Region:North America

Author(s):Geetanshi

Product Code:KRAA1316

Pages:86

Published On:August 2025

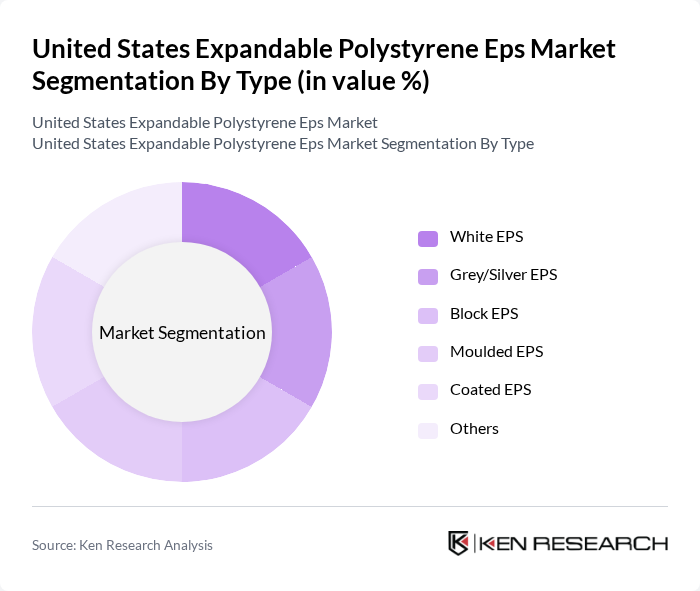

By Type:The market is segmented into various types of EPS, each serving distinct applications and industries. The primary subsegments include White EPS, Grey/Silver EPS, Block EPS, Moulded EPS, Coated EPS, and Others. Among these, White EPS is the most widely used due to its cost-effectiveness and excellent insulation properties, making it a preferred choice in construction and packaging .

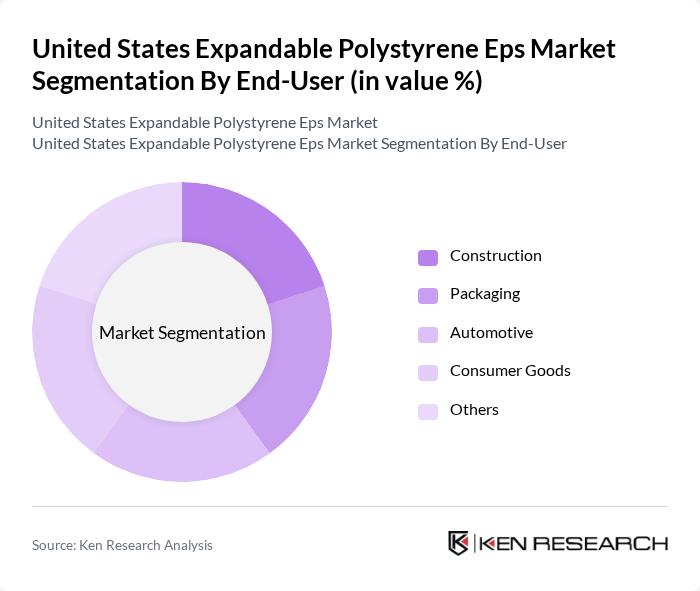

By End-User:The EPS market is further segmented by end-user industries, including Construction, Packaging, Automotive, Consumer Goods, and Others. The construction sector is the leading end-user, driven by the increasing demand for insulation materials in residential and commercial buildings, as well as the growing trend of energy-efficient construction practices. Packaging remains a significant segment due to the rise in e-commerce and demand for protective packaging in electronics, food, and consumer goods .

The United States Expandable Polystyrene EPS market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Corporation, The Dow Chemical Company, TotalEnergies SE, INEOS Styrolution Group GmbH, Knauf Insulation, ACH Foam Technologies (A BEWI Company), JSP Corporation, Sika AG, Sunpor Kunststoff GmbH, Expanded Polystyrene Inc., Cellofoam North America, Inc., Insulfoam (A Carlisle Company), Styrofoam Products, Inc., Rmax Operating, LLC, and Foam Products Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. expandable polystyrene (EPS) market appears promising, driven by technological advancements and a growing emphasis on sustainability. As the construction industry increasingly adopts energy-efficient materials, EPS is likely to see expanded applications in insulation and packaging. Additionally, the ongoing development of recycling technologies will enhance the material's sustainability profile, making it more appealing to environmentally conscious consumers and businesses. This trend is expected to shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | White EPS Grey/Silver EPS Block EPS Moulded EPS Coated EPS Others |

| By End-User | Construction Packaging Automotive Consumer Goods Others |

| By Application | Insulation (Building & Construction) Packaging Solutions (Food, Electronics, Pharmaceutical, E-commerce) Building Materials (Panels, Roofing, Geofoam) Automotive Parts (Safety, Lightweight Components) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Northeast Midwest South West Others |

| By Product Form | Sheets Blocks Custom Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry EPS Usage | 100 | Project Managers, Architects, Contractors |

| Packaging Sector Insights | 80 | Product Managers, Supply Chain Coordinators |

| Automotive Applications of EPS | 60 | Design Engineers, Procurement Specialists |

| Insulation Market Analysis | 90 | Building Inspectors, Energy Efficiency Consultants |

| Recycling and Sustainability Practices | 50 | Sustainability Managers, Environmental Compliance Officers |

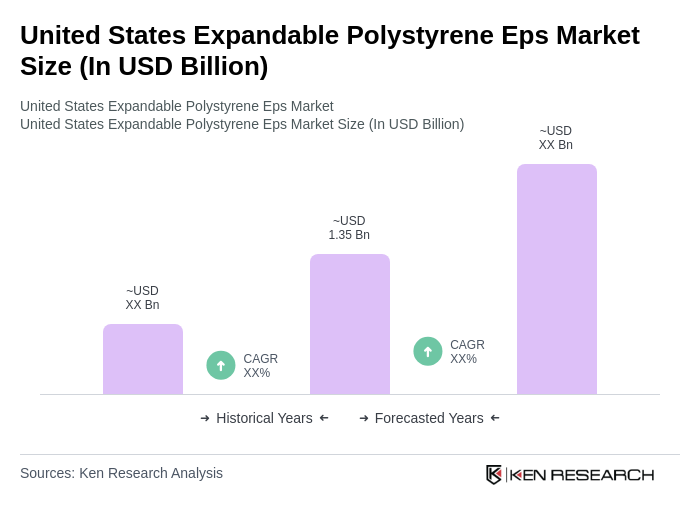

The United States Expandable Polystyrene (EPS) market is valued at approximately USD 1.35 billion, reflecting a significant growth trend driven by demand in construction, packaging, and automotive sectors, particularly for lightweight and energy-efficient materials.