UAE Pet Nutraceutical Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD5099

November 2024

93

About the Report

UAE Pet Nutraceutical Market Overview

- The UAE Pet Nutraceutical Market is valued at USD 2.04 billion, based on a five-year historical analysis. This market is driven primarily by an increase in pet ownership, particularly among high-income households, and a growing awareness of pet health and wellness. The pet nutraceutical industry in the UAE has witnessed a sharp rise in demand due to the increase in disposable income and the shift toward preventive healthcare for pets. Nutraceutical products such as joint health supplements, probiotics, and multivitamins are becoming more popular as pet owners prioritize their pets' health, particularly for dogs and cats, which form the majority of the pet population in the region.

- The dominant cities in the UAE that control the pet nutraceutical market are Dubai and Abu Dhabi. The key reason for their dominance lies in the high urbanization rate and affluent pet owners, who are more inclined to spend on premium pet healthcare products. Additionally, these cities have a higher number of veterinary clinics and pet specialty stores, which offer easy access to nutraceutical products. The increasing number of pet-friendly policies and services, such as dedicated pet zones and parks, also contributes to the high concentration of pet owners in these regions.

- Pet supplements in the UAE must adhere to strict registration requirements set by MOCCAE, including ingredient disclosure, safety testing, and product labeling. In 2023, over 200 new pet supplements were registered with MOCCAE, the average approval process for pet supplements typically takes around22 working days. Companies that fail to comply with these requirements face penalties and market access restrictions.

UAE Pet Nutraceutical Market Segmentation

By Product Type: The market is segmented by product type into Digestive Health Supplements, Joint Health Supplements, Skin and Coat Supplements, Multivitamins, and Weight Management Supplements. Among these, Digestive Health Supplements have a dominant market share in the UAE due to the increasing awareness of gastrointestinal issues in pets, especially dogs and cats. The hot climate in the UAE makes pets more susceptible to digestive disorders, leading pet owners to invest in probiotics and enzymes to ensure optimal gut health. This segment has benefited from the widespread availability of specialized products in both online and offline channels, catering to different breeds and dietary needs.

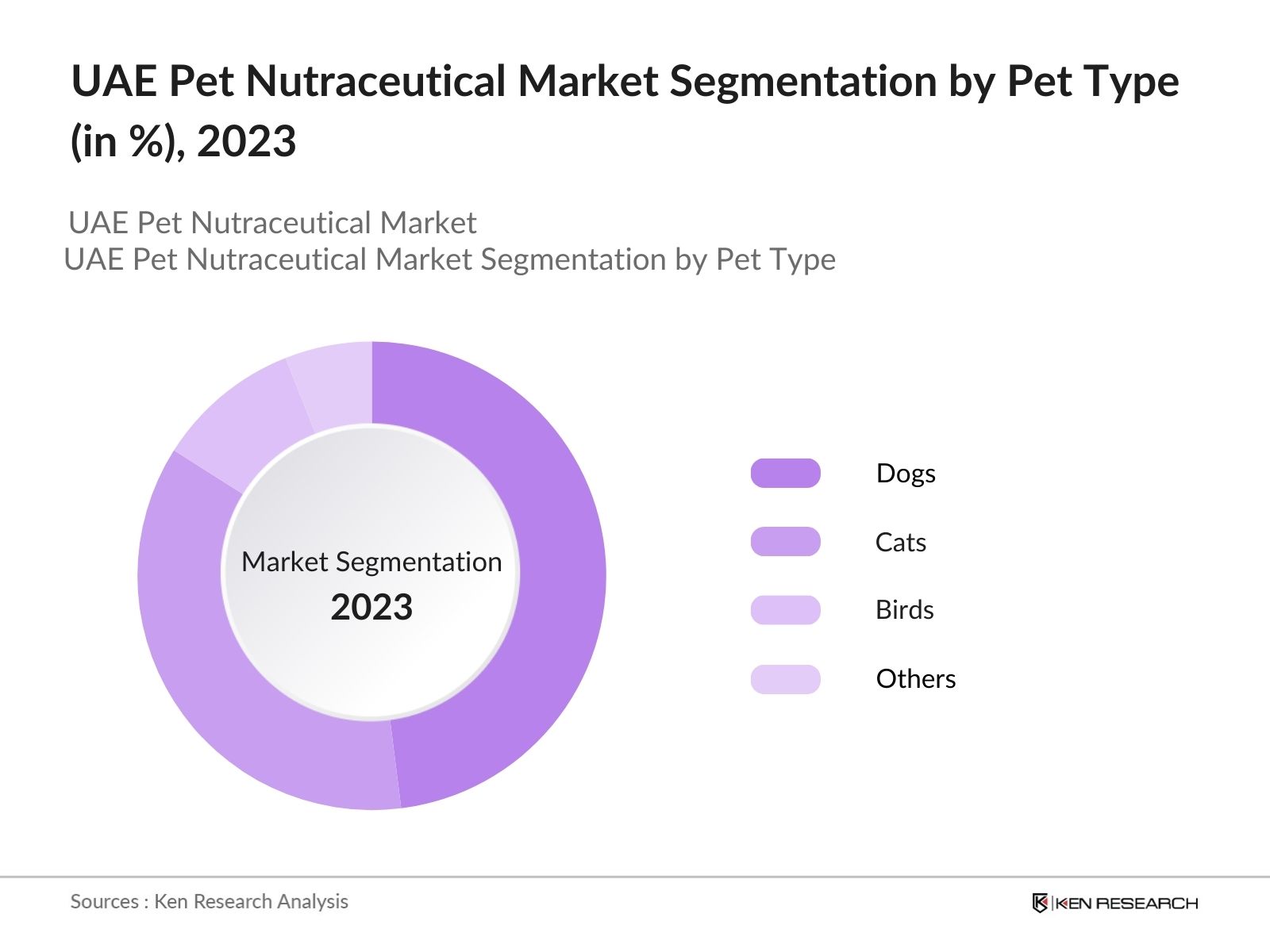

By Pet Type: The market is also segmented by pet type into Dogs, Cats, Birds, and Others. Dogs dominate the market under this segmentation due to their prevalence as pets in the UAE and the higher spending capacity of dog owners on premium healthcare products. The popularity of certain breeds, such as Bulldogs, Retrievers, and Poodles, which are prone to joint and skin issues, drives the demand for specific nutraceuticals. Furthermore, dog owners in Dubai and Abu Dhabi are more likely to use supplements as part of their pets regular diet, further boosting this segment's dominance.

UAE Pet Nutraceutical Market Competitive Landscape

The UAE Pet Nutraceutical Market is highly competitive, with several key global and local players dominating the market. The market's competitive landscape is characterized by well-established companies that have an extensive product portfolio and distribution network, ensuring their products are available through multiple retail channels, including online platforms and veterinary clinics. Companies like Nestl Purina PetCare and Mars Petcare are market leaders due to their reputation for quality and strong brand loyalty. Additionally, local manufacturers are emerging, offering region-specific products that cater to the unique needs of pets in the UAE's climate.

|

Company |

Establishment Year |

Headquarters |

Product Range |

R&D Spending |

Market Share |

Revenue |

Presence in UAE |

|

Nestl Purina PetCare |

1894 |

Switzerland |

|||||

|

Mars Petcare |

1932 |

USA |

|||||

|

Royal Canin |

1968 |

France |

|||||

|

Hill's Pet Nutrition |

1907 |

USA |

|||||

|

Zoetis |

1952 |

USA |

UAE Pet Nutraceutical Industry Analysis

Growth Drivers

- Growth in Pet Humanization: Pet humanization continues to be a key driver of the UAE pet nutraceutical market. In 2023, the UAE's pet ownership rate increased, with over 40% of urban households owning pets, according to regional data from government sources. Pet owners in the UAE are spending substantially on pet care products, with figures indicating that the local pet industry is currently valued at approximately$300 millionand is projected to reach$2 billionby 2025. The country's GDP per capita of over $45,000 also supports higher spending on premium pet nutrition products, reflecting this humanization trend.

- Rise in Preventative Healthcare for Pets: Preventive healthcare for pets is growing rapidly in the UAE, with increased veterinary consultations. The UAE Ministry of Climate Change and Environment (MOCCAE) reported a 25% increase in veterinary clinic visits from 2022 to 2023. Pet nutraceuticals, such as joint supplements and immune boosters, are part of this trend, addressing chronic health issues in pets. With the rise in veterinary costs, pet owners are investing in preventative supplements, valued at AED 500 million annually.

- Increased Demand for Specialized Pet Nutrition: Demand for functional ingredients like Omega-3 and probiotics in pet nutrition has risen in the UAE. In 2023, the market for specialized pet nutraceuticals grew by AED 320 million, as more pet owners sought products targeting specific health concerns such as coat health and digestive support. Omega-3 supplements alone accounted for over 10,000 units sold monthly, according to retail data, supported by the country's rising middle-class income levels.

Market Challenges

- High Cost of Premium Pet Nutraceuticals: The high cost of premium pet nutraceuticals remains a challenge in the UAE market, where the average monthly expenditure on pet health supplements exceeds AED 500 per pet. With the country's inflation rate at 3.2% in 2024, pet owners face difficulties in maintaining a regular supply of these products. Premium products, particularly those imported from the US and Europe, contribute significantly to the higher costs, making affordability a major concern for pet owners.

- Limited Awareness of Pet Supplements among Consumers: A lack of consumer awareness regarding the benefits of pet supplements is another challenge in the UAE market. Although pet ownership is high, surveys conducted by the UAEs municipal departments in 2023 indicated that only 30% of pet owners regularly purchase nutraceuticals for their pets. Educational campaigns are limited, and many pet owners remain unaware of the preventative health benefits of these supplements, leading to lower adoption rates.

UAE Pet Nutraceutical Market Future Outlook

The UAE Pet Nutraceutical Market is expected to witness significant growth over the next five years. This growth will be driven by increasing pet ownership rates, the rising trend of pet humanization, and the growing awareness of pet healthcare. Furthermore, continuous innovations in pet nutraceutical products, including organic and natural supplements, will contribute to market expansion. As e-commerce continues to grow in the UAE, online sales of pet nutraceuticals are projected to rise, providing pet owners with easy access to a wide range of products.

Future Market Opportunities

- Demand for Organic and Natural Pet Supplements: There is rising demand for organic and natural pet supplements in the UAE, reflecting global trends towards clean-label products. In 2024, the organic pet supplement segment was valued at AED 300 million, with consumers increasingly choosing natural alternatives over synthetic products. Pet owners in the UAE are becoming more health-conscious, seeking organic ingredients such as flaxseed, turmeric, and natural probiotics to boost pet health without chemical additives.

- Market Penetration in Veterinary Clinics: Veterinary clinics in the UAE are increasingly incorporating pet nutraceuticals into treatment plans, offering supplements for conditions such as joint pain and digestive issues. In 2023, over 150 clinics across the UAE partnered with nutraceutical companies, contributing to AED 100 million in sales through veterinary channels. This collaboration is further supported by government initiatives to improve veterinary care standards, allowing nutraceutical products to gain visibility and consumer trust.

Scope of the Report

|

By Product Type |

Digestive Health Supplements Joint Health Supplements Skin and Coat Supplements Multivitamins Weight Management Supplements |

|

By Pet Type |

Dogs Cats Birds Others |

|

By Distribution Channel |

Online Retail Veterinary Clinics Pet Specialty Stores Hypermarkets and Supermarkets |

|

By Ingredient Type |

Omega Fatty Acids Probiotics Antioxidants Proteins & Amino Acids Botanicals |

|

By Region |

Dubai Abu Dhabi Sharjah Northern Emirates |

Products

Key Target Audience

Pet Food Manufacturers

Veterinary Clinics

Pet Product Retailers

Banks and Financial Institutes

Government and Regulatory Bodies (UAE Food Safety Department)

Investment and Venture Capitalist Firms

Pet Owners and Pet Communities

E-commerce Platforms Specializing in Pet Products

Pharmaceutical Companies Specializing in Pet Health

Companies

List of Major Players

Nestl Purina PetCare

Mars Petcare

Royal Canin

Hill's Pet Nutrition

Zoetis

PetMD

Vetoquinol

Nutramax Laboratories

Bayer Animal Health

VetriScience Laboratories

PetIQ

Ark Naturals

Zesty Paws

Elanco Animal Health

Garmon Corporation (NaturVet)

Table of Contents

1. UAE Pet Nutraceutical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Growth of pet adoption, increasing awareness of pet wellness)

1.4. Market Segmentation Overview

2. UAE Pet Nutraceutical Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Driven by rise in disposable income, consumer preference for premium pet food)

2.3. Key Market Developments and Milestones

3. UAE Pet Nutraceutical Market Analysis

3.1. Growth Drivers

3.1.1. Growth in Pet Humanization

3.1.2. Rise in Preventative Healthcare for Pets

3.1.3. Increased Demand for Specialized Pet Nutrition (Functional ingredients like Omega-3, Probiotics, etc.)

3.1.4. Expansion of Pet Product Retail Outlets

3.2. Market Challenges

3.2.1. High Cost of Premium Pet Nutraceuticals

3.2.2. Regulatory Hurdles (Local regulatory framework)

3.2.3. Limited Awareness of Pet Supplements among Consumers

3.3. Opportunities

3.3.1. Rise of E-commerce Channels for Pet Products

3.3.2. Demand for Organic and Natural Pet Supplements

3.3.3. Market Penetration in Veterinary Clinics

3.4. Trends

3.4.1. Growth in Subscription-Based Pet Nutrition Services

3.4.2. Increasing Usage of Pet-specific Probiotics and Vitamins

3.4.3. Expansion of Local Manufacturing Facilities for Pet Nutraceuticals

3.5. Government Regulation

3.5.1. Pet Supplement Registration Requirements (UAE local law)

3.5.2. Food and Drug Authority Guidelines on Pet Supplements

3.5.3. Labeling and Health Claim Restrictions

3.6. SWOT Analysis

3.7. Stake Ecosystem (Pet food manufacturers, veterinarians, retailers, and e-commerce platforms)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. UAE Pet Nutraceutical Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Digestive Health Supplements

4.1.2. Joint Health Supplements

4.1.3. Skin and Coat Supplements

4.1.4. Multivitamins

4.1.5. Weight Management Supplements

4.2. By Pet Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Birds

4.2.4. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Veterinary Clinics

4.3.3. Pet Specialty Stores

4.3.4. Hypermarkets and Supermarkets

4.4. By Ingredient Type (In Value %)

4.4.1. Omega Fatty Acids

4.4.2. Probiotics

4.4.3. Antioxidants

4.4.4. Proteins & Amino Acids

4.4.5. Botanicals

4.5. By Region (In Value %)

4.5.1. Dubai

4.5.2. Abu Dhabi

4.5.3. Sharjah

4.5.4. Northern Emirates

5. UAE Pet Nutraceutical Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl Purina PetCare

5.1.2. Mars Petcare

5.1.3. Royal Canin

5.1.4. Hills Pet Nutrition

5.1.5. PetMD

5.1.6. Vetoquinol

5.1.7. Nutramax Laboratories

5.1.8. Bayer Animal Health

5.1.9. VetriScience Laboratories

5.1.10. Zoetis

5.1.11. PetIQ

5.1.12. Ark Naturals

5.1.13. Zesty Paws

5.1.14. Elanco Animal Health

5.1.15. Garmon Corporation (NaturVet)

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Annual Revenue, Market Share, Product Range, R&D Spending, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. UAE Pet Nutraceutical Market Regulatory Framework

6.1. Food Safety and Regulatory Standards

6.2. Compliance Requirements for Nutraceutical Ingredients

6.3. Certification Processes for Pet Supplements

7. UAE Pet Nutraceutical Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. UAE Pet Nutraceutical Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. UAE Pet Nutraceutical Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE Pet Nutraceutical Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the UAE Pet Nutraceutical Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

In the final step, all data was synthesized to develop a comprehensive report. The analysis was cross verified with multiple stakeholders in the supply chain, ensuring the accuracy and reliability of the research findings.

Frequently Asked Questions

01. How big is the UAE Pet Nutraceutical Market?

The UAE Pet Nutraceutical market is valued at USD 2.04 billion, driven by the increasing humanization of pets and a rising focus on their health and wellness.

02. What are the challenges in the UAE Pet Nutraceutical Market?

Key challenges in the UAE Pet Nutraceutical market include the high cost of premium nutraceutical products and limited awareness among certain segments of consumers. Additionally, regulatory hurdles regarding product approval and labeling standards also pose significant challenges.

03. Who are the major players in the UAE Pet Nutraceutical Market?

Key players in the UAE Pet Nutraceutical market include Nestl Purina PetCare, Mars Petcare, Royal Canin, Vetoquinol, and Nutramax Laboratories. These companies lead the market due to their established distribution networks and focus on premium product offerings.

04. What are the growth drivers of the UAE Pet Nutraceutical Market?

The growth of the UAE Pet Nutraceutical market is driven by the increasing focus on preventive pet healthcare, rising pet adoption rates, and the availability of specialized nutraceutical products that cater to the specific health needs of pets.

05. Which product type dominates the UAE Pet Nutraceutical Market?

Digestive health supplements dominate the product type segment in the UAE Pet Nutraceutical market, primarily due to the rising awareness of pet owners about gastrointestinal issues in pets and the benefits of supplements that support gut health.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.