United States Household Appliances Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD9379

December 2024

85

About the Report

United States Household Appliances Market Overview

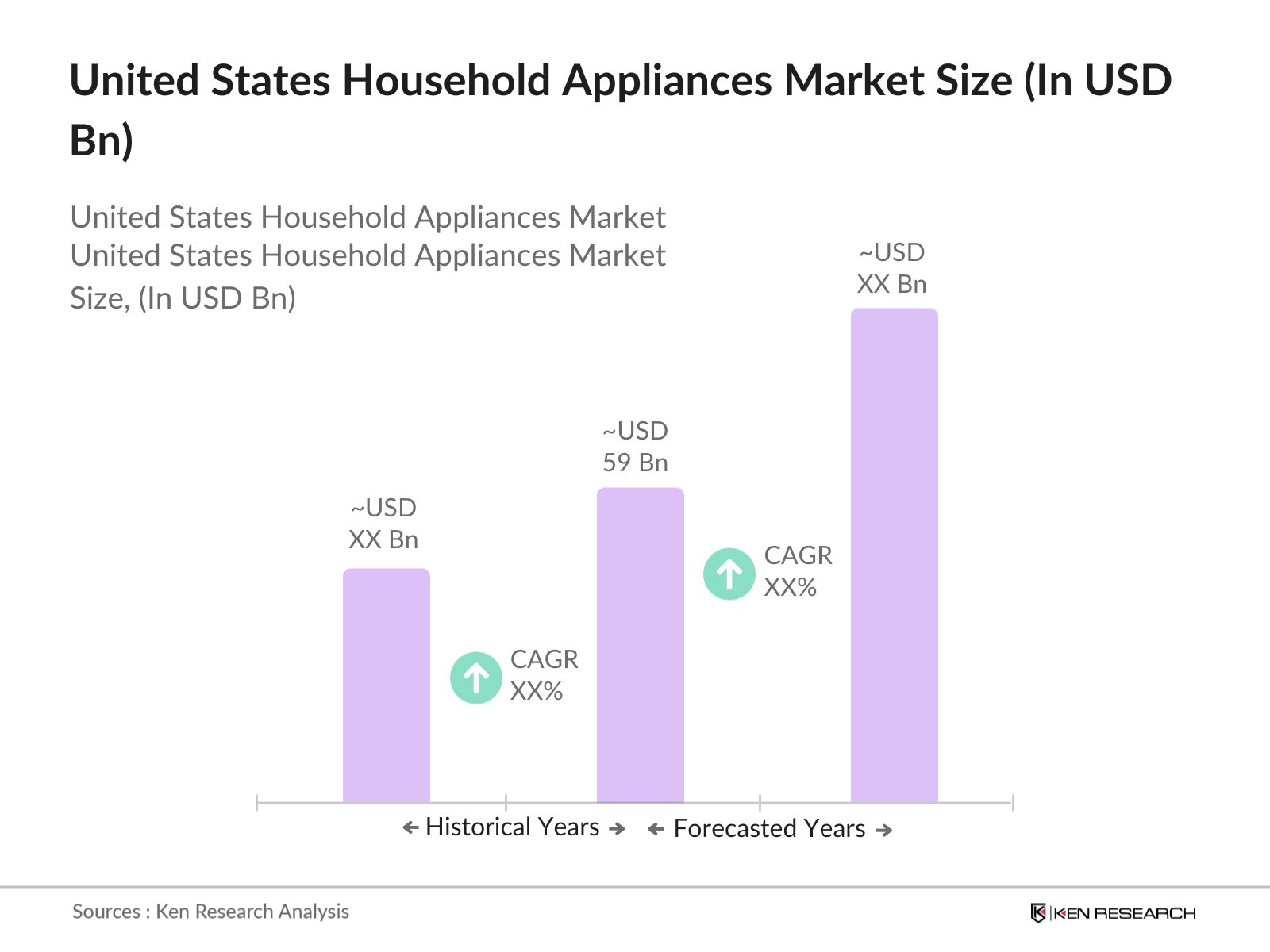

- The United States household appliances market is valued at USD 59 billion, driven by rising consumer demand for technologically advanced, energy-efficient appliances. Growing awareness about sustainability, coupled with government incentives promoting energy-efficient appliances, has accelerated market growth. The expansion of e-commerce and increasing disposable income have further fueled demand for smart appliances, which feature connectivity and energy-saving functionalities, making them highly attractive to the modern consumer base.

- The market is primarily dominated by metropolitan areas such as New York, Los Angeles, and Chicago. These cities dominate due to their high population density, higher disposable incomes, and strong demand for smart and premium appliances. Additionally, regions with a more established e-commerce infrastructure see greater penetration of online appliance purchases, further consolidating their market dominance.

- The U.S. government has stringent regulations regarding the energy efficiency of household appliances, with the Energy Star certification being one of the most prominent programs. In 2023, over 300 million Energy Star-certified appliances were in use across the U.S., reducing energy consumption by over 1,000 terawatt-hours annually. The U.S. Department of Energy enforces compliance with Energy Star standards, and non-certified products face higher tariffs and import restrictions. This regulatory framework is essential for manufacturers looking to compete in the U.S. market.

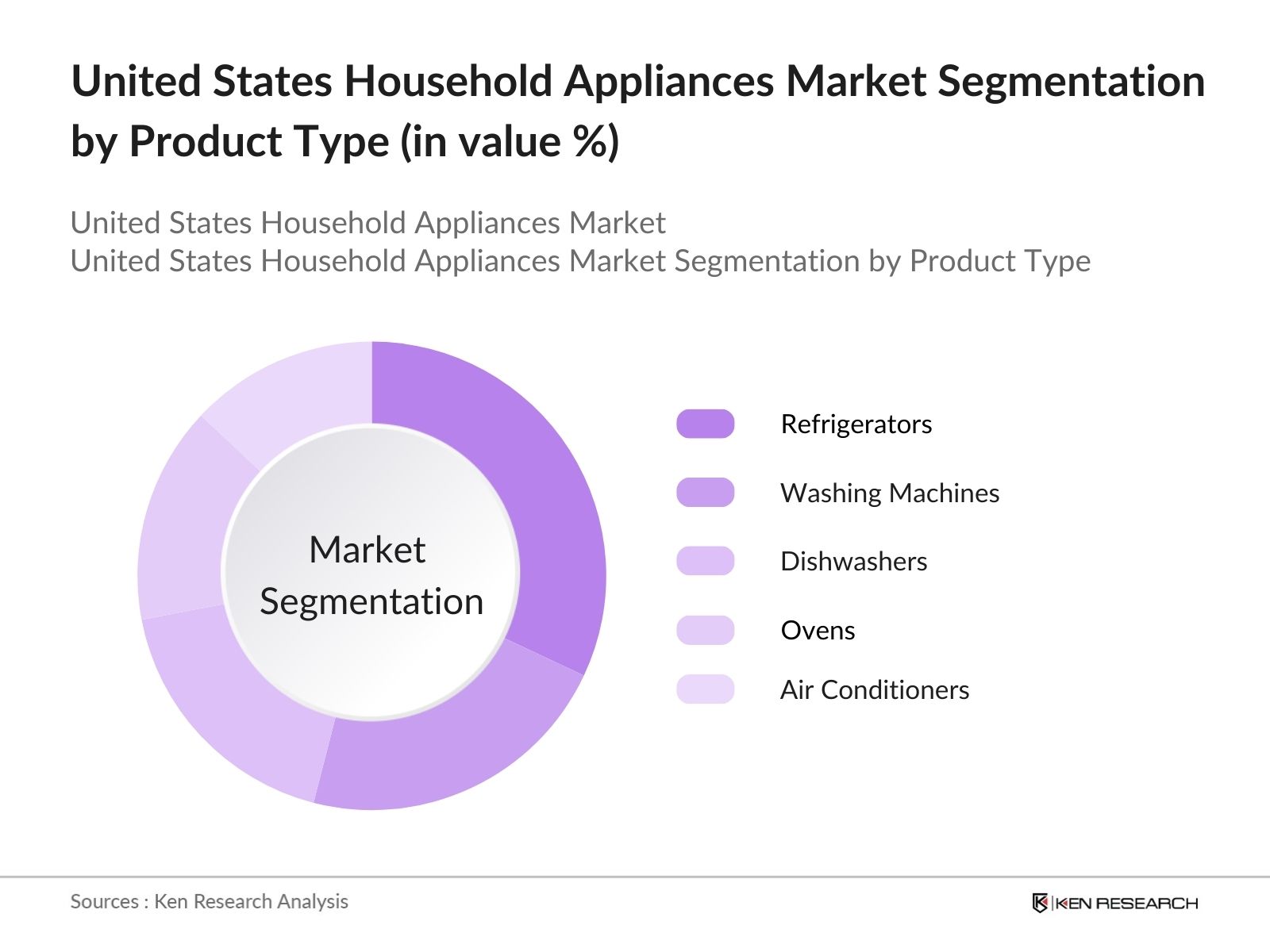

United States Household Appliances Market Segmentation

- By Product Type: The United States household appliances market is segmented by product type into refrigerators, washing machines, dishwashers, ovens, and air conditioners. Refrigerators have a dominant market share within this segmentation. This dominance is largely due to their necessity in every household, technological innovations like smart refrigeration, and increasing consumer demand for energy-efficient models. Refrigerators, being indispensable household appliances, also witness regular upgrades as consumers seek features like internet connectivity and advanced cooling mechanisms.

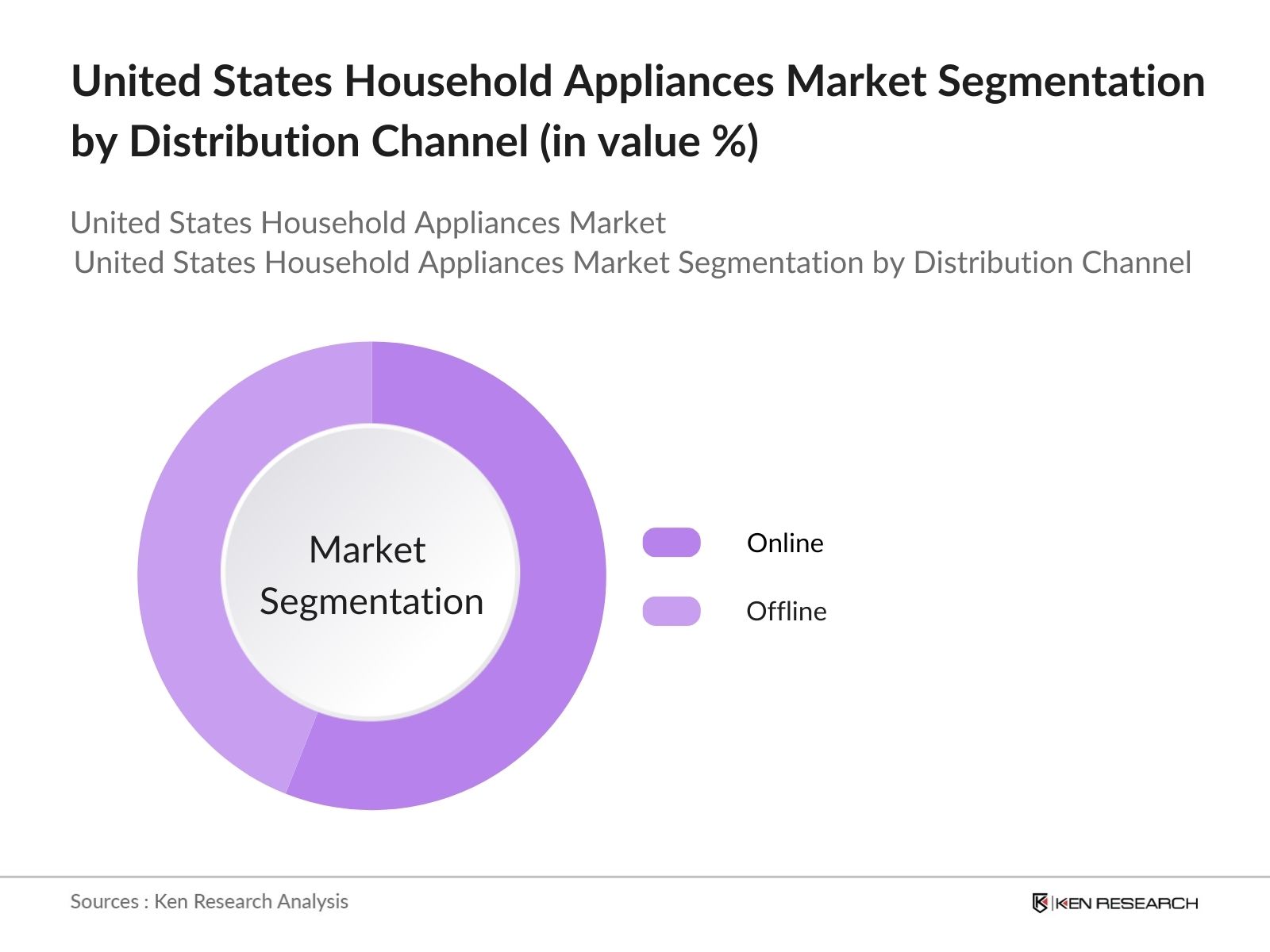

- By Distribution Channel: The United States household appliances market is segmented by distribution channel into online and offline channels. Online channels dominate the market share, thanks to the rise of e-commerce giants like Amazon, as well as exclusive brand-owned websites. The convenience of online shopping, product reviews, and wide product selection, coupled with competitive pricing and home delivery options, have all contributed to the growth of online sales channels, especially in urban and suburban regions.

United States Household Appliances Market Competitive Landscape

The United States household appliances market is dominated by several key players, both domestic and international. The competition is characterized by a strong presence of premium brands focusing on technological innovation, sustainability, and product durability. Some companies have carved out significant market share through extensive product offerings, strong brand recognition, and continuous investment in R&D to cater to consumer demand for smart and eco-friendly appliances.

The market is led by companies such as Whirlpool Corporation and General Electric (GE), along with international players like Samsung and LG. These companies dominate due to their wide product portfolios, strong distribution channels, and focus on innovation. Their extensive marketing campaigns and product placements, especially in the smart appliance category, also provide them a competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

|

Whirlpool Corporation |

1911 |

Benton Harbor, Michigan |

||

|

General Electric (GE) |

1892 |

Boston, Massachusetts |

||

|

Samsung Electronics America |

1969 |

Ridgefield Park, New Jersey |

||

|

LG Electronics USA |

1958 |

Englewood Cliffs, New Jersey |

||

|

Electrolux North America |

1919 |

Charlotte, North Carolina |

United States Household Appliances Industry Analysis

Market Growth Drivers

- Technological Advancements (Smart Appliances, Energy Efficiency): Technological advancements have played a pivotal role in shaping the U.S. household appliances market, with the introduction of smart appliances leading the trend. In 2023, over 60 million U.S. households were equipped with smart appliances, including connected refrigerators and energy-efficient washing machines. These innovations are supported by government initiatives, such as the Federal Energy Management Program (FEMP), which promotes energy-efficient appliances through incentives and rebates. The push towards energy conservation, backed by policies such as the Energy Star certification, aligns with the goal of reducing national energy consumption.

- Changing Consumer Preferences (Demand for Connected and Eco-Friendly Products): Consumer preferences in the U.S. have shifted towards connected, eco-friendly household appliances. According to U.S. Census data, nearly 35% of consumers prioritized eco-friendly products in 2023. This shift has led to an increase in sales of appliances such as energy-efficient dishwashers and smart home devices that allow real-time energy monitoring. The Environmental Protection Agency (EPA) reported that sales of Energy Star-certified products grew by 15 million units between 2022 and 2024, underscoring a growing consumer preference for sustainability and connectivity.

- Expanding E-commerce Sector: E-commerce has transformed how household appliances are purchased, especially post-pandemic. By 2023, the U.S. e-commerce sector reached sales of $1.05 trillion, up from $960 billion in 2022. A significant portion of this growth has been driven by household appliances, with companies like Amazon and Walmart seeing a surge in online appliance sales. The ease of comparing products, combined with growing online retail infrastructure, is a key driver, with e-commerce accounting for 40% of total household appliance sales in 2023.

Market Challenges

- Intense Market Competition (Consolidation, New Entrants): The U.S. household appliances market is highly competitive, with several established brands consolidating their market positions. However, new entrants, particularly from Asia, have increased competition. According to the Federal Trade Commission (FTC), merger activity in the sector remained robust in 2023, with over 10 notable mergers and acquisitions. This market consolidation has led to price competition and decreased margins, challenging both established players and new entrants. Additionally, the presence of low-cost manufacturers from China and South Korea has added to the competitive pressure.

- Rising Raw Material Costs: The rising costs of raw materials such as steel, aluminum, and copper have significantly impacted the household appliances industry. Data from the U.S. Bureau of Labor Statistics (BLS) showed that the Producer Price Index (PPI) for steel increased by 5.8% between 2022 and 2023, while aluminum prices rose by 3.2%. This increase in raw material costs has led to higher production expenses, pressuring manufacturers to either raise prices or absorb the costs, which affects profitability.

United States Household Appliances Market Future Outlook

Over the next five years, the United States household appliances market is expected to witness strong growth driven by technological innovations, a growing preference for energy-efficient appliances, and the rise of smart home technologies. The continued expansion of e-commerce platforms and increasing consumer disposable incomes are likely to further support the demand for high-end, connected appliances. Government regulations on energy conservation and sustainability initiatives will also play a critical role in shaping the future market landscape.

Market Opportunities

- Adoption of IoT in Household Appliances: The Internet of Things (IoT) is revolutionizing the U.S. household appliances market, with an estimated 250 million IoT-connected devices in American homes by 2023. Smart appliances, such as refrigerators that track food expiration and washers that notify users of maintenance needs, have become popular. The Federal Communications Commission (FCC) supports this growth by expanding broadband access, which facilitates the integration of IoT in appliances. Manufacturers who adopt IoT capabilities in their product lines are well-positioned to capture market share.

- Growth of Rental Appliance Models: The rise of the rental economy is creating new opportunities in the household appliances market. Data from the U.S. Census Bureau indicates that in 2023, over 35% of U.S. households were renting some form of household appliance, with refrigerators and washing machines being the most common. This trend is driven by the flexibility of short-term leasing models and the increasing mobility of the younger population. Companies offering subscription-based or rental services for appliances have seen a rise in demand, particularly in urban areas.

Scope of the Report

Products

Key Target Audience

Household Appliance Manufacturers

Retailers and Distributors

E-commerce Platforms

Energy Efficiency Consultants

Consumer Electronics Stores

Smart Home Solutions Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Energy Star)

Companies

United States Household Appliances Market Major Players

Whirlpool Corporation

General Electric (GE)

Samsung Electronics America

LG Electronics USA

Electrolux North America

Bosch Home Appliances

Panasonic Corporation of North America

Midea America Corporation

Haier US Appliance Solutions

Maytag

Sub-Zero Group, Inc.

Viking Range, LLC

KitchenAid

Dyson, Inc.

Smeg USA, Inc.

Table of Contents

1. United States Household Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. United States Household Appliances Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. United States Household Appliances Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements (Smart Appliances, Energy Efficiency)

3.1.2. Changing Consumer Preferences (Demand for Connected and Eco-Friendly Products)

3.1.3. Rising Disposable Income

3.1.4. Expanding E-commerce Sector

3.2. Market Challenges

3.2.1. Intense Market Competition (Consolidation, New Entrants)

3.2.2. Rising Raw Material Costs

3.2.3. Supply Chain Disruptions (Post-Pandemic)

3.3. Opportunities

3.3.1. Adoption of IoT in Household Appliances

3.3.2. Growth of Rental Appliance Models

3.3.3. Expanding Smart City Infrastructure

3.4. Trends

3.4.1. Integration of AI and Voice Assistants in Appliances

3.4.2. Sustainability and Energy-Efficient Products

3.4.3. Modular Kitchen and Built-in Appliances

3.5. Government Regulations

3.5.1. Energy Star Certification

3.5.2. Federal Appliance Standards (Energy Conservation)

3.5.3. Tax Incentives for Energy-Efficient Appliances

3.5.4. Environmental Compliance Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. United States Household Appliances Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Refrigerators

4.1.2. Washing Machines

4.1.3. Dishwashers

4.1.4. Ovens

4.1.5. Air Conditioners

4.2. By Technology (In Value %)

4.2.1. Smart Appliances

4.2.2. Traditional Appliances

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.4. By Distribution Channel (In Value %)

4.4.1. Online (E-commerce)

4.4.2. Offline (Brick-and-Mortar Stores)

4.5. By Energy Consumption (In Value %)

4.5.1. Energy Star Appliances

4.5.2. Non-Energy Star Appliances

5. United States Household Appliances Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Whirlpool Corporation

5.1.2. General Electric (GE) Appliances

5.1.3. Samsung Electronics America, Inc.

5.1.4. LG Electronics USA, Inc.

5.1.5. Electrolux North America, Inc.

5.1.6. Bosch Home Appliances

5.1.7. Panasonic Corporation of North America

5.1.8. Midea America Corporation

5.1.9. Haier US Appliance Solutions

5.1.10. Maytag

5.1.11. Sub-Zero Group, Inc.

5.1.12. Viking Range, LLC

5.1.13. KitchenAid

5.1.14. Dyson, Inc.

5.1.15. Smeg USA, Inc.

5.2. Cross Comparison Parameters (Headquarters, Revenue, Market Share, Technological Capabilities, Innovation, Product Portfolio, Customer Service, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. United States Household Appliances Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Safety and Compliance Regulations

6.3. Environmental Standards

6.4. Certification Processes

7. United States Household Appliances Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. United States Household Appliances Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Energy Consumption (In Value %)

9. United States Household Appliances Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we constructed an ecosystem map that identifies all key stakeholders in the U.S. Household Appliances Market. Secondary research and proprietary databases were used to gather critical industry-level data, focusing on the key variables influencing market dynamics, such as product innovation, distribution channels, and regulatory frameworks.

Step 2: Market Analysis and Construction

his step involved compiling and analyzing historical market data for the U.S. Household Appliances Market. We assessed market penetration and revenue generation across the product categories and distribution channels. Additionally, customer satisfaction and product lifecycle data were analyzed to ensure accurate revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed through primary interviews with industry experts, including manufacturers, distributors, and regulators. These consultations were instrumental in validating market trends, consumer preferences, and emerging technologies.

Step 4: Research Synthesis and Final Output

The final phase included direct engagement with appliance manufacturers and retailers to acquire insights on sales performance, emerging technologies, and consumer preferences. This step ensured the accuracy and reliability of the final market estimates, providing a comprehensive analysis of the U.S. Household Appliances Market.

Frequently Asked Questions

01. How big is the United States Household Appliances Market?

The United States household appliances market was valued at USD 59 billion, driven by increasing consumer demand for smart and energy-efficient appliances. E-commerce growth and higher disposable incomes further propel the market.

02. What are the challenges in the United States Household Appliances Market?

Challenges in United States household appliances market include supply chain disruptions, rising raw material costs, and intense competition from both domestic and international players. Furthermore, meeting stringent government regulations on energy efficiency adds to operational complexity.

03. Who are the major players in the United States Household Appliances Market?

Major players in United States household appliances market include Whirlpool Corporation, General Electric (GE), Samsung Electronics America, LG Electronics USA, and Electrolux North America. These companies dominate the market through innovation, broad product portfolios, and strong global distribution channels.

04. What are the growth drivers of the United States Household Appliances Market?

The United States household appliances market is driven by technological advancements in smart appliances, government regulations on energy efficiency, and rising consumer demand for environmentally friendly and connected household products.

05. What trends are shaping the future of the United States Household Appliances Market?

Key trends in United States household appliances market include the integration of AI and IoT in appliances, the growth of modular kitchens, and the increasing focus on sustainability through energy-efficient product designs. Expansion of e-commerce is also significantly influencing consumer purchasing patterns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.