United States Men Hair Care Products Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD10280

December 2024

93

About the Report

United States Men Hair Care Products Market Overview

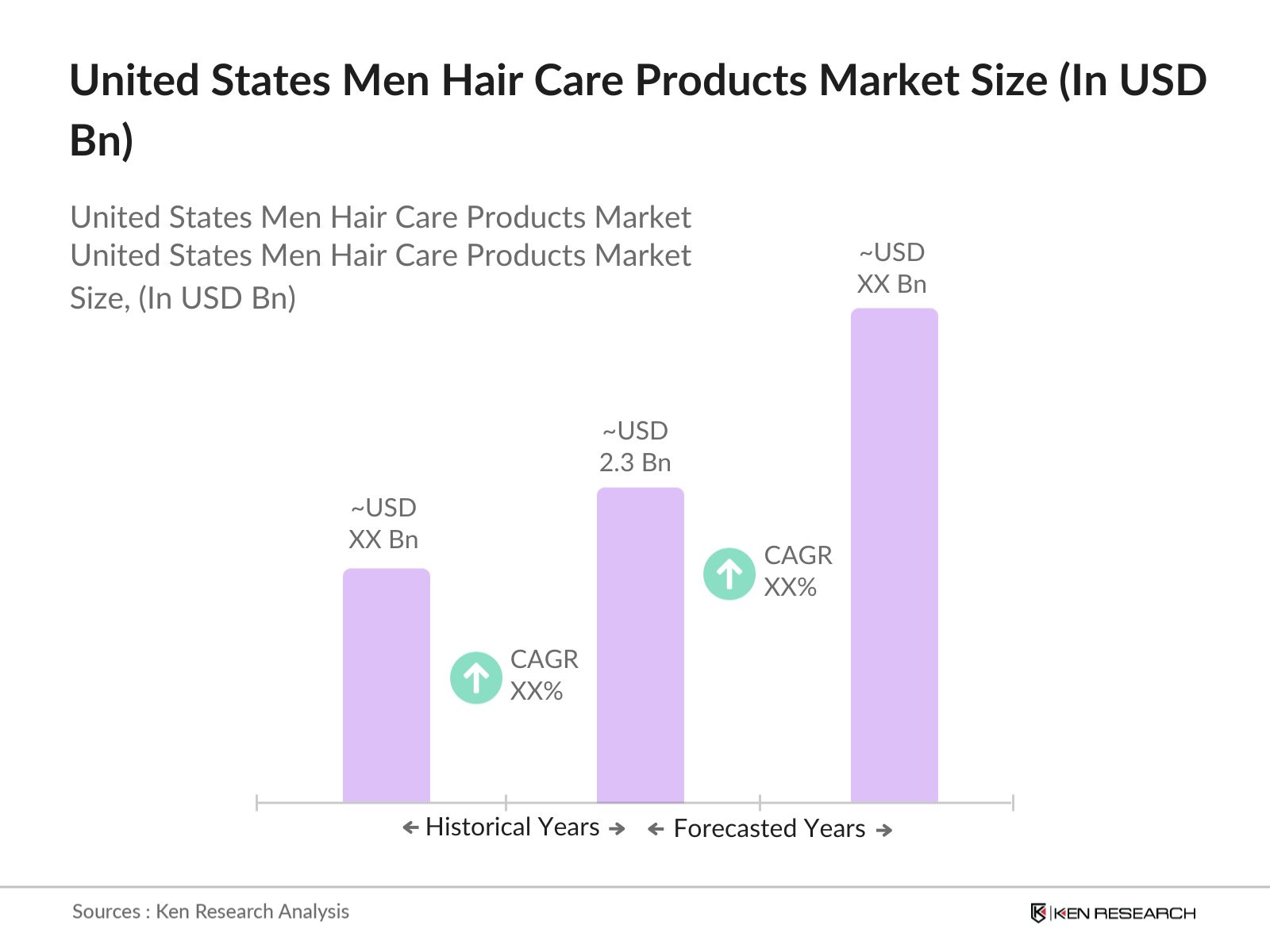

- The United States Men Hair Care Products market is valued at USD 2.3 billion, driven primarily by an increasing focus on grooming and personal care among male consumers. The market's growth is attributed to the rising demand for specialized hair care solutions such as anti-hair loss treatments, hair styling products, and hair regrowth formulas. This trend is further fueled by the increasing popularity of natural and organic products, as well as the expanding influence of male grooming on social media platforms, influencing consumer preferences and purchasing behavior.

- Dominant cities like New York, Los Angeles, and Chicago lead the market due to their large population size, high disposable incomes, and a strong emphasis on grooming and lifestyle trends. These urban areas also have a well-established retail and e-commerce infrastructure, allowing consumers easy access to a wide range of hair care products. Additionally, the presence of top salons, barber shops, and beauty influencers in these regions accelerates product adoption, driving their dominance in the U.S. Men Hair Care Products market.

- The U.S. Food and Drug Administration (FDA) plays a crucial role in regulating hair care products, ensuring safety and proper labeling. In 2023, the FDA reported that it conducted inspections on over 150 hair care products to ensure compliance with safety standards. Manufacturers must comply with the Federal Food, Drug, and Cosmetic Act, which governs product ingredients, claims, and packaging. Non-compliance can result in penalties or product recalls, making adherence to these regulations essential for market players.

United States Men Hair Care Products Market Segmentation

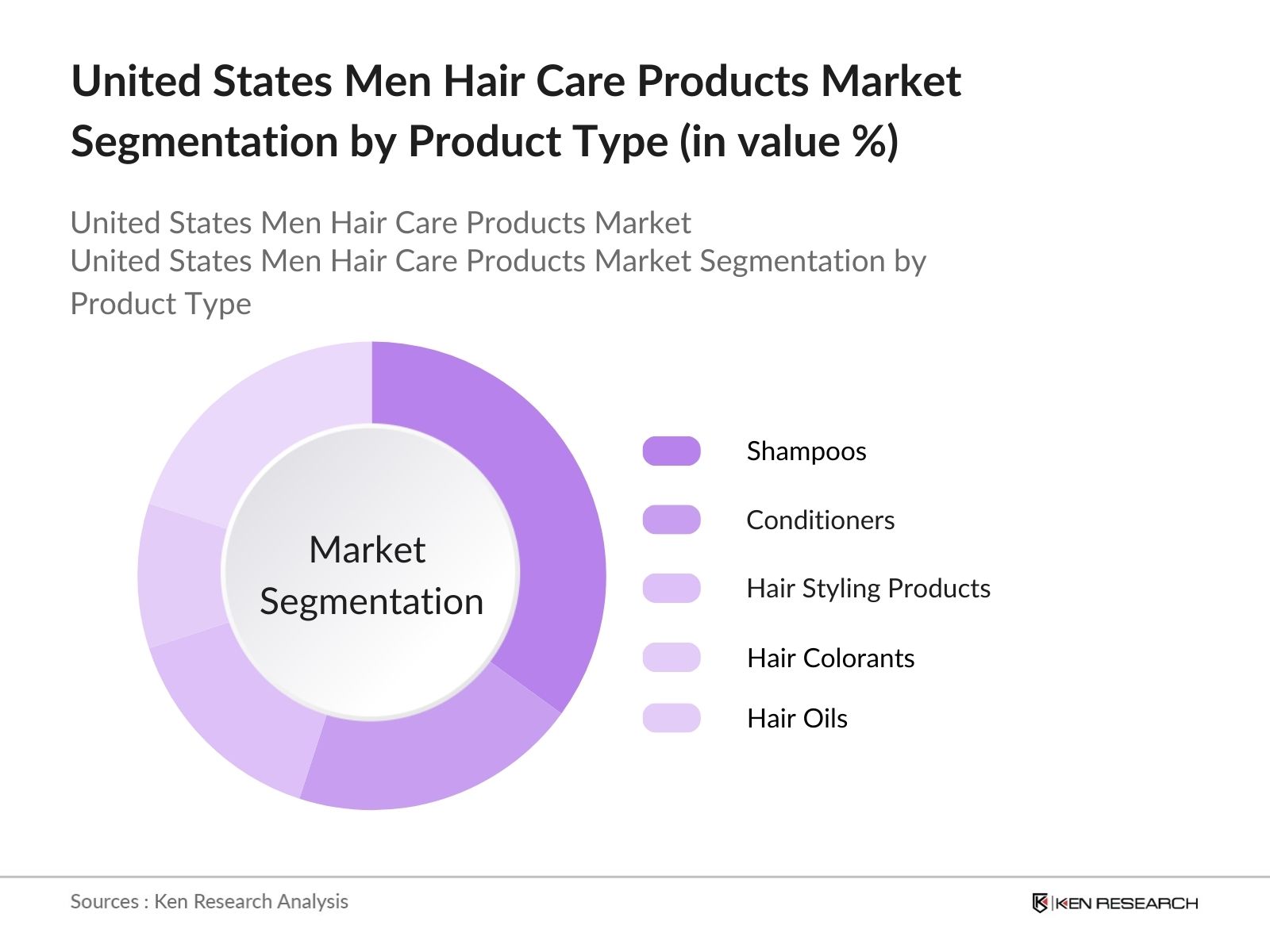

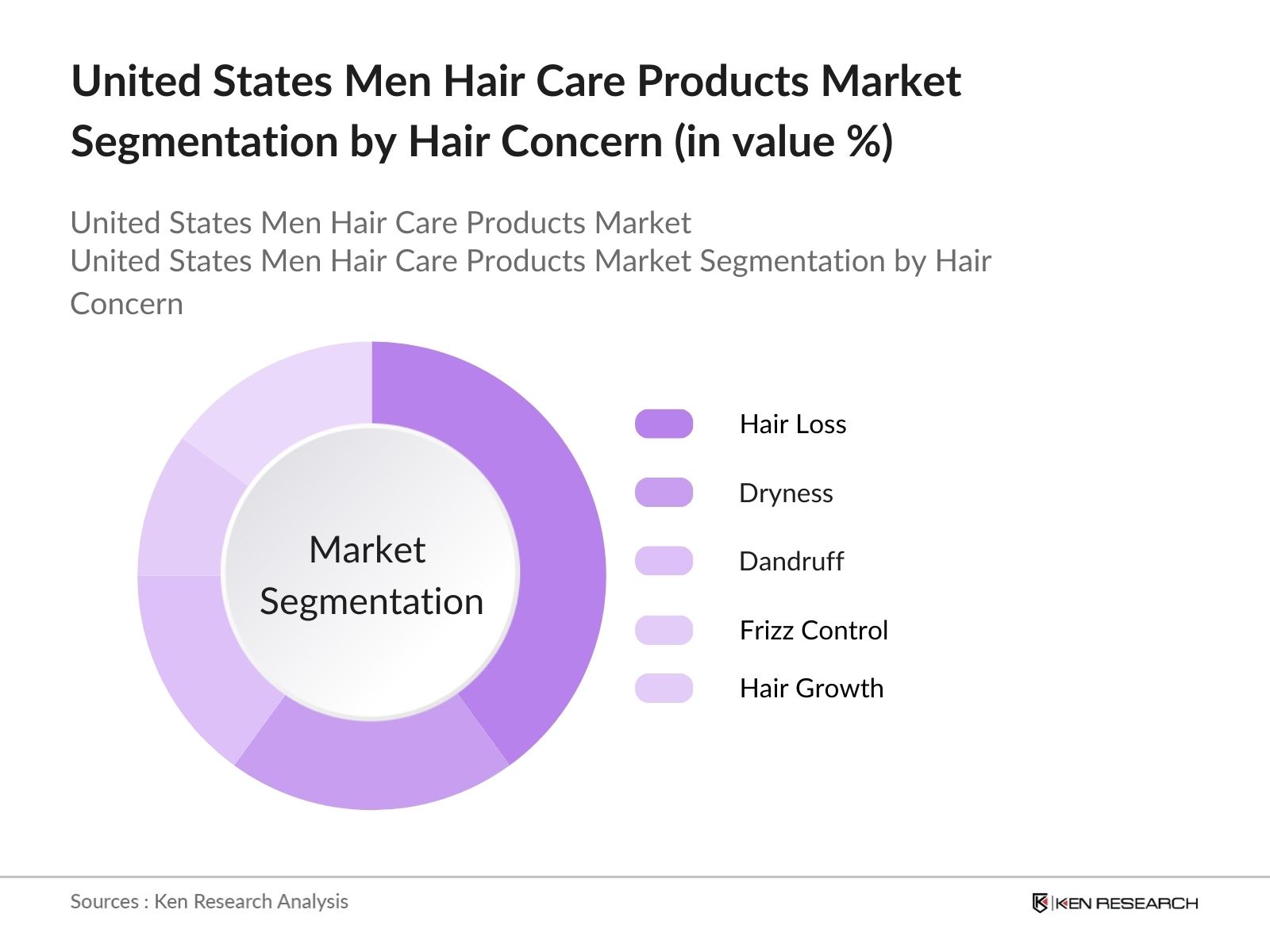

The U.S. Men Hair Care Products market is segmented by product type and by hair concern.

- By Product Type: The U.S. Men Hair Care Products market is segmented by product type into shampoos, conditioners, hair styling products (gel, pomades, wax), hair colorants, and hair oils.

Shampoos currently hold the dominant market share due to their widespread usage across all consumer demographics. The demand for anti-dandruff, anti-hair fall, and natural ingredient-based shampoos has increased significantly, with major brands launching specialized shampoos catering to these needs. The segments growth is driven by consumer preference for daily use products that address specific hair concerns while being gentle on the scalp.

- By Hair Concern: This segment is divided into hair loss, dryness, dandruff, frizz control, and hair growth. Hair loss treatments dominate this segment, as male consumers increasingly seek solutions for preventing and mitigating hair thinning and baldness. The rise in awareness about hair loss treatments, coupled with advancements in hair regrowth technologies and therapies, has made this sub-segment the leader. Popular products such as topical treatments, specialized shampoos, and serums contribute to its significant market share.

United States Men Hair Care Products Market Competitive Landscape

The U.S. Men Hair Care Products market is dominated by both global giants and local players, offering a variety of products to cater to the growing demands of the male consumer base. Key companies have leveraged marketing strategies, celebrity endorsements, and a wide product range to maintain their dominance. Global leaders such as Procter & Gamble and Unilever have invested heavily in R&D to innovate new products tailored to men's specific hair care needs, further cementing their leadership positions.

United States Men Hair Care Products Industry Analysis

Growth Drivers

- Increasing Grooming Awareness: The increasing awareness around grooming among men in the United States has been significantly driven by social trends and cultural shifts. In 2023, data from the U.S. Bureau of Labor Statistics highlighted those men spent an average of $193 annually on grooming and personal care products, up from $167 in 2022. This rise reflects a growing trend toward self-care, with hair care being a major focus. Additionally, the cultural emphasis on appearance in professional and social settings continues to drive this shift. Government surveys indicate a rise in male consumer focus on hygiene and hair aesthetics.

- Rising Disposable Income: Disposable income in the U.S. saw steady growth from 2022 to 2024, with per capita personal income reaching $63,000 in 2023, according to the U.S. Department of Commerce. This increase in disposable income has led to higher consumer spending on non-essential items, including men's hair care products. The personal grooming industry, particularly in hair care, has benefited from this trend as consumers are more willing to invest in premium products. In 2023, the consumer spending index showed an increase of 4.2% in discretionary spending, further bolstering the hair care segment.

- Shift Towards Organic Products: There is a clear consumer shift towards organic and natural hair care products, driven by a rising awareness of the harmful effects of synthetic chemicals. The U.S. Department of Agriculture noted a 12% increase in certified organic product sales in 2023, which includes hair care. This trend is particularly noticeable in urban areas where consumers are increasingly willing to pay a premium for eco-friendly and non-toxic products. Organic hair care products targeting men, such as those free from sulfates and parabens, have seen a significant rise in demand, with reports showing a marked preference for natural ingredients.

Market Challenges

- Intense Market Competition: The U.S. mens hair care market is highly competitive, with numerous brands offering a variety of products, from shampoos to styling gels. In 2023, the Federal Trade Commission reported that there were over 750 brands competing in this space, with new entrants continually emerging. This saturation leads to stiff competition, with many smaller brands struggling to establish themselves. Established brands dominate shelf space and have strong consumer loyalty, making it challenging for new players to gain market share.

- High Product Substitution Rates: A major challenge in the U.S. mens hair care market is the high rate of product substitution, where consumers frequently switch brands or try new products. A 2023 consumer behavior study by the U.S. Department of Commerce revealed that 42% of male consumers change their preferred brand of hair care products every six months. This volatility is fueled by aggressive marketing, promotional discounts, and the frequent introduction of new products. As a result, customer retention remains a key challenge for brands.

United States Men Hair Care Products Market Future Outlook

Over the next five years, the U.S. Men Hair Care Products market is expected to experience significant growth, driven by increasing consumer awareness, product innovations, and the growing trend of personalized grooming solutions. As male consumers become more conscious about their appearance and wellness, brands are focusing on developing targeted solutions such as chemical-free shampoos, anti-aging hair products, and advanced hair restoration techniques. The rise of e-commerce platforms and direct-to-consumer models will also enhance market accessibility, enabling companies to reach a broader audience.

Market Opportunities

- Expansion into Specialized Products (Beard Care, Anti-hair Loss): With the growing demand for specialized grooming solutions, there is a significant opportunity for expanding product lines into areas such as beard care and anti-hair loss treatments. In 2023, the National Institute of Health reported that 30 million men in the U.S. suffer from hair loss, a statistic that has driven increased demand for hair loss prevention and treatment products. Similarly, the rising popularity of beards among men has spurred a surge in the beard care segment, with sales of beard grooming products increasing by 15% in 2023.

- Growth of E-commerce Platforms: E-commerce platforms have seen robust growth in the U.S., and this trend presents a significant opportunity for mens hair care brands. In 2023, the U.S. Census Bureau reported that online retail sales reached $1.1 trillion, with grooming products among the fast-growing segments. Digital platforms offer brands a direct-to-consumer approach, bypassing traditional retail channels. This has led to the emergence of niche brands that cater to specific grooming needs, while established brands use e-commerce to expand their reach and offer personalized products.

Scope of the Report

|

Shampoos Conditioners Styling Products (Gel, Pomades, Wax) Hair Colorants Hair Oils |

|

|

By Hair Concern |

Hair Loss Dryness Dandruff Frizz Control Hair Growth |

|

By Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Pharmacies E-commerce Barber Shops/Salons |

|

By Ingredients |

Synthetic Ingredients Natural Ingredients Organic Ingredients Vegan Products |

|

By Region |

North East West South |

Products

Key Target Audience

Hair Care Product Manufacturers

Retailers & Distributors

E-commerce Platforms

Investment and Venture Capitalist Firms

Barber Shops and Salons

Government and Regulatory Bodies (e.g., FDA, Environmental Protection Agency)

Packaging and Sustainability Consultants

Consumer Goods Marketing Agencies

Companies

Players Mention in the Report:

Procter & Gamble

Unilever

L'Oral

Johnson & Johnson

Beiersdorf AG

Church & Dwight Co., Inc.

Coty Inc.

American Crew

Jack Black LLC

Baxter of California

Redken (LOral Group)

Paul Mitchell

Revlon Inc.

Henkel AG & Co. KGaA

The Este Lauder Companies Inc.

Table of Contents

1. United States Men Hair Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Consumer Preference, Product Availability)

1.4. Market Segmentation Overview

2. United States Men Hair Care Products Market Size (In USD Bn)

2.1. Historical Market Size (Product Sales, Consumer Demand)

2.2. Year-On-Year Growth Analysis (Retail Channels, E-commerce Performance)

2.3. Key Market Developments and Milestones (Product Launches, Innovations)

3. United States Men Hair Care Products Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Grooming Awareness

3.1.2. Rising Disposable Income

3.1.3. Shift Towards Organic Products

3.1.4. Marketing and Celebrity Endorsements

3.2. Market Challenges

3.2.1. Intense Market Competition

3.2.2. High Product Substitution Rates

3.2.3. Regulatory and Compliance Issues

3.3. Opportunities

3.3.1. Expansion into Specialized Products (Beard Care, Anti-hair Loss)

3.3.2. Growth of E-commerce Platforms

3.3.3. Increased Focus on Sustainability and Eco-Friendly Packaging

3.4. Trends

3.4.1. Growth of Natural and Organic Ingredients

3.4.2. Personalization in Hair Care Solutions

3.4.3. Adoption of Digital Marketing Strategies

3.5. Government Regulation

3.5.1. FDA Regulations on Hair Care Products

3.5.2. Import/Export Compliance

3.5.3. Environmental Regulations on Packaging

3.6. SWOT Analysis (Market Specific to Consumer Behavior, Competition)

3.7. Stakeholder Ecosystem (Retailers, Manufacturers, Consumers)

3.8. Porters Five Forces (Bargaining Power of Consumers, Supplier Dominance)

3.9. Competition Ecosystem

4. United States Men Hair Care Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Shampoos

4.1.2. Conditioners

4.1.3. Styling Products (Gel, Pomades, Wax)

4.1.4. Hair Colorants

4.1.5. Hair Oils

4.2. By Hair Concern (In Value %)

4.2.1. Hair Loss

4.2.2. Dryness

4.2.3. Dandruff

4.2.4. Frizz Control

4.2.5. Hair Growth

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Specialty Stores

4.3.3. Pharmacies

4.3.4. E-commerce

4.3.5. Barber Shops/Salons

4.4. By Ingredients (In Value %)

4.4.1. Synthetic Ingredients

4.4.2. Natural Ingredients

4.4.3. Organic Ingredients

4.4.4. Vegan Products

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. United States Men Hair Care Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble Co.

5.1.2. Unilever PLC

5.1.3. Johnson & Johnson

5.1.4. The Este Lauder Companies Inc.

5.1.5. Beiersdorf AG

5.1.6. L'Oral S.A.

5.1.7. Coty Inc.

5.1.8. Revlon Inc.

5.1.9. Henkel AG & Co. KGaA

5.1.10. Church & Dwight Co., Inc.

5.1.11. American Crew

5.1.12. Jack Black LLC

5.1.13. Baxter of California

5.1.14. Redken (LOral Group)

5.1.15. Paul Mitchell

5.2. Cross Comparison Parameters (Revenue, Market Share, Distribution Reach, Innovation Focus, Pricing Strategy, Product Diversification, Sustainability Initiatives, Consumer Ratings)

5.3. Market Share Analysis (Top 5 Competitors)

5.4. Strategic Initiatives (Partnerships, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (R&D, Marketing Spend)

5.7. Venture Capital Funding

5.8. Government Grants (Sustainability, Innovation in Packaging)

5.9. Private Equity Investments

6. United States Men Hair Care Products Market Regulatory Framework

6.1. FDA Compliance on Ingredients and Labeling

6.2. Packaging Regulations (Sustainability, Recycling Mandates)

6.3. Advertising and Marketing Guidelines

7. United States Men Hair Care Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Key Growth Drivers)

7.2. Key Factors Driving Future Market Growth (Online Sales, Consumer Preferences)

8. United States Men Hair Care Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Hair Concern (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredients (In Value %)

8.5. By Region (In Value %)

9. United States Men Hair Care Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was developed for the U.S. Men Hair Care Products Market. Extensive desk research, utilizing secondary and proprietary databases, was conducted to gather industry-level information. This step aimed to identify the critical variables influencing market dynamics, such as consumer behavior, product innovation, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data for the market was analyzed, assessing product performance, revenue growth, and market penetration. Key metrics such as distribution reach, brand loyalty, and consumer purchasing patterns were evaluated to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through in-depth interviews with industry experts, including product managers and marketing professionals from leading companies. These consultations provided operational insights that helped fine-tune the market estimates.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating insights from multiple hair care product manufacturers to verify sales data, consumer preferences, and emerging trends. This synthesis provided a comprehensive analysis of the U.S. Men Hair Care Products market.

Frequently Asked Questions

01. How big is the U.S. Men Hair Care Products Market?

The U.S. Men Hair Care Products market is valued at USD 2.3 billion, driven by rising consumer demand for specialized hair care products and growing interest in natural and organic ingredients.

02. What are the challenges in the U.S. Men Hair Care Products Market?

Challenges in U.S. Men Hair Care Products market include intense competition from global and local brands, product substitution, and compliance with evolving regulatory standards. Moreover, the market faces challenges from counterfeit products and fluctuating raw material costs.

03. Who are the major players in the U.S. Men Hair Care Products Market?

Key players in U.S. Men Hair Care Products market include Procter & Gamble, Unilever, L'Oral, Johnson & Johnson, and Beiersdorf AG. These companies maintain their dominance through extensive product portfolios, strong branding, and significant investment in marketing and R&D.

04. What are the growth drivers of the U.S. Men Hair Care Products Market?

The U.S. Men Hair Care Products market is propelled by increased grooming awareness, rising disposable income, and the growing trend of personalized hair care solutions. Additionally, the rise of natural and organic products has boosted consumer interest.

05. Which regions dominate the U.S. Men Hair Care Products Market?

Cities like New York, Los Angeles, and Chicago dominate the U.S. Men Hair Care Products market due to their large urban populations, high disposable incomes, and access to premium retail and e-commerce channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.