UAE New Car Market Outlook to 2029

Region:Middle East

Author(s):Harsh Saxena

Product Code:KR1523

August 2025

90

About the Report

UAE New Car Market Overview

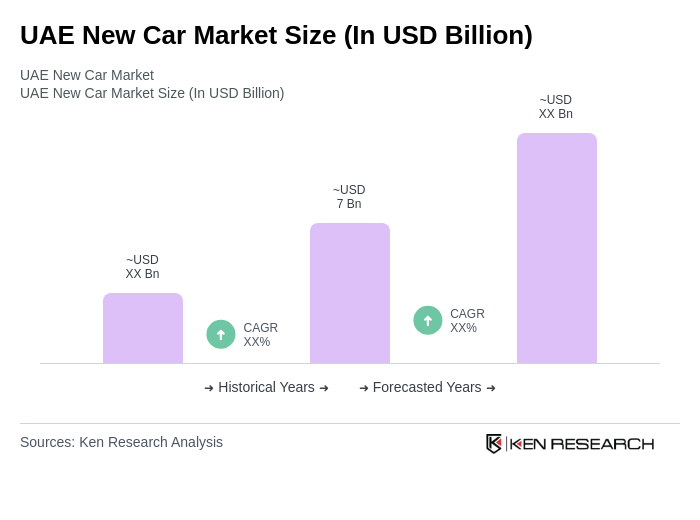

- The UAE New Car Market is valued at around USD 7 billion as of recent years, with strong growth expected to push the market to over USD 25 billion by 2032. This expansion is driven by increasing disposable incomes, a growing population, and rising demand for luxury and electric vehicles. Consumer preferences are shifting toward advanced automotive technologies and eco-friendly options, supporting overall sector growth.

- Key cities such as Dubai and Abu Dhabi dominate the UAE New Car Market due to their high population density, economic prosperity, and status as major business hubs. The affluent lifestyle of residents, combined with robust infrastructure and a growing expatriate community, sustains strong demand for new vehicles, particularly luxury and high-performance models.

- The UAE government introduced updated regulations requiring all new vehicles sold or imported into the country to comply with stricter emissions standards, equivalent to Euro 6B or higher. These regulations are designed to reduce carbon emissions and promote the adoption of electric vehicles, aligning with the UAE's vision for sustainable development and environmental conservation.

UAE New Car Market Segmentation

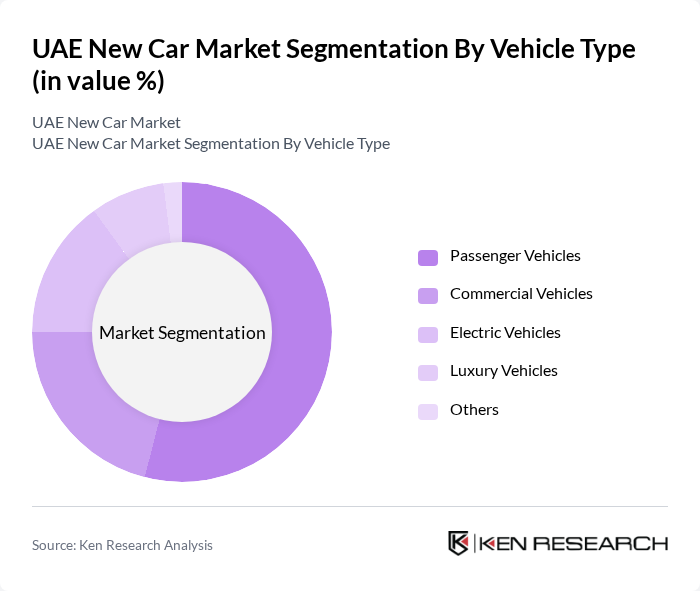

By Vehicle Type: The vehicle type segmentation includes categories such as passenger vehicles, commercial vehicles, electric vehicles, luxury vehicles, and others. Passenger vehicles lead the market, driven by their widespread use for personal transportation and the growing trend of urbanization. The demand for personal mobility solutions continues to rise, especially among the expanding expatriate population. Electric vehicles are also gaining momentum, supported by government incentives, infrastructure investment, and increasing environmental awareness.

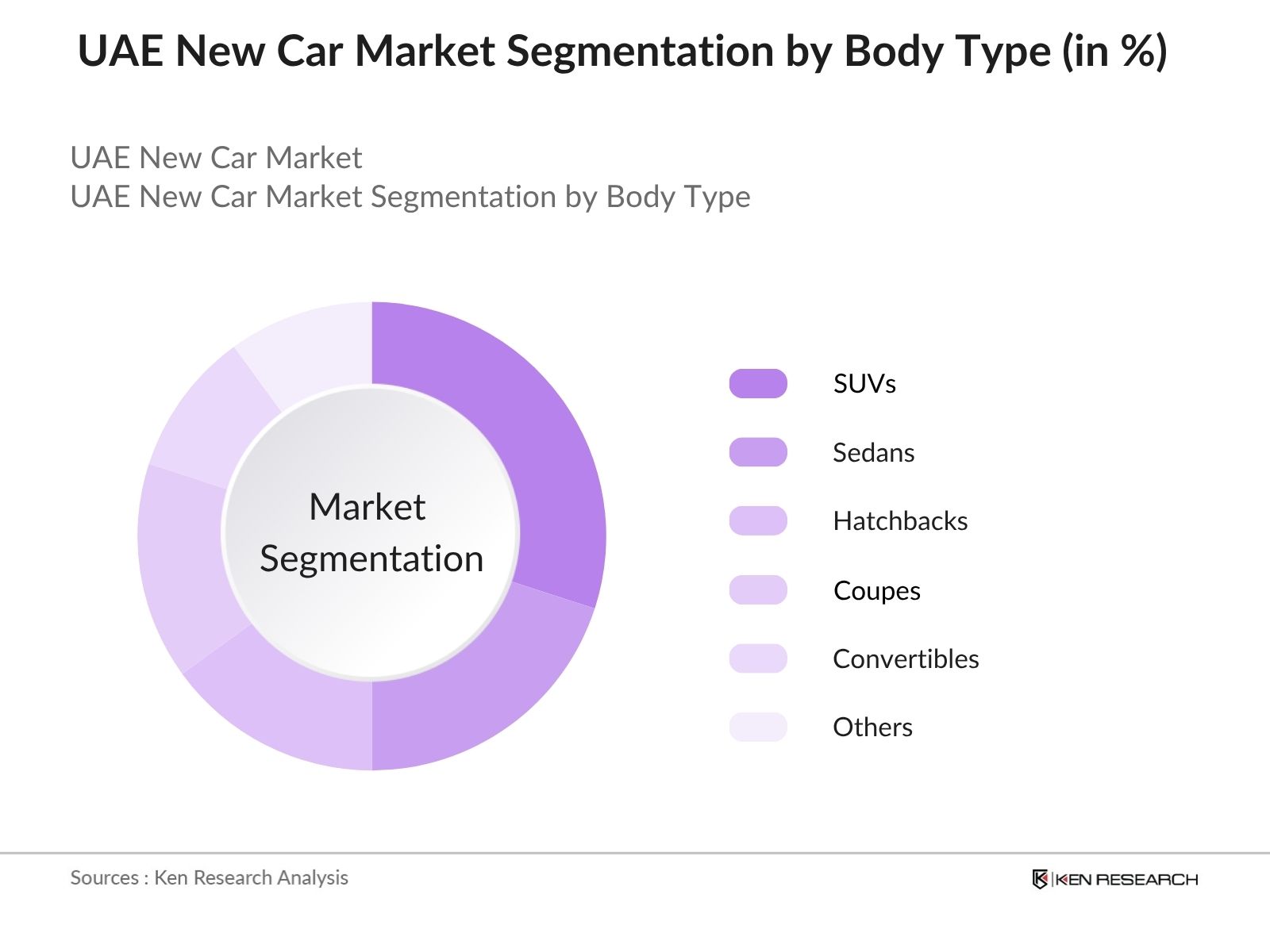

By Body Type: The body type segmentation covers sedans, SUVs, hatchbacks, coupes, convertibles, and others. SUVs have become the most popular body type in the UAE market, favored for their spaciousness, versatility, and suitability for both city and desert driving. The preference for family-oriented vehicles and higher driving positions continues to drive SUV sales. Sedans and hatchbacks remain significant, appealing to those seeking compact, fuel-efficient options.

UAE New Car Market Competitive Landscape

The UAE New Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Motors (Toyota, Lexus, Honda, Volvo), Arabian Automobiles (Nissan, Infiniti, Renault), Al Nabooda Automobiles (Volkswagen, Audi, Porsche), Emirates Motor Company (Mercedes-Benz), Juma Al Majid Group (Hyundai, Kia, Genesis) contribute to innovation, geographic expansion, and service delivery in this space.

| Al-Futtaim Motors | 1955 | Dubai, UAE | – | – | – | – | – | – |

| Arabian Automobiles | 1968 | Dubai, UAE | – | – | – | – | – | – |

| Al Nabooda Automobiles | 1976 | Dubai, UAE | – | – | – | – | – | – |

| Emirates Motor Company | 1962 | Abu Dhabi, UAE | – | – | – | – | – | – |

| Juma Al Majid Group | 1950 | Dubai, UAE | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Market Share (%) | Revenue from New Car Sales (AED) | Average Transaction Price | Dealer Network Size | Customer Satisfaction Index (CSI) | After-Sales Service Coverage |

|---|

UAE New Car Market Industry Analysis

Growth Drivers

- Increasing Disposable Income: The UAE's GDP per capita is projected to reach approximately $44,200 by 2025, reflecting steady growth in disposable income. This economic growth enables consumers to spend more on luxury and new vehicles. Rising personal wealth is expected to drive demand for high-end cars, with luxury vehicle sales seeing strong annual growth. This trend is supported by a growing middle class increasingly inclined to invest in new cars.

- Expanding Urbanization: Urbanization in the UAE is accelerating, with over 88% of the population residing in urban areas as of 2025. This shift is increasing demand for personal vehicles as urban dwellers seek convenience and mobility. The government’s investment in infrastructure, including road expansions and public transport systems, is expected to support this growth. Consequently, the number of registered vehicles is projected to rise by around 8% annually, reflecting urban residents’ increasing need for personal transportation.

- Government Initiatives for Electric Vehicles: The UAE government targets 50% electric vehicle sales by 2050, supported by initiatives such as the Dubai Clean Energy Strategy and large-scale investments in charging infrastructure. Significant incentives, including tax exemptions and rebates, promote EV purchases. This commitment fosters sustainable transportation and encourages manufacturers to boost electric vehicle production, expanding the new car market.

Market Challenges

- High Competition Among Brands: The UAE new car market is highly competitive, with around 40 to 50 major brands actively competing for market share. This saturation leads to aggressive pricing strategies that can pressure profit margins. Competitive dynamics are driving brands to differentiate through innovative features and superior customer service to retain customers amid intense rivalry. While a modest decline in average new car prices is plausible due to competition, a concrete forecast of a 5% price drop is not specifically confirmed. Brands continuously innovate to balance pricing pressure and value proposition in this fast-evolving market.

- Fluctuating Fuel Prices: Fuel prices in the UAE are subject to volatility, influenced by global oil market trends. Recently, gasoline prices average around USD 0.70 per liter, with monthly fluctuations affecting consumer purchasing decisions, especially for fuel-inefficient vehicles. As consumers become more price-sensitive, there may be a shift towards fuel-efficient and electric vehicles, posing challenges for traditional combustion engine manufacturers.

UAE New Car Market Future Outlook

The UAE new car market is poised for significant transformation driven by technological advancements and changing consumer preferences. The shift towards electric and hybrid vehicles is expected to accelerate, supported by government incentives and increasing environmental awareness. Additionally, the rise of digital platforms for car sales will reshape the purchasing process, making it more accessible. As urbanization continues, the demand for smart car technologies and integrated mobility solutions will further influence market dynamics, creating a more sustainable automotive landscape.

Market Opportunities

- Growth in Online Car Sales: The online car sales segment in the UAE is projected to grow significantly, with e-commerce platforms facilitating increasing vehicle transactions. This shift enables consumers to browse, compare, and purchase cars conveniently from home, enhancing the buying experience. As digital platforms become more sophisticated, they attract younger buyers, expanding the market reach for new car sales.

- Expansion of Financing Options: The introduction of flexible financing options is anticipated to boost car sales, with the total value of auto loans already exceeding USD 12 billion. Financial institutions increasingly offer tailored packages, including low-interest rates and extended repayment terms. This accessibility enables more consumers, particularly first-time buyers and younger demographics, to purchase new vehicles, driving overall market growth.

Scope of the Report

| By Vehicle Type |

Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Others |

| By Body Type |

Sedans SUVs Hatchbacks Coupes Convertibles Others |

| By End-User |

Individual Consumers Corporate Fleets Government Agencies Rental Services |

| By Price Range |

Budget Cars Mid-Range Cars Luxury Cars Premium Cars |

| By Sales Channel |

Dealerships Online Platforms Direct Sales |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Economy, Emirates Authority for Standardization and Metrology)

Automobile Manufacturers and Producers

Distributors and Retailers

Automotive Aftermarket Service Providers

Technology Providers (e.g., Electric Vehicle Charging Infrastructure Companies)

Industry Associations (e.g., UAE Automobile Association)

Financial Institutions (e.g., Banks offering auto loans and financing solutions)

Companies

Players Mentioned in the Report:

Al-Futtaim Motors (Toyota, Lexus, Honda, Volvo)

Arabian Automobiles (Nissan, Infiniti, Renault)

Al Nabooda Automobiles (Volkswagen, Audi, Porsche)

Emirates Motor Company (Mercedes-Benz)

Juma Al Majid Group (Hyundai, Kia, Genesis)

Al Tayer Motors (Ford, Lincoln, Jaguar, Land Rover, Maserati, Ferrari)

Gargash Enterprises (Mercedes-Benz)

AGMC (BMW, MINI, Rolls-Royce)

Al Yousuf Motors (Chevrolet, Suzuki, MG)

Nissan Middle East

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. UAE New Car Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 UAE New Car Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. UAE New Car Market Analysis

3.1 Growth Drivers

3.1.1 Increasing disposable income

3.1.2 Expanding urbanization

3.1.3 Government initiatives for electric vehicles

3.1.4 Rising demand for luxury vehicles

3.2 Market Challenges

3.2.1 High competition among brands

3.2.2 Fluctuating fuel prices

3.2.3 Regulatory compliance costs

3.2.4 Economic fluctuations affecting consumer spending

3.3 Market Opportunities

3.3.1 Growth in online car sales

3.3.2 Expansion of financing options

3.3.3 Increasing interest in sustainable vehicles

3.3.4 Development of smart car technologies

3.4 Market Trends

3.4.1 Shift towards electric and hybrid vehicles

3.4.2 Rise of car-sharing services

3.4.3 Integration of advanced driver-assistance systems (ADAS)

3.4.4 Growing importance of digital marketing strategies

3.5 Government Regulation

3.5.1 Emission standards for vehicles

3.5.2 Incentives for electric vehicle purchases

3.5.3 Safety regulations for new cars

3.5.4 Import tariffs on foreign vehicles

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. UAE New Car Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. UAE New Car Market Segmentation

8.1 By Vehicle Type

8.1.1 Passenger Vehicles

8.1.2 Commercial Vehicles

8.1.3 Electric Vehicles

8.1.4 Luxury Vehicles

8.1.5 Others

8.2 By Body Type

8.2.1 Sedans

8.2.2 SUVs

8.2.3 Hatchbacks

8.2.4 Coupes

8.2.5 Convertibles

8.2.6 Others

8.3 By End-User

8.3.1 Individual Consumers

8.3.2 Corporate Fleets

8.3.3 Government Agencies

8.3.4 Rental Services

8.4 By Price Range

8.4.1 Budget Cars

8.4.2 Mid-Range Cars

8.4.3 Luxury Cars

8.4.4 Premium Cars

8.5 By Sales Channel

8.5.1 Dealerships

8.5.2 Online Platforms

8.5.3 Direct Sales

9. UAE New Car Market Competitive Analysis

9.1 Market Share of Key Players

9.2 KPIs for Cross Comparison of Key Players

9.2.1 Annual New Car Sales Volume

9.2.2 Market Share (%)

9.2.3 Revenue from New Car Sales (AED)

9.2.4 Average Transaction Price

9.2.5 Dealer Network Size

9.2.6 Customer Satisfaction Index (CSI)

9.2.7 After-Sales Service Coverage

9.2.8 Inventory Turnover Ratio

9.2.9 Brand Awareness Score

9.2.10 Electric Vehicle Sales Penetration (%)

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 List of Major Companies

9.5.1 Al-Futtaim Motors (Toyota, Lexus, Honda, Volvo)

9.5.2 Arabian Automobiles (Nissan, Infiniti, Renault)

9.5.3 Al Nabooda Automobiles (Volkswagen, Audi, Porsche)

9.5.4 Emirates Motor Company (Mercedes-Benz)

9.5.5 Juma Al Majid Group (Hyundai, Kia, Genesis)

9.5.6 Al Tayer Motors (Ford, Lincoln, Jaguar, Land Rover, Maserati, Ferrari)

9.5.7 Gargash Enterprises (Mercedes-Benz)

9.5.8 AGMC (BMW, MINI, Rolls-Royce)

9.5.9 Al Yousuf Motors (Chevrolet, Suzuki, MG)

9.5.10 Nissan Middle East

10. UAE New Car Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government fleet procurement policies

10.1.2 Budget allocation for vehicle purchases

10.1.3 Preference for local dealerships

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in electric vehicle infrastructure

10.2.2 Corporate fleet management strategies

10.2.3 Partnerships with automotive manufacturers

10.3 Pain Point Analysis by End-User Category

10.3.1 High maintenance costs

10.3.2 Limited availability of spare parts

10.3.3 Challenges in financing options

10.4 User Readiness for Adoption

10.4.1 Awareness of electric vehicle benefits

10.4.2 Readiness for new technology integration

10.4.3 Acceptance of online purchasing

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Evaluation of vehicle performance

10.5.2 Cost savings from fuel efficiency

10.5.3 Expansion of fleet usage

11. UAE New Car Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market gaps identification

1.2 Value proposition development

1.3 Revenue model exploration

1.4 Customer segmentation analysis

1.5 Competitive landscape overview

1.6 Key partnerships identification

1.7 Risk assessment

2. Marketing and Positioning Recommendations

2.1 Branding strategies

2.2 Product USPs

2.3 Target audience definition

2.4 Marketing channels selection

2.5 Campaign planning

3. Distribution Plan

3.1 Urban retail strategies

3.2 Rural NGO tie-ups

3.3 Online sales channels

3.4 Logistics and supply chain management

4. Channel & Pricing Gaps

4.1 Underserved routes

4.2 Pricing bands analysis

4.3 Competitor pricing strategies

4.4 Customer willingness to pay

5. Unmet Demand & Latent Needs

5.1 Category gaps identification

5.2 Consumer segments analysis

5.3 Emerging trends exploration

5.4 Future demand forecasting

6. Customer Relationship

6.1 Loyalty programs design

6.2 After-sales service strategies

6.3 Customer feedback mechanisms

6.4 Community engagement initiatives

7. Value Proposition

7.1 Sustainability initiatives

7.2 Integrated supply chains

7.3 Customer-centric offerings

7.4 Competitive advantages

8. Key Activities

8.1 Regulatory compliance

8.2 Branding efforts

8.3 Distribution setup

8.4 Training and development

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product mix considerations

9.1.2 Pricing band strategies

9.1.3 Packaging options

9.2 Export Entry Strategy

9.2.1 Target countries analysis

9.2.2 Compliance roadmap development

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital requirements analysis

11.2 Timelines for market entry

12. Control vs Risk Trade-Off

12.1 Ownership considerations

12.2 Partnerships evaluation

13. Profitability Outlook

13.1 Breakeven analysis

13.2 Long-term sustainability strategies

14. Potential Partner List

14.1 Distributors identification

14.2 Joint Ventures opportunities

14.3 Acquisition targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Activity planning

15.2.2 Milestone tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of automotive sales data from the UAE Ministry of Economy and relevant trade associations

- Review of market reports from industry publications and automotive market research firms

- Examination of consumer behavior studies and trends in vehicle preferences from local surveys

Primary Research

- Interviews with automotive industry experts, including dealership owners and sales managers

- Surveys conducted with potential car buyers to understand preferences and purchasing motivations

- Focus groups with current car owners to gather insights on satisfaction and brand loyalty

Validation & Triangulation

- Cross-validation of findings with data from automotive trade shows and exhibitions

- Triangulation of consumer insights with sales data and economic indicators

- Sanity checks through expert panel reviews involving automotive analysts and economists

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of total addressable market based on national vehicle registration statistics

- Segmentation of market size by vehicle type (e.g., sedans, SUVs, electric vehicles)

- Incorporation of government initiatives promoting electric vehicle adoption and sustainability

Bottom-up Modeling

- Collection of sales data from major dealerships and automotive manufacturers operating in the UAE

- Analysis of average transaction prices and financing options available to consumers

- Volume estimates based on historical sales trends and economic growth projections

Forecasting & Scenario Analysis

- Multi-factor regression analysis incorporating GDP growth, oil prices, and consumer confidence indices

- Scenario modeling based on potential regulatory changes and shifts in consumer preferences

- Development of baseline, optimistic, and pessimistic forecasts through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| New Car Buyers | 120 | First-time buyers, families, young professionals |

| Luxury Vehicle Market | 60 | High-income individuals, business executives |

| Electric Vehicle Adoption | 40 | Environmentally conscious consumers, tech enthusiasts |

| Used Car Market Insights | 50 | Budget-conscious buyers, students, expatriates |

| Fleet Purchasers | 40 | Corporate fleet managers, rental car companies |

Frequently Asked Questions

What is the current value of the UAE New Car Market?

The UAE New Car Market is valued at approximately USD 7 billion, driven by increasing disposable incomes, a growing population, and a strong demand for luxury and electric vehicles, reflecting significant growth in consumer preferences for advanced automotive technologies.

Which cities dominate the UAE New Car Market?

Dubai and Abu Dhabi are the leading cities in the UAE New Car Market due to their high population density, economic prosperity, and status as major business hubs, resulting in sustained demand for new vehicles, particularly luxury and high-performance models.

What recent regulations have been introduced in the UAE New Car Market?

In 2023, the UAE government implemented updated regulations requiring all new vehicles sold in the country to comply with stricter emissions standards. These regulations aim to reduce carbon emissions and promote the adoption of electric vehicles, supporting sustainable development goals.

What types of vehicles are most popular in the UAE?

Passenger vehicles lead the UAE New Car Market, driven by personal transportation needs. SUVs have become particularly popular due to their spaciousness and versatility, while electric vehicles are gaining traction, supported by government incentives and increasing environmental awareness.

How is urbanization affecting the UAE New Car Market?

Urbanization in the UAE is accelerating, with over 86% of the population living in urban areas. This trend increases demand for personal vehicles as urban dwellers seek convenience and mobility, supported by government investments in infrastructure and road expansions.

What government initiatives support electric vehicle adoption in the UAE?

The UAE government aims for 10% of all vehicles on the road to be electric, supported by initiatives like the Dubai Clean Energy Strategy. Future allocations of $1 billion for incentives, including tax exemptions and rebates, will further promote electric vehicle purchases.

What challenges does the UAE New Car Market face?

The UAE New Car Market faces challenges such as high competition among over 50 brands, leading to aggressive pricing strategies that can erode profit margins. Additionally, fluctuating fuel prices may impact consumer purchasing decisions, especially for fuel-inefficient vehicles.

What is the expected growth rate for the UAE New Car Market?

The UAE New Car Market is projected to grow significantly, with the number of registered vehicles expected to rise by 8% annually. This growth is driven by increasing disposable incomes, urbanization, and a rising demand for luxury and electric vehicles.

How are online car sales evolving in the UAE?

The online car sales segment in the UAE is expected to grow significantly, with e-commerce sales projected to reach $500 million. This shift allows consumers to browse and purchase vehicles conveniently, appealing to a younger demographic and enhancing market accessibility.

What financing options are available for new car buyers in the UAE?

Flexible financing options are becoming increasingly available in the UAE, with total auto loans expected to exceed $2 billion. Financial institutions offer tailored packages, including low-interest rates and extended repayment terms, making it easier for consumers, especially first-time buyers, to purchase new vehicles.

What role do luxury vehicles play in the UAE New Car Market?

Luxury vehicles are a significant segment in the UAE New Car Market, with sales increasing by 15% annually. The rise in disposable income and a growing middle class contribute to the demand for high-end cars, reflecting the affluent lifestyle of many residents.

How does the competitive landscape look in the UAE New Car Market?

The UAE New Car Market features a dynamic mix of regional and international players, including major brands like Toyota, Nissan, and Mercedes-Benz. This competitive landscape drives innovation, geographic expansion, and improved service delivery among automotive manufacturers and dealers.

What trends are shaping the future of the UAE New Car Market?

Key trends shaping the future of the UAE New Car Market include a shift towards electric and hybrid vehicles, the rise of digital platforms for car sales, and increasing demand for smart car technologies. These trends reflect changing consumer preferences and a focus on sustainability.

What is the impact of fluctuating fuel prices on car sales in the UAE?

Fluctuating fuel prices in the UAE can significantly impact consumer purchasing decisions, particularly for fuel-inefficient vehicles. As consumers become more price-sensitive, there may be a shift towards more fuel-efficient and electric vehicles, posing challenges for traditional combustion engine manufacturers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.