U.S. Artificial Intelligence (AI) Market Outlook to 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11444

November 2024

82

About the Report

U.S. Artificial Intelligence (AI) Market Overview

- The U.S. Artificial Intelligence (AI) market is valued at USD 42.0 billion, driven by rapid technological advancements and widespread adoption across various industries. The proliferation of big data, coupled with significant investments in AI research and development, has accelerated market growth. Additionally, the rise in machine learning applications, natural language processing, and predictive analytics is boosting demand for AI technologies across the healthcare, automotive, and retail sectors.

- Major tech hubs such as Silicon Valley, Seattle, and Boston dominate the AI landscape due to the concentration of leading technology companies, research institutions, and a highly skilled workforce. Silicon Valley, in particular, benefits from its proximity to industry giants and start-ups alike, enabling a robust ecosystem for AI innovation. This regions dominance is further supported by extensive venture capital funding and a strong culture of innovation.

- The U.S. government has begun to introduce AI policy frameworks to manage the ethical, economic, and social implications of AI. In 2023, the White House announced the National AI Initiative, a multi-billion-dollar investment aimed at maintaining U.S. leadership in AI technology while ensuring that AI development aligns with ethical standards. These frameworks provide businesses with guidance on how to navigate regulatory challenges and ensure that AI is developed and deployed responsibly.

U.S. Artificial Intelligence (AI) Market Segmentation

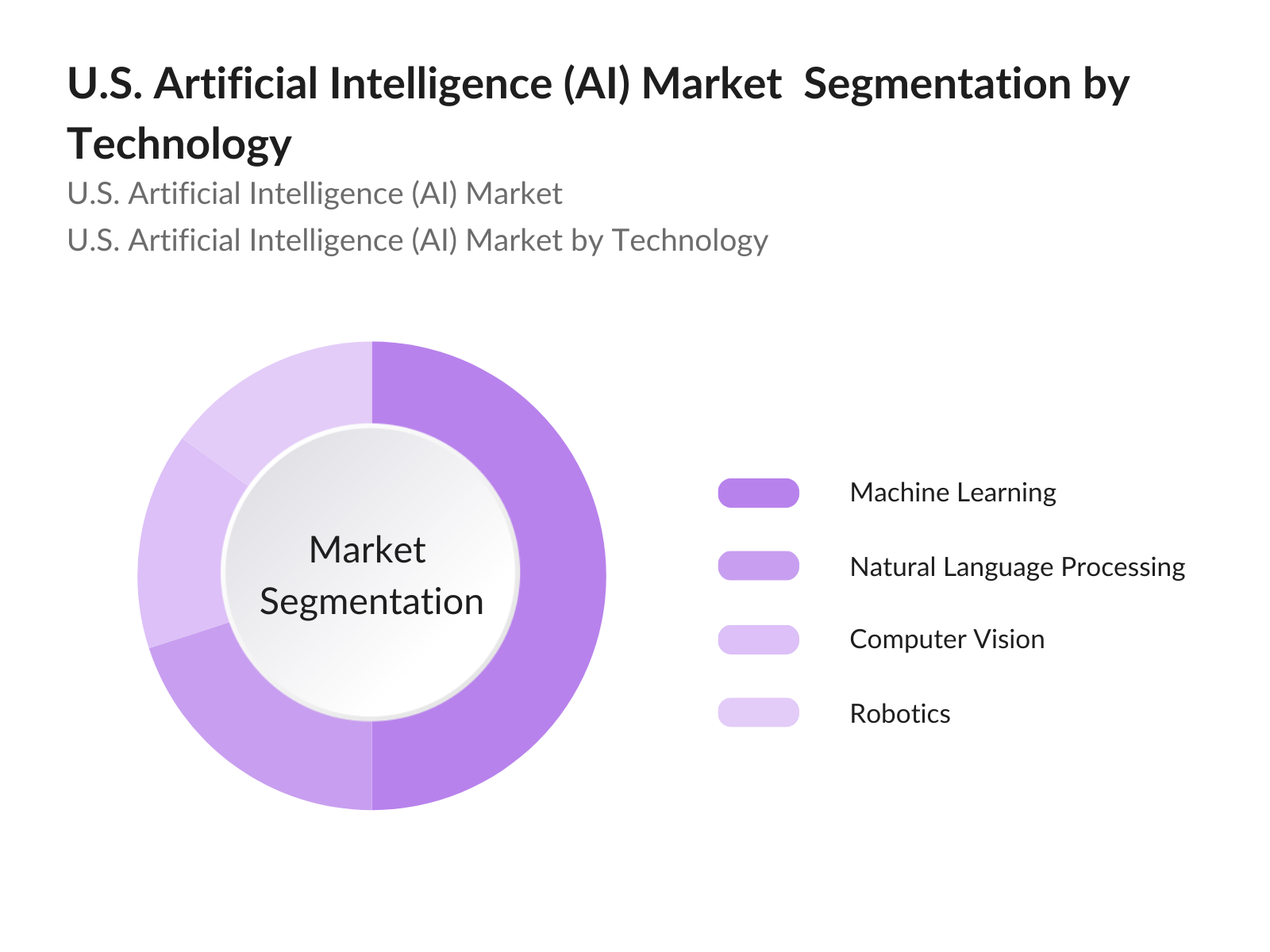

- By Technology: The U.S. AI market is segmented by technology into machine learning, natural language processing, computer vision, and robotics. Machine learning holds a dominant market share due to its wide application across diverse industries. This segments popularity is fueled by advancements in data processing capabilities and the increased availability of training data, which allow organizations to improve their AI models and drive higher efficiency in operations.

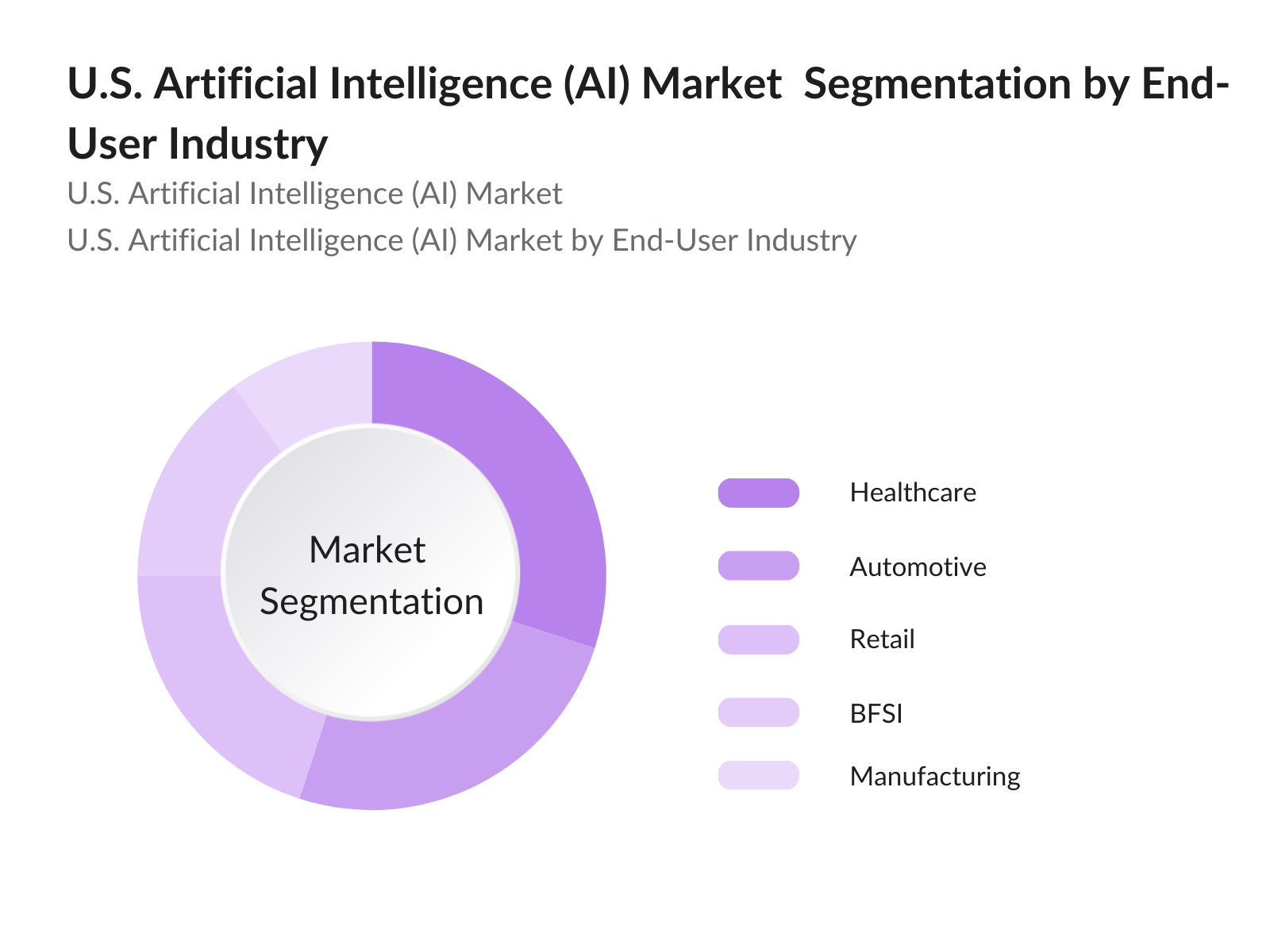

- By End-User Industry: The market segmentation by end-user industry includes healthcare, automotive, retail, BFSI, and manufacturing. The healthcare sector is experiencing rapid AI adoption, driven by the need for predictive analytics, diagnostics, and patient management solutions. AI-powered tools in healthcare are transforming patient care by enabling early diagnosis, personalized treatments, and automated administrative tasks, contributing to this segments high market share.

U.S. Artificial Intelligence (AI) Competitive Landscape

U.S. Artificial Intelligence (AI) Competitive Landscape

The U.S. AI market is characterized by the presence of several leading technology companies, many of which are pioneers in AI research and development. Companies like IBM, Google, and Microsoft leverage their extensive product portfolios, cloud services, and R&D investments to maintain competitive positions in the AI space.

|

Company |

Establishment Year |

Headquarters |

Revenue ($ Bn) |

Employee Strength |

AI Patents Held |

R&D Investment |

Specialized AI Services |

Strategic Partnerships |

|

IBM Corporation |

1911 |

Armonk, NY |

||||||

|

Google LLC |

1998 |

Mountain View, CA |

||||||

|

Microsoft Corporation |

1975 |

Redmond, WA |

||||||

|

Amazon Web Services, Inc. |

2006 |

Seattle, WA |

||||||

|

NVIDIA Corporation |

1993 |

Santa Clara, CA |

U.S. Artificial Intelligence (AI) Market Analysis

Market Growth Drivers

- Technological Advancements: Technological advancements in machine learning, deep learning, and neural networks are major drivers of AI market growth in the U.S. In 2023, the U.S. is leading in AI research and development, with over of global AI patents filed by U.S.-based companies. Innovations in natural language processing (NLP), computer vision, and autonomous systems are creating new opportunities across industries. Additionally, AI models like GPT-4 and new advancements in quantum computing are pushing the boundaries of AI capabilities, enabling businesses to deploy smarter solutions in areas ranging from automation to predictive analytics.

- Increased Adoption Across Industries: AI adoption is expanding rapidly across various sectors such as healthcare, finance, retail, and manufacturing. In 2023, more than of U.S. enterprises have integrated AI into their business processes. For example, AI-driven solutions for predictive maintenance in manufacturing are improving operational efficiency, while AI in finance is being used for fraud detection and automated trading. The healthcare sector is also leveraging AI for diagnostics, personalized treatment plans, and drug discovery. This broadening of AI applications is fueling the markets growth, making AI an essential component of digital transformation.

- Government Initiatives and Funding: The U.S. government is heavily investing in AI research and development. In 2023, the U.S. government allocated over $1.5 billion to AI-related initiatives through programs like the National AI Initiative Act and DARPA. These investments aim to strengthen the U.S.s global leadership in AI, focusing on areas like defense, healthcare, and education. Additionally, the government's funding supports AI startups and academic research, accelerating the commercialization of cutting-edge AI technologies. This government backing plays a pivotal role in driving AI innovation and market expansion.

Market Challenges:

- High Implementation Costs: The implementation of AI technologies remains costly, especially for small to medium-sized enterprises (SMEs). The costs associated with purchasing AI software, training staff, and setting up the necessary infrastructure can exceed several hundred thousand dollars, making it a significant financial burden. Additionally, the cost of computing power required to run complex AI models, particularly in machine learning, can be prohibitively high. In 2023, U.S. businesses spent an average of $500,000 to implement AI in their operations, posing a barrier to entry for smaller companies.

- Data Privacy Concerns: Data privacy concerns are growing in the U.S. as AI technologies rely heavily on vast amounts of personal and sensitive data. With high-profile data breaches becoming more frequent, consumers and businesses alike are concerned about the misuse of their data. The implementation of AI solutions must comply with stringent data privacy regulations, including the California Consumer Privacy Act (CCPA) and other federal guidelines. In 2023, the Federal Trade Commission (FTC) proposed new guidelines to protect consumers' data in AI applications, increasing compliance burdens for businesses deploying AI solutions.

U.S. Artificial Intelligence (AI) Future Outlook

The U.S. AI market is expected to grow substantially over the next five years, driven by increased investment in AI-based healthcare solutions, advancements in autonomous vehicles, and growing demand for generative AI tools. Key sectors such as healthcare, automotive, and BFSI are likely to continue embracing AI innovations for improved operational efficiency, customer engagement, and risk management.

Market Opportunities:

- Integration with IoT: The integration of AI with the Internet of Things (IoT) presents significant opportunities in the U.S. By 2024, over 50 billion IoT devices are expected to be active globally, creating vast amounts of data that can be analyzed using AI. In the U.S., AI-powered IoT applications are transforming industries like manufacturing, agriculture, and logistics. For instance, smart factories equipped with IoT sensors and AI analytics enable predictive maintenance and process optimization, offering businesses a powerful tool to increase efficiency and reduce costs.

- Expansion in Healthcare Sector: The healthcare sector in the U.S. presents a growing opportunity for AI applications, particularly in areas like diagnostics, personalized medicine, and drug discovery. In 2023, the FDA approved multiple AI-driven diagnostic tools, including those for detecting cancer and heart disease. Additionally, AI is being increasingly utilized in clinical trials to predict patient outcomes and improve recruitment strategies. The U.S. healthcare AI market is expected to continue expanding as new applications emerge, presenting significant opportunities for AI technology providers to enhance the quality and efficiency of healthcare services.

Scope of the Report

|

By Technology |

Machine Learning Natural Language Processing Computer Vision Robotics |

|

By End-User Industry |

Healthcare |

|

By Deployment Mode |

Cloud-Based |

|

By Organization Size |

Small and Medium Enterprises (SMEs) |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Healthcare Providers

Automotive Manufacturers

Retail Enterprises

Government and Regulatory Bodies(e.g., National Institute of Standards and Technology)

Investments and Venture Capitalist Firms

Financial Institutions

Telecom and IT Service Providers

Manufacturing Companies

Companies

Players mentioned in the report

IBM Corporation

Microsoft Corporation

Google LLC

Amazon Web Services, Inc.

NVIDIA Corporation

Intel Corporation

Oracle Corporation

Salesforce.com, Inc.

Facebook, Inc.

Apple Inc.

SAP SE

Adobe Inc.

Baidu, Inc.

Tencent Holdings Ltd.

Alibaba Group Holding Limited

Table of Contents

1. U.S. Artificial Intelligence (AI) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Artificial Intelligence (AI) Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Artificial Intelligence (AI) Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements

3.1.2. Increased Adoption Across Industries

3.1.3. Government Initiatives and Funding

3.1.4. Availability of Big Data

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Data Privacy Concerns

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Integration with IoT

3.3.2. Expansion in Healthcare Sector

3.3.3. Development of AI Ethics and Governance

3.4. Trends

3.4.1. Rise of Generative AI

3.4.2. AI in Autonomous Vehicles

3.4.3. AI-Powered Cybersecurity Solutions

3.5. Government Regulations

3.5.1. AI Policy Frameworks

3.5.2. Data Protection Laws

3.5.3. Ethical Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. U.S. Artificial Intelligence (AI) Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Machine Learning

4.1.2. Natural Language Processing

4.1.3. Computer Vision

4.1.4. Robotics

4.2. By End-User Industry (In Value %)

4.2.1. Healthcare

4.2.2. Automotive

4.2.3. Retail

4.2.4. BFSI

4.2.5. Manufacturing

4.3. By Deployment Mode (In Value %)

4.3.1. Cloud-Based

4.3.2. On-Premises

4.4. By Organization Size (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Artificial Intelligence (AI) Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Microsoft Corporation

5.1.3. Google LLC

5.1.4. Amazon Web Services, Inc.

5.1.5. NVIDIA Corporation

5.1.6. Intel Corporation

5.1.7. Oracle Corporation

5.1.8. Salesforce.com, Inc.

5.1.9. Facebook, Inc.

5.1.10. Apple Inc.

5.1.11. SAP SE

5.1.12. Adobe Inc.

5.1.13. Baidu, Inc.

5.1.14. Tencent Holdings Ltd.

5.1.15. Alibaba Group Holding Limited

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, R&D Investment, AI Patents Held, Market Share, Product Portfolio, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Artificial Intelligence (AI) Regulatory Framework

6.1. AI Policy Frameworks

6.2. Data Protection and Privacy Laws

6.3. Ethical Guidelines and Standards

7. U.S. Artificial Intelligence (AI) Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. U.S. Artificial Intelligence (AI) Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Deployment Mode (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. U.S. Artificial Intelligence (AI) Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Positioning Strategies

9.3. Investment and Strategic Partnerships

9.4. White Space Analysis for Growth

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders, identifying technological advancements, and assessing market dynamics in the U.S. AI Market. This step incorporates extensive desk research and proprietary database analysis.

Step 2: Market Analysis and Construction

Historical data on AI applications, adoption rates, and revenue generation is analyzed to create a comprehensive overview of market size, segmentation, and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts validate findings, providing insights into the competitive landscape, strategic partnerships, and the technology adoption cycle.

Step 4: Research Synthesis and Final Output

A final synthesis of research findings and expert inputs ensures a validated and in-depth analysis of the U.S. AI market, offering actionable insights and market projections.

Frequently Asked Questions

01. How big is the U.S. Artificial Intelligence Market?

The U.S. Artificial Intelligence Market is valued at USD 42.0 billion, fueled by significant investments and the integration of AI across sectors such as healthcare and automotive.

02. What are the challenges in the U.S. AI Market?

Challenges include high implementation costs, data privacy concerns, and a shortage of skilled professionals needed to develop and manage AI systems effectively.

03. Who are the major players in the U.S. AI Market?

Key players include IBM, Microsoft, Google, Amazon Web Services, and NVIDIA, who dominate with extensive R&D investments and robust AI portfolios.

04. What are the growth drivers of the U.S. AI Market?

Growth drivers include technological advancements, big data availability, government support, and the adoption of AI across diverse industries like healthcare and finance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.