UAE Pet Care Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD5080

December 2024

94

About the Report

UAE Pet Care Market Overview

- The UAE Pet Care market is valued at USD 149 million, based on a five-year historical analysis. This growth is primarily driven by the increasing pet ownership rate among expatriates and high-income households, along with the rising demand for premium pet products and services. The shift toward pet humanization, where pets are treated as family members, has led to greater spending on veterinary care, grooming, and specialized pet foods, boosting the markets expansion in recent years.

- Dominant regions in the UAE Pet Care market include Dubai and Abu Dhabi, where urbanization and higher-income demographics have led to a significant surge in pet ownership. These cities boast a well-established infrastructure for pet services, including veterinary clinics, pet grooming centers, and pet-friendly facilities, driving the growth of the pet care industry. The strong presence of international pet product brands in these cities further enhances their dominance in the UAE Pet Care market.

- The UAEs stringent pet food import regulations require all imported pet foods to comply with national health and safety standards. In 2023, the UAE Ministry of Climate Change and Environment introduced additional labeling requirements for imported pet foods, ensuring transparency and traceability. The regulatory framework mandates that all imported pet products be free from harmful additives and preservatives, with inspections conducted by relevant authorities upon arrival at UAE ports.

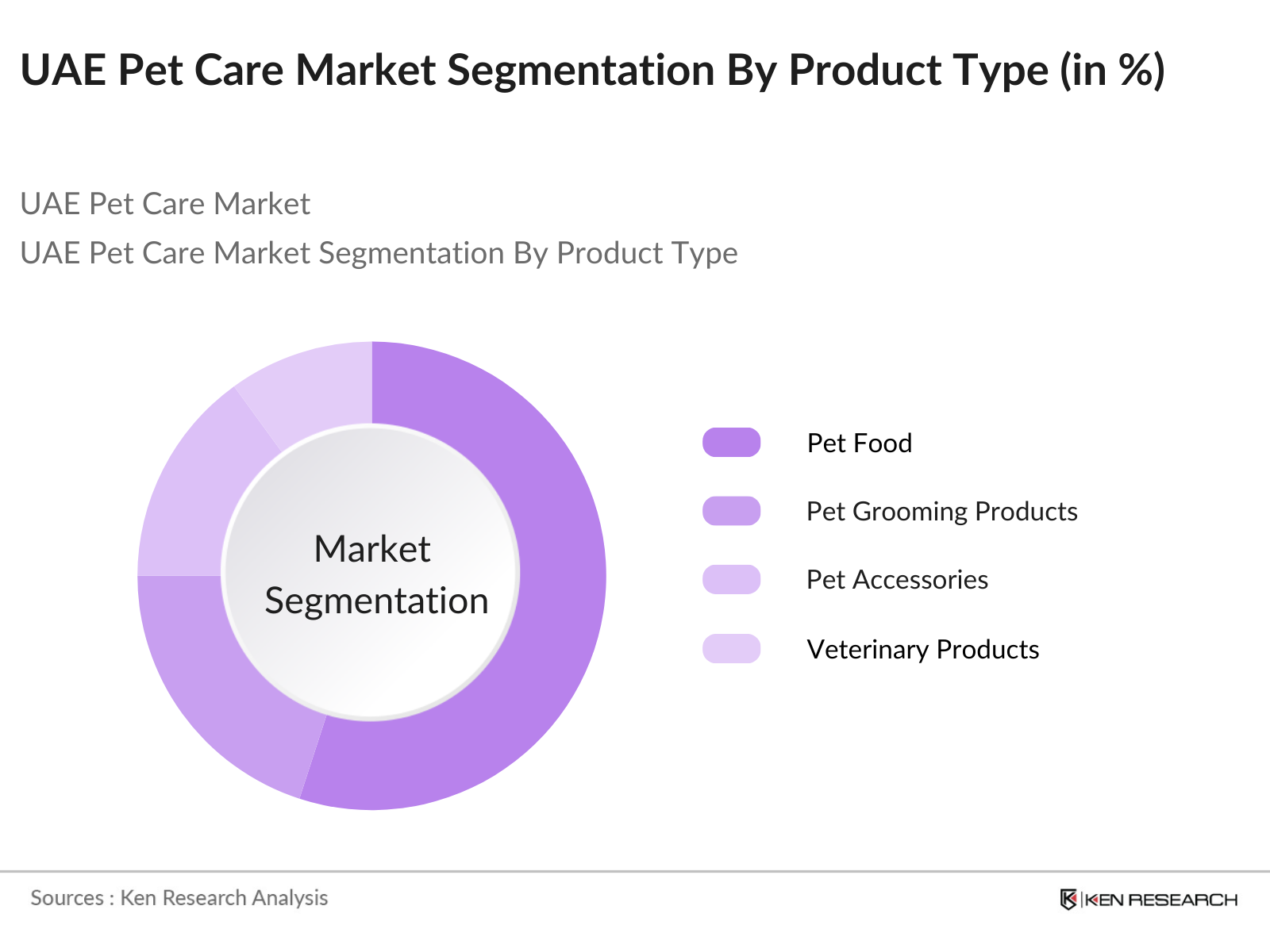

UAE Pet Care Market Segmentation

By Product Type: The market is segmented by product type into pet food, pet grooming products, pet accessories, veterinary products, and smart pet care devices. Among these, pet food holds the largest market share due to the rising demand for premium and organic pet food. Consumers in the UAE are increasingly concerned about their pets' health and well-being, leading to a shift towards high-quality, nutritious pet food.

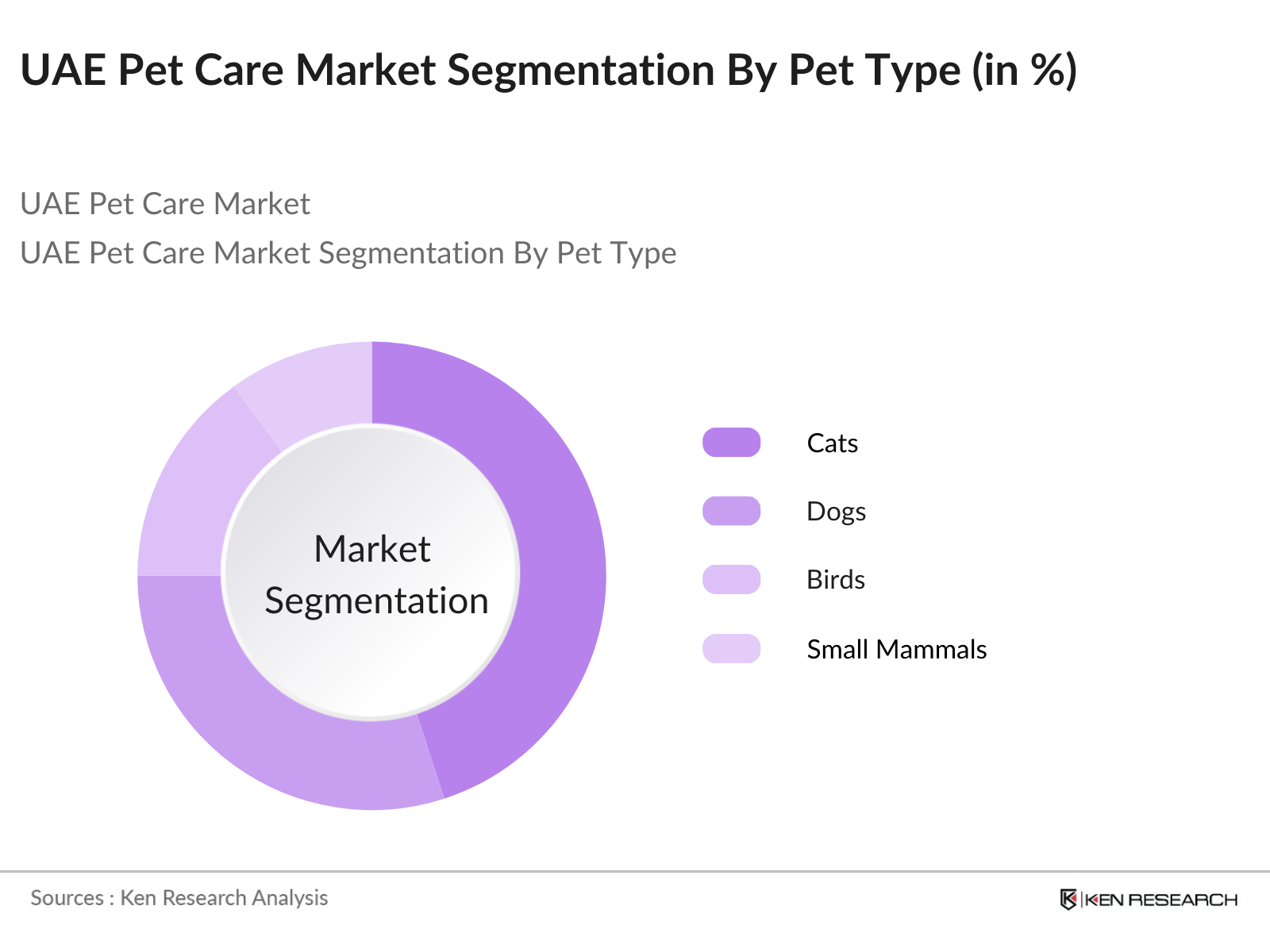

By Pet Type: The market is further segmented by pet type, including cats, dogs, birds, small mammals, and exotic pets. Cats dominate the UAE pet market, accounting for the highest share in this segment. This dominance is attributed to the preference for smaller pets that require less space and maintenance compared to dogs. Moreover, the hot climate of the UAE makes it challenging for larger pets, such as dogs, to thrive, further contributing to the preference for cats.

UAE Pet Care Market Competitive Landscape

The UAE Pet Care market is dominated by several key players that provide a wide range of pet care products and services. These players include both global and local companies, with a strong focus on expanding their offerings in response to the growing demand for premium pet care products. The competitive landscape of the UAE Pet Care market includes major players like Mars Petcare, Nestl Purina, and local players such as Dubai Pet Food and Sharjah Pet Supplies.

UAE Pet Care Industry Analysis

Growth Drivers

- Rising Pet Adoption (Pet ownership statistics, demographic breakdown): The UAE has witnessed a steady rise in pet ownership, with over 200,000 households owning pets by 2023, driven by an increasing number of expatriates and urban dwellers adopting companion animals. This trend is strongly supported by the UAEs affluent population and growing awareness around animal welfare. A survey by the UAE Ministry of Climate Change and Environment found that pet ownership is particularly popular among households earning over AED 150,000 annually, with cats and dogs being the most common pets.

- Increasing Disposable Income (Effect on premium pet services): Rising disposable income, averaging AED 175,000 per capita in 2023, has spurred demand for premium pet services like grooming, boarding, and high-end pet foods. This has also driven pet owners toward spending on luxury products, including pet spa services and specialized training. The UAEs high-income expatriate population, especially in cities like Dubai and Abu Dhabi, is significantly contributing to this market shift, with approximately 30% of households reportedly spending AED 500-1,000 monthly on pet-related services.

- Pet Humanization Trends: The humanization of pets is reshaping the UAEs pet care market, with more pet owners treating their animals as family members. This is particularly visible in the demand for organic food, luxury bedding, and personalized healthcare. The pet humanization trend is linked to the country's younger, affluent population, which tends to invest more in pet wellness and comfort. An estimated 60% of pet owners in Dubai prefer organic and gourmet pet food options, reflecting their desire to enhance the quality of life for their pets.

Market Challenges

- High Pet Maintenance Costs: Maintaining pets in the UAE is expensive, with annual costs for pet care, including food, veterinary services, and grooming, ranging from AED 5,000 to AED 10,000 per pet in 2023. These costs are particularly burdensome for middle-income families, with veterinary services accounting for the largest expense. A study by the Abu Dhabi Agriculture and Food Safety Authority found that high-quality pet food and medical treatments are priced significantly higher than global averages, making pet ownership prohibitive for many.

- Limited Availability of Specialized Pet Services: Despite the growing demand for specialized pet services like behavioral training and advanced veterinary care, availability remains limited, especially outside major urban centers like Dubai and Abu Dhabi. In 2023, only 20 specialized pet clinics were operating across the UAE, mostly concentrated in these two cities. Rural and suburban pet owners often have to travel significant distances for advanced veterinary care, causing delays in treatment and discouraging regular check-ups.

UAE Pet Care Market Future Outlook

Over the next five years, the UAE Pet Care market is expected to experience steady growth driven by an increasing focus on pet health and wellness, a rising expatriate population, and the expanding availability of premium pet services. The demand for organic pet food, smart pet care devices, and subscription-based pet care products is anticipated to further boost market growth. The expansion of veterinary clinics and the introduction of pet insurance are also likely to contribute to the market's positive outlook.

Market Opportunities

- Growth of Pet Insurance Market: Pet insurance is a burgeoning opportunity in the UAE, where currently only 15% of pet owners have insurance coverage for their animals. With rising veterinary costs, more pet owners are recognizing the value of insuring their pets, especially for costly medical procedures. The UAEs insurance market, valued at over AED 70 billion, is expanding into niche areas such as pet insurance, with companies offering tailored policies covering everything from routine check-ups to emergency surgeries.

- Expansion of Veterinary Services and Clinics: The UAE government is investing in expanding veterinary services, with the number of veterinary clinics expected to grow by 15% in 2024. This expansion is part of a broader strategy to improve animal health standards across the country, especially in response to the increased demand for high-quality veterinary care. As of 2023, there were 120 veterinary clinics registered across the UAE, concentrated primarily in Dubai and Abu Dhabi.

Scope of the Report

|

Product Type |

Pet Food Pet Grooming Products Pet Accessories Veterinary Products Smart Pet Care Devices |

|

Pet Type |

Cats Dogs Birds Small Mammals Exotic Pets |

|

Distribution Channel |

E-commerce Supermarkets/Hypermarkets Specialty Pet Stores Veterinary Clinics |

|

Service Type |

Veterinary Care Pet Grooming Services Boarding and Daycare Services Pet Insurance |

|

Region |

Dubai Abu Dhabi Sharjah Northern Emirates |

Products

Key Target Audience

Pet Product Manufacturers

Veterinary Clinics

Pet Food Suppliers

Pet Service Providers (Grooming, Boarding, etc.)

Pet Retail Chains and E-commerce Platforms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Climate Change and Environment)

Pet Insurance Providers

Companies

Players Mentioned in the Report

Mars Petcare

Nestl Purina

Pethaus LLC

Royal Canin

Pedigree

Procter & Gamble Pet Care

Jollyes Petfood Superstores

Dubai Pet Food

Pethub UAE

My Pet Store UAE

Table of Contents

1. UAE Pet Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Factors: Urbanization, Pet Ownership Increase, Expatriate Influence)

1.4. Market Segmentation Overview

2. UAE Pet Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Key Regulatory Changes, Industry Collaborations)

3. UAE Pet Care Market Analysis

3.1. Growth Drivers

3.1.1. Rising Pet Adoption (Pet ownership statistics, demographic breakdown)

3.1.2. Increasing Disposable Income (Effect on premium pet services)

3.1.3. Pet Humanization Trends

3.1.4. Expanding E-commerce (Online sales of pet products)

3.2. Market Challenges

3.2.1. High Pet Maintenance Costs

3.2.2. Limited Availability of Specialized Pet Services

3.2.3. Regulatory Compliance (Import/export regulations for pet products)

3.3. Opportunities

3.3.1. Growth of Pet Insurance Market

3.3.2. Expansion of Veterinary Services and Clinics

3.3.3. Rising Demand for Organic and Natural Pet Foods

3.3.4. Pet-Friendly Travel Services

3.4. Trends

3.4.1. Pet Fashion and Grooming Services

3.4.2. Subscription-Based Pet Products

3.4.3. Smart Pet Care Devices (Wearables, GPS Trackers)

3.4.4. Sustainable Pet Products

3.5. Government Regulations

3.5.1. UAE Pet Food Import Laws

3.5.2. Veterinary Health Regulations

3.5.3. Animal Welfare Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Impact of new market entrants and established players)

4. UAE Pet Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pet Food

4.1.2. Pet Grooming Products

4.1.3. Pet Accessories

4.1.4. Veterinary Products

4.1.5. Smart Pet Care Devices

4.2. By Pet Type (In Value %)

4.2.1. Cats

4.2.2. Dogs

4.2.3. Birds

4.2.4. Small Mammals (Rabbits, Hamsters)

4.2.5. Exotic Pets (Reptiles, Fish)

4.3. By Distribution Channel (In Value %)

4.3.1. E-commerce

4.3.2. Supermarkets/Hypermarkets

4.3.3. Specialty Pet Stores

4.3.4. Veterinary Clinics

4.4. By Service Type (In Value %)

4.4.1. Veterinary Care

4.4.2. Pet Grooming Services

4.4.3. Boarding and Daycare Services

4.4.4. Pet Insurance

4.5. By Region (In Value %)

4.5.1. Dubai

4.5.2. Abu Dhabi

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE Pet Care Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Mars Petcare

5.1.2. Nestl Purina

5.1.3. Pethaus LLC

5.1.4. Royal Canin

5.1.5. Pedigree

5.1.6. Procter & Gamble Pet Care

5.1.7. Jollyes Petfood Superstores

5.1.8. Dubai Pet Food

5.1.9. Pethub UAE

5.1.10. My Pet Store UAE

5.1.11. Petland Group

5.1.12. Dibaq Petcare

5.1.13. Trixie UAE

5.1.14. Sharjah Pet Supplies

5.1.15. Al Ain Pet Care Services

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Service Portfolio, Online Presence, Market Reach, Product Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Collaborations, Market Expansion)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. UAE Pet Care Market Regulatory Framework

6.1. Pet Food Import Regulations

6.2. Veterinary Certification Requirements

6.3. Animal Transportation Rules

6.4. Certification Processes

7. UAE Pet Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. UAE Pet Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Service Type (In Value %)

8.5. By Region (In Value %)

9. UAE Pet Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the key stakeholders of the UAE Pet Care Market through secondary research and proprietary databases. We aim to identify critical variables influencing the market, including pet ownership rates, consumer behavior, and market penetration by product type and service.

Step 2: Market Analysis and Construction

We analyze historical data and trends in the UAE Pet Care Market, focusing on product adoption rates and service penetration across major urban centers. This helps establish accurate revenue estimates for each segment and sub-segment.

Step 3: Hypothesis Validation and Expert Consultation

To validate the data, we engage industry experts in the UAE's pet care industry via interviews. This step provides firsthand insights on market dynamics, competitor strategies, and emerging trends, which are crucial for refining the research findings.

Step 4: Research Synthesis and Final Output

In the final step, we consolidate all findings and validate them with detailed feedback from key market players, ensuring a comprehensive and accurate analysis of the UAE Pet Care market.

Frequently Asked Questions

01. How big is the UAE Pet Care Market?

The UAE Pet Care market is valued at USD 149 million, based on a five-year historical analysis. This growth is primarily driven by the increasing pet ownership rate among expatriates and high-income households, along with the rising demand for premium pet products and services.

02. What are the challenges in the UAE Pet Care Market?

Challenges include high maintenance costs for pets, stringent regulatory requirements for pet food imports, and a limited number of specialized pet service providers in certain regions.

03. Who are the major players in the UAE Pet Care Market?

Key players include Mars Petcare, Nestl Purina, Pethaus LLC, and Dubai Pet Food, all of which have a significant influence on the market due to their broad product portfolios and strong market presence.

04. What are the growth drivers of the UAE Pet Care Market?

The market is propelled by an increasing pet ownership rate, the rising expatriate population, and growing consumer awareness regarding pet health and wellness, as well as premium pet care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.