United States Smart Homes Market Outlook to 2030

Region:North America

Author(s):Pranav Krishn

Product Code:KROD316

July 2024

100

About the Report

United States Smart Homes Market Overview

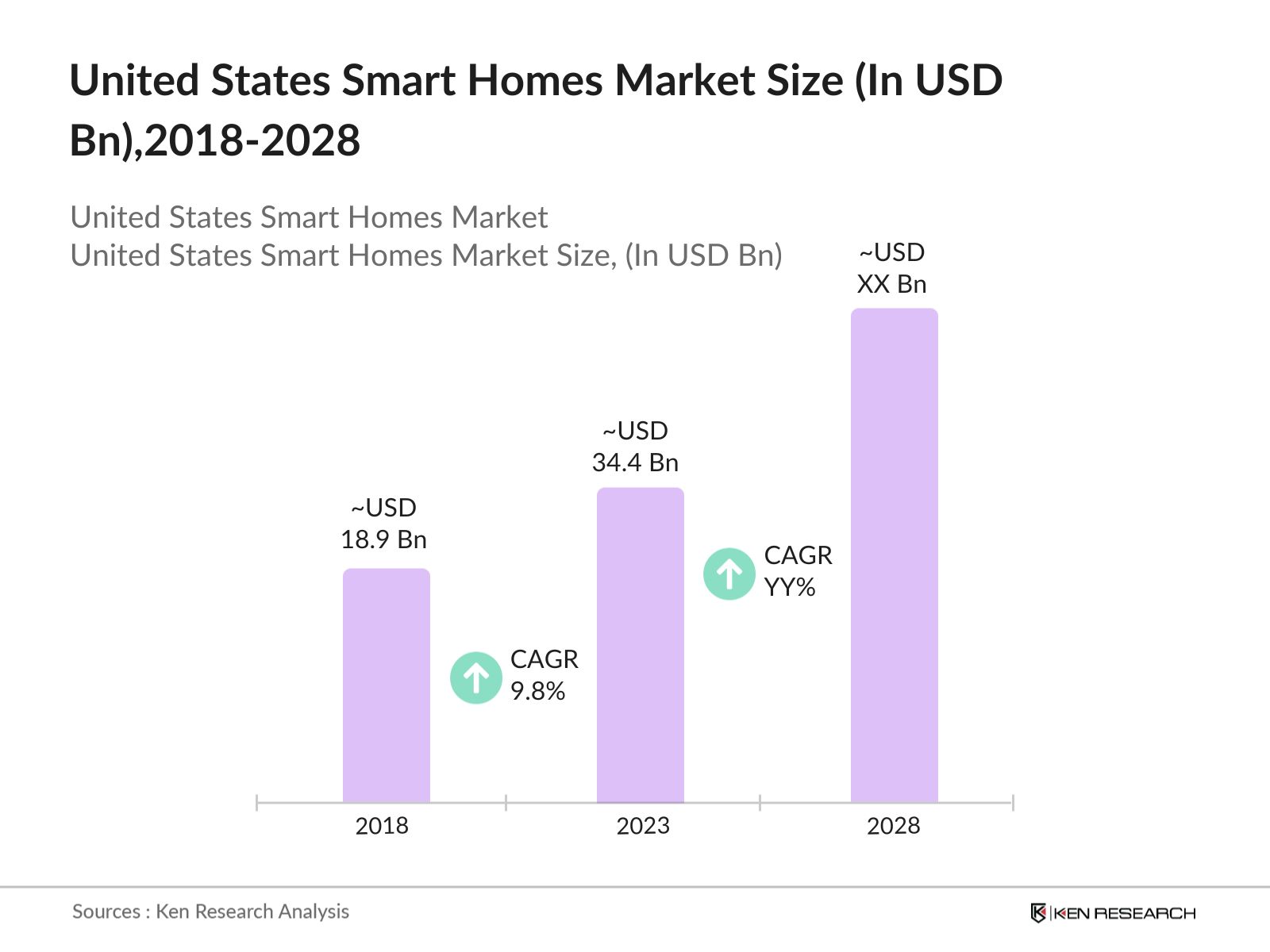

- The United States Smart Homes Market was valued at USD 18.9 billion in 2018 and reached USD 34.4 billion by 2023, reflecting a compound annual growth rate (CAGR) of 9.8% during this period.

- The United States Smart Homes Market is highly competitive, with major companies including Amazon, Google, Apple, Samsung, and Honeywell, dominating the market through innovation and extensive product ranges.

- In 2023, Amazon announced the launch of its new Alexa-powered smart home ecosystem, which includes an advanced AI feature that can learn and adapt to users’ behaviors over time. This development is expected to significantly enhance user experience and boost market growth.

United States Smart Homes Market Analysis

- Technological advancements have significantly improved the functionality and user-friendliness of smart home devices, with 77 million smart speakers shipped in 2022. Consumer demand for convenience is rising, as shown by 22 million new households adopting voice-controlled devices. Additionally, energy efficiency concerns drive market growth, with smart home systems saving 50 billion kWh of energy, according to the U.S. Environmental Protection Agency.

- The smart homes market has revolutionized the way consumers interact with their living spaces. Enhanced security, improved energy management, and increased convenience are some of the significant impacts. The adoption of smart home technology has also led to a surge in the development of smart cities, contributing to overall societal advancements.

- The North-East region of the United States, particularly states like New York and Massachusetts, dominates the smart homes market. This dominance is due to higher disposable incomes, greater consumer awareness, and better access to high-speed internet.

United States Smart Homes Market Segmentation

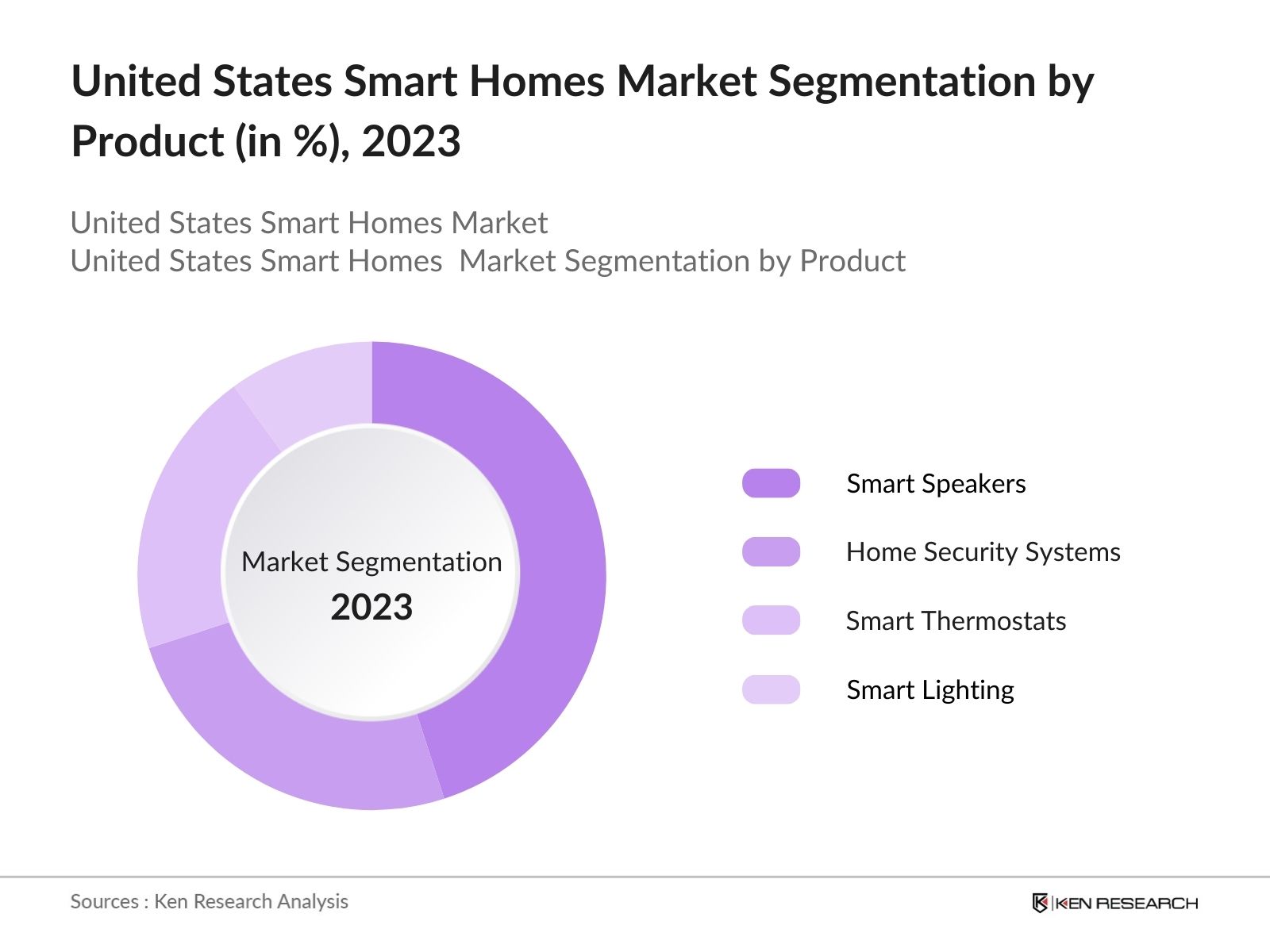

By Product: In 2023, US Smart Homes Market is segmented by product into smart speaker, home security systems, smart thermostats and smart lightning. Smart speakers dominate the U.S. smart homes market primarily due to their multifunctionality, ease of use, and widespread adoption. With voice assistants like Alexa and Google Assistant integrated, they serve as central hubs for controlling other smart devices, attracting a large consumer base.

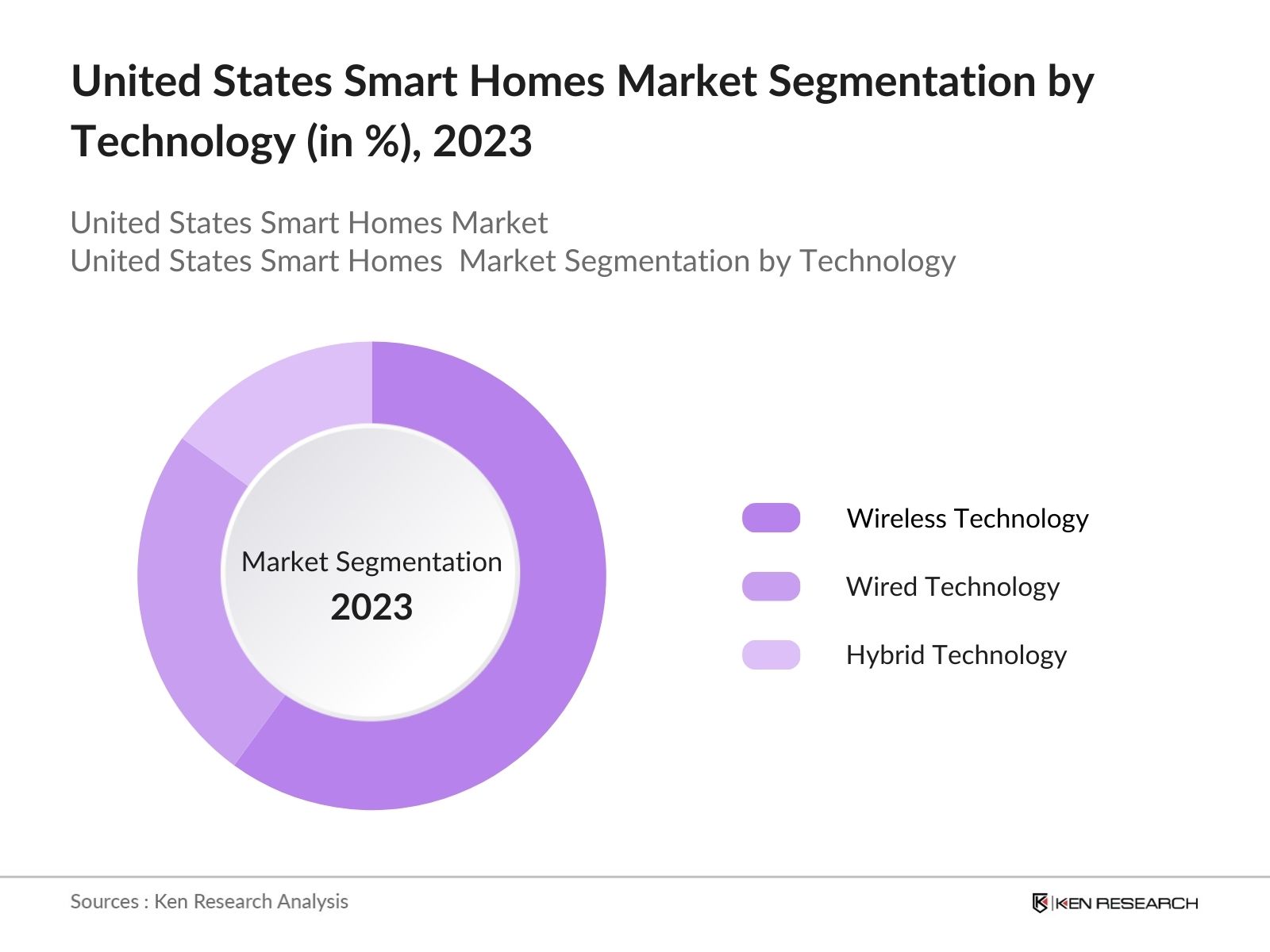

By Technology: In 2023, US Smart Homes Market is segmented by technology into wireless, wired and hybrid technology. Wireless technology dominates the U.S. smart homes market due to its versatility and convenience. It offers easy installation, flexibility in device placement, and seamless integration, meeting consumer preferences for hassle-free connectivity and smart home control.

By Application: In 2023, US Smart Homes Market is segmented by application into Residential, Commercial and Others. This dominance of Residential sub segment is driven by the widespread integration of smart home technologies in households, driven by the desire for convenience, security, and energy efficiency, aligning with consumer lifestyles and preferences.

United States Smart Homes Market Competitive Landscape

- Major players such as Amazon, Google, Apple, Samsung, and Honeywell drive innovation and market growth in the smart home industry. Amazon dominates with Alexa-enabled devices, Google excels with Google Nest products, Apple offers seamless HomeKit integration, Samsung provides a broad range of smart appliances, and Honeywell specializes in smart thermostats and security solutions.

- In 2023, Google announced a significant update to its Nest Hub, integrating advanced AI capabilities to enhance user experience. This move is expected to strengthen Google's position in the smart home market.

- Apple's introduction of Thread technology in its HomePod Mini in 2023 represents a significant innovation, providing more reliable and faster connectivity for smart home devices.

United States Smart Homes Industry Analysis:

United States Smart Homes Market Growth Drivers

- Energy Efficiency and Sustainability Awareness: The growing awareness of energy efficiency and sustainability has become a critical driver for the smart homes market. According to the U.S. Energy Information Administration, residential energy consumption accounted for 4,200 trillion BTUs in 2022. Smart home devices, such as smart thermostats and energy-efficient lighting, help reduce energy consumption and lower utility bills.

- Technological Advancements: Advancements in IoT and AI technologies have revolutionized the smart home industry, driving market growth. The integration of AI into smart home devices allows for personalized user experiences and enhanced automation. For instance, smart speakers equipped with voice assistants like Amazon Alexa and Google Assistant have become central hubs for smart home ecosystems.

- Increasing Home Renovations and Remodeling: The trend of home renovations and remodeling has significantly contributed to the growth of the smart homes market. Americans spent over $400 billion on home renovations in 2022. Many homeowners are incorporating smart technologies into their renovation projects to enhance home automation, security, and energy efficiency.

United States Smart Homes Market Challenges

- High Initial Costs: The high initial costs associated with smart home technologies remain a significant barrier to market penetration. Although prices have gradually decreased, the cost of setting up a comprehensive smart home system can still be prohibitive for many consumers. The average cost of a basic smart home system is around $1,200, with more advanced systems costing upwards of $5,000. This significant investment deters many potential buyers.

- Limited Internet Connectivity in Rural Areas: Limited internet connectivity in rural areas is a substantial barrier to the adoption of smart home technologies. According to the Federal Communications Commission (FCC), approximately 19 million Americans, particularly in rural regions, lack access to high-speed internet. Smart home devices rely heavily on stable internet connections for functionality and integration.

United States Smart Homes Market Government Initiatives

- Energy Star Program (2023): The Energy Star program, managed by the U.S. Environmental Protection Agency (EPA), continues to promote energy-efficient products, including smart home devices. In 2023, the program reported that certified smart thermostats saved an estimated 50 billion kWh of energy, highlighting its impact on the smart homes market by driving the adoption of efficient technologies.

- Federal Tax Credits for Energy Efficiency (2022): Introduced in 2022, federal tax credits for energy-efficient home improvements have incentivized homeowners to invest in smart home technologies. According to the U.S. Department of Energy, the tax credits contributed to the installation of 2.7 million energy-efficient smart home devices, making them more accessible and affordable for consumers.

- Smart Cities Initiative (2021): The U.S. Smart Cities Initiative, launched in 2021, aims to integrate advanced technologies into urban infrastructure to improve city living standards. In 2022, the initiative allocated $500 million to various smart city projects, promoting the adoption of smart home devices as part of broader urban development plans.

United States Smart Homes Market Future Outlook

The Smart Home market is expected to grow substantially, driven by continuous technological advancements, increasing consumer demand for convenience, and rising awareness about energy efficiency. The integration of AI and machine learning in smart home devices will further boost market growth.

Future Trends:

-

- Integration of AI and Machine Learning: The integration of AI and machine learning into smart home devices is expected to drive future market growth. AI-powered devices can learn user preferences and automate functions to enhance convenience and energy efficiency. For instance, smart thermostats with AI capabilities can optimize heating and cooling schedules based on user behavior, leading to energy savings and increased comfort.

- Voice-Controlled Smart Home Devices: Voice-controlled smart home devices are becoming increasingly popular due to their convenience and ease of use. This trend is driven by advancements in natural language processing and the integration of voice assistants into a wide range of smart home devices. The Consumer Technology Association predicts an increase of 10 million voice-controlled devices in U.S. households by 2025, highlighting their growing importance in the market.

Scope of the Report

|

By Product |

Smart Speakers Home Security Systems Smart Thermostats Smart Lighting |

|

By Technology |

Wireless Technology Wired Technology Hybrid Technology |

|

By Application |

Residential Commercial Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Smart Appliance Manufacturers

Home Automation Software Providers

Residential Security System Providers

Smart Home Energy Management Companies

Real Estate Investment Firms

Homebuilders and Developers

Retail Chains Selling Smart Devices

Broadband and Internet Service Providers

Property Management Services

Home Renovation and Remodeling Companies

HVAC System Providers

Municipal Smart City Planners

Renewable Energy Solution Providers

Government and regulatory bodies

Bank and financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Amazon

Google

Apple

Samsung

Honeywell

ADT

Vivint

Philips

SimpliSafe

Ring

Ecobee

August Home

Sonos

Wyze

Lutron

Table of Contents

1. United States Smart Homes Market Overview

1.1 United States Smart Homes Market Taxonomy

2. United States Smart Homes Market Size (in USD Bn), 2018-2023

3. United States Smart Homes Market Analysis

3.1 United States Smart Homes Market Growth Drivers

3.2 United States Smart Homes Market Challenges and Issues

3.3 United States Smart Homes Market Trends and Development

3.4 United States Smart Homes Market Government Regulation

3.5 United States Smart Homes Market SWOT Analysis

3.6 United States Smart Homes Market Stake Ecosystem

3.7 United States Smart Homes Market Competition Ecosystem

4. United States Smart Homes Market Segmentation, 2023

4.1 United States Smart Homes Market Segmentation by Product Type (in %), 2023

4.2 United States Smart Homes Market Segmentation by Technology (in %), 2023

4.3 United States Smart Homes Market Segmentation by Application (in %), 2023

5. United States Smart Homes Market Competition Benchmarking

5.1 United States Smart Homes Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. United States Smart Homes Market Future Market Size (in USD Bn), 2023-2028

7. United States Smart Homes Market Future Market Segmentation, 2028

7.1 United States Smart Homes Market Segmentation by Product Type (in %), 2028

7.2 United States Smart Homes Market Segmentation by Technology (in %), 2028

7.3 United States Smart Homes Market Segmentation by Application (in %), 2028

8. United States Smart Homes Market Analysts’ Recommendations

8.1 United States Smart Homes Market TAM/SAM/SOM Analysis

8.2 United States Smart Homes Market Customer Cohort Analysis

8.3 United States Smart Homes Market Marketing Initiatives

8.4 United States Smart Homes Market White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on United States Smart Homes Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for United States Smart Homes Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple smart homes device companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from smart homes device industry specific companies.

Frequently Asked Questions

01 How big is United States Smart Homes Market?

The current market size of the United States Smart Homes Market is USD 34.4 billion in 2023. This impressive growth is driven by several factors, including advancements in Internet of Things (IoT) technology, increasing consumer awareness about energy efficiency, and rising disposable incomes.

02 Who are the major players of the United States Smart Homes Market?

The major players of the United States Smart Homes Market are Amazon, Google, Apple, Samsung and Honeywell. The market is highly competitive due to constant innovations and extensive product ranges.

03 What factors drive the United States Smart Homes Market?

Factors driving the United States Smart Homes Market include Technological Advancements, Energy Efficiency, Safety and SecurityConsumer Preferences and Smartphone Penetration. The growing awareness of energy efficiency and sustainability has become a critical driver for the smart homes market.

04 What are the challenges in the United States Smart Homes Market?

Main challenges in the United State Smart Homes Market include High Initial Costs, Privacy Concerns, Complex Integration, Reliability Issues and Market Fragmentation. The high initial costs associated with smart home technologies remain a significant barrier to market penetration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.