UK Surfing Apparel and Accessories Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9269

December 2024

82

About the Report

UK Surfing Apparel and Accessories Market Overview

- The UK Surfing Apparel and Accessories market is valued at USD 390 million, based on a five-year historical analysis. This market is primarily driven by the increasing popularity of surfing as a recreational activity, growth in surf tourism, and the rising demand for high-performance surf gear. The presence of robust e-commerce platforms has further supported market expansion, allowing consumers to access a broader range of products and brands. Additionally, the increasing focus on sustainable and eco-friendly materials in manufacturing has aligned with consumer preferences, driving demand for organic cotton and recycled polyester products.

- The market is concentrated in regions such as Cornwall, Devon, and South Wales, which are known for their surfing culture and favorable coastal conditions. Cornwall, with its well-established surf schools and annual surf festivals, has become a key hub, attracting both local and international surfers. Devon's popular beaches like Croyde and Woolacombe have bolstered regional demand for surfing gear. South Wales benefits from easy accessibility from major cities and consistent surf conditions, making it another dominant region in the market.

- Environmental conservation efforts along UK coastlines have promoted sustainable practices within the surf apparel industry. Government-sponsored coastal cleanup programs in 2024 mobilized over 100,000 volunteers, raising awareness of ocean pollution. These initiatives have encouraged surf brands to adopt eco-friendly materials, aligning with consumer demand for sustainable products.

UK Surfing Apparel and Accessories Market Segmentation

By Product Type: The UK Surfing Apparel and Accessories market is segmented by product type into surf apparel and surf accessories. Recently, surf apparel has a dominant market share under the segmentation by product type. This is due to the continuous demand for wetsuits that are specifically designed to suit the colder waters of the UK. Wetsuits made from high-quality neoprene material offer thermal insulation, attracting professional and recreational surfers. Additionally, the trend towards surf fashion has elevated the demand for surf tees and board shorts, blending functionality with style.

By Distribution Channel: The UK Surfing Apparel and Accessories market is segmented by distribution channels into offline and online channels. The offline segment, comprising specialty surf shops, has maintained a leading market share due to its strong local presence and personalized customer service. Specialty stores provide expert guidance and access to high-quality, premium surf gear, making them a preferred choice among serious surfers. However, the online channel is rapidly growing, driven by the convenience of direct-to-consumer brand websites and large e-commerce platforms offering competitive pricing and a broader product range.

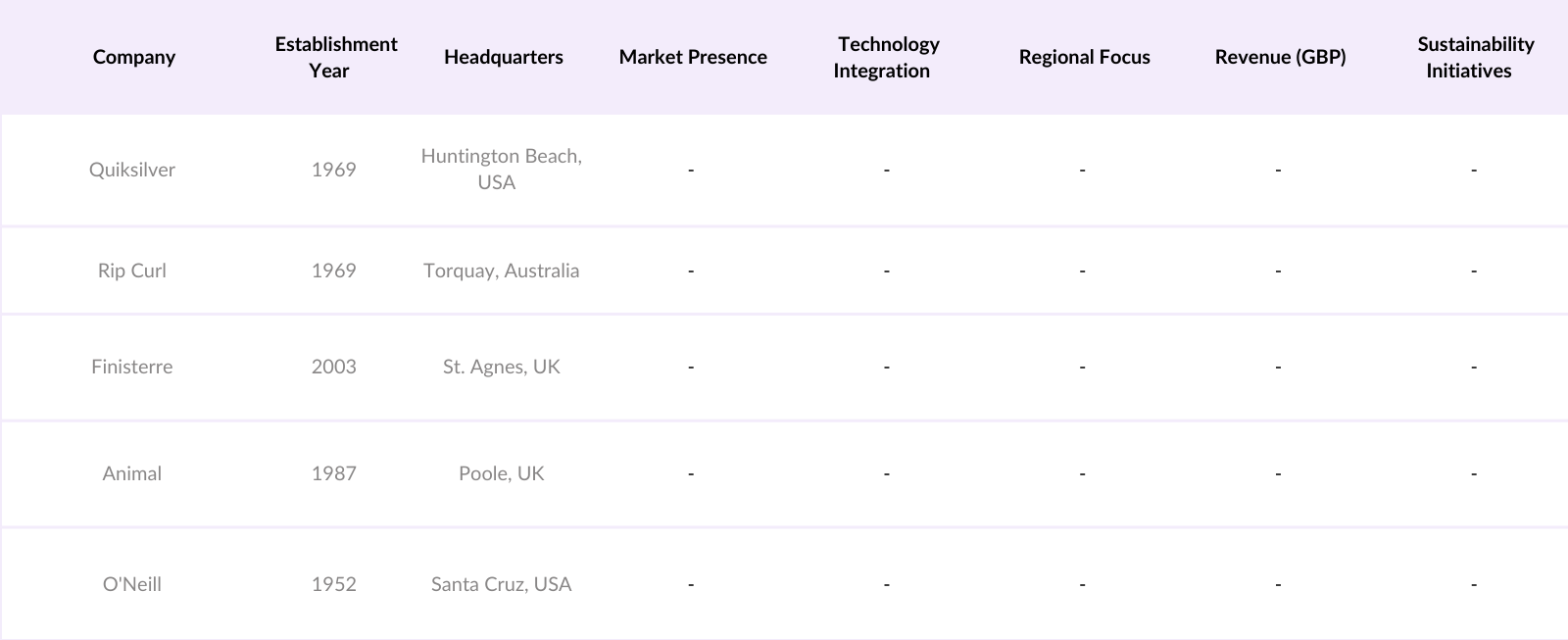

UK Surfing Apparel and Accessories Market Competitive Landscape

The UK Surfing Apparel and Accessories market is dominated by a mix of international brands and domestic players, who have established strong market presence through high-quality products and strategic marketing. These key companies leverage their brand reputation, technological advancements in fabric design, and sustainable practices to capture market share.

UK Surfing Apparel and Accessories Market Analysis

Growth Drivers

- The popularity of water sports, particularly surfing, has seen a considerable increase in the UK, with over 500,000 people participating in surfing activities annually. This surge in water sports culture has fueled demand for surfing apparel and accessories, creating an essential market within the UK. Data from the British Surfing Association suggests that increased awareness of surfing's mental and physical health benefits is driving participation and influencing consumer spending on surf-related products.

- Adventure tourism, including coastal and surf-focused travel, is on the rise in the UK, attracting around 4 million adventure tourists yearly. This trend has led to a growing demand for specialized surfing apparel and gear, as consumers seek high-quality products that enhance their experiences. Government tourism data from 2024 emphasizes the importance of adventure tourism for economic growth, with coastal towns benefiting from increased footfall and spending on related apparel and accessories.

- The increase in brand endorsements from well-known athletes and influencers has significantly boosted the UK surfing apparel market. Several local and global surfing brands have collaborated with professional surfers and adventure influencers who collectively reach over 20 million people across social media. This visibility has led to greater consumer awareness and interest in surf apparel, particularly among younger demographics. Surveys show that brand endorsements directly impact purchasing decisions, with nearly 40% of young consumers considering endorsements a primary factor in buying surf apparel.

Market Challenges

- The seasonal nature of surfing in the UK creates fluctuations in demand for apparel and accessories. Data from 2024 shows that surfing apparel sales peak between May and September, coinciding with warmer months. However, off-season demand drops by nearly 60%, challenging brands to maintain consistent revenue streams and balance inventory effectively throughout the year.

- The specialized nature of surf gear production, especially with eco-friendly materials, leads to high production costs. For example, the average production cost for a sustainable wetsuit is around 30% higher than standard materials due to sourcing and manufacturing complexities. These costs impact retail prices, creating a barrier for some consumers and constraining market expansion among price-sensitive buyers.

UK Surfing Apparel and Accessories Market Future Outlook

The UK Surfing Apparel and Accessories market is expected to witness steady growth in the coming years. The market's future expansion will be driven by the increasing emphasis on sustainability, with brands focusing on environmentally friendly materials like recycled polyester and organic cotton. Rising participation in surfing and water sports, supported by growing surf tourism, will fuel demand for advanced surfing gear. Additionally, the integration of technology in surfing accessories, such as smart wetsuits with temperature control and data-tracking capabilities, will appeal to tech-savvy consumers. Collaborations between surfing brands and high-profile surf competitions will further enhance market visibility and drive growth.

Market Opportunities

- The expansion of e-commerce channels has broadened market access, allowing UK surf brands to reach customers beyond traditional brick-and-mortar stores. E-commerce sales of surf apparel and accessories reached approximately 200,000 orders in 2024, a substantial increase driven by convenience and a broader range of product offerings. This shift has allowed brands to capture a wider audience, especially in inland regions where physical surf shops are scarce.

- The demand for customized and personalized surf apparel is increasing as consumers seek unique and tailored products. This trend is evident in wetsuit orders, where custom fits and designs have gained traction, accounting for around 20,000 units sold annually. Customization options, such as personalized logos and eco-friendly materials, enable brands to cater to niche segments and command higher price points.

Scope of the Report

|

By Product Type |

Surfboards Wetsuits and Rash Guards Board Shorts and Swimwear Surf Accessories Apparel |

|

By Material |

Neoprene Organic Cotton Recycled Polyester Bamboo Fiber |

|

By Distribution Channel |

Specialty Surf Shops Online Retail Department Stores Supermarkets and Hypermarkets |

|

By End User |

Professional Surfers Recreational Surfers Surf Schools and Camps |

|

By Region |

England Scotland Wales Northern Ireland |

Products

Key Target Audience

Surfing Schools and Training Centers

Surf Retail Chains and Specialty Stores

Online Retail Platforms

Surf Equipment Manufacturers

Apparel Wholesalers and Distributors

Outdoor Sportswear Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., UK Environment Agency)

Companies

Players Mentioned in the Report:

Quiksilver

Rip Curl

Finisterre

Animal

O'Neill

Billabong International

Hurley

RVCA

Volcom

Reef Sports

Table of Contents

1. UK Surfing Apparel and Accessories Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. UK Surfing Apparel and Accessories Market Size (In GBP Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. UK Surfing Apparel and Accessories Market Analysis

3.1 Growth Drivers

3.1.1 Rising Popularity of Water Sports

3.1.2 Surge in Adventure Tourism

3.1.3 Increasing Brand Endorsements

3.1.4 Sustainable and Eco-Friendly Materials

3.2 Market Challenges

3.2.1 Seasonal Demand Fluctuations

3.2.2 High Production Costs for Specialized Gear

3.2.3 Limited Skilled Workforce for Quality Production

3.3 Opportunities

3.3.1 Expansion of E-commerce Channels

3.3.2 Customization and Personalization in Apparel

3.3.3 Collaborative Initiatives with Surfing Communities

3.4 Trends

3.4.1 Adoption of Sustainable Fabrics

3.4.2 Digital Marketing & Influencer Endorsements

3.4.3 Smart Technology Integration in Accessories

3.5 Government Regulation

3.5.1 Standards for Product Safety in Surf Gear

3.5.2 Environmental Compliance for Materials

3.5.3 Consumer Protection Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. UK Surfing Apparel and Accessories Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Surfboards

4.1.2 Wetsuits and Rash Guards

4.1.3 Board Shorts and Swimwear

4.1.4 Surf Accessories (Leashes, Wax, Bags)

4.1.5 Apparel (T-shirts, Hoodies, Headwear)

4.2 By Material (In Value %)

4.2.1 Neoprene

4.2.2 Organic Cotton

4.2.3 Recycled Polyester

4.2.4 Bamboo Fiber

4.3 By Distribution Channel (In Value %)

4.3.1 Specialty Surf Shops

4.3.2 Online Retail

4.3.3 Department Stores

4.3.4 Supermarkets and Hypermarkets

4.4 By End User (In Value %)

4.4.1 Professional Surfers

4.4.2 Recreational Surfers

4.4.3 Surf Schools and Camps

4.5 By Region (In Value %)

4.5.1 England

4.5.2 Scotland

4.5.3 Wales

4.5.4 Northern Ireland

5. UK Surfing Apparel and Accessories Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Billabong

5.1.2 Quiksilver

5.1.3 Rip Curl

5.1.4 ONeill

5.1.5 Vans

5.1.6 Volcom

5.1.7 Hurley

5.1.8 Patagonia

5.1.9 Dakine

5.1.10 Roxy

5.1.11 Finisterre

5.1.12 Globe International

5.1.13 Reef

5.1.14 C-Skins

5.1.15 Saltrock

5.2 Cross Comparison Parameters (Revenue, Market Presence, Sustainability Initiatives, Product Innovation, Customer Reviews, Social Media Reach, E-commerce Ratings, Brand Endorsements)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. UK Surfing Apparel and Accessories Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. UK Surfing Apparel and Accessories Future Market Size (In GBP Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. UK Surfing Apparel and Accessories Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Material (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. UK Surfing Apparel and Accessories Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the key stakeholders in the UK Surfing Apparel and Accessories Market, supported by desk research through various proprietary and public databases. This helps in identifying core variables, including consumer preferences, product trends, and competitive dynamics.

Step 2: Market Analysis and Construction

This phase focuses on gathering and analyzing historical data, examining market penetration levels, and understanding the interplay between offline and online distribution channels. Data on product innovations and regional market dynamics is also analyzed to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts, surf shop owners, and brand representatives. These consultations provide deeper insights into trends and consumer behavior, ensuring the reliability of the market analysis.

Step 4: Research Synthesis and Final Output

In the final stage, data is synthesized to present a comprehensive view of the market. This involves validating bottom-up and top-down data through direct engagement with manufacturers and distributors, ensuring a robust and detailed analysis of the UK Surfing Apparel and Accessories market.

Frequently Asked Questions

01. How big is the UK Surfing Apparel and Accessories Market?

The UK Surfing Apparel and Accessories market is valued at USD 390 million, based on a five-year historical analysis. It is driven by the increasing popularity of surfing and rising demand for high-quality, eco-friendly surf gear.

02. What are the challenges in the UK Surfing Apparel and Accessories Market?

Challenges in the UK Surfing Apparel and Accessories market include seasonal fluctuations in demand, intense competition from international brands, and environmental concerns regarding production materials, which necessitate sustainable practices.

03. Who are the major players in the UK Surfing Apparel and Accessories Market?

Major players in the UK market include Quiksilver, Rip Curl, Finisterre, Animal, and O'Neill. These brands have maintained strong market presence through a combination of product innovation and strong distribution networks.

04. What are the growth drivers of the UK Surfing Apparel and Accessories Market?

Key growth drivers include the rising popularity of surfing as a recreational sport, growth in surf tourism, and an increasing preference for eco-friendly surf gear. The shift towards e-commerce has also significantly boosted market accessibility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.