistics Market?

The UAE logistics market was valued at USD 30 billion in 2023. The market is driven by the UAEs strategic position as a global trade hub and its advanced infrastructure.

02. What are the growth drivers of the UAE Logistics Market?

Key growth drivers include the rapid expansion of e-commerce, increased demand for pharmaceutical logistics, and significant government investments in infrastructure such as port expansions and logistics hubs like JAFZA and KEZAD. Additionally, the adoption of advanced technologies like AI, blockchain, and IoT is enhancing operational efficiency.

03. What are challenges faced by the UAE Logistics Market?

The UAE logistics market faces challenges such as disruptions in the supply chain due to the Red Sea crisis and fluctuations in fuel prices, which significantly impact transportation costs. Additionally, the market is highly competitive, with fragmented segments and increasing regulatory requirements adding to operational complexities.

04. Who are the major players in the UAE Logistics Market?

Major players in the UAE logistics market include Aramex, Emirates Post, DHL Express, FedEx, and UPS. These companies dominate due to their extensive networks, comprehensive service offerings, and strong market presence both domestically and internationally, making them key drivers of the market's growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.