United States Maritime Information Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD10490

November 2024

98

About the Report

United States Maritime Information Market Overview

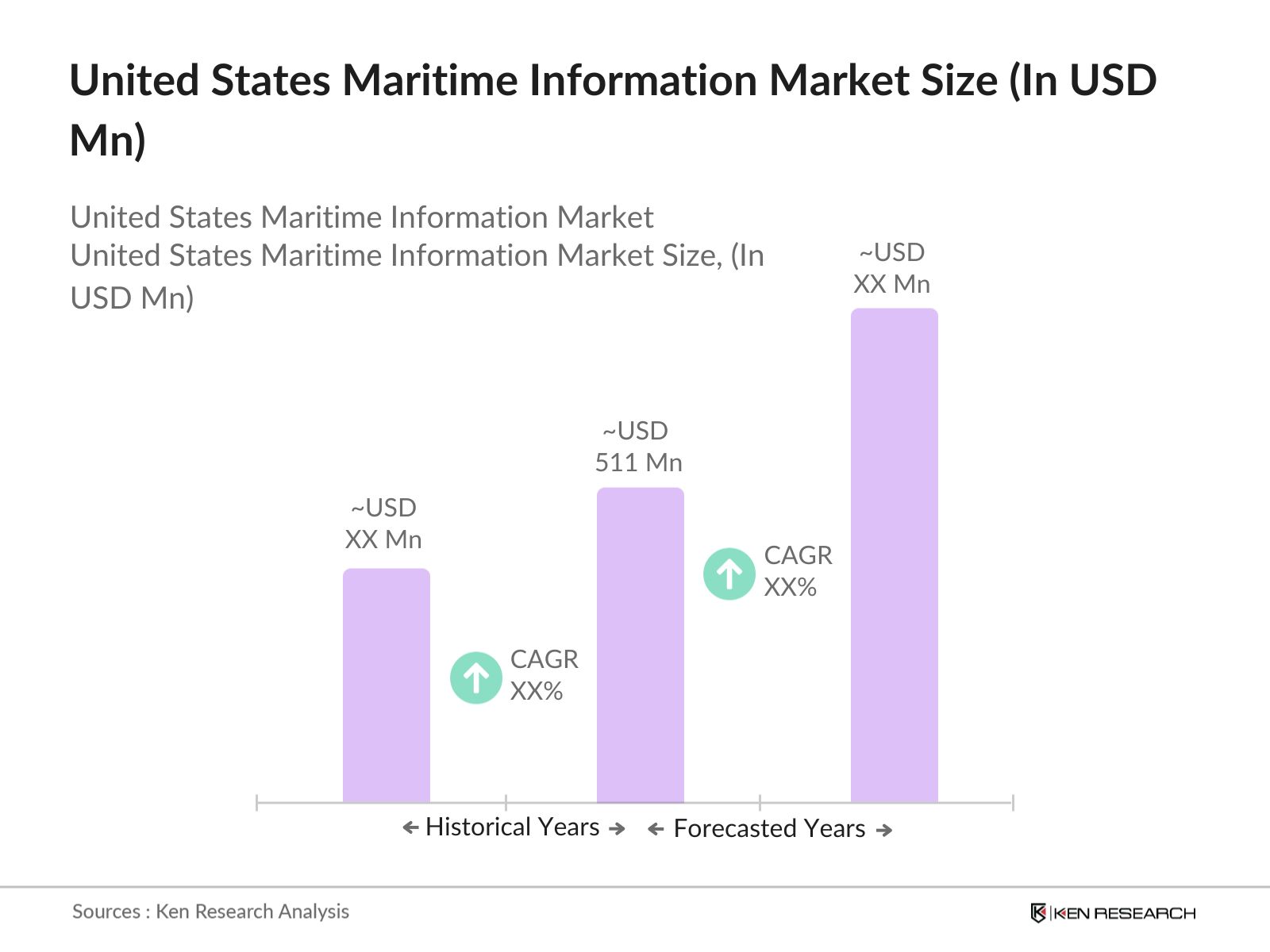

- The U.S. Maritime Information Market is valued at USD 511 million, reflecting the critical demand for real-time maritime data across applications, including fleet management, port operations, and cargo tracking. This growth is fueled by increased technological integrationsuch as the adoption of AIS (Automatic Identification System) and satellite trackingand heightened emphasis on regulatory compliance. As maritime security remains a top priority, investments in advanced tracking systems and data analytics have surged, contributing to market expansion based on a five-year historical analysis.

- Regions such as the East and Gulf Coasts dominate the U.S. maritime information market. The significant concentration of high-traffic ports, like the Port of Los Angeles and the Port of Houston, supports the high demand for maritime information. These areas benefit from robust port infrastructure and substantial digital investments, which are essential for handling dense shipping volumes and complying with evolving regulatory standards.

- The U.S. Coast Guard mandates strict operational and safety protocols for vessels operating in U.S. waters. As of 2024, over 12,000 vessels comply with regulations involving safety inspections, AIS monitoring, and reporting requirements. These regulations drive demand for maritime information systems that facilitate compliance, tracking, and reporting, ensuring that vessel operators adhere to mandatory safety standards.

United States Maritime Information Market Segmentation

The U.S. maritime information market is segmented by solution type and by application.

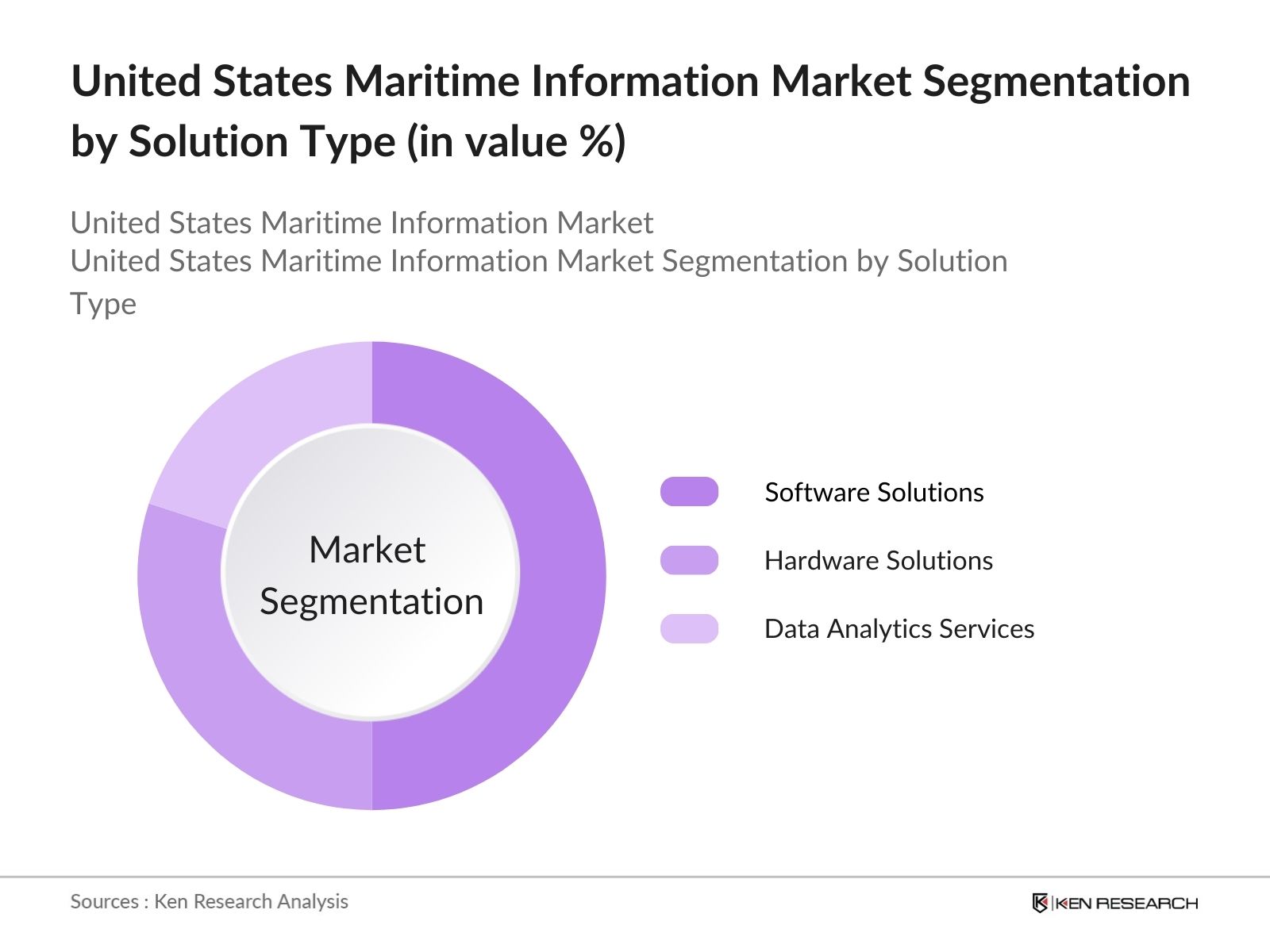

- By Solution Type: The U.S. maritime information market is segmented by solution type into software solutions, hardware solutions, and data analytics services. Software solutions account for a substantial market share, largely due to their real-time analytics and integration features that enhance fleet and cargo management. Leading ports and shipping lines rely on these tools to optimize operations and ensure compliance, driving the popularity of this segment.

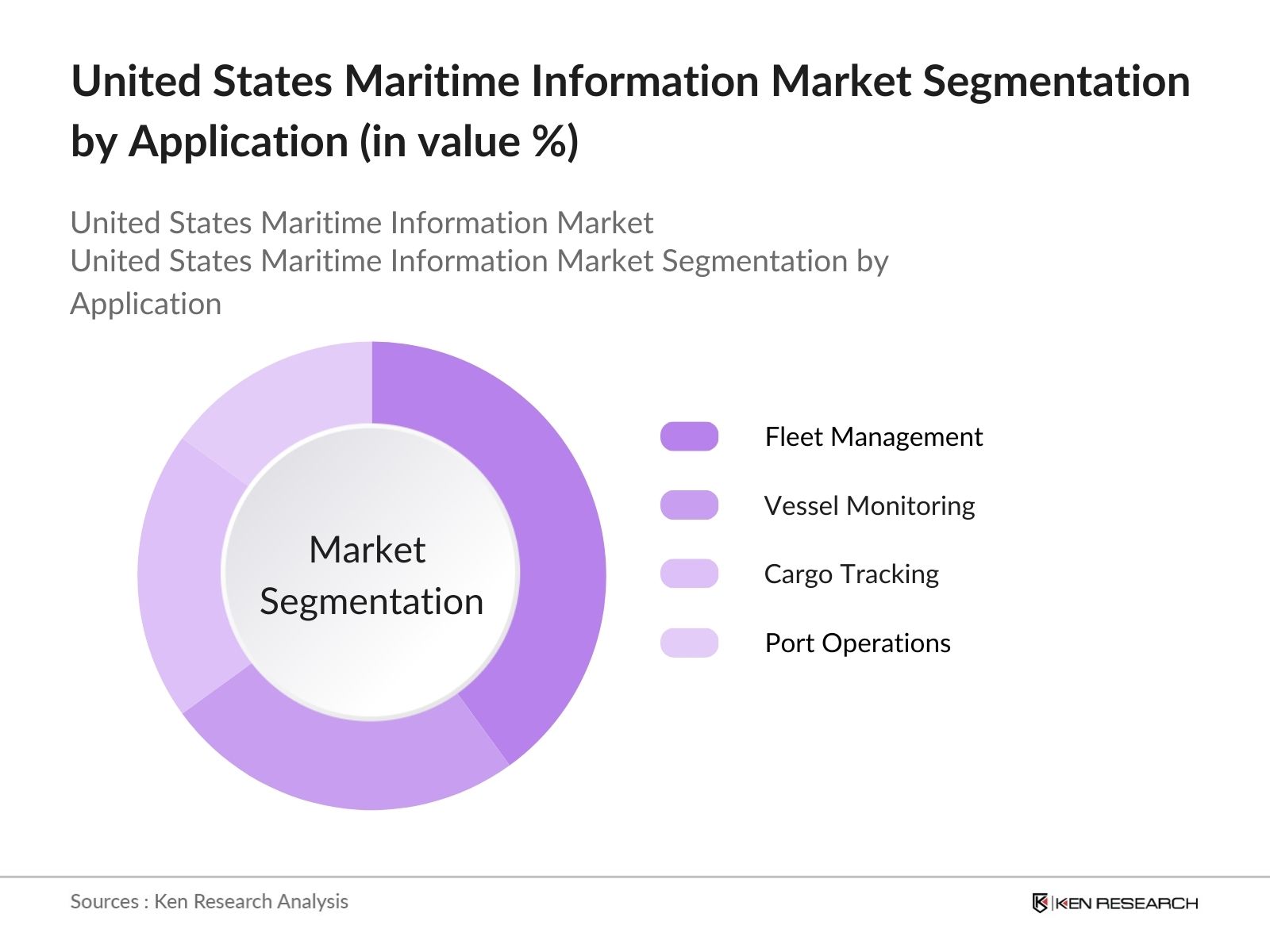

- By Application: Application segmentation includes fleet management, vessel monitoring, cargo tracking, and port operations. Fleet management dominates this segmentation due to the need for precise vessel tracking and efficient route management, enhancing operational performance. The integration of advanced analytics in fleet management helps optimize fuel usage, ensure route accuracy, and comply with industry regulations.

United States Maritime Information Market Competitive Landscape

The U.S. Maritime Information Market features key players with substantial influence, including domestic and international entities known for AIS coverage, advanced analytics, and robust maritime information services. This consolidation underscores the high barriers to entry, dominated by companies with comprehensive data offerings.

United States Maritime Information Market Analysis

Growth Drivers

- Increased Port Activity: In recent years, the United States has observed a steady increase in port activities driven by heightened trade volumes. According to the U.S. Bureau of Transportation Statistics, cargo handling at major U.S. ports reached a record of 1.7 billion metric tons in 2023, reflecting the significant role of maritime information systems in managing increased cargo volumes effectively. The Port of Los Angeles alone handled over 10 million TEUs in 2023, requiring advanced data analytics to manage vessel traffic, cargo logistics, and security protocols. This surge in port activity supports the demand for comprehensive maritime information systems that streamline port operations efficiently.

- Technological Advancements (IoT, AIS Data Integration): The adoption of IoT and Automatic Identification Systems (AIS) has transformed the maritime sector, enabling real-time vessel tracking and data analytics. In 2023, over 80% of U.S. commercial vessels integrated AIS technology, as per the U.S. Maritime Administration. The integration of IoT and AIS enables enhanced data-driven decision-making, optimizing navigation, fuel consumption, and safety protocols. This technological evolution has fueled the demand for maritime information platforms capable of processing and integrating vast data volumes in real-time, providing a competitive edge to port authorities and shipping companies.

- Rising Emphasis on Maritime Security: Amid escalating geopolitical tensions, maritime security has become a crucial focus for the U.S. government. In 2023, the U.S. allocated over $1.8 billion towards maritime security initiatives, according to the U.S. Coast Guard. This allocation underscores the emphasis on real-time monitoring systems to safeguard the nations waters and critical port infrastructure against illegal activities. Maritime information systems that support advanced tracking and threat assessment tools are instrumental in fulfilling these security requirements, aligning with the governments objective to strengthen maritime security through enhanced data integration and situational awareness.

Market Challenges

- Data Security Concerns: The cybersecurity landscape in maritime data management presents significant challenges. According to the U.S. Department of Homeland Security, cyberattacks on maritime systems saw a 27% increase in 2023, raising concerns about data integrity and confidentiality. The high-profile breaches have prompted an urgent need for fortified cybersecurity protocols within maritime information platforms. Addressing these vulnerabilities is essential for safeguarding sensitive information, reinforcing the need for robust and secure data frameworks within the industry.

- Integration with Legacy Systems: Many U.S. ports still operate on legacy systems, complicating the integration of advanced maritime information platforms. The Federal Maritime Commission (FMC) noted in 2023 that over 40% of U.S. ports reported issues integrating new data systems due to outdated infrastructure. The lack of compatibility with modern data technologies creates significant operational bottlenecks and increases the time and cost of implementation, presenting a barrier to adopting comprehensive digital solutions across the industry.

United States Maritime Information Market Future Outlook

The U.S. Maritime Information Market is anticipated to grow steadily, propelled by the continuous digitalization of the maritime sector, advancements in satellite tracking, and stringent regulatory requirements. Key regions such as the East and Gulf Coasts are expected to remain at the forefront, driven by increased port investments and technological advancements.

Market Opportunities

- Expansion into Inland Waterways: Inland waterway freight transport in the U.S. saw a 5% increase in ton-miles, reaching over 570 billion in 2023, according to the Army Corps of Engineers. As inland water transport becomes increasingly viable, there is a growing demand for maritime information systems that can facilitate navigation, traffic management, and real-time data sharing across rivers and canals. Expansion into inland waterways offers a new avenue for growth, creating opportunities for tailored maritime information services adapted to non-coastal environments.

- Integration of Satellite and UAV Data: The demand for satellite and UAV (unmanned aerial vehicle) integration in maritime monitoring has risen, with U.S. spending on satellite data services surpassing $2 billion in 2023, according to NASA. Satellite and UAV data enable enhanced maritime situational awareness by providing high-resolution imagery, tracking vessel positions, and monitoring environmental conditions. Integrating this data with maritime information systems enables comprehensive monitoring, especially in remote or high-risk areas, supporting improved operational efficiency and safety measures.

Scope of the Report

|

Software Solutions Hardware Solutions Data Analytics Services |

|

|

By Application |

Fleet Management Vessel Monitoring Cargo Tracking Port Operations |

|

By Technology |

AIS Systems Satellite Communication Data Analytics & Machine Learning |

|

By End-User |

Port Authorities Shipping Lines Government Agencies Logistics & Freight Forwarders |

|

By Region |

North East West South |

Products

Key Target Audience

Port Authorities (U.S. Coast Guard, U.S. Maritime Administration)

Shipping Lines

Vessel Monitoring and Fleet Management Companies

Maritime Data Analytics Providers

Government and Regulatory Bodies (NOAA, Department of Transportation)

Investments and Venture Capitalist Firms

Logistics & Freight Forwarders

Satellite Communication Service Providers

Companies

Players Mention in the Report:

exactEarth Ltd.

Spire Global, Inc.

ORBCOMM Inc.

L3Harris Technologies

MarineTraffic Ltd.

Thales Group

Kongsberg Gruppen ASA

Raytheon Technologies Corporation

Northrop Grumman Corporation

Airbus S.A.S.

Lockheed Martin Corporation

Furuno Electric Co., Ltd.

SAAB AB

VesselFinder Ltd.

Inmarsat Global Limited

Table of Contents

1. United States Maritime Information Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Maritime Information and Analytics Scope

2. United States Maritime Information Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Major Developments and Milestones

3. United States Maritime Information Market Analysis

3.1. Growth Drivers

3.1.1. Increased Port Activity

3.1.2. Technological Advancements (IoT, AIS Data Integration)

3.1.3. Rising Emphasis on Maritime Security

3.1.4. Regulatory Compliance Pressure

3.2. Market Challenges

3.2.1. Data Security Concerns

3.2.2. Integration with Legacy Systems

3.2.3. High Initial Costs

3.3. Opportunities

3.3.1. Expansion into Inland Waterways

3.3.2. Integration of Satellite and UAV Data

3.3.3. Growth of E-Navigation Systems

3.4. Trends

3.4.1. Big Data Analytics Adoption

3.4.2. Use of Blockchain for Transparency

3.4.3. Rise in Real-Time AIS Data Use

3.5. Government Regulation

3.5.1. U.S. Coast Guard Regulations

3.5.2. IMO Compliance Standards

3.5.3. Cybersecurity Regulations

3.5.4. Environmental Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. United States Maritime Information Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Software Solutions

4.1.2. Hardware Solutions

4.1.3. Data Analytics Services

4.2. By Application (In Value %)

4.2.1. Fleet Management

4.2.2. Vessel Monitoring

4.2.3. Cargo Tracking

4.2.4. Port Operations

4.3. By Technology (In Value %)

4.3.1. AIS Systems

4.3.2. Satellite Communication

4.3.3. Data Analytics & Machine Learning

4.4. By End-User (In Value %)

4.4.1. Port Authorities

4.4.2. Shipping Lines

4.4.3. Government Agencies

4.4.4. Logistics & Freight Forwarders

4.5. By Region (In Value %)

4.5.1. East

4.5.2. North

4.5.3. West

4.5.4. South

5. United States Maritime Information Market Competitive Analysis

.1. Detailed Profiles of Major Companies

5.1.1. exactEarth Ltd.

5.1.2. Spire Global, Inc.

5.1.3. ORBCOMM Inc.

5.1.4. L3Harris Technologies, Inc.

5.1.5. Kongsberg Gruppen ASA

5.1.6. SAAB AB

5.1.7. Thales Group

5.1.8. Furuno Electric Co., Ltd.

5.1.9. MarineTraffic Ltd.

5.1.10. Inmarsat Global Limited

5.1.11. VesselFinder Ltd.

5.1.12. Raytheon Technologies Corporation

5.1.13. Northrop Grumman Corporation

5.1.14. Airbus S.A.S.

5.1.15. Lockheed Martin Corporation

5.2. Cross Comparison Parameters (Number of Ships Monitored, Fleet Data Integration, Headquarters Location, Inception Year, Revenue, AIS Data Coverage, Satellite Access, Data Analytics Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

6. United States Maritime Information Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. Maritime Data Privacy Standards

6.4. Cybersecurity Standards for Maritime Data

7.United States Maritime Information Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. United States Maritime Information Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. United States Maritime Information Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of key stakeholders within the U.S. Maritime Information Market. Secondary and proprietary databases are utilized to gather comprehensive data on market dynamics, allowing identification of essential variables that shape the industry.

Step 2: Market Analysis and Construction

This stage compiles and analyzes historical data on market penetration, vendor competition, and revenue trends. An assessment of service quality and user demand helps refine revenue projections and understand the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through industry expert consultations, including interviews with market practitioners. These insights provide operational and financial data that strengthen market forecasts and segment performance assessments.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data through direct engagements with maritime information providers, ensuring accuracy and detail in market segmentation, competitive landscape, and customer insights. This process ensures a reliable and validated understanding of the U.S. Maritime Information Market.

Frequently Asked Questions

01. How big is the United States Maritime Information Market?

The United States Maritime Information Market is valued at USD 511 million, driven by advancements in data analytics and the need for real-time maritime data.

02. What are the major challenges in the U.S. Maritime Information Market?

Challenges in United States Maritime Information Market include cybersecurity concerns, high implementation costs, and integration with legacy systems. Ensuring data accuracy and reliability are also significant issues faced by stakeholders.

03. Who are the main players in the U.S. Maritime Information Market?

Leading players in United States Maritime Information Market include exactEarth, Spire Global, ORBCOMM, MarineTraffic, and L3Harris Technologies, all known for their extensive AIS coverage and advanced data solutions.

04. What drives growth in the U.S. Maritime Information Market?

United States Maritime Information Market Growth is propelled by increased digitalization, environmental compliance, and advancements in satellite-based tracking and data analytics, which enhance operational efficiencies and security.

05. How is the maritime information used in the U.S. Maritime Information Market?

The information supports various functions, including fleet management, port operations, vessel tracking, and cargo monitoring. Real-time data improves decision-making and compliance with regulatory standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.