United States E-Bike Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD8245

December 2024

87

About the Report

United States E-Bike Market Overview

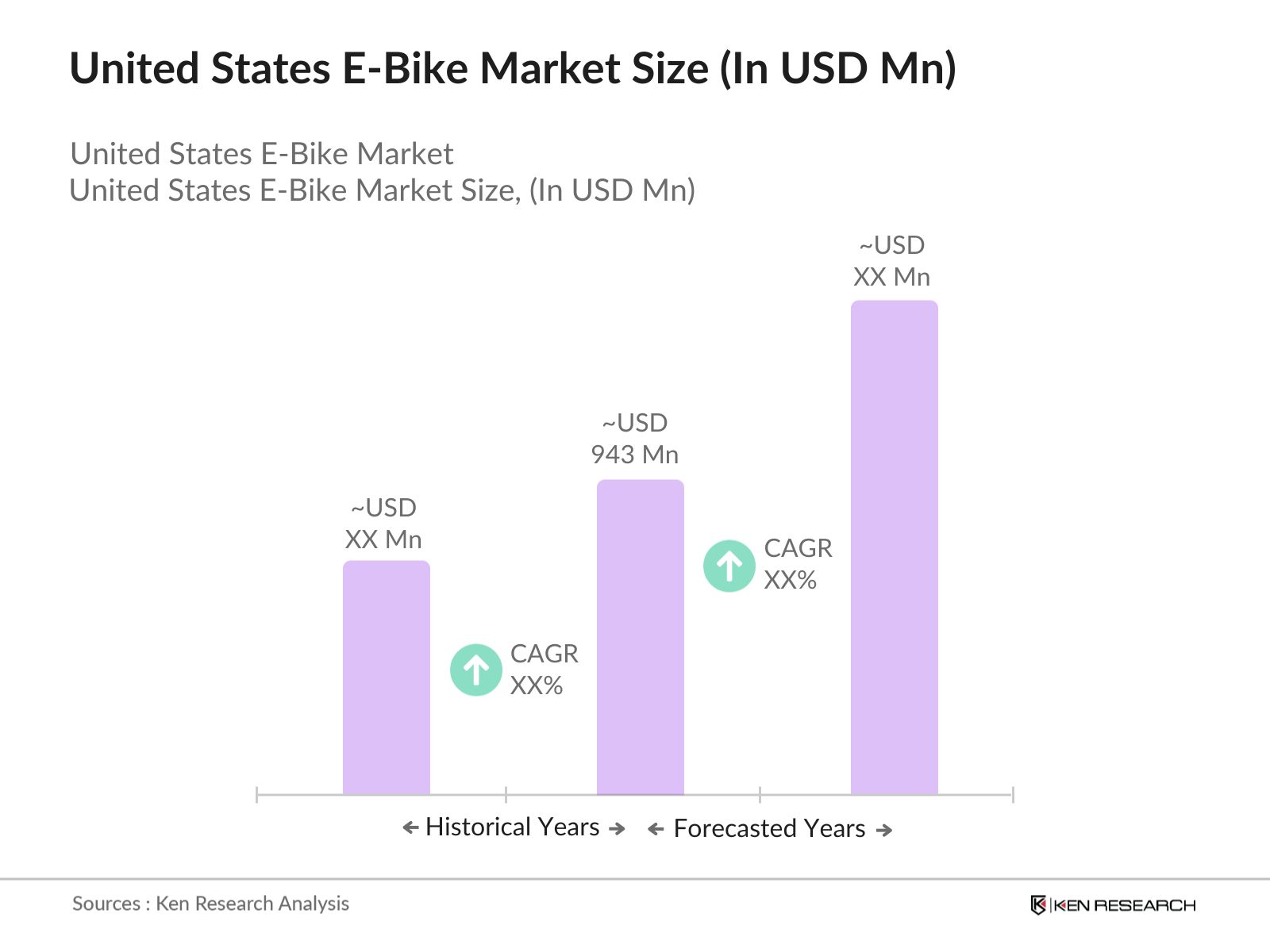

- The United States E-Bike market is valued at USD 943 million, based on a five-year historical analysis. This market is primarily driven by the increasing demand for eco-friendly transportation solutions and government incentives to promote electric vehicle (EV) adoption. Consumers are shifting toward e-bikes due to rising fuel prices, urban traffic congestion, and a growing focus on sustainability. Moreover, technological advancements in battery efficiency and motor power have further propelled the market's growth, making e-bikes a preferred choice for short-distance commutes.

- The United States E-Bike market sees dominance in cities such as New York, San Francisco, and Portland due to strong urban infrastructure, environmental awareness, and high disposable income. These cities also offer extensive cycling lanes, which makes commuting by e-bikes easier. Additionally, the West Coast, with its tech-forward consumers and green transportation policies, leads in e-bike adoption. States like California continue to invest in EV infrastructure and offer generous subsidies, further contributing to their dominance in the market.

- The U.S. federal government offers tax credits of up to $1,500 per e-bike purchase, significantly reducing the upfront cost for consumers. In 2023, this tax incentive was part of the broader Green Energy initiative aimed at reducing carbon emissions by promoting electric mobility. The Internal Revenue Service reported that over 100,000 e-bike purchases in 2023 benefitted from this tax credit, helping to boost sales and make e-bikes more affordable for a wider audience.

United States E-Bike Market Segmentation

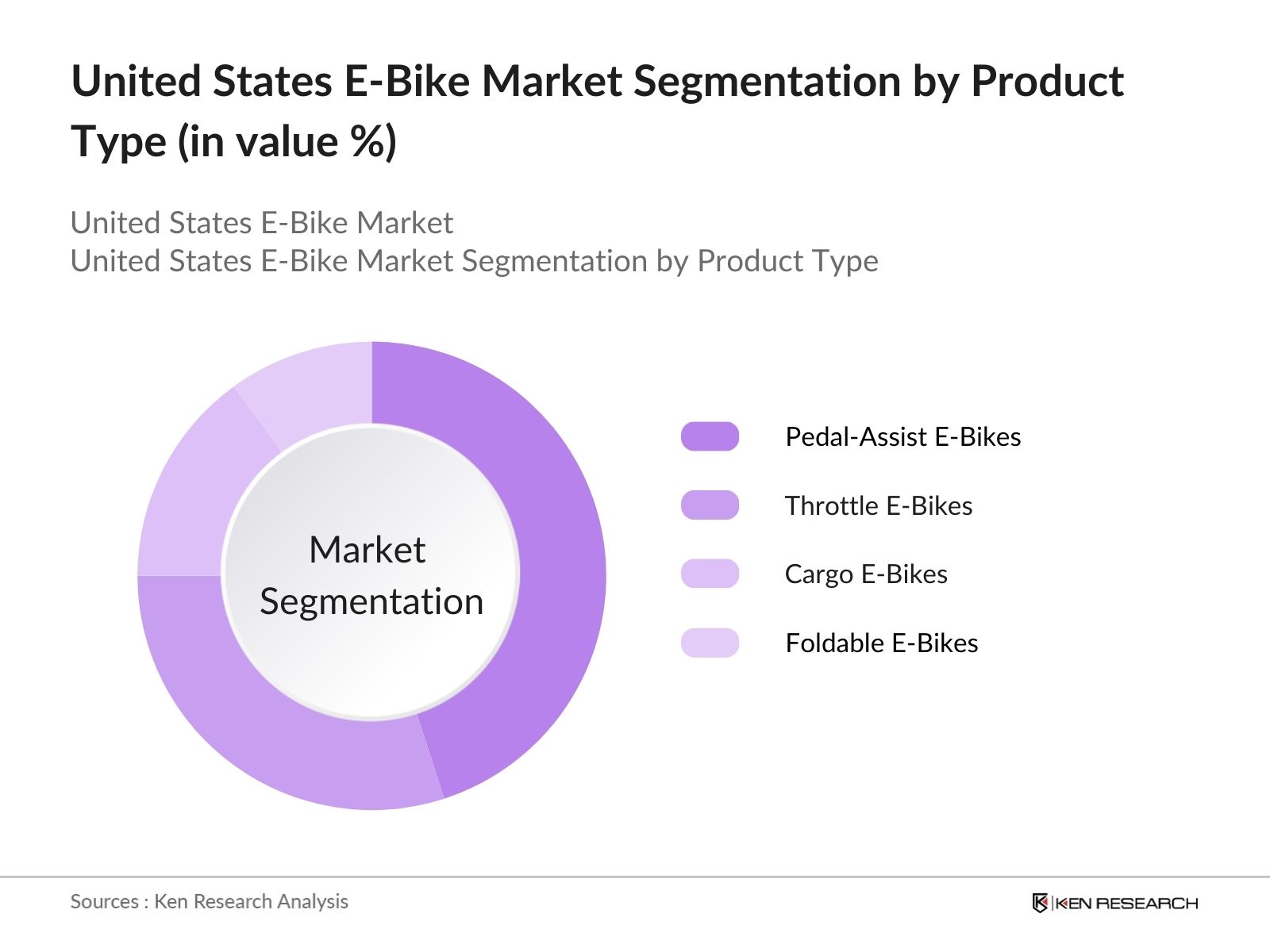

- By Product Type The market is segmented by product type into pedal-assist e-bikes, throttle e-bikes, cargo e-bikes, and foldable e-bikes. Recently, pedal-assist e-bikes have dominated the market under this segmentation. Their popularity stems from their intuitive design and ability to extend battery life by using pedaling power. This segment is ideal for urban commuters who want the benefits of electric mobility but prefer a workout option, aligning with health-conscious consumers.

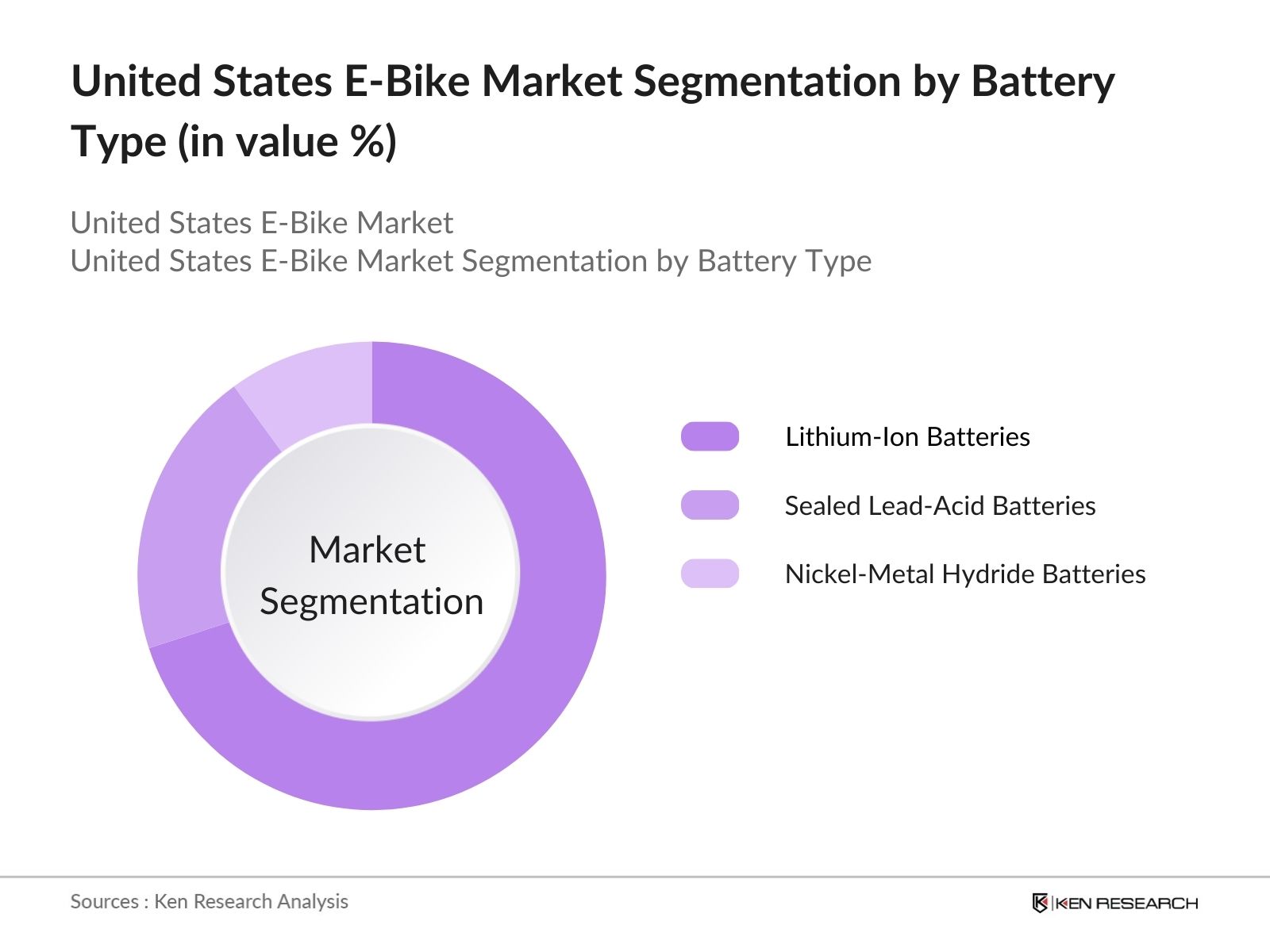

- By Battery Type The market is segmented by battery type into lithium-ion batteries, sealed lead-acid batteries, and nickel-metal hydride batteries. Lithium-ion batteries dominate the market under this segmentation due to their lightweight, higher energy density, and longer lifespan. The improved charging times and enhanced power-to-weight ratio of lithium-ion batteries make them the preferred choice for consumers and manufacturers alike, propelling their dominance in the market.

United States E-Bike Market Competitive Landscape

The United States E-Bike market is characterized by a few major players who have consolidated their market position through innovation, brand loyalty, and strong distribution networks. The landscape includes a mix of traditional bicycle manufacturers, EV companies, and newer startups focusing solely on e-bikes. Companies such as Trek Bicycle Corporation and Rad Power Bikes have led the market due to their established customer base and consistent product innovations. New entrants like Aventon Bikes and Juiced Bikes continue to gain traction through their focus on affordability and style.

|

Company |

Establishment Year |

Headquarters |

Battery Technology |

Motor Power Range |

|

Trek Bicycle Corporation |

1976 |

Waterloo, Wisconsin |

||

|

Rad Power Bikes |

2007 |

Seattle, Washington |

||

|

Specialized Bicycle Components |

1974 |

Morgan Hill, California |

||

|

Aventon Bikes |

2012 |

Ontario, California |

||

|

Juiced Bikes |

2009 |

Chula Vista, California |

United States E-Bike Industry Analysis

Market Growth Drivers

- Urban Mobility Shift: The U.S. is witnessing a transformation in urban mobility, with over 75% of urban areas implementing plans to reduce car dependency in favor of sustainable alternatives like e-bikes. New York, for instance, has allocated $500 million to promote electric mobility by constructing bike lanes and dedicated infrastructure in 2023. Cities like Los Angeles and Chicago are also promoting shared mobility models that incorporate electric bicycles into public transport networks, further driving e-bike adoption. As of 2024, government-backed urban mobility plans support e-bike growth by streamlining infrastructure and reducing emissions.

- Government Incentives for EV Adoption: Government incentives are playing a critical role in boosting e-bike sales across the U.S. For instance, the federal government offers a tax credit of up to $1,500 per e-bike purchase, as part of the broader initiative to promote electric vehicles. In 2023, California allocated $10 million to fund e-bike rebate programs, targeting low-income residents. The Biden administration's clean energy goals further allocate $7 billion towards electric mobility programs, including e-bikes, by investing in infrastructure upgrades and incentivizing adoption.

- Expansion of Dedicated Bike Lanes and Paths: The U.S. Department of Transportation has committed to expanding bike lane infrastructure, with over 3,000 miles of new bike paths being constructed across major cities in 2023. New York City saw an investment of $1 billion in its bike lane expansion project, making e-bikes a viable and safe option for commuters. Additionally, cities like Portland and San Francisco have pledged to increase their bike lane networks by 15% by 2025, ensuring safe passage for e-bike riders and encouraging greater usage.

Market Challenges

- High Initial Costs: Despite government incentives, the high initial cost of e-bikes remains a barrier to widespread adoption. The average cost of a high-quality e-bike in the U.S. is between $1,500 and $3,000, which is out of reach for many consumers, even with tax credits. In 2023, a report by the U.S. Energy Department revealed that the upfront costs of electric mobility devices, including e-bikes, remain a significant challenge, particularly in lower-income areas where uptake has been slower.

- Limited Charging Infrastructure: Charging infrastructure for e-bikes is still limited in the U.S., particularly in rural and suburban areas. According to the Department of Energys 2023 report, less than 10% of public charging stations are equipped for electric bicycles. Cities like Boston and Miami have plans to increase charging points, but this will take time to implement. As of 2024, only 25% of major U.S. cities have adequate infrastructure to support e-bike charging, highlighting a critical gap that could slow down market growth.

United States E-Bike Market Future Outlook

Over the next five years, the United States E-Bike market is expected to witness significant growth. This can be attributed to increased government support through tax credits, advancing battery technologies, and a rise in consumer awareness regarding eco-friendly transportation. E-bikes are increasingly seen as a viable alternative to cars for urban commuting, reducing both traffic congestion and carbon emissions. Moreover, improvements in battery life and motor efficiency will further drive adoption, especially in cities where e-bikes can be integrated with public transport systems.

Market Opportunities

- Advancements in Battery Technology: Technological innovations in battery technology present a significant opportunity for the U.S. e-bike market. In 2023, advancements in solid-state batteries, which are lighter, charge faster, and offer longer range, began to enter the e-bike market. Companies like Tesla and QuantumScape are exploring partnerships with e-bike manufacturers to commercialize these batteries by 2024. The U.S. Department of Energy allocated $2 billion towards research in advanced battery technologies, which is expected to benefit the e-bike industry by offering more efficient power solutions.

- Rising Interest in Subscription Models: Subscription-based models for e-bikes are gaining traction in the U.S., particularly in urban areas. By 2023, companies like Swapfiets had launched subscription services, allowing users to rent e-bikes for a fixed monthly fee. These models cater to the growing demand for flexible, low-commitment transport options and are particularly popular in cities like New York and Los Angeles. According to the Federal Highway Administration, subscription-based e-bike services grew by 35% in 2023, offering significant potential for the expansion of the e-bike market.

Scope of the Report

|

Pedal-Assist E-Bikes Throttle E-Bikes Cargo E-Bikes Foldable E-Bikes |

|

|

By Battery Type |

Lithium-Ion Batteries Sealed Lead-Acid Batteries Nickel-Metal Hydride Batteries |

|

By Consumer Age Group |

Personal Commuting E-Commerce Deliveries Tourism and Recreational Use Ride-Sharing Services |

|

By Nicotine Content |

Below 250W 250W to 500W Above 500W |

|

By Region |

North East West South |

Products

Key Target Audience

Electric Vehicle Manufacturers

E-Bike Component Suppliers

Urban Mobility Solution Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Transportation, Environmental Protection Agency)

Retail and E-Commerce Companies

Public Transport Authorities

Fleet Management Companies

Companies

Major Players

Trek Bicycle Corporation

Rad Power Bikes

Specialized Bicycle Components

Aventon Bikes

Juiced Bikes

Bosch eBike Systems

Giant Bicycles Inc.

Pedego Electric Bikes

Cannondale

Yamaha Motor Corporation

Gazelle Bicycles

Shimano Inc.

Brompton Bicycle Ltd.

Riese & Mller

Bafang Electric

Table of Contents

1. United States E-Bike Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. United States E-Bike Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. United States E-Bike Market Analysis

3.1. Growth Drivers (Electric Mobility Demand, Sustainability Goals, Infrastructure Developments)

3.1.1. Urban Mobility Shift

3.1.2. Government Incentives for EV Adoption

3.1.3. Rise in Environmental Consciousness

3.1.4. Expansion of Dedicated Bike Lanes and Paths

3.2. Market Challenges (Battery Technology, Supply Chain, Infrastructure Gaps)

3.2.1. High Initial Costs

3.2.2. Limited Charging Infrastructure

3.2.3. Battery Recycling Challenges

3.2.4. Component Shortages

3.3. Opportunities (Technological Innovation, Aftermarket Expansion, Global Partnerships)

3.3.1. Advancements in Battery Technology

3.3.2. Rising Interest in Subscription Models

3.3.3. Opportunities in Rural and Suburban Markets

3.3.4. Growth in Fleet Management Services

3.4. Trends (Connected E-Bikes, Lightweight Materials, Ride-Sharing Platforms)

3.4.1. Integration of Smart Features (IoT, GPS)

3.4.2. Use of Carbon Fiber for Frame Construction

3.4.3. Rise of E-Bike Sharing Services

3.5. Government Regulation (Subsidies, Emission Standards, Urban Planning)

3.5.1. Federal Tax Credits for E-Bike Purchases

3.5.2. Emissions Reduction Targets for Urban Areas

3.5.3. Infrastructure Projects for Sustainable Transport

3.5.4. Public-Private Partnerships for Green Mobility

4. United States E-Bike Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pedal-Assist E-Bikes

4.1.2. Throttle E-Bikes

4.1.3. Cargo E-Bikes

4.1.4. Foldable E-Bikes

4.2. By Battery Type (In Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Sealed Lead-Acid Batteries

4.2.3. Nickel-Metal Hydride Batteries

4.3. By Application (In Value %)

4.3.1. Personal Commuting

4.3.2. E-Commerce Deliveries

4.3.3. Tourism and Recreational Use

4.3.4. Ride-Sharing Services

4.4. By Motor Power (In Value %)

4.4.1. Below 250W

4.4.2. 250W to 500W

4.4.3. Above 500W

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. United States E-Bike Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Trek Bicycle Corporation

5.1.2. Giant Bicycles Inc.

5.1.3. Pedego Electric Bikes

5.1.4. Rad Power Bikes

5.1.5. Aventon Bikes

5.1.6. Specialized Bicycle Components

5.1.7. Juiced Bikes

5.1.8. Cannondale

5.1.9. Brompton Bicycle Ltd.

5.1.10. Yamaha Motor Corporation

5.1.11. Gazelle Bicycles

5.1.12. Bosch eBike Systems

5.1.13. Bafang Electric

5.1.14. Shimano Inc.

5.1.15. Riese & Mller

5.2. Cross Comparison Parameters (Battery Capacity, Motor Power, Production Capacity, Innovation Index, Distribution Channels, Revenue, Global Footprint, R&D Spending)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. United States E-Bike Market Regulatory Framework

6.1. Road Safety Regulations

6.2. Federal & State Compliance

6.3. Industry Certification Standards (UL, EN Standards)

6.4. Licensing and Registration Requirements

7. United States E-Bike Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. United States E-Bike Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Battery Type (In Value %)

8.3. By Application (In Value %)

8.4. By Motor Power (In Value %)

8.5. By Region (In Value %)

9. United States E-Bike Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the e-bike ecosystem in the United States. This includes identifying key variables such as consumer preferences, government policies, and technology innovations that impact market dynamics. Primary research, supplemented by secondary data from proprietary databases, helps in creating a comprehensive market overview.

Step 2: Market Analysis and Construction

During this phase, historical data on the market is compiled, including key metrics such as market size, product penetration, and geographic reach. This analysis focuses on factors such as product innovation and demand across different regions, ensuring reliable revenue estimation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are then validated through interviews with industry experts from leading companies in the e-bike space. These consultations offer insights into the latest trends, challenges, and market opportunities, ensuring a well-rounded analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research insights obtained through primary and secondary sources. A bottom-up approach is used to validate the market size and growth drivers, ensuring a complete and accurate analysis of the United States E-Bike market.

Frequently Asked Questions

01. How big is the United States E-Bike Market?

The United States E-Bike market is valued at USD 943 million. This growth is driven by an increase in urban mobility needs, rising environmental awareness, and the implementation of government subsidies for electric vehicles.

02. What are the key growth drivers in the United States E-Bike Market?

The primary drivers of the United States E-Bike market include government incentives for electric mobility, advances in battery technology, and the rising popularity of e-bikes for short-distance commuting in urban areas.

03. What are the challenges in the United States E-Bike Market?

Challenges in the United States E-Bike market include high initial costs, limited charging infrastructure, and issues related to battery recycling. Additionally, there is a lack of widespread consumer awareness in rural areas.

04. Who are the major players in the United States E-Bike Market?

Major players in the market include Trek Bicycle Corporation, Rad Power Bikes, Specialized Bicycle Components, Aventon Bikes, and Juiced Bikes. These companies dominate due to their innovation, strong brand presence, and extensive distribution networks.

05. What are the trends in the United States E-Bike Market?

The integration of IoT technology into e-bikes, the use of lightweight materials such as carbon fiber for frames, and the rise of e-bike sharing services are key trends shaping the United States E-Bike market.

06. What opportunities exist in the United States E-Bike Market?

Opportunities in the market include the expansion of e-bike fleet services, advancements in battery technology, and growth in suburban and rural markets as e-bikes become more accessible and affordable.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.