Region:North America

Author(s):Shubham

Product Code:KRAB0734

Pages:87

Published On:August 2025

By Type:

The strategic consulting services market is segmented into Management Consulting, IT Consulting, Human Resources Consulting, Financial Advisory, Marketing Consulting, Operations Consulting, Strategy Consulting, Sustainability/ESG Consulting, and Others. Management Consulting remains the leading subsegment, propelled by the need for organizations to improve operational efficiency, drive digital transformation, and achieve strategic alignment. Companies are investing in management consulting to enhance competitiveness, adapt to evolving market conditions, and implement best practices for sustainable growth .

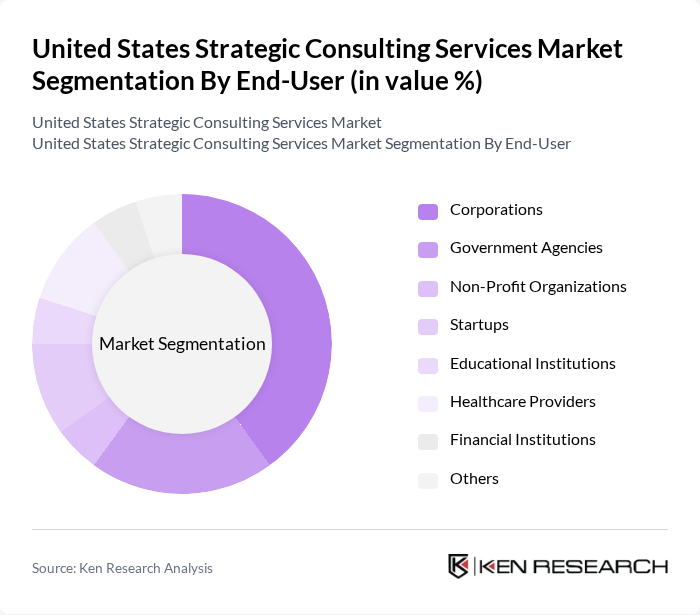

By End-User:

This market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, Startups, Educational Institutions, Healthcare Providers, Financial Institutions, and Others. Corporations are the dominant end-user segment, relying on consulting services to drive growth, enhance operational efficiency, and navigate complex regulatory and technological environments. Demand from corporations is further fueled by the need for strategic insights, digital transformation, and tailored solutions to address evolving business challenges .

The United States Strategic Consulting Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group, Bain & Company, Deloitte Consulting LLP, Accenture Strategy, PwC Advisory Services, Ernst & Young (EY) Advisory, KPMG Advisory, Oliver Wyman, A.T. Kearney, Roland Berger, FTI Consulting, Booz Allen Hamilton, Protiviti, ZS Associates, Navigant Consulting, Alvarez & Marsal, LEK Consulting, West Monroe Partners, and Slalom Consulting contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. strategic consulting services market appears promising, driven by the ongoing digital transformation and the increasing complexity of business operations. Firms are expected to invest more in data analytics and AI-driven solutions, enhancing their service offerings. Additionally, the focus on sustainability and ESG factors will likely shape consulting strategies, as businesses seek to align with consumer expectations and regulatory requirements. This evolving landscape presents significant opportunities for growth and innovation within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Management Consulting IT Consulting Human Resources Consulting Financial Advisory Marketing Consulting Operations Consulting Strategy Consulting Sustainability/ESG Consulting Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Startups Educational Institutions Healthcare Providers Financial Institutions Others |

| By Service Delivery Model | On-Site Consulting Remote Consulting Hybrid Consulting |

| By Industry Vertical | Healthcare Financial Services Manufacturing Retail Technology Energy & Utilities Public Sector Others |

| By Project Size | Small Projects Medium Projects Large Projects |

| By Client Relationship Type | Long-Term Contracts Project-Based Engagements Retainer Agreements |

| By Geographic Focus | National Focus Regional Focus Global Focus |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Management Consulting Services | 100 | Senior Consultants, Project Managers |

| IT Consulting Services | 80 | IT Directors, Technology Strategists |

| Financial Advisory Services | 60 | Financial Analysts, CFOs |

| Human Resources Consulting | 50 | HR Managers, Talent Acquisition Specialists |

| Marketing Consulting Services | 70 | Marketing Directors, Brand Managers |

The United States Strategic Consulting Services Market is valued at approximately USD 78 billion, reflecting a significant growth driven by the increasing complexity of business operations and the demand for specialized expertise across various sectors.