United States Gelatin Substitute Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD8215

December 2024

83

About the Report

USA Gelatin Substitute Market Overview

- The USA gelatin substitute market is valued at USD 7.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for plant-based and vegan alternatives as more consumers shift towards health-conscious and environmentally sustainable diets. The rise of food allergies and sensitivities, particularly to animal-derived products, has accelerated the adoption of substitutes like agar-agar, pectin, and carrageenan. Additionally, the growing trend for clean-label products has boosted the popularity of gelatin substitutes in various food and beverage applications, including confectionery, dairy, and pharmaceuticals.

- The USA market is dominated by states like California, New York, and Texas, which are hubs for food innovation, large-scale food production, and consumer preferences for plant-based and sustainable products. California, in particular, is home to numerous food technology companies and a high concentration of health-conscious consumers, which has positioned it as a leader in the gelatin substitute market. Furthermore, Texas and New York have seen strong growth due to increasing demand from both food manufacturers and consumers seeking alternatives to animal-derived ingredients.

- The FDA closely regulates food additives, including gelatin substitutes, to ensure they meet safety standards for human consumption. As per the FDA's Food Additive Status List, new gelatin substitutes must undergo extensive safety testing before receiving approval for commercial use. This process ensures that gelatin substitutes meet strict safety guidelines, providing consumers with confidence in the products they purchase. The FDA's regulatory oversight helps maintain high-quality standards for gelatin substitutes in the U.S. market.

USA Gelatin Substitute Market Segmentation

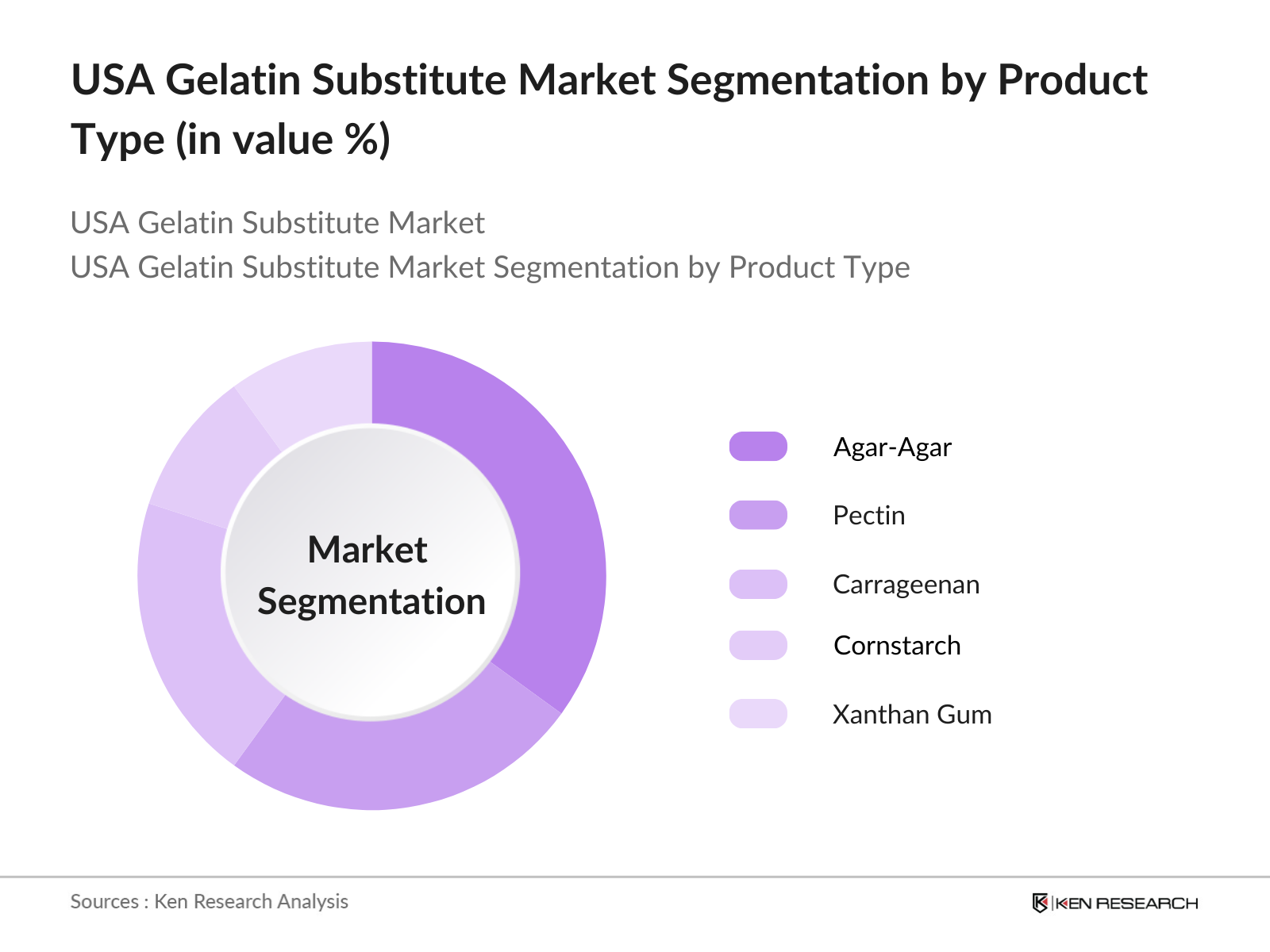

- By Product Type: The USA gelatin substitute market is segmented by product type into agar-agar, pectin, carrageenan, cornstarch, and xanthan gum. Among these, agar-agar holds a dominant market share due to its versatile application in food processing and its ability to replicate the texture and properties of gelatin effectively. Agar-agar is extensively used in confectionery, dairy, and plant-based products, especially in the vegan food industry. Its popularity stems from its plant-based origin, making it highly favored among consumers avoiding animal products. It also offers health benefits, including low-calorie content and digestive advantages, making it a preferred choice for health-conscious buyers.

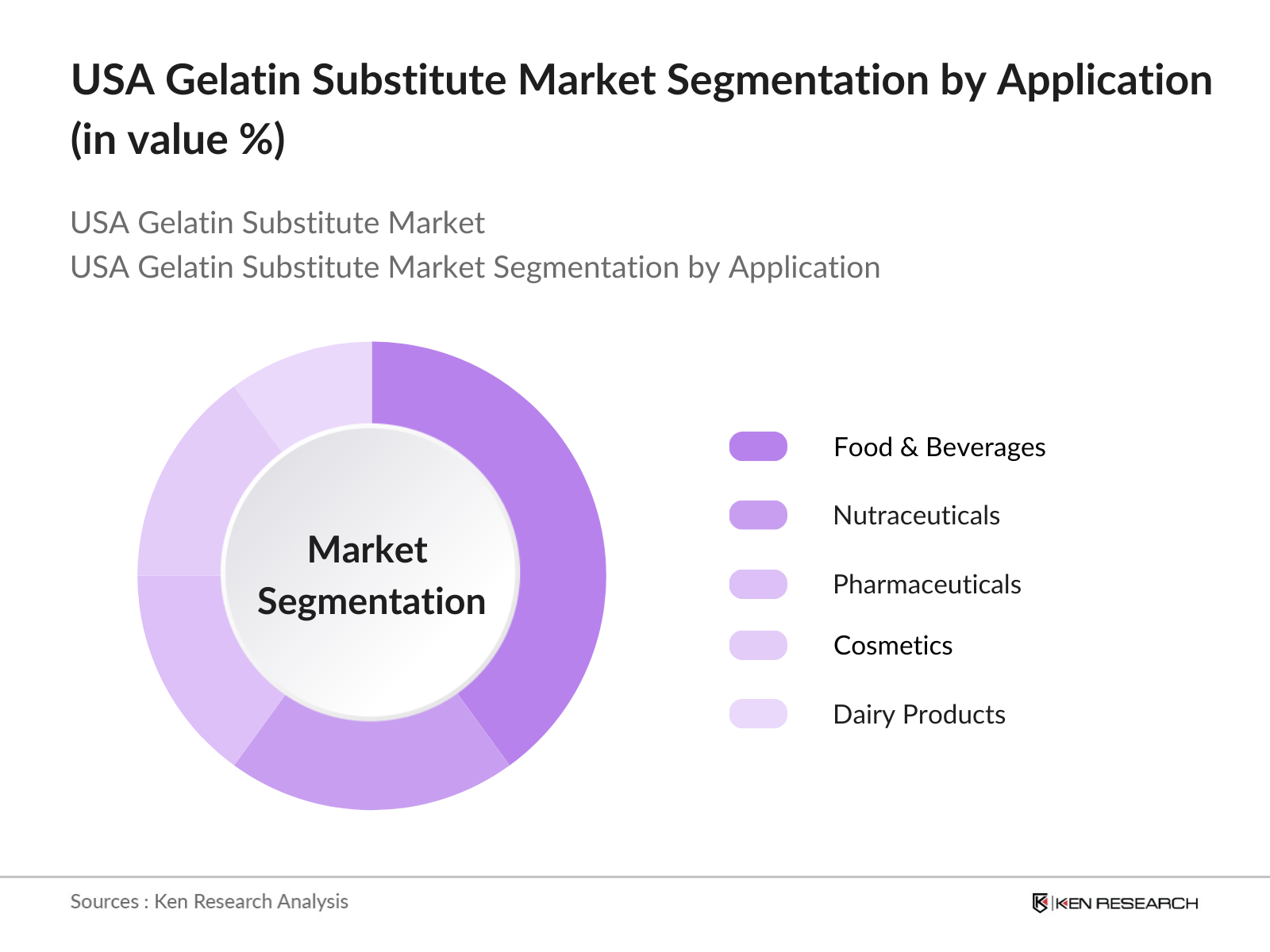

- By Application: The USA gelatin substitute market is segmented by application into food & beverages, nutraceuticals, pharmaceuticals, cosmetics, and dairy products. Food & beverages dominate the market due to the high demand for plant-based alternatives in confectionery, desserts, and dairy products. The increasing consumer preference for vegan and organic products has driven the adoption of gelatin substitutes in this segment. Furthermore, the rise in health-consciousness and the need for functional ingredients in food items have led to the increased use of gelatin alternatives in this segment.

USA Gelatin Substitute Market Competitive Landscape

The USA gelatin substitute market is competitive, with several key players dominating the landscape. These companies lead due to their strong research and development capabilities, broad product portfolios, and significant investments in plant-based food innovations. The market is characterized by the presence of both large multinational corporations and specialized companies focusing on alternative ingredients.

USA Gelatin Substitute Market Analysis

USA Gelatin Substitute Market Growth Drivers

- Shift Towards Plant-based Alternatives: The increasing shift towards plant-based alternatives is being driven by a growing awareness of the environmental and ethical impact of animal-based gelatin. As of 2024, over 9 million people in the USA identify as vegan or vegetarian, according to recent USDA data. The demand for plant-based gelatin substitutes, like agar-agar and pectin, has significantly increased in response to these dietary changes. This trend aligns with broader sustainability goals, with nearly 25% of U.S. consumers actively seeking plant-based food products as of 2023, reported by the USDA.

- Rising Health and Wellness Trends: Health-conscious consumers are opting for gelatin substitutes due to concerns over the potential health risks associated with animal-derived gelatin. According to the National Health and Nutrition Examination Survey, 78% of U.S. adults report actively managing their diets to improve health, which has fueled the demand for plant-based alternatives. Additionally, the consumption of gelatin substitutes has risen in correlation with the growing preference for products perceived as healthier and more natural, such as organic plant-based proteins. This shift highlights the growing consumer inclination towards gelatin substitutes in line with health trends.

- Sustainability and Environmental Awareness: Gelatin production is heavily linked to livestock farming, which contributes to environmental degradation. The U.S. Environmental Protection Agency (EPA) indicates that livestock farming is responsible for 11% of total greenhouse gas emissions in the U.S., which is pushing consumers toward plant-based alternatives that have a lower environmental impact. The USDA reports that 43% of consumers are more likely to purchase a product if it's marketed as environmentally sustainable, demonstrating the growing demand for gelatin substitutes that align with sustainability goals.

USA Gelatin Substitute Market Challenges

- Regulatory Approvals and Compliance: One of the major hurdles for gelatin substitute manufacturers is navigating the strict regulatory landscape in the USA. The U.S. Food and Drug Administration (FDA) regulates food additives, including gelatin substitutes, and securing approval for new ingredients can be a lengthy and costly process. According to the FDA, it can take up to 24 months to complete the full review and approval process for new food additives, which creates significant delays for companies looking to introduce innovative substitutes.

- High Production Costs: The production of plant-based gelatin substitutes, such as agar and pectin, remains expensive due to the higher cost of sourcing raw materials. According to the USDA, production costs for plant-based substitutes can be 30% to 50% higher than traditional animal-based gelatin, primarily due to the specialized processing and supply chain complexities involved in sourcing plant-based ingredients. This cost disparity remains a significant barrier to wider adoption among manufacturers.

USA Gelatin Substitute Market Future Outlook

Over the next five years, the USA gelatin substitute market is expected to show significant growth driven by consumer demand for plant-based ingredients, clean-label products, and the increasing prevalence of food allergies and dietary restrictions. The market is also poised for growth due to the rising awareness of the environmental impact of traditional gelatin production, as well as the advancements in food technology that allow for better alternatives. Moreover, the expanding use of gelatin substitutes in pharmaceutical and cosmetic industries presents further opportunities for market growth.

USA Gelatin Substitute Market Opportunities

- Development of Alternative Protein Ingredients: The development of new alternative protein ingredients presents a significant opportunity for the gelatin substitute market. With increased funding for research into plant-based proteins, the USDA has reported an uptick in investment for developing novel food ingredients. As of 2023, the U.S. government allocated $500 million towards innovation in plant-based food technology, aimed at reducing reliance on animal-based products. This funding is helping manufacturers explore new, cost-effective gelatin substitutes with improved functionality.

- Expansion into Niche Markets: There is growing demand for gelatin substitutes that cater to niche markets, including gluten-free, halal, and kosher products. The U.S. Department of Agriculture reports that 12 million consumers in the USA now follow gluten-free diets, while 3.45 million adhere to halal dietary laws, and 6 million seek kosher-certified products. This growing demand provides manufacturers with ample opportunities to expand their product offerings to serve these segments more effectively.

Scope of the Report

|

By Product Type |

Agar-Agar Pectin Carrageenan Cornstarch Xanthan Gum |

|

By Application |

Food & Beverages Nutraceuticals Pharmaceuticals Cosmetics Dairy Products |

|

By Source |

Plant-Based Synthetic Microbial-Based |

|

By Form |

Powder Liquid Sheets |

|

By Distribution Channel |

Online Retail Specialty Stores Supermarkets/Hypermarkets Direct-to-Consumer |

Products

Key Target Audience

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetics & Personal Care Brands

Nutraceutical Companies

Banks and Financial Institutions

Ingredient Suppliers

Packaging Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Companies

Players Mentioned in the Report

DuPont

CP Kelco

Gelita AG

Cargill Incorporated

Ingredion Incorporated

Tate & Lyle

Nexira

Archer Daniels Midland Company

W Hydrocolloids, Inc.

Florida Food Products

Table of Contents

1. USA Gelatin Substitute Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Gelatin Substitute Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Gelatin Substitute Market Analysis

3.1. Growth Drivers (Plant-based substitutes, increasing vegan population, health-conscious trends, environmental concerns)

3.1.1. Shift Towards Plant-based Alternatives

3.1.2. Rising Health and Wellness Trends

3.1.3. Sustainability and Environmental Awareness

3.1.4. Increasing Vegan and Vegetarian Population

3.2. Market Challenges (Regulatory hurdles, limited availability, consumer perception, high cost)

3.2.1. Regulatory Approvals and Compliance

3.2.2. High Production Costs

3.2.3. Consumer Awareness and Acceptance

3.2.4. Limited Raw Material Supply

3.3. Opportunities (New product innovations, alternative protein sources, collaboration with food industries)

3.3.1. Development of Alternative Protein Ingredients

3.3.2. Expansion into Niche Markets (gluten-free, halal, kosher)

3.3.3. Collaborations with Food & Beverage Industry

3.3.4. Growing Demand in Nutraceuticals and Pharmaceuticals

3.4. Trends (Clean-label products, organic sourcing, technological advancements)

3.4.1. Rise of Clean-label Gelatin Substitutes

3.4.2. Organic and Non-GMO Ingredients

3.4.3. Technological Advancements in Food Processing

3.4.4. Customized Ingredients for Food Applications

3.5. Government Regulations (FDA guidelines, USDA standards, organic certification)

3.5.1. FDA Regulations on Food Additives

3.5.2. USDA Standards for Gelatin Substitutes

3.5.3. Organic Certification Guidelines

3.5.4. Labeling and Packaging Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Gelatin Substitute Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Agar-Agar

4.1.2. Pectin

4.1.3. Carrageenan

4.1.4. Cornstarch

4.1.5. Xanthan Gum

4.2. By Application (In Value %)

4.2.1. Food & Beverages

4.2.2. Nutraceuticals

4.2.3. Pharmaceuticals

4.2.4. Cosmetics

4.2.5. Dairy Products

4.3. By Source (In Value %)

4.3.1. Plant-Based

4.3.2. Synthetic

4.3.3. Microbial-Based

4.4. By Form (In Value %)

4.4.1. Powder

4.4.2. Liquid

4.4.3. Sheets

4.5. By Distribution Channel (In Value %)

4.5.1. Online Retail

4.5.2. Specialty Stores

4.5.3. Supermarkets/Hypermarkets

4.5.4. Direct-to-Consumer

5. USA Gelatin Substitute Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DuPont

5.1.2. CP Kelco

5.1.3. Gelita AG

5.1.4. Cargill Incorporated

5.1.5. Koninklijke DSM N.V.

5.1.6. Darling Ingredients

5.1.7. Ingredion Incorporated

5.1.8. Nexira

5.1.9. Tate & Lyle

5.1.10. W Hydrocolloids, Inc.

5.1.11. Archer Daniels Midland Company

5.1.12. Florida Food Products

5.1.13. Kerry Group

5.1.14. AEP Colloids

5.1.15. Herbstreith & Fox GmbH & Co. KG

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation Index, Number of Employees, Geographical Presence, R&D Expenditure, Manufacturing Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Gelatin Substitute Market Regulatory Framework

6.1. FDA Guidelines

6.2. USDA Standards

6.3. Organic Certification Processes

6.4. Labeling and Packaging Regulations

6.5. Halal and Kosher Certifications

7. USA Gelatin Substitute Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Gelatin Substitute Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By Form (In Value %)

8.5. By Distribution Channel (In Value %)

9. USA Gelatin Substitute Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the major stakeholders in the USA Gelatin Substitute Market. Extensive desk research is conducted using both secondary and proprietary data sources to gather comprehensive information on the market landscape. This step identifies the critical factors influencing market growth, including consumer preferences and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to understand penetration rates, key applications, and revenue generation. This includes assessing demand trends in the food, pharmaceutical, and cosmetic sectors. The data is cross-verified with industry reports to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with key industry players, including manufacturers and suppliers, are conducted via computer-assisted telephone interviews (CATIs). This helps validate market hypotheses and provides insights into current trends, product innovations, and consumer behavior.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings into a detailed report. This is accomplished by consolidating the data gathered from both bottom-up and top-down approaches, ensuring a comprehensive analysis of the market.

Frequently Asked Questions

01. How big is the USA Gelatin Substitute Market?

The USA gelatin substitute market is valued at USD 7.4 billion, driven by the growing demand for plant-based alternatives and rising consumer awareness of health and environmental impacts.

02. What are the challenges in the USA Gelatin Substitute Market?

Key challenges include high production costs, limited raw material supply, and the regulatory hurdles associated with food ingredients. These factors may slow down market growth.

03. Who are the major players in the USA Gelatin Substitute Market?

The major players include DuPont, CP Kelco, Gelita AG, Cargill Incorporated, and Ingredion Incorporated. These companies lead the market due to their strong R&D capabilities and product innovation.

04. What are the growth drivers of the USA Gelatin Substitute Market?

Growth drivers include increasing consumer demand for plant-based ingredients, rising awareness of food allergies and sensitivities, and the growing vegan and vegetarian population.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.