US AI in Healthcare Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD528

December 2024

91

About the Report

US AI in Healthcare Market Overview

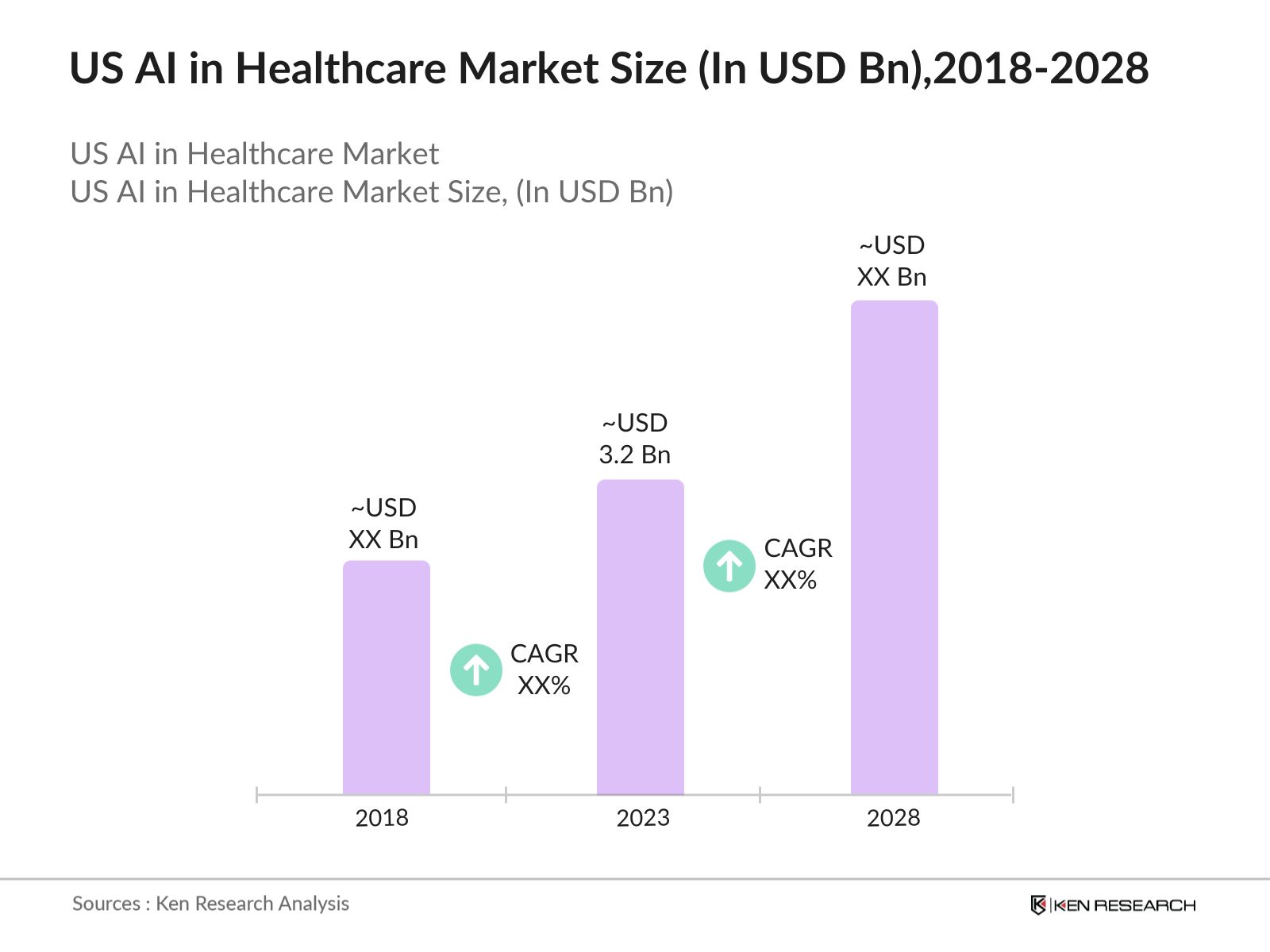

- US AI in Healthcare Market is valued at USD 3.2 billion in 2023. The market's rapid expansion is primarily driven by the increasing demand for advanced diagnostic tools, the integration of AI in drug discovery, and the adoption of AI-powered healthcare solutions. The aging population and the increasing prevalence of chronic diseases further propel the demand for AI applications in healthcare, enhancing diagnostic accuracy and reducing costs.

- Prominent players in the US AI in Healthcare market include IBM Watson Health, Microsoft Healthcare, Google Health, NVIDIA, and GE Healthcare. These companies have established a significant market presence through continuous innovations and strategic collaborations with healthcare providers and research institutions. Their AI-driven platforms are extensively used for predictive analytics, personalized medicine, and efficient management of healthcare data.

- In 2023, Medtronic has launched the GI Genius AI Access platform, which utilizes advanced AI technologies to assist in detecting polyps during colonoscopies. This system is designed to improve diagnostic accuracy and is seen as a significant advancement in endoscopic care, particularly in the fight against colorectal cancer.

- Cities such as New York, San Francisco, and Boston dominate the US AI in Healthcare market. New York's leadership is due to its concentration of major hospitals and healthcare institutions investing in AI technologies. San Francisco and Boston are tech hubs with strong AI research ecosystems and numerous healthcare startups. These cities attract significant investment and talent, making them pivotal in driving market growth.

US AI in Healthcare Market Segmentation

The US AI in Healthcare Market can be segmented based on several factors:

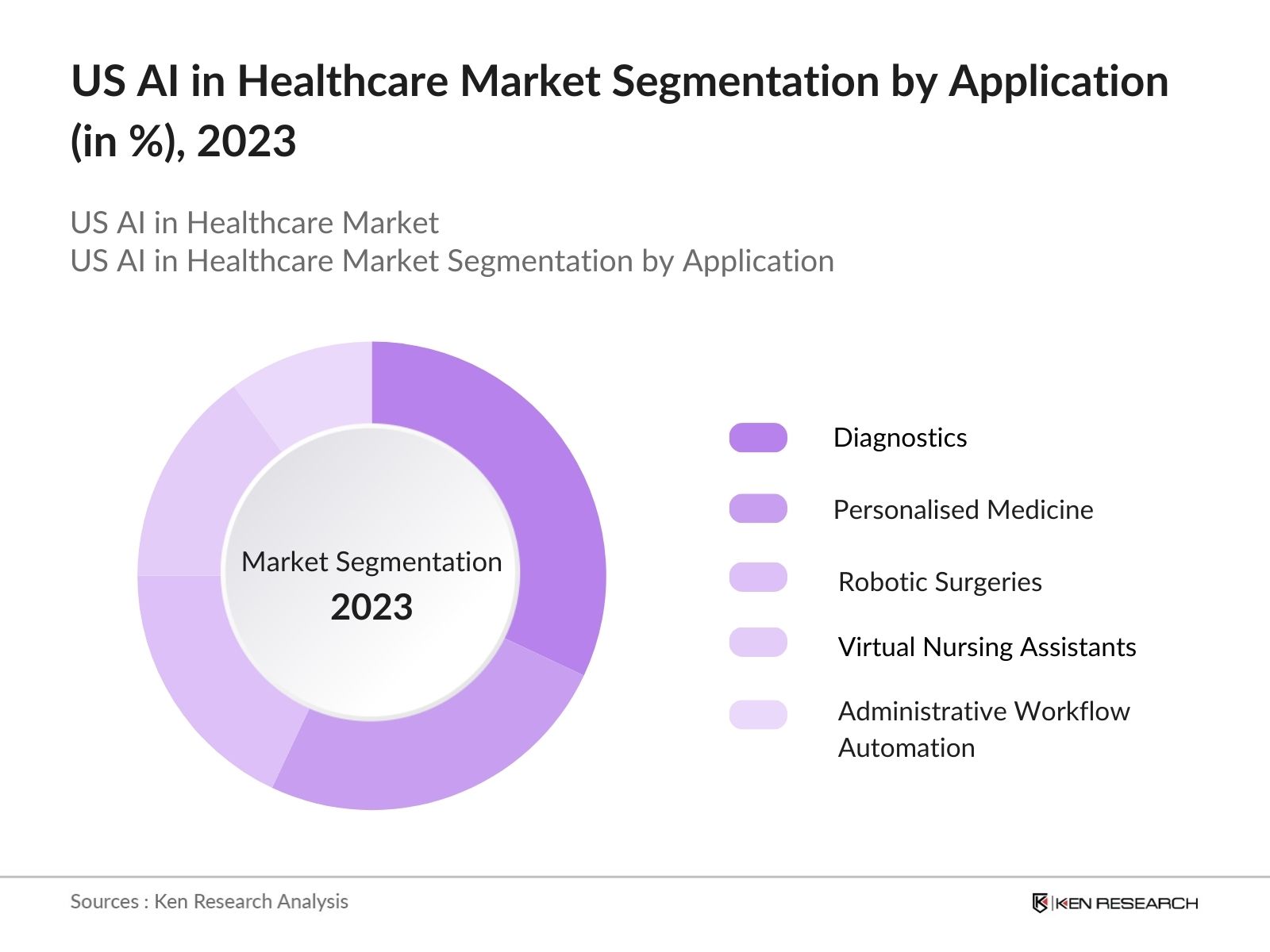

By Application: US AI in Healthcare market is segmented by application into diagnostics, personalized medicine, robotic surgeries, virtual nursing assistants, and administrative workflow automation. In 2023, the diagnostics segment held the dominant market share due to its widespread adoption in imaging and pathology. AI-driven diagnostic tools improve accuracy and speed, making them essential in early disease detection and management.

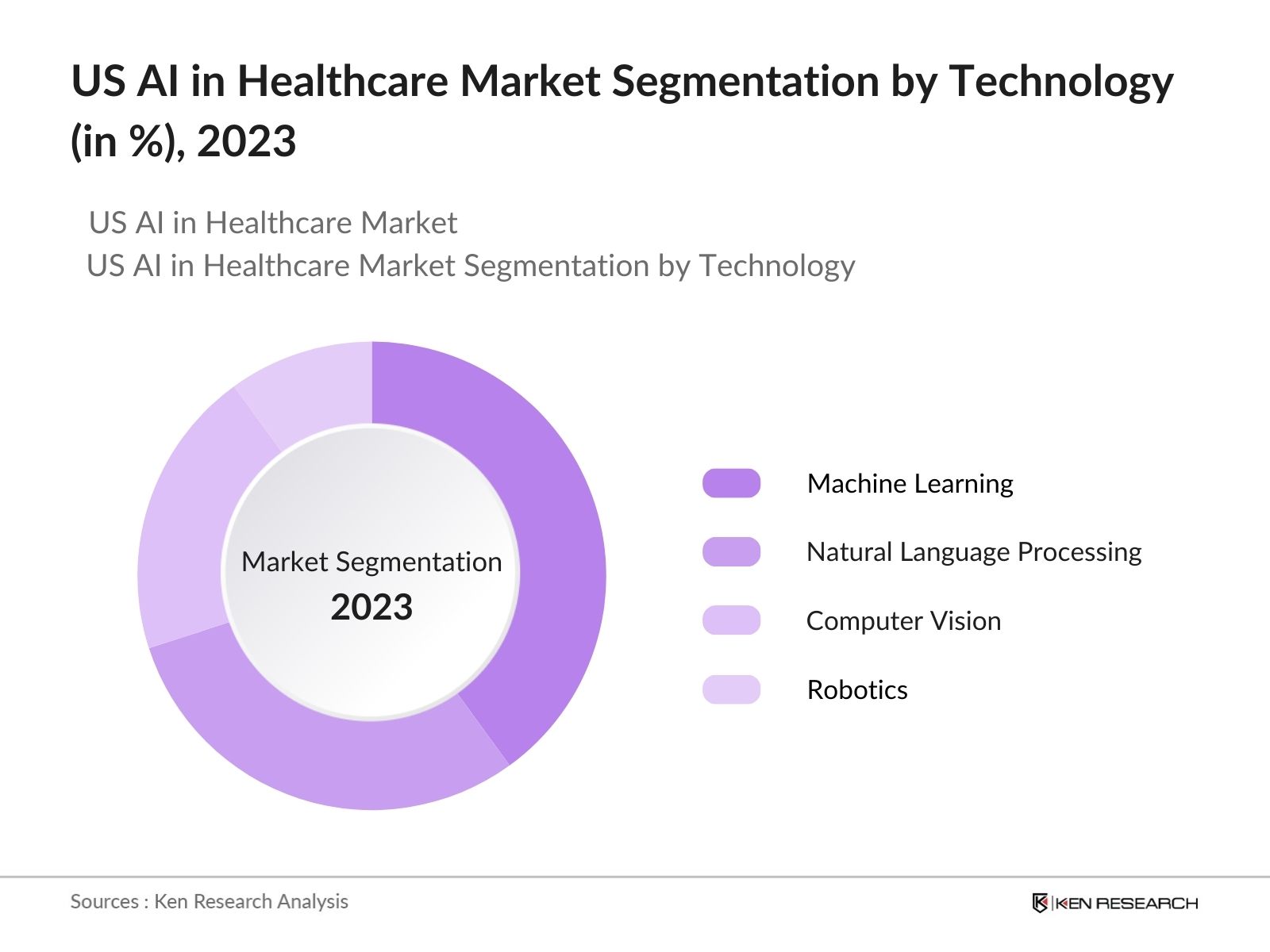

By Technology: US AI in Healthcare market is also segmented by technology into machine learning, natural language processing (NLP), computer vision, and robotics. Machine learning is the most dominant sub-segment in 2023. This dominance is due to its extensive application in predictive analytics, drug discovery, and personalized treatment plans. Machine learning algorithms analyze vast datasets to identify patterns and predict outcomes, making it a valuable tool in improving healthcare delivery and patient care.

By Region: US AI in Healthcare market is regionally segmented into North, South, East, and West. The North region holds the dominant market share in 2023. This dominance is attributed to the presence of major AI research institutions and leading healthcare providers that are early adopters of AI technologies. The region's strong technological infrastructure and investment in healthcare innovation further bolster its market leadership.

US AI in Healthcare Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM Watson Health |

2015 |

Cambridge, MA |

|

Microsoft Healthcare |

2014 |

Redmond, WA |

|

Google Health |

2018 |

Mountain View, CA |

|

NVIDIA |

1993 |

Santa Clara, CA |

|

GE Healthcare |

1994 |

Chicago, IL |

- NVIDIA: In 2024, NVIDIA launched over two dozen new healthcare microservices designed to help healthcare enterprises leverage generative AI. These services include advanced imaging, natural language processing, and digital biology capabilities. The new offerings aim to facilitate drug discovery, medical imaging, and genomics analysis by providing optimized AI models and workflows that can be deployed across various cloud platforms.

- Microsoft Healthcare: In 2023, Microsoft has expanded the capabilities of its Azure AI Health Bot, allowing healthcare organizations to create customized generative AI chatbots. These bots can handle administrative tasks and improve patient interactions by providing tailored responses based on unstructured data from healthcare content sources.

US AI in Healthcare Industry Analysis

US AI in Healthcare Market Growth Drivers:

- Increased Adoption of AI in Diagnostics and Imaging: The adoption of AI technologies in diagnostics and imaging has significantly accelerated due to their ability to enhance accuracy and reduce diagnostic times. The integration of AI in medical imaging has resulted in a 50% reduction in the time required for image interpretation, allowing for quicker decision-making in clinical settings. The increased utilization of these AI-driven solutions has been supported by a growing demand for more efficient healthcare services amid rising patient loads and a shortage of healthcare professionals.

- Rising Investment in AI Healthcare Startups: The US AI in Healthcare market has seen substantial growth in investment. In 2023, Microsoft Corp. and Mercy partnered to leverage generative AI and other digital innovations to enhance patient care and experience, signifying the increasing adoption of cutting-edge technologies in healthcare. This investment surge is driven by the increasing need for innovative AI solutions to enhance patient care and operational efficiency.

- Expansion of Telemedicine and Remote Patient Monitoring: The expansion of telemedicine and remote patient monitoring has become a crucial driver for the AI in Healthcare market in the US. AI applications in connected care, including remote monitoring through wearables and intelligent telehealth systems, are expected to improve patient outcomes by enabling timely interventions. This reflects a growing trend towards integrating AI with telemedicine.

US AI in Healthcare Market Challenges:

- Data Privacy and Security Concerns: The integration of AI in healthcare requires access to large datasets, which raises concerns about data protection and privacy. The Health Insurance Portability and Accountability Act (HIPAA) sets strict guidelines for handling patient data, and non-compliance can result in significant fines and loss of trust among patients and providers. This challenge necessitates robust security measures and compliance protocols for AI developers and healthcare providers.

- High Costs of Implementation and Maintenance: The high costs associated with the implementation and maintenance of AI technologies pose a significant barrier to market growth. In 2024, it was estimated that the average cost of deploying an AI system in a mid-sized hospital was around $1.2 million, including hardware, software, and training expenses. These costs are often prohibitive for smaller healthcare providers, limiting the widespread adoption of AI technologies.

US AI in Healthcare Market Government Initiatives:

- Healthcare Technology Act (2023): Health Technology Act of 2023 (H.R.206), aims to establish guidelines for the use of artificial intelligence (AI) and machine learning technologies in prescribing medications. This act recognizes the potential of AI to enhance healthcare delivery, particularly in the area of medication management. The act encourages collaboration between AI developers and healthcare professionals to ensure that AI tools are designed with practical clinical needs in mind.

- Advancing AI Act (2021): The Advancing American AI Act (S.1353) was introduced in the U.S. Senate on April 22, 2021, with the aim of promoting the use of artificial intelligence (AI) technologies. The Act encourages federal agencies to adopt advanced AI technologies, which can lead to improved healthcare delivery and operational efficiencies within healthcare systems. This ultimately enhances patient care and outcomes by integrating AI tools in clinical settings.

US AI in Healthcare Future Market Outlook

US AI in Healthcare Market is poised for exponential growth in 2028 by the increasing integration of AI technologies across various healthcare applications. The market is expected to benefit from ongoing advancements in AI algorithms, enhanced data analytics capabilities, and the rising demand for personalized medicine

Future Trends

- Advancements in Predictive Analytics: Predictive analytics will become a cornerstone of AI applications in healthcare, enabling providers to anticipate patient needs and optimize care plans. AI-powered predictive models will be increasingly used for early detection of diseases, risk stratification, and personalized treatment recommendations, significantly enhancing patient outcomes and reducing healthcare costs.

- Growth of AI in Drug Discovery: The use of AI in drug discovery is expected to accelerate, with pharmaceutical companies leveraging AI algorithms to identify potential drug candidates and predict their efficacy and safety. This trend will not only shorten the drug development timeline but also reduce costs, making it possible to bring new treatments to market faster. The integration of AI in drug discovery will revolutionize the pharmaceutical industry, driving innovation and improving patient access to novel therapies.

Scope of the Report

|

By Application |

Diagnostics Personalized Medicine Robotic Surgeries Virtual Nursing Assistants Administrative Workflow Automation |

|

By Technology |

Machine Learning Natural Language Processing (NLP) Computer Vision Robotics |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Hospitals and Healthcare Providers

Medical Device Manufacturers

Pharmaceutical Companies

Health Insurance Companies

AI and Technology Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Health & Human Services)

Health Insurance Companies

AI and Technology Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

IBM Watson Health

Microsoft Healthcare

Google Health

NVIDIA

GE Healthcare

Philips Healthcare

Siemens Healthineers

Medtronic

Cerner Corporation

Epic Systems Corporation

Amazon Web Services (AWS)

Salesforce Health Cloud

Intuitive Surgical

Butterfly Network

Tempus Labs

Table of Contents

1. US AI in Healthcare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. US AI in Healthcare Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. US AI in Healthcare Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of AI in Diagnostics and Imaging

3.1.2. Rising Investment in AI Healthcare Startups

3.1.3. Expansion of Telemedicine and Remote Patient Monitoring

3.1.4. Integration of AI in Administrative Workflow Automation

3.2. Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Costs of Implementation and Maintenance

3.2.3. Lack of Standardization and Interoperability

3.3. Opportunities

3.3.1. Advancements in AI Algorithms

3.3.2. Growth of AI in Drug Discovery

3.3.3. Increasing Demand for Personalized Medicine

3.4. Trends

3.4.1. Adoption of AI in Predictive Analytics

3.4.2. Integration with Electronic Health Records (EHR)

3.4.3. Increased Use of AI for Operational Efficiency

3.5. Government Initiatives

3.5.1. Healthcare Technology Act (2023)

3.5.2. Advancing AI Act (2021)

3.5.3. AI in Healthcare Research Initiative (2024)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. US AI in Healthcare Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Diagnostics

4.1.2. Personalized Medicine

4.1.3. Robotic Surgeries

4.1.4. Virtual Nursing Assistants

4.1.5. Administrative Workflow Automation

4.2. By Technology (in Value %)

4.2.1. Machine Learning

4.2.2. Natural Language Processing (NLP)

4.2.3. Computer Vision

4.2.4. Robotics

4.3. By End-User (in Value %)

4.3.1. Hospitals

4.3.2. Clinics

4.3.3. Research Institutes

4.3.4. Healthcare Payers

4.4. By Component (in Value %)

4.4.1. Software

4.4.2. Hardware

4.4.3. Services

4.5. By Region (in Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. US AI in Healthcare Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Watson Health

5.1.2. Microsoft Healthcare

5.1.3. Google Health

5.1.4. NVIDIA

5.1.5. GE Healthcare

5.1.6. Philips Healthcare

5.1.7. Siemens Healthineers

5.1.8. Medtronic

5.1.9. Cerner Corporation

5.1.10. Epic Systems Corporation

5.1.11. Amazon Web Services (AWS)

5.1.12. Salesforce Health Cloud

5.1.13. Intuitive Surgical

5.1.14. Butterfly Network

5.1.15. Tempus Labs

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. US AI in Healthcare Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. US AI in Healthcare Market Regulatory Framework

7.1. Regulatory Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. US AI in Healthcare Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. US AI in Healthcare Future Market Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Technology (in Value %)

9.3. By End-User (in Value %)

9.4. By Component (in Value %)

9.5. By Region (in Value %)

10. US AI in Healthcare Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on US AI in Healthcare Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for US AI in Healthcare Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple AI in healthcare companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from AI in healthcare companies.

Frequently Asked Questions

01 How big is US AI in Healthcare Market?

US AI in Healthcare Market is valued at $3.2 billion in 2023. The market's rapid expansion is primarily driven by the increasing demand for advanced diagnostic tools, the integration of AI in drug discovery, and the adoption of AI-powered healthcare solutions.

02. What are the growth drivers of the US AI in Healthcare Market?

US AI in Healthcare Market is driven by factors such as increased adoption of AI in diagnostics, rising investments in AI healthcare startups, and the expansion of telemedicine and remote patient monitoring. These drivers are enhancing healthcare delivery and operational efficiency across the sector.

03 What are the challenges in US AI in Healthcare Market?

Challenges in the US AI in Healthcare market include data privacy and security concerns, high implementation costs, and a lack of skilled professionals. Ensuring compliance with regulations such as HIPAA while maintaining data integrity is a significant hurdle for market growth.

04 Who are the major players in the US AI in Healthcare Market?

Key players in the US AI in Healthcare Market include IBM Watson Health, Microsoft Healthcare, Google Health, NVIDIA, and GE Healthcare. These companies lead the market due to their innovative AI solutions, strategic partnerships, and extensive research and development efforts.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.