UAE Storage Systems Market Outlook to 2028

Region:Middle East

Author(s):Khushi Khatreja

Product Code:KR1459

December 2024

96

About the Report

UAE Storage Systems Market Overview

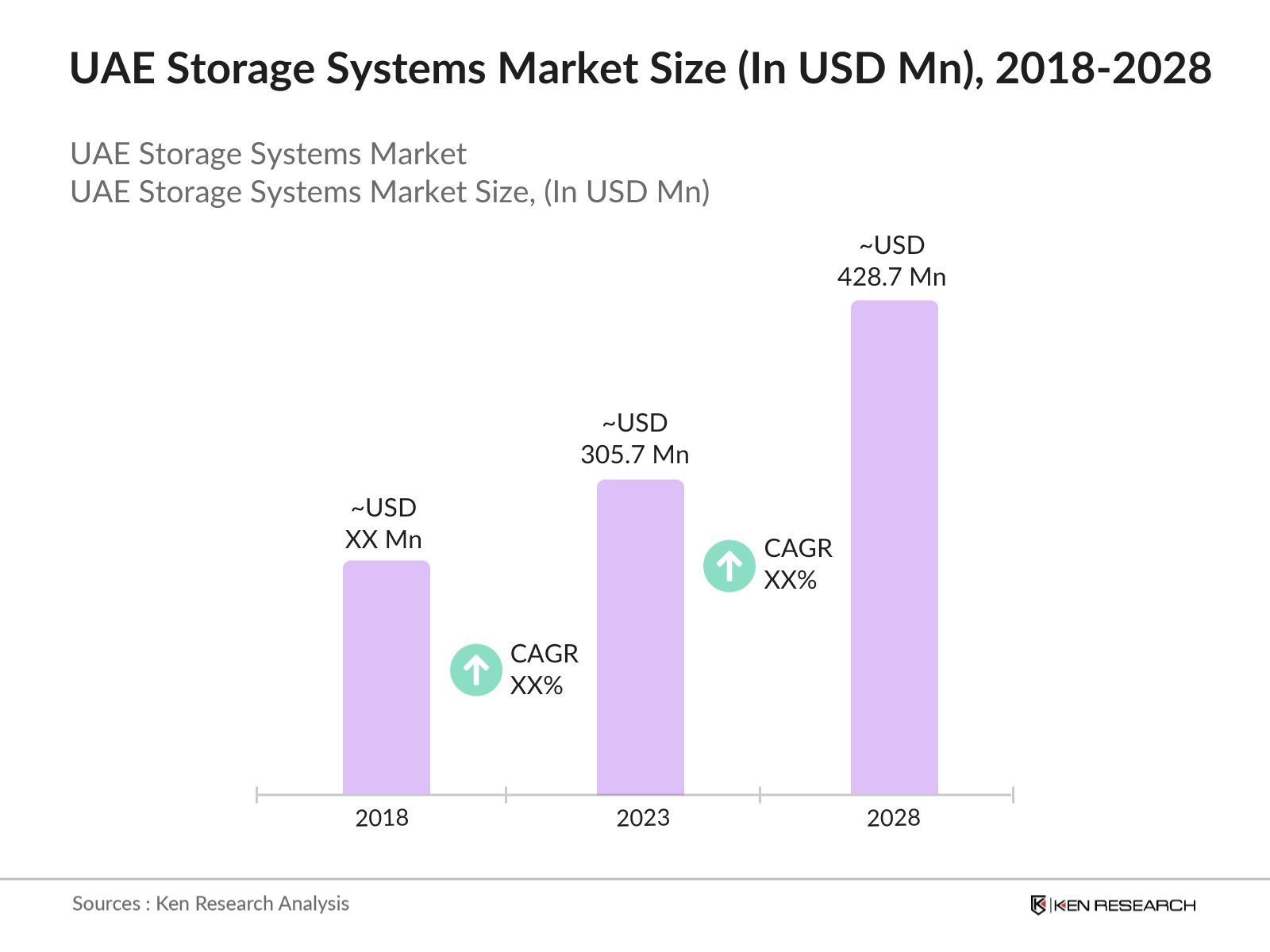

- The UAE Storage Systems Market, valued at USD 305.7 million in 2023, reflects the growing demand and investment in data storage solutions within Saudi Arabia. The increasing need for efficient supply chain management in retail, manufacturing, and logistics further fuels market expansion. The governments push towards modernizing storage facilities, such as cold storage for food products, also contributes to the market's growth.

- Dubai and Abu Dhabi are the leading cities in the UAE Storage Systems Market due to their status as economic and trade hubs of the region. Dubai, in particular, benefits from its strategic location as a gateway between East and West, with a large concentration of logistics and distribution centers.

- The Dubai Industrial Strategy 2030 is a crucial initiative designed to enhance the industrial sector's contribution to the UAE's economy. The strategy aims to boost this contribution to AED 300 billion by 2031, with a particular emphasis on improving logistics and transportation infrastructure. This ambitious plan is part of the broader Operation 300bn, which highlights the industrial sector as a vital driver of sustainable economic growth.

UAE Storage Systems Market Segmentation

The UAE Storage Systems Market is segmented by various factors like product type, end-user, region, etc.

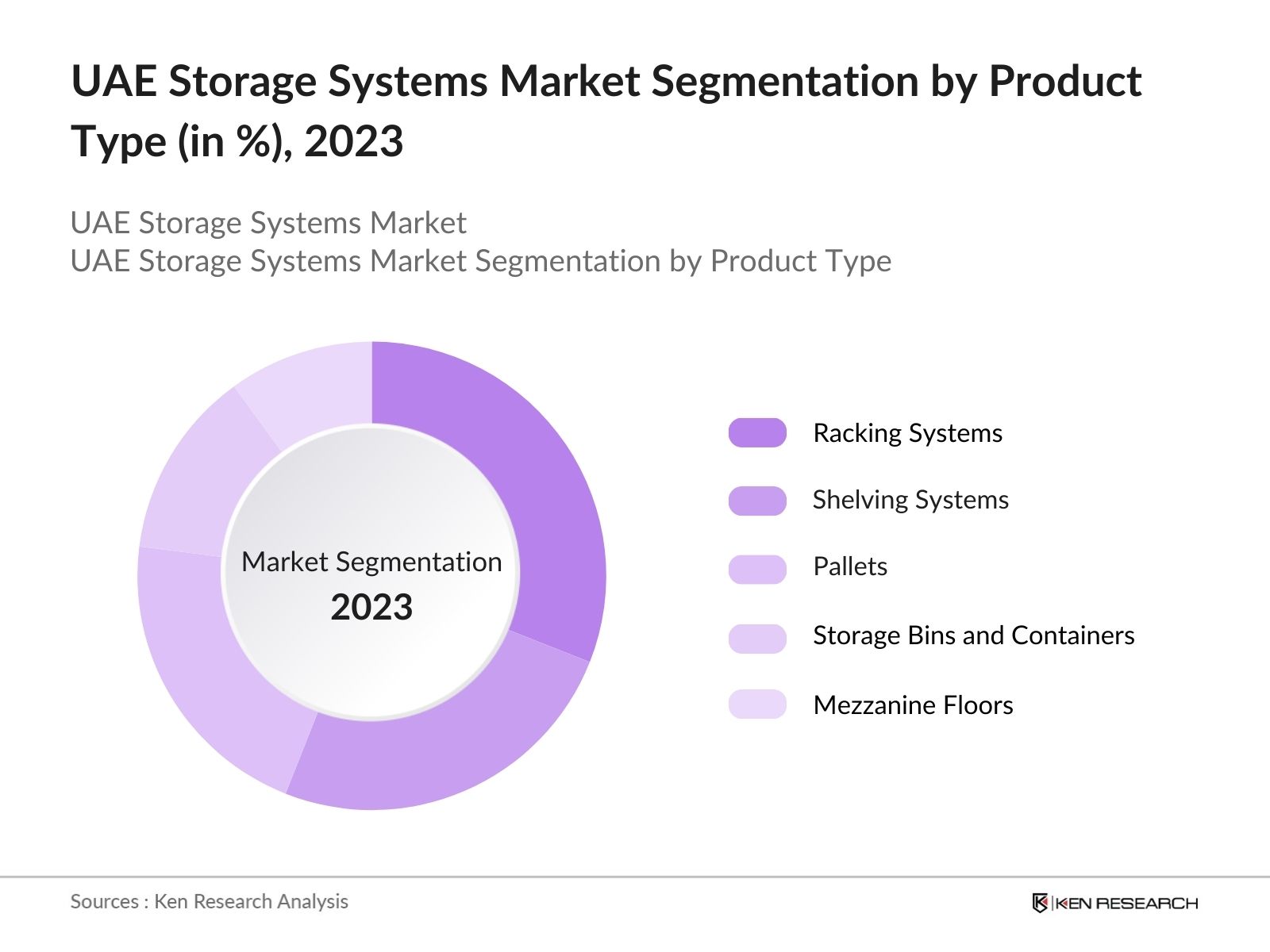

- By Product Type: The UAE Storage Systems Market is segmented by product type into Racking Systems, Shelving Systems, Pallets, Storage Bins and Containers, and Mezzanine Floors. Among these, rack systems hold the largest market share. Their dominance is attributed to their versatility and efficiency in maximizing storage space, which is essential for warehouses and distribution centers.

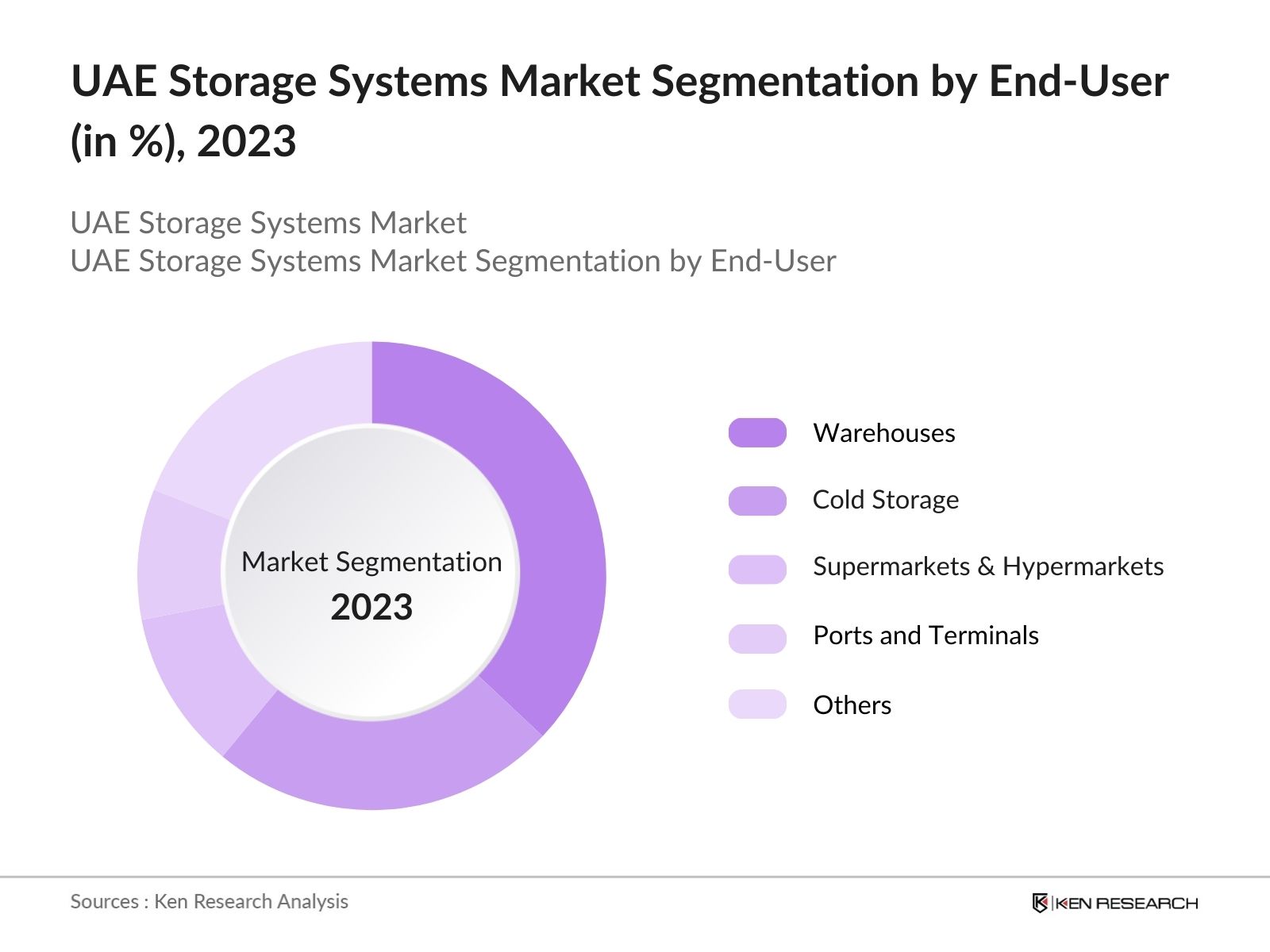

- By End-User: The UAE Storage Systems Market is segmented by End-User into Warehouses, Cold Storage, Supermarkets & Hypermarkets, and Ports and Terminals. Warehouses are the predominant end-users in this market. The surge in e-commerce and retail activities has led to increased demand for warehousing solutions to manage inventory effectively.

- By region: The United Arab Emirates (UAE) is a federation comprising seven emirates: Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, Fujairah, and Ras Al Khaimah. Dubai's dominance is attributed to its strategic location, advanced infrastructure, and status as a global trade hub, which necessitates extensive storage solutions. Abu Dhabi's significant industrial and governmental activities contribute to its substantial market share.

UAE Storage Systems Market Competitive Landscape

The storage systems market in the UAE primarily consists of companies that import products from global manufacturers and serve as installation and service providers for their clients. This sector experiences intense competition, resulting in competitive pricing and the availability of cost-effective solutions.

UAE Storage Systems Industry Analysis

Market Growth Drivers

- Increasing Energy Resilience Needs: The growing need for energy security and resilience against outages is driving demand for home energy storage systems. These systems allow users to store excess energy generated during peak production times for use during high-demand periods or outages. In 2023, the residential segment accounted for approximately58.98%of revenue share within the UAE's battery energy storage market, highlighting its significance in overall market dynamics.

- Technological Advancements: Innovations in battery technologies, such as lithium-ion and molten salt thermal energy storage, are enhancing the efficiency and effectiveness of energy storage solutions. The Mohammed bin Rashid Al Maktoum Solar Park, which is set to have a production capacity of 5,000 MW by 2030, exemplifies this shift towards cutting-edge technology.

- Rising Demand for Renewable Energy: The UAE's commitment to renewable energy, encapsulated in the UAE Energy Strategy 2050, aims for a 50% clean energy mix by 2050. This necessitates advanced energy storage solutions to manage the intermittent nature of solar and wind power, creating a significant demand for storage systems.

Market Challenges

- Infrastructure Disparities: There are notable disparities in storage infrastructure across different Emirates. Some regions lack modern storage facilities and efficient transportation networks, which can hinder the overall effectiveness of the supply chain. For example, while Dubai has advanced logistics capabilities, other Emirates may not have the same level of infrastructure, affecting service delivery.

- Technological Obsolescence: Rapid advancements in technology mean that storage systems can quickly become outdated. Companies must continually invest in upgrading their technologies to remain competitive. For instance, as new battery technologies emerge, older systems may need to be replaced or significantly upgraded to meet market demands.

UAE Storage Systems Future Market Outlook

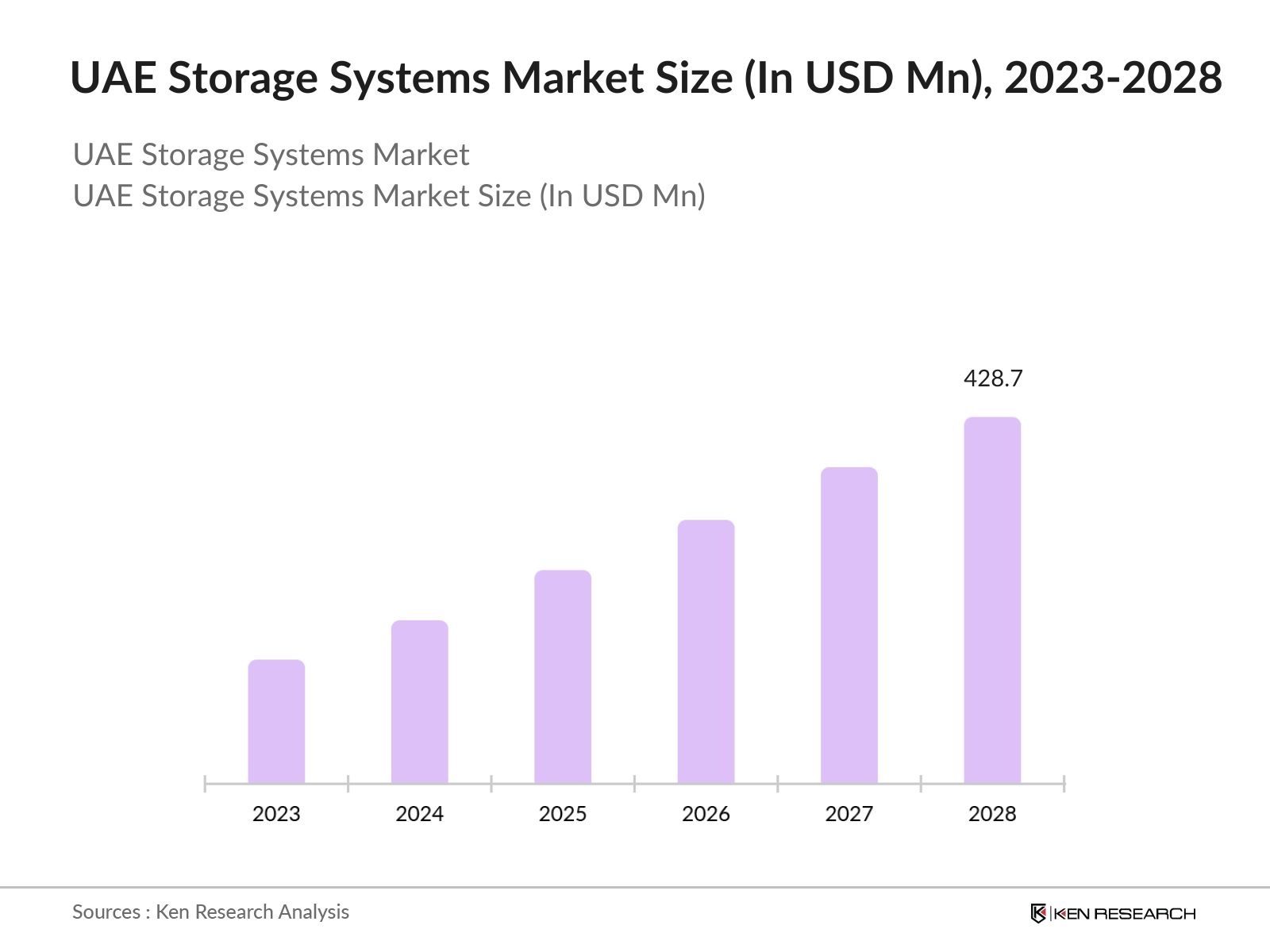

The storage systems market in UAE is set for major growth over the coming years with a market size of USD 428.7 Mn in 2028, driven by various factors including economic diversification, advancements in technology, and the increasing demand from e-commerce and other sectors.

Market Opportunities

- Development of Logistics Zones: The UAE government is actively investing in logistics infrastructure to enhance supply chain efficiency. Initiatives like Dubai Logistics City and expansions in Abu Dhabi's Khalifa Port are creating specialized logistics zones that facilitate streamlined operations for storage providers. The establishment of free trade zones, such as the Jebel Ali Free Zone (JAFZA), encourages businesses to set up warehouses and distribution centers, increasing the demand for advanced storage solutions.

- Sustainability Initiatives: As sustainability becomes a priority, there is an opportunity for storage providers to develop eco-friendly solutions, such as energy-efficient warehouses equipped with renewable energy sources. This aligns with the UAE's commitment to sustainability as outlined in its Energy Strategy 2050. Implementing green practices in storage facilities can attract environmentally conscious clients and comply with regulatory standards promoting sustainability.

Scope of the Report

|

Product Type |

Racking Systems Shelving Systems Pallets Storage Bins and Containers Mezzanine Floors |

|

End-User |

Warehouses Cold Storage Supermarkets & Hypermarkets Ports and Terminals |

|

Technology |

Residential Storage Systems Commercial Storage Systems Industrial Storage Systems |

|

Region |

Dubai Abu Dhabi Sharjah Other |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (UAE Ministry of Economy, Dubai Economy)

Industrial and Manufacturing Enterprises

E-commerce and Logistics Companies

Retail Chains and Distribution Centers

Warehouse Operators

Real Estate Developers and Investors

Supply Chain Management Companies

Companies

Players Mentioned in the report

Dematic

SSI Schaefer

Swisslog

Khalifa Port

Al Harithi Group

Interroll

KION Group

Vanderlande

Jungheinrich

TGW Logistics Group

Robot System Products

Honeywell Intelligrated

Mitsubishi Logisnext

Daifuku

Mecalux

Table of Contents

1. Executive Summary

1.1. Executive Summary of UAE and Storage Systems Market

2. Market Overview

2.1. Product Taxonomy

2.2. Revenue Model of a Storage Systems Company

2.3. Material Handling and Storage Systems Market Landscape

2.4. Value Chain Analysis

2.4.1. List of Entities

2.4.2. Margins

2.4.3. Key Insights

2.5. UAE Latest Industry Developments, 2023

2.6. Latest Industry Developments, 2023

2.7. UAE vs Material Handling and Storage Systems Market

2.8. Growth Drivers

2.9. Trends and Developments

2.10. Key Challenges

2.11. Different Solutions as per Customer Requirements

2.12. Cross-Comparison of Various Pallet Racking Solutions

2.12.1. Surface Area

2.12.2. Volume

2.12.3. Speed

2.12.4. Height

2.12.5. Width

2.12.6. Initial Investment

2.12.7. Rotation

3. Storage Systems Market

3.1. Market Ecosystem

3.2. Heatmap of Major Local Players in UAE

3.3. Market Sizing and Segmentation

3.3.1. Storage Systems Market Size (Revenue in $ Mn), 2018-2023

3.3.2. Segmentation by Product Type (Revenue in %), 2023

3.3.3. Segmentation by End-Users (Revenue in %), 2023

3.3.4. Major End-User Landscape in UAE, 2023

3.4. Competition Framework

3.4.1. Competition Landscape

3.4.2. Positioning Matrix

3.4.3. Cross-Comparison of Major Players

3.5. Refrigerated Display Cabinets Market

3.5.1. Heatmap of Major Players

3.5.2. Market Overview, Sizing, and Segmentation

3.5.3. Competition Landscape

3.6. Loading Bay Solutions Market

3.6.1. Heatmap of Major Players

3.6.2. Market Overview, Sizing, and Segmentation

4. Future Outlook and Projections

4.1. UAE and Market Size Projections, 2023-2028

4.2. Segmentation by Product Type and End-Users, 2028

5. Analyst Recommendations

5.1. Identifying Whitespaces and Growth Opportunities

5.2. Entry Barriers and Potential Risks

5.3. Strategic Roadmaps for Business Expansion

6. Kuwait Forklift Market

6.1. Overview of Kuwait Forklift Market

6.2. Kuwait Forklift Market Sizing, 2018-2028

7. Research Methodology

7.1. Market Definitions and Assumptions

7.2. Market Sizing Approach

7.3. Consolidated Research Approach

7.4. Sample Size Inclusion

7.5. Research Limitations

Disclaimer

Contact Us

Research Methodology

Step 1:Identification of Major Players and Product Mapping

In this phase, the identification of key players in the UAE Storage Systems Market is conducted, along with mapping their product offerings across various storage types. These include automated storage and retrieval systems (ASRS), shelving systems, pallet systems, mezzanine floors, cantilever racks, and other advanced storage technologies. The market size is derived from credible industry sources, including government reports from the UAE Ministry of Economy, warehouse associations, industrial development bodies, and manufacturers' sales data. Additionally, industry publications, market research reports, and product-specific releases are analyzed to ensure the accuracy of the data.

Step 2: CATI (Computer-Assisted Telephonic Interviews)

CATIs are conducted with key stakeholders across the UAE Storage Systems Market. This includes interviews with C-level executives, warehouse operators, storage system manufacturers, government representatives (such as from the UAE Ministry of Climate Change and Environment), and logistics infrastructure providers. These interviews help uncover market trends, pricing models, and profit margins across different storage systems. Secondary research supports these findings to ascertain typical profit margins and pricing, providing a solid base for market size estimation.

Step 3: Exhaustive Secondary Research

The research methodology employs a Bottom-Up approach to evaluate the segmentation shares by product type (e.g., automated systems, shelving units), end-user industries (e.g., retail, e-commerce, manufacturing, logistics), and regions (e.g., Dubai, Abu Dhabi, Sharjah). Market size and segmentation shares are validated using a variety of data sources, including revenue data from key players, import/export records, and official government publications. Secondary research also includes an assessment of advanced technology adoption, such as IoT and AI-driven storage systems, and their penetration across different industries in the UAE.

Step 4: Bottom-Up Market Estimation Approach

This phase involves further validation of market size estimates and segmentation shares using industry expert interviews, warehouse operators, and stakeholders like logistics service providers, distributors, and original equipment manufacturers (OEMs). Key indicators such as demand for warehouse space in major UAE cities, the adoption of automated storage systems, and average warehouse sizes are considered in refining the market estimates. Additional factors, including economic indicators, real estate development trends, and government initiatives (such as UAE Vision 2021 and national infrastructure projects), are also integrated into the final market size estimates. This step ensures that the overall market landscape is accurately represented.

Frequently Asked Questions

01. How big is the UAE Storage Systems Market?

The UAE Storage Systems Market is valued at approximately USD 305.7 million in 2023, driven by rapid infrastructure growth and the expanding logistics sector.

02. What are the challenges in the UAE Storage Systems Market?

UAE Storage Systems Market Challenges include high capital investment costs for advanced systems, particularly in automation, and the need for skilled labor to manage complex storage systems.

03. Who are the major players in the UAE Storage Systems Market?

Key players in the UAE Storage Systems Market include Dematic, SSI Schaefer, Swisslog, Khalifa Port, and Al Harithi Group, each offering a range of advanced storage solutions.

04. What are the growth drivers of the UAE Storage Systems Market?

The market is driven by the rise of e-commerce, increased demand for automation in warehouses, and government investments in infrastructure development.

05. What are the future trends in the UAE Storage Systems Market?

Future trendsin the UAE Storage Systems Market include the increased adoption of robotics and automation, AI-powered storage solutions, and the expansion of cold storage facilities in the UAE.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.