UK Aerospace and Defense Market Outlook to 2030

Region:Europe

Author(s):Sanjeev

Product Code:KROD1591

November 2024

94

About the Report

UK Aerospace and Defense Market Overview

- The UK Aerospace and Defense Market holds a prominent position, valued at USD 24.7 billion, based on comprehensive industry analysis. This market is fueled by several factors, including significant government investments in defense technologies, robust export initiatives, and the demand for advanced civil aerospace solutions. Increasing global demand for aerospace components and continuous innovations in defense technologies are key drivers for sustained growth in this sector.

- London and Bristol are dominant hubs within the UK Aerospace and Defense Market due to their dense clusters of high-tech manufacturing firms and proximity to key government defense institutions. London, as a global financial hub, facilitates high-level partnerships and investments, while Bristols concentration of aerospace companies and access to skilled labor fortifies its position in the industry.

- The DE&S standards mandate rigorous quality and security requirements for defense equipment manufacturing, influencing nearly 70% of projects within the UK defense sector. These standards have enforced critical performance benchmarks across procurement and production, with significant oversight to ensure alignment with national defense policies. DE&S compliance remains central to maintaining the quality and reliability of UK defense equipment.

UK Aerospace and Defense Market Segmentation

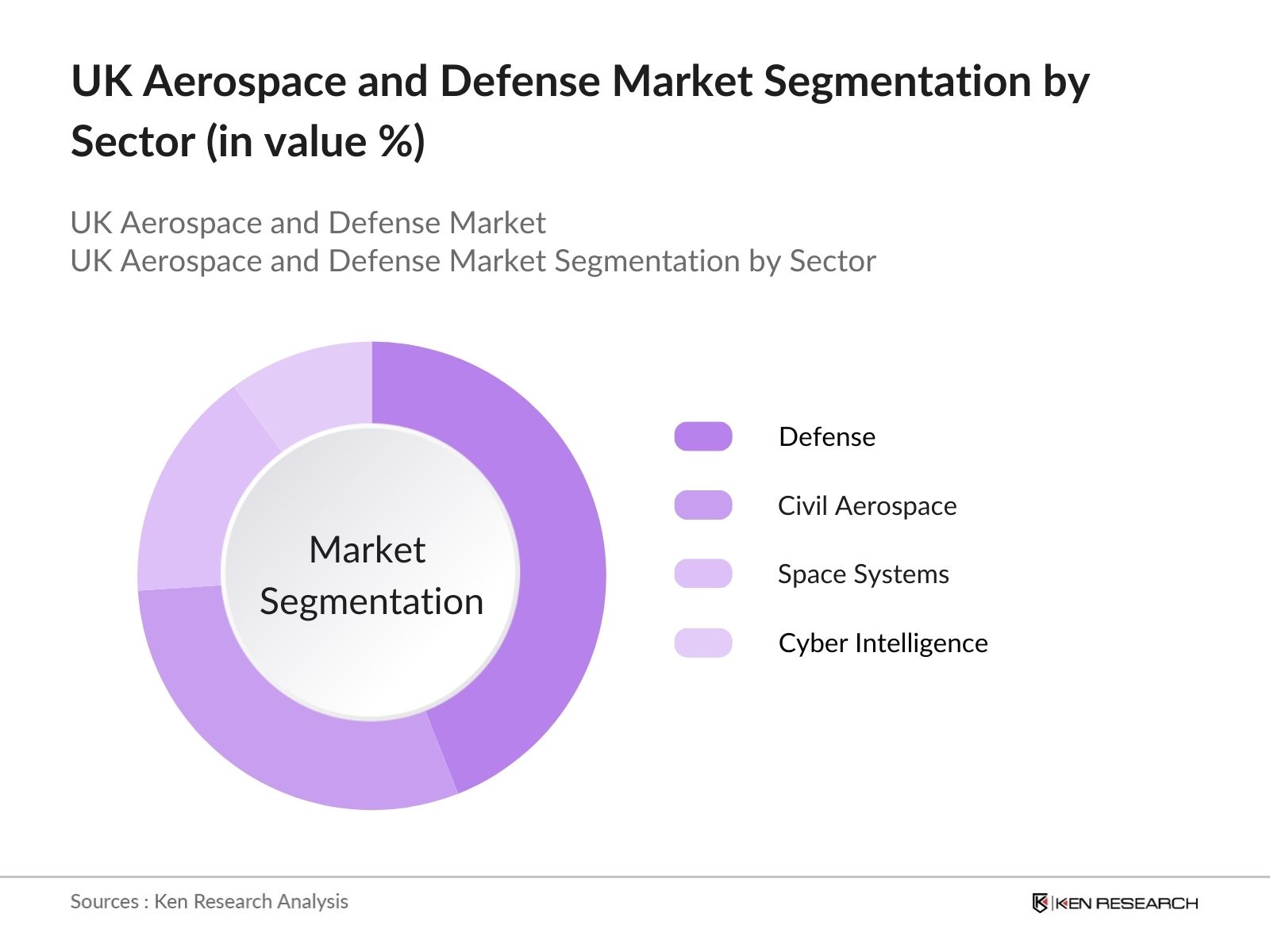

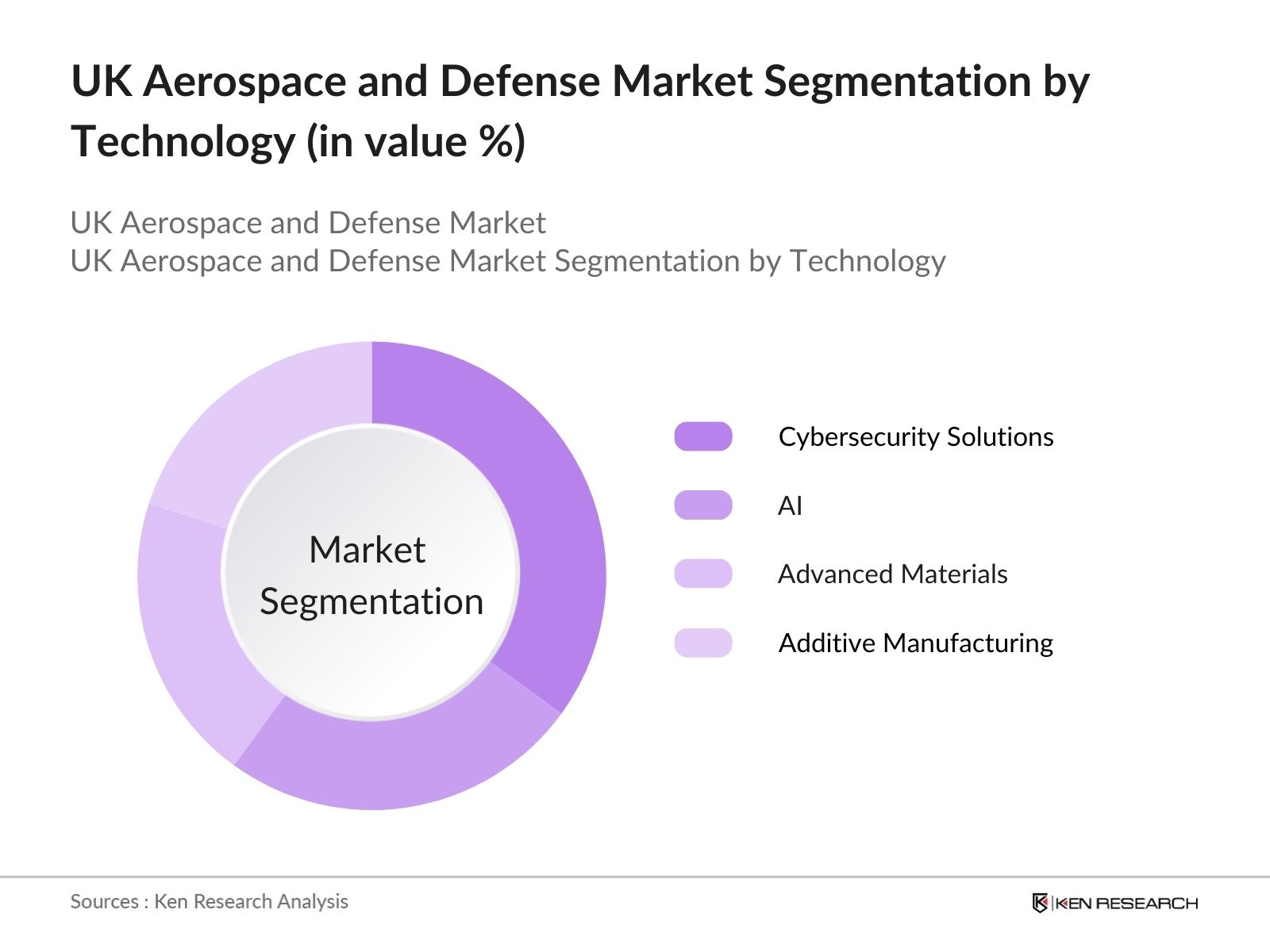

The UK Aerospace and Defense Market is segmented by sector and by technology.

- By Sector: The market is segmented by sector into Defense, Civil Aerospace, Space Systems, and Cyber Intelligence. The defense sector commands a dominant market share, primarily due to significant government contracts and strategic importance to national security. Companies like BAE Systems and Rolls-Royce are central players, leveraging deep-rooted industry expertise to maintain the sectors growth.

- By Technology: Segmented by technology, the market includes Artificial Intelligence (AI), Cybersecurity Solutions, Advanced Materials, and Additive Manufacturing. Cybersecurity holds a substantial market share due to the increasing frequency and sophistication of cyber threats facing aerospace and defense systems. The UK governments investments in cybersecurity infrastructure have bolstered this segment's dominance.

UK Aerospace and Defense Market Competitive Landscape

The UK Aerospace and Defense Market is led by key players who leverage long-standing industry experience and technological prowess. The major players in this market include local giants like BAE Systems and Rolls-Royce and global aerospace and defense firms with UK-based operations, ensuring strong competitive dynamics.

UK Aerospace and Defense Market Analysis

Growth Drivers

- Demand for Cutting-edge Technology: The UK aerospace and defense industry is seeing an accelerated demand for advanced technologies such as artificial intelligence, machine learning, and autonomous systems in response to evolving security challenges. According to recent government data, over 25% of UK defense projects initiated since 2022 have focused on AI and autonomous systems development to bolster national security. This trend aligns with the UK's goal to enhance its defense technology capabilities, aiming to increase the deployment of such technologies in over 300 systems across the military by 2025. This demand for cutting-edge solutions is supported by initiatives from the Defence Science and Technology Laboratory (DSTL) aimed at enhancing technological resilience in defense capabilities.

- Government Investment Initiatives: The UK government has dedicated over 11 billion to defense modernization programs since 2023 to sustain and grow its aerospace and defense sector, with specific allocations for developing missile defense and cyber-resilience. This strategic investment reinforces the countrys position as a global leader in defense technology while boosting manufacturing and R&D capacities within the sector. Government initiatives are directly benefiting over 200 defense-focused firms across the UK, which now employ approximately 10,000 workers focused on defense R&D activities. These investments signal strong national backing for the defense industry, further supporting its expansion and innovation efforts.

- International Defense Collaborations: he UKs collaborative defense partnerships, such as the AUKUS trilateral security pact with the U.S. and Australia, have been pivotal in fostering cross-border R&D and technology sharing. These alliances facilitate the exchange of nuclear, AI, and submarine technologies, with the UK set to play a significant role in submarine production for AUKUS. Such international partnerships are not only bolstering the UKs defense industry expertise but are expected to support over 5,000 direct jobs related to collaborative defense production projects by 2025. The partnership aligns with the UKs defense export goals, projected to grow by 15% year-on-year through its collaborations with NATO countries.

Market Challenges

- Stringent Regulations: The UK aerospace and defense industry faces rigorous regulatory requirements, particularly under the Defense Equipment and Support (DE&S) standards that impact manufacturing and export procedures. Recent government reports indicate that compliance with DE&S standards adds approximately 20-30% to the project timelines for new defense equipment, affecting project profitability and competitiveness in international markets. Compliance challenges have led to regulatory overheads, estimated at nearly 1.5 billion annually, which is a significant financial strain for defense contractors and SMEs within the sector.

- High Manufacturing Costs: Manufacturing costs in the UK aerospace and defense sector are significantly elevated due to stringent environmental standards, reliance on imported raw materials, and skilled labor shortages. Data from the UK Department for Business, Energy & Industrial Strategy highlights that production costs have increased by 12% from 2022 to 2024, driven by elevated costs in advanced materials and energy prices. Additionally, skilled labor shortages contribute to wage inflation, with defense-specific roles paying 20% higher than the national average, impacting operational budgets across the industry. UK Department for Business, Energy & Industrial Strategy

UK Aerospace and Defense Market Future Outlook

Over the next five years, the UK Aerospace and Defense Market is expected to expand significantly. This growth is anticipated to be fueled by advancements in aerospace technology, increased government budgets, and the rising global demand for cybersecurity solutions within defense systems. Expanding the UKs presence in civil aerospace and space exploration initiatives will further contribute to market growth, alongside the focus on sustainable aerospace solutions.

Market Opportunities

- Emerging Space Exploration Market: The UKs space exploration market is expanding with government plans to invest 1.4 billion in space projects by 2025, creating a significant opportunity for aerospace firms. The establishment of spaceports in Cornwall and Scotland reflects this momentum, aiming to support approximately 150 satellite launches annually by 2025. These investments are anticipated to generate over 2,500 direct jobs, particularly in satellite technology and space vehicle manufacturing, propelling the UK toward becoming a global player in the space industry.

- Civil Aerospace Growth: Civil aerospace has seen renewed interest, with passenger air traffic in the UK projected to reach pre-pandemic levels by 2024. According to the UK Civil Aviation Authority, 250 million passengers are expected to transit through UK airports in 2024, creating demand for commercial aircraft and maintenance services. The growth is generating economic opportunities within aerospace manufacturing and MRO (maintenance, repair, and overhaul) services, particularly as UK-based airlines increase fleet sizes, leading to demand for over 200 new commercial aircraft by 2025.

Scope of the Report

|

||

|

By Component Type |

Aircraft |

|

|

By Technology |

AI and Machine Learning |

|

|

By Platform |

Air-based |

|

|

By Region |

North East West South |

Products

Key Target Audience

Defense Ministry (Ministry of Defence UK)

Aerospace Manufacturers

Cybersecurity Firms

Government and Regulatory Bodies (Civil Aviation Authority)

Investor and Venture Capitalist Firms

Space Agencies (UK Space Agency)

Private Equity Firms

Banks and Financial Institutes

Aircraft Maintenance and Repair Companies

Companies

Players Mention in the Report:

BAE Systems

Rolls-Royce

Leonardo UK

Lockheed Martin UK

Thales Group

Airbus Group UK

Raytheon UK

Northrop Grumman UK

Boeing UK

MBDA UK

QinetiQ Group

General Dynamics UK

Cobham Ltd

Ultra Electronics

Serco Group

Table of Contents

1. UK Aerospace and Defense Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. UK Aerospace and Defense Market Size (in GBP Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. UK Aerospace and Defense Market Analysis

3.1. Growth Drivers (Emerging Demand for Advanced Defense Systems, Increased Defense Budgets)

3.1.1. Demand for Cutting-edge Technology

3.1.2. Government Investment Initiatives

3.1.3. International Defense Collaborations

3.2. Market Challenges (Regulatory Complexities, Cost Management)

3.2.1. Stringent Regulations

3.2.2. High Manufacturing Costs

3.2.3. Dependency on Global Supply Chains

3.3. Opportunities (Expansion of Civil Aerospace, Space Industry Potential)

3.3.1. Emerging Space Exploration Market

3.3.2. Civil Aerospace Growth

3.3.3. Potential in UAV and Drone Technologies

3.4. Trends (Adoption of AI, Increased Focus on Cybersecurity)

3.4.1. Artificial Intelligence in Defense Applications

3.4.2. Cybersecurity for Defense Systems

3.4.3. Emphasis on Sustainable Manufacturing

3.5. Government Regulations

3.5.1. Defense Equipment and Support (DE&S) Standards

3.5.2. Export Control Requirements

3.5.3. UK Space Agency Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. UK Aerospace and Defense Market Segmentation

4.1. By Sector (in Value %)

4.1.1. Defense

4.1.2. Civil Aerospace

4.1.3. Space Systems

4.1.4. Intelligence and Cyber

4.2. By Component Type (in Value %)

4.2.1. Aircraft

4.2.2. Naval Systems

4.2.3. Land Systems

4.2.4. Satellite and Space Systems

4.3. By Technology (in Value %)

4.3.1. AI and Machine Learning

4.3.2. Cybersecurity Solutions

4.3.3. Additive Manufacturing

4.3.4. Advanced Materials

4.4. By Platform (in Value %)

4.4.1. Air-based

4.4.2. Land-based

4.4.3. Sea-based

4.4.4. Space-based

4.5. By Region (in Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. UK Aerospace and Defense Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BAE Systems

5.1.2. Rolls-Royce Holdings

5.1.3. Leonardo UK

5.1.4. Lockheed Martin UK

5.1.5. Airbus Group UK

5.1.6. Thales Group UK

5.1.7. Northrop Grumman UK

5.1.8. Raytheon UK

5.1.9. Boeing UK

5.1.10. MBDA UK

5.1.11. QinetiQ Group

5.1.12. General Dynamics UK

5.1.13. Cobham Ltd

5.1.14. Ultra Electronics Holdings

5.1.15. Serco Group

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Inception Year, Headquarters, Market Reach, Product Range, Technological Capabilities, ESG Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Alliances

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Government Grants and Incentives

5.8. Private Equity and Venture Capital Investments

6. UK Aerospace and Defense Market Regulatory Framework

6.1. Compliance and Certification Standards

6.2. Export and Import Controls

6.3. Environmental Impact Regulations

6.4. Cybersecurity Compliance Requirements

7. UK Aerospace and Defense Future Market Size (in GBP Mn)

7.1. Future Market Size Projections

7.2. Key Factors for Future Market Growth

8. UK Aerospace and Defense Future Market Segmentation

8.1. By Sector (in Value %)

8.2. By Component Type (in Value %)

8.3. By Technology (in Value %)

8.4. By Platform (in Value %)

8.5. By Region (in Value %)

9. UK Aerospace and Defense Market Analysts Recommendations

9.1. Market Entry Strategy Analysis

9.2. Customer Demographics Analysis

9.3. Strategic Marketing Initiatives

9.4. Competitive White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing a detailed map of stakeholders in the UK Aerospace and Defense Market. Extensive desk research and proprietary databases provide in-depth information, allowing identification and definition of critical market dynamics.

Step 2: Market Analysis and Data Construction

Historical data collection for the UK market includes market penetration rates, ratio analysis of key sectors, and revenue estimations. Service quality metrics ensure reliable revenue calculations, forming a solid basis for market size analysis.

Step 3: Hypothesis Validation through Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts across various segments. These insights directly from the market participants provide accurate financial and operational data for a more refined analysis.

Step 4: Research Synthesis and Final Report Compilation

Engagements with key aerospace and defense manufacturers and stakeholders contribute detailed insights into product segments, sales, and preferences. These interactions substantiate data and validate the bottom-up approach for final market analysis.

Frequently Asked Questions

01. How big is the UK Aerospace and Defense Market?

The UK Aerospace and Defense Market was valued at USD 24.7 billion, driven by significant investments in defense technology and expanding civil aerospace demands.

02. What are the main challenges in the UK Aerospace and Defense Market?

Challenges in UK Aerospace and Defense Market include regulatory complexity, high production costs, and dependency on international supply chains, impacting manufacturing and development.

03. Who are the key players in the UK Aerospace and Defense Market?

The UK Aerospace and Defense Market includes key players like BAE Systems, Rolls-Royce, Leonardo UK, and Lockheed Martin UK, who dominate through technological prowess and government partnerships.

04. What drives growth in the UK Aerospace and Defense Market?

UK Aerospace and Defense Market Growth is primarily driven by increased government budgets, technological advancements, and the UK's focus on civil aerospace and cybersecurity in defense systems.

05. What are the dominant technologies in the UK Aerospace and Defense Market?

Dominant technologies include cybersecurity, AI, and additive manufacturing, each addressing specific sector demands and enhancing market competitiveness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.