US Antiviral Drugs Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4239

December 2024

81

About the Report

US Antiviral Drugs Market Overview

- The US antiviral drugs market, driven by an increasing incidence of viral infections such as HIV, hepatitis, and influenza, is valued at USD 30.5 billion. The markets growth is propelled by advancements in drug development, including innovations like mRNA-based therapies, and significant government support through research funding and favorable policies. The rapid adoption of antiviral therapies in the wake of the COVID-19 pandemic has also played a critical role in sustaining market expansion.

- The dominance of major metropolitan areas, such as New York, California, and Texas, is attributed to their advanced healthcare infrastructures, concentration of pharmaceutical research facilities, and a higher patient population suffering from chronic viral diseases. These states benefit from a high rate of hospital admissions for viral infections, fostering greater demand for antiviral therapies.

- Recent announcements indicate that the Biden-Harris Administration allocatedmore than $1.4 billionspecifically for the Ryan White HIV/AIDS Program in 2024, which supports access to antiviral treatments for patients across the U.S. This initiative is pivotal in ensuring widespread access to HIV antiviral drugs, increasing the demand for these treatments and encouraging pharmaceutical companies to expand their antiviral portfolios.

US Antiviral Drugs Market Segmentation

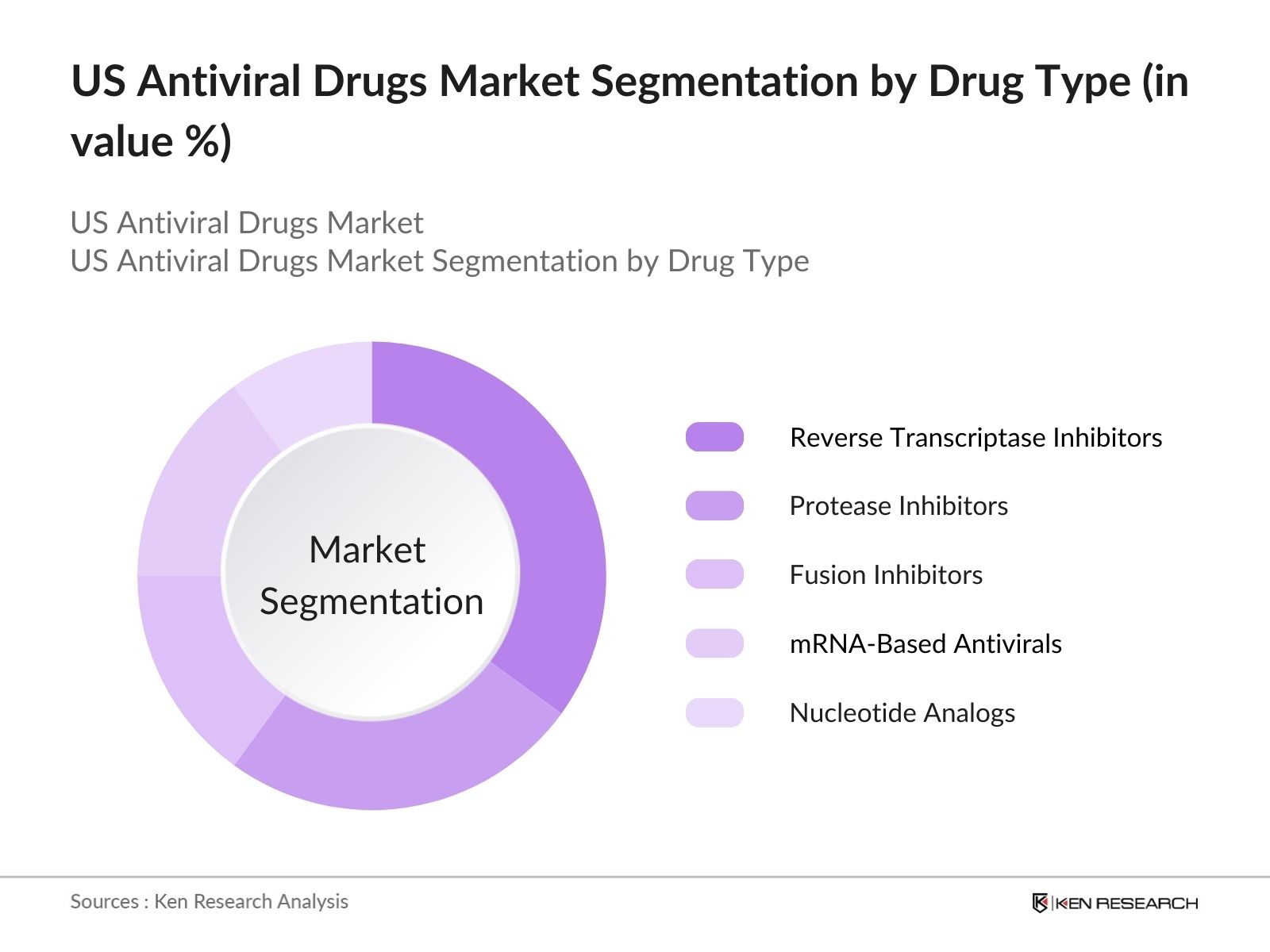

By Drug Type: The US antiviral drugs market is segmented by drug type into reverse transcriptase inhibitors, protease inhibitors, fusion inhibitors, nucleotide analogs, and mRNA-based antivirals. Currently, reverse transcriptase inhibitors hold the dominant share of the market due to their established efficacy in treating chronic conditions like HIV/AIDS. These drugs have been the cornerstone of antiviral therapy for years, primarily because they prevent the virus from multiplying by inhibiting the action of the reverse transcriptase enzyme, which is crucial for viral replication. Market players such as Gilead Sciences have played a pivotal role in maintaining this segments dominance with their well-known drug portfolios.

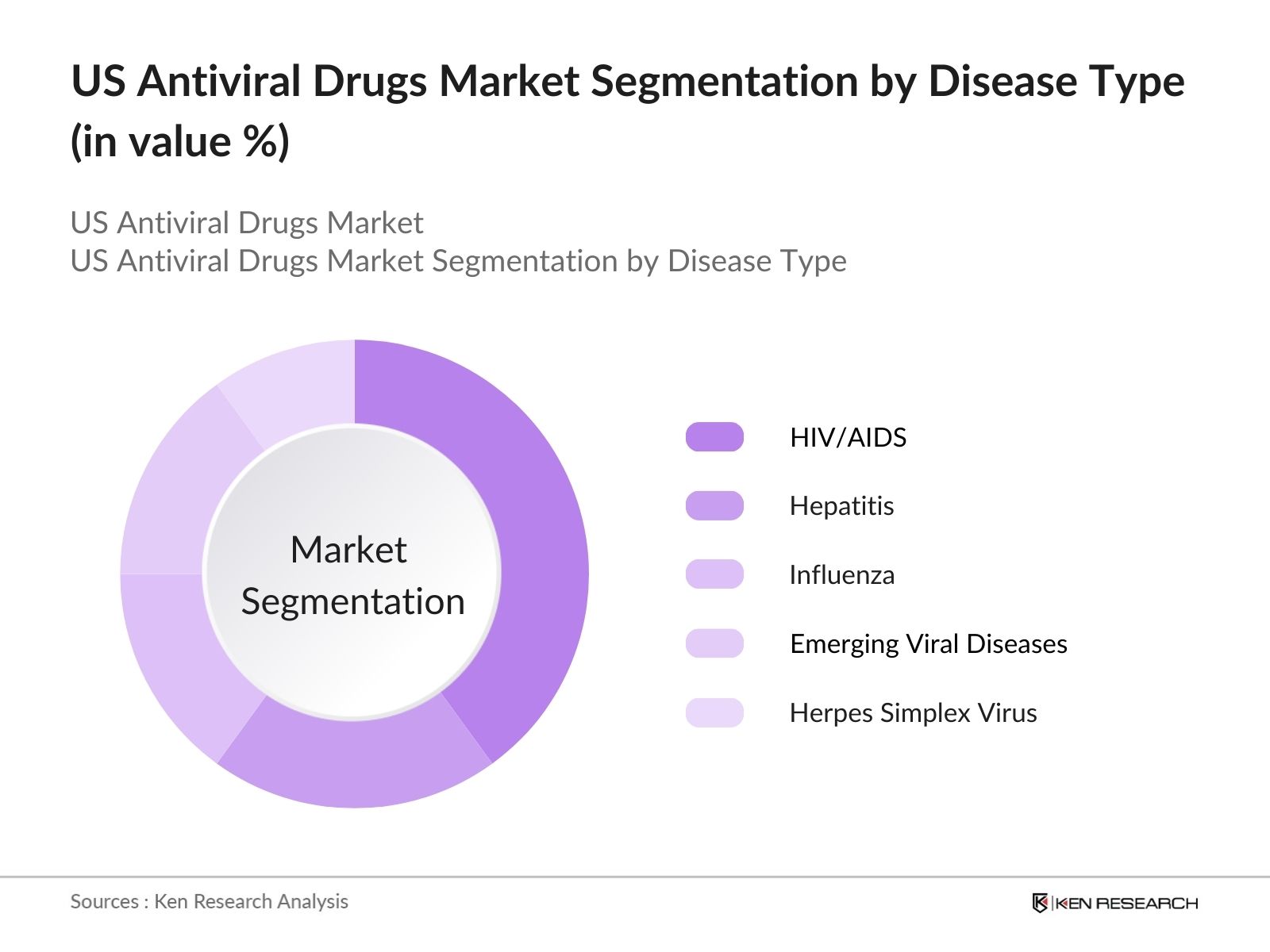

By Disease Type: The US antiviral drugs market is further segmented by disease type into HIV/AIDS, hepatitis, influenza, herpes simplex virus, and emerging viral diseases such as COVID-19. The HIV/AIDS segment is the largest due to the chronic nature of the disease and the necessity for lifelong antiviral treatment. In the US, public health initiatives have bolstered the demand for effective antiviral drugs to manage the symptoms and viral load in HIV patients. Pharmaceutical companies continue to focus on developing innovative treatments for HIV, which ensures the sustained dominance of this segment.

US Antiviral Drugs Market Competitive Landscape

The US antiviral drugs market is highly competitive, dominated by major pharmaceutical companies that invest heavily in research and development. The competitive landscape is shaped by the introduction of new drugs, strategic partnerships, and mergers and acquisitions. The market is driven by companies that hold extensive drug pipelines and possess the resources to navigate the stringent regulatory environment.

|

Company |

Established |

Headquarters |

Market Share (2023) |

R&D Spending |

FDA Approvals |

Drug Pipeline |

Patents |

Partnerships |

Global Reach |

|

Gilead Sciences |

1987 |

Foster City, CA |

- | - | - | - | - | - | - |

|

Merck & Co. |

1891 |

Kenilworth, NJ |

- | - | - | - | - | - | - |

|

Bristol-Myers Squibb |

1887 |

New York, NY |

- | - | - | - | - | - | - |

|

Johnson & Johnson |

1886 |

New Brunswick, NJ |

- | - | - | - | - | - | - |

|

Pfizer Inc. |

1849 |

New York, NY |

- | - | - | - | - | - | - |

US Antiviral Drugs Market Analysis

Growth Drivers

- Increasing Prevalence of Viral Infections in the U.S.: The rising prevalence of viral infections, such as HIV, hepatitis, and influenza, continues to drive the demand for antiviral drugs in the U.S. The CDC estimates that 1.2 million individuals are living with HIV in the country. Furthermore, the U.S. recorded over 9 million cases of influenza in 2023, according to CDC data. With nearly 2.4 million people affected by hepatitis C, as reported by the American Liver Foundation, the rising burden of these viral infections significantly contributes to the antiviral drugs market.

- Government Spending on HIV and Pandemic Preparedness: The U.S. government has allocated substantial resources to combat viral infections, directly supporting the antiviral drugs market. The U.S. Department of Health and Human Services reported a $10 billion allocation in 2024 to support HIV treatment through various healthcare initiatives. Additionally, the federal government has earmarked $2.1 billion for pandemic preparedness, which includes antiviral drug development for emerging viral threats. This level of government support ensures steady market demand and growth for antiviral drug development and distribution.

- Advancements in Antiviral Drug Development (mRNA and Gene Therapy): The adoption of advanced technologies like mRNA and gene therapy is boosting the U.S. antiviral drugs market. In 2023, the FDA approved the use of mRNA-based vaccines for influenza, indicating a growing trend of applying this technology to antiviral treatments. Furthermore, gene therapy is showing potential for treating viral diseases, with over 30 clinical trials ongoing for viral infections like hepatitis. These innovations are expected to lead to the approval of novel antiviral treatments in the coming years.

Market Challenges

- High Research and Development Costs: The cost of developing antiviral drugs remains a significant challenge for pharmaceutical companies. According to the Tufts Center for the Study of Drug Development, the average cost of developing a new antiviral drug reached $2.6 billion in 2023. This high cost is driven by the need for extensive clinical trials, safety assessments, and regulatory compliance, which often span multiple years and require substantial investment. This creates financial barriers for companies, particularly smaller biotech firms, to enter the market.

- Stringent Regulatory Approval Processes: The regulatory landscape for antiviral drugs in the U.S. is highly complex, with the FDA approving only 37 new molecular entities in 2023. Of these, less than 10 were antiviral treatments. The lengthy and stringent approval process involves multiple phases of trials and compliance with safety protocols, making it difficult for new drugs to enter the market quickly. This creates a significant bottleneck in the introduction of innovative antiviral therapies, slowing down the markets expansion.

US Antiviral Drugs Market Future Outlook

The US antiviral drugs market is expected to witness robust growth over the next five years, driven by the increasing prevalence of viral diseases and ongoing advancements in therapeutic technologies. The rise of mRNA-based antivirals, coupled with expanding government support for antiviral drug research, will likely fuel market expansion. Furthermore, the introduction of combination therapies targeting multiple viruses in a single treatment regimen is poised to change the landscape of antiviral treatment, making it more efficient and accessible for a wider patient base.

Market Opportunities

- Development of Broad-Spectrum Antivirals: There is a growing interest in the development of broad-spectrum antivirals, which can target multiple viruses. In 2023, NIH funded over $200 million in grants specifically for research in broad-spectrum antiviral therapies. With the rise of emerging viral diseases, including the continued mutation of COVID-19 variants, broad-spectrum antivirals represent a promising area of growth for the U.S. market. Research from the CDC also points out that the incidence of multiple viral co-infections is on the rise, which further strengthens the need for broad-spectrum treatments

- Collaborations Between Biotech Firms and Research Institutes: The U.S. antiviral drug market is experiencing a surge in collaborations between biotech firms and research institutes. In 2023, over 50 new partnerships were established, with leading institutions like the NIH and private companies investing in next-generation antiviral therapies. Notably, Moderna announced a strategic collaboration with academic institutions to accelerate mRNA-based antiviral drug development. These partnerships are vital in sharing knowledge and resources, enabling quicker advancements in drug discovery and regulatory approval processes, creating significant growth opportunities for the market.

Scope of the Report

|

By Drug Type |

Reverse Transcriptase Inhibitors Protease Inhibitors Fusion Inhibitors Nucleotide Analogs mRNA-Based Antivirals |

|

By Disease Type |

HIV/AIDS Hepatitis Influenza Herpes Simplex Virus Emerging Viral Diseases (COVID-19, Ebola, Zika) |

|

By Administration Route |

Oral Intravenous Inhalation Topical |

|

By End-User |

Hospitals Retail Pharmacies Online Pharmacies Specialty Clinics |

|

By Region |

Northeast Midwest West South |

Products

Key Target Audience

Hospitals and Healthcare Providers

Pharmaceutical Manufacturers

Biotech Companies

Government Agencies (FDA, CDC)

Research Institutions

Investors and Venture Capitalist Firms

Insurance Companies

Government and Regulatory Bodies (NIH, BARDA)

Companies

Players Mentioned in the Report:

Gilead Sciences

Merck & Co.

Bristol-Myers Squibb

Johnson & Johnson

Pfizer Inc.

Roche

AbbVie Inc.

BioNTech SE

Moderna Inc.

Viiv Healthcare

Table of Contents

1. US Antiviral Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. US Antiviral Drugs Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. US Antiviral Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Viral Infections (HIV, Influenza, Hepatitis, COVID-19)

3.1.2. Advancements in Antiviral Drug Development (mRNA, Gene Therapy)

3.1.3. Favorable Government Policies and Funding (Orphan Drug Act, PEPFAR)

3.1.4. Rising Awareness of Antiviral Treatments

3.2. Market Challenges

3.2.1. High R&D Costs

3.2.2. Stringent Regulatory Approval Processes (FDA, EMA)

3.2.3. Patent Expiry and Generic Competition

3.3. Opportunities

3.3.1. Development of Broad-Spectrum Antivirals

3.3.2. Collaborations Between Biotech Firms and Research Institutes

3.3.3. Expanding Use of Antivirals in Emerging Viral Diseases

3.4. Trends

3.4.1. Growth in Combination Antiviral Therapies

3.4.2. Emergence of Long-Acting Antiviral Formulations

3.4.3. Increasing Demand for Antivirals in Pediatric and Geriatric Populations

3.5. Government Regulations

3.5.1. FDA Drug Approval Process (Fast-Track, Breakthrough Therapy Designation)

3.5.2. Medicare and Medicaid Reimbursement Policies

3.5.3. Federal Funding Initiatives (NIH, BARDA)

3.5.4. Incentives for Antiviral Drug Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. US Antiviral Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Reverse Transcriptase Inhibitors

4.1.2. Protease Inhibitors

4.1.3. Fusion Inhibitors

4.1.4. Nucleotide Analogs

4.1.5. mRNA-Based Antivirals

4.2. By Disease Type (In Value %)

4.2.1. HIV/AIDS

4.2.2. Hepatitis

4.2.3. Influenza

4.2.4. Herpes Simplex Virus

4.2.5. Emerging Viral Diseases (COVID-19, Ebola, Zika)

4.3. By Administration Route (In Value %)

4.3.1. Oral

4.3.2. Intravenous

4.3.3. Inhalation

4.3.4. Topical

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.4.4. Specialty Clinics

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. West

4.5.4. South

5. US Antiviral Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Gilead Sciences

5.1.2. Merck & Co.

5.1.3. Bristol-Myers Squibb

5.1.4. AbbVie Inc.

5.1.5. Johnson & Johnson

5.1.6. Roche

5.1.7. Pfizer Inc.

5.1.8. GlaxoSmithKline

5.1.9. BioNTech SE

5.1.10. Moderna Inc.

5.1.11. Viiv Healthcare

5.1.12. Sanofi

5.1.13. Atea Pharmaceuticals

5.1.14. Vir Biotechnology

5.1.15. Novartis AG

5.2. Cross Comparison Parameters (Market Share, Drug Pipeline, R&D Spending, Recent FDA Approvals, Clinical Trial Success Rate, Partnerships, Number of Patents, Regulatory Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. US Antiviral Drugs Market Regulatory Framework

6.1. FDA Antiviral Drug Guidelines

6.2. IP and Patent Protection Laws

6.3. Clinical Trial Regulations

6.4. Post-Market Surveillance and Adverse Event Reporting

7. US Antiviral Drugs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. US Antiviral Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Disease Type (In Value %)

8.3. By Administration Route (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. US Antiviral Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Innovation and R&D Priorities

9.4. Customer Segmentation and Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping out the ecosystem of stakeholders within the US antiviral drugs market. Extensive desk research and a combination of secondary and proprietary databases were utilized to gather key data points, including market dynamics, drug pipeline analysis, and clinical trial results. This step focuses on identifying the key drivers of market growth and the barriers that influence market performance.

Step 2: Market Analysis and Construction

In this step, we compiled and analyzed historical data on antiviral drug adoption rates, revenue generated from key market segments, and the influence of regulatory approvals on market penetration. Special attention was paid to drug efficacy data and clinical trial outcomes, ensuring the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts from leading pharmaceutical companies. These experts provided insights into R&D spending trends, competitive strategies, and market opportunities. This step was critical for verifying the data collected and refining our understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from multiple antiviral drug manufacturers to validate sales performance, product segmentation, and consumer preferences. This approach, combined with bottom-up analysis, ensured a comprehensive, accurate, and validated report.

Frequently Asked Questions

01. How big is the US antiviral drugs market?

The US antiviral drugs market is valued at USD 30.5 billion, supported by the increasing prevalence of viral infections and advancements in therapeutic technologies.

02. What are the challenges in the US antiviral drugs market?

Challenges in the US antiviral drugs market include high R&D costs, stringent regulatory approval processes, and the risk of patent expiry, which can lead to increased competition from generics.

03. Who are the major players in the US antiviral drugs market?

Key players in the US antiviral drugs market include Gilead Sciences, Merck & Co., Bristol-Myers Squibb, Johnson & Johnson, and Pfizer Inc., dominating due to their extensive drug pipelines and strong presence in the antiviral segment.

04. What are the growth drivers of the US antiviral drugs market?

Growth drivers in the US antiviral drugs market include the increasing incidence of viral infections, government funding for research, and the introduction of innovative therapies such as mRNA-based antivirals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.