United States Packaging Materials Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11084

November 2024

83

About the Report

United States Packaging Materials Market Overview

- The United States packaging materials market, valued at USD 265 billion, has shown substantial growth driven by the robust expansion of sectors like food and beverages, healthcare, e-commerce, and industrial goods. This growth is largely fueled by increasing demand for packaging solutions that ensure product safety, convenience, and longer shelf life. Food and beverage packaging remains a significant driver, especially with the rise of ready-to-eat meals, on-the-go beverages, and pre-packaged items.

- Cities such as New York, Los Angeles, and Chicago are key influencers in the U.S. packaging materials market. These metropolitan areas have a high population density, significant commercial activity, and serve as major distribution hubs, creating a consistent demand for diverse packaging solutions. Furthermore, states like California and Texas play pivotal roles due to their large consumer bases, leading manufacturing facilities, and extensive trade networks.

- The EPA has established comprehensive guidelines to manage packaging waste and promote recycling. In 2021, the EPA reported that containers and packaging materials generated approximately 82.2 million tons of waste, representing 28.1% of the total municipal solid waste. To address this, the EPA's National Recycling Strategy aims to increase the national recycling rate to 50% by 2030, emphasizing the importance of sustainable packaging practices. These guidelines encourage manufacturers to design packaging that is recyclable or compostable, thereby reducing environmental impact.

United States Packaging Materials Market Segmentation

By Material Type: The United States packaging materials market is segmented by material type into plastic, paper and paperboard, metal, glass, and others. Plastic packaging materials hold a dominant market share due to their versatility, lightweight nature, and cost-effectiveness, making them suitable for a wide range of applications across various industries.

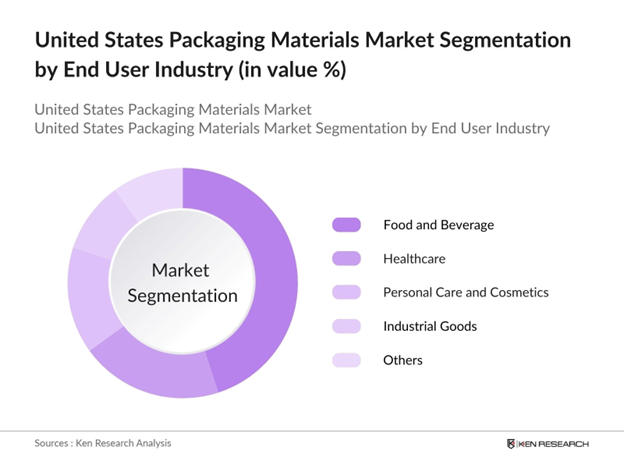

By End-Use Industry: The market is also segmented by end-use industry into food and beverage, healthcare, personal care and cosmetics, industrial goods, and others. The food and beverage industry commands the largest market share, driven by the continuous demand for packaged foods, beverages, and ready-to-eat meals, necessitating diverse packaging solutions to ensure product safety and shelf life.

United States Packaging Materials Market Competitive Landscape

The U.S. packaging materials market is characterized by the presence of several key players who contribute significantly to market dynamics.

United States Packaging Materials Market Analysis

Growth Drivers

- E-commerce Expansion: The United States has witnessed a significant surge in e-commerce activities, with online retail sales reaching $1.03 trillion in 2022, marking a substantial increase from $870 billion in 2021. This growth has intensified the demand for packaging materials, as products require secure and efficient packaging for distribution. This upward trend underscores the critical role of packaging in facilitating the safe and efficient delivery of goods to consumers nationwide.

- Sustainability Initiatives: Environmental sustainability has become a focal point in the packaging industry. The U.S. Environmental Protection Agency (EPA) reported that in 2021, containers and packaging constituted 28.1% of municipal solid waste, amounting to approximately 82.2 million tons. In response, there has been a concerted effort to reduce waste through recycling and the adoption of sustainable materials. The EPA's National Recycling Strategy aims to increase the national recycling rate to 50% by 2030, promoting the use of recyclable and biodegradable packaging materials.

- Technological Advancements: Technological innovations are transforming the packaging sector. The integration of smart packaging solutions, such as QR codes and RFID tags, enhances product tracking and consumer engagement. The U.S. Department of Commerce has highlighted the importance of advanced manufacturing technologies, including automation and digital printing, in improving packaging efficiency and customization. These advancements enable companies to meet diverse consumer preferences and regulatory requirements more effectively.

Challenges

- Regulatory Compliance: The packaging industry must navigate a complex landscape of regulations. The U.S. Food and Drug Administration (FDA) enforces stringent standards to ensure that packaging materials are safe for food contact, as outlined in Title 21 of the Code of Federal Regulations. Compliance with these regulations requires continuous monitoring and adaptation, posing challenges for manufacturers in terms of cost and operational efficiency.

- Environmental Concerns: Environmental issues, including plastic pollution and waste management, present significant challenges. The EPA reported that in 2021, 6% of plastic materials were recycled, highlighting the need for improved waste management practices. Public awareness and regulatory pressures are driving the industry towards more sustainable practices, necessitating investments in research and development for eco-friendly materials and processes.

United States Packaging Materials Market Future Outlook

Over the next five years, the United States packaging materials market is expected to experience steady growth, driven by advancements in sustainable packaging solutions, increasing consumer awareness regarding environmental impact, and the expansion of e-commerce, which necessitates innovative packaging designs to ensure product safety and customer satisfaction.

Market Opportunities

- Biodegradable Materials Adoption: The shift towards biodegradable materials offers substantial growth opportunities. The U.S. Department of Agriculture's BioPreferred Program reported a 20% increase in the use of biobased products in 2022. This trend reflects a growing consumer preference for environmentally friendly packaging solutions, encouraging manufacturers to invest in biodegradable materials that reduce environmental impact and comply with emerging regulations.

- Smart Packaging Solutions: The adoption of smart packaging technologies is on the rise. The U.S. Department of Commerce noted that the integration of Internet of Things (IoT) technologies in packaging can enhance supply chain transparency and improve consumer engagement. For instance, QR codes on packaging allow consumers to access product information and verify authenticity, adding value and differentiating products in a competitive market.

Scope of the Report

|

Segment |

Sub-Segments |

|

Material Type |

Plastic |

|

Packaging Type |

Rigid Packaging |

|

End-Use Industry |

Food and Beverage |

|

Function |

Primary Packaging |

|

Region |

Northeast |

Products

Key Target Audience

Packaging Manufacturers

Raw Material Suppliers

Food and Beverage Companies

Healthcare Product Manufacturers

Personal Care and Cosmetics Companies

Industrial Goods Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency)

Companies

Players Mentioned in the Report

Amcor PLC

International Paper Company

Berry Global Inc.

Sealed Air Corporation

Crown Holdings Inc.

Smurfit Kappa Group PLC

WestRock Company

Ball Corporation

Mondi PLC

Huhtamaki OYJ

Table of Contents

1. United States Packaging Materials Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. United States Packaging Materials Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. United States Packaging Materials Market Analysis

3.1 Growth Drivers

3.1.1 E-commerce Expansion

3.1.2 Sustainability Initiatives

3.1.3 Technological Advancements

3.1.4 Consumer Preference Shifts

3.2 Market Challenges

3.2.1 Regulatory Compliance

3.2.2 Raw Material Price Volatility

3.2.3 Environmental Concerns

3.3 Opportunities

3.3.1 Biodegradable Materials Adoption

3.3.2 Smart Packaging Solutions

3.3.3 Emerging Markets Expansion

3.4 Trends

3.4.1 Lightweight Packaging

3.4.2 Recyclable Materials Usage

3.4.3 Digital Printing Integration

3.5 Government Regulations

3.5.1 Environmental Protection Agency (EPA) Guidelines

3.5.2 Food and Drug Administration (FDA) Packaging Standards

3.5.3 State-Level Packaging Waste Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competitive Landscape

4. United States Packaging Materials Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Plastic

4.1.2 Paper and Paperboard

4.1.3 Metal

4.1.4 Glass

4.1.5 Others

4.2 By Packaging Type (In Value %)

4.2.1 Rigid Packaging

4.2.2 Flexible Packaging

4.2.3 Semi-Rigid Packaging

4.3 By End-Use Industry (In Value %)

4.3.1 Food and Beverage

4.3.2 Healthcare

4.3.3 Personal Care and Cosmetics

4.3.4 Industrial Goods

4.3.5 Others

4.4 By Function (In Value %)

4.4.1 Primary Packaging

4.4.2 Secondary Packaging

4.4.3 Tertiary Packaging

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. United States Packaging Materials Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor PLC

5.1.2 International Paper Company

5.1.3 Berry Global Inc.

5.1.4 Sealed Air Corporation

5.1.5 Crown Holdings Inc.

5.1.6 Smurfit Kappa Group PLC

5.1.7 WestRock Company

5.1.8 Ball Corporation

5.1.9 Mondi PLC

5.1.10 Huhtamaki OYJ

5.2 Cross Comparison Parameters

- Revenue

- Market Share

- Product Portfolio

- Regional Presence

- Sustainability Initiatives

- Technological Innovations

- Mergers and Acquisitions

- R&D Investments

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. United States Packaging Materials Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. United States Packaging Materials Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. United States Packaging Materials Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Function (In Value %)

8.5 By Region (In Value %)

9. United States Packaging Materials Market Analysts’ Recommendations

9.1 Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the United States Packaging Materials Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the United States Packaging Materials Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple packaging materials manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the United States Packaging Materials Market.

Frequently Asked Questions

01. How big is the United States Packaging Materials Market?

The United States packaging materials market is valued at USD 267 billion, driven by the expansion of the food and beverage sector and the growing demand for secure and convenient packaging solutions.

02. What are the challenges in the United States Packaging Materials Market?

Challenges in United States packaging materials market include regulatory compliance, raw material price volatility, and environmental concerns related to waste management and sustainability, which necessitate continuous innovation and adaptation by industry players.

03. Who are the major players in the United States Packaging Materials Market?

Key players in United States packaging materials market include Amcor PLC, International Paper Company, Berry Global Inc., Sealed Air Corporation, and Crown Holdings Inc., among others, each contributing significantly to market dynamics.

04. What are the growth drivers of the United States Packaging Materials Market?

United States packaging materials market is propelled by factors such as the expansion of e-commerce, sustainability initiatives, technological advancements, and shifts in consumer preferences towards eco-friendly and convenient packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.