United States Consumer Goods Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1118

November 2024

94

About the Report

United States Consumer Goods Market Overview

- The United States Consumer Goods Market is valued at USD 550 billion, driven primarily by increasing consumer demand across various categories, including food and beverages, personal care, and electronics. With a robust economy and consumer confidence, the market is fueled by innovations in product offerings, digital transformation in retail, and growing trends towards sustainability. Consumer preferences have shifted towards convenience and health-conscious products, further influencing the market's growth trajectory.

- Cities like New York, Los Angeles, and Chicago dominate the consumer goods market due to their large populations, advanced retail infrastructures, and high disposable incomes. These cities also benefit from strong e-commerce growth and diverse consumer demographics, which allow for a broad range of product categories to flourish. The purchasing power and consumption patterns in these urban hubs significantly contribute to the markets overall dominance.

- The U.S. Federal Trade Commission (FTC) enforces strict guidelines regarding product labeling and advertising to ensure transparency and protect consumers from misleading claims. In 2024, companies are required to provide clear and accurate information on packaging, especially for food and health-related products. Failure to comply with labeling laws can result in substantial fines. Retailers and manufacturers are facing growing scrutiny over health claims, sustainability credentials, and product sourcing, pushing companies to ensure all consumer communications adhere to FTC standards.

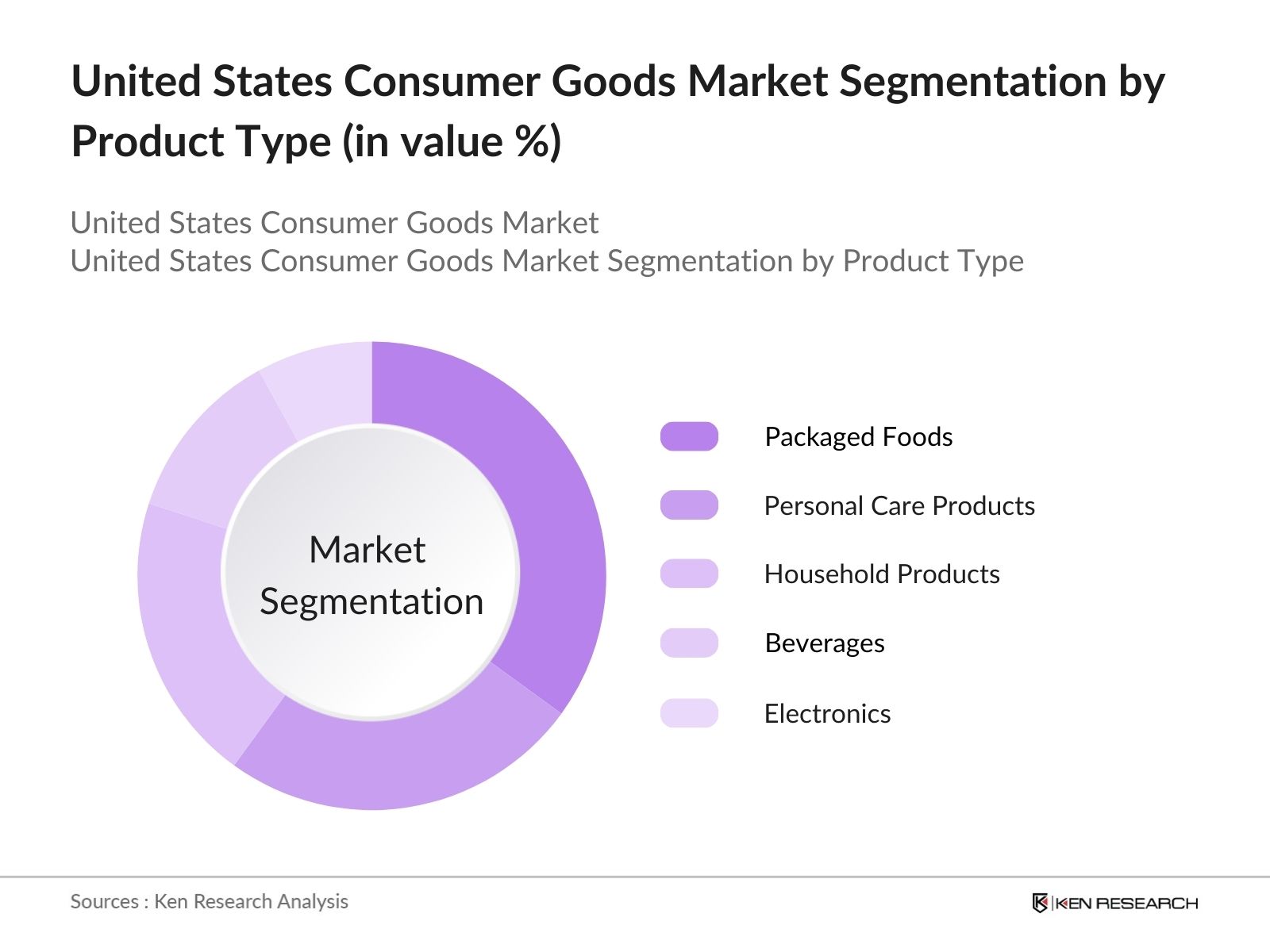

United States Consumer Goods Market Segmentation

- By Product Type: The market is segmented by product type into household products, personal care products, packaged foods, beverages, and electronics. In this segmentation, packaged foods hold a dominant market share. The growth of this sub-segment is driven by increasing consumer demand for ready-to-eat meals and snacks, alongside rising health awareness. Companies like Nestl and General Mills have introduced products catering to the health-conscious consumer, further solidifying their hold in this segment.

- By Distribution Channel: The market is also segmented by distribution channel into offline and online platforms. Online channels, led by e-commerce giants like Amazon and Walmart, have emerged as the dominant distribution segment. This shift is primarily driven by consumer convenience, the growth of mobile shopping, and the increasing adoption of digital payment systems. Retailers are leveraging data analytics to enhance personalized shopping experiences, contributing to the continued expansion of online sales.

United States Consumer Goods Market Competitive Landscape

The U.S. Consumer Goods market is characterized by intense competition among major global and domestic players, each offering diverse product portfolios to cater to the varied preferences of consumers. The consolidation of market share by a few dominant players showcases their ability to innovate and meet consumer needs.

|

Company Name |

Established |

Headquarters |

Product Portfolio |

Sustainability Initiatives |

Digital Presence |

|

Procter & Gamble |

1837 |

Cincinnati, Ohio |

|||

|

Unilever |

1929 |

London, UK |

|||

|

Johnson & Johnson |

1886 |

New Brunswick, NJ |

|||

|

PepsiCo |

1965 |

Purchase, New York |

|||

|

Nestl USA |

1866 |

Arlington, Virginia |

United States Consumer Goods Industry Analysis

Market Growth Drivers

- Rise in Disposable Income: The United States witnessed an increase in disposable personal income, reaching $18.2 trillion by mid-2024, according to the U.S. Bureau of Economic Analysis. This rise, driven by wage growth in sectors such as technology and healthcare, supports higher consumer spending on goods, including discretionary items like electronics, clothing, and household products. As income levels rise, consumers tend to shift from necessity-driven purchases to more premium, high-value products. This trend is particularly significant in urban regions, where incomes are highest, bolstering demand across the entire consumer goods spectrum.

- Increasing Online Shopping Penetration: In 2024, e-commerce continues its rapid expansion in the U.S., contributing $1.07 trillion to retail sales. Digital shopping platforms such as Amazon, Walmart, and Shopify have seen significant growth as consumer habits shift from traditional in-store shopping to online purchases. Factors such as convenience, fast delivery, and a wide range of product options have fueled this transition. Furthermore, the increase in mobile payment systems has streamlined the purchasing process, with over 210 million U.S. consumers now using smartphones for online shopping.

- Expansion of Health-Conscious Product Offerings: Health-conscious consumer behavior has grown markedly, driving the demand for organic, non-GMO, and low-sugar products. In 2024, the U.S. health food market is supported by the fact that over 93 million U.S. adults are affected by obesity, prompting higher sales of healthier food alternatives. This trend also reflects increasing attention to preventive healthcare measures. Retailers are expanding their offerings of plant-based, gluten-free, and keto-friendly products, reshaping the food and beverage landscape. This demand is particularly high in urban centers, where health and wellness trends are more prevalent.

Market Challenges

- Supply Chain Disruptions: Ongoing supply chain challenges in the U.S., exacerbated by geopolitical tensions and labor shortages, have led to disruptions in product availability across retail sectors. In 2024, transportation bottlenecks and shipping delays have impacted everything from electronics to grocery supplies. The Bureau of Transportation Statistics reported a significant decline in international container throughput, creating challenges in maintaining consistent stock levels. Retailers have had to navigate these disruptions by adopting more localized supply chains and optimizing inventory management systems to mitigate delays.

- Regulatory Hurdles: The consumer goods industry in the U.S. faces various regulatory challenges in 2024, particularly related to product safety, environmental standards, and labor laws. The Environmental Protection Agency (EPA) has tightened restrictions on packaging waste and carbon emissions for manufacturing. These regulations increase compliance costs for companies, especially in sectors such as electronics and apparel, where sustainability is becoming a key consumer demand. Furthermore, labor regulations continue to evolve, with a focus on worker protection and wage standards, creating additional compliance pressures for businesses.

United States Consumer Goods Market Future Outlook

The United States Consumer Goods Market is set to witness subtantial growth over the next five years, driven by continuous digital transformation, evolving consumer preferences, and the rising demand for sustainable and health-conscious products. With advancements in e-commerce technology, data-driven marketing strategies, and increasing investments in green products, the market is poised to expand further. The adoption of innovative retail models such as subscription services and direct-to-consumer platforms will continue to shape the future trajectory of this market.

Market Opportunities

- Growth in E-commerce and Digital Retailing: E-commerce is expected to continue its momentum, with over 20% of total retail sales projected to come from online platforms in 2024. With the rise of digital payments and mobile commerce, online retailing offers significant growth potential for brands. Consumers are increasingly favoring omnichannel experiences that integrate both online and in-store interactions. Retailers are leveraging data analytics and digital marketing tools to enhance the online shopping experience, making it a key area of opportunity for growth in the U.S. consumer goods market.

- Rising Demand for Sustainable Products: Sustainability is becoming a critical focus for U.S. consumers in 2024, with growing demand for eco-friendly and ethically produced goods. More than 85% of consumers surveyed by the National Retail Federation prefer to buy from brands that are environmentally conscious. This trend has opened new market opportunities for companies investing in sustainable practices, from recycled packaging to energy-efficient production. Retailers and manufacturers that incorporate sustainable materials and processes are better positioned to capture consumer loyalty and capitalize on the growing green market.

Scope of the Report

Products

Key Target Audience

Consumer Goods Manufacturers

Retailers and E-commerce Platforms

Marketing and Advertising Agencies

Government and Regulatory Bodies (FTC, FDA)

Investment and Venture Capitalist Firms

Logistics and Supply Chain Companies

Sustainability and Environmental Advocacy Groups

Packaging and Raw Material Suppliers

Companies

Players mention in the Report:

Procter & Gamble

Unilever

Colgate-Palmolive

Johnson & Johnson

PepsiCo

Coca-Cola Company

Nestl USA

Kimberly-Clark Corporation

General Mills

Mars, Inc.

Kraft Heinz Company

Newell Brands

Amazon

Target Corporation

Walmart

Table of Contents

1. United States Consumer Goods Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. United States Consumer Goods Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. United States Consumer Goods Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Disposable Income

3.1.2. Increasing Online Shopping Penetration

3.1.3. Expansion of Health-Conscious Product Offerings

3.1.4. Technological Advancements in Retail

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Hurdles

3.2.3. Inflationary Pressures

3.3. Opportunities

3.3.1. Growth in E-commerce and Digital Retailing

3.3.2. Rising Demand for Sustainable Products

3.3.3. Personalization and Data-Driven Marketing

3.4. Trends

3.4.1. Subscription-Based Models

3.4.2. Eco-Friendly and Ethical Consumerism

3.4.3. Increased Investment in Smart Packaging

3.5. Government Regulation

3.5.1. Consumer Protection and Labeling Laws

3.5.2. Tariffs Impacting Imports

3.5.3. FTC Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. United States Consumer Goods Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Household Products

4.1.2. Personal Care Products

4.1.3. Packaged Foods

4.1.4. Beverages

4.1.5. Electronics

4.2. By Distribution Channel (In Value %)

4.2.1. Offline (Supermarkets, Specialty Stores)

4.2.2. Online (E-Commerce, Direct Sales)

4.3. By Consumer Group (In Value %)

4.3.1. Millennials

4.3.2. Gen Z

4.3.3. Baby Boomers

4.4. By Purchase Mode (In Value %)

4.4.1. In-Store

4.4.2. Online

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. United States Consumer Goods Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble

5.1.2. Unilever

5.1.3. Johnson & Johnson

5.1.4. PepsiCo

5.1.5. Nestl USA

5.1.6. Coca-Cola Company

5.1.7. Kimberly-Clark Corporation

5.1.8. General Mills

5.1.9. Mars, Inc.

5.1.10. Kraft Heinz Company

5.1.11. Newell Brands

5.1.12. Amazon

5.1.13. Target Corporation

5.1.14. Walmart

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Innovation Index, Sustainability Initiatives, E-Commerce Strategies, Global Presence, Consumer Satisfaction)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

5.8. Government Grants

6. United States Consumer Goods Market Regulatory Framework

6.1. Consumer Protection Regulations

6.2. Compliance with Product Labeling Standards

6.3. Sustainability Regulations

6.4. Certification Processes

7. United States Consumer Goods Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. United States Consumer Goods Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Purchase Mode (In Value %)

8.5. By Region (In Value %)

9. United States Consumer Goods Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Digital Marketing Strategies

Research Methodology

Step 1: Identification of Key Variables

The research began by mapping out all major stakeholders within the U.S. Consumer Goods market. This step included a comprehensive review of the entire value chain, gathering insights from various secondary sources, including proprietary databases and industry reports, to identify critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to market penetration and consumer trends were analyzed. This also involved evaluating revenue generation, distribution channels, and regional consumption patterns to derive reliable market estimates and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from top consumer goods manufacturers and retailers. These consultations provided financial and operational insights, helping to refine and validate our assumptions.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with key market players enabled the cross-verification of collected data. This ensured that the final report included accurate, validated insights into the current and future market landscape.

Frequently Asked Questions

01. How big is the United States Consumer Goods Market?

The U.S. consumer goods market is valued at USD 550 billion, driven by rising consumer demand, digital transformation, and a growing focus on sustainability.

02. What are the challenges in the U.S. Consumer Goods Market?

Challenges include supply chain disruptions, rising inflation, and increasing regulatory scrutiny. Companies also face growing pressure to adopt sustainable practices to meet consumer and governmental demands.

03. Who are the major players in the U.S. Consumer Goods Market?

Key players in The U.S. consumer goods market include Procter & Gamble, Unilever, Johnson & Johnson, PepsiCo, and Nestl USA, known for their diverse product portfolios and strong brand presence.

04. What are the growth drivers of the U.S. Consumer Goods Market?

The U.S. consumer goods market Growth is propelled by increasing consumer spending, innovations in product offerings, and the rising popularity of online shopping. Health-conscious trends and eco-friendly products also boost market growth.

05. What are the dominant segments in the U.S. Consumer Goods Market?

Packaged foods and online distribution channels dominate the U.S. consumer goods market due to their widespread demand and convenience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.