UAE luxury furniture Market Outlook to 2029

Region:Middle East

Author(s):Kartik and Nishika

Product Code:KR1490

April 2025

120-150

About the Report

UAE luxury Furniture Market Overview

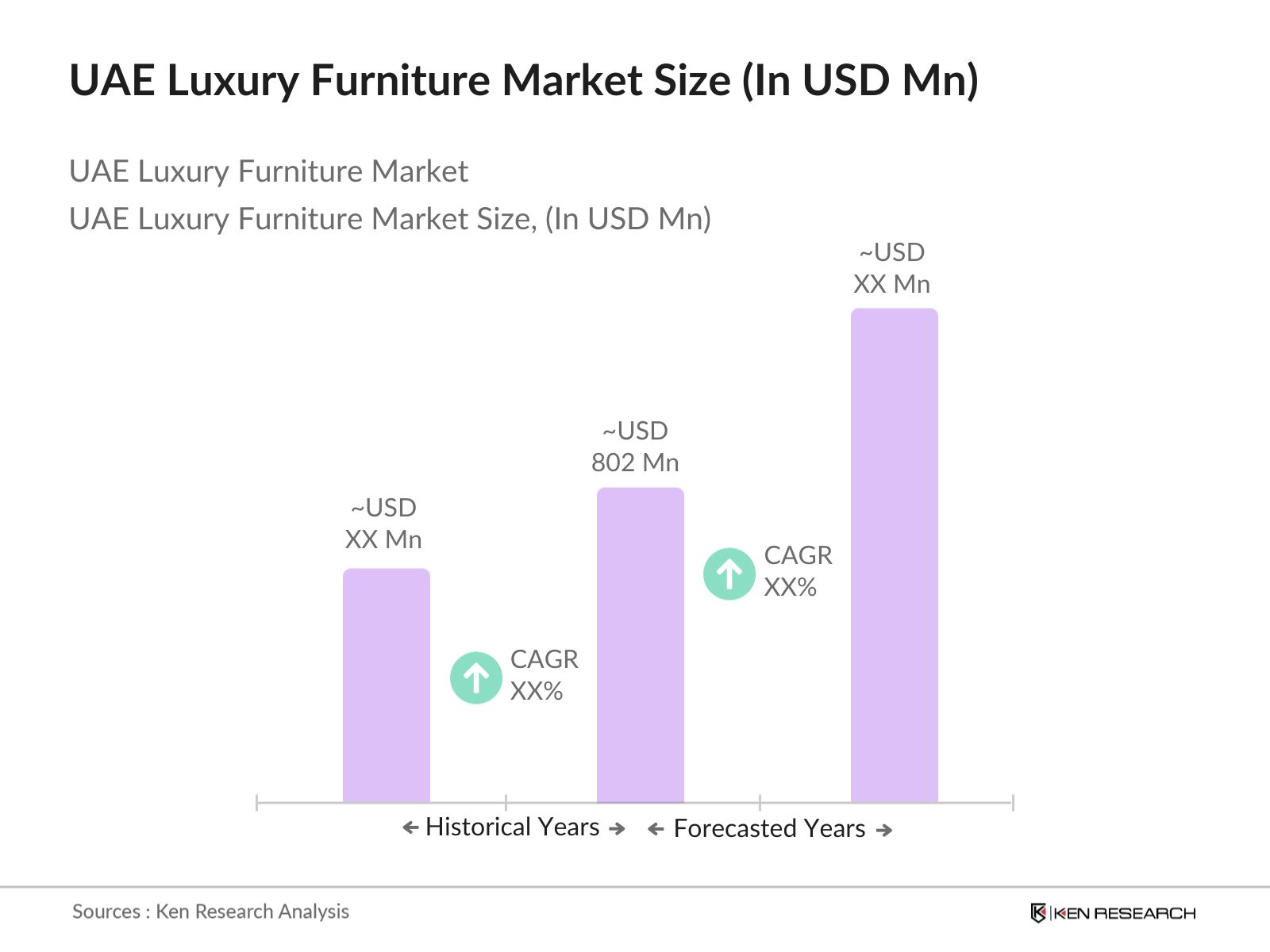

The UAE Luxury Furniture Market is valued at USD 802 Million, based on a five-year historical analysis. Growth has been driven by the expansion of the residential and hospitality sectors, supported by large-scale real estate developments and increased household formation. The sector has also benefited from urban migration and rising interest in modern, modular, and space-saving furniture. An increased focus on lifestyle aesthetics and tech-integrated furniture has further supported consumer spending across both mass and premium segments.

Riyadh, Jeddah, and Dammam continue to dominate the UAE LUXURY Furniture Market due to their strong economic activity, higher population densities, and expansive real estate projects. Riyadh leads in premium housing and villa development, while Jeddah serves as a trade and logistics hub enabling efficient supply and retail distribution. Dammam benefits from industrial and infrastructure development under Vision 2030, making it a hotspot for commercial and residential furniture demand.

The UAE Ministry of Climate Change and Environment mandates that luxury furniture imports comply with the Emirates Green Building Councils sustainability protocols and FSC-certified wood usage. Additionally, all high-end furniture imports must adhere to ESMA (Emirates Authority for Standardization and Metrology) guidelines for material safety, chemical treatments, and formaldehyde emissions to ensure indoor air quality standards.

UAE luxury furniture Market Segmentation

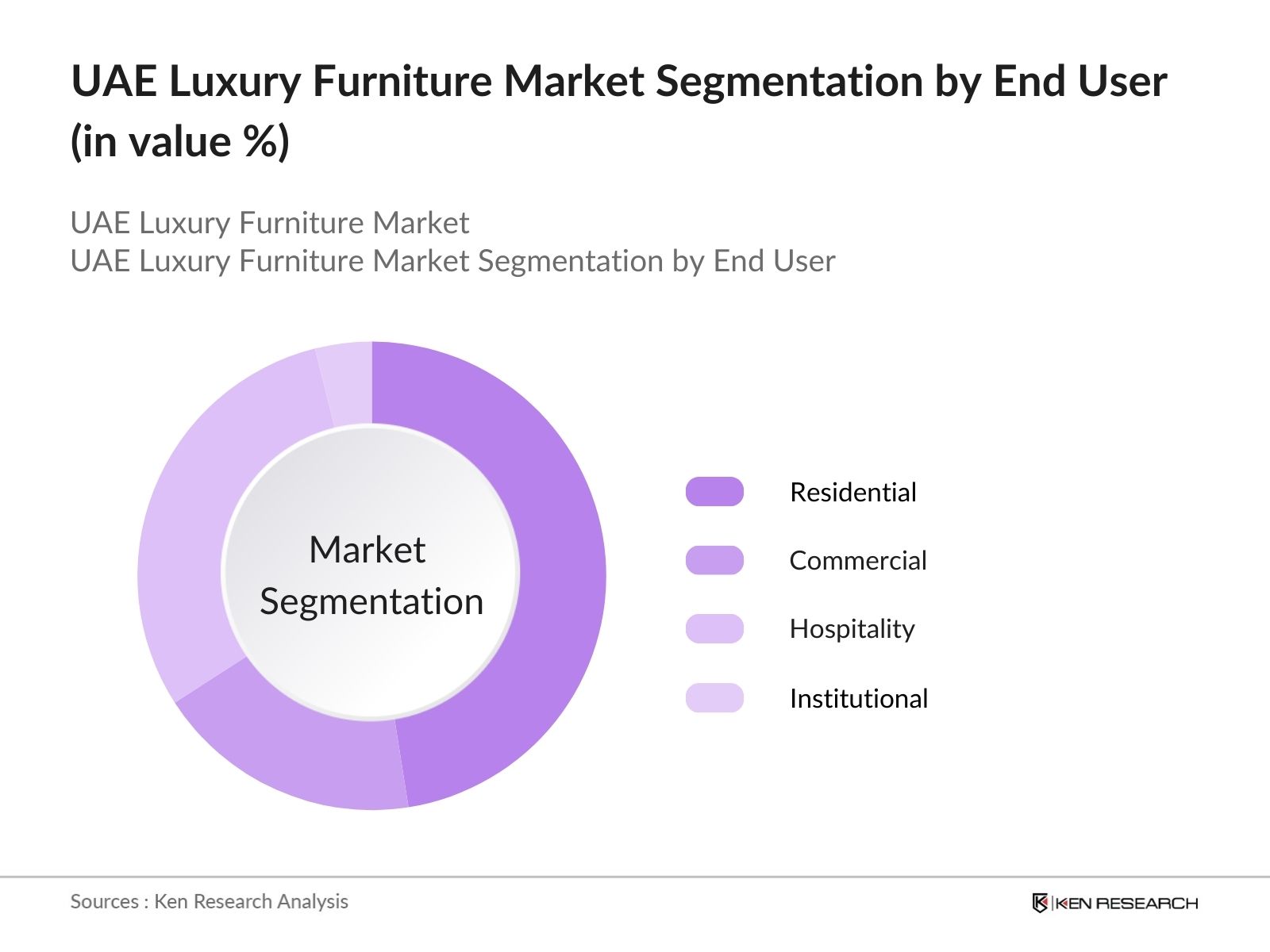

By End User: The UAE Luxury Furniture Market is segmented by end user into Residential, Commercial, Hospitality, and Institutional. Residential usage holds the largest share in the UAE Luxury Furniture Market. This dominance stems from the surge in premium villa and apartment handovers across master-planned developments like Dubai Hills and Emirates Living. These projects increasingly demand bespoke interiors, Italian-crafted wardrobes, and modular luxury furniture lines, boosting residential consumption of luxury furniture brands.

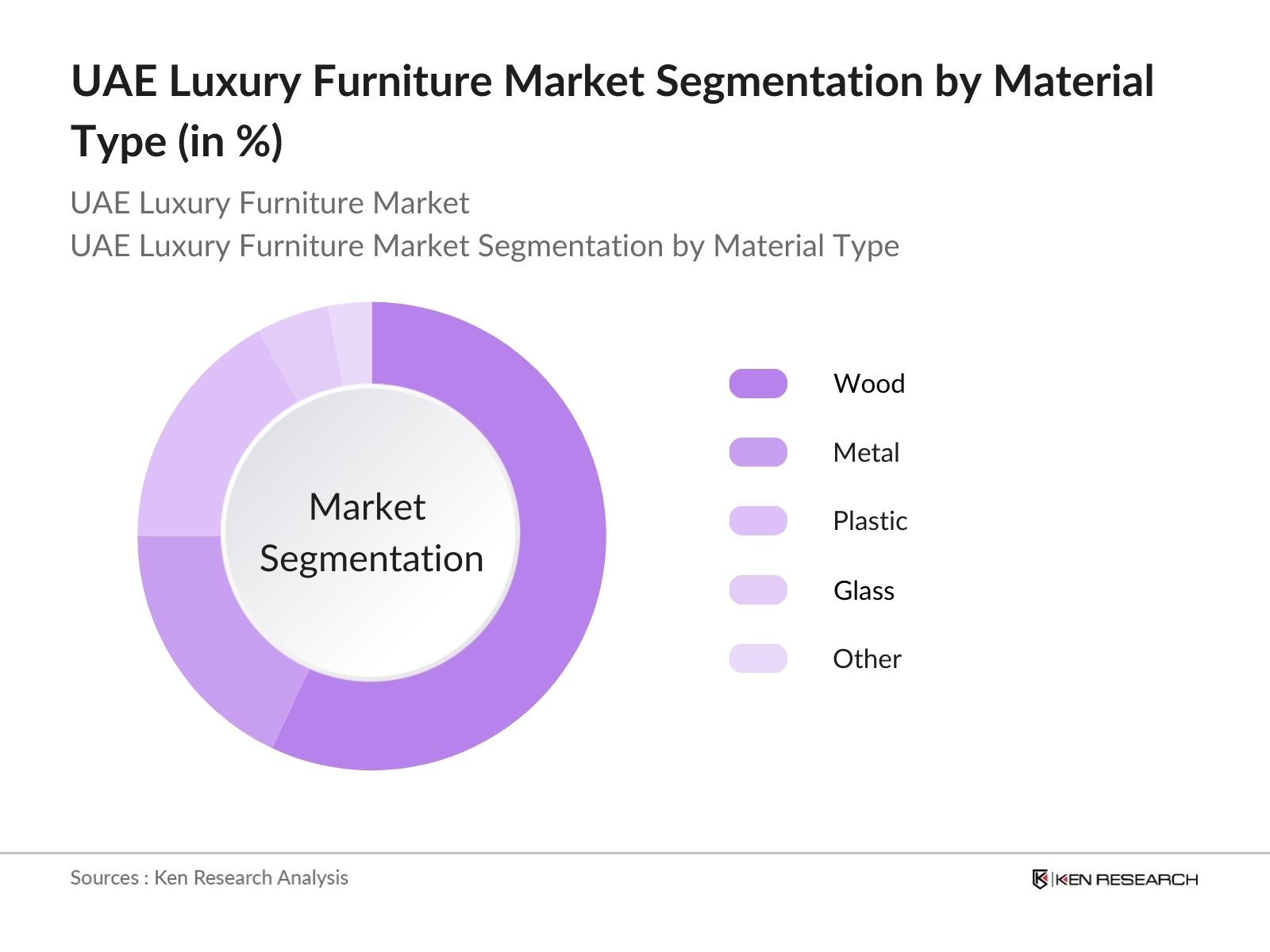

By Material Type: The UAE Luxury Furniture Market is segmented by material into Wood, Metal, Glass, Leather, and Others. Wooden furniture remains the most preferred material in the UAE Luxury Furniture Market due to its blend of tradition and modernity. High-end mahogany, walnut, and oak finishes are widely used in majlis, premium bedrooms, and lobby furniture. Brands with exclusive woodwork portfolios have successfully leveraged this demand in the UAEs luxury home segment.

UAE luxury furniture Market Competitive Landscape

The UAE Luxury Furniture Market is characterized by the presence of both international and local brands with strong design portfolios and flagship retail footprints. Companies such as Marina Home, IKEA UAEs luxury segment, and BoConcept cater to different tastes ranging from Arabic contemporary to Scandinavian minimalism. European luxury houses dominate the top-tier segment, while local distributors leverage showroom presence and project-based customizations.

UAE luxury Furniture Market Analysis

Growth Drivers

Surge in High-End Residential Developments: The UAE has witnessed a significant increase in high-end residential developments, particularly in cities like Dubai and Abu Dhabi. According to the UAE Federal Competitiveness and Statistics Authority, the number of residential building permits issued in 2023 reached 45,000, marking a substantial rise from previous years. This surge indicates a growing demand for luxury housing, which directly correlates with an increased need for premium furniture to furnish these residences. The influx of expatriates and high-net-worth individuals seeking upscale living spaces further amplifies this demand.

Growth in Tourism and Hospitality Sector: The UAE's tourism and hospitality sector has experienced robust growth, contributing to the demand for luxury furniture in hotels and resorts. Data from the UAE Ministry of Economy indicates that hotel occupancy rates in 2023 averaged 75%, with over 25 million international visitors recorded. The expansion of luxury hotels and resorts to accommodate this influx necessitates high-quality furnishings to meet guest expectations, thereby driving the luxury furniture market.

Rise in Disposable Income and Consumer Spending: The UAE has seen a notable increase in disposable income among its residents, leading to higher consumer spending on luxury goods, including furniture. The World Bank reports that the UAE's Gross National Income (GNI) per capita reached USD 43,470 in 2023. This financial growth empowers consumers to invest in premium home furnishings, reflecting their lifestyle aspirations and contributing to market expansion.

Market Challenges

Dependence on Imports and Supply Chain Disruptions: The UAE luxury furniture market heavily relies on imports, making it susceptible to global supply chain disruptions. In 2023, the UAE imported furniture worth approximately USD 2.5 billion, as per the Federal Customs Authority. Any international logistical challenges or trade restrictions can lead to delays and increased costs, hindering market growth and affecting consumer satisfaction.

High Competition and Market Saturation: The luxury furniture market in the UAE faces intense competition, with numerous international and local players vying for market share. This saturation leads to pricing pressures and reduced profit margins. Additionally, consumers have a plethora of choices, making brand differentiation challenging. Companies must continuously innovate and offer unique value propositions to maintain their market position.

UAE luxury Furniture Market Future Outlook

Over the next five years, the UAE luxury furniture market is projected to witness strong expansion driven by a sustained boom in high-income expatriate settlements, luxury housing deliveries, and upscale hotel and wellness projects. The launch of free zone interior clusters and upcoming designer villa projects in Aljada, Mohammed Bin Rashid City, and Reem Island will significantly influence demand. The market is also expected to benefit from digital luxury configurators, eco-conscious furniture lines, and blockchain-enabled designer authentication services.

Market Opportunities

Emphasis on Sustainable and Eco-Friendly Furniture: There is a growing consumer preference for sustainable and eco-friendly luxury furniture in the UAE. The UAE government has launched initiatives promoting sustainability, such as the "UAE Vision 2021," aiming for a sustainable environment. This shift encourages manufacturers to develop furniture using sustainable materials and processes, opening new market segments and appealing to environmentally conscious consumers.

Integration of Smart Technology in Furniture: The integration of smart technology into luxury furniture presents a significant opportunity. With the UAE's high smartphone penetration rate of 99% and a tech-savvy population, there is a demand for furniture that offers technological conveniences. Features like wireless charging, adjustable settings via apps, and built-in speakers cater to modern lifestyles, enhancing user experience and driving market growth.

Scope of the Report

|

End User |

Residential |

|

Material Type |

Wood |

|

Distribution Channel |

Offline (Retail, Wholesale, Direct) |

|

Business Type |

B2B |

|

Region |

Riyadh |

Products

Key Target Audience

Luxury Real Estate Developers (Emaar, Aldar)

Interior Designers and Decor Consultants

High-End Retail Chains and Showroom Franchisors

Investment and Venture Capitalist Firms

Hospitality Groups and Luxury Hotel Chains

Procurement Heads (Designer Villas, Royal Estates)

Government and Regulatory Bodies (Dubai Municipality, ADDED)

Online Retail Integrators with Premium SKU Segments

Companies

Players Mentioned in the Report

Marina Home Interiors

Natuzzi Italia

BoConcept

THE One

Indigo Living

Table of Contents

1. UAE LUXURY Furniture Market Overview

1.1. Definition and Scope (Product Categories, Market Coverage)

1.2. Market Taxonomy (End-User, Material, Distribution, Region, Business Type)

1.3. Historical Growth Rate (Value, Volume, Avg. Price/Unit)

1.4. Market Segmentation Overview (Sub-segment Contributions)

1.5. Value Chain Mapping (Manufacturers, Importers, Distributors, Retailers)

2. UAE LUXURY Furniture Market Size (In USD Bn, Mn Units, Avg. USD/Unit)

2.1. Historical Market Size (By Value, Volume, Price)

2.2. Year-On-Year Growth Analysis

2.3. Channel-Wise Revenue Split (Offline, Online, Hybrid)

2.4. Business Type Split (B2B vs B2C)

2.5. Key Market Milestones and Demand Shifts

3. UAE LUXURY Furniture Market Analysis

3.1. Growth Drivers

3.1.1. Construction Sector Expansion

3.1.2. Custom & Modular Furniture Demand

3.1.3. Omnichannel Penetration

3.1.4. Furniture E-Commerce Surge

3.1.5. Government Push for Local Manufacturing

3.2. Restraints

3.2.1. High Dependency on Imported Materials

3.2.2. Fragmented Retail Ecosystem

3.2.3. Lack of High-Skilled Workforce

3.3. Opportunities

3.3.1. Entry of Regional & Global Brands

3.3.2. Hospitality Project Expansion

3.3.3. Local Product Customization Demand

3.4. Trends

3.4.1. AR Integration for Home Visualization

3.4.2. Digital-First Furniture Brands

3.4.3. Premiumization of Residential Furniture

3.5. Government Regulation

3.5.1. Tariff & Import Guidelines by ZATCA

3.5.2. Sustainability Certifications & Green Codes

3.5.3. MISA Local Content Regulations

3.5.4. Retail Compliance & Licensing Norms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Retailers, Contractors, Platforms)

3.8. Porters Five Forces

3.9. Innovation Matrix (Product, Retail, Distribution)

4. UAE LUXURY Furniture Market Segmentation

4.1. By End User (In Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Hospitality

4.1.4. Retail

4.1.5. Others (Schools, Hospitals, Labs)

4.2. By Material Type (In Value %)

4.2.1. Wood

4.2.2. Metal

4.2.3. Plastic

4.2.4. Glass

4.2.5. Others (Rattan, Leather, Melamine)

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Retail Stores, Wholesale, Direct

4.3.2. Online Brand Website, Mobile App, Marketplace

4.4. By Business Type (In Value %)

4.4.1. B2B

4.4.2. B2C

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Others (Khobar, Jubail, Al Hofuf, Taif)

5. UAE LUXURY Furniture Market Competitive Analysis

5.1. Market Share of Major Players (Revenue, %)

5.2. Strategic Initiatives (Local Manufacturing, Online Expansion, AR Adoption)

5.3. Business Model Comparison (Omnichannel, E-Com Exclusive, Brick & Mortar)

5.4. Pricing Matrix by Brand & Product Type

5.5. Retail Footprint Analysis

5.6. Company Profiles 15 Key Competitors

5.6.1. IKEA

5.6.2. Homecentre

5.6.3. ABYAT

5.6.4. Almutlaq

5.6.5. Simple City

5.6.6. Home Box

5.6.7. Al Rugaib Furniture

5.6.8. Al Omar

5.6.9. PAN Home

5.6.10. Arabian Furniture

5.6.11. Idiyas Furniture

5.6.12. LOFT

5.6.13. Ashley

5.6.14. Baytonia

5.6.15. Homzmart

5.7. Cross Comparison Parameters

No. of Retail Outlets

Regional Penetration (Riyadh, Jeddah, Dammam)

Average Price Range (Sofa, Dining Set, Bedroom)

Distribution Strategy (Offline, Omnichannel, Online)

E-Commerce Capabilities (Website, App, 3rd Party)

Brand Partnerships (Ashley, Flavia, Simpson, etc.)

End-User Focus (Residential, Hospitality, Commercial)

5.8. Market Share Analysis (Top 8 Players)

5.9. Funding Landscape (VC, PE, Series Rounds)

5.10. Mergers & Acquisitions

5.11. Strategic Alliances (Brand & Distribution Deals)

6. UAE LUXURY Furniture Market Regulatory Framework

6.1. Import Tariffs and VAT Impact

6.2. Local Manufacturing Licensing Norms

6.3. Sustainability and Green Compliance Norms

6.4. Retail Licensing & Zoning Requirements

7. UAE LUXURY Furniture Market Future Outlook

7.1. Market Size Forecast (Value, Volume, Price)

7.2. Growth Forecast by Segment (End-User, Channel, Region)

7.3. Investment Opportunities in Online & Modular Furniture

7.4. Projected Retail Channel Evolution

8. UAE LUXURY Furniture Market Future Segmentation

8.1. By End User (In Value %)

8.2. By Material Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Business Type (In Value %)

8.5. By Region (In Value %)

9. Analysts Strategic Recommendations

9.1. TAM, SAM, SOM Analysis

9.2. White Space & Blue Ocean Opportunities

9.3. Recommended Market Entry Strategy

9.4. Digital Disruption Opportunities (AR/VR, Apps)

9.5. Channel Mix Optimization Strategy

Research Methodology

Step 1: Identification of Key Variables

This phase involved developing a stakeholder ecosystem for the UAE luxury furniture space, including manufacturers, importers, designers, and showroom operators. A structured analysis of consumption habits and architectural trends was conducted using proprietary and secondary sources.

Step 2: Market Analysis and Construction

Detailed historical performance was reviewed using shipping manifests, import databases, and showroom data to establish consumption volume and design category splits. A qualitative review of interior design preferences supported volume allocation accuracy.

Step 3: Hypothesis Validation and Expert Consultation

CATIs were conducted with showroom managers, interior contractors, and villa developers to refine assumptions. Feedback on demand cycles, delivery preferences, and seasonal inventories provided depth to the demand-side analysis.

Step 4: Research Synthesis and Final Output

A comparative output was developed by integrating industry-level and player-level findings. Price band analysis, brand visibility, and custom demand drivers were reviewed before final report compilation.

Frequently Asked Questions

01. How big is the UAE Luxury Furniture Market?

The UAE Luxury Furniture Market was valued at USD 802 Million, with demand driven by premium housing handovers, commercial refurbishments, and rising investment in custom-designed interiors.

02. What are the key challenges in the UAE Luxury Furniture Market?

UAE Luxury Furniture Market Key challenges include high import dependency, long lead times for European designer brands, and intense competition from regional players. Delays in material clearances also impact delivery timelines.

03. Who are the major players in the UAE Luxury Furniture Market?

Key players of UAE Luxury Furniture Market include Marina Home, BoConcept, Natuzzi Italia, THE One, and Indigo Living. These companies dominate showroom visibility and cater to diverse customer tastes through exclusive collections.

04. What are the growth drivers of the UAE Luxury Furniture Market?

UAE Luxury Furniture Market Growth is being propelled by new freehold property launches, high-spend consumers moving to the UAE, and increased collaboration between designers and developers for curated living spaces.

05. Which cities dominate the UAE Luxury Furniture Market?

UAE Luxury Furniture Market lead by Dubai and Abu Dhabi due to their scale of luxury real estate projects, investment influx, and growing high-income resident base. Their infrastructure supports widespread furniture imports and distribution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.