United States Rodenticides Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD9144

December 2024

96

About the Report

United States Rodenticides Market Overview

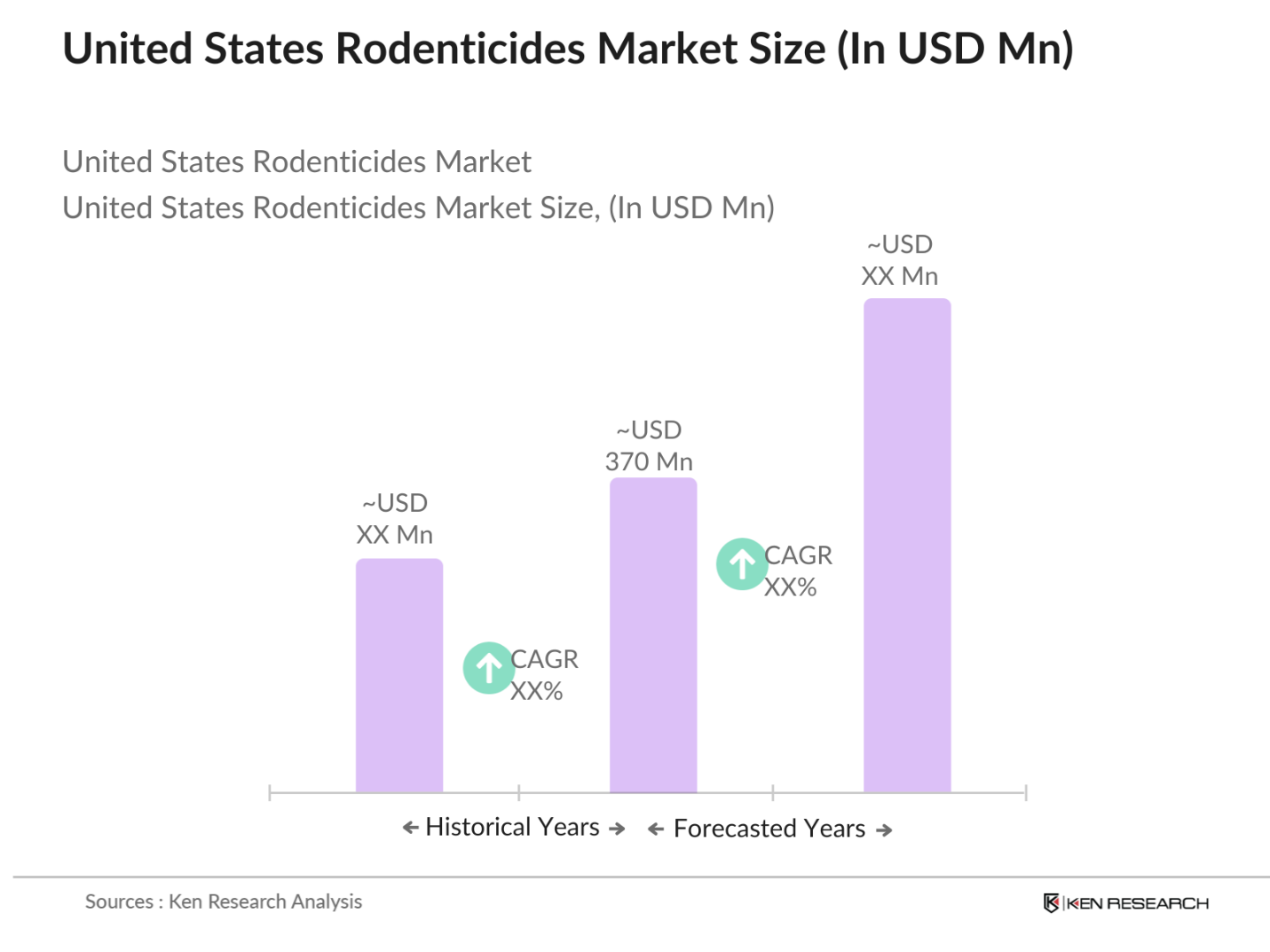

- The United States Rodenticides Market is valued at USD 370 million, driven by rising public health concerns and increased agricultural activities that necessitate effective pest control. The demand for rodenticides has also surged due to urbanization and industrial expansion, leading to a greater need for pest management in urban centers, residential areas, and warehouses. This growth is underpinned by reliable data sources indicating that rodenticides remain an essential component of pest management solutions across various sectors.

- In terms of geographic dominance, California, Texas, and Florida are leading states in the U.S. rodenticides market. Californias dominance can be attributed to its extensive agricultural sector, while Texas and Florida also exhibit significant market presence due to their large urban populations and high demand for rodent control in residential and commercial sectors. These regions prioritize pest management, given their extensive infrastructure, urbanization, and regulations addressing pest control for public health.

- The EPA's guidelines in 2024 emphasize responsible rodenticide use to mitigate environmental impact. These guidelines enforce restrictions on high-risk chemicals, limiting their use near water bodies and agricultural fields. The EPA has also mandated buffer zones around protected areas, impacting the placement and volume of rodenticides applied in commercial pest control. Compliance with these regulations ensures safer use but may increase operational costs for pest control providers.

United States Rodenticides Market Segmentation

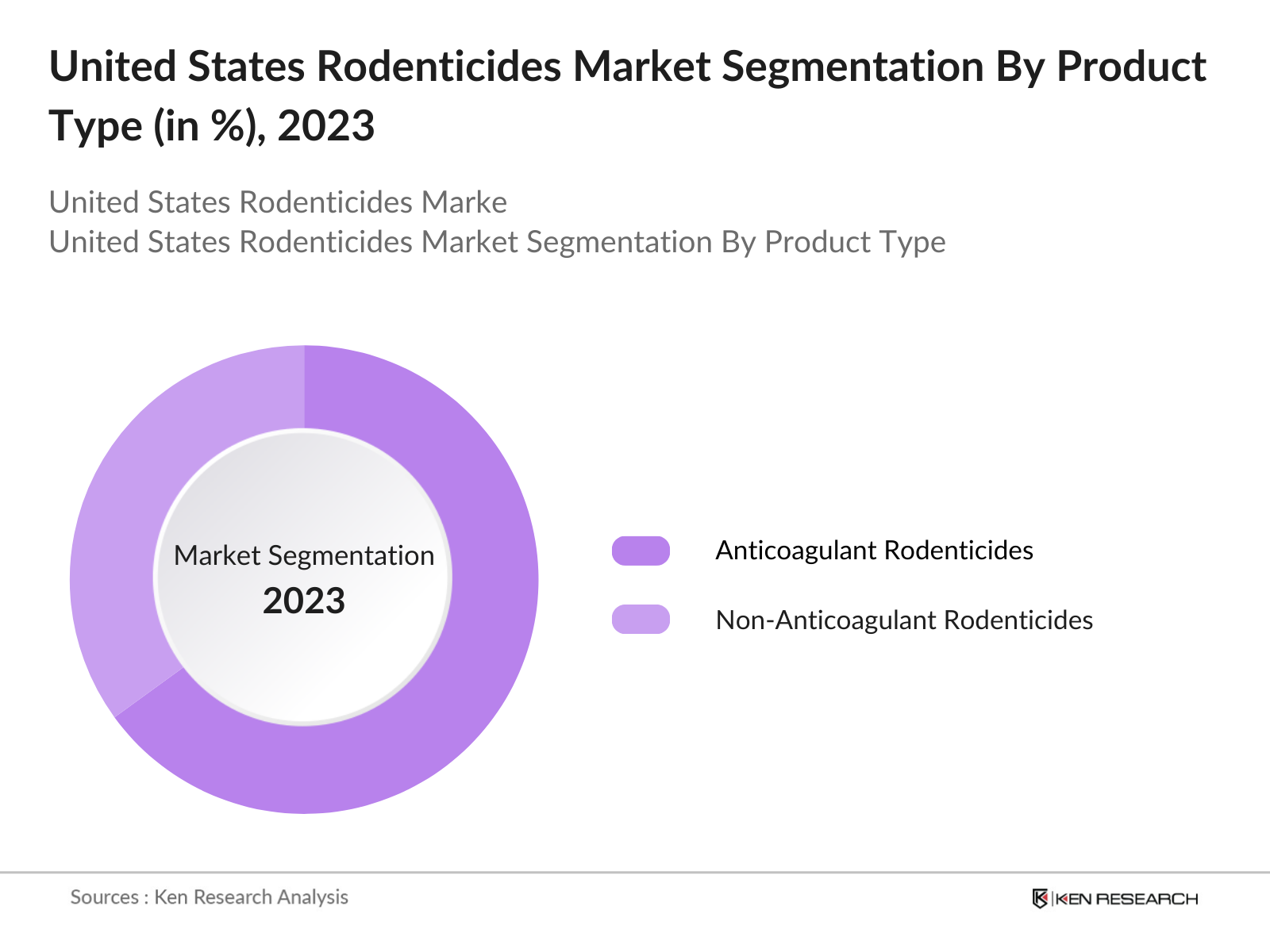

By Product Type: The U.S. Rodenticides Market is segmented by product type into anticoagulant rodenticides and non-anticoagulant rodenticides. Anticoagulant rodenticides hold a dominant market share within this segment, driven by their effectiveness in controlling rodent populations. Anticoagulant rodenticides offer a gradual but effective mechanism to prevent rodent infestation over a period, making them a preferred choice among pest control professionals. Products in this category, such as first- and second-generation anticoagulants, are widely used due to their proven efficacy, even in challenging pest control environments.

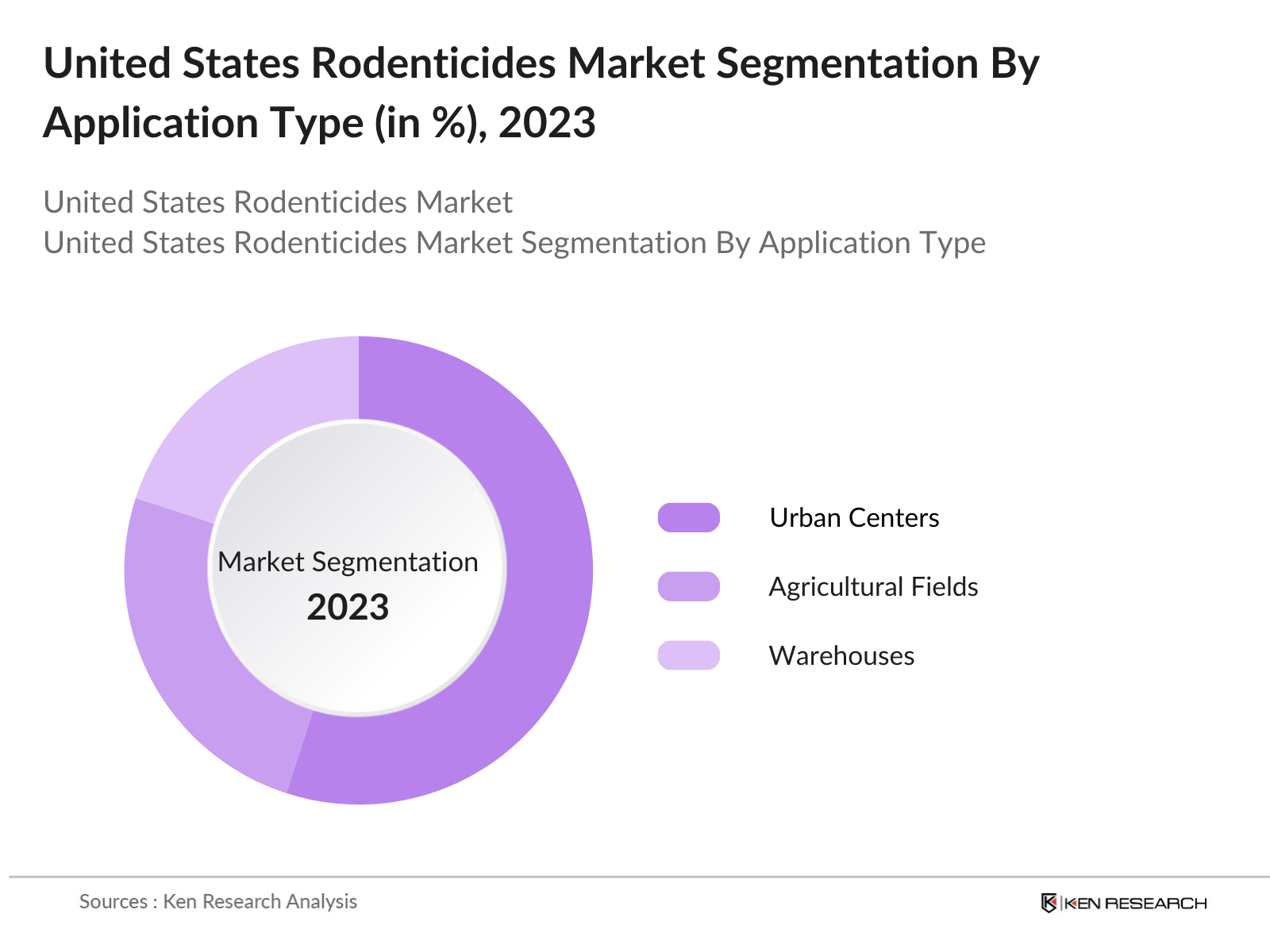

By Application: The market is segmented by application into agricultural fields, warehouses, and urban centers, which are further classified into residential and commercial spaces. Urban centers, particularly residential spaces, dominate this segment due to the increasing awareness about public health and the need for pest control in densely populated areas. With urbanization on the rise, residents and municipalities increasingly rely on rodenticides to mitigate rodent-related health risks and protect infrastructure, contributing to the stronghold of this segment.

United States Rodenticides Market Competitive Landscape

The United States Rodenticides Market is dominated by both established global players and local manufacturers who compete on product efficacy, innovation, and adherence to regulatory standards. Companies such as Bayer AG, BASF SE, and Syngenta AG lead due to their extensive distribution networks and established brands. This competitive consolidation highlights the significant influence of key players with a strong foothold in the market.

United States Rodenticides Industry Analysis

Growth Drivers

- Urbanization and Industrial Expansion: The ongoing urbanization and industrial expansion in 2024 has heightened the demand for rodent control services. In regions with high urban density, like Southeast Asia and parts of South America, rodent populations have surged due to increased food and waste availability. For example, urban population in Southeast Asia has grown by 2.4 million in 2024, amplifying food and habitat sources for rodents, thereby escalating rodent control requirements. With industrial zones expanding globally, factories are at higher risk of rodent infestation, particularly in logistics and food production, where the potential for contamination is significant. Government regulations mandate stricter hygiene controls, pushing industries to adopt robust rodent control solutions.

- Agricultural Activities and Crop Protection: In 2024, the agricultural sector has shown an upsurge in rodent control efforts due to the direct impact on crop yields. In South Asia, rodents are responsible for approximately 6 million metric tons of crop loss annually, affecting food security and economic stability. Additionally, heightened awareness of food safety standards has driven the adoption of rodent control measures in agricultural zones. Global crop production indices indicate high vulnerability to rodent infestations, especially in rice and maize farming areas, where losses can reach 10% of potential yield annually. This trend has made rodent control integral to ensuring food security and economic stability.

- Public Health Concerns and Disease Control: Public health concerns have led to increased emphasis on rodent control in densely populated regions. Rodents transmit diseases like hantavirus and leptospirosis, which have seen a rise in cases. In 2024, Southeast Asia alone reported over 35,000 cases of leptospirosis linked to rodent exposure. Government health agencies, recognizing the threat, have intensified rodent control initiatives. In the United States, the CDC has allocated funding specifically for rodent-borne disease prevention in major cities, particularly where homelessness and poverty increase the risk of rodent infestations.

Market Challenges

- Regulatory Restrictions on Rodenticide Use: Government regulations have imposed limitations on rodenticide usage due to their environmental and health impacts. For instance, the EU banned second-generation anticoagulants in certain areas in 2024, affecting 30% of the rodent control chemicals used across the EU. The EPA in the U.S. has similarly restricted rodenticide availability, impacting both commercial pest control providers and farmers, who now face higher costs and limited product options. These restrictions challenge the market, prompting companies to seek alternative, eco-friendly methods for effective rodent control.

- Environmental and Non-Target Species Impact: Rodent control products can harm non-target wildlife, especially birds and mammals, leading to restrictions. Studies in 2024 revealed that rodenticides impact species like owls and hawks, with 15% of surveyed bird populations in urban areas showing signs of secondary poisoning. Additionally, concerns around waterway contamination have led to increased scrutiny of rodenticide application, especially in rural areas adjacent to protected ecosystems. These factors challenge the industry to balance efficacy with environmental responsibility, encouraging innovation in less harmful alternatives.

United States Rodenticides Market Future Outlook

Over the next five years, the United States Rodenticides Market is expected to witness steady growth, fueled by advancements in product formulations, stricter pest control regulations, and increasing demand in urban centers. Key factors, such as technological advancements in rodent control methods and the development of environmentally friendly products, will further drive market expansion. The introduction of non-toxic and eco-friendly rodenticides is anticipated to align with consumer preferences and regulatory standards, supporting sustainable growth in the market.

Opportunities

- Development of Eco-Friendly Rodenticides: The demand for eco-friendly rodenticides is on the rise as regulators push for greener solutions. Organic rodenticides, which utilize compounds like zinc phosphide, have shown promising results, particularly in agricultural areas. For instance, these alternatives have gained 20% of the market share in New Zealand's pest control market in 2024. Innovations in green rodenticides present opportunities for companies to align with sustainable practices, tapping into environmentally-conscious markets and expanding product offerings.

- Integration with Integrated Pest Management (IPM) Programs: The integration of rodent control within IPM strategies provides a substantial opportunity, especially in regions emphasizing sustainable agriculture. IPM-based rodent control has shown efficacy in reducing crop losses by 15% in pilot programs across Asia, with the Asian Development Bank supporting its rollout in agricultural zones. This integrated approach attracts funding and government support, as it combines biological control with targeted rodenticides, reducing environmental impact and improving long-term pest control outcomes.

Scope of the Report

|

Product Type |

Anticoagulant Rodenticides |

|

Form |

Pellets |

|

Application |

Agricultural Fields |

|

Rodent Type |

Rats |

|

Region |

Northeast |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Pest Control Companies

Agriculture and Farming Compnaies

Urban Municipalities and Local Governments (Environmental Protection Agencies)

Public Health Companies

Food and Beverage Manufacturing Industries

Warehousing and Distribution Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency, USDA)

Companies

Players Mentioned in the Report

Bayer AG

BASF SE

Syngenta AG

Neogen Corporation

JT Eaton & Co., Inc.

Liphatech Inc.

PelGar International

SenesTech, Inc.

Bell Laboratories, Inc.

Rollins, Inc.

Table of Contents

1. United States Rodenticides Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. United States Rodenticides Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. United States Rodenticides Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Industrial Expansion

3.1.2. Agricultural Activities and Crop Protection

3.1.3. Public Health Concerns and Disease Control

3.1.4. Technological Advancements in Rodent Control

3.2. Market Challenges

3.2.1. Regulatory Restrictions on Rodenticide Use

3.2.2. Environmental and Non-Target Species Impact

3.2.3. Development of Rodent Resistance

3.3. Opportunities

3.3.1. Development of Eco-Friendly Rodenticides

3.3.2. Integration with Integrated Pest Management (IPM) Programs

3.3.3. Expansion into Untapped Markets

3.4. Trends

3.4.1. Shift Towards Non-Chemical Control Methods

3.4.2. Adoption of Digital Monitoring and Smart Traps

3.4.3. Increased Use of Biological Rodenticides

3.5. Government Regulations

3.5.1. Environmental Protection Agency (EPA) Guidelines

3.5.2. State-Level Regulations and Compliance

3.5.3. Restrictions on Second-Generation Anticoagulants

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. United States Rodenticides Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Anticoagulant Rodenticides

4.1.1.1. First-Generation Anticoagulants

4.1.1.2. Second-Generation Anticoagulants

4.1.2. Non-Anticoagulant Rodenticides

4.2. By Form (In Value %)

4.2.1. Pellets

4.2.2. Blocks

4.2.3. Powders

4.2.4. Sprays

4.3. By Application (In Value %)

4.3.1. Agricultural Fields

4.3.2. Warehouses

4.3.3. Urban Centers

4.3.3.1. Residential

4.3.3.2. Commercial

4.4. By Rodent Type (In Value %)

4.4.1. Rats

4.4.2. Mice

4.4.3. Others (e.g., Squirrels, Chipmunks)

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. United States Rodenticides Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Bayer AG

5.1.3. Syngenta AG

5.1.4. Liphatech Inc.

5.1.5. PelGar International

5.1.6. JT Eaton & Co., Inc.

5.1.7. Neogen Corporation

5.1.8. Rentokil Initial plc

5.1.9. Ecolab Inc.

5.1.10. Anticimex

5.1.11. SenesTech, Inc.

5.1.12. Rollins, Inc.

5.1.13. Bell Laboratories, Inc.

5.1.14. UPL Limited

5.1.15. Terminix Global Holdings, Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, R&D Investment, Strategic Initiatives, Number of Employees, Year of Establishment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. United States Rodenticides Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. United States Rodenticides Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. United States Rodenticides Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Application (In Value %)

8.4. By Rodent Type (In Value %)

8.5. By Region (In Value %)

9. United States Rodenticides Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all key stakeholders within the U.S. Rodenticides Market. Extensive desk research is conducted to gather industry-level information from secondary sources, aiming to identify critical variables affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data for the U.S. Rodenticides Market is compiled, assessing factors like market penetration, product demand, and revenue streams. A statistical analysis of usage trends ensures the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through expert interviews using computer-assisted telephone interviews (CATI). This step provides operational and financial insights directly from industry experts to enhance data reliability.

Step 4: Research Synthesis and Final Output

The final stage includes primary consultations with major manufacturers to verify product segmentation, sales performance, and customer preferences. This ensures a comprehensive, validated analysis of the U.S. Rodenticides Market, combining both bottom-up and top-down approaches.

Frequently Asked Questions

01. How big is the United States Rodenticides Market?

The United States Rodenticides Market is valued at approximately USD 370 million, driven by urbanization and the need for pest control in various sectors including agriculture and residential areas.

02. What are the main challenges in the United States Rodenticides Market?

Key challenges include regulatory restrictions, environmental impact concerns, and rodent resistance to certain rodenticides, which necessitates continuous innovation in product formulations.

03. Who are the major players in the United States Rodenticides Market?

Leading players include Bayer AG, BASF SE, Syngenta AG, Neogen Corporation, and JT Eaton & Co., Inc., all of which have strong distribution networks and a focus on product innovation.

04. What factors drive growth in the United States Rodenticides Market?

Growth is driven by increased urbanization, the necessity for pest control in agricultural and urban centers, and innovations in rodenticide formulations that address resistance and environmental concerns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.