United States Baby Care Products Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD11331

November 2024

88

About the Report

United States Baby Care Products Market Overview

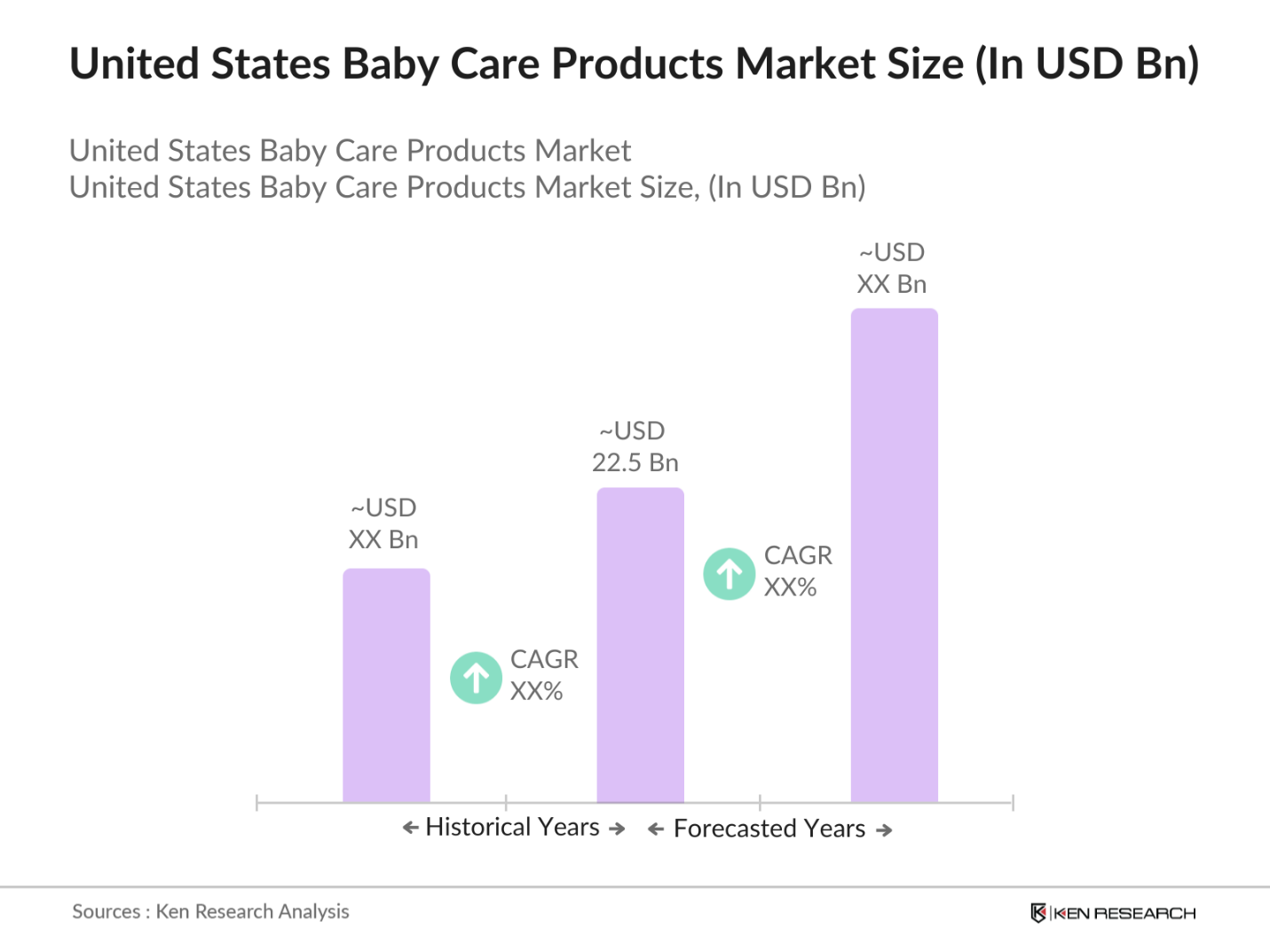

The United States baby care products market, valued at USD 22.5 billion, is driven by increasing parental awareness regarding infant health and hygiene, coupled with rising disposable incomes. The demand for premium and organic baby products has surged, reflecting a shift towards high-quality offerings that ensure safety and efficacy for infants.

Major metropolitan areas such as New York City, Los Angeles, and Chicago dominate the market due to their large populations and higher income levels. These cities exhibit a strong preference for premium baby care products, influenced by greater access to diverse product ranges and heightened health consciousness among parents.

Import and export controls have tightened, particularly on products containing chemicals in baby items. The World Customs Organization reported an increase in trade compliance inspections, influencing global logistics and distribution strategies. As of 2023, enhanced trade regulations in Europe require certification from manufacturers to ensure product safety in baby care imports.

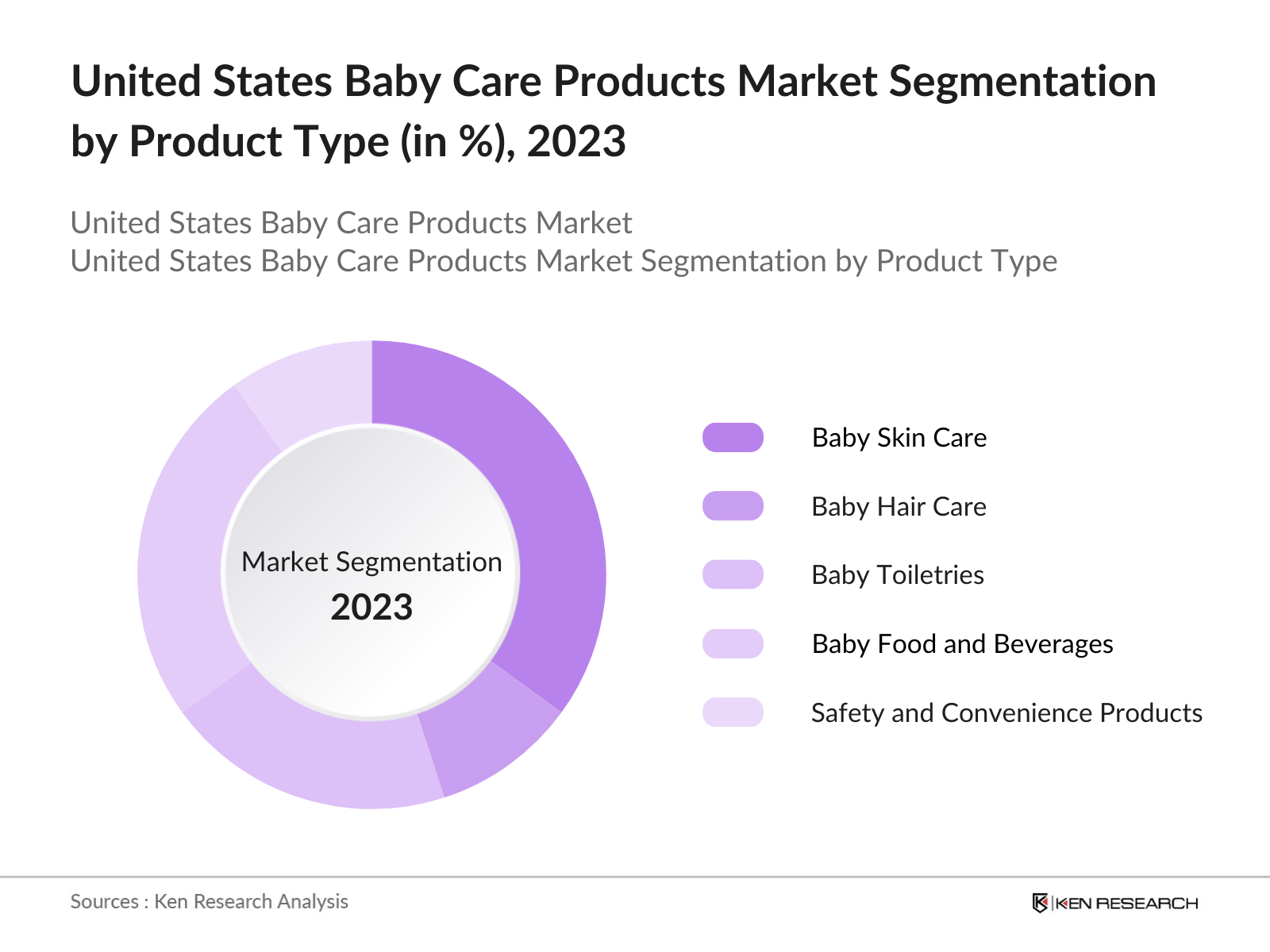

United States Baby Care Products Market Segmentation

By Product Type: The market is segmented by product type into baby skin care, baby hair care, baby toiletries, baby food and beverages, and safety and convenience products. Among these, baby skin care products hold a dominant market share, driven by the increasing focus on infant skin health and the availability of a wide range of specialized products catering to various skin needs.

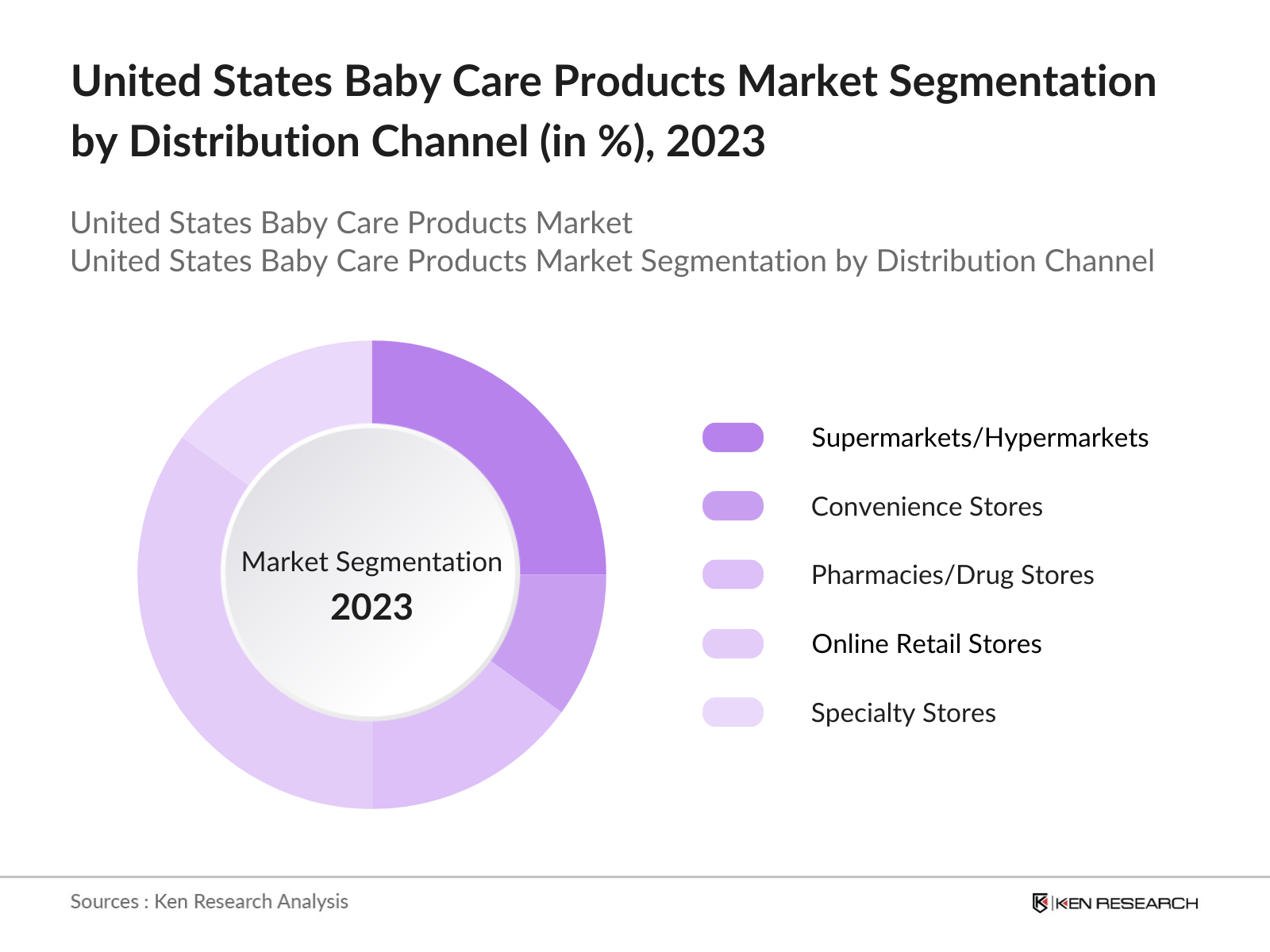

By Distribution Channel: The market is also segmented by distribution channel into supermarkets/hypermarkets, convenience stores, pharmacies/drug stores, online retail stores, and specialty stores. Online retail stores have gained significant traction, accounting for a substantial market share. This growth is attributed to the convenience of online shopping, a broader selection of products, and competitive pricing, which appeal to tech-savvy parents seeking efficient purchasing options.

United States Baby Care Products Market Competitive Landscape

The U.S. baby care products market is characterized by the presence of several key players, each contributing to the market's competitive dynamics. The table below provides an overview of five major companies, including their establishment year, headquarters, and other pertinent details:

United States Baby Care Products Market Analysis

Growth Drivers

Rising Disposable Income: Increased disposable income in key regions has positively impacted spending on baby products. As of 2024, the World Bank notes that GDP per capita in high-demand markets such as the United States, China, and Germany shows a consistent upward trend, reflecting the ability for increased household expenditure on specialized products like infant care. In China, disposable income per capita in urban households reached nearly 40,000 yuan in 2023, showing a positive trajectory that suggests more spending power among parents.

Increasing Awareness of Infant Health and Hygiene: Improved awareness surrounding infant health has seen governments and NGOs globally emphasize health standards. UNICEF reports show that campaigns across Southeast Asia have resulted in over 10 million caregivers adopting safe hygiene practices for children. Health ministries, like the U.S. Department of Health and Human Services, estimate that over 75% of new parents in developed countries now prioritize organic or hypoallergenic products for infants, supported by government advisories. UNICEF - Infant Health Campaigns Data.

Expansion of E-commerce Platforms: The rise of e-commerce has opened new channels for baby product distribution. According to the World Trade Organization (WTO), e-commerce revenue across markets including North America, Europe, and Asia has increased, with cross-border sales in baby products showing notable gains. In the Asia-Pacific region alone, digital retail accounts for over 10% of the baby care market revenue, supported by government initiatives to enhance digital connectivity.

Market Challenges

Declining Birth Rates: Birth rates in numerous developed economies continue to fall. World Bank data reflects a consistent decline in birth rates across Europe and North America. Japan's Ministry of Health also recorded fewer than 800,000 births in 2023, with projections for the U.S. indicating a similar trend as reported by the CDC. These reductions impact the baby products market, with fewer households having children requiring these items.

High Competition Among Key Players: The baby care market faces significant competition among key manufacturers, often driving up marketing costs and price sensitivity. According to the European Commissions reports on consumer goods, around 20 leading brands dominate over 50% of the market share, with competitive pressures forcing smaller players to innovate or reduce prices to remain competitive.

United States Baby Care Products Market Future Outlook

Over the next five years, the U.S. baby care products market is expected to experience steady growth, driven by continuous innovation in product offerings, increasing consumer preference for organic and natural products, and the expansion of e-commerce platforms. Companies are likely to invest in research and development to introduce products that cater to evolving consumer demands, focusing on safety, sustainability, and convenience.

Future Market Opportunities

Demand for Organic and Natural Products: As health awareness rises, the demand for organic baby products has surged. Government health advisories in the EU and U.S. recommend organic materials for baby care, and current data shows that organic product sales are growing, with 4 million U.S. households opting for chemical-free baby items.

Innovation in Product Offerings: Expanding product innovation, from eco-friendly materials to advanced baby tech, aligns with market demand. Reports from the Organisation for Economic Co-operation and Development (OECD) highlight increased research funding in baby care innovation, with 2023 data showing significant R&D investments in non-toxic materials, opening doors for novel baby care products.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Product Type |

- Baby Skin Care |

|

Age Group |

- Newborns (0-2 months) |

|

Distribution Channel |

- Supermarkets/Hypermarkets |

|

Price Range |

- Low |

|

Region |

- Northeast |

Products

Key Target Audience

Baby Care Product Manufacturers

Retailers and Distributors

Healthcare Providers

Pediatricians and Childcare Specialists

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration)

Investor and Venture Capitalist Firms

Consumer Advocacy Groups

Research and Development Organizations

Companies

Major Players

Johnson & Johnson

Procter & Gamble Co.

Kimberly-Clark Corporation

Unilever PLC

Nestl S.A.

Abbott Laboratories

Danone S.A.

Reckitt Benckiser Group plc

Unicharm Corporation

Beiersdorf AG

Sebapharma GmbH & Co. KG

The Himalaya Drug Company

Honasa Consumer Pvt. Ltd.

California Baby

Dorel Industries Inc.

Table of Contents

United States Baby Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

United States Baby Care Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

United States Baby Care Products Market Analysis

3.1. Growth Drivers

3.1.1. Rising Birth Rates

3.1.2. Increasing Disposable Income

3.1.3. Growing Awareness about Infant Hygiene

3.1.4. Expansion of E-commerce

3.2. Market Challenges

3.2.1. High Competition Among Brands

3.2.2. Rising Concerns about Product Safety

3.2.3. Regulatory Restrictions

3.3. Opportunities

3.3.1. Innovation in Organic Baby Products

3.3.2. Increasing Demand for Premium Products

3.3.3. Penetration into Rural Markets

3.4. Trends

3.4.1. Preference for Eco-Friendly Packaging

3.4.2. Integration of Technology in Baby Monitoring Devices

3.4.3. Increased Focus on Personalized Baby Products

3.5. SWOT Analysis

3.6. Porter’s Five Forces

3.7. Competition Ecosystem

United States Baby Care Products Market Segmentation

4.1. By Product Type (In Value %)

Baby Skin Care

Baby Hair Care

Baby Toiletries

Baby Food and Beverages

Safety and Convenience Products

4.2. By Age Group (In Value %)

Newborns (0-2 months)

Infants (3-12 months)

Toddlers (1-3 years)

4.3. By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Convenience Stores

Pharmacies/Drug Stores

Online Retail Stores

Specialty Stores

4.4. By Price Range (In Value %)

Low

Medium

High

4.5. By Region (In Value %)

Northeast

Midwest

South

West

United States Baby Care Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

Johnson & Johnson

Procter & Gamble

Kimberly-Clark Corporation

Nestlé

Abbott Laboratories

The Honest Company

Earth’s Best

Beiersdorf AG

Unilever

Huggies

Burt’s Bees Baby

Chicco

Philips Avent

Pigeon Corporation

Munchkin, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

United States Baby Care Products Market Regulatory Framework

6.1. Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

United States Baby Care Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

United States Baby Care Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

United States Baby Care Products Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. baby care products market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. baby care products market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple baby care product manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. baby care products market.

Frequently Asked Questions

How big is the U.S. baby care products market?

The U.S. baby care products market is valued at approximately USD 22.5 billion, driven by increasing parental awareness regarding infant health and hygiene, coupled with rising disposable incomes.

What are the challenges in the U.S. baby care products market?

Challenges in the U.S. baby care products market include declining birth rates, high competition among key players, and stringent regulatory compliance requirements. Additionally, the demand for sustainable and eco-friendly products necessitates continuous innovation and adaptation by manufacturers.

Who are the major players in the U.S. baby care products market?

Key players in the U.S. baby care products market include Johnson & Johnson, Procter & Gamble Co., Kimberly-Clark Corporation, Unilever PLC, and Nestl S.A. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

What are the growth drivers of the U.S. baby care products market?

The U.S. baby care products market is propelled by factors such as rising disposable incomes, increasing awareness of infant health and hygiene, expansion of e-commerce platforms, and technological advancements in product development. The growing preference for organic and natural products also contributes to market growth.

What trends are driving the U.S. baby care products market?

Notable trends in the U.S. baby care products market include the shift towards organic and natural products, the adoption of digital marketing strategies, and a focus on eco-friendly and sustainable baby care products. Additionally, product innovation in areas like biodegradable diapers and hypoallergenic skincare has gained momentum, meeting the demands of health-conscious parents.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.